UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

| For the month of |

August |

|

2024 |

| Commission File Number |

001-41722 |

|

|

| METALS ACQUISITION LIMITED |

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

METALS ACQUISITION LIMITED |

| |

|

|

(Registrant) |

| |

|

|

|

|

|

| Date: |

August 28, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

29 August 2024

APPENDIX 4D

HALF YEAR

ENDED 30 JUNE 2024

The Directors

of Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey,

Channel Islands (MAC or MAL or the Company) are pleased to provide the Appendix 4D and Half Year Report, for the

half year ended 30 June 2024.

The Half

Year Report, comprising this page and the following 37 pages, constitutes the half year end financial information given to the ASX

under Listing Rule 4.2A and should be read in conjunction with the Financial Report for the year ended 31 December 2023.

The Half

Year Report has been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), with a reconciliation of any non-IFRS measure.

The functional

currency of the majority of the Company’s operations is United States dollars and, unless otherwise defined in this report, $,

USD and US$ amounts are in United States dollars and A$ are in Australian dollars.

Current reporting period:

6 months ended 30 June 2024 (H1 FY24)

Previous corresponding reporting

period: 6 months ended 30 June 2023 (H1 FY23)

Results for the announcement

to the market

| | |

Movement | | |

H1 FY24 | | |

H1 FY23 | |

| | |

Change | |

% | | |

US$’000 | | |

US$’000 | |

| Revenue from ordinary activities | |

Increase | |

| 881 | % | |

| 182,160 | | |

| 18,576 | |

| Net profit/(loss) from ordinary activities after tax (NPAT) attributable to members | |

Increase | |

| 217 | % | |

| (102,169 | ) | |

| (32,263 | ) |

| Underlying

EBITDA1 | |

Increase | |

| 5,501 | % | |

| 90,569 | | |

| 1,617 | |

Distributions

There were no dividends paid to shareholders

during this reporting period (H1 FY23: Nil). There is no final dividend declared or proposed for the half year ended 30 June 2024 (H1

FY23: Nil).

Net tangible assets

| | | |

30 June 2024 | | |

30 June 2023 | |

| $ Net tangible assets per share | | |

| 5.90 | | |

| 7.46 | |

Contacts

| Mick

McMullen |

Morne

Engelbrecht |

| Chief

Executive Officer |

Chief

Financial Officer |

| Metals

Acquisition Limited |

Metals

Acquisition Limited |

| investors@metalsacqcorp.com |

|

This announcement is authorised for release by the Board

of Directors.

1 Refer to table 2 for the reconciliation

of Underlying EBITDA

JUNE 2024 HALF YEAR FINANCIAL

RESULTS

RECORD

PRODUCTION2, EARNINGS AND CASH FLOW GENERATION SUPPORTED BY A MORE THAN DOUBLING OF MINE LIFE

HIGHLIGHTS

During

the half year ended 30 June 2024, we delivered record production and earnings generation while making strong progress towards our strategic

goals.

Record copper production

under MAC ownership

| • | Record copper production under MAC of 19,650

tonnes produced for H1 FY24, despite a major planned maintenance shutdown in April, with

record copper production of 5,378 tonnes in June |

| • | Average Cu grade of 3.8% achieved in H1

FY24, with 4.2% in Q2 FY24 as the mine plan shifted to higher grade stopes including the

first double stope development and dilution control was improved |

| | • | Copper production tracking to mid-point of 2024 guidance with no change to 2025

and 2026 guidance |

Generating

material earnings and free cash flow

| |

• |

Record Underlying EBITDA3 of US$91 million

for H1 FY24 |

| |

• |

Cash and cash equivalents

increased by ~174% to US$88.7 million compared to 31 December 2023 |

| • | Repaid ~US$160 million of interest-bearing liabilities since

the acquisition of the CSA Copper Mine |

| • | Raised ~US$214 million (A$325 million) (before costs) at the

top of the indicative price range4. |

| |

• |

Generated operational cash

flows of US$61 million with an average realised Copper sales price of US$4.14/lb5 (H1 FY24 Copper spot averaged at US$4.12/lb) |

| |

• |

Free cashflow of US$37 million for H1 FY24 |

| |

• |

C1 cash cost6

of US$2.08/lb compared to US$2.96/lb in H1 FY23, a decrease of 30% |

| • | All in cash cost7 of US$2.89/lb compared to US$3.96/lb

in H1 FY23, a decrease of 27% |

Strategic

investment and simplification of capital structure

| |

• |

MAC made a strategic investment

in POL with an initial A$2.5m invested for a 4.31% interest in POL, which also provides for access to water rights and Zinc processing

capacity8 |

| |

• |

Simplified the capital structure through the redemption

of the Private and Public warrants9 |

67%

increase in mine life to 11 years with new Resource and Reserve (“R+R10”) issued

| |

• |

64% increase in contained

Copper (“Cu”) after replacement of depletion in Ore Reserves at 3.3% Cu average grade |

| |

• |

42% increase in contained

Cu after replacement of depletion in Mineral Resources at 4.9% Cu average grade |

| |

• |

2023 Ore Reserve only extends

95m vertically below the current decline position |

| |

• |

All deposits11,

are open in at least one direction and drilling is continuing to further increase the R+R |

Implemented

remediation strategies to bring down the Total Recordable Injury Frequency Rate (TRIFR) of 14.4 which resulted in zero recordable

injuries in the month of June

| 2 | Record

production referencing the record production in June 2024 of the CSA Copper Mine under MAC

ownership |

| 3 | Refer to table 2 for the reconciliation

of Underlying EBITDA |

| 4 | Top of the guidance range of A$17.00

per CDI, commenced trading on ASX on 20 February 2024 under the code ‘MAC’ |

| 5 | Realised sales price excluding hedging

impact |

| 6 | Refer to table 4 for the reconciliation

of C1 cash cost |

| 7 | Refer to table 5 for the reconciliation

of All in cash cost |

| 8 | Refer to ASX release ‘Strategic

Investment in Polymetals Limited’ dated 27 May 2024 |

| 9 | Refer to ASX release ‘Completion

of the Redemption of Warrants’ dated 10 June 2024 |

| 10 | Refer to Reserves and Resource Statement

issued subsequent to quarter end on 23 April 2024. |

| 11 | Other than QTSSU-A which is subject

to a feasibility study. Also subject to exploration success and economic factors. |

Summary of financial results

| | |

H1 FY24 | | |

H1 FY23 | | |

Change | |

| | |

US$’000 | | |

US$’000 | | |

US$’000 | | |

% | |

| Statutory financial measures | |

| | |

| | |

| | |

| |

| Revenue | |

| 182,160 | | |

| 18,576 | | |

| 163,584 | | |

| 881 | % |

| Income/(loss) from operations – before net | |

| 46,019 | | |

| (19,507 | ) | |

| 65,526 | | |

| 336 | % |

| finance expenses and income tax expense | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period - after tax (NPAT) | |

| (102,169 | ) | |

| (32,263 | ) | |

| (69,906 | ) | |

| (217 | )% |

| Basic and diluted loss per ordinary share (US$ per | |

| (1.56 | ) | |

| (3.13 | ) | |

| 1.57 | | |

| 50 | % |

| share) | |

| | | |

| | | |

| | | |

| | |

| Non-statutory measures | |

US$’000 | | |

US$’000 | | |

US$’000 | | |

| |

| Underlying EBITDA12 | |

| 90,569 | | |

| 1,617 | | |

| 88,952 | | |

| 5,501 | % |

| C1 cash cost (US$/lb)13 | |

| 2.08 | | |

| 2.96 | | |

| (0.88 | ) | |

| (30 | )% |

| All in cash cost (US$/lb)14 | |

| 2.89 | | |

| 3.96 | | |

| (1.07 | ) | |

| (27 | )% |

Metals Acquisition Limited’s CEO,

Mick McMullen, said:

“A record production,

earnings and cashflow for the CSA Copper Mine under MAC ownership despite the planned mill shutdown in April. The execution of the mine

plan lead to higher grade stopes being mined including our first successful double stope lift, with milled copper grade improving to

4.2% in the second quarter. This is an incredibly strong result when considered in the context of the bulk of the production and cash

flow coming from the last two months of the half year alone.

