- Full-Year 2025 Revenue Guidance(1) Range of $61.0 to $64.0

Billion

- Full-Year 2025 Adjusted(2) Diluted EPS Guidance Range of $2.80

to $3.00

- Expect Full-Year 2025 Adjusted(2) Diluted EPS Operational(3)

Growth of 10% to 18% from the Midpoint of 2024 Guidance After

Adjusting for 2024 Non-Recurring Items(4)

- Achieved Goal of $4.0 Billion in Net Cost Savings Through 2024

and Anticipate an Additional $500 Million in Savings in 2025 from

Ongoing Cost Realignment Program

- First Phase of Manufacturing Optimization Program On Track to

Deliver Initial Net Cost Savings in the Latter Part of 2025, Toward

Goal of Improving Gross Margin Performance

Pfizer Inc. (NYSE:PFE) today provided its full-year 2025

guidance(1) and reaffirmed its October 29, 2024 full-year 2024

guidance(1). The accompanying presentation can be found at

www.pfizer.com/investors.

Full-Year 2025 Revenue Guidance(1)

Pfizer anticipates full-year 2025 revenues to be in the range of

$61.0 to $64.0 billion, which includes the expectation of revenues

from our COVID-19 products in 2025 being largely consistent with

2024 after excluding approximately $1.2 billion of non-recurring

revenue for Paxlovid in 2024. Pfizer expects full-year 2025

operational(3) revenue growth, year-over-year, in a range of

approximately flat to 5% from the midpoint of 2024 baseline

guidance(4), which excludes 2024 non-recurring items(4).

2025 Revenue guidance takes into consideration the anticipated

net unfavorable impact to revenue of approximately $1 billion,

year-over-year, related to the Inflation Reduction Act (IRA) Part D

Redesign changes that take effect in 2025. The IRA makes

significant changes to the Medicare Part D benefit design, which

will impact Pfizer revenue in 2025, including: an expected

favorable impact from the $2,000 annual out-of-pocket cap and new

Prescription Payment Plan, more than offset by an expected

unfavorable impact from the sunsetting of the Coverage Gap Discount

Program and the addition of new manufacturer discounts in the

initial and catastrophic coverage phases.

Full-Year 2025 Adjusted(2) SI&A and Adjusted(2) R&D

Guidance(1)

Pfizer anticipates full-year 2025 Adjusted(2) SI&A expenses

to be in the range of $13.3 to $14.3 billion and full-year 2025

Adjusted(2) R&D expenses to be in the range of $10.7 to $11.7

billion. Consequently, total 2025 Adjusted(2) SI&A and R&D

expenses are expected to be in the range of $24.0 to $26.0 billion.

This range reflects approximately $4.0 billion in net operating

expense savings from our cost realignment program achieved through

the end of 2024 and anticipates an additional $500 million of

savings in 2025.

Full-Year 2025 Adjusted(2) Diluted EPS Guidance(1)

Pfizer anticipates full-year 2025 Adjusted(2) diluted EPS to be

in a range of $2.80 to $3.00, reflecting expected operational(3)

growth of 10% to 18%, year-over-year, from the midpoint of our 2024

baseline guidance(4), which excludes 2024 non-recurring items(4).

2025 Adjusted(2) diluted EPS guidance primarily reflects our

expected revenues, anticipated operating margin improvement from

continued cost management, and the non-recurrence of the following

items that are expected to favorably impact 2024 Adjusted(2)

diluted EPS by approximately $0.30:

- During 2024, Pfizer recognized Paxlovid revenue of $1.2 billion

from two one-time items: $771 million from a U.S. Government

revenue credit true-up and $442 million from the fulfillment of our

obligated delivery of one million treatment courses to the U.S.

Strategic National Stockpile;

- With the reduction of our Haleon ownership percentage in the

fourth quarter of 2024, Haleon equity method income will no longer

be included in Adjusted(2) earnings in 2025; and

- Our 2024 tax rate on adjusted income was favorably impacted by

the timing of Pillar 2 and, to a lesser extent, audit

settlements.

