TIDMRLD

RNS Number : 8560D

Richland Resources Ltd

02 November 2020

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL .

Capitalised terms used in this announcement carry the same

meanings as those ascribed to them in the Company's Admission

Document, unless the context requires otherwise.

2 November 2020

Richland Resources Ltd

("Richland" or the "Company")

Update re Proposed Reverse Takeover Transaction

Publication of Admission Document,

Notice of Annual General Meeting,

Proposed Acquisition of Global Asset Resources Ltd, Proposed

Board Change,

Proposed Fundraising, Proposed Change of Name,

Proposed Share Capital Consolidation,

Proposed Repayment of Loan,

Proposed Issue of Director and Senior Management Fee Shares and

Adviser Fee Shares and Proposed Grant of Options

Richland (AIM: RLD) is pleased to announce that, further to the

binding share purchase agreement ("SPA") with the existing

shareholders of Global Asset Resources Ltd ("GAR"), as announced on

27 July 2020, the Company has now published an Admission Document

dated 30 October 2020, incorporating a formal Notice of Annual

General Meeting, in relation to, inter alia, the conditional

acquisition of GAR (the "Proposed Transaction" or "Acquisition")

and an associated conditional placing and subscription for New

Common Shares (as defined below) to raise, in aggregate, gross

proceeds of GBP3,327,201. GAR, via its wholly owned subsidiary,

Global Asset Resources Holdings, Inc., holds a 51 per cent.

interest in and operatorship of four gold exploration projects in

North and South Carolina in the United States.

Strand Hanson Limited is acting as Nominated and Financial

Adviser to the Company, and Peterhouse Capital Limited is acting as

Broker to the Company.

The Proposed Transaction constitutes a reverse takeover

transaction pursuant to Rule 14 of the AIM Rules for Companies (the

"AIM Rules") and, accordingly, is conditional on, inter alia, the

approval of Shareholders at an Annual General Meeting to be held at

10.00 a.m. (Bermuda time) on 23 November 2020 at Clarendon House, 2

Church Street, Hamilton, HM11, Bermuda.

Key Highlights :

-- Proposed acquisition of GAR, which via its wholly owned US

subsidiary, holds a 51% interest in four gold exploration projects

in North and South Carolina, being :

o the Jones-Keystone-Loflin Project

o the Carolina Belle Project

o the Jennings-Pioneer Project; and

o the Argo Project

(together, the "GAR Projects").

-- Initial Consideration : an aggregate payment on completion of

the Acquisition ("Completion") to the Sellers and URI of AU$60,000

(approximately GBP33,900 or US$43,392) in cash and the issue of

21,367,288 New Common Shares at 2.75 pence per share being the

price of the proposed Placing (as described below) equivalent to

approximately AU$1.04m (approximately US$752,128; GBP587,600). In

addition, Richland made two non-refundable cash payments to GAR of

US$29,340 on 31 July 2020 and US$22,818 on 30 September 2020,

respectively.

-- Deferred Consideration : potential further future payments to

be made to the Sellers and URI, in cash or New Common Shares at

Richland's sole discretion, of, in aggregate, AU$1.5m (the "Tranche

1 Deferred Consideration") and AU$3m (the "Tranche 2 Deferred

Consideration"), subject to the achievement of certain material,

value-generative performance milestones, or the occurrence of

certain vesting events within five years of Completion. Absent the

earlier occurrence of certain Vesting Events, the Tranche 1

Deferred Consideration will fall due upon confirmation of a

prescribed minimum estimated level of JORC 2012 compliant resources

and the Tranche 2 Deferred Consideration will fall due on

completion of a pre-feasibility study confirming a pre-tax NPV of

more than US$50m in respect of any of the GAR Projects (with the

Tranche 1 Deferred Consideration also falling due upon the

achievement of such performance milestone if not previously

triggered/paid).

-- Proposed share capital consolidation : the Company is

proposing a share capital consolidation at a ratio of 10:1 such

that, subject to the passing of the relevant Resolutions (as

defined below), Shareholders will be issued one new common share of

US$0.003 (a "New Common Share") for every 10 existing common shares

of US$0.0003 (the "Existing Common Shares") currently held.