We ended the half year

with a large broken ore stockpile of high-grade ore which will underpin production over the second half of the year. Based on the reserve

plan, we expect copper production to slightly increase over the second half of the year with copper production tracking to mid-point

of 2024 guidance.

During the half year,

we also successfully listed on the ASX with the listing a major milestone and used the additional liquidity to help reduce our overall

interest-bearing liabilities by approximately US$160 million since the acquisition of the CSA Copper mine in June 2023, which further

support our strong balance sheet.

As part of the ongoing

turnaround and optimisation at the CSA Copper Mine, we also announced the new Reserve and Resource Statement, which is a snapshot in

time based on information available back in August 2023. As reported earlier in the half year, the new 2023 Reserves and Resources Statement

shows a substantial increase of 64% in contained copper after replacement of depletion to 0.5Mt in Ore Reserves at an average grade of

3.3% Cu, and an impressive 42% increase in total contained Cu after replacement of depletion to 0.7Mt in total Mineral Resources at an

average grade of 4.9% Cu, respectively, compared to the 2022 Reserve and Resource Statement. The operational performance and the resource

upgrade very much support our belief that the CSA Copper Mine is a high-quality, free cash flow generating, long life copper asset.

The performance of the

site team in the second part of this half year has showcased just what this mine can do when operations perform the way we know it can,

and the Board and I would like to express our thanks to the entire team for the strong performance.”

12 Refer to table 2 for the reconciliation of Underlying EBITDA

13 Refer to table 4 for the reconciliation of C1 cash cost

14 Refer to table 5 for the reconciliation of All in cash cost

IMPORTANT INFORMATION AND DISCLAIMER

Estimates of mineral resources and ore reserves and production

target

This release contains estimates of Ore Reserves

and Mineral Resources as well as a Production Target. The Ore Reserves, Mineral Resources and Production Target are reported in MAC’s

ASX Announcement dated 23 April 2024 titled ‘Updated Resource and Reserve Statement and Production Guidance’ (the R&R

Announcement). The Company is not aware of any new information or data that materially affects the information included in the R&R

Announcement, and that all material assumptions and technical parameters underpinning the estimates or Ore Reserves and Mineral Resources

in the R&R Announcement continue to apply and have not materially changed. The material assumptions underpinning the Production Target

in the R&R Announcement continue to apply and have not materially changed. It is a requirement of the ASX Listing Rules that the

reporting of ore reserves and mineral resources in Australia comply with the JORC Code. Investors outside Australia should note that

while exploration results, mineral resources and ore reserves estimates of MAC in this presentation comply with the JORC Code, they may

not comply with the relevant guidelines in other countries and, in particular, do not comply with (i) National Instrument 43-101 (Standards

of Disclosure for Mineral Projects) of the Canadian Securities Administrators; or (ii) the requirements adopted by the Securities and

Exchange Commission (SEC) in its Subpart 1300 of Regulation S-K. Information contained in this release describing mineral deposits may

not be comparable to similar information made public by companies subject to the reporting and disclosure requirements of Canadian or

US securities laws.

Forward looking statements

This release includes “forward-looking

statements.” The forward-looking information is based on the Company’s expectations, estimates, projections and opinions

of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements

are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of

copper, continuing commercial production at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals,

the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing

list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the

assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the

forward-looking information will prove to be accurate.

MAC’s actual results may differ from expectations,

estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words

or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation,

MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward -looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include,

but are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production,

costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated

reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in

geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and other risks and uncertainties indicated from

time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive.

MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does

not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements

to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information

on potential factors that could affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s

public reports filed with the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results

could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not

presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in

the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future

events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments

to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims

any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing MAC’s

assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward

- looking statements.

Non-IFRS financial information

MAC’s results are reported under International Financial Reporting Standards (IFRS), noting the results

in this report have not been audited or reviewed. This release may also include certain non-IFRS measures including C1 and Total Cash

costs. These C1 and Total Cash cost measures are used internally by management to assess the performance of our business, make decisions

on the allocation of our resources and assess operational management. Non-IFRS measures have not been subject to audit or review and should

not be considered as an indication of or alternative to an IFRS measure of financial performance.

C1 cash cost

C1 costs are defined as the

costs incurred to produce copper at an operational level. This includes costs incurred in mining, processing and general and administration

as well freight and realisation and selling costs. By-product revenue is credited against these costs to calculate a dollar per pound

metric. This metric is used as a measure operational efficiency to illustrate the cost of production per pound of copper produced.

All in cash cost

Total cash costs include C1 cash costs plus royalties and sustaining capital less inventory WIP movements. This metric

is used as a measure operational efficiency to further illustrate the cost of production per pound of copper produced whilst incurring

government-based royalties and capital to sustain operations.

Free cash flow

Free cash flow is defined as net cash provided by operating

activities less additions to property, plant, equipment and mineral interests. This measure, which is used internally to evaluate our

underlying cash generation performance and provides investors with the ability to evaluate our underlying performance.

Underlying EBITDA

Underlying EBITDA is profit before net finance costs, tax, depreciation and amortisation and after any earnings adjustment items,

impacting profit. We believe that Underlying EBITDA provides useful information, but should not be considered as an indication of, or

alternative to, profit or attributable profit as an indicator of operating performance.

FINANCIAL AND OPERATIONAL REVIEW

The Half Year Report reflects

the consolidated results of MAC and its subsidiaries (collectively referred to as the MAC, MAC Group or the Group). The

financial results of the MAC Group for the half year ended 30 June 2024 were largely driven by the operation of its core asset being

its 100% owned CSA Copper Mine. The CSA Copper Mine is an established, high grade, producing, underground copper mine, with estimated

ore reserves supporting approximately ten and a half years of operation as at 30 June 2024.

FINANCIAL PERFORMANCE SUMMARY

| | |

H1 FY24 | | |

H1 FY23 | | |

Change | |

| | |

| US$’000 | | |

| US$’000 | | |

| US$’000 | | |

| % | |

| Statutory financial measures | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 182,160 | | |

| 18,576 | | |

| 163,584 | | |

| 881 | % |

| Income/(loss) from operations - before net finance | |

| 46,019 | | |

| (19,507 | ) | |

| 65,526 | | |

| 336 | % |

| expenses and income tax expense | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period - after tax (NPAT) | |

| (102,169 | ) | |

| (32,263 | ) | |

| (69,906 | ) | |

| (217 | )% |

| Cash flows from operating activities | |

| 61,234 | | |

| (4,006 | ) | |

| 65,240 | | |

| 1,629 | % |

| Cash and cash equivalents | |

| 88,738 | | |

| 43,732 | | |

| 45,006 | | |

| 103 | % |

| Basic and diluted loss per ordinary share (US$ per share) | |

| (1.56 | ) | |

| (3.13 | ) | |

| 1.57 | | |

| 50 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Non-statutory measures | |

| | | |

| | | |

| | | |

| | |

| Underlying EBITDA15 | |

| 90,569 | | |

| 1,617 | | |

| 88,952 | | |

| 5,501 | % |

| Free cash flow | |

| 37,121 | | |

| (6,268 | ) | |

| 43,389 | | |

| 692 | % |

| C1 cash cost (US$/lb)16 | |

| 2.08 | | |

| 2.96 | | |

| (0.88 | ) | |

| (30 | )% |

| All in cash cost (US$/lb)17 | |

| 2.89 | | |

| 3.96 | | |

| (1.07 | ) | |

| (27 | )% |

Income statement analysis

Revenue

The 881% increase in MAC

Group’s H1 FY24 revenue when compared with H1 FY23 is primarily due to the acquisition of the CSA Copper Mine, which was acquired

on 16 June 2023 with H1 FY23 revenue only incorporating revenue earned from the CSA Copper Mine after its acquisition.

