false

Q2

--09-30

2024

0001792941

0001792941

2023-10-01

2024-03-31

0001792941

2024-05-12

0001792941

2024-03-31

0001792941

2023-09-30

0001792941

us-gaap:RelatedPartyMember

2024-03-31

0001792941

us-gaap:RelatedPartyMember

2023-09-30

0001792941

us-gaap:SeriesAPreferredStockMember

2024-03-31

0001792941

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001792941

us-gaap:SeriesBPreferredStockMember

2024-03-31

0001792941

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001792941

2024-01-01

2024-03-31

0001792941

2023-01-01

2023-03-31

0001792941

2022-10-01

2023-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-09-30

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-09-30

0001792941

us-gaap:CommonStockMember

2022-09-30

0001792941

us-gaap:TreasuryStockCommonMember

2022-09-30

0001792941

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001792941

us-gaap:RetainedEarningsMember

2022-09-30

0001792941

2022-09-30

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001792941

us-gaap:CommonStockMember

2022-12-31

0001792941

us-gaap:TreasuryStockCommonMember

2022-12-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001792941

us-gaap:RetainedEarningsMember

2022-12-31

0001792941

2022-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001792941

us-gaap:CommonStockMember

2023-09-30

0001792941

us-gaap:TreasuryStockCommonMember

2023-09-30

0001792941

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001792941

us-gaap:RetainedEarningsMember

2023-09-30

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-12-31

0001792941

us-gaap:CommonStockMember

2023-12-31

0001792941

us-gaap:TreasuryStockCommonMember

2023-12-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001792941

us-gaap:RetainedEarningsMember

2023-12-31

0001792941

2023-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-10-01

2022-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-10-01

2022-12-31

0001792941

us-gaap:CommonStockMember

2022-10-01

2022-12-31

0001792941

us-gaap:TreasuryStockCommonMember

2022-10-01

2022-12-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2022-12-31

0001792941

us-gaap:RetainedEarningsMember

2022-10-01

2022-12-31

0001792941

2022-10-01

2022-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-03-31

0001792941

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001792941

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-03-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001792941

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-10-01

2023-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-10-01

2023-12-31

0001792941

us-gaap:CommonStockMember

2023-10-01

2023-12-31

0001792941

us-gaap:TreasuryStockCommonMember

2023-10-01

2023-12-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2023-10-01

2023-12-31

0001792941

us-gaap:RetainedEarningsMember

2023-10-01

2023-12-31

0001792941

2023-10-01

2023-12-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-01-01

2024-03-31

0001792941

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001792941

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-03-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001792941

