UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File No. 001-41010

MAINZ BIOMED N.V.

(Translation of registrant’s name into English)

Robert Koch Strasse 50

55129 Mainz

Germany

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☒ Form

40-F ☐

Other Events

As previously disclosed by Mainz Biomed N.V. (the

“Company”) in a Current Report on Form 6-K on October 18, 2024, the Company N.V. made available its Management’s Discussion

and Analysis of Financial Condition and Results of Operations, and unaudited Financial Statements each for the six months ended June 30,

2024.

Furnished as Exhibit 99.1 to this Report on Form

6-K is a press release of dated October 21, 2024, announcing the Company’s results for the six months ended June 30, 2024.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 21, 2024 |

By: |

/s/ William J. Caragol |

| |

Name: |

William J. Caragol |

| |

Title |

Chief Financial Officer |

2

Exhibit 99.1

Mainz

Biomed Reports Mid-Year 2024 Financial Results and Provides Corporate Update

Revenue increases 4% year over year while

loss from operations decreases by 32%

Pooled Results of ColoFuture and eAArly DETECT

studies published at ASCO showing groundbreaking performance with sensitivity for CRC of 92% and 82% for advanced adenomas, including

95.8% detection of high-grade dysplasia

Company highlights its path to success for

2025

BERKELEY, US – MAINZ, Germany – October 21, 2024 —

Mainz Biomed N.V. (NASDAQ:MYNZ) (“Mainz Biomed” or the “Company”), a molecular genetics diagnostic company

specializing in the early detection of cancer, announced today financial results for the first half

of 2024, an update on 2024 accomplishments, and its outlook for the end of the year and strategic direction for 2025.

Key 2024 Accomplishments

| ● | During

the first six months of 2024, the Company’s revenue increased by 4% year over year while the loss from operations and net loss

decreased by 32% and 26%, respectively. These decreases are the result of the Company’s efforts to reduce costs during the first

half of the year. |

| ● | Mainz

Biomed published key findings from its groundbreaking eAArly DETECT study during a poster presentation at the renowned Digestive Disease

Week (DDW) 2024 in Washington D.C. The Company was awarded as a Poster of Distinction by the Digestive Disease Week judges for the presentation

of industry leading results: 97% sensitivity for colorectal cancer (CRC) and 82% for advanced precancerous lesions. The eAArly DETECT

results demonstrated that within the advanced precancerous lesion patients, 100% of those patients with high grade dysplasia were detected. |

| ● | The

Company presented pivotal data from its largest cohort to date during a poster presentation at the American Society of Clinical Oncology

(ASCO) 2024 Annual Meeting in Chicago, Illinois. This data combined results from the ColoFuture and eAArly DETECT studies including additional

patient samples collected since the first reported study results, demonstrating the significance of its innovative screening approach.

The new study data confirmed previous ColoFuture and eAArly DETECT study performance with sensitivity for CRC of 92% and 82% for advanced

adenomas, including 96% detection of high-grade dysplasia. |

| ● | The

Company announced significant improvements to its ColoAlert® product, currently being commercialized across Europe and in select

international markets. These updates aim to enhance customer satisfaction and streamline lab operations. To increase screening/lab efficiency,

Mainz Biomed introduced a novel DNA stabilizing buffer capable of accommodating varying sample volumes, addressing a common issue in

the industry where samples are often either underfilled or overfilled, rendering them unsuitable for laboratory analysis. The new proprietary

buffer used in ColoAlert® significantly reduces the necessity for additional sample submissions, thereby decreasing the time for

the patients to obtain their results. This enhancement has enabled ColoAlert® to achieve the industry’s lowest retesting rates,

ensuring that screening outcomes are delivered within just 2 – 3 days upon arrival at the laboratory. |

| ● | The

Company expanded its collaboration with Liquid Biosciences to Mainz Biomed’s next-generation detection test for pancreatic cancer.

