Australia's Antitrust Watchdog Backs Apple in Digital Payments Dispute

2017年3月31日 - 8:58AM

Dow Jones News

By Rob Taylor

CANBERRA, Australia--The competition watchdog has blocked a bid

by some of Australia's largest banks to collectively bargain and

boycott cooperation with tech giant Apple (AAPL) over use of its

Apple Pay payments platform.

The Australian Competition and Consumer Commission said it

wasn't satisfied the benefits were big enough to justify finding in

the banks' favor. "We are concerned that the proposed conduct is

likely to reduce or distort competition in a number of markets,"

Chairman Rod Sims said Friday.

Several of Australia's biggest banks--including Commonwealth

Bank of Australia (CBA.AU), Westpac Banking Corp. (WBC.AU),

National Australia Bank Ltd. (NAB.AU) and Bendigo and Adelaide Bank

Ltd. (BEN.AU)--wanted permission to bargain with Apple for access

to the Near-Field Communication controller, or NFC, in the

company's iPhones, as well as reasonable access terms to the App

Store.

The four banks collectively represent almost three-quarters of

Australian debit and credit cardholders that could be used for

Apple Pay and had argued the tech company imposed prohibitive fees

and restrictions around the technology. Apple wasn't immediately

available for comment.

Another major lender, Australia and New Zealand Banking Group

(ANZ.AU), reached an agreement with Apple last year to use the

platform.

A 'digital wallet' is an app on a mobile device that can provide

several of the same functions as a physical wallet, including the

ability to make payments and storing information such as loyalty or

membership cards. A 'mobile payment' is a payment made in-store

using a digital wallet.

The watchdog last November issued a draft determination

proposing to deny the banks, before making a final ruling on

Friday. The banks have argued access is required to enable them to

offer their own integrated digital wallets to iPhone customers in

competition with Apple, without using Apple Pay.

In their submission to the competition watchdog, they said

access to the NFC controller would bring increased competition and

consumer choice in digital wallets and mobile payments in

Australia, as well as greater consumer confidence in mobile payment

technology. They also said it would unleash more innovation and

investment in digital wallets and other mobile applications.

"While the ACCC accepts that the opportunity for the banks to

collectively negotiate and boycott would place them in a better

bargaining position with Apple, the benefits would be outweighed by

detriments," Mr. Sims said.

In the final ruling, the regulator said collective bargaining by

the banks would lead to "likely distortions to and reductions in

competition," including an impact on how Apple was able to compete

with rival Google and the Android platform.

It also said that allowing the banks access to the NFC in

iPhones for the banks could artificially influence emerging uses of

the NFC controller in smartphones, potentially hampering

innovation, as well as impacting on digital wallets and mobile

payments that were still evolving.

"This is likely to hamper the innovations that are currently

occurring around different devices and technologies for mobile

payments," Mr. Sims said.

-Write to Rob Taylor at rob.taylor@wsj.com

(END) Dow Jones Newswires

March 30, 2017 19:43 ET (23:43 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

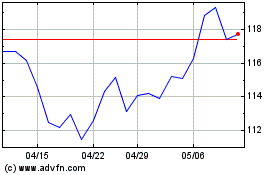

Commonwealth Bank Of Aus... (ASX:CBA)

過去 株価チャート

から 4 2024 まで 5 2024

Commonwealth Bank Of Aus... (ASX:CBA)

過去 株価チャート

から 5 2023 まで 5 2024