false000093303400009330342024-09-182024-09-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 18, 2024

STRATTEC SECURITY CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

Wisconsin |

|

0-25150 |

|

39-1804239 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

3333 West Good Hope Road, Milwaukee, Wisconsin 53209

(Address of Principal Executive Offices, and Zip Code)

(414) 247-3333

Registrant’s Telephone Number, Including Area Code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $.01 par value |

|

STRT |

|

The Nasdaq Global Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Jennifer Slater, President and Chief Executive Officer, and Dennis Bowe, Vice President and Chief Financial Officer of STRATTEC Security Corporation (the “Company”) will present virtually at the Sidoti Small-Cap Virtual Conference on September 18, 2024 (the “Presentation”). Management will also meet virtually with investors registered for the conference. A copy of the Presentation is attached as Exhibit 99.1 hereto.

The information contained in the Presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in the Presentation, although it may do so from time to time as its management believes is warranted.

The investor presentation is furnished herein, as part of this Item 7.01, as Exhibit 99.1. Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

Exhibit Number |

Description |

|

|

99.1 |

Investor presentation |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

STRATTEC SECURITY CORPORATION

By: /s/ Dennis P. Bowe

Dennis P. Bowe, Vice President and

Chief Financial Officer

Date: September 18, 2024

Sidoti Small Cap Conference�September 18, 2024 Jennifer Slater President and CEO Dennis Bowe Vice President and Chief Financial Officer www.strattec.com Nasdaq: STRT Exhibit 99.1

Certain statements contained in these slides contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” and “would.” Such forward-looking statements in this release are inherently subject to many uncertainties in the Company’s operations and business environment. These uncertainties include general economic conditions, in particular, relating to the automotive industry, consumer demand for the Company’s and its customers’ products, competitive and technological developments, customer purchasing actions, changes in warranty provisions and customer product recall policies, work stoppages at the Company or at the location of its key customers as a result of labor disputes, foreign currency fluctuations, uncertainties stemming from U.S. trade policies, tariffs and reactions to same from foreign countries, the volume and scope of product returns, adverse business and operational issues resulting from the continuing effects of the coronavirus (COVID-19) pandemic, matters adversely impacting the timing and availability of component parts and raw materials needed for the production of our products and the products of our customers and fluctuations in our costs of operation (including fluctuations in the cost of raw materials). Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances occurring after the date of this release. In addition, such uncertainties and other operational matters are discussed further in the Company’s quarterly and annual filings with the Securities and Exchange Commission. This presentation will discuss some non-GAAP financial measures, which the Company believes are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. The Company has provided reconciliations of comparable GAAP to non-GAAP measures. Safe Harbor Statement