Production for H1 FY24

was not only impacted by a power outage from a storm event in March but also by a major planned maintenance shutdown in April. Despite

these disruptions, a sequential increase in copper produced and sold together with strong copper prices during H1 FY24 contributed towards

the record revenue and earnings under MAC ownership as summarised in the following table:

15 Refer to table 2 for the

reconciliation of Underlying EBITDA

16 Refer to table 4 for the reconciliation of C1 cash cost

17 Refer to table 5 for the reconciliation of All in cash cost

Table 1: Revenue break-down

| | |

Units | | |

H1 FY24 | | |

H1 FY23 | | |

Change | |

| Copper produced | |

| Tonnes | | |

| 19,650 | | |

| 1,283 | | |

| 18,367 | | |

| 1,432 | % |

| Copper sold | |

| Tonnes | | |

| 20,793 | | |

| 2,330 | | |

| 18,463 | | |

| 792 | % |

| Copper price achieved18 | |

| US$/lb | | |

| 4.14 | | |

| 3.88 | | |

| 0.26 | | |

| 7 | % |

| Gross copper revenue | |

| US$’000 | | |

| 189,569 | | |

| 19,929 | | |

| 169,640 | | |

| 851 | % |

| TC/RC | |

| US$’000 | | |

| (9,464 | ) | |

| (1,628 | ) | |

| (7,836 | ) | |

| 481 | % |

| Copper revenue | |

| US$’000 | | |

| 180,105 | | |

| 18,301 | | |

| 161,804 | | |

| 884 | % |

| Silver revenue | |

| US$’000 | | |

| 5,890 | | |

| 647 | | |

| 5,243 | | |

| 810 | % |

| Total revenue | |

| US$’000 | | |

| 185,995 | | |

| 18,948 | | |

| 167,047 | | |

| 882 | % |

| Freight costs | |

| US$’000 | | |

| (3,835 | ) | |

| (372 | ) | |

| (3,463 | ) | |

| 931 | % |

| Net revenue | |

| US$’000 | | |

| 182,160 | | |

| 18,576 | | |

| 163,584 | | |

| 881 | % |

Earnings analysis

Although MAC Group has

recorded a statutory loss after tax of US$102 million in H1 FY24, it was primarily impacted by net financing costs on loans and borrowings

of US$32 million and other non-cash movements in fair value on financial instruments. Overall financing costs in H1 FY23 were only US$14

million as the CSA Copper Mine was acquired on 16 June 2023. MAC’s H1 FY24 operating profit has increased by US$65 million and

Underlying EBITDA has increased by US$89 million. This is driven by the fact that H1 FY23 incorporated minimal operational activity as

the acquisition of the CSA Copper Mine occurred on 16 June 2023 while H1 FY24 reflects the earnings from ~19.7kt of Cu production and

~20.8kt of Cu sales together with improvement in production grade (from 2.9% in H1 FY23 to 3.8% in H1 FY24) and operational efficiencies

improvements.

Table 2: Reconciliation of loss after tax to Underlying

EBITDA

| | |

H1 FY24 | | |

H1 FY23 | | |

Change | |

| | |

| US$’000 | | |

| US$’000 | | |

| US$’000 | | |

| % | |

| Loss after tax (NPAT) | |

| (102,169 | ) | |

| (32,263 | ) | |

| (69,906 | ) | |

| (217 | )% |

| Income tax expense / (benefit) | |

| 7,066 | | |

| (1,469 | ) | |

| 8,535 | | |

| (581 | )% |

| Net finance costs | |

| 31,799 | | |

| 4,667 | | |

| 27,132 | | |

| 581 | % |

| Net change in fair value of financial instruments | |

| 109,323 | | |

| 9,558 | | |

| 99,765 | | |

| 1,044 | % |

| Operating profit / (loss) | |

| 46,019 | | |

| (19,507 | ) | |

| 65,526 | | |

| 336 | % |

| Organisational restructuring expenses | |

| 988 | | |

| 3,850 | | |

| (2,862 | ) | |

| (74 | )% |

| IPO and transaction costs19 | |

| 2,615 | | |

| 14,073 | | |

| (11,458 | ) | |

| (81 | )% |

| Other significant items20 | |

| 2,582 | | |

| - | | |

| 2,582 | | |

| N/a | |

| Depreciation and amortisation | |

| 38,365 | | |

| 3,201 | | |

| 35,164 | | |

| 1,099 | % |

| Underlying EBITDA | |

| 90,569 | | |

| 1,617 | | |

| 88,952 | | |

| 5,501 | % |

18 Before hedging impact

19 Related to the acquisition of the CSA Copper Mine and the ASX IPO costs

20 Includes discretionary bonuses

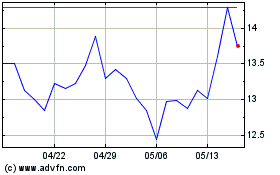

Graph 1: Reconciliation of loss after tax to Underlying EBITDA

Corporate and administration expenses

The US$7 million increase

in corporate and administration expenses, excluding non-routine expenses such as the IPO and transaction costs, during H1 FY24 reflects

the overall increase in the required level of corporate administration after the acquisition of the CSA Copper Mine and listing on the

ASX, noting that such level of activity was not required in H1 FY23 as the mine was only acquired on 16 June 2023 with the ASX listing

occurring on 16 February 2024.

Hedging

Prevailing copper prices

during H1 FY24 were higher than those locked in the commodity swap arrangement and lead to a hedging loss of US$6 million included within

finance costs (H1 FY23: Nil).

Balance sheet analysis

Cash and liquidity

At the end of H1 FY2024,

MAC had a cash balance of US$89 million and access to a US$25 million revolving facility providing it a liquidity of US$114 million (31

December 2023 cash and cash equivalents of US$32 million).

Loans and borrowings

Net reduction in current

and non-current loans and borrowings during the period was driven by US$40 million principal repayments of senior debt facility and US$5

million repayment of silver stream loan (H1 FY23: nil).

Other assets and liabilities

During H1 FY24, the Group

incurred capital expenditure of US$11 million in relation to the development of the CSA Copper Mine (H1 FY23: US$2 million) and acquired

other equipment and assets totalling US$18 million to support the mining operations (H1 FY23: US$16 million).

Redemption of public and

private warrants21 reduced the derivative financial liabilities by US$26 million. However, rising copper prices adversely

affected the fair valuation of derivative financial liabilities at the end of H1 FY24 and resulted in a net increase of US$20 million.

Payments of US$81 million

deferred consideration for the acquisition of the CSA Copper Mine and US$7 million underwriting costs were the main contributors in the

decrease in other financial liabilities to US$141 million (H1 FY23: US$226 million).

21 Refer to ASX release ‘Completion of the Redemption

of Warrants’ dated 11 June 2024

Cash flow statement analysis

Operating activities

MAC generated cash flows from operating

activities of US$61 million in H1 FY24 (outflow of US$4 million and US$8 million in H1 FY23). The cash flows from operating activities

were mainly a result of US$194 million received from Glencore against sale of Copper (US$38 million in H1 FY23), offset by US$110 million

paid to employees and suppliers (US$42 million in H1 FY23) and US$24 million of interest payments (none in H1 FY23).

