0001040161false00010401612024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2024

PIXELWORKS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Oregon | | 000-30269 | | 91-1761992 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

16760 SW Upper Boones Ferry Rd., Suite 101

Portland, OR 97224

(503) 601-4545

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | PXLW | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Pixelworks, Inc. (the “Company”) issued a press release announcing financial results for the three and nine month periods ended September 30, 2024 and held a conference call to discuss the Company's financial results. The press release and conference call contain forward-looking statements regarding the Company, and include cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

The press release issued November 12, 2024 is furnished herewith as Exhibit 99.1, to this Report and a copy of the Company's conference call script announcing these financial results is furnished herewith as Exhibit 99.2. The information in this Item 2.02, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liability of that Section, nor shall such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933 or the Exchange Act, except as otherwise stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PIXELWORKS, INC. |

| | (Registrant) |

| | |

| Dated: | November 12, 2024 | /s/ Haley F. Aman |

| | Haley F. Aman Chief Financial Officer |

Exhibit 99.1

Pixelworks Reports Third Quarter 2024 Financial Results

PORTLAND, Ore., November 12, 2024 – Pixelworks, Inc. (NASDAQ: PXLW), a leading provider of innovative video and display processing solutions, today announced financial results for the third quarter ended September 30, 2024.

Third Quarter and Recent Highlights

•Total revenue increased 12% sequentially

•GAAP gross margin expanded more than 50 basis points sequentially and 800 basis point year-over-year to 51.2%, primarily driven by favorable product mix and lower overhead expenses

•Entered into multi-year, multi-title agreement with Universal Pictures to bring TrueCut MotionTM technology to the theatrical releases of future Universal titles

•DreamWorks Animation’s The Wild Robot was released globally by Universal Pictures to premium large format theaters in TrueCut Motion format

•Pixelworks Shanghai subsidiary received provincial and national-level recognition with the “Little Giant” certification, a designation for leading enterprises in China that have significant growth potential

•Pixelworks retains Morgan Stanley as financial advisor to assist with reviewing potential strategic options specific to inbound interest in the Company’s Pixelworks Shanghai subsidiary

“Third quarter results reflected our expectations for moderate sequential improvement as we continue to work through the previously communicated headwinds in our mobile business,” stated Todd DeBonis, President and CEO of Pixelworks. “Gross margin expanded sequentially and year-over-year to over 51%, while operating expenses decreased as we realized the initial benefits of our previously implemented cost reduction actions.

“Highlighting the most recent milestone for our TrueCut Motion platform, during the quarter we secured a multi-year agreement with Universal Pictures to utilize our industry-leading motion grading technology to enhance the visual experience of several major theatrical releases. Within our mobile business, we recently completed production qualification of our next-generation, flagship mobile visual processor. After successfully meeting or exceeding all performance metrics, we are now engaged with multiple customers on smartphone programs targeted for launch in the coming year. Separately, we are also engaged in customer evaluations for a cost-down version of an existing mobile visual processor that offers unique visual enhancement features. This newly optimized solution addresses broader use-cases, in addition to mobile gaming, as we aim to expand our served target market in higher unit volume mid- and entry-level smartphones.

“In summary, our team has continued to execute well toward overcoming recent challenges and positioning our mobile business for a return to growth in 2025. We currently have a strong pipeline of new program opportunities for our latest visual processor solutions, and we expect to maintain a high level of engagement activity over the next several quarters. We anticipate our previous and continuing cost reduction actions will contribute to meaningful improvement in our operating results as we drive renewed top-line momentum in mobile.”

Third Quarter 2024 Financial Results

Revenue in the third quarter of 2024 was $9.5 million, compared to $8.5 million in the second quarter of 2024 and $16.0 million in the third quarter of 2023. The sequential increase in third quarter revenue was driven by increased sales in the home and enterprise market, while the year-over-year decrease primarily reflected the previously discussed headwinds in the Company’s mobile business.

On a GAAP basis, gross profit margin in the third quarter of 2024 was 51.2%, compared to 50.7% in the second quarter of 2024 and 42.9% in the third quarter of 2023. Third quarter 2024 GAAP operating expenses were $13.5 million, compared to $15.1 million in the second quarter of 2024 and $14.5 million in the year-ago quarter.

On a non-GAAP basis, third quarter 2024 gross profit margin was 51.3%, compared to 51.0% in the second quarter of 2024 and 43.1% in the year-ago quarter. Third quarter 2024 non-GAAP operating expenses were $12.4 million, compared to $12.8 million in the second quarter of 2024 and $13.3 million in the year-ago quarter.

For the third quarter of 2024, the Company recorded a GAAP net loss of $8.1 million, or ($0.14) per share, compared to a GAAP net loss of $10.1 million, or ($0.17) per share, in the second quarter of 2024, and a GAAP net loss of $7.0 million, or ($0.12) per share, in the year-ago quarter. Note, the Company refers to “net loss attributable to Pixelworks, Inc.” as “net loss”.

For the third quarter of 2024, the Company recorded a non-GAAP net loss of $7.1 million, or ($0.12) per share, compared to a non-GAAP net loss of $7.7 million, or ($0.13) per share, in the second quarter of 2024, and a non-GAAP net loss of $5.7 million, or ($0.10) per share, in the third quarter of 2023.