The companies are leveraging Liquid Biosciences proprietary AI analysis technology platform (EMERGE) to extend and optimize the selection

of novel biomarkers for PancAlert. The first phase of the collaboration included the evaluation of biomarkers from the Company’s

research program co-funded by the German Federal Ministry for Education and Research, and applied a single algorithm developed by Liquid

Biosciences using its EMERGE platform. The results of this feasibility analysis were promising, leading the Company and Liquid Biosciences

to believe that a PancAlert diagnostic test could, in the future, be combined with Mainz Biomed’s colorectal cancer screening product. |

Post-period Update

| ● | In

September 2024, Mainz Biomed announced encouraging feedback received from the FDA for the breakthrough device designation with the request

to expand the current clinical data set with additional average risk population. |

| ● | In

October 2024, the Company made the strategic decision to focus its efforts on three key initiatives for the remainder of 2024 and into

2025 in order to maximize shareholder value. Those initiatives are: |

| o | The continued growth of its ColoAlert® business in Europe; |

| o | Development of its next generation colorectal cancer screening product; and |

| o | Running a 2,000 patient study, with average risk patients in

the U.S., to read out in the second half of 2025 (eAArly DETECT 2). With eAArly DETECT 2, the Company addresses the recent FDA feedback

and prepares for a new submission for breakthrough device designation with an expanded data set, including a larger average-risk patient

population. |

In line with these strategic initiatives, the Company restructured its operations and implemented cost reductions which

included decreasing its operating costs, primarily driven by the reduction of personnel and external consulting costs.

“2024 has been a transitional year for Mainz Biomed. While navigating

through a period of difficult markets, especially for small cap technology stocks, we are proud to have achieved many significant accomplishments

to date,” commented Guido Baechler, Chief Executive Officer of Mainz Biomed. “As the Board and management team evaluated our

path forward, we believe that a narrower focus on key strategic initiatives gives us the best opportunity to unlock shareholder value

in the remainder of 2024 and 2025.”

Condensed Consolidated Financial Statements (unaudited):

Mainz Biomed N.V.

Condensed Consolidated Statements of Profit or Loss and Comprehensive Loss (unaudited)

(in U.S. Dollars)

| | |

Six months ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue | |

$ | 520,773 | | |

$ | 499,049 | |

| Cost of sales | |

| 201,735 | | |

| 211,310 | |

| Product margin | |

| 319,038 | | |

| 287,739 | |

| | |

| 61 | % | |

| 58 | % |

| Operating expenses: | |

| | | |

| | |

| Sales and marketing | |

| 2,361,105 | | |

| 3,992,975 | |

| Research and development | |

| 3,242,622 | | |

| 5,481,229 | |

| General and administrative | |

| 4,522,639 | | |

| 5,227,181 | |

| Total operating expenses | |

| 10,126,366 | | |

| 14,701,385 | |

| | |

| | | |

| | |

| Loss from operations | |

| (9,807,328 | ) | |

| (14,413,646 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Other income | |

| 105,851 | | |

| 125,968 | |

| Change in fair value of convertible debt | |

| (528,210 | ) | |

| 45,000 | |

| Finance expense | |

| - | | |

| (250,000 | ) |

| Accretion and interest expense | |

| (659,473 | ) | |

| (88,759 | ) |

| Other expense | |

| (134,602 | ) | |

| (231,206 | ) |

| Total other income (expense) | |

| (1,216,434 | ) | |

| (398,997 | ) |

| | |

| | | |

| | |

| Income (loss) before income tax | |

| (11,023,762 | ) | |

| (14,812,643 | ) |

| Income taxes provision | |

| - | | |

| - | |

| Net loss | |

$ | (11,023,762 | ) | |

$ | (14,812,643 | ) |

| | |

| | | |

| | |

| Foreign currency translation gain (loss) | |

| (62,366 | ) | |

| (150,596 | ) |

| Comprehensive loss | |

$ | (11,086,128 | ) | |

$ | (14,963,239 | ) |

| | |

| | | |

| | |

| Basic and diluted loss per ordinary share | |

$ | (0.49 | ) | |

$ | (1.00 | ) |

| Weighted average number of ordinary shares outstanding | |

| 22,350,033 | | |

| 14,803,243 | |

Condensed Consolidated Financial Statements (unaudited):

Mainz Biomed N.V.