Investing activities

Investing activities in H1 FY24 totalling

US$135 million (H1 FY23: US$ 756 million) primarily included consideration and transaction costs paid for the acquisition of the CSA

Copper Mine amounting to US$104 million (H1 FY23: US$771 million), US$11 million spent for the development of the CSA Copper Mine (H1

FY23: US$2 million) and US$3 million spent on exploration (H1 FY23: Nil).

Financing activities

In H1 FY24, US$214 million (A$325

million at A$17.00 per CDI), before costs, raised as part of the ASX listing was the main contributor of the net inflows from financing

activities. These were offset by repayment of senior debt, Glencore working capital loan and sliver stream loan totalling US$57 million

and underwriting costs of US$13 million. In H1 FY23, proceeds from the issuance of shares to private and public investors, before costs,

amounted to US$319 million and were complemented by proceeds from loans and borrowings of US$492 million which supported the acquisition

of the CSA Copper Mine.

Entities over which control has been gained or lost

during the period

In H1 FY24, the Company has not gained

or lost control over any entity. In H1 FY23, a restructure of the Company and its subsidiaries was undertaken pursuant to which, MAC’s

predecessor entity, Metals Acquisition Corp (MTL), merged with and into MAC, with MAC continuing as the surviving company. In addition,

on 16 June 2023, the Company, through its wholly owned subsidiary, Metals Acquisition Corp (Australia) Pty Ltd (MAC AU), acquired 100%

interest in shares and voting rights in Cobar Management Pty. Limited (CMPL) from Glencore Operations Australia Pty Limited (Glencore).

CMPL operates and owns the CSA Copper Mine near Cobar, New South Wales, Australia (the CSA Copper Mine).

OPERATIONS

Production

Physicals

H1 FY24 was affected by a power outage

from a storm event in March and a planned major shut of mill operations in April, which was offset by a ramp up in production over May

and June. Production further benefited from an increased grade of 4.2% in Q2 when compared with 3.5% in Q1, resulting in an average grade

of 3.80% for the half year. Mining methods have also been refined during the period with blasting techniques reviewed and updated. Double

lift stope extraction sequence performed better than expected, resulting in less mining dilution achieved with stronger grades and less

total ore tonnes for the same metal.

Table 3: Production physicals

| | |

Units | | |

H1 FY24 | | |

H1 FY23 | | |

Change | |

| Ore mined | |

| Tonnes | | |

| 527,500 | | |

| 47,349 | | |

| 480,151 | | |

| 1,014 | % |

| Tonnes milled | |

| Tonnes | | |

| 527,233 | | |

| 45,530 | | |

| 481,703 | | |

| 1,058 | % |

| Copper grade processed | |

| % | | |

| 3.80 | % | |

| 2.89 | % | |

| 0.91 | % | |

| 31 | % |

| Copper recovery | |

| % | | |

| 97.80 | % | |

| 97.61 | % | |

| 0.19 | % | |

| N/a | |

| Copper produced | |

| Tonnes | | |

| 19,650 | | |

| 3,201 | | |

| 16,449 | | |

| 514 | % |

| Silver produced | |

| Ounces | | |

| 236,254 | | |

| 3,201 | | |

| 233,053 | | |

| 7,281 | % |

Cost of production

H1 FY24 C1 cash cost decreased by

30% to US$2.08/lb from US$2.96/lb in H1 FY23. This was a result of higher production tonnes complemented by improved production resulting

from grade, operational efficiencies and consistency improvements in the second quarter of FY24.

Table 4: Reconciliation of cost of goods sold to C1

cash cost

| | |

H1 FY24 | | |

H1 FY23 | | |

Change | |

| Cost of goods sold | |

| 118,158 | | |

| 20,301 | | |

| 97,857 | | |

| 482 | % |

| Selling and distribution expenses | |

| 6,080 | | |

| 1,172 | | |

| 4,908 | | |

| 419 | % |

| Treatment and refining charges deducted from revenue | |

| 9,546 | | |

| 1,628 | | |

| 7,918 | | |

| 486 | % |

| Freight deducted from revenue | |

| 3,835 | | |

| 372 | | |

| 3,463 | | |

| 931 | % |

| Silver credit included in revenue | |

| (5,890 | ) | |

| (647 | ) | |

| (5,243 | ) | |

| 810 | % |

| Movements in copper concentrate included in cost of goods sold | |

| (165 | ) | |

| (10,684 | ) | |

| 10,519 | | |

| 98 | % |

| Total direct and indirect costs | |

| 131,564 | | |

| 12,142 | | |

| 119,422 | | |

| 984 | % |

| Depreciation and amortisation | |

| (38,365 | ) | |

| (3,201 | ) | |

| (35,164 | ) | |

| 1,099 | % |

| Total cash costs excluding capital spend | |

| 93,199 | | |

| 8,941 | | |

| 84,258 | | |

| 942 | % |

| Rates and royalties | |

| (3,126 | ) | |

| (570 | ) | |

| (2,912 | ) | |

| 511 | % |

| C1 cash cost | |

| 90,073 | | |

| 8,371 | | |

| 81,702 | | |

| 976 | % |

| Copper produced (lb’000) | |

| 43,320 | | |

| 2,828 | | |

| 40,492 | | |

| 1,432 | % |

| C1 cash cost/lb | |

| 2.08 | | |

| 2.96 | | |

| (0.88 | ) | |

| (30 | )% |

Table 5: Reconciliation of total cash costs excluding capital spend to All in cash cost

| | |

| H1 FY24 | | |

| H1 FY23 | | |

| Change | |

| Total cash costs excluding capital spend | |

| 93,199 | | |

| 8,941 | | |

| 84,258 | | |

| 942 | % |

| Sustaining capital | |

| 17,405 | | |

| 564 | | |

| 16,841 | | |

| 2,986 | % |

| Capitalised development | |

| 11,318 | | |

| 1,698 | | |

| 9,620 | | |

| 567 | % |

| Exploration | |

| 3,308 | | |

| - | | |

| 3,308 | | |

| N/a | |

| All in cash cost | |

| 125,230 | | |

| 11,203 | | |

| 114,027 | | |

| 1,018 | % |

| Copper produced (lb’000) | |

| 43,320 | | |

| 2,828 | | |

| 40,492 | | |

| 1,432 | % |

| All in cash cost/lb | |

| 2.89 | | |

| 3.96 | | |

| (1.07 | ) | |

| (27 | )% |

Mine Plan, Resource and Reserve

During H1 FY24, we announced

the release of the new 2023 Reserves and Resources Statement (R+R).22 The effective date for the R+R was 31 August 2023.

Acquisition of the remaining 10% interests in the

Shuttleton and Mt Hope Exploration Licence tenements

As part of the acquisition

of the CSA Copper Mine (CMPL) from Glencore in 2023, MAC Group also acquired two tenements (EL6223 and EL6907) which were part

of joint venture arrangements with AuriCula Mines Pty Limited (AuriCula), a wholly owned subsidiary of International Base Metals

Limited. The Shuttleton Joint Venture between CMPL (90)% and AuriCula (10)% covered EL6223, which is located approximately 75km south

of Cobar. The Mt Hope Joint Venture CMPL (90)% and AuriCula (10)% covered EL6907, which is located approximately 130km south of Cobar.