Adjusted EBITDA in the third quarter of 2024 was a negative $6.3 million, compared to a negative $7.0 million in the second quarter of 2024 and a negative $5.0 million in the year-ago quarter.

Business Outlook

The Company’s current business outlook, including guidance for the fourth quarter of 2024, will be discussed as part of the scheduled conference call.

Conference Call Information

Pixelworks will host a conference call today, November 12, 2024, at 2:00 p.m. Pacific Time. To join the conference call via phone, analysts and investors should dial +1-888-596-4144 and enter the following conference ID: 3689417; international participants should dial +1 646-968-2525 and enter the same conference ID. Additionally, a live audio webcast of the conference call will be available and archived for approximately 90 days in the Investors section of the Company’s website at www.pixelworks.com.

A telephone replay of the conference call will also be available through Tuesday, November 19, 2024, and can be accessed by dialing +1-800-770-2030 and using passcode 3689417.

Pixelworks, Inc.

Pixelworks provides industry-leading content creation, video delivery and display processing solutions and technology that enable highly authentic viewing experiences with superior visual quality, across all screens – from cinema to smartphone and beyond. The Company has a 20-year history of delivering image processing innovation to leading providers of consumer electronics, professional displays, and video streaming services. For more information, please visit the company's web site at www.pixelworks.com.

Note: Pixelworks, MotionEngine, TrueCut Motion and the Pixelworks logo are trademarks of Pixelworks, Inc.

Non-GAAP Financial Measures

This earnings release makes reference to non-GAAP gross profit margins, non-GAAP operating expenses, non-GAAP net loss and non-GAAP net loss per share, which exclude stock-based compensation expense and restructuring expense which are both required under GAAP. The press release also makes reference to and reconciles GAAP net loss and adjusted EBITDA, which Pixelworks defines as GAAP net loss attributable to Pixelworks Inc. before interest income and other, net, income tax provision, depreciation and amortization, as well as the specific items listed above.

Pixelworks management uses these non-GAAP financial measures internally to understand, manage and evaluate the business and establish its operational goals, review its operations on a period-to-period basis, for compensation evaluations, to measure performance, and for budgeting and resource allocation. Pixelworks management believes it is useful for the Company and investors to review, as applicable, both GAAP information and non-GAAP financial measures to help assess the performance of Pixelworks’ continuing business and to evaluate Pixelworks’ future prospects. These non-GAAP measures, when reviewed together with the GAAP financial information, provide additional transparency and information for comparison and analysis of operating performance and trends. These non-GAAP measures exclude certain items to facilitate management’s review of the comparability of our core operating results on a period-to-period basis.

Because the Company’s non-GAAP financial measures are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures employed by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures and should be read only in conjunction with the Company’s consolidated financial results as presented in accordance with GAAP. A reconciliation between GAAP and non-GAAP financial measures is included in this earnings release which is available in the investor relations section of the Pixelworks website.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be identified by use of terms such as “begin,” “continue,” “will,” “expect”, “believe,” “anticipate” and similar terms or the negative of such terms, and include, without limitation, statements about expected adoption rates for our mobile visual processors (both flagship and cost-down versions), expansion of our mobile visual processor products into mid- to low-tier smartphones, expected adoption of our TrueCut Motion technology by Universal Studios and other motion picture studios, continued performance of our home and enterprise business, and expected cost savings. All statements other than statements of historical fact are forward-looking statements for purposes of this release, including any projections of revenue or other financial items or any statements regarding the plans and objectives of management for future operations. Such statements are based on management's current expectations, estimates and projections about the Company's business. These statements are not guarantees of future performance and involve numerous risks, uncertainties and assumptions that are difficult to predict. Actual results could vary materially from those contained in forward looking statements due to many factors, including, without limitation: the actual adoption of TrueCut Motion technology by the motion picture industry; the actual performance of the smartphone market; our ability to execute on our strategy; competitive factors, such as rival chip architectures, introduction or traction by competing designs, or pricing pressures; the success of our products in expanding markets; current global economic challenges; changes in the digital display and projection markets; seasonality in the consumer electronics market; our efforts to achieve profitability from operations; our limited financial resources; and our ability to attract and retain key personnel. More information regarding potential factors that could affect the Company's financial results and could cause actual results to differ materially from those discussed in the forward-looking statements is included from time to time in the Company's Securities and Exchange Commission filings, including its Annual Report on Form 10-K for the year ended December 31, 2023, as well as subsequent SEC filings.

The forward-looking statements contained in this release are as of the date of this release, and the Company does not undertake any obligation to update any such statements, whether as a result of new information, future events or otherwise.

