Alina Holdings PLC (ALNA)

Alina Holdings PLC: Interim Report (30 June 2023)

29-Sep-2023 / 09:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Alina Holdings PLC

Alina Holdings PLC

(Reuters: ALNA.L, Bloomberg: ALNA:LN)

("Alina" or the "Company")

Interim Results for the period ended 30 June 2023

The Company is pleased to announce its results for the six months ended 30 June 2023. The interim results have been

submitted to the FCA and will shortly be available on the Company's website: www.alina-holdings.com

Highlights for the 6 months ended 30 June 2023

GROUP RESULTS 1H 2023 versus 1H 2022

Group Net Profit / (Loss) for the period (GBP0.82m) vs. (GBP0.33m)

Group Earnings / (Loss) Per Share (both basic and diluted)*1 (3.62p) vs. (1.44p)

Reported Book value per share*2 GBP0.23 vs. GBP0.26

Net Cash GBP1.5m vs. GBP1.1m

Available for sale financial assets GBP1.9m vs. GBP2.7m

*1 based on weighted average number of shares in issue of 22,697,397 (1H22: 22,697,397)

*2 based on actual number of shares in issue as at 30 June 2023 of 22,697,397

-- Gross Rental Income declined by 16% due to the sale of Shaw

in April 2023 and increased vacancy rates atHastings.

-- Hastings is currently being refurbished following the

departure of Argos (now part of J Sainsbury PLC).The refurbishment

process has been delayed due to the need for Asbestos Treatment.

During remediation furtherincidence of Asbestos was identified,

resulting in further delays as well as significantly more work and

highercosts than originally foreseen. Notwithstanding these delays,

the Board is confident that gross rental income ofthe property

should be substantially increased once works are completed in H2

2023.

-- At Brislington, advanced stage architectural designs have

been completed for the re-development of thesite into a mix of

commercial units and residential apartments. The Board believes

that the project has goodpotential for planning consent as it will

assist the local council in achieving their need for a

substantialincrease in Social Housing.

-- Shares in investment holding HEIQ Plc were down 63% over the

H1 2023 period. Subsequently, the Companyfailed to post its

accounts on a timely basis, which has resulted in the suspension of

its shares.

-- During the period under review Book Value per share declined

14.5% from 26.9p as at 31 December 2022 toGBP23p per share.

Chairman's Statement

Trading update

First Half 2023 results were disappointing due to the negative

impact of refurbishment delays at the Hastings property and the

decline in HEIQ shares. I am confident that once the refurbishment

in Hastings is completed that the Company will find a solid tenant

for the vacant unit at market rates, above what the previous tenant

was paying. Notwithstanding the cyclical nature of all chemical

companies, HEIQ's performance has been more than disappointing, and

the suspension of the Company's shares, due to delayed Audit, is

clearly very concerning.

Macro Background/Outlook

Western economies are in the eye of the storm, with stock market

bulls and bears reacting (read over reacting!) to every snippet of

economic news and comment from the FED and the ECB. China's growth

has stalled and the World waits to see what the impact will be on

Western inflation and economic growth. Worryingly, inflation in

Europe having shown signs of abating, now appears to be on the rise

again.

Niall Fergusson, Bloomberg columnist and the Milbank Family

Senior Fellow at the Hoover Institution at Stanford University

recently wrote.As Humpty Dumpty says to Alice: "When I use a word,

it means just what I choose it to mean - neither more nor less."

Inflation has been above target for nearly two and a half years.

Whenever it returns to 2%, we'll be told: "That's what we meant by

transitory!"

The Company's Board is still in the "Markets are overvalued

camp", and believe that Central Bank fiddling and tinkering will

eventually result in the likelihood of stagflation in the UK and

Europe and, if they get lucky, only recession in US.

Recessions have a habit of creeping up on one and then falling

off a cliff. Past downturns have taken longer than expected to

manifest themselves, but when they arrive they invariable bring

pain and a dose of sanity back to markets as they adjust to the new

"normal".

Given that the FED and ECB are still way behind the curve, their

efforts to curb inflation are, in my opinion, ironically adding to

inflation rather than killing it. The outcome will be a slow and

painful death probably resulting in a longer recession, rather than

the desired short sharp recessions which characterised the past

couple of corrections. In our opinion, the current increase in

interest rates will severely damage property prices in the US, UK

and Europe (the greatest store of personal value for most

families), which will ultimately result in a substantial stock

market correction . that I and other (older!) participants have

alluded to for some time.