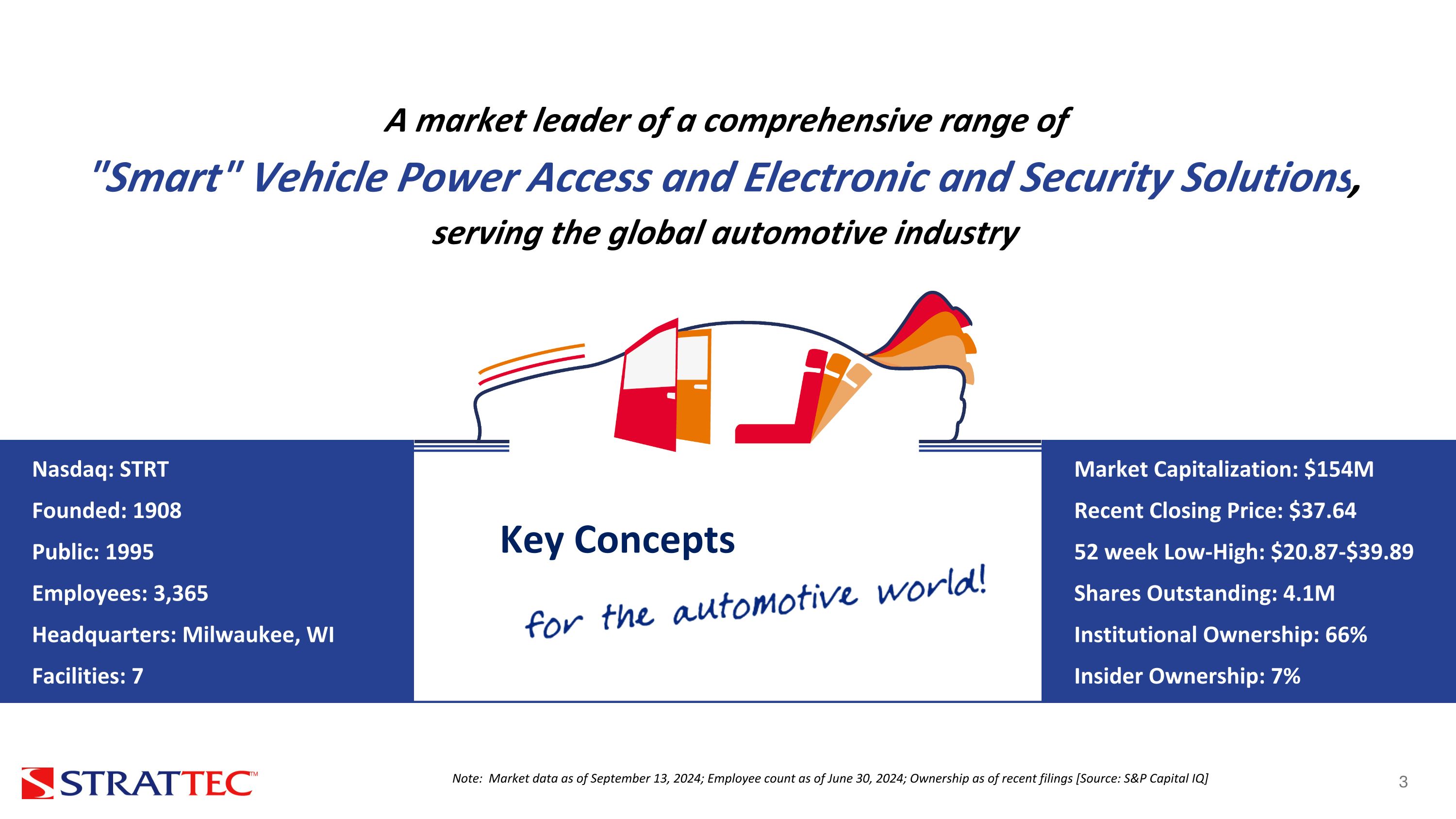

A market leader of a comprehensive range of �"Smart" Vehicle Power Access and Electronic and Security Solutions, �serving the global automotive industry Nasdaq: STRT Founded: 1908 Public: 1995 Employees: 3,365 Headquarters: Milwaukee, WI Facilities: 7 Key Concepts Market Capitalization: $154M Recent Closing Price: $37.64 52 week Low-High: $20.87-$39.89 Shares Outstanding: 4.1M Institutional Ownership: 66% Insider Ownership: 7% Note: Market data as of September 13, 2024; Employee count as of June 30, 2024; Ownership as of recent filings [Source: S&P Capital IQ]

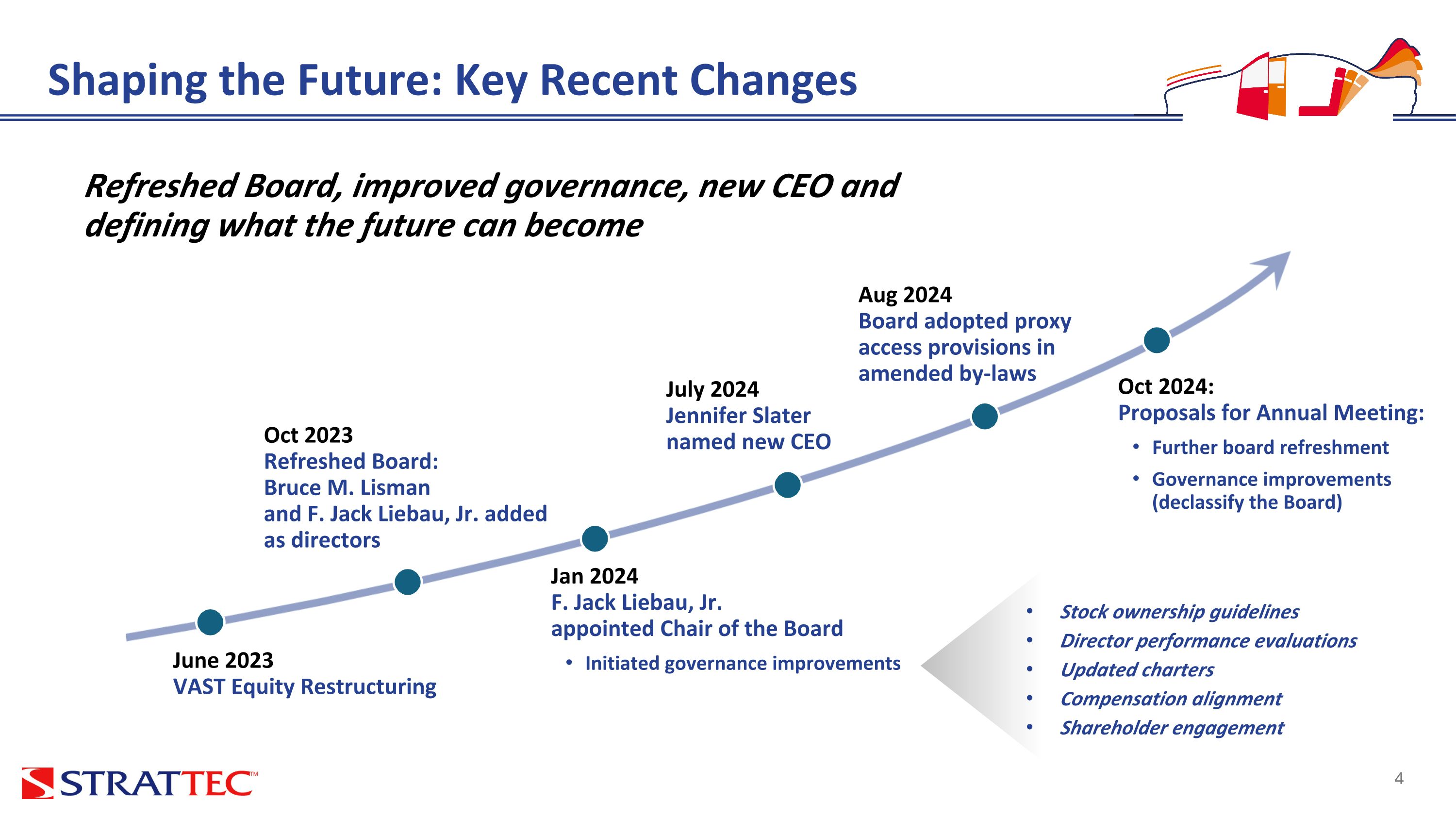

Refreshed Board, improved governance, new CEO and �defining what the future can become Shaping the Future: Key Recent Changes June 2023�VAST Equity Restructuring Oct 2023�Refreshed Board: �Bruce M. Lisman �and F. Jack Liebau, Jr. added as directors Jan 2024�F. Jack Liebau, Jr. �appointed Chair of the Board Initiated governance improvements July 2024�Jennifer Slater named new CEO Aug 2024�Board adopted proxy access provisions in amended by-laws Oct 2024: �Proposals for Annual Meeting: Further board refreshment Governance improvements (declassify the Board) Stock ownership guidelines Director performance evaluations Updated charters Compensation alignment Shareholder engagement