-- Proposed Fundraising : the Company has conditionally raised,

in aggregate, approximately GBP3.33 million (before expenses) via

the proposed issue of i) 84,625,476 New Common Shares pursuant to

the placing (the "Placing Shares") at a price of 2.75 pence per New

Common Share (the "Placing Price") and (ii) 36,363,636 New Common

Shares (the "Subscription Shares") pursuant to the subscription at

the Placing Price (together, the "Fundraising"). The net proceeds

of the Fundraising will be utilised to fund the initial cash

consideration in respect of the Acquisition and the enlarged

group's planned initial two year work programme and requisite

working capital requirements.

-- Proposed Board Change and Other Proposed Corporate Changes :

o Proposed appointment of Rhoderick Grivas, a current director

and shareholder of GAR, to the Board as a Non-Executive Director on

Admission. Mr Grivas is a professional geologist and has

significant operational experience in metals exploration and mining

generally, including specific knowledge of the GAR Projects, and

the Board believes he will be a valuable addition to the

Company.

o Proposed name change to Lexington Gold Ltd to reflect the

transformational nature of the Proposed Transaction (to be effected

shortly following Admission).

The terms of the SPA are set out in more detail in the Company's

announcement of 27 July 2020 and the Company's Admission Document,

however it should be noted that, pursuant to an addendum to the SPA

signed on 30 October 2020, the long-stop date for Completion

pursuant to the SPA has been extended to 15 December 2020.

Similarly, the long-stop date pursuant to the Joint Venture

Implementation Deed between GAR, URI and Carolina Resources has

also, as of 29 October 2020, been extended to the same date of 15

December 2020.

The Proposed Transaction represents a transformational move for

the Company away from being an AIM Rule 15 cash shell to becoming

an operating company with a clear focus on exploration for gold and

other precious metals in North and South Carolina. The Acquisition

rationale is supported by both the Board's belief in the future

potential of GAR's existing project interests and the current

strong market environment in relation to gold. Pursuant to AIM Rule

15, the Company's Common Shares will remain suspended from trading

on AIM until Completion of the Proposed Transaction.

Further comprehensive information on the Acquisition and the

Resolutions can be found in the Company's Admission Document (and

the Notice of Annual General Meeting set out therein), which is

available on the Company's website at www.richlandresourcesltd.com

and has been posted to Shareholders.

Edward Nealon, Non-Executive Chairman of Richland, commented

:

"The proposed rebirth of Richland as Lexington Gold Ltd focused

on the USA represents a move into a world famous mineral zone in

the North and South Carolinas, where the dominant commodity is gold

at a time when gold is performing strongly compared to other

commodities. The acquisition of GAR provides us with not one but

four projects which are all individually highly prospective, with

two of them having walk up drill targets, such that we expect

exciting times ahead."

For further information, please contact :

Bernard Olivier Edward Nealon Mike Allardice

Chief Executive Officer Chairman Group Company Secretary

+27 76 254 2506 +61 409 969 955 +852 91 864 854

Financial & Nominated Broker

Adviser Peterhouse Capital

Strand Hanson Limited Limited

James Harris Duncan Vasey / Lucy

Matthew Chandler Williams (Broking)

James Bellman Eran Zucker (Corporate

+44 (0) 20 7409 3494 Finance)

+44 (0) 20 7469 0930

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

Notice of Annual General Meeting

In accordance with Rule 14 of the AIM Rules, completion of the

Proposed Transaction is subject to approval by Shareholders to be

sought at a forthcoming annual general meeting of the Company to be

held at 10.00 a.m. (Bermuda time) on 23 November 2020 at Clarendon

House, 2 Church Street, Hamilton, HM11, Bermuda (the "Annual

General Meeting"), formal notice of which is incorporated in the

Company's Admission Document (the "Notice of Annual General

Meeting").

A Form of Proxy or Form of Instruction (as applicable) has been

sent to Shareholders alongside the Admission Document and can be

downloaded from the Company's website at:

www.richlandresourcesltd.com. Shareholders are encouraged to return

their Form of Proxy or Form of Instruction as soon as practicable

and, in any event, by no later than 10.00 a.m. (London time) on 19

November 2020 in respect of the Form of Proxy and 10.00 a.m.

