Akerna Corp. Announces Anticipated Closing of the Merger with Gryphon Digital Mining, Inc. and Reverse Stock Split

2024年2月8日 - 1:59AM

Akerna Corp. (Nasdaq: KERN) (“Akerna”), today

announced that the closing of its previously announced merger with

Gryphon Digital Mining, Inc. (“Gryphon”) (the “Merger”) is expected

to take place before markets open on Friday, February 9, 2024.

Prior to closing the Merger, Akerna anticipates completing a

reverse stock split of its common stock at a ratio of one share for

twenty shares. Following completion of the Merger, the combined

company is expected to begin trading at market open on February 9,

2024, on The Nasdaq Capital Market on a reverse stock split basis,

under the new name “Gryphon Digital Mining, Inc.” and under the

symbol “GRYP”.

The estimated exchange ratio of shares of

Akerna’s common stock for Gryphon common stock and Gryphon

preferred stock will be approximately 1.5561 shares of Akerna

common stock for each one share of Gryphon Common Stock and

Preferred Stock based on estimated aggregate merger consideration

of 31,539,011 shares of Akerna common stock, on a post-reverse

stock split basis. The actual exchange ratio and merger

consideration will depend upon the number of shares of Akerna

common stock outstanding as of the closing of the Merger. The

number of shares of Akerna common stock outstanding at the closing

of the Merger will depend upon the price at which Akerna’s

outstanding convertible senior secured notes, subordinated secured

notes, shares of Series C preferred stock and outstanding amounts

due and payable to certain service providers and officers of Akerna

are converted into shares of Akerna common stock based on the

closing price of Akerna’s common stock on the trading day

immediately prior to closing and/or the 5-day volume weighted

average price of Akerna’s common stock immediately prior to

closing.

Immediately after the consummation of the

Merger, Akerna equityholders as of immediately prior to the Merger

are expected to own approximately 7.5% of the outstanding equity

interests of the combined company on a fully diluted basis and

former Gryphon equityholders are expected to own approximately

92.5% of the outstanding equity interests of the combined company

on a fully diluted basis.

At closing, each warrant to purchase common

stock of Gryphon will be assumed by Akerna and become a warrant to

purchase an adjusted number of shares of Akerna common stock, at an

adjusted exercise price per share but subject to the same terms and

conditions as the warrants of Gryphon.

Concurrently with the closing of the Merger,

Akerna anticipates closing the sale of all of the membership

interests of its wholly-owned subsidiary, MJ Freeway LLC to MJ

Acquisition Corp. pursuant to that certain Securities Purchase

Agreement by and between Akerna and MJ Acquisition Corp. dated

April 28, 2023 (the “Sale Transaction”) for gross aggregate cash

proceeds of approximately $1.22 million and the conversion of $1.85

million in notes held by MJ Acquisition Corp. into shares of Akerna

common stock.

At Akerna’s special meeting of stockholders held

on January 29, 2024, Akerna’s stockholders approved the Merger, the

Sale Transaction, the reverse stock split and a name change.

Subsequently, Akerna’s board of directors approved

a 1-for-20 reverse stock split of its shares of Akerna

common stock, $0.0001 par value, that will become effective on

February 8, 2024 at 4:05 p.m. Eastern Standard Time.

The reverse stock split is in relation to the anticipated

closing of the Merger and is contingent upon the Merger

closing.

The reverse stock split will affect all

issued and outstanding shares of Akerna common stock. In relation

to the reverse stock split, all outstanding options, restricted

stock awards, warrants, preferred stock and convertible notes and

other securities entitling their holders to purchase or otherwise

receive shares of Akerna common stock will be adjusted as a result

of the reverse stock split, as required by the terms of each

security. The number of shares of Akerna common stock available to

be awarded under Akerna’s equity incentive plans will also be

appropriately adjusted.

No fractional shares will be issued in

connection with the reverse stock split. All fractional shares will

be rounded up to the nearest whole share. The reverse stock

split will affect all stockholders uniformly and will not

alter any stockholder’s percentage interest in Akerna’s equity

(other than as a result of the rounding up of shares to the nearest

whole share in lieu of issuing fractional shares).

The reverse stock split will not reduce the

authorized number of shares of Akerna common stock. The reverse

stock split did not alter the par value of Akerna common stock or

modify any voting rights or other terms of our shares of Akerna

common stock.

