SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

CHARTER COMMUNICATIONS, INC.

(Name of Issuer)

CLASS A COMMON STOCK, PAR VALUE $0.001

PER SHARE

(Title of Class of Securities)

16119P108

(CUSIP Number)

Renee L. Wilm, Esq.

Chief Legal Officer

Liberty Broadband Corporation

12300 Liberty Boulevard

Englewood, CO 80112

(720) 875-5700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

November 12, 2024

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box o

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

CUSIP Number: 16119P108

| 1. | Names of Reporting Persons. |

| | | I.R.S. Identification

Nos. of above persons (entities only) |

| | | Liberty Broadband Corporation |

| | | |

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) |

| | | |

| | | (a) |

¨ |

| | | (b) |

x

(1) |

| | | |

| 3. | SEC Use Only |

| | | |

| | | |

| 4. | Source of Funds (See Instructions) |

| | | OO |

| | | |

| | | |

| 5. | Check

if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

| | | |

| | | |

| 6. | Citizenship or Place of Organization |

| | | Delaware |

| | | |

| | | |

| |

7. |

Sole Voting Power |

| |

|

45,560,806 (2) |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

|

|

| 8. |

Shared Voting Power |

| |

0 |

| |

|

| |

|

| 9. |

Sole Dispositive Power |

| |

45,560,806 (2) |

| |

|

| |

|

| 10. |

Shared Dispositive Power |

| |

|

0 |

| |

|

|

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person |

| |

|

45,560,806 (2) |

| |

|

|

| |

|

|

| |

12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) x |

| |

|

Excludes shares beneficially owned by the executive

officers and directors of the Reporting Person. |

| |

|

|

| |

|

|

| |

13. |

Percent of

Class Represented by Amount in Row (11) |

| |

|

32.0% (3) |

| |

|

|

| |

|

|

| |

14. |

Type of Reporting Person

(See Instructions) |

| |

|

CO |

| (1) | The

Second Amended and Restated Stockholders Agreement, dated as of May 23, 2015, (as amended

(including by the SHA Amendment (as defined below)), the “Stockholders Agreement”),

by and among Charter Communications, Inc. (“Legacy Charter”), CCH

I, LLC (now known as Charter Communications, Inc., the “Issuer” or

“Charter”), Advance/Newhouse Partnership (“A/N”) and

Liberty Broadband Corporation (“Liberty Broadband” or the “Reporting

Person”), as amended by that certain Amendment No.1 to the Second Amended and Restated

Stockholders Agreement and the Letter Agreement, dated as of November 12, 2024, by and

among Issuer, A/N and the Reporting Person (the “SHA Amendment”), contains

provisions relating to the ownership and voting of the Issuer’s Class A common

stock, par value $0.001 per share (the “Common Stock”), by the Reporting

Person. The Reporting Person expressly disclaims the existence of any membership in a group

with A/N. |

| (2) | Subject

to certain restrictions contained in the Stockholders Agreement. See Item 6 of the Schedule

13D. |

| (3) | Calculated

based on the 142,195,750 shares of Common Stock outstanding as of September 30, 2024,

as reported by the Issuer in its Quarterly Report on Form 10-Q for the fiscal quarter

ended September 30, 2024, filed with the SEC on November 1, 2024. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 11)

Statement of

LIBERTY BROADBAND CORPORATION

Pursuant to Section 13(d) of the Securities

Exchange Act of 1934 in respect of

CHARTER COMMUNICATIONS, INC.

This statement on Schedule

13D/A relates to the Class A common stock, par value $0.001 per share (the “Common Stock”), of Charter Communications, Inc.,

a Delaware corporation (the “Issuer” or “Charter”). The statement on Schedule 13D originally filed

with the Securities and Exchange Commission (the “SEC”) by Liberty Broadband Corporation, a Delaware corporation (“Liberty

Broadband” or the “Reporting Person”), on November 13, 2014, as amended by Amendment No. 1 filed

with the SEC on April 6, 2015, Amendment No. 2 filed with the SEC on June 1, 2015, Amendment No. 3 filed with the

SEC on May 26, 2016, Amendment No. 4 filed with the SEC on December 30, 2016, Amendment No. 5 filed with the SEC

on December 29, 2017, Amendment No. 6 filed with the SEC on March 4, 2020, Amendment No. 7 filed with the SEC on

August 7, 2020, Amendment No. 8 filed with the SEC on December 23, 2020, Amendment No. 9 filed with the SEC on February 24,

2021 and Amendment No. 10 filed with the SEC on September 23, 2024 (together, the “Schedule 13D”), is hereby

further amended and supplemented to include the information set forth herein. This amended statement on Schedule 13D/A constitutes Amendment

No. 11 to the Schedule 13D (this “Amendment,” and together with the Schedule 13D, this “Statement”).