(London time) on 18 November 2020 in respect of the Form of

Instruction. The Form of Proxy or Form of Instruction (as

applicable) must be deposited at or delivered to the Company's

Transfer Secretary, Computershare Investor Services PLC, The

Pavilions, Bridgwater Road, Bristol BS99 6ZY, United Kingdom, or

sent by email to ExternalProxyQueries@computershare.co.uk. The

record date for voting at the Annual General Meeting is close of

business (London time) on 19 November 2020.

The Notice of Annual General Meeting sets out resolutions to

approve, inter alia, the Proposed Transaction, the proposed change

of the Company's name to Lexington Gold Ltd, a 10 for 1 share

capital consolidation to reduce the total number of Common Shares

in issue (the "Share Consolidation"), the proposed appointment of

Rhoderick Grivas to the Board of the Company, and certain changes

to the Company's Bye-laws to bring the Company into greater

alignment with more UK market standard corporate governance

practices (the "Resolutions"). Completion of the Proposed

Transaction is conditional on: approval by Shareholders of all

resolutions set out in the Notice of Annual General Meeting; the

Placing Agreement and Subscription Agreement not being terminated

in accordance with their terms; receipt of the Subscription funds

prior to the AGM; and admission of the Enlarged Share Capital to

trading on AIM. The Existing Directors unanimously recommend that

Shareholders vote in favour of all of the Resolutions.

Assuming that the Resolutions are approved, it is expected that

the Acquisition will complete and that Admission will occur and

trading in the New Common Shares will commence at 8.00 a.m. on 25

November 2020. Accordingly, trading in the Company's shares will

remain suspended until such time.

In the event that, for whatever reason, the Proposed Transaction

is not completed, the Company's Existing Common Shares will remain

suspended until such time as another acquisition which constitutes

a reverse takeover under AIM Rule 14 (including seeking

re-admission under the AIM Rules for Companies) is completed or the

Company becomes an investing company pursuant to AIM Rule 8 (in

either case, a "Re-admission Transaction"). If the Resolutions are

not approved there can be no guarantee that the Company will be

able to complete any alternative Re-admission Transaction within

six months of the suspension date of 1 July 2020 and consequently

be re-admitted to trading on AIM before 31 December 2020 to avoid

the Company's admission to trading being cancelled on 1 January

2020 and/or secure funding on similar commercial terms to the

Placing and Subscription. Accordingly, as stated above, the Board

unanimously recommends that Shareholders vote in favour of all of

the Resolutions.

Proposed Share Consolidation

Admission is conditional upon the approval of the Resolutions,

including the Share Consolidation.

The Share Consolidation, which is expected to take place after

close of business (London time) on 23 November 2020, being the

Record Date, will involve every 10 Existing Common Shares in issue

at such time being consolidated into one New Common Share. The

rights attached to the New Common Shares will be the same as the

rights attaching to the Existing Common Shares and the New Common

Shares will upon Admission, trade on AIM in place of the Existing

Common Shares.

In order to avoid any fractions resulting from the consolidation

of the Company's outstanding Existing Common Shares, which

comprised 1,115,447,891 Existing Common Shares (of which 7,275,000

were held by the Company in Treasury) on 30 October 2020, the

Company has cancelled one Existing Common Share from its Treasury

holdings, such that the total number of Existing Common Shares that

will be suvject to the consolidation is 1,115,447,890 (i.e. a

number exactly divisible by 10, being the Share Consolidation

factor).

No Shareholder will be entitled to a fraction of a New Common

Share and where, as a result of the Share Consolidation, any

Shareholder would otherwise be entitled to a fraction only of a New

Common Share in respect of their holding of Existing Common Shares

on the Record Date (a "Fractional Shareholder"), such fractions

will, in so far as possible, be aggregated with the fractions of

New Common Shares to which other Fractional Shareholders of the

Company would be entitled so as to form full New Common Shares (the

"Fractional Entitlement Shares"). These Fractional Entitlement

Shares will be held in Treasury by the Company.

Shareholders with only a fractional entitlement to a New Common

Share (i.e. those Shareholders holding a total of fewer than 10

Existing Common Shares at the Record Date) will cease to be a

Shareholder of the Company.

The Company will issue new share certificates to those

Shareholders holding shares in certificated form to take account of

the Share Consolidation. Following the issue of new share

certificates, share certificates in respect of Existing Common

Shares will no longer be valid. Shareholders will still be able to

trade in the Company's New Common Shares during the period between

Admission and the date on which Shareholders receive new share

certificates.

