10th Consecutive Quarter of Record Revenue,

Rising 8% Over Prior Year to $16.6 Billion

American Express Company (NYSE: AXP) today reported

third-quarter net income of $2.51 billion, or $3.49 per share,

compared with net income of $2.45 billion, or $3.30 per share, a

year ago.

(Millions, except per share

amounts, and where indicated)

Quarters Ended

September 30,

Percentage Inc/(Dec)

Nine Months Ended

September 30,

Percentage Inc/(Dec)

2024

2023

2024

2023

Billed Business (Billions)

$387.3

$366.2

6%

$1,142.5

$1,079.8

6%

FX-adjusted1

$366.4

6%

$1,076.4

6%

Total Revenues Net of Interest Expense

$16,636

$15,381

8%

$48,770

$44,716

9%

FX-adjusted1

$15,348

8%

$44,535

10%

Net Income

$2,507

$2,451

2%

$7,959

$6,441

24%

Diluted Earnings Per Common Share

(EPS)2

$3.49

$3.30

6%

$10.97

$8.59

28%

Adjusted EPS Excluding Transaction

Gain3

$3.49

$3.30

6%

$10.31

$8.59

20%

Average Diluted Common Shares

Outstanding

709

733

(3)%

716

739

(3)%

“We had another strong quarter that reflects the earnings power

of our business model and our continued investments for growth.

Third-quarter revenue reached another record of $16.6 billion, up 8

percent, and earnings per share of $3.49 was up 6 percent,

year-over-year,” said Stephen J. Squeri, Chairman and Chief

Executive Officer.

“Based on our performance to date and the strong earnings our

core business is generating, we are raising our full-year EPS

guidance to $13.75 - $14.05, up from $13.30 - $13.80 previously. We

continue to expect full-year revenue growth that is within the

annual guidance range we provided in the beginning of the year, at

around 9 percent.

“In the third quarter, total Card Member spending increased 6

percent, and card fee revenue growth accelerated to 18 percent. We

continued to attract large numbers of new premium Card Members with

3.3 million new card acquisitions, while maintaining our high

retention rates, excellent credit performance, and expense

discipline.

“Our continued momentum demonstrates the sustainability of our

product refresh strategy and the growth it is driving in our

portfolio. We have already completed 40 product refreshes globally

since the beginning of the year, including the recent launch of our

new U.S. Consumer Gold Card. The new benefits and capabilities we

have added in popular categories like dining are fueling our growth

with Millennial and Gen-Z consumers, who represent 80 percent of

the new accounts acquired on the U.S. Consumer Gold Card, and

remain our fastest growing consumer cohort overall in the U.S. The

strong early results we’re seeing from our product refreshes

reinforce my confidence that we’re investing in the right areas to

enhance our value propositions and meet the financial and lifestyle

needs of our customers.”

Third-quarter consolidated total revenues net of interest

expense were $16.6 billion, up 8 percent from $15.4 billion a year

ago. The increase was primarily driven by higher net interest

income supported by growth in loan volumes, stable growth in Card

Member spending, and accelerated card fee revenue growth.

Consolidated provisions for credit losses were $1.4 billion,

compared with $1.2 billion a year ago. The increase reflected

higher net write-offs driven by growth in loan balances, partially

offset by a lower net reserve build year-over-year. The

third-quarter net write-off rate was 1.9 percent, compared to 1.8

percent a year ago, and down from 2.1 percent in the prior

quarter.4

Consolidated expenses were $12.1 billion, up 9 percent from

$11.0 billion a year ago. The increase primarily reflected higher

variable customer engagement costs driven by higher Card Member

spending and usage of travel-related benefits, as well as increased

marketing investments and operating expenses.

The consolidated effective tax rate was 21.8 percent, up from

20.9 percent a year ago, primarily reflecting discrete tax benefits

in the prior-year period.

This earnings release should be read in conjunction with the

company’s statistical tables for the third quarter 2024, which

include information regarding our reportable operating segments,

available on the American Express Investor Relations website at

http://ir.americanexpress.com and in a Form 8-K furnished today

with the Securities and Exchange Commission.

An investor conference call will be held at 8:30 a.m. (ET) today

to discuss third-quarter results. Live audio and presentation

slides for the investor conference call will be available to the

general public on the above-mentioned American Express Investor

Relations website. A replay of the conference call will be

available later today at the same website address.