[Financial Tables Follow]

PIXELWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | June 30, | | September 30, | | September 30, | | September 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue, net | | $ | 9,527 | | | $ | 8,535 | | | $ | 16,032 | | | $ | 34,116 | | | $ | 39,603 | |

| Cost of revenue (1) | | 4,648 | | | 4,209 | | | 9,150 | | | 16,797 | | | 22,870 | |

| Gross profit | | 4,879 | | | 4,326 | | | 6,882 | | | 17,319 | | | 16,733 | |

| Operating expenses: | | | | | | | | | | |

| Research and development (2) | | 8,405 | | | 7,943 | | | 8,752 | | | 24,421 | | | 23,925 | |

| Selling, general and administrative (3) | | 5,016 | | | 5,722 | | | 5,776 | | | 16,272 | | | 17,316 | |

| Restructuring | | 90 | | | 1,403 | | | — | | | 1,493 | | | — | |

| Total operating expenses | | 13,511 | | | 15,068 | | | 14,528 | | | 42,186 | | | 41,241 | |

| Loss from operations | | (8,632) | | | (10,742) | | | (7,646) | | | (24,867) | | | (24,508) | |

| Interest income and other, net | | 296 | | | 327 | | | 471 | | | 1,057 | | | 1,615 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loss before income taxes | | (8,336) | | | (10,415) | | | (7,175) | | | (23,810) | | | (22,893) | |

| Provision for income taxes | | 125 | | | 32 | | | 158 | | | 262 | | | 318 | |

| Net loss | | (8,461) | | | (10,447) | | | (7,333) | | | (24,072) | | | (23,211) | |

| Less: Net loss attributable to non-controlling interests and redeemable non-controlling interests | | 320 | | | 298 | | | 334 | | | 716 | | | 779 | |

| Net loss attributable to Pixelworks Inc. | | $ | (8,141) | | | $ | (10,149) | | | $ | (6,999) | | | $ | (23,356) | | | $ | (22,432) | |

| | | | | | | | | | |

| Net loss attributable to Pixelworks Inc. per share - basic and diluted | | $ | (0.14) | | | $ | (0.17) | | | $ | (0.12) | | | $ | (0.40) | | | $ | (0.40) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Weighted average shares outstanding - basic and diluted | | 58,717 | | | 58,151 | | | 56,410 | | | 58,116 | | | 55,917 | |

| | | | | | | | | | |

| —————— | | | | | | | | | | |

| | | | | | | | | | |

| (1) Includes: | | | | | | | | | | |

| Stock-based compensation | | 13 | | | 10 | | | 21 | | | 41 | | | 67 | |

| Restructuring | | — | | | 16 | | | — | | | 16 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| (2) Includes stock-based compensation | | 327 | | | 316 | | | 452 | | | 973 | | | 1,470 | |

| | | | | | | | | | |

| (3) Includes stock-based compensation | | 702 | | | 599 | | | 779 | | | 2,028 | | | 2,140 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

PIXELWORKS, INC.

RECONCILIATION OF GAAP AND NON-GAAP FINANCIAL INFORMATION *

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | June 30, | | September 30, | | September 30, | | September 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of GAAP and non-GAAP gross profit | | | | | | | | | | |

| GAAP gross profit | | $ | 4,879 | | | $ | 4,326 | | | $ | 6,882 | | | $ | 17,319 | | | $ | 16,733 | |

| Stock-based compensation | | 13 | | | 10 | | | 21 | | | 41 | | | 67 | |

| Restructuring | | — | | | 16 | | | — | | | 16 | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total reconciling items included in gross profit | | 13 | | | 26 | | | 21 | | | 57 | | | 67 | |

| Non-GAAP gross profit | | $ | 4,892 | | | $ | 4,352 | | | $ | 6,903 | | | $ | 17,376 | | | $ | 16,800 | |

| Non-GAAP gross profit margin | | 51.3 | % | | 51.0 | % | | 43.1 | % | | 50.9 | % | | 42.4 | % |

| Reconciliation of GAAP and non-GAAP operating expenses | | | | | | | | | | |

| GAAP operating expenses | | $ | 13,511 | | | $ | 15,068 | | | $ | 14,528 | | | $ | 42,186 | | | $ | 41,241 | |

| Reconciling item included in research and development: | | | | | | | | | | |

| Stock-based compensation | | 327 | | | 316 | | | 452 | | | 973 | | | 1,470 | |

| Reconciling items included in selling, general and administrative: | | | | | | | | | | |

| Stock-based compensation | | 702 | | | 599 | | | 779 | | | 2,028 | | | 2,140 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Restructuring | | 90 | | | 1,403 | | | — | | | 1,493 | | | — | |

| Total reconciling items included in operating expenses | | 1,119 | | | 2,318 | | | 1,231 | | | 4,494 | | | 3,610 | |

| Non-GAAP operating expenses | | $ | 12,392 | | | $ | 12,750 | | | $ | 13,297 | | | $ | 37,692 | | | $ | 37,631 | |

| Reconciliation of GAAP and non-GAAP net loss attributable to Pixelworks, Inc. | | | | | | | | | | |

| GAAP net loss attributable to Pixelworks Inc. | | $ | (8,141) | | | $ | (10,149) | | | $ | (6,999) | | | $ | (23,356) | | | $ | (22,432) | |

| Reconciling items included in gross profit | | 13 | | | 26 | | | 21 | | | 57 | | | 67 | |

| Reconciling items included in operating expenses | | 1,119 | | | 2,318 | | | 1,231 | | | 4,494 | | | 3,610 | |

| Tax effect of non-GAAP adjustments | | (74) | | | 74 | | | — | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Non-GAAP net loss attributable to Pixelworks Inc. | | $ | (7,083) | | | $ | (7,731) | | | $ | (5,747) | | | $ | (18,805) | | | $ | (18,755) | |