During H1 FY24, on 2 April

2024, CMPL entered into an agreement with AuriCula to acquire the remaining 10% beneficial interests in these tenures (EL6223 and EL6907)

that it did not already hold for A$200,000. Subsequent to H1 FY24, on 15 July 2024, all the conditions precedent to the agreement were

met and CMPL now holds 100% legal and beneficial title to all the mining and exploration tenure of these tenements (noting that some

tenure remains subject to pre-existing royalty arrangements).23

Exploration

During H1 FY24, MAC invested US$3 million in exploration,

and:

| ● | continued

resource development and exploration diamond drilling surrounding the upper Pb -Zn mineralisation

of the Eastern and Western Systems, for a total of 2,285m which confirmed the presence of

in situ, high-grade Pb-Zn material in the upper portions of the mine, within 10m to 40m of

existing development. |

| ● | continued

exploratory diamond drilling on CML5 for a total of 4,366m. The initial drilling has intersected

areas of structural complexity and base-metal geochemical anomalism indicating the potential

for buried base-metal mineralisation. Preliminary interpretation of the 2024 fixed-loop electromagnetic

geophysical survey data shows late-time anomalies, suggestive of deeply buried conductive

material, in proximity to and along trend of the drilling at the Cherry prospect. |

| ● | recommenced

extensional and infill diamond drilling at the shallow, high-grade QTSSU-A resource. |

| ● | continued

the high-powered Fixed-Loop Electromagnetic Geophysical Survey using low temperature Superconducting

Quantum Interference Device sensors. The survey, upon completion, will cover ~26km²

of highly prospective ground surrounding the CSA Mine on CML5 and encompassing exploration

licence EL5693. |

| ● | completed

multiple Downhole Electromagnetic Geophysical Surveys on underground and surface diamond

drillholes. |

ESG

Safety

The TRIFR for the CSA Copper Mine

at the end of H1 FY24 was 14.4 (H1 FY23: 9.86 and H2 FY23: 10.14). This is below the NSW underground metalliferous TRIFR average for

2023 of 15.5. Q2 2024 has not been favourable for safety performance with four contractor LTI’s, five MTI’s and two RWI recorded

for the period. June improved with no recordable injuries, showing a strong improvement from prior months. Plans are in place to implement

strategies to remediate the increase in TRIFR through increased awareness via extensive training and coaching, as well as increased safety

presence on site.

22 Refer to ASX release ‘Updated

Resource & Reserve Statement & Production Guidance’ dated 23 April 2024.

23 Refer to ASX release ‘June

2024 Quarterly Activities Report’ dated 23 July 2024

Graph 2: 12 Months TRIFR Average: CSA vs Industry

Regulatory

The CSA Mine Rehabilitation

Objectives Statement, Final Landform and Rehabilitation Plan, the Annual Rehabilitation Report and the CSA Mine Forward Program have

all been approved by the NSW Resources Regulator. Scoping is currently underway for alternate energy providers for a mix of both wind

and solar, to potentially secure long term energy security, pricing and reductions in greenhouse gas emissions.

The STSF Stage 9 buttress

bulk earthworks are now complete. Geochemical testing is being completed for Stage 10 material, with the tendering process under way.

Appointment of Ms Leanne Heywood

As announced on the 1st

of May 2024, Ms Leanne Heywood has been appointed as a Non-Executive Director of the Company’s Board of Directors, effective 1

May 2024. Ms Heywood is an experienced non -executive director with broad general management experience gained through an international

career in the mining sector, including 10 years with the Rio Tinto Copper Group.

Appointment of Ms Anne Templeman-Jones

As announced on 23 July 2024, Ms Templeman-Jones has been

appointed as a Non-Executive Director of the Company’s Board of Directors, effective 23 July 2024. Ms Templeman-Jones is an

accomplished listed company director with substantial financial, operational risk, regulatory, governance and strategy experience

from a number of industries, including banking and finance, engineering services in the energy sector, consumer goods and

manufacturing.

In addition to Metals Acquisition

Limited, Ms Templeman-Jones currently serves as a Non-Executive Director, and has been responsible for a diverse range of committee chairs

and memberships for Commonwealth Bank of Australia (Director since March 2018) and Trifork Ag (Director since April 2021). From November

2017 until 1 July 2024, Ms Templeman-Jones was a director of Worley Limited.

Change of Glencore Nominee Director

Mr Mohit Rungta will replace

Mr Matt Rowlinson and Mr John Burton as Glencore’s nominee Director to the Company’s Board of Directors. Glencore is entitled

to nominate one Director for every 10% it holds in the Company. Following completion of the Company’s ASX listing and recent warrant

redemption Glencore now has a 13.5% interest (entitling it to one nominee).

Warrant redemption

On 6 May 2024, MAC announced

that it would redeem all public and private placement warrants that remained outstanding at 5:00 p.m. New York City time on 5 June 2024

for a redemption price of US$0.10 per Warrant and issue ordinary shares of the Company having par value of US$0.0001 per share there

against.

1,026 Warrants were exercised

at an exercise price of $11.50 per Ordinary Share and 15,344,751 Warrants were exercised on a “cashless basis,” resulting

in the exercise of approximately 99.82% of the outstanding Warrants (of which approximately 0.01% were exercised for cash and 99.81%

were exercised on a “cashless basis”) and in the issuance of an aggregate of 4,701,071 Ordinary Shares. The remaining 27,753

Warrants remained unexercised on the Redemption Date and were redeemed by the Company for cash. Accordingly, the Company will have 74,055,263

Ordinary Shares and no public warrants or private placement warrants outstanding as a result of the redemption of the Warrants. The Company

continues to have 3,187,500 financing warrants outstanding to purchase Ordinary Shares, which were issued to Sprott Private Resource

Lending II (Collector-2), LP in connection with a mezzanine loan note facility entered into on March 10, 2023.

Three year production guidance

The copper production guidance provided to the market covering

2024, 2025 and 2026 remains unchanged:

Table 6: CSA Copper Mine Production Guidance

| Year | |

2024 | | |

2025 | | |

2026 | |

| | |

Low | | |

High | | |

Low | | |

High | | |

Low | | |

High | |

| Copper Production (t) | |

| 38,000 | | |

| 43,000 | | |

| 43,000 | | |

| 48,000 | | |

| 48,000 | | |

| 53,000 | |

This 3-year production

guidance is based primarily on Ore Reserves but also on measured and indicated Mineral Resources (as at 31 August 2023) and, given that

all the deposits are open and a large drill program is underway, we consider it likely that there will be changes over the relevant period

as the Company’s overall plan to continue operational and production improvement continues to develop.

Hedging

At the end of June 2024, the remaining copper hedge book consisted

of the following:

Table 7: Hedge position

| | |

| | |

Copper | | |

| |

| | |

2024 | | |

2025 | | |

2026 | | |

Total | |

| Future Sales (t) | |

| 6,210 | | |

| 12,420 | | |

| 5,175 | | |

| 23,805 | |

| Future Sales ($/t) | |

| 3.72 | | |

| 3.72 | | |

| 3.72 | | |

| 3.72 | |

DIRECTORS’

REPORT

The directors present

their report together with the consolidated financial statements of Metals Acquisition Limited (MAC or the Company) and

its subsidiaries, Metals Acquisition Corp. (Australia) Pty Ltd (MAC AU) and Cobar Management Pty Ltd (CMPL) (together the

Group) for the half year ended 30 June 2024 and the auditors’ review report thereon.