Operations

Real Estate

Hastings: the detection of asbestos in Hastings has delayed the

letting of the largest area of the property (nearly 50%).

Remediation is, however, now nearing completion and the unit will

shortly be available to rent, which should have the dual positive

impact of reducing costs (the Company is currently paying rates)

whilst also substantially increasing revenues. With regard to the

upper floors, planning permission has been applied for, and we are

currently awaiting consent from the local council for conversion to

mixed residential and commercial use.

Bristol: the local council is currently carrying out recladding

to the residential tower, which abuts our retail units.

Unfortunately, refurbishment of the adjoining property has been

substantially delayed due to the scarcity of replacement

cladding.

Staffordshire: the refurbishment of the last unlet unit at

Company's small residential property in Staffordshire is now

nearing completion and the property will be put into auction in Q4

2023.

Holdings 1. DCI Advisors Ltd (DCI LN)

https://www.dciadvisorsltd.com/index.html

As at June 30 2023, ALNA owned 3.2% of DCI Advisors Ltd., which

is focused on the development of luxury leisure properties in the

Eastern Mediterranean Greece, Cyprus and Croatia).

The company has had a torrid life and has unsuccessfully been

trying to wind down its property portfolio and return capital to

shareholders for a number of years.

DCI shares are up +15% YTD, in anticipation of the potential

sale of Company assets, whilst the share price movement is welcome

we are disappointed with the Board's decision to use debt to fund

working capital, which it can neither service nor repay unless the

sale of property assets is successfully concluded.in an environment

of increasing interest rates. 2. HEIQ plc (HEIQ LN)

https://www.heiq.com/investors/

We are decidedly annoyed with the situation at HEIQ. The

company's shares have been suspended since 2 May 2023 due to the

company's inability to file audited accounts for 2022, "as a result

of the acquisition and implementation of new systems as well as

changes to processes within the organisation. This has impacted the

timing of the audit work, in this first year for the company's new

auditor, Deloitte".

In both HEIQ's RNSs of 27 April 2023 and 2 May 2023 the company

stated, "The Directors anticipate that the Company will be in a

position to publish the audited report and accounts in the coming

weeks." In its RNS of 2 May 2023, the company stated that "The

company will provide further market updates around the expected

timing of the annual results publication once its financial

reporting and the audit work is sufficiently progressed". The

coming weeks have come and gone, and it is now more than 4 months

since HEIQ's shares were suspended and no further announcements

have, to the best of our knowledge, been made which, given the

number of acquisitions that the Company has made in the past 18

months, gives us substantial cause for concern.

Conclusion

The most recent inflation data might seem to suggest that

warnings of a reprise of the 1970s were wrong. The optimists have

been in the ascendancy since last spring's mini-banking crisis.

Now, the consensus, with the exception of a few older, maybe wiser

heads(?), suggest that the economy can return to the Fed's target

of 2% rate of inflation without a recession. Lest we forget,

pain-free disinflation was a recurring delusion of the 1970s which

suffered painful (Central Bank induced) recessions in 1970, 1974-75

and 1980.

As a reminder for those too young to know, or too old to

remember, monetary policy acts with long and variable time-lags.

The time it takes from the moment the yield curve inverts (as

happened in July 2022) to the start of a recession has historically

ranged between 4 and 16 months. Higher interest rates impact an

economy in multiple complex ways, but ultimately they are bad news

for all indebted companies or individuals who need to refinance

their liabilities in an environment of rising interest rates.

The idea that the West can recover from the fiscal and monetary

excesses of the past twenty years without economic pain seems like

wishful thinking.unless, that is, you believe in miracles or fairy

tales.which brings us back to Humpty Dumpty and Alice in

Wonderland. Duncan Soukup Chairman Thalassa Holdings Ltd 28

September 2028

Responsibility Statement

We confirm that to the best of our knowledge: a. the condensed

set of financial statements has been prepared in accordance with

IAS 34 'Interim FinancialReporting' and gives a true and fair view

of the assets, liabilities, financial position and profit or loss

of theCompany and the undertakings included in the consolidation as

a whole as required by DTR 4.2.4 R; b. the interim management

report includes a fair review of the information required by DTR

4.2.7R(indication of important events during the first six months

and description of principal risks and uncertaintiesfor the

remaining six months of the year); and c. the interim management

report includes a fair review of the information required by DTR

4.2.8R(disclosure of related parties' transactions and changes

therein).

