Kennedy Ventures PLC Operational Update (8138U)

2015年8月3日 - 3:00PM

RNSを含む英国規制内ニュース (英語)

TIDMKENV

RNS Number : 8138U

Kennedy Ventures PLC

03 August 2015

03 August 2015

Kennedy Ventures plc

("Kennedy Ventures" or the "Company")

Operational Update

Kennedy Ventures, which is focused on tantalite production in

Namibia through its 75% holding in African Tantalum (Pty) Limited

("Aftan"), is pleased to provide an update to its shareholders of

operational milestones ahead of first delivery of production from

Aftan to its offtake partner, a leading manufacturer, which is on

track for the beginning of Q4 2015.

Key milestones:

-- The re-commissioning of the power supply and front end of the mine, scheduled for Q3 2015

-- The modification and re-commissioning of the gravity separation plant, scheduled for Q3 2015

-- The resumption of mining activities scheduled for Q3 2015

-- First delivery of production to the offtake partner scheduled for the beginning of Q4 2015

The re-commissioning of the power supply and front end of the

mine has commenced. The Company is making good progress and is

expected to complete mid Q3 2015. Following this the modification

and re-commissioning of the gravity separation plant, which the

Company has found to be in sound condition, will begin. The

resumption of mining activities is predicated on the above work

streams completing on time and at this stage, first delivery of

production to the offtake partner is on track for the beginning of

Q4 2015.

Phased development programme

It is anticipated that the first phase of production, commencing

in Q3 2015, will see a build-up of throughput at the course

recovery plant to treat up to 10,500 tonnes per month; estimated to

produce around 5,000lbs Ta205 per month. The second phase of the

development programme would focus on fines recovery which should

increase throughput to around 15,000 tonnes per month and output of

9,200lbs Ta205 per month by mid-2017. The Directors expect that the

costs of production will be amongst the lowest in the industry. An

independent study has confirmed the estimated resource of 843,000t

grading 490ppm Ta2O5.

Peter Hibberd, CEO of Kennedy Ventures commented:

"It is a busy time for the Company and we continue to make

excellent progress as we work towards bringing the Tantalite Valley

Mine back into production. With a clear timeline to production

outlined, we are confident of delivering this project on time and

to budget and look forward to updating shareholders as further

progress is made."

ENDS

For further information, please contact:

Kennedy Ventures plc 020 3757 4983

Peter Hibberd c/o Billy Clegg

Cenkos Securities (Nominated

Adviser and Joint Broker) 0131 220 6939

Derrick Lee / Nick Tulloch

Shore Capital (Joint Broker) 020 7408 4090

Mark Percy / Toby Gibbs (corporate

finance)

Jerry Keen (corporate broking)

Peterhouse Corporate Finance

(Joint Broker)

Duncan Vasey 020 7469 0935

Camarco

Billy Clegg / Georgia Mann /

Tom Huddart 020 3757 6983

Notes to editors

Tantalite concentrates form the vast majority of feedstock for

all tantalum products. As such they are critical and unreplaceable

parts of a wide range of modern electronics including computers,

tablets, mobile phones, motor components and video game

systems.

Aside from electronics, tantalum has significant usage in super

alloys, specialised steels, corrosion resistant equipment and

medicine.

Tantalum's applications are based on its unique physio -

chemical properties. The oxides and metal have extremely high

melting points, high heat conductivity and strong resistance to

corrosive environments. Combined, these factors have entrenched its

international demand and made it an important component of numerous

research projects and new technologies.

Trade pricing is following tantalum markets as per Asian Metals

and Metal Pages.

In August 2012, the US Securities and Exchange Commission

adopted a rule mandated by the Dodd-Frank Wall Street Reform and

Consumer Protection Act to require companies reporting to the SEC

to publicly disclose the origins of the tantalum they buy in order

to restrict the use of conflict minerals that originated in the

Democratic Republic of the Congo or an adjoining country. As a

result, users of tantalum are encouraged to demonstrate that their

supply chain is transparent to ensure that conflict-free tantalum

is procured.

It is intended that the tantalum produced by Aftan will be

conflict-free.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGUGGRUPAPGP

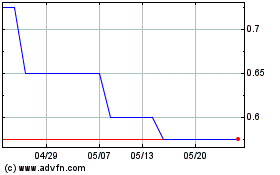

Kazera Global (LSE:KZG)

過去 株価チャート

から 6 2024 まで 7 2024

Kazera Global (LSE:KZG)

過去 株価チャート

から 7 2023 まで 7 2024