Amundi Annual General Meeting 2023

2023年5月13日 - 12:44AM

Amundi Annual General Meeting 2023

Press Release

Paris, 12 May 2023

Amundi Annual General

Meeting

Vote of all resolutions with an average

approval rate of

97.95% “Say

on Climate”:

progress report at the end of

2022

Dividend set at

€4.10 per share

Annual General

Meeting and

dividend

Amundi’s Annual General Meeting was held on

Friday 12 May 2023.

With a quorum of 90.90%, the Meeting approved

all the resolutions submitted by the Board of Directors, with an

average approval rate of 97.95%. The detailed results of the votes

of the Annual General Meeting are available on the website

https://about.amundi.com/.

As announced on 8 February 2023, Amundi’s

financial strength allows it to pursue its dividend policy and to

propose a cash dividend of €4.10 per share, unchanged from the

dividend paid in respect of the fiscal year 2021. This dividend

corresponds to a payout ratio of 75% of net income Group share1,

and a yield of 6.8%2.

The ex-dividend date is set at 22 May 2023 and

the dividend will be paid on 24 May 2023.

“Say on

Climate”: progress

report at the end of 2022

At its 2022 Annual General Meeting, Amundi

submitted its climate strategy to the shareholders’ advisory vote,

a resolution which received 97.7% of votes in favour.

In line with best practice of reporting progress

on an annual basis concerning the climate strategy implementation,

Amundi presented an ex-post "Say on Climate" resolution at today's

Annual General Meeting, detailing progress made during the 2022

financial year. This resolution was voted by 98.26% of

shareholders.

All commitments are on track for completion by

2025.

The table detailing the progress made for each

item is provided from page 28 to 30 in the Notice of Meeting

document, available on the website

https://about.amundi.com/general-meetings.

***

About

Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players3, offers its 100 million

clients - retail, institutional and corporate - a complete range of

savings and investment solutions in active and passive management,

in traditional or real assets. This offering is enhanced with IT

tools and services to cover the entire savings value chain. A

subsidiary of the Crédit Agricole group and listed on the stock

exchange, Amundi currently manages more than €1.9 trillion of

assets4.

With its six international investment hubs5,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,400 employees in 35 countries.

Amundi, a trusted

partner, working every day in the interest of its clients and

society

www.amundi.com

Press contact:

Natacha

Andermahr Tel. +33 1 76 37 86

05natacha.andermahr@amundi.com

Investor contacts:Cyril Meilland,

CFATel. +33 1 76 32 62

67cyril.meilland@amundi.com

Thomas LapeyreTel. +33 1 76 33 70

54thomas.lapeyre@amundi.com

1 The dividend payout ratio is calculated on the

basis of adjusted net income attributable to equity holders of the

parent (€1,074m), excluding Lyxor integration costs (-€46m after

tax)2 Compared with 11 May 2023 closing price3 Source: IPE “Top 500

Asset Managers” published in June 2022, based on assets under

management as at 31/12/20214 Amundi data as at 31/03/20235 Boston,

Dublin, London, Milan, Paris and Tokyo

- PR Amundi AGM 2023 - FINAL

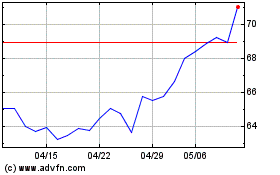

Amundi (EU:AMUN)

過去 株価チャート

から 3 2024 まで 4 2024

Amundi (EU:AMUN)

過去 株価チャート

から 4 2023 まで 4 2024