Cautionary statement

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

Duncan Soukup

Chairman

Thalassa Holdings Ltd

28 September 2023

Interim Condensed Consolidated Statement of Income

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Gross rental income 165 196 351

Property operating expenses (142) (158) (300)

Net rental income 23 38 51

Profit/Loss on disposal of investment properties - - 4

Profit/(loss) from change in fair value of investment holdings (331) (441) 563

Administrative expenses including non-recurring items (373) (297) (604)

Operating loss before net financing costs (681) (700) 14

Depreciation (2) (2) (3)

Financing income* 44 405 318

Financing expenses* (182) (30) (470)

Share of profits of associated entities - - 5

Loss before tax (821) (327) (136)

Taxation - - -

Profit/(loss) for the year from continuing operations (821) (327) (136)

Attributable to:

Equity shareholders of the parent (821) (327) (136)

(821) (327) (136)

Earnings per share - GBP- pence (using weighted average number of shares)

Basic and Diluted 3 (3.62) (1.44) (0.60)

The notes on pages 13 to 16 form an integral part of this

consolidated interim financial information. Interim Condensed

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit/(loss) for the financial year (821) (327) (136)

Total comprehensive income (821) (327) (136)

Attributable to:

Equity shareholders of the parent (821) (327) (136)

Total Comprehensive income (821) (327) (136)

The notes on pages 13 to 16 form an integral part of this

consolidated interim financial information. Interim Condensed

Consolidated Statement of Financial Position

As at 30 June 2023

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Note Unaudited Unaudited Audited

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Investment properties 4 2,502 2,782 2,504

Investments in associated entities 5 - 5

Total non-current assets 2,507 2,782 2,509

Current assets

Trade and other receivables 356 495 233

Available for sale financial assets 5 1,907 2,680 2,597

Investment properties held for sale - - 800

Cash and cash equivalents 1,503 1,129 873

Total current assets 3,766 4,304 4,503

Total assets 6,273 7,086 7,012

Liabilities

Current liabilities

Trade and other payables 673 856 591

Total current liabilities 673 856 591

Finance lease liabilities 6 324 324 324

Total non-current liabilities 324 324 324

Total liabilities 997 1,180 915

Net assets 5,276 5,906 6,097

Shareholders' Equity

Share capital 8 319 319 319

Capital redemption reserve 598 598 598

Retained earnings 4,359 4,989 5,180

Total shareholders' equity 5,276 5,906 6,097

Total equity 5,276 5,906 6,097

The notes on pages 13 to 16 form an integral part of this

consolidated interim financial information.

These financial statements were approved by the board on 28

September 2023.

Signed on behalf of the board by:

Duncan Soukup

Interim Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit/(Loss) for the year before taxation (683) (702) 14

Gain from change in fair value of investment properties - - (563)

(Profit)/Loss from change in fair value of head leases - - (3)

(Profit)/Loss on disposal of investment properties - - (4)

Decrease/(Increase) in trade and other receivables (123) 90 22

(Decrease)/Increase in trade and other payables 82 458 164

Gain/(loss) on foreign exchange (3) 144 126

Lease liability interest (11) (11) (23)

Depreciation 801 2 -

Interest received 9 - 1

Interest paid (3) (17) (19)

Profit from change in fair value of investments held for sale (3) (17) 191

Cash generated by operations 66 (53) (94)

Taxation - - -

Net cash flow from operating activities 66 (53) (94)

Purchase of investments held for sale (341) (3,592) (1,206)

Sale of investments held for sale 574 2,566 -

Unrealised Gain or (Loss) on Investment 331 441 -

Net Proceeds from sale of investment properties - - 403

Net cash flow in investing activities 564 (585) (803)

Cash flows from financing activities

(Increase)/reduction on head lease liabilities - - 3

Net cash flow from financing activities - - 3

Net increase in cash and cash equivalents 630 (638) (894)

Cash and cash equivalents at the start of the year 873 1,767 1,767

Cash and cash equivalents at the end of the year 1,503 1,129 873

The notes on pages 13 to 16 form an integral part of this

consolidated interim financial information.