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-03-31

0001792941

us-gaap:CommonStockMember

2023-03-31

0001792941

us-gaap:TreasuryStockCommonMember

2023-03-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001792941

us-gaap:RetainedEarningsMember

2023-03-31

0001792941

2023-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-03-31

0001792941

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-03-31

0001792941

us-gaap:CommonStockMember

2024-03-31

0001792941

us-gaap:TreasuryStockCommonMember

2024-03-31

0001792941

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001792941

us-gaap:RetainedEarningsMember

2024-03-31

0001792941

GNVR:PaycheckProtectionProgramMember

2020-04-09

0001792941

GNVR:MelWentzMember

2023-10-01

2024-03-31

0001792941

GNVR:BarkleyCapitalLLCNoteMember

2023-09-13

0001792941

GNVR:BarkleyCapitalLLCNoteMember

2023-09-13

2023-09-13

0001792941

GNVR:JohnHareMember

2023-11-11

0001792941

GNVR:JohnHareMember

2023-11-11

2023-11-11

0001792941

GNVR:RKirkHuntsmanMember

2023-12-15

0001792941

GNVR:RKirkHuntsmanMember

2023-12-15

2023-12-15

0001792941

GNVR:BarkleyMember

2024-03-09

0001792941

GNVR:BarkleyMember

2024-03-09

2024-03-09

0001792941

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001792941

us-gaap:WarrantMember

2023-09-30

0001792941

us-gaap:WarrantMember

2022-10-01

2023-09-30

0001792941

GNVR:BrentLilienthalMember

2023-10-01

2024-03-31

0001792941

GNVR:BrentLilienthalMember

2024-03-31

0001792941

GNVR:MelWentzMember

2024-03-31

0001792941

us-gaap:SeriesAPreferredStockMember

2022-08-10

0001792941

us-gaap:SeriesAPreferredStockMember

2022-08-02

2022-08-10

0001792941

GNVR:BradleyWhiteMember

2022-08-16

0001792941

GNVR:DrClaytonYatesMember

2022-08-16

0001792941

GNVR:DrJesseJaynesMember

2022-08-16

0001792941

GNVR:SettlementAgreementMember

us-gaap:SeriesAPreferredStockMember

2023-09-28

2023-09-28

0001792941

us-gaap:SeriesAPreferredStockMember

srt:ExecutiveOfficerMember

2024-03-31

0001792941

us-gaap:SeriesAPreferredStockMember

srt:ExecutiveOfficerMember

2023-09-30

0001792941

us-gaap:SeriesBPreferredStockMember

2022-10-19

0001792941

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:SettlementAgreementMember

us-gaap:SeriesBPreferredStockMember

2023-09-28

2023-09-28

0001792941

us-gaap:SeriesBPreferredStockMember

srt:ExecutiveOfficerMember

2024-03-31

0001792941

us-gaap:SeriesBPreferredStockMember

srt:ExecutiveOfficerMember

2023-09-30

0001792941

2022-04-21

2022-04-21

0001792941

2022-04-21

0001792941

2022-06-30

0001792941

GNVR:TransferAndExchangeAgreementMember

2022-07-01

2022-07-31

0001792941

GNVR:TransferAndExchangeAgreementMember

2022-07-31

0001792941

GNVR:NexionContractorMember

2022-09-08

2022-09-08

0001792941

GNVR:BusinessAdvisoryServicesMember

2024-01-01

2024-01-01

0001792941

GNVR:GoodWorksFundingLLCMember

2024-01-16

2024-01-16

0001792941

GNVR:ChadPawlakMember

2024-01-17

2024-01-17

0001792941

2024-01-17

2024-01-17

0001792941

2024-02-02

2024-02-02

0001792941

2024-02-05

2024-02-05

0001792941

GNVR:GoodWorksFundingLLCMember

2024-02-16

2024-02-16

0001792941

GNVR:ChadPawlakMember

2024-02-17

2024-02-17

0001792941

2024-03-02

2024-03-02

0001792941

2024-03-05

2024-03-05

0001792941

2024-03-11

2024-03-11

0001792941

GNVR:GoodWorksFundingLLCMember

2024-03-16

2024-03-16

0001792941

GNVR:ChadPawlakMember

2024-03-17

2024-03-17

0001792941

us-gaap:InvestorMember

2022-11-17

2022-11-17

0001792941

us-gaap:InvestorMember

2023-05-03

2023-05-03

0001792941

us-gaap:InvestorMember

2023-05-12

2023-05-12

0001792941

us-gaap:InvestorMember

2023-05-29

2023-05-29

0001792941

us-gaap:InvestorMember

2023-07-12

2023-07-12

0001792941

us-gaap:InvestorMember

2023-07-13

2023-07-13

0001792941

us-gaap:InvestorMember

2023-07-14

2023-07-14

0001792941

us-gaap:InvestorMember

2023-07-17

2023-07-17

0001792941

us-gaap:InvestorMember

2023-08-25

2023-08-25

0001792941

us-gaap:InvestorMember

2023-09-16

2023-09-16

0001792941

us-gaap:InvestorMember

2023-09-19

2023-09-19

0001792941

us-gaap:InvestorMember

2023-11-01

2023-11-01

0001792941

GNVR:InvestorOneMember

2023-11-01

2023-11-01

0001792941

GNVR:InvestorTwoMember

2023-11-01

2023-11-01

0001792941

us-gaap:InvestorMember

2023-11-06

2023-11-06

0001792941

us-gaap:InvestorMember

2023-11-08

2023-11-08

0001792941

GNVR:InvestorOneMember

2023-11-08

2023-11-08

0001792941

GNVR:InvestorTwoMember

2023-11-08

2023-11-08

0001792941

GNVR:InvestorThreeMember

2023-11-08

2023-11-08

0001792941

us-gaap:InvestorMember

2023-11-10

2023-11-10

0001792941