Condensed Consolidated Statements of Financial Position

(unaudited)

(in U.S. Dollars)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash | |

$ | 977,764 | | |

$ | 7,070,925 | |

| Trade and other receivables, net | |

| 139,414 | | |

| 93,555 | |

| Inventories | |

| 520,531 | | |

| 613,638 | |

| Prepaid expenses and other current assets | |

| 751,994 | | |

| 1,201,778 | |

| Total Current Assets | |

| 2,389,703 | | |

| 8,979,896 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,625,373 | | |

| 1,702,317 | |

| Intangible assets | |

| 3,206,054 | | |

| 3,394,645 | |

| Right-of-use assets | |

| 1,232,900 | | |

| 1,332,170 | |

| Other assets | |

| - | | |

| | |

| Total assets | |

$ | 8,454,030 | | |

$ | 15,409,028 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 2,903,873 | | |

$ | 3,184,381 | |

| Accounts payable and accrued expense - related party | |

| 426,637 | | |

| 299,936 | |

| Deferred revenue | |

| 116,679 | | |

| 138,889 | |

| Convertible debt | |

| 5,842,003 | | |

| 4,903,310 | |

| Convertible debt - related party | |

| 32,140 | | |

| 33,118 | |

| Silent partnership | |

| 49,036 | | |

| - | |

| Intellectual property acquisition liability - related party | |

| 324,003 | | |

| 388,839 | |

| Lease liabilities | |

| 319,573 | | |

| 288,463 | |

| Total current liabilities | |

| 10,013,944 | | |

| 9,236,936 | |

| | |

| | | |

| | |

| Silent partnerships | |

| 713,856 | | |

| 758,812 | |

| Silent partnerships - related party | |

| 267,206 | | |

| 271,354 | |

| Lease liabilities | |

| 1,046,163 | | |

| 1,165,723 | |

| Intellectual property acquisition liability - related party | |

| 551,561 | | |

| 726,977 | |

| Total Liabilities | |

| 12,592,730 | | |

| 12,159,802 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Share capital | |

| 276,378 | | |

| 235,818 | |

| Share premium | |

| 54,136,785 | | |

| 51,507,526 | |

| Reserve | |

| 22,314,598 | | |

| 21,286,215 | |

| Accumulated deficit | |

| (80,351,783 | ) | |

| (69,328,021 | ) |

| Accumulated other comprehensive income (loss) | |

| (514,678 | ) | |

| (452,312 | ) |

| Total shareholders’ equity | |

| (4,138,700 | ) | |

| 3,249,226 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 8,454,030 | | |

$ | 15,409,028 | |

Please visit Mainz Biomed’s official website for investors

at mainzbiomed.com/investors/ for more information

Please follow us to stay up to date:

LinkedIn

X (Previously Twitter)

Facebook

About Mainz Biomed NV

Mainz

Biomed develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. The Company’s flagship product

is ColoAlert®, a non-invasive and easy-to-use, early-detection diagnostic test for colorectal cancer with high sensitivity and specificity.

ColoAlert® is marketed in Europe and the United Arab Emirates. The Company is currently preparing a pivotal FDA clinical study for

US regulatory approval. Mainz Biomed’s product candidate portfolio also includes PancAlert, an early-stage pancreatic cancer screening

test based on real-time Polymerase Chain Reaction-based (PCR) multiplex detection of molecular-genetic biomarkers in stool samples. To

learn more, visit mainzbiomed.com or follow us on LinkedIn, Twitter and Facebook.

For media inquiries

MC Services AG

Anne Hennecke/Caroline Bergmann

+49 211 529252 20

mainzbiomed@mc-services.eu

For investor inquiries, please contact info@mainzbiomed.com

Forward-Looking Statements

Certain statements made in this press release are “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”,

“estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict

or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect the current

analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying

on forward-looking statements. Due to known and unknown risks, actual results may differ materially from the Company’s expectations

or projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking

statements: (i) the failure to meet projected development and related targets; (ii) changes in applicable laws or regulations; (iii) the

effect of the COVID-19 pandemic on the Company and its current or intended markets; and (iv) other risks and uncertainties described herein,

as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the Securities and

Exchange Commission (the “SEC”) by the Company. Additional information concerning these and other factors that may impact

the Company’s expectations and projections can be found in its initial filings with the SEC, including its annual report on Form

20-F filed on April 9, 2024. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov. Any forward-looking

statement made by us in this press release is based only on information currently available to Mainz Biomed and speaks only as of the

date on which it is made. Mainz Biomed undertakes no obligation to publicly update any forward-looking statement, whether written or oral,

that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by law.

5

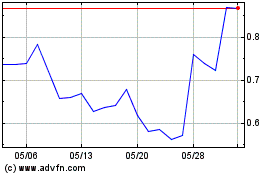

Mainz BioMed NV (NASDAQ:MYNZ)

過去 株価チャート

から 11 2024 まで 12 2024

Mainz BioMed NV (NASDAQ:MYNZ)

過去 株価チャート

から 12 2023 まで 12 2024