Capitalized terms used but not defined herein have the meanings given to such terms in the Schedule 13D. Except as set forth herein,

the Schedule 13D is unmodified.

Item 4. Purpose of Transaction.

The information contained

in Item 4 of the Schedule 13D is hereby amended and supplemented by adding the following information:

On September 23, 2024, the Reporting Person

communicated to the Issuer a non-binding response to a non-binding proposal received from the Issuer, which collectively outlined the

terms of a proposed combination of the Reporting Person with the Issuer.

On November 12, 2024,

the Reporting Person entered into an Agreement and Plan of Merger (the “Merger Agreement”) with the Issuer, Fusion

Merger Sub 1, LLC, a Delaware limited liability company and wholly owned subsidiary of the Issuer (“Merger LLC”),

and Fusion Merger Sub 2, Inc., a Delaware corporation and wholly owned subsidiary of Merger LLC (“Merger Sub”),

whereby, subject to the terms thereof, (i) Merger Sub will merge with and into the Reporting Person (the “Merger”),

with the Reporting Person surviving the Merger as the surviving corporation and a wholly owned subsidiary of Merger LLC, and (ii) the

Merger will be immediately followed by a merger of, the Reporting Person, as such surviving corporation, with and into Merger LLC (the

“Upstream Merger”, and together with the Merger, the “Combination”), with Merger LLC surviving

the Upstream Merger as the surviving company and a wholly owned subsidiary of the Issuer.

In addition, in connection

with the Merger Agreement, on November 12, 2024, certain trusts related to Dr. John C. Malone (collectively, the “Malone

Stockholders”) entered into a Voting Agreement (the “Malone Voting Agreement”) with the Reporting Person

and the Issuer, pursuant to which, among other things, the Malone Stockholders have agreed, subject to the terms of the Malone Voting

Agreement, to vote their respective shares of the Reporting Person’s Series A common stock, par value $0.01 per share (“Series A

Common Stock”), the Reporting Person’s Series B common stock, par value $0.01 per share (“Series B

Common Stock”) and the Reporting Person’s Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share

(“LBC Preferred Stock”, and together with Series A Common Stock and Series B Common Stock, the “Voting

Stock”), in favor of the adoption of the Merger Agreement and the approval of the transactions contemplated thereby, including

the Merger.

Further, in connection with

the Merger Agreement, on November 12, 2024, Gregory B. Maffei and certain related entities (collectively, the “Maffei Stockholders”)

entered into a Voting Agreement (the “Maffei Voting Agreement”, and together with the Malone Voting Agreement, the

“Voting Agreements”) with the Reporting Person and the Issuer, pursuant to which, among other things, the Maffei Stockholders

have agreed, subject to the terms of the Maffei Voting Agreement, to vote their respective shares of the Reporting Person’s Voting

Stock in favor of the adoption of the Merger Agreement and the approval of the transactions contemplated thereby, including the Merger.

The terms of the Merger Agreement, Voting Agreements

and SHA Amendment are summarized below.

Merger Agreement

The Merger Agreement provides

that Merger Sub will be merged with and into the Reporting Person, with the Reporting Person surviving the Merger as a wholly owned subsidiary

of Merger LLC. Immediately following the Merger, the Reporting Person, as the surviving corporation in the Merger, will merge with and

into Merger LLC, with Merger LLC surviving the Upstream Merger as the surviving company and wholly owned subsidiary of the Issuer.

Pursuant to, and subject

to the terms and conditions of, the Merger Agreement, (i) each share of Series A Common Stock, Series B Common Stock and

the Reporting Person’s Series C common stock, par value $0.01 per share (“Series C Common Stock”,

and together with Series A Common Stock, Series B Common Stock and LBC Preferred Stock, “LBC Capital Stock”)

issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”) (other than shares

of Series B Common Stock that are held by any person who is entitled to demand and properly demands appraisal of such shares in

accordance with, and who complied in all respects with, Section 262 of the Delaware General Corporation Law), will automatically

be converted into and become the right to receive 0.2360 of a validly issued, fully paid and nonassessable share of Common Stock, except

that cash (without interest) will be paid in lieu of fractional shares of Common Stock pursuant to the Merger Agreement, and (ii) each

share of LBC Preferred Stock issued and outstanding immediately prior to the Effective Time will automatically be converted into and

become the right to receive one validly issued, fully paid and nonassessable share of the Issuer’s Series A Cumulative Redeemable