The new CUSIP number for the shares of common

stock of the combined company following the reverse stock split and

the name change to “Gryphon Digital Mining, Inc.” upon the

closing of the Merger will be 400510103.

Akerna’s transfer agent, Continental Stock

Transfer & Trust Company (“Continental”), will serve as

exchange agent for the reverse stock split and will provide

instructions to stockholders of record regarding the reverse stock

split. Unless otherwise requested by the stockholder,

Continental will be issuing all of the post-split shares in

paperless, “book-entry” form, and unless otherwise requested by the

stockholder, Continental will hold the shares in an account set up

for the stockholder. All book-entry or other electronic positions

representing issued and outstanding shares of Akerna common stock

will be automatically adjusted. Those stockholders holding Akerna

common stock in “street name” will receive instructions from their

brokers.

For stockholders of Gryphon, Continental will be

sending Gryphon shareholders DRS statements via email.

About Gryphon Digital

Mining

Gryphon Digital Mining, Inc. is an innovative

venture in the bitcoin space dedicated to helping bring digital

assets onto the clean energy grid. With a talented leadership team

coming from globally recognized brands, Gryphon is assembling

thought leaders to improve digital asset network infrastructure.

Its Bitcoin mining operation has a net carbon-negative

strategy.

About Akerna

Akerna (Nasdaq: KERN) is an emerging technology

firm focused on innovative technology.

Cautionary Statements Regarding Forward-Looking

Statements

This press release contains forward-looking

statements based upon the current expectations of Gryphon and

Akerna. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties, which

include, without limitation: (i) the risk that the conditions to

the closing of the proposed transactions are not satisfied; (ii)

uncertainties as to the timing of the consummation of the proposed

transactions and the ability of each of Akerna, Gryphon and MJ

Acquisition Co. to consummate the proposed merger or asset sale, as

applicable; (iii) risks related to Akerna’s ability to manage its

operating expenses and its expenses associated with the proposed

transactions pending closing; (iv) risks related to the failure or

delay in obtaining required approvals from any governmental or

quasi-governmental entity necessary to consummate the proposed

transactions; (v) the risk that as a result of adjustments to the

exchange ratio, Akerna stockholders and Gryphon stockholders could

own more or less of the combined company than is currently

anticipated; (vi) risks related to the market price of Akerna’s

common stock relative to the exchange ratio of outstanding

securities of Akerna at closing; (vii) unexpected costs, charges or

expenses resulting from either or both of the proposed

transactions; (viii) potential adverse reactions or changes to

business relationships resulting from the announcement or

completion of the proposed transactions; (ix) risks related to the

inability of the combined company to obtain sufficient additional

capital to continue to advance its business plan; and (x) risks

associated with the possible failure to realize certain anticipated

benefits of the proposed transactions, including with respect to

future financial and operating results. Actual results and the

timing of events could differ materially from those anticipated in

such forward-looking statements as a result of these risks and

uncertainties. These and other risks and uncertainties are more

fully described under the heading “Risk Factors” in the proxy

statement/prospectus included in the Form S-4 and the periodic

filings with the SEC, including the factors described in the

section titled “Risk Factors” in Akerna’s Annual Report on Form

10-K for the year ended December 31, 2022 and Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, each filed with

the SEC, and in other filings that Akerna makes and will make with

the SEC in connection with the proposed transactions. You should

not place undue reliance on these forward-looking statements, which

are made only as of the date hereof or as of the dates indicated in

the forward-looking statements. Except as required by law, Akerna

and Gryphon expressly disclaim any obligation or undertaking to

update or revise any forward-looking statements contained herein to

reflect any change in its expectations with regard thereto or any

change in events, conditions, or circumstances on which any such

statements are based.

Company Contact

Gryphon Digital Mining

Rob Chang

(877) MINE-ESG, (877) 646-3374

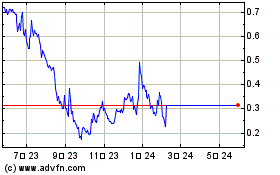

Akerna (NASDAQ:KERN)

過去 株価チャート

から 11 2024 まで 12 2024

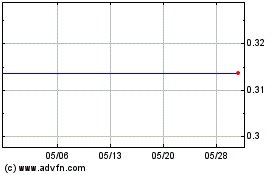

Akerna (NASDAQ:KERN)

過去 株価チャート

から 12 2023 まで 12 2024