TIDMAXS

RNS Number : 1825U

Accsys Technologies PLC

21 November 2023

AIM: AXS

Euronext Amsterdam: AXS

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES OF AMERICA, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR SWITZERLAND OR INTO ANY OTHER JURISDICTION WHERE TO

DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER OF SECURITIES IN ANY JURISDICTION

ACCSYS TECHNOLOGIES PLC

("Accsys" or the "Company" or "Group")

Results of Capital Raise raising gross proceeds of c.EUR34.2

million

Accsys, the fast-growing company that enhances the natural

properties of wood to make high performance and sustainable

building products, announces a c.EUR 34.2 million Capital Raise (of

which c.EUR24.2 million is new money for the Company) by way of a

successful Placing and Subscription and CLN Issuance.

Placing and Subscription

The Placing and Subscription of New Ordinary Shares will raise

gross proceeds of EUR13.2 million. Further to the Company's

announcement earlier today regarding the proposed Placing to be

conducted by way of the Bookbuild ("Launch Announcement"), the

Company has placed 19,127,888 New Ordinary Shares at a price of

69.35 Euro cents (61 GBP pence) per ordinary share (the "Issue

Price").

Steven Salo, Chief Financial Officer, has subscribed for 16,393

New Ordinary Shares at the Issue Price through the Subscription

representing an investment of approximately GBP10,000.

A total of 19,144,281 New Ordinary Shares will be issued

pursuant to the Placing and Subscription, representing 8.7% of the

Company's existing issued share capital.

CLN Issuance

The CLN Issuance will raise gross proceeds of EUR21 million (of

which EUR11 million is new money for the Company). The CLN Issuance

includes the refinancing and discharge of the existing 2022 EUR10

million convertible loan.

As at the date of the CLN Issuance (subject to adjustments), the

total number of Ordinary Shares that could be issued pursuant to

the New CLNs and potential rolled up PIK interest will be

31,824,510, representing 14.5% of the Company's current issued

ordinary share capital.

As announced within the Launch Announcement, the New CLNs have a

6 year term and carry a fixed rate coupon of 9.5% for the first 2.5

years which will be rolled up and deferred and at the CLN holder's

discretion either (i) converted into shares (ii) paid in cash over

the remaining 3.5 years (ii) or partially converted with the

residual interest paid in cash over the remaining 3.5 years.

Further detail is contained within the Launch Announcement.

Application for Admission and Total Voting Rights

The Issue is conditional, inter alia, upon the Admission

becoming effective. Application will be made for 19,144,281 New

Ordinary Shares connected with the Placing and Subscription to be

admitted to listing and trading on Euronext Amsterdam and to

trading on AIM. It is expected that Admission will become effective

and that dealings in the New Ordinary Shares will commence on

Euronext Amsterdam and on AIM at 8:00 a.m. (BST) on 23 November

2023 .

Following Admission, the Company's issued ordinary share capital

will comprise 239,301,165 Ordinary Shares, each with voting rights.

This figure of 239,301,165 may therefore be used by Shareholders as

the denominator for the calculations by which they may determine if

they are required to notify their interest in, or a change to their

interest in, the Company's securities under the FCA's Disclosure

Guidance and Transparency Rules.

Capitalised terms used, and not defined elsewhere, in this

announcement shall have the meaning given to them in the Launch

Announcement, save where the context requires otherwise.

For further information, please contact: Accsys Technologies PLC ir@accsysplc.com

Katharine Rycroft, Investor Relations

========================================= ======================

Deutsche Numis (London)

Nominated Adviser, Joint Bookrunner

and Broker

Oliver Hardy (NOMAD), Ben Stoop +44 (0) 20 7260 1000

========================================= ======================

ABN AMRO Bank N.V. (Amsterdam)

Joint Bookrunner

Julie Wakkie, Diederik Berend +31 20 628 5789

========================================= ======================

FTI - PR

Matthew O'Keeffe, Alex Le May, Georgia

Badcock +44 (0) 20 3727 1340

========================================= ======================

The person responsible for making this announcement is Nick

Hartigan, General Counsel and Company Secretary, Accsys

Technologies PLC.

Director/PDMR Shareholding

The Notification of Dealing Form set out below are provided in

accordance with the requirements of the UK Market Abuse

Regulation.

