Haemonetics Cuts Guidance on CSL Plasma Deal

2019年5月14日 - 10:20PM

Dow Jones News

By Michael Dabaie

Haemonetics Corp. (HAE) cut its fiscal 2020 revenue and

per-share earnings forecast to reflect the pending transfer of

ownership of its Union, S.C., manufacturing facility.

Haemonetics, which provides hematology products, said Tuesday it

would transfer ownership of the manufacturing facility, operating

assets and some inventories to CSL Plasma Inc. CSL, part of CSL

Ltd. (CSL.AU), will pay Haemonetics about $10 million and release

the company from a 2014 supply agreement with CSL. The deal is

expected to close during the first quarter of fiscal 2020.

Haemonetics cut its 2020 reported revenue guidance to growth of

3% to 5%, from a forecast of 5% to 7% made earlier this month.

The company now sees EPS of $1.25 to $1.45, below pervious

guidance of $1.90 to $2.10.

Haemonetics backed its full year adjusted EPS guidance of $2.80

to $3.00.

Haemonetics said in a Securities and Exchange Commission filing

that it will recognize an impairment charge of about $49 million in

the first quarter of fiscal 2020, primarily related to the carrying

balances of the property, plant and equipment.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

May 14, 2019 09:05 ET (13:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

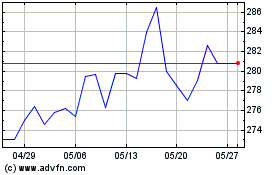

CSL (ASX:CSL)

過去 株価チャート

から 11 2024 まで 12 2024

CSL (ASX:CSL)

過去 株価チャート

から 12 2023 まで 12 2024

Real-Time news about CSL Limited (オーストラリア証券取引所): 0 recent articles

その他のCsl Fpoニュース記事