2018 Market Outlook: Investors Should Focus on High Quality Securities, Fixed Income Products That Can be Responsive to Inter...

2018年2月7日 - 10:30PM

Arrow Funds, sponsors of a family of innovative exchange traded

funds (ETFs) and mutual funds, today released its Market Outlook

for 2018.

Among the firm’s recommendations: Investors should focus on high

quality securities and fixed income products that can respond to a

changing interest rate environment. In addition, Arrow says

investors should look outside the U.S. for opportunities and

consider alternative strategies for defensive positioning.

“We are now in the middle of one of the longest economic

expansions in the country’s history, and with the new tax cuts in

place and the potential for substantial infrastructure spending on

the horizon, we expect the growth to continue,” said Joe Barrato,

CEO and Director of Investment Strategies at Arrow Funds. “However,

given where we are in the cycle, it’s important for advisors to

invest strategically, keeping in mind that markets can go down as

well as

up.”

Key points in Arrow’s 2018 Market Outlook include:

- Investors should consider a more prudent approach in 2018,

incorporating alternative investments that have the potential to

enhance returns while hedging risk;

- With the Fed in the early stages of a new tightening cycle,

consider funds that can respond to a changing interest rate

environment, including commodities and managed futures;

- Look abroad for opportunities in both equities and

income-generating investments;

- When in doubt, look at what some of the biggest endowments are

doing. Yale, for example, has moved to a diversified,

equity-oriented allocation that has been delivering strong

results.

The Arrow family of funds includes the multi-factor Arrow QVM

Equity Factor ETF, (NYSE:QVM); fixed income products like the Arrow

Dynamic Income Fund, (NASDAQ:ASFNX) and the ultrashort-term bond

ETF the Arrow Reserve Capital Management ETF (BATS:ARCM);

diversified multi-asset funds like the Arrow Dow Jones Global Yield

ETF (NYSE:GYLD); alternative investment strategies like Arrow

Managed Futures Strategy Fund (NASDAQ:MFTNX); a suite of offerings

built on the industry-leading technical analysis of Dorsey Wright

& Associates; and its endowment-like Arrow DWA Balanced Fund

(NASDAQ:DWANX) and its global macro strategy Arrow DWA

Tactical ETF (NASDAQ:DWAT).

Most recently, Arrow launched two international equity ETFs: the

Arrow Dogs of the World ETF (NYSE:DOGS), which finds value among

the worst performing international securities where a mean

reversion is expected; and the Arrow DWA Country Rotation ETF

(NASDAQ:DWCR), which offers a systematic price momentum

strategy.

“DOGS and DWCR are our ‘yin and yang’ when it comes to

approaching the international equity markets and were a natural

extension of our fund lineup,” continued Barrato. “When we look at

the 2018 market environment, we see a lot of opportunity for

investors looking to add tactical and adaptive strategies into the

mix, but it’s important that investors consider correlations to

achieve true diversification. That is a major theme of our outlook

piece this year, which we’re very pleased to be sharing with

investors and advisors.”

About Arrow: Arrow Funds,

including the exchange traded product line ArrowShares, is a

company that offers targeted portfolio solutions for ever-changing

markets. The company’s vision is to be the leading provider of

alternative and tactical investment solutions with a focus on

education, research and client service as the cornerstones. To

learn more, visit www.ArrowFunds.com.

Shares of exchange traded products are bought and sold at market

price, not NAV, and are not individually redeemed from the fund.

Buying and selling shares generally results in brokerage

commissions which will reduce returns. The market price may be

higher (premium) or lower (discount) than the Net Asset Value

(NAV).

Before investing, please read the prospectus and shareholder

reports to learn about the investment strategy and potential risks.

Investing involves risks, including the potential for loss of

principal. An investor should consider the fund’s investment

objective, charges, expenses and risks carefully before

investing. This and other information is contained in

the prospectus, which can be obtained by calling

1-877-277-6933. Content reviewed by an affiliate, Archer

Distributors, LLC (member FINRA). AD-020618

Media Contact:Chris

Sullivanchris@macmillancom.com, (212) 473-4442

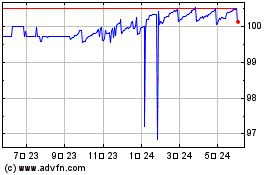

Arrow Reserve Capital Ma... (AMEX:ARCM)

過去 株価チャート

から 11 2024 まで 12 2024

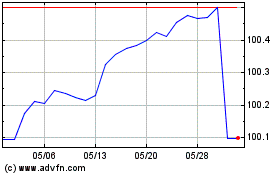

Arrow Reserve Capital Ma... (AMEX:ARCM)

過去 株価チャート

から 12 2023 まで 12 2024