Directors

The directors of the Company at any time during or since the end of

the financial year are:

| Name |

Role |

|

| Ms Patrice Merrin |

Chair |

|

| Mr Michael McMullen |

Chief Executive Officer |

|

| Mr Rasmus Gerdeman |

Audit Chair |

|

| Mr Graham van’t Hoff |

Independent Non-Executive

Director |

|

| Mr Charles McConnell |

Independent Non-Executive

Director |

|

| Mr John Rhett Miles Bennett |

Independent Non-Executive

Director |

(Resigned on 3 April 2024) |

| Ms Leanne Heywood |

Independent Non-Executive

Director |

(Appointed on 1 May 2024) |

| Ms Anne Templeman-Jones |

Independent Non-Executive

Director |

(Appointed on 22 July 2024) |

| Mr Mohit Rungta |

Glencore nominated Non-Executive

Director |

(Appointed on 22 July 2024) |

| Mr Matthew Rowlinson |

Glencore nominated Non-Executive

Director |

(Resigned on 22 July 2024) |

| Mr John Burton |

Glencore nominated Non-Executive

Director |

(Resigned on 22 July 2024) |

The directors held office for the entire period unless otherwise stated.

Principal activities

The principal activities of the Group during

the course of the half year were the operation of the CSA Copper Mine in Australia for the mining and production of copper and silver.

The CSA Copper Mine is an established, high grade,

producing, underground copper mine, with current estimated Ore Reserves supporting approximately ten and a half years of operation.

There were no other significant changes in the nature of the activities

of the Group during the half year.

Review of the results and operations

The review of the results and operations of the Group is set

out on pages 6 to 13, and forms part of the Directors’ Report.

Dividends

No dividends were declared and paid by the Company to its members

in respect of the half year ended 30 June 2024 (2023: $nil).

Auditor’s Independence

The Directors obtained an independence declaration from the Company’s

auditors, Ernst & Young.

This directors’ report is made out in accordance with a resolution

of the directors:

| Patrice Merrin | M McMullen |

| Chair | CEO |

Dated at Perth this 29th day of August 2024

Metals

Acquisition Limited

Half

year financial statements

for

the six months ended 30 June 2024

Metals Acquisition Limited

Half year financial statements

for the six months ended 30 June

2024

| Contents |

Page |

| Condensed

consolidated financial statements |

|

| Condensed

consolidated statement of comprehensive income |

17 |

| Condensed

consolidated statement of financial position |

18 |

| Condensed

consolidated statement of changes in equity |

19 |

| Condensed consolidated

statement of cash flows |

20 |

| Notes to the

condensed consolidated financial statements |

21 |

Metals Acquisition Limited

Condensed consolidated statement of

comprehensive income

for the six months ended

| | |

| | |

30 June | | |

30 June | |

| US$ thousand | |

Notes | | |

2024 | | |

2023 | |

| Revenue | |

| 6 | | |

| 182,160 | | |

| 18,576 | |

| Cost of goods sold | |

| | | |

| (118,158 | ) | |

| (20,301 | ) |

| Administrative expenses | |

| | | |

| (12,222 | ) | |

| (16,610 | ) |

| Selling and distribution expenses | |

| | | |

| (6,080 | ) | |

| (1,172 | ) |

| Other income, net | |

| | | |

| 319 | | |

| - | |

| Income/(loss) from operations | |

| | | |

| 46,019 | | |

| (19,507 | ) |

| | |

| | | |

| | | |

| | |

| Finance income | |

| 7 | | |

| 1,652 | | |

| 5,460 | |

| Finance costs | |

| 7 | | |

| (33,451 | ) | |

| (10,127 | ) |

| Net change in fair value of financial

instruments | |

| 7 | | |

| (109,323 | ) | |

| (9,558 | ) |

| Net finance costs | |

| | | |

| (141,122 | ) | |

| (14,225 | ) |

| | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| | | |

| (95,103 | ) | |

| (33,732 | ) |

| Income tax (expense)/benefit | |

| 8 | | |

| (7,066 | ) | |

| 1,469 | |

| Net loss for the period | |

| | | |

| (102,169 | ) | |

| (32,263 | ) |

| | |

| | | |

| | | |

| | |

| Total comprehensive loss for the

period | |

| | | |

| (102,169 | ) | |

| (32,263 | ) |

| | |

| | | |

| | | |

| | |

| Basic and diluted loss per ordinary share | |

| | | |

| (1.56 | ) | |

| (3.13 | ) |

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Metals Acquisition Limited

Condensed

consolidated statement of financial position

as at

| | |

| | |

| | |

31 December | |

| | |

| | |

30 June | | |

2023 | |

| US$ thousand | |

Notes | | |

2024 | | |

Restated* | |

| Assets | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| | | |

| 88,738 | | |

| 32,372 | |

| Trade and other receivables | |

| | | |

| 8,509 | | |

| 33,242 | |

| Inventories | |

| 9 | | |

| 22,683 | | |

| 21,528 | |

| Derivative financial assets | |

| 15 | | |

| - | | |

| 234 | |

| Prepayments and other current assets | |

| | | |

| 926 | | |

| 1,560 | |

| Total current assets | |

| | | |

| 120,856 | | |

| 88,936 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment | |

| 10 | | |

| 1,184,694 | | |

| 1,194,480 | |

| Exploration and evaluation | |

| | | |

| 21,271 | | |

| 17,918 | |

| Inventories | |

| 9 | | |

| 261 | | |

| 300 | |

| Investments | |

| | | |

| 1,351 | | |

| - | |

| Derivative financial assets | |

| 15 | | |

| - | | |

| 3,767 | |

| Prepayments and other non-current assets | |

| | | |

| 174 | | |

| 67 | |

| Total non-current assets | |

| | | |

| 1,207,751 | | |

| 1,216,532 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| | | |

| 1,328,607 | | |

| 1,305,468 | |

| | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Trade and other payables | |

| | | |

| 34,447 | | |

| 86,425 | |

| Lease liability | |

| | | |

| 4,475 | | |

| 5,848 | |

| Loans and borrowings | |

| 11 | | |

| 51,637 | | |

| 68,909 | |

| Derivative financial liabilities | |

| 15 | | |

| 30,163 | | |

| 17,130 | |

| Current tax liability | |

| | | |

| 4,321 | | |

| 1,137 | |

| Provisions | |

| 12 | | |

| 13,186 | | |

| 13,273 | |

| Other financial liabilities | |

| 13 | | |

| 5,043 | | |

| 94,689 | |

| Total current liabilities | |

| | | |

| 143,272 | | |

| 287,411 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Lease liability | |

| | | |

| 8,054 | | |

| 9,958 | |

| Loans and borrowings | |

| 11 | | |

| 362,225 | | |

| 379,966 | |

| Derivative financial liabilities | |

| 15 | | |

| 84,201 | | |

| 81,397 | |

| Deferred tax liability | |

| 8 | | |

| 127,629 | | |

| 124,084 | |

| Provisions | |

| 12 | | |

| 25,084 | | |

| 28,505 | |

| Liability for cash-settled share-based payments | |

| | | |

| 5,180 | | |

| 3,193 | |

| Other financial liabilities | |

| 13 | | |

| 136,205 | | |

| 122,927 | |

| Total non-current liabilities | |

| | | |

| 748,578 | | |

| 750,030 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| | | |

| 891,850 | | |

| 1,037,441 | |

| | |

| | | |

| | | |

| | |

| Net assets | |

| | | |

| 436,757 | | |

| 268,027 | |

| | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 16 | | |

| 7 | | |

| 5 | |

| Share premium | |

| 16 | | |

| 703,192 | | |

| 432,295 | |

| Other capital reserves | |

| 16 | | |

| 1,212 | | |

| 1,212 | |

| Accumulated deficit | |

| | | |

| (267,654 | ) | |

| (165,485 | ) |

| Total equity | |

| | | |

| 436,757 | | |

| 268,027 | |

The accompanying notes are an integral part of these condensed

consolidated financial statements.

*Refer to Note 20 for details of the restatement of comparatives.