| | | | | | | | | | |

| Non-GAAP net loss attributable to Pixelworks Inc. per share - basic and diluted | | $ | (0.12) | | | $ | (0.13) | | | $ | (0.10) | | | $ | (0.32) | | | $ | (0.34) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Non-GAAP weighted average shares outstanding - basic and diluted | | 58,717 | | | 58,151 | | | 56,410 | | | 58,116 | | | 55,917 | |

| | | | | | | | | | |

| | | | | | | | | | |

| *Set forth above are reconciliations of the non-GAAP financial measure to the most directly comparable GAAP financial measure. The non-GAAP financial measure disclosed by the company has limitations and should not be considered a substitute for, or superior to, the financial measure prepared in accordance with GAAP, and the reconciliations from GAAP to Non-GAAP actuals should be carefully evaluated. Please refer to "Non-GAAP Financial Measures” in this document for an explanation of the adjustments made to the comparable GAAP measures, the ways management uses the non-GAAP measures, and the reasons why management believes the non-GAAP measures provide useful information for investors. |

PIXELWORKS, INC.

RECONCILIATION OF GAAP AND NON-GAAP NET LOSS PER SHARE

(Figures may not sum due to rounding)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended |

| | | September 30, | | | | June 30, | | | | September 30, | | | | September 30, | | | | September 30, |

| | | 2024 | | | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 |

| | | | Dollars per share | | | | Dollars per share | | | | Dollars per share | | | | Dollars per share | | | | Dollars per share |

| | | | Basic | | Diluted | | | | Basic | | Diluted | | | | Basic | | Diluted | | | | Basic | | Diluted | | | | Basic | | Diluted |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP and non-GAAP net loss attributable to Pixelworks, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP net loss attributable to Pixelworks Inc. | | | | $ | (0.14) | | | $ | (0.14) | | | | | $ | (0.17) | | | $ | (0.17) | | | | | $ | (0.12) | | | $ | (0.12) | | | | | $ | (0.40) | | | $ | (0.40) | | | | | $ | (0.40) | | | $ | (0.40) | |

| Reconciling items included in gross profit | | | | — | | | — | | | | | — | | | — | | | | | — | | | — | | | | | — | | | — | | | | | — | | | — | |

| Reconciling items included in operating expenses | | | | 0.02 | | | 0.02 | | | | | 0.04 | | | 0.04 | | | | | 0.02 | | | 0.02 | | | | | 0.08 | | | 0.08 | | | | | 0.06 | | | 0.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP net loss attributable to Pixelworks Inc. | | | | $ | (0.12) | | | $ | (0.12) | | | | | $ | (0.13) | | | $ | (0.13) | | | | | $ | (0.10) | | | $ | (0.10) | | | | | $ | (0.32) | | | $ | (0.32) | | | | | $ | (0.34) | | | $ | (0.34) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| *Set forth above are reconciliations of the non-GAAP financial measure to the most directly comparable GAAP financial measure. The non-GAAP financial measure disclosed by the company has limitations and should not be considered a substitute for, or superior to, the financial measure prepared in accordance with GAAP, and the reconciliations from GAAP to Non-GAAP actuals should be carefully evaluated. Please refer to "Non-GAAP Financial Measures” in this document for an explanation of the adjustments made to the comparable GAAP measures, the ways management uses the non-GAAP measures, and the reasons why management believes the non-GAAP measures provide useful information for investors. |

PIXELWORKS, INC.

RECONCILIATION OF GAAP AND NON-GAAP GROSS PROFIT MARGIN *

(Figures may not sum due to rounding)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | | Nine Months Ended |

| | | | September, 30 | | | | June 30, | | | | September 30, | | | | September 30, | | | | September 30, |

| | | | 2024 | | | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 |

| Reconciliation of GAAP and non-GAAP gross profit margin | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| GAAP gross profit margin | | | | 51.2 | % | | | | 50.7 | % | | | | 42.9 | % | | | | 50.8 | % | | | | 42.3 | % |

| Stock-based compensation | | | | 0.1 | | | | | 0.1 | | | | | 0.1 | | | | | 0.1 | | | | | 0.2 | |

| | | | | | | | | | | | | | | | | | | | |

| Restructuring | | | | — | | | | | 0.2 | | | | | — | | | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total reconciling items included in gross profit | | | | 0.1 | | | | | 0.3 | | | | | 0.1 | | | | | 0.2 | | | | | 0.2 | |

| Non-GAAP gross profit margin | | | | 51.3 | % | | | | 51.0 | % | | | | 43.1 | % | | | | 50.9 | % | | | | 42.4 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| *Set forth above are reconciliations of the non-GAAP financial measure to the most directly comparable GAAP financial measure. The non-GAAP financial measure disclosed by the company has limitations and should not be considered a substitute for, or superior to, the financial measure prepared in accordance with GAAP, and the reconciliations from GAAP to Non-GAAP actuals should be carefully evaluated. Please refer to "Non-GAAP Financial Measures” in this document for an explanation of the adjustments made to the comparable GAAP measures, the ways management uses the non-GAAP measures, and the reasons why management believes the non-GAAP measures provide useful information for investors. |

PIXELWORKS, INC.