1. Details of the person discharging managerial responsibilities

/ person closely associated

Name Steven Salo

---------------------------------------- -----------------------------------

2. Reason for the Notification

-----------------------------------------------------------------------------

Position/Status Chief Financial Officer

---------------------------------------- -----------------------------------

Initial notification/amendment Initial notification

---------------------------------------- -----------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer, or auction monitor

-----------------------------------------------------------------------------

Name Accsys Technologies plc

---------------------------------------- -----------------------------------

LEI 213800HKRFK8PNUNV581

---------------------------------------- -----------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------------

Description of the Financial Ordinary shares of EUR0.05 each

instrument, type of instrument in Accsys Technologies plc

---------------------------------------- -----------------------------------

Identification code GB00BQQFX454

---------------------------------------- -----------------------------------

Nature of the Transaction Subscription for New Ordinary

Shares

---------------------------------------- -----------------------------------

Price(s) and volume(s) Price(s) Volume(s)

---------------------------------------- ----------------- ----------------

61 pence 16,393

--------------------------------------------------------------- ----------------

Aggregated information: Purchase of 16,393 New Ordinary

Aggregated volume Shares at 61 pence per share

As above

---------------------------------------- ----------------------------------------

Date of the transaction 21 November 2023

---------------------------------------- ----------------------------------------

Place of the transaction Outside a trading venue

---------------------------------------- ----------------------------------------

IMPORTANT NOTICES

This announcement including its appendices (the " Announcement

") and the information contained in it is not for publication,

release, transmission distribution or forwarding, in whole or in

part, directly or indirectly, in or into the United States,

Australia, Canada, Japan, Switzerland or the Republic of South

Africa or any other jurisdiction in which publication, release or

distribution would be unlawful. This Announcement is for

information purposes only and does not constitute an offer to sell

or issue, or the solicitation of an offer to buy, acquire or

subscribe for shares in the capital of the Company in the United

States, Australia, Canada, Japan, Switzerland or the Republic of

South Africa or any other state or jurisdiction. This Announcement

has not been approved by the FCA, the London Stock Exchange or the

AFM. Any failure to comply with the restrictions set out in this

Announcement may constitute a violation of the securities laws of

such jurisdictions.

The New Ordinary Shares have not been and will not be registered

under the US Securities Act or under the securities law or with any

securities regulatory authority of any state or other jurisdiction

of the United States and may not be offered, sold, pledged, taken

up, exercised, resold, renounced, transferred or delivered,

directly or indirectly, in or into the United States absent

registration under the US Securities Act, except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States. The New Ordinary Shares

are being offered and sold outside of the United States in offshore

transactions in accordance with Regulation S under the US

Securities Act. The New Ordinary Shares have not been approved,

disapproved or recommended by the U.S. Securities and Exchange

Commission, any state securities commission in the United States or

any other U.S. regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of

the New Ordinary Shares. Subject to certain exceptions, the

securities referred to herein may not be offered or sold in the

United States, Australia, Canada, Japan, Switzerland or the

Republic of South Africa or to, or for the account or benefit of,

any national, resident or citizen of the United States, Australia,

Canada, Japan, Switzerland or the Republic of South Africa.

No public offering of securities is being made in the United

States, the United Kingdom or elsewhere.

All offers of New Ordinary Shares will be made pursuant to an

exemption under the EU Prospectus Regulation and the UK Prospectus

Regulation (as applicable) from the requirement to produce a

prospectus. This Announcement is being distributed to persons in

the United Kingdom only in circumstances in which section 21(1) of

FSMA does not apply.

No prospectus will be made available in connection with the

Placing and no such prospectus is required (in accordance with the

EU Prospectus Regulation or the UK Prospectus Regulation) to be

published. This Announcement and the terms and conditions set out

herein are for information purposes only. The Placing is directed

only at persons who are: (a) if in a member state of the European

Economic Area, persons who are qualified investors within the

meaning of article 2(e) of the EU Prospectus Regulation; (b) if in

the United Kingdom, persons who (i) are "investment professionals"

specified in article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (the "Order") and/or (ii)

fall within article 49(2)(a) to (d) of the Order (and only where

the conditions contained in those articles have been, or will at

the relevant time be, satisfied), and, in each case, who are also

qualified investors within the meaning of article 2 of the UK

Prospectus Regulation; or (c) persons to whom it may otherwise be

lawfully communicated (all such persons together being referred to

as "Relevant Persons").

This Announcement and the terms and conditions set out herein

must not be acted on or relied on by persons who are not Relevant

Persons. Persons distributing this Announcement must satisfy

themselves that it is lawful to do so. Any investment or investment

activity to which this Announcement and the terms and conditions

set out herein relates is available only to Relevant Persons and

will be engaged in only with Relevant Persons. This Announcement

does not itself constitute an offer for sale or subscription of any

securities in Accsys.