The Fundraising

In connection with the Acquisition, the Company has

conditionally raised, in aggregate, approximately GBP3.33 million

(before expenses) via the issue of, in aggregate, 120,989,112 New

Common Shares at a price of 2.75 pence per New Common Share (the

"Fundraising Shares"), comprising 84,625,476 Placing Shares and

36,363,636 Subscription Shares.

Completion of the Fundraising is conditional on approval by

Shareholders of all Resolutions set out in the Notice of Annual

General Meeting, the Placing Agreement and Subscription Agreement

not being terminated in accordance with their terms, receipt of the

Subscription monies prior to the AGM and admission of the Enlarged

Share Capital to trading on AIM.

The net proceeds of the Fundraising, being approximately GBP2.53

million, will be utilised to fund the initial cash consideration in

respect of the Acquisition and the enlarged group's planned initial

two year work programme and requisite working capital

requirements.

Significant Shareholders

On Admission, the Company's significant shareholders holding

over 3 per cent. of the Enlarged Share Capital are expected to

comprise:

Shareholder Number of New Common Percentage of the

Shares held on Admission Enlarged Share Capital

held on Admission

Doris Chiatanasen 36,363,636 13.91

-------------------------- ------------------------

Trevor Allan 36,363,636 13.91

-------------------------- ------------------------

Mark Mitchell Greenwood 33,244,999 12.71

-------------------------- ------------------------

Argon Financial Limited 10,909,092 4.17

-------------------------- ------------------------

Board Change

As noted above, one of the Resolutions relates to the proposed

appointment of Rhoderick Grivas to the Board of the Company.

Rhoderick Grivas is a current director and shareholder of GAR and

it is proposed that he be appointed to the Board as a Non-Executive

Director from Admisson. Mr Grivas is a professional geologist and

has significant operational experience in metals exploration and

mining generally and specific knowledge of the GAR Projects and the

Board believes he will be a valuable addition to the Company.

Further information on Rhoderick Grivas, including the

information required to be disclosed pursuant to Schedule 2(g) of

the AIM Rules, is provided in the Company's Admission Document and

will also be announced on conclusion of the Annual General Meeting

subject to the Resolutions being approved by Shareholders.

Lock-in arrangements

Each of the Rule 7 Locked-In Shareholders, which includes all of

the Existing Directors, the Proposed Director, Mark Greenwood and

certain applicable employees, has undertaken to the Company, Strand

Hanson and Perterhouse Capital that they will not dispose of any

interest in the common shares of the Company held by them for a

period of 12 months from the date of Admission pursuant to the

requirements of AIM Rule 7. In total, the Rule 7 Locked-In

Shareholders will hold 56,821,906 New Common Shares representing

approximately 21.73 per cent. of the Enlarged Share Capital at

Admission.

In addition, the Locked-In Sellers being the Founder Sellers

excluding the Proposed Director (who is a Locked-In Shareholder)

have agreed that they will not dispose of any interest in the New

Common Shares held by them on Admission for a period of six months

from the date of Admission. The Locked-in Sellers will, on

Admission, hold 8,347,393 New Common Shares representing

approximately 3.19 per cent. of the Enlarged Share Capital.

ISIN/TIDM and Change of Name of the Company

The Board notes that, assuming the Resolutions are approved by

Shareholders, the Company will commence trading on its re-admission

to AIM under the new ISIN BMG7567C1304 and under its existing name

of Richland Resources Ltd, with the TIDM remaining as AIM:RLD.

Following the Annual General Meeting, the Company will apply to the

Registrar of Companies in Bermuda to effect the change of name to

Lexington Gold Ltd and to the Bermuda Stock Exchange for a further

new ISIN for its new common shares to reflect the change of name

(as per the relevant requirements in Bermuda). Once such process

has been duly completed, the change of name, ISIN and change of

TIDM (to AIM:LEX) will be effected so as to ensure no disruption to

trading, and details of the new ISIN and confirmation of the name

change being effected will be announced in due course following the

Annual General Meeting.

Proposed Repayment of Loan

As announced on 29 September 2020, Edward Nealon, Non-Executive

Chairman of the Company, provided a three month short-term

unsecured working capital facility of US$100,000 via his company,

Almaretta Pty Limited (the "Working Capital Facility"). The Company

intends to repay the Working Capital Facility in full via the issue

of 2,840,909 New Common Shares to Almaretta Pty Limited (the "Loan

Repayment Shares") following the AGM.

