Is The Bitcoin Bull Run Over? Top Analyst Predicts What’s Next For Crypto

2024年10月11日 - 5:00PM

NEWSBTC

Crypto analyst Bob Loukas has released a new video analysis titled

“No Bull.” In the video, Loukas delves into the current state of

the Bitcoin market, addressing growing concerns about the

possibility of a canceled bull run. Loukas begins by acknowledging

the prolonged period of consolidation for the Bitcoin price. He

senses that “there is now some fear creeping into the market,”

partly due to factors such as the Bitcoin ETF being “out for quite

some time” and the halving having “come and go,” without leading to

significant upward price movement. Is The Bitcoin Bull Run Over?

Loukas observes that while traditional markets are performing

robustly—with “the stock market making all-time highs seemingly

every week” and “even gold making big all-time highs”—Bitcoin

continues to “languish,” and altcoins are “pretty much dying a slow

death.” He notes that “the only thing out there that’s really

working is the really speculative memecoins,” contributing to

negative sentiment in the crypto space. However, he considers this

development to be “kind of normal,” emphasizing that despite these

challenges, Bitcoin remains “close to the all-time highs from the

prior cycle.” Discussing the eight months of consolidation in

Bitcoin’s price, Loukas interprets this period as a bullish sign.

“Eight months of consolidation is actually pretty bullish if the

timing is right in the four-year cycle. Sentiment is right, it’s

been reset; fundamentals, macro, I think they all look right,” he

states. Related Reading: Bitcoin’s Path To $80,000 “Melt-Up” In Q4

2024 – Details Inside Loukas further highlights that the market is

“23 months in” since the lows of the last cycle in November 2022,

“just shy of a 24-month or 2-year anniversary of this cycle,” which

is due to conclude around November-December 2026. He acknowledges

the “quite a bit of fear that’s sort of crept into this market”

following a “very bullish, very frothy period” from the ETF

approval leak in September-October 2023 up to the peak in March

2024. One of the main fears, according to Loukas, is that Bitcoin

made its last all-time high seven months ago in March, and since

then, “we’ve been forming these lower highs on the monthly and also

to some extent a lower low structure.” This has created anxiety

among investors who “entered the market way too late, waiting for

confirmation,” only to find themselves “locked out when the market

went on this five straight months move,” without providing an

opportunity to buy during a dip. He points out that many investors

have “rolled into a bunch of altcoins in this later period that are

now down 50, 60, 70%,” leading to a situation where, despite

Bitcoin being “still up around 3x off the lows,” a lot of people

feel they haven’t “extracted any sort of value out of this cycle”

or have even “lost money over this period.” Loukas considers this

scenario to be “quite normal from a cycle structure perspective.”

He emphasizes that during this bullish phase, the market didn’t

experience a “typical 30% decline at any given point,” with the

“biggest declines” being “mostly time-based and were only around

about 20% from peak to trough before making a new high.” This

atypical behavior “threw a lot of people off” and “made it

difficult for people to get in,” as they were “looking to buy on a

dip which never really eventuated.” Loukas suggests that the

current consolidation is a necessary phase to “completely reset

sentiment in order to prepare for the next phase of this four-year

cycle.” He finds it significant that Bitcoin is “sitting here 23

months, just around 20% or so off the all-time highs of the last

four-year cycle high back in 2021,” which makes it feel “more

primed for the next phase of the four-year cycle than anything

else.” He also draws parallels with previous cycles, noting that

from the cycle low in December 2018 to the first point where

Bitcoin made a new high, “it took 23 months to get to the price

four-year cycle high to exceed that.” Similar patterns were

observed in earlier cycles, with timeframes of “around 25 months”

and “around 22 months” to reach new all-time highs. In contrast,

the current cycle achieved this milestone “in just 16 months, much

sooner,” which he attributes largely to the ETF news that “forced

buyers in earlier in the cycle than normal.” Loukas believes that

this accelerated timeline has created a dynamic where “we now have

to rotate a lot of coins,” allowing “a lot of whales, a lot of

old-timers” to “unlock” and “exit and rotate,” while “institutional

players, larger account players have been accumulating those coins

in this period.” He views this as “a matter of time more than

anything else,” interpreting the current period as a process where

the market “ends up erasing all that bullish sentiment” from the

previous phase, thus allowing “a complete separation from one phase

of the cycle to this phase of the cycle”—essentially a “mid-cycle

decline.” When Will BTC Price Break Out? Overall, Loukas remains

largely optimistic: “So far in this four-year cycle, I see nothing

that has changed that trajectory, nothing in the profile or the

structure that tells me that this cycle is any different to the

last cycles.” He cites several factors supporting his bullish

outlook, including “massive inflows into Bitcoin, mostly

institutional players,” and the absorption of large sell-offs by

entities like “the German government” and “the US government,”

which have not significantly impacted the price. Loukas emphasizes

that “price is down only 20%; it’s held up well.” He also mentions

that “the ETF is still there; it’s going to be pushed through the

independent advisor channels,” and “the timing is there; the macro,

the fundamentals are there.” Loukas is particularly excited about

the cyclical patterns, noting that “the third year of each of these

four cycles is where the magic happens.” He explains that “the

first year surprises everybody, that makes up a lot of ground. The

second year seems like it stalls because it consolidates that first

year of gains. And the third year is the mania year. And right now,

beginning next month, we have the mania year that is on deck.”

Related Reading: Bitcoin Price Hope: Mt. Gox Delays Repayment Plan

Until October 2025 He predicts that “within the next 90 days… we’re

going to break out of this consolidating range; we’re going to

break to the upside.” Once this happens, he believes Bitcoin “isn’t

going to look back,” anticipating a period that “may only see one

or two red monthly candles and mostly green candles.” While he

refrains from providing specific price targets, he acknowledges

that reaching “somewhere between $120,000 and $180,000 also seems

very reasonable.” Loukas emphasizes that the focus should be on

“time and sentiment,” aiming for a move “in the range where prior

cycles have peaked,” which has been “very consistent at around

month 35 since the last low.” This timing would place the projected

peak around “October of 2025,” giving “another 12 months to an

expected or projected peak.” He notes that this is not set in stone

and that the peak could come “three, four, five months earlier,” as

market movements “can come in many different flavors.” Turning to

the immediate future, Loukas admits that the next two months are “a

little murky,” with “a lot of factors still at play right now.” He

brings up the upcoming US election on November 4th, mentioning that

“Trump and the GOP have really been pushing crypto and Bitcoin,”

and that “the market is certainly going to respond very, very

favorably to an election win by the GOP purely because of their

stance on crypto.” However, he clarifies that he doesn’t think “it

matters one bit” who wins, as Bitcoin has thrived even when

“governments have been very hostile towards it.” Loukas speculates

that the market might “trend sideways into that period in

November,” and that a significant move might not occur until after

the election concludes. He suggests that “we still have around

three to four weeks of some trending sideways action,” and he would

be “highly surprised if this market can push into the $70,000s

before the election here in the US.” At press time, BTC traded at

$60,699. Featured image created with DALL.E, chart from

TradingView.com

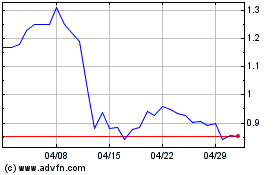

Flow (COIN:FLOWUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Flow (COIN:FLOWUSD)

過去 株価チャート

から 11 2023 まで 11 2024