RECONCILIATION OF GAAP AND NON-GAAP FINANCIAL INFORMATION *

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | June 30, | | September 30, | | September 30, | | September 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of GAAP net loss attributable to Pixelworks Inc. and adjusted EBITDA | | | | | | | | | | |

| GAAP net loss attributable to Pixelworks Inc. | | $ | (8,141) | | | $ | (10,149) | | | $ | (6,999) | | | $ | (23,356) | | | $ | (22,432) | |

| Stock-based compensation | | 1,042 | | | 925 | | | 1,252 | | | 3,042 | | | 3,677 | |

| Restructuring | | 90 | | | 1,419 | | | — | | | 1,509 | | | — | |

| Tax effect of non-GAAP adjustments | | (74) | | | 74 | | | — | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Non-GAAP net loss attributable to Pixelworks Inc. | | $ | (7,083) | | | $ | (7,731) | | | $ | (5,747) | | | $ | (18,805) | | | $ | (18,755) | |

| EBITDA adjustments: | | | | | | | | | | |

| Depreciation and amortization | | $ | 920 | | | $ | 1,059 | | | $ | 1,053 | | | $ | 3,088 | | | $ | 3,211 | |

| Non-GAAP interest income and other, net | | (296) | | | (327) | | | (471) | | | (1,057) | | | (1,615) | |

| Non-GAAP provision (benefit) for income taxes | | 199 | | | (42) | | | 158 | | | 262 | | | 318 | |

| Adjusted EBITDA | | $ | (6,260) | | | $ | (7,041) | | | $ | (5,007) | | | $ | (16,512) | | | $ | (16,841) | |

*Set forth above are reconciliations of the non-GAAP financial measure to the most directly comparable GAAP financial measure. The non-GAAP financial measure disclosed by the company has limitations and should not be considered a substitute for, or superior to, the financial measure prepared in accordance with GAAP, and the reconciliations from GAAP to Non-GAAP actuals should be carefully evaluated. Please refer to "Non-GAAP Financial Measures” in this document for an explanation of the adjustments made to the comparable GAAP measures, the ways management uses the non-GAAP measures, and the reasons why management believes the non-GAAP measures provide useful information for investors |

PIXELWORKS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 28,830 | | | $ | 47,544 | |

| | | |

| Accounts receivable, net | 4,497 | | | 10,075 | |

| Inventories | 4,398 | | | 3,968 | |

| Prepaid expenses and other current assets | 2,009 | | | 3,138 | |

| Total current assets | 39,734 | | | 64,725 | |

| Property and equipment, net | 7,600 | | | 5,997 | |

| Operating lease right of use assets | 3,953 | | | 4,725 | |

| Other assets, net | 1,436 | | | 2,115 | |

| | | |

| Goodwill | 18,407 | | | 18,407 | |

| Total assets | $ | 71,130 | | | $ | 95,969 | |

LIABILITIES, REDEEMABLE NON-CONTROLLING INTEREST AND

SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,944 | | | $ | 2,416 | |

| Accrued liabilities and current portion of long-term liabilities | 7,753 | | | 9,692 | |

| | | |

| Current portion of income taxes payable | 199 | | | 189 | |

| Total current liabilities | 9,896 | | | 12,297 | |

| Long-term liabilities, net of current portion | 533 | | | 1,373 | |

| Deposit liability | 13,422 | | | 13,781 | |

| Operating lease liabilities, net of current portion | 2,065 | | | 2,567 | |

| | | |

| Income taxes payable, net of current portion | 1,052 | | | 939 | |

| Total liabilities | 26,968 | | | 30,957 | |

| Redeemable non-controlling interest | 28,513 | | | 28,214 | |

| Total Pixelworks, Inc. shareholders’ equity | (8,029) | | | 12,541 | |

| Non-controlling interest | 23,678 | | | 24,257 | |

| Total shareholders' equity | 15,649 | | | 36,798 | |

| Total liabilities, redeemable non-controlling interest and shareholders’ equity | $ | 71,130 | | | $ | 95,969 | |

Contacts:

Investor Contact

Shelton Group

Brett Perry

P: +1-214-272-0070

E: bperry@sheltongroup.com

Company Contact

Pixelworks, Inc.

Haley Aman

P: +1-503-601-4540

E: haman@pixelworks.com

Exhibit 99.2

Pixelworks, Inc. 3Q 2024 Conference Call

Tuesday, November 12, 2024

Operator

Good day ladies and gentlemen, and welcome to Pixelworks Inc.’s third quarter 2024 earnings conference call. I will be your operator for today’s call. At this time, all participants are in a listen-only mode. Following management’s prepared remarks, instructions will be given for the question-and-answer session. This conference call is being recorded for replay purposes. I would now like to turn the call over to Brett Perry with Shelton Group Investor Relations.

Brett Perry

Good afternoon and thank you for joining today’s call. With me on the call are Pixelworks’ President and CEO, Todd DeBonis, and Chief Financial Officer, Haley Aman. The purpose of today's conference call is to supplement the information provided in Pixelworks' press release issued earlier today announcing the Company's financial results for the third quarter of 2024.

Before we begin, I would like to remind you that various remarks we make on this call, including those about our projected future financial results, economic and market trends and our competitive position constitute forward-looking statements. These forward-looking statements and all other statements made on this call that are not historical facts are subject to a number of risks and uncertainties that may cause actual results to differ materially.