Interim Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 June 2023

Capital

Share redemption Retained

Capital reserve Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31 December 2021 319 598 5,316 6,233

Loss for Period - - (327) (327)

Balance as at 30 June 2022 319 598 4,989 5,906

Total comprehensive income for the year - - 191 191

Balance as at 31 December 2022 319 598 5,180 6,097

Loss for Period - - (821) (821)

Balance as at 30 June 2023 319 598 4,359 5,276

The notes on pages 13 to 16 form an integral part of this

consolidated interim financial information. Notes to the Interim

Condensed Consolidated Financial Information

1. General information

Alina Holdings PLC ("Alina" or the "Company") is a company

registered on the Main Market of the London Stock Exchange.

2. Significant Accounting policies

The Group prepares its accounts in accordance with applicable UK

Adopted International Accounting Standards (IFRSs).

The accounting policies applied by the Company in this unaudited

consolidated interim financial information are the same as those

applied by the Company in its consolidated financial statements as

at and for the period ended 31 December 2022 except as detailed

below.

The financial information has been prepared under the historical

cost convention, as modified by the accounting standard for

financial instruments at fair value.

Estimates

There are no changes to the estimates since last reporting

period.

Segmental reporting

IFRS 8 requires operating segments to be identified on the basis

of internal reports that are regularly reported to the chief

operating decision maker to allocate resources to the segments and

to assess their performance. Since the strategy review in July 2013

the Group has identified one operation and one reporting segment,

being rental income in the UK, which is reported to the Board of

directors on a quarterly basis. The Board of directors is

considered to be the chief operating decision maker.

2.1. Basis of preparation

The condensed consolidated interim financial information for the

six months ended 30 June 2023 has been prepared in accordance with

International Accounting Standard No. 34, 'Interim Financial

Reporting'. They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Company as at and

for the year ended 31 December 2022.

These condensed interim financial statements for the six months

ended 30 June 2023 and 30 June 2022 are unaudited and do not

constitute full accounts. The comparative figures for the period

ended 31 December 2022 are extracted from the 2022 audited

financial statements. The independent auditor's report on the 2022

financial statements was not qualified.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation.

2.2. Going concern

The financial information has been prepared on the going concern

basis as management consider that the Group has sufficient cash to

fund its current commitments for the foreseeable future.

3. Earnings per share

Six months Six months Year

ended ended ended

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

The calculation of earnings per share is based on the following loss and number of

shares:

Profit/(loss) for the period (GBP'000) (821) (327) (136)

Weighted average number of shares of the Company ('000) 22,697 22,697 22,697

Earnings per share:

Basic and Diluted (GBP - pence) (3.62) (1.44) (0.60)

Number of shares outstanding at the period end: 22,697,397 22,697,397 22,697,397

Notes to the Interim Condensed Consolidated Financial

Information Continued

4. Investment Properties

Freehold Leasehold Investment

Investment Investment Properties

Properties Properties Held for sale Total

GBP000 GBP000 GBP000 GBP000

At 31 December 2021 40 2,744 330 3,114

Fair value adjustment - head leases - - - -

Depreciation - head leases - (2) - (2)

At 30 June 2022 40 2,742 330 3,112

Depreciation - head leases - (1) - (1)

Fair value adjustment - property - 563 563

Reclassification of property for sale - (800) 800 -

Sale of property (40) - (330) (370)

At 31 December 2022 - 2,504 800 3,304

Fair value adjustment - head leases - - - -

Depreciation - head leases - (2) - (2)

Sale of property - - (800) (800)

At 30 June 2023 - 2,502 - 2,502

The Directors are pleased to announce the completion of sale on

26th April 2023 of the Oldham, Manchester property held for sale as

at 31 December 2022.

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Portfolio valuation 2,168 2,445 2,968

Investment Properties held for sale - - (800)

Head leases treated as investment properties per IFRS 16 334 337 336

Total per Balance Sheet 2,502 2,782 2,504

Notes to the Interim Condensed Consolidated Financial

Information Continued

5. Investment Holdings

The Group classifies the following financial assets at fair

value through profit or loss (FVPL):-

Equity investments that are held for trading

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Securities investments

At the beginning of the period 1,749 1,783 1,783

Additions 1,117 2,844 5,532

Unrealised gain/(losses) (385) (169) (211)

Disposals (574) (2,566) (5,355)

1,907 1,892 1,749

Investment Holdings

Securities held 1,907 1,892 1,749

Portfolio Holdings - 788 848

1,907 2,680 2,597

Investments have been valued incorporating Level 1 inputs in

accordance with IFRS7. They are a combination of cash and

securities held with the listed broker.