________________________________

1

As used in this release,

FX-adjusted information assumes a constant exchange rate between

the periods being compared for purposes of currency translations

into U.S. dollars (i.e., assumes the foreign exchange rates used to

determine results for current period apply to the corresponding

prior-year period against which such results are being compared).

FX-adjusted revenues is a non-GAAP measure. The company believes

the presentation of information on an FX-adjusted basis is helpful

to investors by making it easier to compare the company’s

performance in one period to that of another period without the

variability caused by fluctuations in currency exchange rates.

2

Diluted earnings per common share

(EPS) was reduced by the impact of (i) earnings allocated to

participating share awards of $18 million and $19 million for the

three months ended September 30, 2024 and 2023, respectively, and

$59 million and $50 million for the nine months ended September 30,

2024 and 2023, respectively, and (ii) dividends on preferred shares

of $15 million and $14 million for the three months ended September

30, 2024 and 2023, respectively, and $44 million and $43 million

for the nine months ended September 30, 2024 and 2023,

respectively.

3

Adjusted diluted earnings per

common share, a non-GAAP measure, excludes the $0.66 per share

impact of the gain from the sale of Accertify, Inc. recognized in

the second quarter of 2024. See Appendix I for a reconciliation to

EPS on a GAAP basis. Management believes adjusted EPS is useful in

evaluating the ongoing operating performance of the company.

4

Net write-off rates are based on

principal losses only (i.e., excluding interest and/or fees) and

represent consumer and small business Card Member loans and

receivables (net write-off rates based on principal losses only are

unavailable for corporate). We present a net write-off rate based

on principal losses only to be consistent with industry convention.

Net write-off rates including interest and fees are presented in

the Statistical Tables for the third quarter of 2024 available on

the above-mentioned American Express Investor Relations website, as

our practice is to include uncollectible interest and/or fees as

part of our total provision for credit losses.

As used in this release:

- Card Member spending (billed business) represents transaction

volumes, including cash advances, on payment products issued by

American Express.

- Operating expenses represent salaries and employee benefits,

professional services, data processing and equipment, and other,

net.

- Reserve releases and reserve builds represent the portion of

the provisions for credit losses for the period related to

increasing or decreasing reserves for credit losses as a result of,

among other things, changes in volumes, macroeconomic outlook,

portfolio composition, and credit quality of portfolios. Reserve

releases represent the amount by which net write-offs exceed the

provisions for credit losses. Reserve builds represent the amount

by which the provisions for credit losses exceed net

write-offs.

- Variable customer engagement costs represent the aggregate of

Card Member rewards, business development, and Card Member services

expenses.

ABOUT AMERICAN EXPRESS

American Express is a globally integrated payments company,

providing customers with access to products, insights and

experiences that enrich lives and build business success. Learn

more at americanexpress.com and connect with us on

facebook.com/americanexpress, instagram.com/americanexpress,

linkedin.com/company/american-express, X.com/americanexpress, and

youtube.com/americanexpress.

Key links to products, services and corporate sustainability

information: personal cards, business cards and services, travel

services, gift cards, prepaid cards, merchant services, Business

Blueprint, Resy, corporate card, business travel, diversity and

inclusion, corporate sustainability and Environmental, Social, and

Governance reports.

Source: American Express Company

Location: Global

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

which are subject to risks and uncertainties. The forward-looking

statements, which address American Express Company’s current

expectations regarding business and financial performance,

including management’s outlook for 2024 and long-term growth

aspiration, among other matters, contain words such as “believe,”

“expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,”

“should,” “could,” “would,” “likely,” “continue” and similar

expressions. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

on which they are made. The company undertakes no obligation to

update or revise any forward-looking statements. Factors that could

cause actual results to differ materially from these

forward-looking statements include, but are not limited to, those

that are set forth under the caption “Cautionary Note Regarding

Forward-Looking Statements” in the company’s current report on Form

8-K filed with the Securities and Exchange Commission (SEC) on

October 18, 2024 (the Form 8-K Cautionary Note), which are

incorporated by reference into this release. Those factors include,

but are not limited to, the following:

- the company’s ability to achieve its 2024 earnings per common

share (EPS) outlook and grow EPS in the future, which will depend

in part on revenue growth, credit performance and the effective tax

rate remaining consistent with current expectations and the

company’s ability to continue investing at high levels in areas

that can drive sustainable growth (including its brand, value

propositions, customers, colleagues, marketing, technology and

coverage), controlling operating expenses, effectively managing

risk and executing its share repurchase program, any of which could

be impacted by, among other things, the factors identified in the

subsequent paragraph and the Form 8-K Cautionary Note, as well as

the following: macroeconomic conditions, such as recession risks,

higher rates of unemployment, changes in interest rates, effects of

inflation, supply chain issues, energy costs, tariffs and fiscal

and monetary policies; geopolitical instability, including the

ongoing Ukraine and Israel wars, broader regional hostilities and

tensions involving China and the U.S.; the impact of any future

contingencies, including, but not limited to, legal costs and

settlements, the imposition of fines or monetary penalties,

increases in Card Member remediation, investment gains or losses,

restructurings, impairments and changes in reserves; issues

impacting brand perceptions and the company’s reputation; impacts

related to sales and acquisitions and new or renegotiated cobrand

and other partner agreements and joint ventures; and the impact of

regulation and litigation, which could affect the profitability of

the company’s business activities, limit the company’s ability to

pursue business opportunities, require changes to business

practices or alter the company’s relationships with Card Members,

partners and merchants; and

- the company’s ability to achieve its 2024 revenue growth

outlook and grow revenues net of interest expense in the future,

which could be impacted by, among other things, the factors

identified above and in the Form 8-K Cautionary Note, as well as

the following: spending volumes and the spending environment not

being consistent with expectations, including a decline in spending

by U.S. small and mid-sized enterprise Card Members, or a slowdown

in U.S. consumer or international spending volumes; an inability to

address competitive pressures, attract and retain customers, invest

in and enhance the company’s Membership Model of premium products,

differentiated services and partnerships, successfully refresh its

card products, grow spending and lending with customers across age

cohorts, including Millennial and Gen-Z customers, and implement

strategies and business initiatives, including within the premium

consumer space, commercial payments and the global network; the

effects of regulatory initiatives, including pricing and network

regulation; merchant coverage growing less than expected or the

reduction of merchant acceptance; increased surcharging, steering,

suppression or differential acceptance of the company’s products;

merchant discount rates changing by a greater or lesser amount than

expected; and changes in foreign currency exchange rates.

A further description of these uncertainties and other risks can

be found in American Express Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, Quarterly Reports on Form

10-Q for the quarters ended March 31 and June 30, 2024 and the

company’s other reports filed with the SEC, including in the Form

8-K Cautionary Note.

(Preliminary)

American Express Company

Appendix I

Reconciliation of Adjusted EPS

Excluding Transaction Gain

Quarters Ended

September 30,

Nine Months Ended

September 30,

2024

2023

YoY%

Inc/(Dec)

2024

2023

YoY%

Inc/(Dec)

GAAP Diluted EPS

$

3.49

$

3.30

6

%

$

10.97

$

8.59

28

%

Accertify Gain on Sale (pretax)

$

—

$

—

$

0.73

$

—

Tax Impact of Accertify Gain on Sale

$

—

$

—

$

(0.07

)

$

—

Accertify Gain on Sale (after tax)

$

—

$

—

$

0.66

$

—

Adjusted Diluted EPS Excluding the Impact

of Accertify Gain on Sale

$

3.49

$

3.30

6

%

$

10.31

$

8.59

20

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017171332/en/

Media Contacts: Melanie Backs, Melanie.L.Backs@aexp.com,

+1.212.640.2164 Deniz Yigin, Deniz.Yigin@aexp.com, +1.332.999.0836

Investors/Analysts Contacts: Kartik Ramachandran,

Kartik.Ramachandran@aexp.com, +1.212.640.5574 Kristy Ashmawy,

Kristy.Ashmawy@aexp.com, +1.212.640.5574

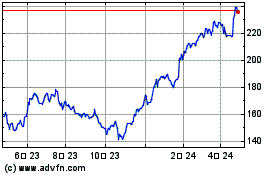

American Express (NYSE:AXP)

過去 株価チャート

から 11 2024 まで 12 2024

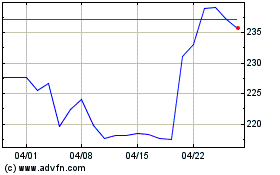

American Express (NYSE:AXP)

過去 株価チャート

から 12 2023 まで 12 2024