Reasons for joining STRT Excellent Board leadership and strengthened governance Untapped potential provides opportunities to drive growth and earnings power Strong balance sheet Strong legacy in the automotive industry Solid business with reputation of innovation and strong market positions with �broad customer base What I found Inadequate management operating system Lack of predictability in operating and financial performance Siloed organization Antiquated and disparate information technology systems Need to develop strategy to drive sustainable growth The First 100 days: Listen, Learn, Lead

Develop a culture of accountability and predictable performance Focus on high value, sustainable products Continue to optimize our cost structure Define key competencies to drive future growth organically Prioritize resources to sustain the future growth of the business Develop strategic plan to transform the business Setting the Course for the Future Near-term Priorities and Opportunities:

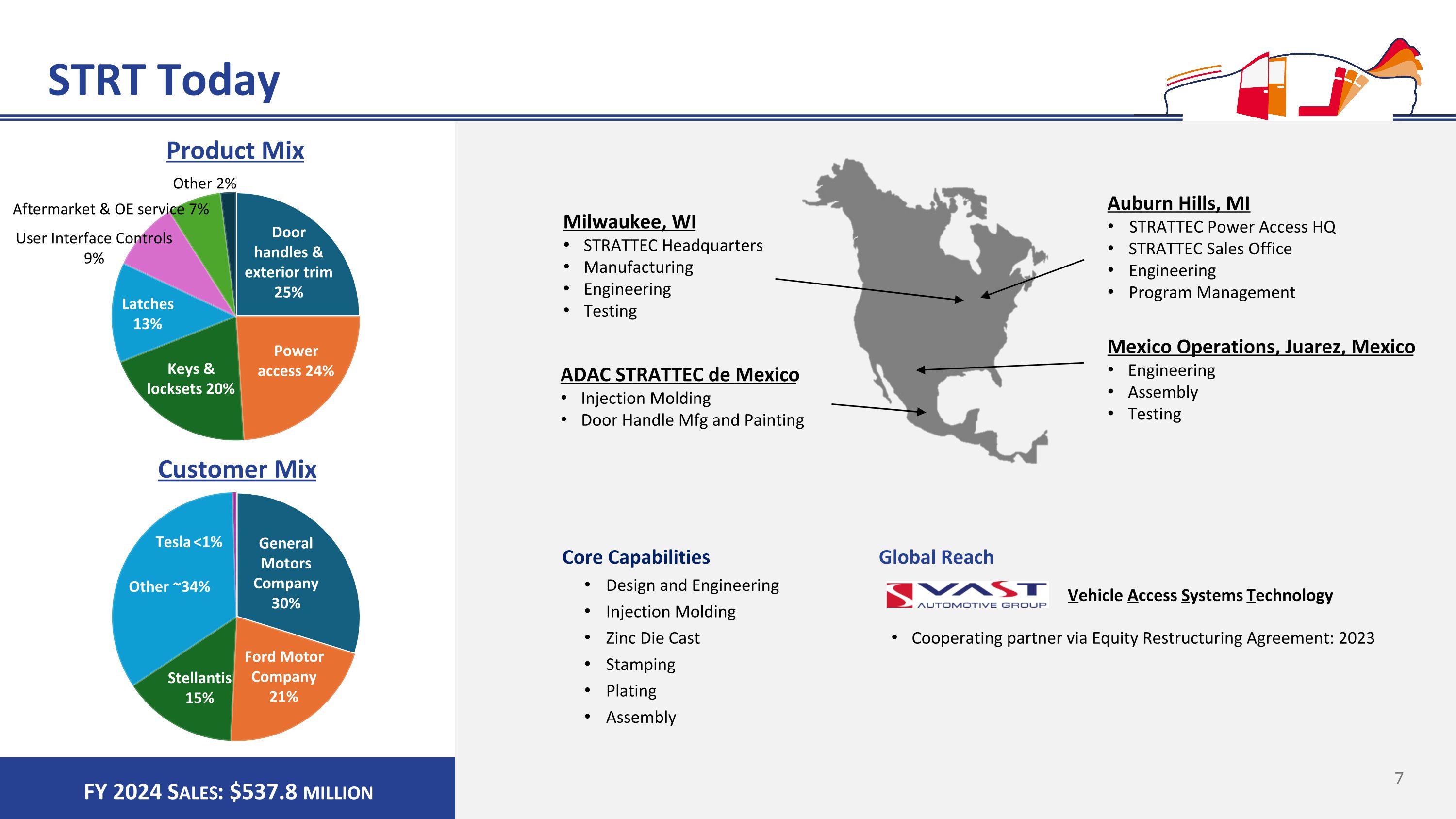

STRT Today Core Capabilities Design and Engineering Injection Molding Zinc Die Cast Stamping Plating Assembly Milwaukee, WI STRATTEC Headquarters Manufacturing Engineering Testing Auburn Hills, MI STRATTEC Power Access HQ STRATTEC Sales Office Engineering Program Management Mexico Operations, Juarez, Mexico Engineering Assembly Testing ADAC STRATTEC de Mexico Injection Molding Door Handle Mfg and Painting Global Reach Cooperating partner via Equity Restructuring Agreement: 2023 Vehicle Access Systems Technology FY 2024 Sales: $537.8 million