The contents of this Announcement are not to be construed as

legal, business, financial or tax advice. Each investor or

prospective investor should consult his, her or its own legal

adviser, business adviser, financial adviser or tax adviser for

legal, financial, business or tax advice. The contents of this

Announcement have not been reviewed by any regulatory authority in

the United Kingdom or elsewhere. Each Shareholder or prospective

Shareholder is advised to exercise caution in relation to the

Issue.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by any of

the Joint Bookrunners, or by any of their respective partners,

directors, officers, employees, advisers, consultants, affiliates

or agents as to or in relation to, the accuracy, fairness or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

Notice to all investors

Deutsche Numis is authorised and regulated in the United Kingdom

by the FCA . Deutsche Numis and ABN AMRO are acting for Accsys and

are acting for no one else in connection with the Issue and will

not regard any other person (whether or not a recipient of this

Announcement) as a client in relation to the Issue and will not be

responsible to anyone other than Accsys for providing the

protections afforded to their respective clients, nor for providing

advice in connection with the Issue or any other matter,

transaction or arrangement referred to herein.

Deutsche Numis' responsibilities as the Company's nominated

adviser under the AIM Rules for Nominated Advisers are owed solely

to the London Stock Exchange and are not owed to the Company or to

any Director or to any other person.

None of the information in this Announcement has been

independently verified by any of the Joint Bookrunners or any of

their respective partners, directors, officers, employees,

advisers, consultants, agents or affiliates. Apart from the

responsibilities and liabilities, if any, which may be imposed upon

the Joint Bookrunners by FSMA, neither of the Joint Bookrunners nor

any of their subsidiary undertakings, affiliates or any of their

directors, officers, employees, consultants, advisers or agents

accept any responsibility or liability whatsoever (whether arising

in tort, contract or otherwise) for the contents of the information

contained in this Announcement (including, but not limited to, any

errors, omissions or inaccuracies in the information or any

opinions) or for any other statement made or purported to be made

by or on behalf of any of the Joint Bookrunners or any of their

respective partners, directors, officers, employees, advisers,

consultants, agents or affiliates in connection with Accsys or the

New Ordinary Shares or the Issue and nothing in this Announcement

is, or shall be relied upon as, a promise or representation in this

respect, whether as to the past or future. The Joint Bookrunners

accept no liability or responsibility for any loss, costs or damage

suffered or incurred howsoever arising, directly or indirectly,

from any use of this Announcement or its content or otherwise in

connection therewith or any acts or omissions by the Company. Each

of the Joint Bookrunners and their subsidiary undertakings,

affiliates or any of their directors, officers, employees, advisers

and agents accordingly disclaims to the fullest extent permitted by

law all and any responsibility and liability whether arising in

tort, contract or otherwise (save as referred to above) which it

might otherwise have in respect of this Announcement or any such

statement and no representation, warranty, express or implied, is

made by any of the Joint Bookrunners or any of their respective

partners, directors, officers, employees, advisers, consultants,

agents or affiliates as to the accuracy, fairness, completeness or

sufficiency of the information contained in this Announcement.

In connection with the Issue, the Joint Bookrunners and any of

their affiliates, acting as investors for their own accounts, may

subscribe for or purchase New Ordinary Shares as a principal

position and in that capacity may retain, purchase, sell, offer to

sell or otherwise deal for their own accounts in such New Ordinary

Shares and other securities of the Company or related investments

in connection with the Issue or otherwise. Accordingly, references

to the New Ordinary Shares being offered, subscribed, acquired,

placed or otherwise dealt in should be read as including any offer

to, or subscription, acquisition, placing or dealing by the Joint

Bookrunners and any of their affiliates acting as investors for

their own accounts. In addition, the Joint Bookrunners or their

affiliates may enter into financing arrangements and swaps in

connection with which they or their affiliates may from time to

time acquire, hold or dispose of New Ordinary Shares. The Joint

Bookrunners have no intention to disclose the extent of any such

investment or transactions otherwise than in accordance with any

legal or regulatory obligations to do so.

Cautionary statement regarding forward-looking statements

This Announcement contains certain "forward-looking statements".