Preferred Stock, par value $0.001 per share (“Charter Preferred Stock”), except that, in the case of each of clauses

(i) and (ii) above, each share of LBC Capital Stock (A) held by the Reporting Person as treasury stock or by any of its

wholly owned subsidiaries immediately prior to the Effective Time or (B) owned by the Issuer or any of its wholly owned subsidiaries

immediately prior to the Effective Time, in each case, will automatically be cancelled without consideration.

The foregoing description

of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger

Agreement, which is included as Exhibit 7(cc) to this Amendment and is incorporated into this Item 4 by reference. In addition,

for further information on the Combination and the Merger Agreement, see the Form 8-K filed by the Reporting Person with the SEC

on November 13, 2024 (the “Form 8-K”).

Malone Voting Agreement

The Malone Voting Agreement

provides that, among other things, the Malone Stockholders have agreed to vote their respective shares of the Reporting Person’s

Voting Stock, representing approximately 48% of the total voting power of the issued and outstanding shares of the Reporting Person’s

Voting Stock in the aggregate, in favor of the adoption of the Merger Agreement and the approval of the transactions contemplated thereby,

including the Merger, except that in the event that the board of directors of the Reporting Person changes its recommendation and the

Issuer elects not to terminate the Merger Agreement prior to the Reporting Person’s stockholder meeting, the Malone Stockholders

will only be obligated to vote shares representing the sum of (x) 33.37% of the total voting power of the shares of Voting Stock

minus (y) the aggregate voting power of the shares of Voting Stock held by the Maffei Stockholders, in favor thereof, with any shares

in excess of such amount to be voted on such matters in the same proportion as voted by the Reporting Person’s stockholders other

than the Malone Stockholders and the Maffei Stockholders.

The foregoing description

of the Malone Voting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Malone Voting Agreement, which is included as Exhibit 7(dd) to this Amendment and is incorporated into this Item 4 by reference.

In addition, for further information on the Malone Voting Agreement, see the Form 8-K.

Maffei Voting Agreement

The Maffei Voting Agreement

provides that, among other things, the Maffei Stockholders have agreed to vote their respective shares of the Reporting Person’s

Voting Stock, representing approximately 4% of the total voting power of the issued and outstanding shares of the Reporting Person’s

Voting Stock in the aggregate, in favor of the adoption of the Merger Agreement and the approval of the transactions contemplated thereby,

including the Merger.

The foregoing description

of the Maffei Voting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Maffei Voting Agreement, which is included as Exhibit 7(ee) to this Amendment and is incorporated into this Item 4 by reference.

In addition, for further information on the Maffei Voting Agreement, see the Form 8-K.

The information contained in Item 6 of this Amendment

is incorporated by reference into this Item.

Other than as set forth in

this Amendment, the Reporting Person does not have any present plans or proposals which relate to or would result in: (i) any acquisition

by any person of additional securities of the Issuer, or any disposition of securities of the Issuer; (ii) any extraordinary corporate

transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (iii) any sale or

transfer of a material amount of assets of the Issuer or any of its subsidiaries; (iv) any change in the board or management of

the Issuer, including any plans or proposals to change the number or term of directors or to fill any vacancies on the board; (v) any

material change in the present capitalization or dividend policy of the Issuer; (vi) any other material change in the Issuer’s

business or corporate structure; (vii) any change in the Issuer’s charter or bylaws or other actions which may impede the

acquisition of control of the Issuer by any person; (viii) any delisting from a national securities exchange or any loss of authorization

for quotation in an inter-dealer quotation system of a registered national securities association of a class of securities of the Issuer;

(ix) any termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), of a class of equity securities of the Issuer; or (x) any action similar to any of those

enumerated above.

Notwithstanding the foregoing,

the Reporting Person may determine to change his intentions with respect to the Issuer at any time in the future and may, for example,

elect (i) to acquire additional securities of the Issuer in open market or privately negotiated transactions or (ii) to dispose

of all or a portion of the Reporting Person’s holdings of securities of the Issuer. In reaching any determination as to his future

course of action, the Reporting Person will take into consideration various factors, such as the Issuer’s business and prospects,

other developments concerning the Issuer, other business opportunities available to the Reporting Person, tax and estate planning considerations,

liquidity needs and general economic and stock market conditions, including, but not limited to, the market prices of the securities.