Broad Product Portfolio

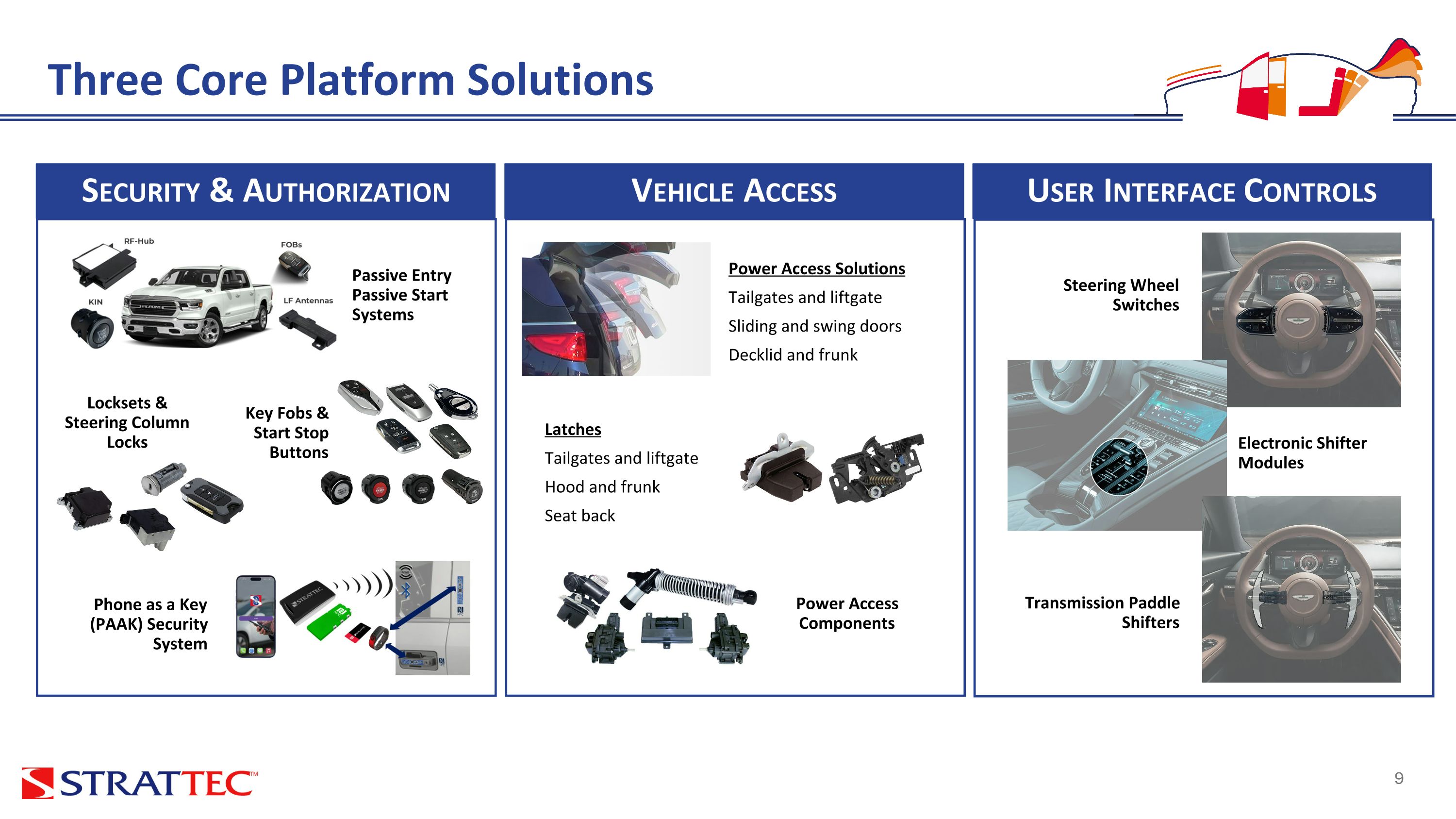

Three Core Platform Solutions Power Access Solutions Tailgates and liftgate Sliding and swing doors Decklid and frunk Vehicle Access Latches Tailgates and liftgate Hood and frunk Seat back Power Access Components User Interface Controls Steering Wheel Switches Electronic Shifter Modules Transmission Paddle Shifters Security & Authorization Passive Entry Passive Start Systems Key Fobs & Start Stop Buttons Locksets & Steering Column Locks Phone as a Key (PAAK) Security System