us-gaap:InvestorMember

2023-11-13

2023-11-13

0001792941

us-gaap:InvestorMember

2023-11-14

2023-11-14

0001792941

us-gaap:InvestorMember

2023-12-08

2023-12-08

0001792941

us-gaap:InvestorMember

2023-12-11

2023-12-11

0001792941

us-gaap:InvestorMember

2023-12-13

2023-12-13

0001792941

us-gaap:InvestorMember

2023-12-14

2023-12-14

0001792941

us-gaap:InvestorMember

2023-12-20

2023-12-20

0001792941

us-gaap:InvestorMember

2023-12-26

2023-12-26

0001792941

us-gaap:InvestorMember

2024-01-08

2024-01-08

0001792941

us-gaap:InvestorMember

2024-01-16

2024-01-16

0001792941

us-gaap:InvestorMember

2024-02-29

2024-02-29

0001792941

us-gaap:InvestorMember

2024-03-14

2024-03-14

0001792941

us-gaap:InvestorMember

2024-03-26

2024-03-26

0001792941

2023-06-14

2023-06-14

0001792941

2023-07-01

2023-07-01

0001792941

2023-10-16

2023-10-16

0001792941

2023-10-19

2023-10-19

0001792941

2023-12-15

2023-12-15

0001792941

2024-03-09

2024-03-09

0001792941

2024-01-16

2024-01-16

0001792941

us-gaap:RelatedPartyMember

us-gaap:WarrantMember

2022-10-01

2023-09-30

0001792941

us-gaap:RelatedPartyMember

us-gaap:WarrantMember

2023-09-30

0001792941

us-gaap:WarrantMember

2023-10-01

2024-03-31

0001792941

us-gaap:WarrantMember

2024-03-31

0001792941

us-gaap:RelatedPartyMember

us-gaap:WarrantMember

2023-10-01

2024-03-31

0001792941

us-gaap:RelatedPartyMember

us-gaap:WarrantMember

2024-03-31

0001792941

GNVR:JaynesInvestmentLLCMember

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:ACTHoldingsLLCMember

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:LASBFamilyTrustMember

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:JesseMichaelJaynesMember

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:BradleyWhiteMember

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:PJAdvisoryGroupMember

us-gaap:SeriesBPreferredStockMember

2022-10-19

2022-10-19

0001792941

GNVR:ConsultingAgreementsMember

GNVR:MsMillerMember

2023-10-01

2024-03-31

0001792941

GNVR:SettlementAgreementMember

GNVR:BradleyWhiteMember

2023-09-28

0001792941

GNVR:SettlementAgreementMember

GNVR:BradleyWhiteMember

GNVR:TranchesMember

2023-09-28

0001792941

GNVR:SettlementAgreementMember

GNVR:BradleyWhiteMember

us-gaap:SeriesAPreferredStockMember

2023-09-28

2023-09-28

0001792941

GNVR:SettlementAgreementMember

GNVR:BradleyWhiteMember

us-gaap:SeriesBPreferredStockMember

2023-09-28

2023-09-28

0001792941

GNVR:SettlementAgreementMember

GNVR:BradleyWhiteMember

us-gaap:SeriesBPreferredStockMember

2024-03-31

0001792941

GNVR:ExecutiveConsultingAgreementMember

GNVR:MsMillerMember

2023-10-01

2024-03-31

0001792941

us-gaap:SeriesAPreferredStockMember

GNVR:BradleyWhiteMember

2022-08-16

0001792941

us-gaap:SeriesAPreferredStockMember

GNVR:DrClaytonYatesMember

2022-08-16

0001792941

us-gaap:SeriesAPreferredStockMember

GNVR:DrJesseJaynesMember

2022-08-16

0001792941

us-gaap:WarrantMember

2024-01-17

2024-01-17

0001792941

GNVR:GoodWorksFundingLLCMember

us-gaap:InvestorMember

2024-02-16

2024-02-16

0001792941

GNVR:GoodWorksFundingLLCMember

us-gaap:InvestorMember

2024-03-16

2024-03-16

0001792941

GNVR:ChadPawlakMember

us-gaap:InvestorMember

2024-01-17

2024-01-17

0001792941

GNVR:ChadPawlakMember

us-gaap:InvestorMember

2024-02-17

2024-02-17

0001792941

GNVR:ChadPawlakMember

us-gaap:InvestorMember

2024-03-17

2024-03-17

0001792941

GNVR:GoodWorksFundingLLCMember

us-gaap:InvestorMember

2024-01-16

2024-01-16

0001792941

us-gaap:WarrantMember

GNVR:MsMillerMember

2023-10-01

2024-03-31

0001792941

us-gaap:WarrantMember

GNVR:MsMillerMember

2024-03-31

0001792941

GNVR:RobertBubeckMember

2017-10-01

2018-03-31

0001792941

GNVR:RobertBubeckMember

2024-03-31

0001792941

GNVR:RobertBubeckMember

2023-09-30

0001792941

us-gaap:WarrantMember

GNVR:RobertBubeckMember

2023-10-01

2024-03-31

0001792941

GNVR:MsMillerMember

2024-01-17

2024-01-17

0001792941

GNVR:DrJesseJaynesMember

2024-01-17

2024-01-17

0001792941

GNVR:DrClaytonYatesMember

2024-01-17

2024-01-17

0001792941

GNVR:MrPawlakMember

2024-01-17

2024-01-17

0001792941

us-gaap:SubsequentEventMember

us-gaap:InvestorMember

2024-04-05

2024-04-05

0001792941

us-gaap:SubsequentEventMember

us-gaap:InvestorMember

2024-04-16

2024-04-16

0001792941

GNVR:GoodWorksFundingLLCMember

us-gaap:SubsequentEventMember

2024-04-16

2024-04-16

0001792941

GNVR:ChadPawlakMember

us-gaap:SubsequentEventMember

2024-04-17

2024-04-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended March 31, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ____________ to ____________