All forward-looking statements are based on the Company's beliefs as of today, Tuesday, November 12, 2024. The Company undertakes no obligation to update any such statements to reflect events or circumstances occurring after today. Please refer to today's press release, the Company’s annual report on Form 10-K for the year ended December 31, 2023, and subsequent SEC filings for a description of factors that could cause forward-looking statements to differ materially from actual results.

Additionally, the Company's press release and management statements during this conference call will include discussions of certain measures and financial information in GAAP and non-GAAP terms, including gross margin, operating expenses, net loss, and net loss per share. Non-GAAP measures exclude restructuring costs and stock-based compensation expense.

The Company uses these non-GAAP measures internally to assess its operating performance. We believe these non-GAAP measures provide a meaningful perspective on our core operating results and underlying cash flow dynamics. We caution investors to consider these measures in addition to, and not as a substitute for nor superior to, the Company's consolidated financial results as presented in accordance with GAAP.

Also note, throughout the Company's press release and management statements during this conference, we refer to net loss attributable to Pixelworks, Inc. as simply net loss. For additional details and reconciliations of GAAP to non-GAAP net loss and GAAP net loss to adjusted EBITDA, please refer to the Company’s press release issued earlier today.

With that, I will now turn the call over to Pixelworks’ CEO, Todd DeBonis, for his opening remarks.

Todd DeBonis

Thank you, Brett. Good afternoon and welcome to everyone on the phone and webcast. We appreciate you joining us on today’s call.

As reported in our press release earlier today, our third quarter results were consistent with our prior expectations for moderate sequential improvement. Revenue was at the midpoint of guidance, primarily reflecting steady demand in home and enterprise as we continued to work through the near term headwinds in our mobile business. Gross margin expanded sequentially and year-over-year to over 51%, mainly due to product mix during the quarter. Additionally, operating expenses decreased from the prior quarter, as we began to realize the initial benefits of our previously implemented cost reductions.

To briefly recap our recent and ongoing cost actions, as well as the expected benefits. At the end of the second quarter, we initiated a broad series of actions to reduce expenses and focus on operational efficiencies to better align operating expenses with anticipated near-term revenue levels. This included a reduction in headcount effective June 30, resulting in expected annualized cost savings of approximately $4 million. Due to certain one-time expenses incurred in the third quarter, we expect to realize a more significant reduction in operating expenses beginning in the fourth quarter. Together with other cost containment measures that we have taken, we continue to believe our collective actions will contribute to total cost savings of approximately $10 million over six quarters – through year-end 2025.

For a review of end markets, starting with our Mobile business. Revenue was down by 7% sequentially and 76% year over year, reflecting the expected multi-quarter impact from the headwinds that I discussed last quarter. Mobile revenue in the

quarter was primarily comprised of shipments of prior generation mobile visual processors in support of smartphones initially launched by customers in the first half of the year.

Due to the previously communicated delay of our next-generation visual processor, and the missed design cycle window for new device launches in the second half of this year, our primary focus has been on positioning for a return to growth in 2025. In support of achieving this renewed growth, we are focused on three key strategic objectives. First, is the continued expansion of our IRX-branded gaming ecosystem. Second, is to secure significant targeted design wins for our next-generation flagship visual processor, which I will provide an update on in a moment. And third, is to expand our available market in mobile by driving more meaningful penetration of visual processing technology in mid-tier and entry-level smartphones.

For the mobile market, but particularly across Asia and in China, mobile gaming consistently ranks among the top influencing factors for consumers when choosing which smartphone to purchase. Recognizing this and the increasing influence of mobile gaming in the design and marketing of newly launched smartphones, our IRX gaming ecosystem continues to be a fundamental part of our mobile strategy. As highlighted on prior conference calls, Pixelworks’ unique IRX rendering acceleration represents both a proven and practical solution to dramatically enhance visual performance for mobile gaming. More specifically, it enables simultaneous high image resolution and ultra-high frame rate with desktop-level photo-realism, while also overcoming the device temperature and power consumption challenges frequently associated with mobile gaming.

By design, the differentiated visual display and device performance that IRX brings to mobile gaming further elevates the core value proposition of our mobile visual processors. A larger and growing IRX ecosystem makes this value proposition even more compelling, and we believe further increases the incentive for smartphone OEM customers to adopt our visual processors across a broader range of new models. As such, we are continuing towards expanding the size and awareness of the IRX gaming ecosystem. This includes our team’s ongoing work with leading gaming studios on additional IRX certified mobile games, as well as continuing to grow the existing list of over 100 games that we have IRX qualified.

Regarding an update on our next-generation, flagship mobile visual processor. Following our engineering team’s incorporation of requisite design changes, during the quarter we received new samples of our next-gen device and conducted further extensive testing and verification. Today, I’m pleased to report that we recently completed production qualification of our new flagship mobile processor, with it successfully meeting or exceeding all qualifications criteria and targeted performance metrics. We have since delivered early production samples and are now engaged with multiple customers on smartphone programs targeted for launch in the coming year.

As Pixelworks’ first-ever visual processor utilizing 12nm process technology and specifically architected to fully leverage the advantages of our IRX gaming ecosystem, we continue to believe our new flagship mobile visual processor stands to be a disruptive force within the mobile gaming market.