Financial Highlights www.strattec.com

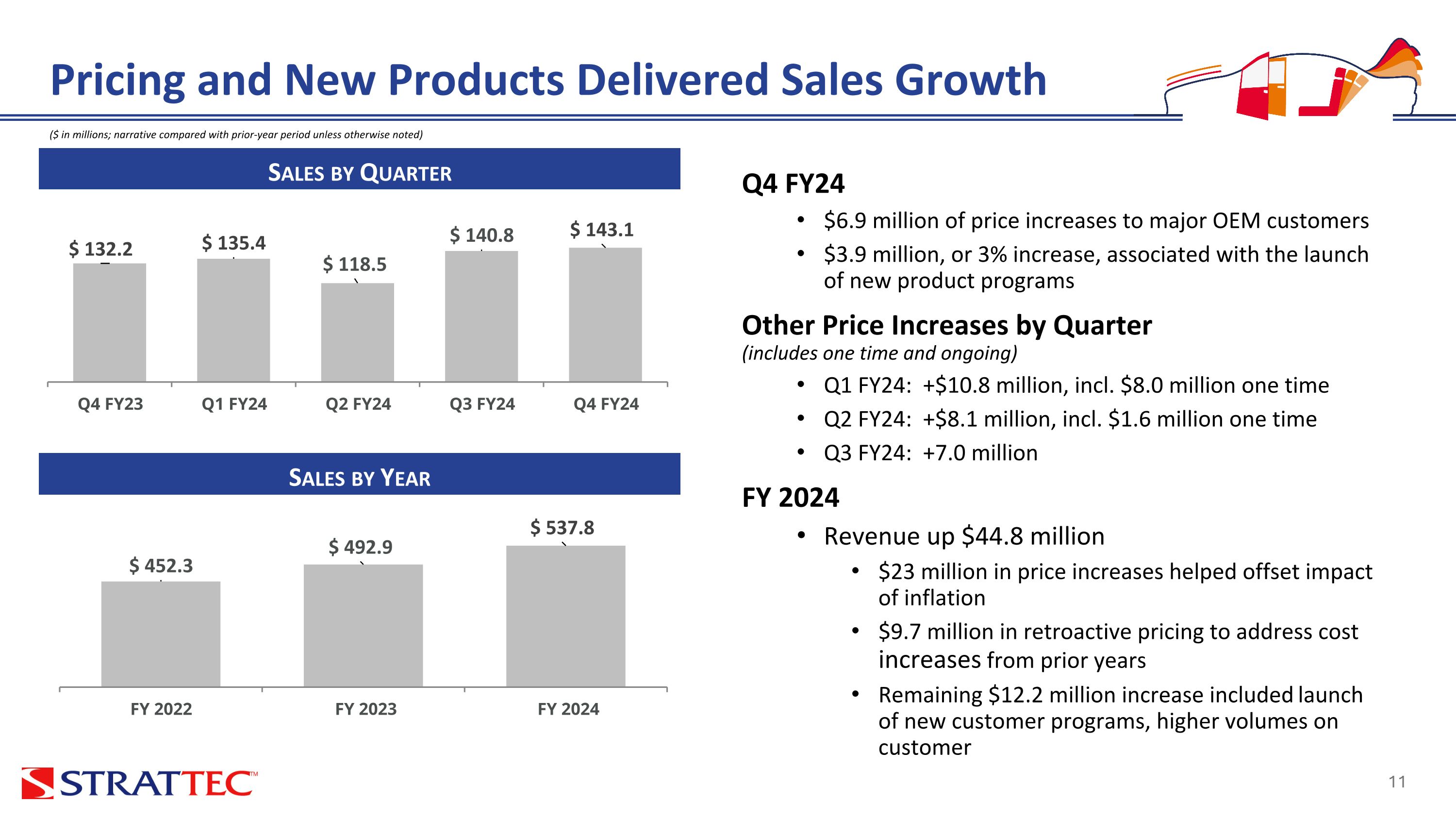

Q4 FY24 $6.9 million of price increases to major OEM customers $3.9 million, or 3% increase, associated with the launch of new product programs Other Price Increases by Quarter �(includes one time and ongoing) Q1 FY24: +$10.8 million, incl. $8.0 million one time Q2 FY24: +$8.1 million, incl. $1.6 million one time Q3 FY24: +7.0 million FY 2024 Revenue up $44.8 million $23 million in price increases helped offset impact of inflation $9.7 million in retroactive pricing to address cost increases from prior years Remaining $12.2 million increase included launch of new customer programs, higher volumes on customer Pricing and New Products Delivered Sales Growth Sales by Quarter Sales by Year ($ in millions; narrative compared with prior-year period unless otherwise noted)