A comparison of Pfizer’s 2024 Financial Guidance to its 2025

Financial Guidance(1) is presented below.

2024 Guidance(1) (as of

December 17, 2024)

2024 Non-Recurring

Items(4)

2024 Guidance(4)

(Baseline excluding non-recurring items)

2025 Financial

Guidance(1)

Revenues ($ in billions)

$61.0 – $64.0

~($1.2)

$59.8 – $62.8

$61.0 – $64.0

Adjusted(2) SI&A Expenses ($

in billions)

$13.8 – $14.8

$13.3 – $14.3

Adjusted(2) R&D Expenses ($ in

billions)

$11.0 – $12.0

$10.7 – $11.7

Effective Tax Rate on Adjusted(2)

Income

~13%

~15%

Adjusted(2) Diluted EPS

$2.75 – $2.95

~($0.30)

$2.45 – $2.65

$2.80 – $3.00

Pfizer’s expected 2025 operational(3) revenue and Adjusted(2)

diluted EPS growth, year-over-year, versus its 2024 baseline

guidance(4) midpoint is presented below.

2024 Guidance(4) (Baseline

excluding non-recurring items)

2025 Financial

Guidance(1)

Operational Growth(5)

Revenues ($ in billions)

$59.8 – $62.8 (midpoint

$61.3)

$61.0 – $64.0

~ flat to ~ 5%

Adjusted(2) Diluted EPS

$2.45 – $2.65 (midpoint

$2.55)

$2.80 – $3.00

~ 10% to ~ 18%

Financial guidance for Adjusted(2) diluted EPS is calculated

using approximately 5.74 billion weighted average shares

outstanding, and assumes no share repurchases in 2024 or 2025.

Executive Commentary

Dr. Albert Bourla, Pfizer Chairman and Chief Executive Officer,

stated: “Pfizer is in a strong position to continue making a

positive impact for patients and delivering on our financial

commitments in 2025. Our team will build on a year of disciplined

execution in 2024 and our product portfolio remains strong.

“We also expect to continue improving our operating margins with

focused financial discipline. We’ve been successful in delivering

on our goal of $4 billion in net operating expense savings through

2024 from our cost realignment program, with an additional $500

million still expected to come in 2025. Additionally, in support of

our ongoing efforts to improve gross margin performance, we will

work to make additional progress with our Manufacturing

Optimization Program in the coming year.

“As we look forward, we are confident in our future. With our

clear strategic roadmap, a robust pipeline of potential innovative

medicines and vaccines and a talented team laser-focused on

execution, we believe we are on course to deliver significant

shareholder value.”

Pfizer intends to provide additional commentary in an analyst

webcast scheduled for 8:30 a.m. EST, Tuesday, December 17, 2024;

details can be found at www.investors.pfizer.com.

(1)

Pfizer does not provide guidance for U.S.

generally accepted accounting principles (GAAP) Reported financial

measures (other than revenues) or a reconciliation of

forward-looking non-GAAP financial measures to the most directly

comparable GAAP Reported financial measures on a forward-looking

basis because it is unable to predict with reasonable certainty the

ultimate outcome of unusual gains and losses, certain

acquisition-related expenses, gains and losses from equity

securities, actuarial gains and losses from pension and

postretirement plan remeasurements, potential future asset

impairments and pending litigation without unreasonable effort.

These items are uncertain, depend on various factors, and could

have a material impact on U.S. GAAP Reported results for the

guidance period.

Financial guidance for full-year 2025

reflects the following:

- Does not assume the completion of any business development

transactions not completed as of December 16, 2024.

- Reflects an anticipated negative revenue impact of

approximately $0.6 billion due to recent and expected generic and

biosimilar competition for certain products that have recently lost

patent or regulatory protection or that are anticipated to lose

patent or regulatory protection.

- Exchange rates assumed are actual rates at mid-November

2024.

- Guidance for Adjusted(2) diluted EPS assumes diluted

weighted-average shares outstanding of approximately 5.74 billion

shares, and assumes no share repurchases in 2025.