Complementing this now production-ready flagship solution for the high-end segment of the market, we are simultaneously focused on addressing a larger served market with a cost-down version of a prior generation visual processor – specifically targeting higher unit volume opportunities in mid- and entry-level smartphones.

Leveraging a cost-down derivative of our prior-generation X5 visual processor, we have worked closely with one of our Tier 1 customers to increase several high frame rate, graphical use cases in addition to high frame rate mobile gaming. As display technology has evolved faster than the display pipeline in lower end Application Processors – the OEMs have a very challenging time utilizing the High Frame Rate capabilities of the display. This mismatch has created an opportunity for a new tier of Visual Processors from Pixelworks. We are currently engaged in customer evaluations of this new solution on programs targeted for launch in the first half of next year. In addition, our visual processor product roadmap now has prioritized this new low cost, graphical focused solution.

Turning to an update on our TrueCut Motion platform. Our team continues to focus on cultivating new and expanded ecosystem partnerships. The progress we are making from this persistent activity and its contribution toward new commercial engagements is difficult to assess externally. However, we believe there are growing indications of a dramatic shift in perception – with broader industry recognition that motion grading is required for the new Theatrical and Home Entertainment displays being introduced , and that TrueCut is the only solution for cinematic motion grading.

As evidence of this evolving perception, during the quarter we announced a multi-year agreement with Universal Pictures to utilize our industry-leading motion grading technology to enhance the visual experience for major theatrical releases of future Universal titles. This multi-title commitment by one of the world’s largest movie studios represented another tangible milestone. Unlike previous announcements of a single title, this agreement demonstrated recognition in advance that multiple planned future releases would benefit from utilizing TrueCut Motion.

In late September, DreamWorks Animation’s ‘The Wild Robot’ became the first major title released as part this agreement. The movie was released globally in TrueCut motion format on over 300 of the world’s highest grossing premium large format screens and achieved domestic opening box office of $35 million. The Wild Robot movie also received universally high praise

from both critics and audiences, and it has since succeeded in grossing over $270 million in worldwide box office – on an estimated $78 million production budget.

In addition to TrueCut being endorsed by two of the largest global premium large format exhibitors, we are also seeing growing interest from top post-production companies. Independent of work on any specific title or studio, we are exploring how post-production shops could add TrueCut motion grading to their existing service offerings. This concept is still in early discussion, however it could effectively bring motion grading upstream as part of the standard post-production process. It would then be more readily accessible to a broader group of filmmakers, contributing to accelerated adoption. The simple fact that these types of conversations are taking place with leading post-production companies is further evidence that the film industry is moving in the direction of motion grading becoming a future standard practice.

Shifting to our Home and Enterprise business, predominantly consisting of our visual processor System-on-Chips for the 3LCD digital projector market. Revenue increased sequentially and was consistent with expected positive seasonality for third quarter projector shipments. The overall demand for digital projector SOC’s has remained reasonably stable in recent quarters, although end market demand for projector systems has continued to be relatively flat, primarily reflecting the prolonged period of macroeconomic uncertainty in China as well as the U.S. and European education markets.

As indicated last quarter, we received initial purchase orders for our co-developed next-generation projector SoC from our lead customer. We have since begun initial volume production and remain on schedule to deliver the first production shipments of this new projector SoC during the fourth quarter. Based on previews of our customer’s planned product introductions, we continue to anticipate gradual but healthy incremental adoption of our newest projector solution throughout 2025 and beyond.

Lastly, related to Home and Enterprise, during the third quarter we began a process to end-of-life our small remaining portfolio of consumer transcoding products. Collectively, these legacy video delivery products have consistently amounted to less than 5% of our total revenue in recent years. As unit volumes of these products declined, it became increasingly difficult and prohibitively expensive to source the required substrate and packaging capabilities to support their continued production. We expect to fulfill a relatively small number of last-time purchase orders for these EOL products during the fourth quarter. The end-of-life of these legacy products will also further streamline our Home and Enterprise business to be primarily comprised of our digital projection solutions, contributing to more optimized allocation of resources and improved operational efficiencies.

Switching gears, I want to briefly highlight a couple of recent developments related to our Pixelworks Shanghai subsidiary. As a reminder and for those newer to our story, several years ago we restructured the entire organization to operate all of our semiconductor business through our Shanghai-based subsidiary. There were several strategic reasons for adopting this structure, including that a majority of our employees are based in China, in addition to our largely Asia-centric customer base. We also previously leveraged this structure to secure additional equity capital at a time when valuations were very attractive in China. Today, the U.S.-based parent company Pixelworks Inc. continues to hold a 78.7% equity interest in our subsidiary.

Of note, our Pixelworks Shanghai subsidiary was recently awarded with the designation of “Little Giant”, contributing to both provincial and national-level recognition within China. The designation “Little Giant” is part of an ambitious government program overseen by China’s Ministry of Industry and Information Technology, with the purpose of identifying and issuing formal certification to outstanding small and medium-sized enterprises based on a series of strict criteria. In addition to completing an extensive application process to be considered, certification requires undergoing multiple stages of in-dept business reviews that a majority of applying companies fail to pass. Designated ‘Little Giants’ benefit from increased local and national prominence, having been recognized by the Chinese government as a leading company with unique strengths in areas such as innovation and R&D capabilities, as well as for having significant growth potential. Also notable, this designation qualifies enterprises to apply for various forms of government mandated subsidies, including grants and R&D credits. Pixelworks Shanghai was recently awarded one such subsidy, and our team is now in the process of applying for other potential financial awards as part of the ‘Little Giant’ program.

