Polygon Processes Over $214 Billion In DEX Volume As Adoption Explodes, Why Is POL Struggling?

2024年9月12日 - 8:15AM

NEWSBTC

Polygon, the Ethereum sidechain, recently upgraded, kickstarting

their migration into a new era of scaling as highlighted by their

Polygon 2.0 mission. Even though POL prices are still struggling,

on-chain data points to a robust ecosystem that could support

prices in the medium to long term. Over $214 Billion In DEX Volume

Processed Via Polygon Aggregating data from DeFiLlama, an analytic

platform, and the Aggegration Layer, a core hub for Polygon, the

sidechain said it has deep liquidity and maintains a strong

alignment with Ethereum. This alignment instills confidence in the

platform’s interoperability, positioning Polygon as a preferred

choice for developers launching dapps in a low-fee, scalable

environment. Related Reading: Analyst Eyes 7% Dogecoin Jump—Will It

Smash The $0.15 Barrier? Since the start of the year, Polygon has

been growing rapidly. To put in the numbers, the platform has

processed over $214 billion in decentralized exchange volume. At

the same time, it has enabled the addition of $102 billion worth of

assets through centralized exchanges like Binance, Coinbase, and

others. These impressive figures show that the platform is popular

despite the availability of layer-2 alternatives, and it can also

easily handle large-scale transactions securely. Besides the huge

transaction count processed by Polygon, going by trends, it is

highly likely that the Aggregation Layer, better known as the

AggLayer, will boost liquidity and general utility. The

AggLayer will be central to Polygon’s mission to scale Ethereum

further while connecting all layer-2s technology built using its

technology. In this design, the goal will be to ensure that POL has

more utility while all layer-2s connecting access instant

liquidity. Polygon Tech Finding Adoption: Why Is POL Down? With the

upgrade from MATIC to POL on September 4, the new token means

holders play a heavier role. For example, besides POL being used to

reward validators who stake, it will be used to secure other

platforms linked via the AggLayer. These added functionalities will

help prop up bulls as the sidechain progresses in its goal of

scaling. Related Reading: Bullish Signals Emerge For Ethereum:

Price Rises Above Downward Trendline And Key MA Levels That Polygon

is eager to scale without comprising security could explain the

rising adoption levels. Recently, the Italian government issued a

€25 million digital bond on Polygon PoS. Meanwhile, Franklin

Templeton, Ondo, and Spiko all leverage Polygon technology as they

tokenize United States Treasuries, according to RWA.xyz data. Even

as impressive as Polygon has been growing, POL is still struggling.

After the highly anticipated migration, the token edged lower,

finding support at $0.35. Sows have the upper hand until there is a

comprehensive close above the descending channel and $0.60. Feature

image from Shutterstock, chart from TradingView

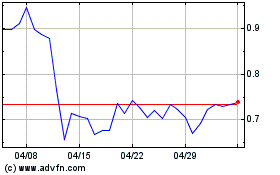

Polygon (COIN:MATICUSD)

過去 株価チャート

から 8 2024 まで 9 2024

Polygon (COIN:MATICUSD)

過去 株価チャート

から 9 2023 まで 9 2024