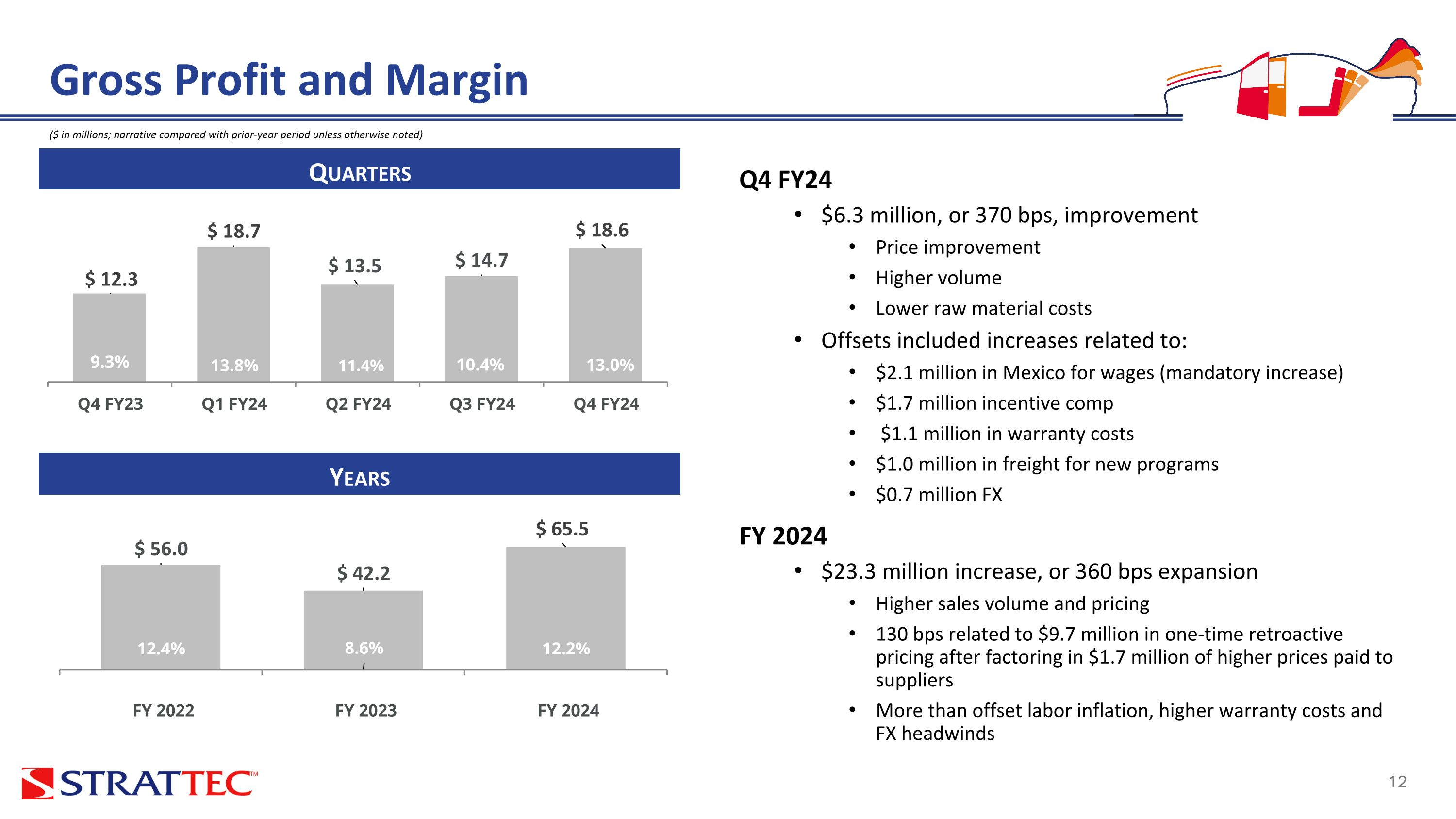

Q4 FY24 $6.3 million, or 370 bps, improvement Price improvement Higher volume Lower raw material costs Offsets included increases related to: $2.1 million in Mexico for wages (mandatory increase) $1.7 million incentive comp $1.1 million in warranty costs $1.0 million in freight for new programs $0.7 million FX FY 2024 $23.3 million increase, or 360 bps expansion Higher sales volume and pricing 130 bps related to $9.7 million in one-time retroactive pricing after factoring in $1.7 million of higher prices paid to suppliers More than offset labor inflation, higher warranty costs and FX headwinds Gross Profit and Margin Quarters Years ($ in millions; narrative compared with prior-year period unless otherwise noted)

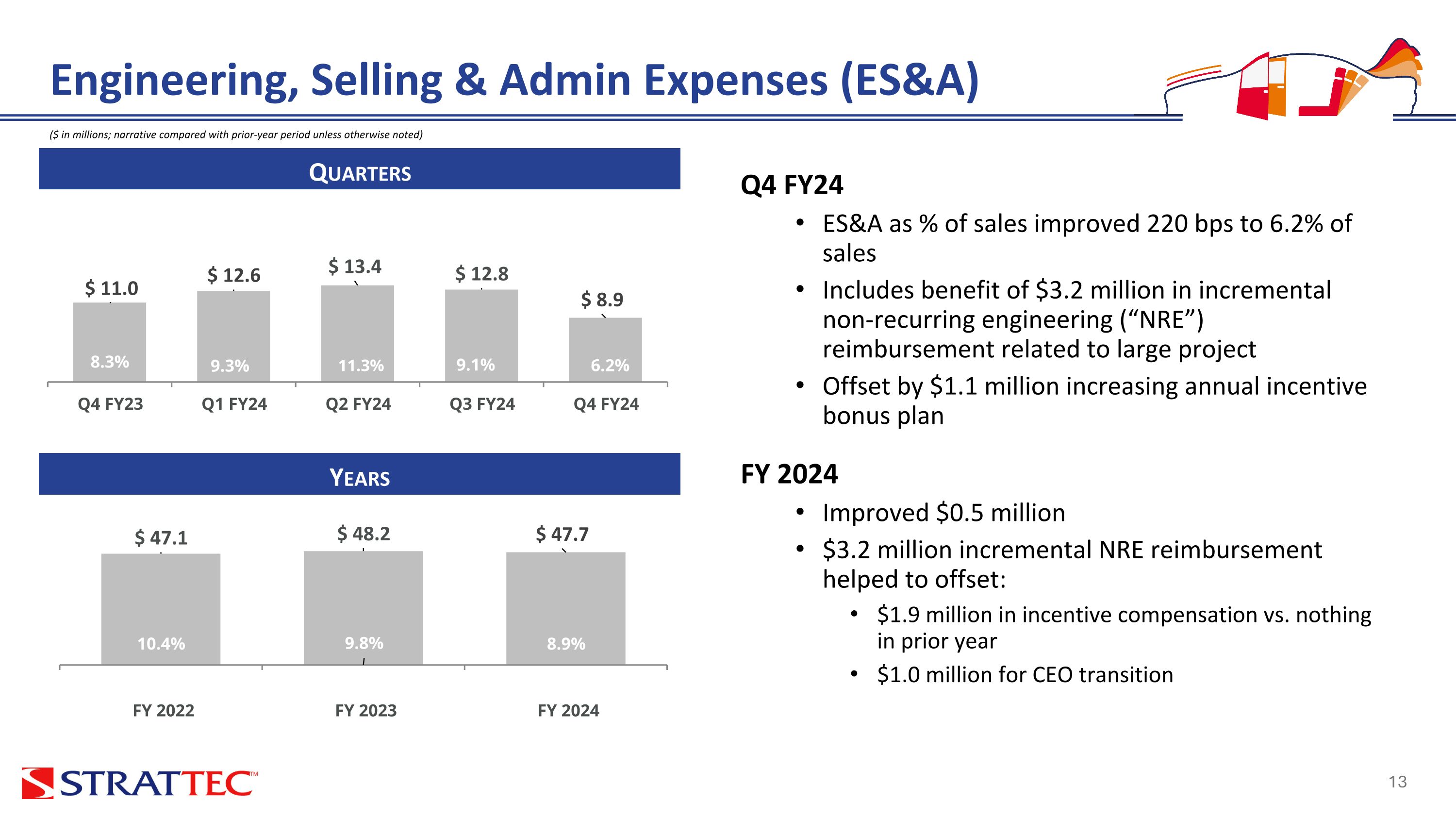

Q4 FY24 ES&A as % of sales improved 220 bps to 6.2% of sales Includes benefit of $3.2 million in incremental non-recurring engineering (“NRE”) reimbursement related to large project Offset by $1.1 million increasing annual incentive bonus plan FY 2024 Improved $0.5 million $3.2 million incremental NRE reimbursement helped to offset: $1.9 million in incentive compensation vs. nothing in prior year $1.0 million for CEO transition Engineering, Selling & Admin Expenses (ES&A) Quarters Years ($ in millions; narrative compared with prior-year period unless otherwise noted)