Item 5. Interest in Securities of the Issuer.

The information contained in Item 5 of the Schedule 13D

is hereby amended and restated in its entirety as follows:

(a) - (b) The Reporting

Person is the beneficial owner of 45,560,806 shares of Common Stock, constituting 32.0% of the outstanding shares of Common Stock, calculated

based on the 142,195,750 shares of Common Stock outstanding as of September 30, 2024, as reported by the Issuer in its Quarterly

Report on Form 10-Q for the fiscal quarter ended September 30, 2024, filed with the SEC on November 1, 2024.

Mr. John C. Malone beneficially

owns 1,691 shares of Common Stock. Mr. Gregory B. Maffei beneficially owns 7,569 shares of Common Stock. To the Reporting Person’s

knowledge, Mr. Malone and Mr. Maffei each have sole voting and dispositive power over the shares of Common Stock beneficially

owned by them. J. David Wargo beneficially owns 15,045 shares of Common Stock. To the Reporting Person’s knowledge, Mr. Wargo

has shared dispositive power over the shares of Common Stock beneficially owned by him. Gregg L. Engles beneficially owns 97 shares of

Common Stock consisting of nine shares held by his spouse and 88 shares held by a family partnership. To the Reporting Person’s

knowledge, Mr. Engles has shared voting and dispositive power over the shares of Common Stock held by his spouse and sole voting

and dispositive power over the shares of Common Stock held by a family partnership. Julie D. Frist beneficially owns 4,415 shares of

Common Stock, which includes (i) 1,898 shares of Common Stock held by four trusts of which Ms. Frist is the trustee for the

benefit of her immediate family members and (ii) 2,517 shares held by three trusts over which Ms. Frist may be deemed to have

shared dispositive power. To the Reporting Person’s knowledge, Ms. Frist has sole voting and dispositive power over the shares

of Common Stock described in clause (i) of the prior sentence and shared dispositive power over the shares of Common Stock described

in clause (ii) of the prior sentence. Ms. Frist disclaims beneficial ownership of these securities except to the extent of

her pecuniary interest therein, and the inclusion of these shares in this Amendment shall not be deemed an admission of beneficial ownership

of all of the reported shares for purposes of Section 13(d) of the Exchange Act, or for any other purpose.

The Reporting Person has

the sole power to vote or to direct the voting of 45,571,206 shares of Common Stock beneficially owned by it and has the sole power to

dispose or direct the disposition of such shares, subject to the terms of the Second Amended and Restated Stockholders Agreement, dated

as of May 23, 2015, (as amended (including by the SHA Amendment (as defined below)), the “Stockholders Agreement”),

by and among Charter Communications, Inc. (“Legacy Charter”), Charter, A/N and Liberty Broadband, including the

limitations described in Item 6 of the Schedule 13D.

(c) On

October 15, 2024, the Reporting Person sold 10,400 shares of Common Stock to the Issuer for $331.55 per share in cash. On September 17,

2024, the Reporting Person sold 40,027 shares of Common Stock to the Issuer for $356.64 per share in cash. Other than as disclosed in

this Statement, no transactions were effected by the Reporting Person, or, to the knowledge of the Reporting Person, any Schedule 1 Person,

with respect to the Common Stock in the past sixty days.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information contained in Item 6 of the Schedule

13D is hereby amended and supplemented by adding the following information:

SHA Amendment

Simultaneously with the execution and delivery

of the Merger Agreement, Reporting Person, Issuer and Advance/Newhouse Partnership, a New York general partnership (“A/N”)

have entered into an amendment (“Stockholders and Letter Agreement Amendment”) to (i) that certain Second Amended

and Restated Stockholders Agreement, dated as of May 23, 2015 (as amended, the “Stockholders Agreement”), by

and among the Reporting Person, Issuer and A/N, and (ii) that certain Letter Agreement, dated as of February 23, 2021

(the “Letter Agreement”), by and between the Reporting Person and Issuer. The Stockholders and Letter Agreement Amendment

sets forth certain agreements relating to the governance of the Issuer and the participation of the Reporting Person in the Issuer’s

share repurchase program.