Our reaffirmed financial guidance for

full-year 2024 reflects assumptions that are consistent with those

outlined in Note (1) within Pfizer’s Q3-24 Earnings Release.

(2)

Adjusted income and Adjusted diluted

earnings per share (EPS) are defined as U.S. GAAP net income

attributable to Pfizer Inc. common shareholders and U.S. GAAP

diluted EPS attributable to Pfizer Inc. common shareholders before

the impact of amortization of intangible assets, certain

acquisition-related items, discontinued operations, and certain

significant items. Adjusted income and its components and Adjusted

diluted EPS measures are not, and should not be viewed as,

substitutes for U.S. GAAP net income and its components and diluted

EPS(6), have no standardized meaning prescribed by U.S. GAAP and

may not be comparable to the calculation of similar measures of

other companies. See the Non-GAAP Financial Measure: Adjusted

Income section of Management’s Discussion and Analysis of Financial

Condition and Results of Operations in Pfizer’s 2023 Annual Report

on Form 10-K for a definition of each component of Adjusted income

as well as other relevant information.

(3)

References to operational variances in

this press release pertain to period-over-period changes that

exclude the impact of foreign exchange rates. Although exchange

rate changes are part of Pfizer’s business, they are not within

Pfizer’s control and because they can mask positive or negative

trends in the business, Pfizer believes presenting operational

variances excluding these foreign exchange changes provides useful

information to evaluate Pfizer’s results.

(4)

Pfizer reaffirms 2024 Guidance (last

updated on October 29, 2024) as of the publication of this December

17, 2024 press release. Within this press release and other related

materials, all references to Pfizer’s 2024 baseline guidance

indicates our 2024 Guidance excluding 2024 non-recurring items. Our

2024 baseline Revenue guidance range excludes $1.2 billion in

non-recurring 2024 Paxlovid revenues, and our baseline Adjusted(2)

diluted EPS guidance range excludes an anticipated favorable impact

in 2024 of approximately $0.30 from non-recurring items, as

outlined under the ‘Full-Year 2025 Adjusted(2) Diluted EPS

Guidance’ section of this press release.

(5)

Expected operational growth percentage, on

a year-over-year basis, represents lower and upper end of the 2025

guidance range versus the midpoint of the 2024 baseline guidance

range.

(6)

Revenues is defined as revenues in

accordance with U.S. GAAP. Reported net income and its components

are defined as net income attributable to Pfizer Inc. common

shareholders and its components in accordance with U.S. GAAP.

Reported diluted EPS is defined as diluted EPS attributable to

Pfizer Inc. common shareholders in accordance with U.S. GAAP.

DISCLOSURE NOTICE: The information contained in this

press release is as of December 17, 2024. Pfizer assumes no

obligation to update forward-looking statements contained in this

release or the webcast as the result of new information or future

events or developments.

This press release and the webcast contain or may contain

forward-looking information about, among other topics, our

anticipated operating and financial performance, including

financial guidance and projections; reorganizations; business

plans, strategy, goals and prospects; expectations for our product

pipeline, in-line products and product candidates, including

anticipated regulatory submissions, data read-outs, study starts,

approvals, launches, clinical trial results and other developing

data, revenue contribution and projections, potential pricing and

reimbursement, potential market dynamics, including demand, market

size and utilization rates and growth, performance, timing of

exclusivity and potential benefits; strategic reviews; capital

allocation objectives; an enterprise-wide cost realignment program,

which we launched in October 2023 (including anticipated costs,

savings and potential benefits); a Manufacturing Optimization

Program to reduce our cost of goods sold, which we announced in May

2024 (including anticipated costs, savings and potential benefits);

dividends and share repurchases; plans for and prospects of our

acquisitions, dispositions and other business development

activities, including our December 2023 acquisition of Seagen, and

our ability to successfully capitalize on growth opportunities and

prospects; manufacturing and product supply; our ongoing efforts to

respond to COVID-19, including our plans and expectations regarding

Comirnaty and our oral COVID-19 treatment (Paxlovid); our

expectations regarding the impact of COVID-19 on our business,

operations and financial results; and our Environmental, Social and

Governance (ESG) priorities, strategies and goals. Given their

forward-looking nature, these statements involve substantial risks,

uncertainties and potentially inaccurate assumptions and we cannot

assure that any outcome expressed in these forward-looking

statements will be realized in whole or in part. You can identify

these statements by the fact that they use future dates or use

words such as “will,” “may,” “could,” “likely,” “ongoing,”

“anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” “assume,” “target,” “forecast,” “guidance,” “goal,”

“objective,” “aim,” “seek,” “potential,” “hope” and other words and

terms of similar meaning. Pfizer’s financial guidance is based on

estimates and assumptions that are subject to significant

uncertainties.

Among the factors that could cause actual results to differ

materially from past results and future plans and projected future

results are the following:

Risks Related to Our Business, Industry

and Operations, and Business Development:

- the outcome of research and development (R&D) activities,

including the ability to meet anticipated pre-clinical or clinical

endpoints, commencement and/or completion dates for our

pre-clinical or clinical trials, regulatory submission dates,

and/or regulatory approval and/or launch dates; the possibility of

unfavorable pre-clinical and clinical trial results, including the

possibility of unfavorable new pre-clinical or clinical data and

further analyses of existing pre-clinical or clinical data; risks

associated with preliminary, early stage or interim data; the risk

that pre-clinical and clinical trial data are subject to differing

interpretations and assessments, including during the peer

review/publication process, in the scientific community generally,

and by regulatory authorities; whether and when additional data

from our pipeline programs will be published in scientific journal

publications and, if so, when and with what modifications and

interpretations; and uncertainties regarding the future development

of our product candidates, including whether or when our product

candidates will advance to future studies or phases of development

or whether or when regulatory applications may be filed for any of

our product candidates;

- our ability to successfully address comments received from

regulatory authorities such as the FDA or the EMA, or obtain

approval for new products and indications from regulators on a

timely basis or at all;

- regulatory decisions impacting labeling, including the scope of

indicated patient populations, product dosage, manufacturing

processes, safety and/or other matters, including decisions

relating to emerging developments regarding potential product

impurities; uncertainties regarding the ability to obtain, and the

scope of, recommendations by technical or advisory committees; and

the timing of, and ability to obtain, pricing approvals and product

launches, all of which could impact the availability or commercial

potential of our products and product candidates;

- claims and concerns that may arise regarding the safety or

efficacy of in-line products and product candidates, including

claims and concerns that may arise from the conduct or outcome of

post-approval clinical trials, pharmacovigilance or Risk Evaluation

and Mitigation Strategies, which could impact marketing approval,

product labeling, and/or availability or commercial potential;

- the success and impact of external business development

activities, such as the December 2023 acquisition of Seagen,

including the ability to identify and execute on potential business

development opportunities; the ability to satisfy the conditions to

closing of announced transactions in the anticipated time frame or

at all; the ability to realize the anticipated benefits of any such

transactions in the anticipated time frame or at all; the potential

need for and impact of additional equity or debt financing to

pursue these opportunities, which has in the past and could in the

future result in increased leverage and/or a downgrade of our

credit ratings and could limit our ability to obtain future

financing; challenges integrating the businesses and operations;

disruption to business and operations relationships; risks related

to growing revenues for certain acquired or partnered products;

significant transaction costs; and unknown liabilities;

- competition, including from new product entrants, in-line

branded products, generic products, private label products,

biosimilars and product candidates that treat or prevent diseases

and conditions similar to those treated or intended to be prevented

by our in-line products and product candidates;

- the ability to successfully market both new and existing

products, including biosimilars;

- difficulties or delays in manufacturing, sales or marketing;

supply disruptions, shortages or stock-outs at our facilities or

third-party facilities that we rely on; and legal or regulatory

actions;

- the impact of public health outbreaks, epidemics or pandemics

(such as COVID-19) on our business, operations and financial

condition and results, including impacts on our employees,

manufacturing, supply chain, sales and marketing, R&D and

clinical trials;