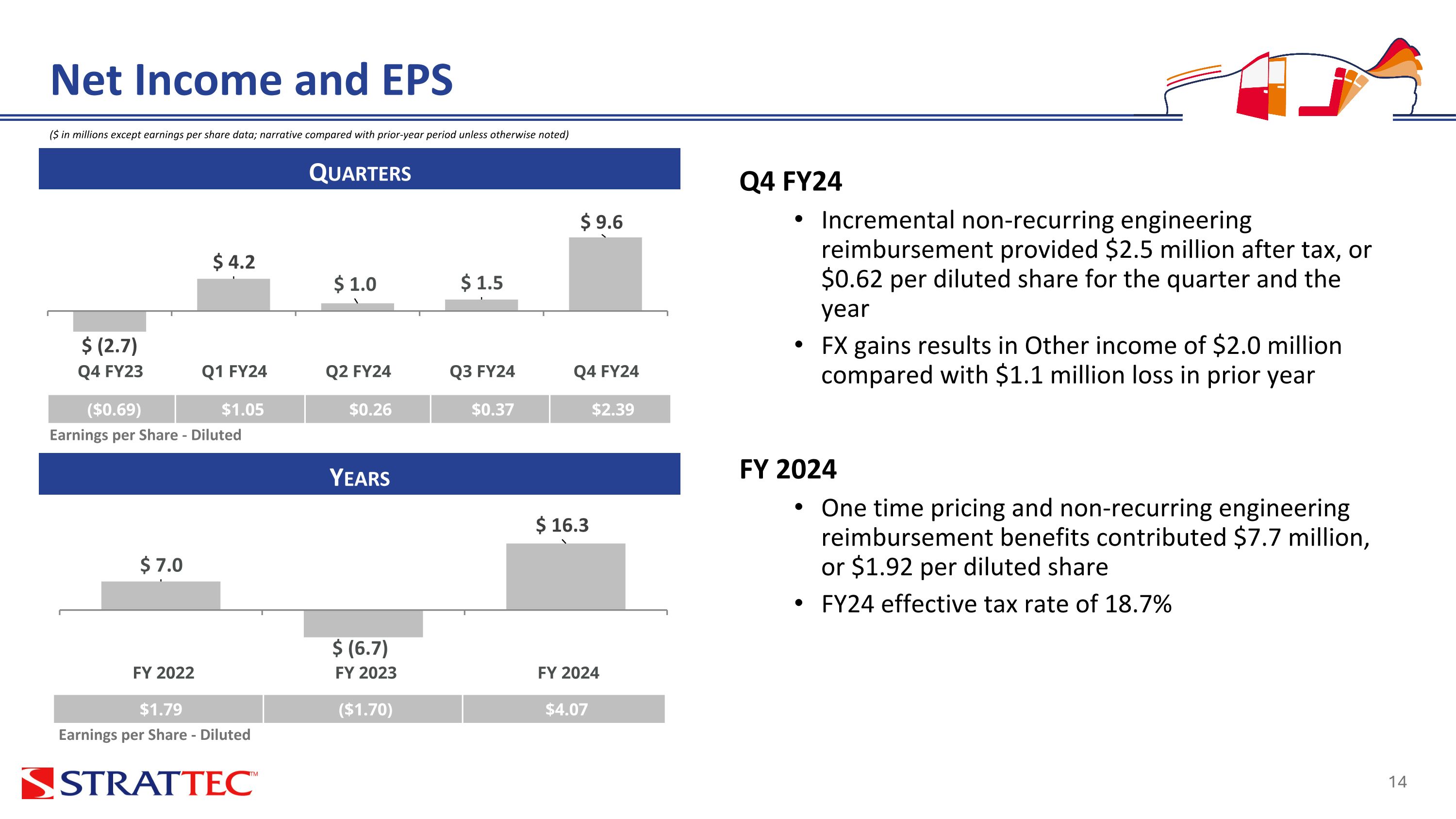

$1.79 ($1.70) $4.07 Net Income and EPS Quarters Years ($ in millions except earnings per share data; narrative compared with prior-year period unless otherwise noted) ($0.69) $1.05 $0.26 $0.37 $2.39 Earnings per Share - Diluted Earnings per Share - Diluted Q4 FY24 Incremental non-recurring engineering reimbursement provided $2.5 million after tax, or $0.62 per diluted share for the quarter and the year FX gains results in Other income of $2.0 million compared with $1.1 million loss in prior year FY 2024 One time pricing and non-recurring engineering reimbursement benefits contributed $7.7 million, or $1.92 per diluted share FY24 effective tax rate of 18.7%