Financial instruments require classification of fair value as

determined by reference to the source of inputs used to derive the

fair value. This classification uses the following three-level

hierarchy:

Level 1 - quoted prices (unadjusted) in active markets for

identical assets or liabilities;

Level 2 - inputs other than quoted prices included within level

1 that are observable for the asset or liability, either directly

(i.e., as prices) or indirectly (i.e., derived from prices);

Level 3 - inputs for the asset or liability that are not based

on observable market data (unobservable inputs).

For period ending 30 Jun 23, portfolio holdings cash balances

have been reclassified to cash and cash equivalents.

6. Lease liabilities

Minimum

Finance lease liabilities on head rents are payable as follows: Lease

Payment Interest Principal

GBP000 GBP000 GBP000

At 30 June 2022 3,018 (2,672) 346

Movement in value (12) 12 -

At 31 December 2022 3,006 (2,660) 346

Movement in value (11) 11 -

At 30 June 2023 2,995 (2,649) 346

Short term liabilities 22 - 22

Long term liabilities 2,996 (2,672) 324

At 30 June 2022 3,018 (2,672) 346

Short term liabilities 22 - 22

Long term liabilities 2,984 (2,660) 324

At 31 December 2022 3,006 (2,660) 346

Short term liabilities 22 - 22

Long term liabilities 2,973 (2,649) 324

At 30 June 2023 2,995 (2,649) 346

In the above table, interest represents the difference between

the carrying amount and the contractual liability/ cash flow. All

leases expire in more than five years.

Notes to the Interim Condensed Consolidated Financial

Information Continued

7. Related party balances and transactions

As at the period end the Group owed GBP49,886.70 (December 2022:

GBP17,073, June 2022: GBP49,303) to Thalassa Holdings Limited

("Thalassa"), a company under common directorship. The balance

relates to accounting and registered office services supplied to

the Group by Thalassa at cost. The total amount is treated as an

unsecured, interest free loan made repayable on demand.

During the period the Group accrued GBP75,755 (December 2022:

GBP155,000, June 2022: GBP88,887) for consultancy and

administrative services provided to the Group by a company in which

the Chairman has a beneficial interest. The balance owed by the

Group at the period end date was (GBP33,245) (December 2022:

GBP717, June 2022: GBP88,887).

Athenium Consultancy Ltd, a company in which the Group owns

shares invoiced the group for financial and corporate

administration services totalling GBP90,750 for the period (Jun

2022: GBP82,500).

8. Share capital

As at As at As at

30 Jun 23 30 Jun 22 31 Dec 22

Unaudited Unaudited Audited

GBP GBP GBP

Allotted, issued and fully paid:

22,697,397 ordinary shares of GBP0.01 each 226,970 226,970 226,970

9,164,017 treasury shares of GBP0.01 each 91,640 91,640 91,640

Total Share Capital 318,610 318,610 318,610

During the year to 30 September 2019, the Company underwent a

Court approved restructure of capital and buy back of shares. Under

this action the issued 20p shares were converted to 1p; capital

reserves were transferred to distributable reserves; 59,808,456

shares were repurchased, and a new Capital Redemption Reserve of

GBP0.598m was established.

Investment in Own Shares

At the year-end, 9,164,017 shares were held in treasury (June

2022: 9,164,017), and at the date of this report 9,164,017 were

held in treasury.

9. Subsequent events

There were no subsequent events.

10. Copies of the Interim Report

The interim report is available on the Company's website:

www.alina-holdings.com.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B1VS7G47

Category Code: IR

TIDM: ALNA

LEI Code: 213800SOAIB9JVCV4D57

OAM Categories: 1.2. Half yearly financial reports and audit reports/limited reviews

Sequence No.: 274694

EQS News ID: 1737213

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1737213&application_name=news

(END) Dow Jones Newswires

September 29, 2023 04:00 ET (08:00 GMT)

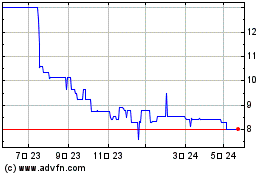

Alina (LSE:ALNA)

過去 株価チャート

から 11 2024 まで 12 2024

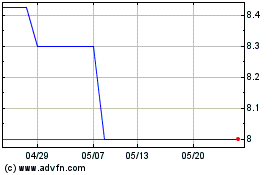

Alina (LSE:ALNA)

過去 株価チャート

から 12 2023 まで 12 2024