Metals Acquisition Limited

Condensed

consolidated statement of changes in equity

for the six months ended 30 June 2024 and 2023

| US$ thousand |

|

|

Notes |

|

|

|

Share

capital |

|

|

|

Share

premium |

|

|

|

Other

capital

reserves |

|

|

|

Accumulated

deficit |

|

|

|

Total |

|

| Balance as of 1 January 2024 |

|

|

|

|

|

|

5 |

|

|

|

432,295 |

|

|

|

1,212 |

|

|

|

(165,485 |

) |

|

|

268,027 |

|

| ASX capital raise |

|

|

16 |

|

|

|

2 |

|

|

|

211,708 |

|

|

|

- |

|

|

|

- |

|

|

|

211,710 |

|

| Shares issuance costs |

|

|

16 |

|

|

|

- |

|

|

|

(6,912 |

) |

|

|

- |

|

|

|

- |

|

|

|

(6,912 |

) |

| Shares issued on redemption of warrants |

|

|

16 |

|

|

|

- |

|

|

|

65,854 |

|

|

|

- |

|

|

|

- |

|

|

|

65,854 |

|

| Shares issued on redemption of DSUs |

|

|

16 |

|

|

|

- |

|

|

|

246 |

|

|

|

- |

|

|

|

- |

|

|

|

246 |

|

| Net loss |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(102,169 |

) |

|

|

(102,169 |

) |

| Balance as of 30 June 2024 |

|

|

|

|

|

|

7 |

|

|

|

703,192 |

|

|

|

1,212 |

|

|

|

(267,654 |

) |

|

|

436,757 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of 1 January 2023 |

|

|

|

|

|

|

1 |

|

|

|

24 |

|

|

|

945 |

|

|

|

(20,931 |

) |

|

|

(19,961 |

) |

| Contribution of conversion price in excess of fair value of warrants |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

198 |

|

|

|

- |

|

|

|

198 |

|

| Amount in excess of the face value over the present value on related promissory

note |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

69 |

|

|

|

- |

|

|

|

69 |

|

| Shares issued to private placement investors |

|

|

|

|

|

|

3 |

|

|

|

259,514 |

|

|

|

- |

|

|

|

- |

|

|

|

259,517 |

|

| Shares issued to Osisko under the Redemptions Backstop Facility |

|

|

|

|

|

|

- |

|

|

|

25,000 |

|

|

|

- |

|

|

|

- |

|

|

|

25,000 |

|

| Shares issued to public shareholders on non- redemption |

|

|

|

|

|

|

- |

|

|

|

34,431 |

|

|

|

- |

|

|

|

- |

|

|

|

34,431 |

|

| Rollover shares issued to Glencore |

|

|

|

|

|

|

1 |

|

|

|

99,999 |

|

|

|

- |

|

|

|

- |

|

|

|

100,000 |

|

| Shares issuance costs |

|

|

|

|

|

|

- |

|

|

|

(5,763 |

) |

|

|

- |

|

|

|

- |

|

|

|

(5,763 |

) |

| Net loss |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(32,263 |

) |

|

|

(32,263 |

) |

| Balance as of 30 June 2023 |

|

|

|

|

|

|

5 |

|

|

|

413,205 |

|

|

|

1,212 |

|

|

|

(53,194 |

) |

|

|

361,228 |

|

The accompanying notes are an integral part of these condensed consolidated

financial statements.

Metals Acquisition Limited

Condensed

consolidated statement of cash flows

for the six months ended

| | |

30 June | | |

30 June | |

| US$ thousand | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

| (95,103 | ) | |

| (33,732 | ) |

| Adjustments to reconcile net loss to net cash used in operating

activities: | |

| | | |

| | |

| Depreciation and amortisation | |

| 38,365 | | |

| 3,201 | |

| Net foreign exchange gains | |

| (886 | ) | |

| (130 | ) |

| Finance income | |

| (766 | ) | |

| (5,330 | ) |

| Finance costs | |

| 33,451 | | |

| 10,127 | |

| Net change in fair value measurements of financial assets and liabilities | |

| 109,323 | | |

| 9,558 | |

| Movement in provisions | |

| (2,187 | ) | |

| 1,057 | |

| Other non-cash transactions | |

| (2,099 | ) | |

| (133 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Decrease/(increase) in trade receivables due from related parties | |

| 24,524 | | |

| (18,576 | ) |

| Decrease/(increase) in other receivables | |

| 336 | | |

| (611 | ) |

| Decrease in prepayments | |

| 529 | | |

| 1,095 | |

| (Increase)/decrease in inventories | |

| (1,048 | ) | |

| 10,292 | |

| Increase in trade payables to related parties | |

| - | | |

| 484 | |

| Decrease in trade payables | |

| (388 | ) | |

| (3,042 | ) |

| Increase in other payables | |

| (9,622 | ) | |

| 26,800 | |

| Decrease in derivative financial instruments | |

| (11,593 | ) | |

| - | |

| Increase in liability for cash-settled share-based payments | |

| 4,627 | | |

| - | |

| Decrease in deferred liabilities | |

| (3,057 | ) | |

| (5,066 | ) |

| Cash used in operating activities | |

| 84,406 | | |

| (4,006 | ) |

| Interest received | |

| 766 | | |

| - | |

| Interest paid | |

| (23,938 | ) | |

| - | |

| Net cash from/(used in) operating activities | |

| 61,234 | | |

| (4,006 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property, plant, and equipment and intangibles | |

| (24,113 | ) | |

| (2,262 | ) |

| Proceeds from disposal of property, plant, and equipment | |

| - | | |

| 16,564 | |

| Exploration and evaluation | |

| (3,308 | ) | |

| - | |

| Investment in a listed entity | |

| (1,846 | ) | |

| - | |

| Acquisition of subsidiary | |

| (81,129 | ) | |

| (770,516 | ) |

| Payment of contingent royalty consideration | |

| (1,815 | ) | |

| - | |

| Stamp duty paid on acquisition of subsidiary | |

| (23,213 | ) | |

| - | |

| Net cash used in investing activities | |

| (135,424 | ) | |

| (756,214 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issue of share capital | |

| 204,796 | | |

| 313,186 | |

| Payment of deferred underwriting and transaction costs | |

| (12,968 | ) | |

| - | |

| Proceeds from convertible promissory note - related party | |

| - | | |

| 300 | |

| Proceeds from issue of promissory note | |

| - | | |

| 1,082 | |

| Proceeds from loans and borrowings | |

| - | | |

| 476,657 | |

| Proceeds from working capital loan - related party | |

| - | | |

| 15,000 | |

| Repayment of loans and borrowings | |

| (45,441 | ) | |

| - | |

| Repayment of working capital loan - related party | |

| (11,522 | ) | |

| - | |

| Repayment of promissory note | |

| - | | |

| (1,869 | ) |

| Payment of lease liabilities | |

| (4,002 | ) | |

| (29 | ) |

| Net cash from financing activities | |

| 130,863 | | |

| 804,327 | |

| | |

| | | |

| | |

| Net change in cash | |

| 56,673 | | |

| 44,107 | |

| Cash, beginning of the period | |

| 32,372 | | |

| 42 | |

| Net foreign exchange difference | |

| (307 | ) | |

| (417 | ) |

| Cash, end of the period | |

| 88,738 | | |

| 43,732 | |

The accompanying notes are an integral part of these condensed consolidated

financial statements.