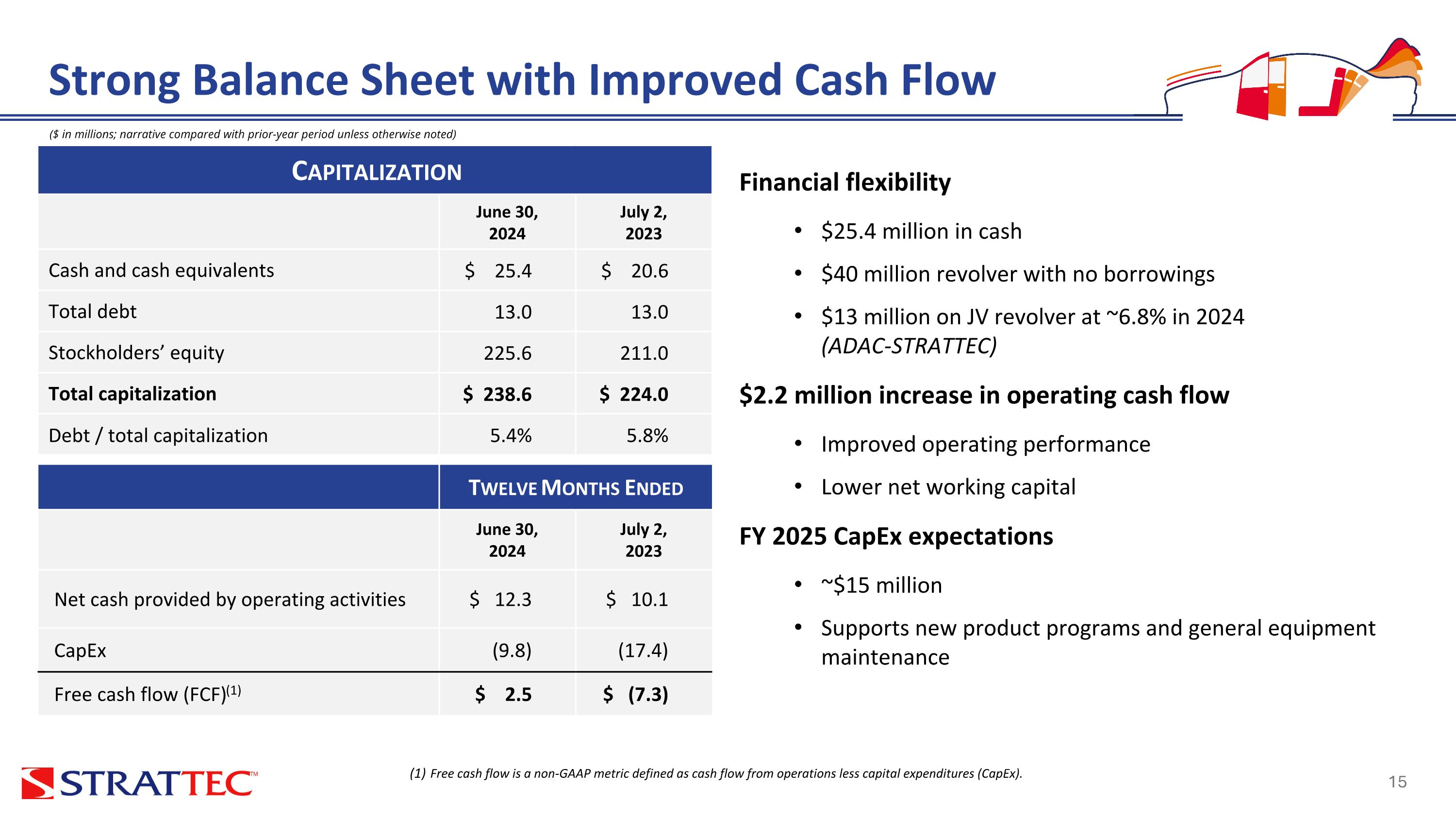

Financial flexibility $25.4 million in cash $40 million revolver with no borrowings $13 million on JV revolver at ~6.8% in 2024 �(ADAC-STRATTEC) $2.2 million increase in operating cash flow Improved operating performance Lower net working capital FY 2025 CapEx expectations ~$15 million Supports new product programs and general equipment maintenance Strong Balance Sheet with Improved Cash Flow Capitalization June 30, 2024 July 2, 2023 Cash and cash equivalents $ 25.4 $ 20.6 Total debt 13.0 13.0 Stockholders’ equity 225.6 211.0 Total capitalization $ 238.6 $ 224.0 Debt / total capitalization 5.4% 5.8% Twelve Months Ended June 30, 2024 July 2, 2023 Net cash provided by operating activities $ 12.3 $ 10.1 CapEx (9.8) (17.4) Free cash flow (FCF)(1) $ 2.5 $ (7.3) Free cash flow is a non-GAAP metric defined as cash flow from operations less capital expenditures (CapEx). ($ in millions; narrative compared with prior-year period unless otherwise noted)

Strengthened governance and leadership focused on modernizing operations, �upgrading IT systems and developing a strategy to drive growth Solid business with reputation of innovation and strong market positions with �broad customer base Relevant engineered technologies designed into several leading vehicle models creating solution stickiness with customers Strong balance sheet to support investment Untapped potential provides opportunity to improve position and �deliver sustainable, profitable growth STRATTEC Investment Rationale

Sidoti Small Cap Conference�September 18, 2024 www.strattec.com Nasdaq: STRT Investor Relations Contact: Deborah K. Pawlowski, Kei Advisors | An Alliance Advisors Company�716-843-3908 dpawlowski@keiadvisors.com

Leadership Team Jennifer L. Slater President and �Chief Executive Officer Dennis P. Bowe Vice President Chief Financial Officer Rolando J. Guillot Senior Vice President Chief Operations Officers Richard P. Messina Vice President Chief Technology Officer

Customers OEM Manufacturers - Passenger Vehicles OEM Manufacturers - Commercial Vehicles Tier 1 System Suppliers

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Strattec Security (NASDAQ:STRT)

過去 株価チャート

から 9 2024 まで 10 2024

Strattec Security (NASDAQ:STRT)

過去 株価チャート

から 10 2023 まで 10 2024