Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

2024年11月19日 - 8:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT

OF 1934

For the month of November

2024

Commission File Number: 001-38590

CANGO INC.

8F, New Bund Oriental Plaza II

556 West Haiyang Road, Pudong

New Area

Shanghai 200124

People’s Republic of China

(Address of principal executive

offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F

¨

EXHIBIT INDEX

Exhibit 99.1 — Cango Inc. Completes Cash-Settled Acquisitions of Crypto Mining Assets

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

CANGO INC. |

| |

|

| |

By: |

/s/ Yongyi Zhang |

| |

Name: |

Yongyi Zhang |

| |

Title: |

Chief Financial Officer |

Date: November 19, 2024

Exhibit 99.1

Cango Inc. Completes Cash-Settled Acquisitions

of Crypto Mining Assets

SHANGHAI, Nov. 15, 2024 /PRNewswire/-- Cango

Inc. (NYSE: CANG) ("Cango" or the "Company"), a leading automotive transaction service platform in China, today announced

that it has completed the previously announced acquisition of on-rack crypto mining machines with an aggregate hashrate of 32 Exahash

per second (“EH”) for a total purchase price of US$256 million in cash (the “Cash-Settled Transaction”) from Bitmain

Technologies Georgia Limited and Bitmain Development Limited (together, “Bitmain”), a leading manufacturer of digital currency

mining servers. The Company announced the Cash-Settled Transaction on November 6, 2024, together with its proposed acquisition of

on-rack crypto mining machines with an aggregate hashrate of 18 EH from Golden TechGen Limited and certain other sellers for a total purchase

price of approximately US$144 million, which will be paid through issuance of shares to the sellers by the Company (the “Share-Settled

Transactions” and together with the Cash-Settled Transaction, the “Proposed Transactions”).

The Cash-Settled Transaction was consummated after

the relevant closing conditions are satisfied. Based on further due diligence with the sellers, the Company and the sellers have concluded

that no related sellers will sell U.S. assets with an aggregate value of US$119.5 million or more to the Company in the Proposed Transactions,

and therefore the anti-trust filing and clearance in the U.S. is not required for the Proposed Transactions and the relevant closing condition

is deemed to have been satisfied. As such, the Company and Bitmain closed the Cash-Settled Transaction through assignment to the Company

of all hash computing power of the mining machines to be delivered in the Cash-Settled Transaction, and transfer of these machines’

ownership to the Company is expected to occur at a later stage as agreed by the parties.

The closing of the Share-Settled Transactions

is subject to certain closing conditions that are yet to be satisfied or waived and the Company is working with the relevant parties towards

the closing of the Share-Settled Transactions.

About Cango Inc.

Cango Inc. (NYSE:

CANG) is a leading automotive transaction service platform in China, connecting car buyers, dealers, financial institutions, and other

industry participants. Founded in 2010 by a group of pioneers in China’s automotive finance industry, the Company is headquartered

in Shanghai and has a nationwide network. Leveraging its competitive advantages in technological innovation and big data, Cango has established

an automotive supply chain ecosystem, and developed a matrix of products centering on customer needs for auto transactions, auto financing

and after-market services. By working with platform participants, Cango endeavors to make car purchases simple and enjoyable, and make

itself customers’ car purchase service platform of choice. For more information, please visit: www.cangoonline.com.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates,"

"future," "intends," "plans," "believes," "estimates" and similar statements. Among

other things, the "Business Outlook" section and quotations from management in this announcement, contain forward-looking statements.

Cango may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Cango's beliefs and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained

in any forward-looking statement, including but not limited to the following: Cango's goal and strategies; Cango's expansion plans; Cango's

future business development, financial condition and results of operations; Cango's expectations regarding demand for, and market acceptance

of, its solutions and services; Cango's expectations regarding keeping and strengthening its relationships with dealers, financial institutions,

car buyers and other platform participants; general economic and business conditions; and assumptions underlying or related to any of

the foregoing. Further information regarding these and other risks is included in Cango's filings with the SEC. All information provided

in this press release and in the attachments is as of the date of this press release, and Cango does not undertake any obligation to update

any forward-looking statement, except as required under applicable law.

Investor Relations Contact

Yihe Liu

Cango Inc.

Tel: +86 21 3183 5088 ext.5581

Email: ir@cangoonline.com

Helen Wu

Piacente Financial Communications

Tel: +86 10 6508 0677

Email: ir@cangoonline.com

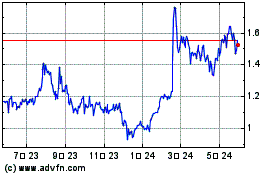

Cango (NYSE:CANG)

過去 株価チャート

から 11 2024 まで 12 2024

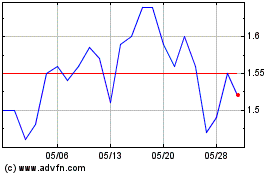

Cango (NYSE:CANG)

過去 株価チャート

から 12 2023 まで 12 2024