Metals Acquisition Limited

Notes to the condensed consolidated financial statements

Index of the notes to the condensed consolidated financial statements

| 1. |

Corporate information |

22 |

| 2. |

Basis of accounting |

22 |

| 3. |

Changes in accounting standards and the Group’s accounting policies |

22 |

| 4. |

Use of judgements and estimates |

23 |

| 5. |

Segment information |

23 |

| 6. |

Revenue |

23 |

| 7. |

Finance income and costs |

24 |

| 8. |

Income taxes |

24 |

| 9. |

Inventories |

25 |

| 10. |

Property, plant and equipment |

25 |

| 11. |

Loans and borrowings |

25 |

| 12. |

Provisions |

26 |

| 13. |

Other financial liabilities |

26 |

| 14. |

Financial instruments and financial risk management |

27 |

| 15. |

Fair value measurement |

28 |

| 16. |

Share capital |

34 |

| 17. |

Related party disclosures |

34 |

| 18. |

Commitments and contingencies |

35 |

| 19. |

Subsequent events |

36 |

| 20. |

Restatement of comparatives |

36 |

Metals Acquisition Limited

Notes

to the condensed consolidated financial statements

(continued)

Metals Acquisition Limited (“MAL”,

the “Company” or “we”), is a Company incorporated under the laws of Jersey, with limited liability. MAL was incorporated

on 29 July 2022 with registered address 3rd Floor, 44 Esplanade St. Helier, JE4 9WG, Jersey. The Company and its subsidiaries (collectively

referred herein as the “Group”) are primarily engaged in the operation of the Cornish, Scottish and Australian underground

copper mine (the “CSA mine”) in Australia, owned by Cobar Management Pty Limited (“CMPL”), one of the wholly owned

subsidiaries of the Company. The principal place of business of the Company is 3rd Floor, 44 Esplanade St. Helier, JE4 9WG, Jersey.

| (a) | Statement of compliance |

These condensed consolidated interim

financial statements (“interim financial statements”) of the Group are general purpose financial statements prepared in accordance

with IAS 34 Interim Financial Reporting.

These interim financial statements

do not include all of the information required for a complete set of annual financial statements and should be read in conjunction with

the annual financial statements of the Group for the year ended 31 December 2023. However, selected explanatory notes are included to

explain events and transactions that are significant to an understanding of the changes in the Group’s financial position and performance

since the last annual consolidated financial statements as at and for the year ended 31 December 2023.

These interim financial statements

reflect all adjustments, which consist of normal and recurring adjustments necessary to present fairly the financial position as at 30

June 2024 and the results of operations and cash flows for the six months ended 30 June 2024 (“interim reporting period”).

Operating results for the six months ended 30 June 2024 are not necessarily indicative of the results that may be expected for the full

year ending 31 December 2024.

These interim financial statements

have been prepared on an accruals basis and are based on historical cost except for certain financial assets and liabilities which are

measured at fair value. Historical cost is generally based on the fair values of the consideration given in exchange for assets.

All values in these interim financial

statements are rounded to the nearest thousand, except where otherwise indicated.

| (c) | Functional and presentation currency |

These interim financial statements

are presented in U.S. dollars (“USD”, “US$” or “$”), which is the Group’s functional currency.

These interim financial statements

have been prepared on a going concern basis, which contemplates the continuity of normal business activities and the realisation of assets

and the settlement of liabilities in the ordinary course of business.

As at 30 June 2024, the Group’s

current liabilities exceed current assets by $22,416 thousand (31 December 2023: $198,475 thousand). Management have prepared cashflow

forecast for the period covering at least 12 months from the date of these interim financial statements to support the assessment of going

concern, which anticipates that the Group will be able to pay its debts as and when they fall due during this period without drawing down

on any additional funding. Noting the inherent risks associated with achieving the cashflow forecast, key assumptions in the cashflow

forecast include:

| · | The CSA mine achieving copper production within the guidance range announced by the Company; |

| · | The Group continuing to maintain the efficiencies achieved within the CSA mine; and |

| · | The CSA mine producing sufficient cash inflows to fund MAL’s financing arrangements. |

The Directors have a reasonable expectation

that these assumptions can be satisfied and believe it is appropriate to prepare these interim financial statements on a going concern

basis. In the event that the key assumptions noted above are not achieved and additional funding is required, the Group can seek alternative

sources of funding which the Directors believe would be available including the draw down of any revolving facilities.

| 3. | Changes in accounting standards and the Group’s accounting

policies |

The accounting policies applied in

these interim financial statements are consistent with those applied in the Group’s full year consolidated financial statements.

The Group has not early adopted any standard, interpretation or amendment that has been issued but is not yet effective. Several amendments

apply for the first time in 2024, but do not have a material impact on the interim financial statements of the Group.

Metals Acquisition Limited

Notes

to the condensed consolidated financial statements

(continued)

| 4. | Use of judgements and estimates |

In preparing these interim financial

statements, management has made judgements and estimates that affect the application of the Group’s accounting policies and the

reported amounts of assets, liabilities, income and expenses.

Actual results may differ from these estimates.

The significant judgements made by

management in applying the Group’s accounting policies and the key sources of estimation uncertainty were the same as those described

in the full year consolidated financial statements.

Estimates and underlying assumptions

are reviewed on an ongoing basis and are consistent with the Group’s risk management commitments, where appropriate. Revisions to

estimates are recognised prospectively.

Measurement of fair values

A number of the Group’s accounting

policies require the measurement of fair values, for both financial assets and liabilities and non-financial assets and liabilities.

Fair value is the price that would

be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value

of an asset or a liability, the Group takes into account the characteristics of the asset or liability if market participants would take

those characteristics into account when pricing the asset or liability at the measurement date. Fair value for measurement and/or disclosure

purposes in these interim financial statements is determined on such a basis, except for leasing transactions that are within the scope

of IFRS 16 Leases (“IFRS 16”), and measurements that have some similarities to fair value but are not fair value, such

as net realisable value in IAS 2 Inventories (“IAS 2”) or value in use in IAS 36 Impairment of Assets (“IAS

36”).

In addition, for financial reporting

purposes, fair value measurements are categorised into Level 1, 2 or 3 based on the degree to which the inputs to the fair value measurements

are observable and the significance of the inputs to the fair value measurement in its entirety, which are described as follows:

| · | Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets

or liabilities that the entity can access at the measurement date; |

| · | Level 2 inputs are inputs, other than quoted prices included within Level 1, that

are observable for the asset or liability, either directly or indirectly; and |

| · | Level 3 inputs are unobservable inputs for the asset or liability. |

Further information about the assumptions made in measuring

fair values is included in Note 15.

The chief operating decision maker

has been identified as the Chief Executive Officer ("CEO"). The CEO makes decisions with respect to allocation of resources

and assesses performance of the Group. The Group is organised and operates in one single operating segment focused on the mining and production

of copper and silver from the CSA mine. As such the performance of the Group is assessed and managed in totality.

| | |

Six months ended 30 June | |

| US$ thousand | |

2024 | | |

2023 | |

| Sale of commodities – Copper | |

| 176,270 | | |

| 17,929 | |

| Sale of commodities – Silver | |

| 5,890 | | |

| 647 | |

| Total | |

| 182,160 | | |

| 18,576 | |

Revenue is derived principally from

the sale of commodities, recognised once the control of the goods has transferred from the Group to the customer.

Products of the Group may be provisionally

priced at the date revenue is recognised. As at 30 June 2024, the Group had 9,659 payable copper metal tonnes of provisionally priced

copper sales subject to final pricing over the next several months (31 December 2023: 2,680.34 payable copper metal tonnes). The average

provisional price per tonne of these provisionally priced sales subject to final pricing is $9,813.77 (31 December 2023: $8,451.90). Impact

of provisionally priced sales is accounted under IFRS 9 Financial Instruments (“IFRS 9”). Final settlements are recognised

within revenue.

Metals Acquisition Limited

Notes to

the condensed consolidated financial statements

(continued)