- risks and uncertainties related to our efforts to continue to

develop and commercialize Comirnaty and Paxlovid or any potential

future COVID-19 vaccines, treatments or combinations, as well as

challenges related to their manufacturing, supply and distribution,

including, among others, the risk that as the market for COVID-19

products continues to become more endemic and seasonal, demand for

our COVID-19 products has and may continue to be reduced or not

meet expectations, or may no longer exist, which has and may

continue to lead to reduced revenues, excess inventory on-hand

and/or in the channel which, for Paxlovid and Comirnaty, resulted

in significant inventory write-offs in 2023 and could continue to

result in inventory write-offs, or other unanticipated charges;

risks related to our ability to develop and commercialize variant

adapted vaccines; uncertainties related to the public’s adherence

to vaccines, boosters, treatments or combinations; risks related to

our ability to accurately predict or achieve our revenue forecasts

for Comirnaty and Paxlovid or any potential future COVID-19

vaccines or treatments; and potential third-party royalties or

other claims related to Comirnaty or Paxlovid;

- trends toward managed care and healthcare cost containment, and

our ability to obtain or maintain timely or adequate pricing or

favorable formulary placement for our products;

- interest rate and foreign currency exchange rate fluctuations,

including the impact of currency devaluations and monetary policy

actions in countries experiencing high inflation or deflation

rates;

- any significant issues involving our largest wholesale

distributors or government customers, which account for a

substantial portion of our revenues;

- the impact of the increased presence of counterfeit medicines,

vaccines or other products in the pharmaceutical supply chain;

- any significant issues related to the outsourcing of certain

operational and staff functions to third parties;

- any significant issues related to our JVs and other third-party

business arrangements, including modifications or disputes related

to supply agreements or other contracts with customers including

governments or other payors;

- uncertainties related to general economic, political, business,

industry, regulatory and market conditions including, without

limitation, uncertainties related to the impact on us, our

customers, suppliers and lenders and counterparties to our

foreign-exchange and interest-rate agreements of challenging global

economic conditions, such as inflation or interest rate

fluctuations, and recent and possible future changes in global

financial markets;

- the exposure of our operations globally to possible capital and

exchange controls, economic conditions, expropriation, sanctions

and/or other restrictive government actions, changes in

intellectual property legal protections and remedies, unstable

governments and legal systems and inter-governmental disputes;

- the impact of disruptions related to climate change and natural

disasters;

- any changes in business, political and economic conditions due

to actual or threatened terrorist activity, geopolitical

instability, political or civil unrest or military action,

including the ongoing conflicts between Russia and Ukraine and in

the Middle East and the resulting economic or other

consequences;

- the impact of product recalls, withdrawals and other unusual

items, including uncertainties related to regulator-directed risk

evaluations and assessments, such as our ongoing evaluation of our

product portfolio for the potential presence or formation of

nitrosamines, and our voluntary withdrawal of all lots of Oxbryta

in all markets where it is approved and any potential regulatory or

other impact on other sickle cell disease assets;

- trade buying patterns;

- the risk of an impairment charge related to our intangible

assets, goodwill or equity-method investments;

- the impact of, and risks and uncertainties related to,

restructurings and internal reorganizations, as well as any other

corporate strategic initiatives and growth strategies, and

cost-reduction and productivity initiatives, including any

potential future phases, each of which requires upfront costs but

may fail to yield anticipated benefits and may result in unexpected

costs, organizational disruption, adverse effects on employee

morale, retention issues or other unintended consequences;

- the ability to successfully achieve our climate goals and

progress our environmental sustainability and other ESG

priorities;

Risks Related to Government Regulation and

Legal Proceedings:

- the impact of any U.S. healthcare reform or legislation or any

significant spending reduction or cost control efforts affecting

Medicare, Medicaid or other publicly funded or subsidized health

programs, including the Inflation Reduction Act of 2022, or changes

in the tax treatment of employer-sponsored health insurance that

may be implemented;