Director, Former Directors and Senior Management's proposed fee

conversions

Edward Nealon, certain former directors (being Anthony Brooke

and Nicholas Sibley), and certain consultants and members of senior

management have agreed to convert, in aggregate, US$128,000 of

accrued fees due to them (which to date have been deferred), into,

in aggregate, 3,636,363 New Common Shares at the Placing Price (the

"Conversion Shares"). The Conversion Shares are intended to be

issued following the AGM and the beneficial interests of the

relevant individuals will be as set out below on Admission:

Individual Position Number Resulting Resulting

of Conversion number of percentage

Shares New Common of Enlarged

to be received Shares on Share Capital

Admission on Admission

Edward Nealon Non-Executive Chairman 454,545 6,259,895* 2.39

------------------------- ---------------- ------------ ---------------

Nicholas

Sibley Former Director 426,136 6,954,856 2.66

------------------------- ---------------- ------------ ---------------

Anthony Brooke Former Director 852.273 6,348,426 2.43

------------------------- ---------------- ------------ ---------------

Michael Allardice Group Company Secretary 1,136,364 6.566,801** 2.51

------------------------- ---------------- ------------ ---------------

Chief Financial

Louis Swart Officer 767,045 5,889,261 2.25

------------------------- ---------------- ------------ ---------------

* Includes the 2,840,909 Loan Repayment Shares to be issued to

Almaretta Pty Ltd.

** To be held by Strategic Investments International Ltd, a

company wholly owned by Michael Allardice.

Proposed Issue of Adviser Fee Shares

The Company has agreed to issue, in aggregate, 1,827,849 New

Common Shares following the AGM to certain advisers and introducers

in lieu of fees due pursuant to the Proposed Transaction (the

"Adviser Fee Shares").

Proposed Issue of Adviser Warrants

The Company has agreed to issue, in aggregate, 7,844,364

warrants over New Common Shares exercisable at the Placing Price

for a period of three years from Admission to certain of its

advisers.

Admission, Settlement and Dealings

Application will be made for the Fundraising Shares, the

Consideration Shares, the Adviser Fee Shares and the Conversion

Shares to be admitted to trading on AIM at the same time as

application is made for admission of all of the other New Common

Shares to trading on AIM pursuant to completion of the Proposed

Transaction and the Share Consolidation. If all of the Resolutions

are passed at the Annual General Meeting, it is expected that such

admission of, in aggregate, 261,478,810 New Common Shares will

become effective and dealings commence at 8.00 a.m. on 25 November

2020. Trading in the Company's Existing Common Shares will remain

suspended until such time.

A summary of the Acquisition and Fundraising statistics

andexpected timetable of principal events is set out at the end of

this announcement.

If the Resolutions are not passed at the Annual General Meeting,

the Acquisition will not proceed and the Directors will need to

consider alternative options for the Company. The Company will have

expended sizeable monies in pursuing the proposed transaction and

will therefore incur significant abort costs and there can be no

guarantee that a suitable alternative Re-admission Transaction

and/or funding on similar commercial terms to the Placing and

Subscription can be obtained on a timely basis or at all.

Propose Grant of Options

The Company intends shortly after the AGM to grant, in

aggregate, 19,610,910 options over New Common Shares to certain

directors, the proposed director and senior managers of the Company

exercisable at a price of 2.75 pence per share (the "Options"). The

Options will vest in three equal tranches being: (i) one third on

the date of issue; (ii) one third on the first anniversary of

Admission; and (iii) one third on the second anniversary of

Admission, and will be exercisable for a period of 10 years from

Admission (the "Options"):

Director / Senior Manager Number of Options

Edward Nealon 2,614,788

------------------

Bernard Olivier 4,140,081

------------------

Melissa Sturgess 2,614,788

------------------

Rhoderick Grivas 2,614,788

------------------

Senior Managers 7,626,465

------------------

Total 19,610,910

------------------

Related Party Transactions

The proposed issues of the Conversion Shares and Loan Repayment

Shares, as detailed above, are deemed to be related party

transactions pursuant to Rule 13 of the AIM Rules for Companies.