Pursuant to the Stockholders and Letter Agreement

Amendment, each month during the pendency of the proposed Transactions, Issuer will repurchase shares of Common Stock from the Reporting

Person in an amount equal to the greater of (i) $100 million, and (ii) an amount such that immediately after giving effect

thereto, the Reporting Person would have sufficient cash to satisfy certain obligations as set forth in the Stockholders and Letter Agreement

Amendment and Merger Agreement, provided that if any repurchase would reduce the Reporting Person’s equity interest in the Issuer

below 25.25% after giving effect to such repurchase or if all or a portion of such repurchase is not permitted under applicable law,

then the Issuer shall instead loan to the Reporting Person an amount equal to the lesser of (x) the repurchase amount that cannot

be repurchased and (y) the Reporting Person minimum liquidity threshold less the repurchase amount that is repurchased, with such

loan on the terms set forth in the Stockholders and Letter Agreement Amendment. From and after the date the Reporting Person’s

exchangeable debentures are no longer outstanding, the amount of monthly repurchases will be the lesser of (i) $100 million and

(ii) an amount equal to the sum of (x) an amount such that immediately after giving effect thereto, the Reporting Person would

satisfy certain minimum liquidity requirements as set forth in the Stockholders and Letter Agreement Amendment and (y) the aggregate

outstanding principal amount of the Reporting Person margin loan. The foregoing description of the SHA Amendment does not purport to

be complete and is qualified in its entirety by reference to the full text of the SHA Amendment, which is included as Exhibit 7(ff)

to this Amendment and is incorporated into this Item 4 by reference. In addition, for further information on the SHA Amendment, see the

Form 8-K.

The information contained in Item 4 of this Amendment is

incorporated by reference into this Item.

Item 7. Material to be Filed as Exhibits

Item 7 of the Schedule 13D is hereby amended and supplemented

by adding the following:

| 7(cc) | Agreement and Plan of Merger, dated November 12,

2024, by and among Liberty Broadband Corporation, Charter Communications, Inc., Fusion

Merger Sub 1, LLC and Fusion Merger Sub 2, Inc. (incorporated by reference to Exhibit 2.1

to the Reporting Person’s Current Report on Form 8-K (SEC File No. 001-35707)

filed with the SEC on November 13, 2024). |

| 7(dd) | Voting Agreement, dated November 12,

2024, by and among Liberty Broadband Corporation, Charter Communications, Inc., The

John C. Malone 1995 Revocable Trust, The Leslie A. Malone 1995 Revocable Trust, The Malone

Family Land Preservation Foundation and the John C. Malone June 2003 Charitable Unitrust

(incorporated by reference to Exhibit 10.1 to the Reporting Person’s Current Report

on Form 8-K (SEC File No. 001-35707) filed with the SEC on November 13, 2024). |

| 7(ee) | Voting Agreement, dated November 12,

2024, by and among Liberty Broadband Corporation, Charter Communications, Inc., Gregory

B. Maffei, Maven GRAT 1, LLC, Maven 2017-1 GRAT, LLC and the Maffei Foundation (incorporated

by reference to Exhibit 10.2 to the Reporting Person’s Current Report on Form 8-K

(SEC File No. 001-35707) filed with the SEC on November 13, 2024). |

| 7(ff) | Amendment No. 1 to the Second Amended

and Restated Stockholders Agreement and the Letter Agreement, dated November 12, 2024,

by and among Liberty Broadband Corporation, Charter Communications, Inc. and Advance/Newhouse

Partnership (incorporated by reference to Exhibit 10.3 to the Reporting Person’s

Current Report on Form 8-K (SEC File No. 001-35707) filed with the SEC on November 13,

2024). |

Signature

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

| Dated: November 14, 2024 |

LIBERTY BROADBAND CORPORATION |

| |

|

| |

By: |

/s/ Katherine C.

Jewell |

| |

|

Name: Katherine C. Jewell |

| |

|

Title: Vice President and Assistant Secretary |

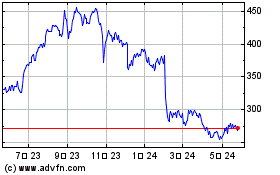

Charter Communications (NASDAQ:CHTR)

過去 株価チャート

から 11 2024 まで 12 2024

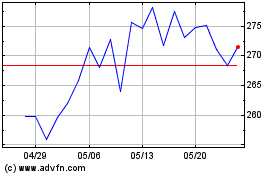

Charter Communications (NASDAQ:CHTR)

過去 株価チャート

から 12 2023 まで 12 2024