Separately, I want to briefly highlight another new and ongoing development in China. We recently received inbound strategic interest in our Pixelworks Shanghai subsidiary, and we have formally retained Morgan Stanley as a financial advisor to assist with reviewing various potential strategic options specific to our Shanghai entity. I want to emphasize that we are still just beginning a comprehensive review process. Given the recent designation of “Little Giant” and the inbound interest, we continue to have strong confidence in our Shanghai-based subsidiary and it’s highly innovative technology, as well as it’s long-term growth potential. We are evaluating different ownership and collaboration structures that could enhance and accelerate this potential.

In summary, our team has continued to execute well toward overcoming recent challenges, and we believe our mobile business is well positioned for a return to growth in 2025. We have a strong pipeline of new program opportunities for our latest mobile solutions, including our new flagship visual processor as well as the cost-down derivative solution that we are particularly excited about. We expect to sustain a high level of customer engagement activity over the next several quarters,

particularly as we target an expanded served market for our visual processing solutions in mid- to entry-level smartphones. Moreover, we remain committed to optimizing near-term operation efficiencies in order to reduce the financial impact of temporarily lower revenue. Coupled with our previous and ongoing cost reduction actions, we expect to realize meaningful improvement in our operating results as we drive renewed top-line momentum in mobile in the coming year.

With that, I’ll hand the call to Haley to review the financials and provide our guidance for the fourth quarter.

Haley Aman

Thank you, Todd.

Revenue for the third quarter of 2024 was $9.5 million, which was the midpoint of our guidance, and compared to $8.5 million in the second quarter and $16.0 million in the third quarter of 2023. The sequential increase in third quarter revenue was driven by increased sales in the Home and Enterprise market, while the year-over-year decline primarily reflected the previously discussed headwinds in Mobile.

The breakdown of revenue in the third quarter was as follows:

•Revenue from Mobile was approximately $2.0 million.

•Home and Enterprise revenue was approximately $7.5 million.

Third quarter non-GAAP gross profit margin expanded 30 basis points sequentially to 51.3%, from 51.0% in the second quarter of 2024, and increased 820 basis points from 43.1% in the third quarter of 2023. The significant year-over-year expansion in gross margin reflects a more favorable product mix and our ongoing focus to drive healthy margins.

Non-GAAP operating expenses decreased to $12.4 million in the third quarter, from $12.8 million in the prior quarter and $13.3 million in the third quarter of 2023. The sequential and year-over-year decrease in third quarter operating expenses reflected the initial benefits from the cost reduction actions implemented at the end of the second quarter, however were partially offset by a one-time expense associated with the design revisions completed on our next-generation mobile visual processor. We continue to expect to realize approximately $4.0 million in annualized savings from our previously taken cost reduction measures.

On a non-GAAP basis, third quarter 2024 net loss was $7.1 million, or a loss of ($0.12) cents per share, compared to a net loss of $7.7 million, or a loss of ($0.13) cents per share, in the prior quarter, and a net loss of $5.7 million, or a loss of ($0.10) cents per share, in the third quarter of 2023.

Adjusted EBITDA for the third quarter of 2024 was a negative $6.3 million, compared to a negative $7.0 million in the prior quarter and a negative $5.0 million in the third quarter of 2023.

Turning to the balance sheet, we ended the third quarter with cash and cash equivalents of $28.8 million, compared to $37.8 million at the end of the second quarter. The cash used in the third quarter included approximately $3.6M in one-time severance and related cash payments associated with the restructuring implemented at the end of June, as well as a one-time expense associated with the design revision completed on our next-generation mobile visual processor. Absent these non-recurring cash expenses, we expect to realize significantly lower cash burn in the fourth quarter of 2024.

Shifting to our current expectations and guidance for the fourth quarter of 2024.

Based on existing backlog and anticipated order trends, we currently expect total revenue for the fourth quarter to be in a range of between $9.0 million and $10.0 million.

In terms of gross profit margin. For the fourth quarter, we expect non-GAAP gross profit margin to be between 49% and 51%.

With respect to operating expenses, we expect to realize incremental benefits from our previously implemented cost reduction actions. Specific to the fourth quarter, we anticipate operating expenses to range between $10.0 million and $11.0 million on a non-GAAP basis.

Lastly, we expect fourth quarter non-GAAP EPS to range between a loss of ($0.08) cents per share and a loss of ($0.11) cent per share.

That completes our prepared remarks, and we look forward to taking your questions. Operator, please proceed with the Q&A session. Thank you.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

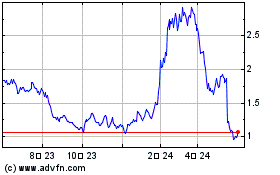

Pixelworks (NASDAQ:PXLW)

過去 株価チャート

から 2 2025 まで 3 2025

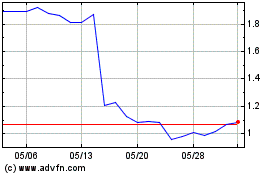

Pixelworks (NASDAQ:PXLW)

過去 株価チャート

から 3 2024 まで 3 2025