- U.S. federal or state legislation or regulatory action and/or

policy efforts affecting, among other things, pharmaceutical

product pricing, intellectual property, reimbursement or access or

restrictions on U.S. direct-to-consumer advertising; limitations on

interactions with healthcare professionals and other industry

stakeholders; as well as pricing pressures for our products as a

result of highly competitive biopharmaceutical markets;

- legislation or regulatory action in markets outside of the

U.S., such as China or Europe, including, without limitation, laws

related to pharmaceutical product pricing, intellectual property,

medical regulation, environmental protections, reimbursement or

access, including, in particular, continued government-mandated

reductions in prices and access restrictions for certain

biopharmaceutical products to control costs in those markets;

- legal defense costs, insurance expenses, settlement costs and

contingencies, including without limitation, those related to legal

proceedings and actual or alleged environmental contamination;

- the risk and impact of an adverse decision or settlement and

risk related to the adequacy of reserves related to legal

proceedings;

- the risk and impact of tax related litigation and

investigations;

- governmental laws and regulations affecting our operations,

including, without limitation, the Inflation Reduction Act of 2022,

changes in laws and regulations or their interpretation, including,

among others, changes in tax laws and regulations internationally

and in the U.S., the adoption of global minimum taxation

requirements outside the U.S. generally effective in most

jurisdictions since January 1, 2024, and potential changes to

existing tax laws, tariffs, or changes to other laws and

regulations proposed by the U.S. presidential administration;

Risks Related to Intellectual Property,

Technology and Security:

- any significant breakdown or interruption of our information

technology systems and infrastructure (including cloud

services);

- any business disruption, theft of confidential or proprietary

information, security threats on facilities or infrastructure,

extortion or integrity compromise resulting from a cyber-attack,

which may include those using adversarial artificial intelligence

techniques, or other malfeasance by, but not limited to, nation

states, employees, business partners or others;

- risks and challenges related to the use of software and

services that include artificial intelligence-based functionality

and other emerging technologies;

- the risk that our currently pending or future patent

applications may not be granted on a timely basis or at all, or any

patent-term extensions that we seek may not be granted on a timely

basis, if at all; and

- risks to our products, patents and other intellectual property,

such as: (i) claims of invalidity that could result in patent

revocation; (ii) claims of patent infringement, including asserted

and/or unasserted intellectual property claims; (iii) claims we may

assert against intellectual property rights held by third parties;

(iv) challenges faced by our collaboration or licensing partners to

the validity of their patent rights; or (v) any pressure, or legal

or regulatory action by, various stakeholders or governments that

could potentially result in us not seeking intellectual property

protection or agreeing not to enforce or being restricted from

enforcing intellectual property rights related to our products,

including Comirnaty and Paxlovid.

Should known or unknown risks or uncertainties materialize or

should underlying assumptions prove inaccurate, actual results

could vary materially from past results and those anticipated,

estimated or projected. Investors are cautioned not to put undue

reliance on forward-looking statements. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and in our subsequent reports on Form 10-Q, in

each case including in the sections thereof captioned

“Forward-Looking Information and Factors That May Affect Future

Results” and “Item 1A. Risk Factors,” and in our subsequent reports

on Form 8-K, all of which are filed with the U.S. Securities and

Exchange Commission and available at www.sec.gov and

www.pfizer.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217352989/en/

Media Contact: PfizerMediaRelations@Pfizer.com +1 (212)

733-1226

Investor Contact: IR@Pfizer.com +1 (212) 733-4848

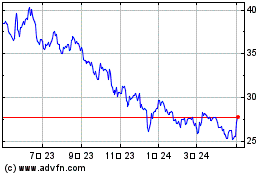

Pfizer (NYSE:PFE)

過去 株価チャート

から 12 2024 まで 12 2024

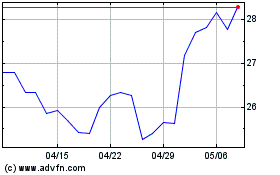

Pfizer (NYSE:PFE)

過去 株価チャート

から 12 2023 まで 12 2024