Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas” or the

“

Company”) announced that it intends to offer and

sell, subject to market conditions, 55,000,000 of its common shares

(the “

Common Shares”) in an underwritten public

offering (the “

Offering”). All of the Common

Shares to be sold in the Offering will be offered by Lithium

Americas. The Offering is subject to market and other conditions,

and there can be no assurance as to whether or when the Offering

may be completed, or as to the actual size or terms of the

Offering. Lithium Americas also expects to grant the underwriters a

30-day option to purchase up to an additional 15% of the Common

Shares (the “

Over-Allotment Option”).

Evercore ISI, Goldman

Sachs & Co. LLC and BMO Capital Markets (together, the

“Lead Underwriters”) will lead a syndicate of

underwriters and are acting as the co-lead book-running managers

for the proposed Offering.

The Offering will be

made in the United States by way of a prospectus supplement (the

“U.S. Prospectus Supplement”) to

the Company’s existing base shelf prospectus (the

“U.S. Base Shelf Prospectus”)

forming part of an effective registration statement on Form F-3

(File No. 333-274883) (the “Registration

Statement”), and will be made in Canada by way of a

prospectus supplement (the “Canadian Prospectus

Supplement”, together with the U.S. Prospectus Supplement,

the “Prospectus Supplements”) to the Company’s

existing base shelf prospectus (the “Canadian Base Shelf

Prospectus”, together with the U.S. Base Shelf Prospectus,

the “Base Shelf Prospectuses”). The Offering is

being made in the United States and in each of the provinces and

territories of Canada, except Québec. The Prospectus Supplements,

the Base Shelf Prospectuses and the Registration Statement contain

important information about the Company and the proposed Offering.

Prospective investors should read the Prospectus Supplements, the

Base Shelf Prospectuses and the Registration Statement and the

other documents the Company has filed before making an investment

decision. The preliminary Canadian Prospectus Supplement (together

with the related Canadian Base Shelf Prospectus) is available on

SEDAR+ at www.sedarplus.ca. The preliminary U.S. Prospectus

Supplement (together with the Registration Statement) is available

on the U.S. Securities and Exchange Commission’s website at

www.sec.gov. Alternatively, the final U.S. Prospectus Supplement

(together with the Registration Statement) may be obtained, when

available, upon request by contacting Evercore Group L.L.C.,

Attention: Equity Capital Markets, 55 East 52nd Street, 35th Floor,

New York, NY 10055 by telephone at (888) 474-0200 or by email at

ecm.prospectus@evercore.com; Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York, NY

10282 by telephone at (866) 471-2526 or by email at

prospectus-ny@ny.email.gs.com; or BMO Nesbitt Burns Inc.,

Attention: Brampton Distribution Centre C/O The Data Group of

Companies, 9195 Torbram Road, Brampton, Ontario L6S 6H2, by

telephone at 905-791-3151 EXT 4312 or by email at

torbramwarehouse@datagroup.ca.

This news release does

not constitute an offer to sell or the solicitation of an offer to

buy securities, nor will there be any sale of the securities in any

province, territory, state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such province,

territory, state or jurisdiction. The securities being offered have

not been approved or disapproved by any regulatory authority, nor

has any such authority passed upon the accuracy or adequacy of the

Prospectus Supplements, the Base Shelf Prospectuses or the

Registration Statement.

ABOUT LITHIUM AMERICAS

The Company is a Canadian-based lithium resource

company that owns 100% of the Thacker Pass project located in

Humboldt County in northern Nevada, through its wholly-owned

subsidiary, Lithium Nevada Corp.

INVESTOR

CONTACT

Virginia Morgan, VP, IR and

ESG+1-778-726-4070ir@lithiumamericas.com

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation, and “forward-looking statements” within the meaning of

the United States Private Securities Litigation Reform Act of 1995

(collectively referred to as “forward-looking information”

(“FLI”)). All statements, other than statements of

historical fact, are FLI and can be identified by the use of

statements that include, but are not limited to, words, such as

“anticipate,” “plan,” “continues,” “estimate,” “expect,” “may,”

“will,” “projects,” “predict,” “proposes,” “potential,” “target,”

“implement,” “scheduled,” “forecast,” “intend,” “would,” “could,”

“might,” “should,” “believe” and similar terminology, or statements

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved. FLI in this news

release includes, but is not limited to, statements related to the

Offering, including the size of the Offering, the Over-Allotment

Option, and other terms of the Offering, as well as the completion

of the Offering; as well as other statements with respect to

management’s beliefs, plans, estimates and intentions, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations that are not historical

facts.

FLI involves known and unknown risks,

assumptions and other factors that may cause actual results or

performance to differ materially. FLI reflects the Company’s

current views about future events, and while considered reasonable

by the Company as of the date of this news release, are inherently

subject to significant uncertainties and contingencies.

Accordingly, there can be no certainty that they will accurately

reflect actual results. Assumptions upon which such FLI is based

include, without limitation, the ability to raise financing in a

timely manner and on acceptable terms; all regulatory approvals

required for the Offering will be obtained in a timely manner; all

conditions precedent to the completion of the Offering will be

fulfilled in a timely manner; that the Offering will be completed;

as well as assumptions concerning general economic and industry

growth rates, commodity prices, currency exchange and interests

rates and competitive conditions. Although the Company believes

that the assumptions and expectations reflected in such FLI are

reasonable, the Company can give no assurance that these

assumptions and expectations will prove to be correct.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. There can be no assurance that FLI

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information.

As such, readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein and in the

preliminary Canadian and U.S. Prospectus Supplements, the Base

Shelf Prospectuses and the Registration Statement, including the

documents incorporated therein by reference.

The FLI contained in this news release is

expressly qualified by these cautionary statements. All FLI in this

news release speaks as of the date of this news release. The

Company does not undertake any obligation to update or revise any

FLI, whether as a result of new information, future events or

otherwise, except as required by law. Additional information about

these assumptions and risks and uncertainties is contained in the

Company’s filings with securities regulators, including the

Company’s most recent Annual Report on Form 20-F and most recent

management’s discussion and analysis for our most recently

completed financial year and, if applicable, interim financial

period, which are available on SEDAR+ at www.sedarplus.ca and on

EDGAR at www.sec.gov. All FLI contained in this news release is

expressly qualified by the risk factors set out in the

aforementioned documents.

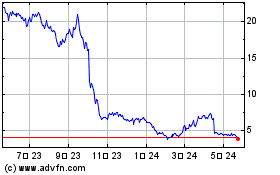

Lithium Americas (NYSE:LAC)

過去 株価チャート

から 11 2024 まで 12 2024

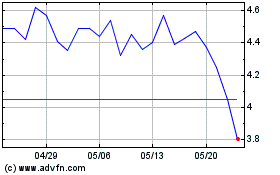

Lithium Americas (NYSE:LAC)

過去 株価チャート

から 12 2023 まで 12 2024