Accordingly, the independent directors for the purposes of such

share issues, being Melissa Sturgess and Bernard Olivier, having

consulted with the Company's Nominated Adviser, Strand Hanson

Limited, consider that the terms of the issues of the Conversion

Shares and the Loan Repayment Shares to the relevant individuals

are fair and reasonable insofar as the Company's Shareholders are

concerned.

Expected Timetable of Principal Events

Publication of the Admission Document 30 October 2020

Latest time and date for receipt of Forms 10.00 a.m. on 18

of Instruction November 2020

Latest time and date for receipt of Forms 10.00 a.m. on 19

of Proxy November 2020

Annual General Meeting 10.00 a.m. (Bermuda

time) on 23 November

2020

Record time and date for the Share Consolidation Close of business

(London time) on

23 November 2020

Admission effective and dealings in the 8.00 a.m. (London

Enlarged Share Capital expected to commence time) on 25 November

on AIM 2020

Completion of the Acquisition 25 November 2020

CREST accounts expected to be credited with 25 November 2020

the Consideration Shares, the Placing Shares,

the Subscription Shares, the Conversion

Shares, the Loan Repayment Shares, the Adviser

FeeShares and all other New Common Shares

(where applicable)

Definitive share certificates for the Consideration 9 December 2020

Shares, the Placing Shares, the Subscription

Shares, the Conversion Shares, the Loan

Repayment Shares, the Adviser Fee Shares

and all other New Common Shares (where applicable)

expected to be despatched by

Note: Each of the times and dates in the above timetable is

subject to change. All references are to London time unless

otherwise stated. Temporary documents of title will not be issued.

If any of the details contained in this timetable should change,

the revised times and/or dates will be notified by means of an

announcement through a Regulatory Information Service.

Acquisition and Fundraising Statistics

Number of Existing Common Shares* 1,108,172,891

Closing mid market price per Common Share on 0.325 pence

30 June 2020 (being the last dealing day prior

to the suspension of the Common Shares from

trading on AIM)

Share Consolidation Ratio 10:1

Number of Consideration Shares to be issued

pursuant to the Acquisition** 21,367,288

Number of Placing Shares and Subscription Shares

to be issued pursuant to the Placing and Subscription** 120,989,112

Number of Adviser Fee Shares** 1,827,849

Number of Conversion Shares** 3,636,363

Number of Loan Repayment Shares** 2,840,909

Number of New Common Shares in issue on Admission** 261,478,810

Placing Price 2.75p

Market capitalisation of the Company at the GBP7,190,667

Placing Price on Admisssion

Value of Consideration Shares at the Placing GBP587,600

Price

Percentage of the Enlarged Share Capital represented 8.17 per cent.

by the Consideration Shares at Admission

Percentage of the Enlarged Share Capital represented 46.27 per cent.

by the Placing Shares and the Subscription

Shares at Admission

Percentage of the Enlarged Share Capital held 4.25 per cent.

by the Existing Directors and Proposed Director

at Admission

Gross proceeds of the Placing and Subscription GBP3,327,201

Estimated net proceeds of the Placing and Subscription GBP2,525,613

receivabe by the Company

Current AIM symbol RLD

Proposed new AIM symbol upon change of the LEX

Company's name***

ISIN of the Existing Common Shares BMG7567C1064

ISIN of the New Common Shares on Admission BMG7567C1304

Notes:

* excluding the 7,274,999 Common Shares currently held in

treasury. To facilitate the Share Consolidation, one of the

Existing Common Shares previously held in treasury was cancelled by

the Company on 30 October 2020.

** the number of shares is stated following implementation of

the Share Consolidation.

*** subject to the receipt of shareholder approval, the change

of name is expected to be implemented as soon as practicable

following Admission and will be announced via a Regulatory

Information Service once effected.

Exchange rates applied to currency conversions within this

announcement :

GBP1:US$1.28

GBP1:AU$1.77

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQXFLLBBFLZFBX

(END) Dow Jones Newswires

November 02, 2020 02:00 ET (07:00 GMT)

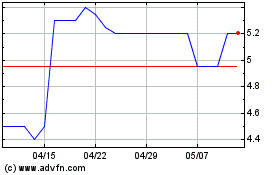

Lexington Gold (LSE:LEX)

過去 株価チャート

から 6 2024 まで 7 2024

Lexington Gold (LSE:LEX)

過去 株価チャート

から 7 2023 まで 7 2024