Words such as "believes", "anticipates", "estimates", "expects",

"intends", "aims", "potential", "will", "would", "could",

"considered", "likely", "estimate" and variations of these words

and similar future or conditional expressions are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. All statements other than

statements of historical fact included in this Announcement are

forward-looking statements. Forward-looking statements appear in a

number of places throughout this Announcement and include

statements regarding the Directors' or the Company's intentions,

beliefs or current expectations concerning, among other things,

operating results, financial condition, prospects, growth,

expansion plans, strategies, the industry in which the Group

operates and the general economic outlook.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend upon

circumstances that may or may not occur in the future and are

therefore based on current beliefs and expectations about future

events. Forward-looking statements are not guarantees of future

performance. Investors are therefore cautioned that a number of

important factors could cause actual results or outcomes to differ

materially from those expressed in any forward-looking

statements.

Neither the Company, nor any member of the Group, nor any of the

Joint Bookrunners undertakes any obligation to update or revise any

of the forward-looking statements, whether as a result of new

information, future events or otherwise, save in respect of any

requirement under applicable law or regulation (including, without

limitation, FSMA, the AIM Rules for Companies, UK MAR, the Dutch

Financial Supervision Act and EU MAR).

Information to Distributors

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended (" MiFID II "); (b) Articles 9

and 10 of Commission Delegated Directive (EU) 2017/593

supplementing MiFID II; and (c) local implementing measures

(together, the " MiFID II Product Governance Requirements "), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the MiFID II Product Governance Requirements) may otherwise have

with respect thereto, the New Ordinary Shares have been subject to

a product approval process, which has determined that the New

Ordinary Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the " Target

Market Assessment "). Notwithstanding the Target Market Assessment,

distributors should note that: the price of the New Ordinary Shares

may decline and investors could lose all or part of their

investment; the New Ordinary Shares offer no guaranteed income and

no capital protection; and an investment in the New Ordinary Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Issue. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, the Joint

Bookrunners will only procure investors who meet the criteria of

professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any 'manufacturer' (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the New Ordinary Shares have been subject to a product

approval process, which has determined that such New Ordinary

Shares are: (i) compatible with an end target market of: (a)

investors who meet the criteria of professional clients as defined

in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it

forms part of domestic UK law by virtue of the European Union

(Withdrawal) Act 2018 and the European Union (Withdrawal Agreement)

Act 2020; (b) eligible counterparties, as defined in the FCA

Handbook Conduct of Business Sourcebook ("COBS"); and (c) retail

clients who do not meet the definition of professional client under

(b) or eligible counterparty per (c); and (ii) eligible for

distribution through all distribution channels as are permitted by

Directive 2014/65/EU (the "UK target market assessment").

Notwithstanding the UK target market assessment, distributors

should note that: the price of the New Ordinary Shares may decline

and investors could lose all or part of their investment; the New

Ordinary Shares offer no guaranteed income and no capital

protection; and an investment in the New Ordinary Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The UK target market assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the UK target market assessment, the Joint

Bookrunners will only procure investors who meet the criteria of

professional clients and eligible counterparties. For the avoidance

of doubt, the UK target market assessment does not constitute: (a)

an assessment of suitability or appropriateness for the purposes of

COBS 9A and COBS 10A, respectively; or (b) a recommendation to any

investor or group of investors to invest in, or purchase or take

any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own UK

target market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

Market Abuse Regulation

This Announcement contains inside information for the purposes

of EU MAR and UK MAR (together, "MAR"). In addition, market

soundings (as defined in MAR) were taken in respect of the matters

contained in this Announcement, with the result that certain

persons became aware of such inside information as permitted by

MAR. That inside information is set out in this Announcement and

has been disclosed as soon as possible in accordance with paragraph

7 of article 17 of both EU MAR and UK MAR. Upon the publication of

this Announcement, the inside information is now considered to be

in the public domain and such persons shall therefore cease to be

in possession of inside information in relation to the Company and

its securities.

The person responsible for making this Announcement on behalf of

Accsys is Nick Hartigan, General Counsel & Company

Secretary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFEIFIFEDSEDF

(END) Dow Jones Newswires

November 21, 2023 10:37 ET (15:37 GMT)

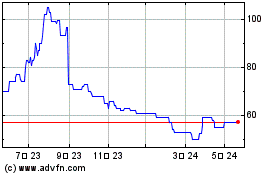

Accsys Technologies (AQSE:AXS.GB)

過去 株価チャート

から 11 2024 まで 12 2024

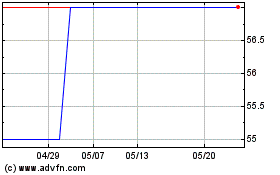

Accsys Technologies (AQSE:AXS.GB)

過去 株価チャート

から 12 2023 まで 12 2024