Commission

File Number: 000-56589

| GENVOR

INCORPORATED |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

83-2054746 |

| (State

or other jurisdiction of incorporation) |

|

(IRS

Employer Identification Number) |

201

S. Elliott Road, Suite 538

Chapel

Hill, North Carolina 27514

(Address

of principal executive offices)

(984)

261-7338

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Securities

registered under Section 12(g) of the Act:

Common

Stock, $0.001 par value

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant

was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| ☐ |

Large

accelerated filer |

☐ |

Accelerated

filer |

| ☒ |

Non-accelerated

filer |

☒ |

Smaller

reporting company |

| |

|

☒ |

Emerging

growth company |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

On

March 31, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value

of the registrant’s common stock held by non-affiliates of the registrant had an undetermined value as the registrant’s common

stock was not trading on any exchange, nor was it quoted for trading on the OTC Link ATS or any other over-the-counter market or alternative

trading system.

The

number of the registrant’s shares of common stock issued, issuable and outstanding was 20,204,608 as of May 12,

2024.

GENVOR

INCORPORATED

INDEX

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

Genvor

Incorporated

Index

to Financial Statements

Genvor

Incorporated

Condensed

Consolidated Balance Sheets

| | |

March

31, | | |

September

30, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current

assets: | |

| | | |

| | |

| Cash | |

$ | 8,923 | | |

$ | 44,354 | |

| Prepaid

expenses | |

| 9,975 | | |

| 21,975 | |

| Total

current assets | |

| 18,898 | | |

| 66,329 | |

| | |

| | | |

| | |

| Fixed

assets, net | |

| 14,818 | | |

| 15,734 | |

| | |

| | | |

| | |

| Total

assets | |

$ | 33,716 | | |

$ | 82,063 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current

liabilities: | |

| | | |

| | |

| Convertible

notes payable | |

$ | 867,000 | | |

$ | 1,319,500 | |

| Accounts

payable and accrued expenses | |

| 181,044 | | |

| 388,809 | |

| Due

to related party | |

| 37,969 | | |

| 30,000 | |

| SBA

loan | |

| 48,750 | | |

| 48,750 | |

| Total

current liabilities | |

| 1,134,763 | | |

| 1,787,059 | |

| Total

liabilities | |

| 1,134,763 | | |

| 1,787,059 | |

| | |

| | | |

| | |

| Commitments

and contingencies (Note 6) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’

deficit: | |

| | | |

| | |

| Preferred

stock, $0.001 par value, 20,000,000 shares authorized | |

| | | |

| | |

| Preferred

stock - series A, 10 shares authorized, 9 and 9 shares issued as of March 31, 2024 and September 30, 2023, respectively, and 6 and 9 shares outstanding as of March 31, 2024 and September 30,

2023, respectively | |

| - | | |

| - | |

| Preferred

stock – series B, 2,500,000 shares authorized, 2,060,536 and 2,060,536 shares issued as of March 31, 2024 and September 30, 2023,

respectively, 1,558,024 and 1,558,024 outstanding as of March 31, 2024 and September 30, 2023, respectively | |

| 2,061 | | |

| 2,061 | |

| Preferred stock value | |

| 2,061 | | |

| 2,061 | |

| Common

stock, $0.001 par value, 300,000,000 shares authorized, 20,094,608 and 19,061,936 shares issued, issuable and outstanding as of March

31, 2024 and September 30, 2023, respectively | |

| 20,095 | | |

| 19,062 | |

| Treasury

stock, 502,512 and 502,512 shares of series B preferred stock at March 31, 2024 and September 30, 2023, respectively | |

| (300,000 | ) | |

| (300,000 | ) |

| Additional

paid-in capital | |

| 19,019,586 | | |

| 16,293,188 | |

| Accumulated

deficit | |

| (19,842,789 | ) | |

| (17,719,307 | ) |

| Total

stockholders’ deficit | |

| (1,101,047 | ) | |

| (1,704,996 | ) |

| | |

| | | |

| | |

| Total

liabilities and stockholders’ deficit | |

$ | 33,716 | | |

$ | 82,063 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Genvor

Incorporated

Condensed

Consolidated Statements of Operations

(unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

For

the Three Months Ended

March 31, | | |

For

the Six Months Ended

March 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

expenses | |

| | | |

| | | |

| | | |

| | |

| Professional

fees | |

| 177,453 | | |

| 58,858 | | |

| 445,039 | | |

| 65,662 | |

| Payroll

related expenses | |

| 69,965 | | |

| 37,500 | | |

| 69,965 | | |

| 75,000 | |

| Research

and development | |

| 33,110 | | |

| - | | |

| 33,110 | | |

| - | |

| Stock-based

compensation | |

| 406,250 | | |

| - | | |

| 1,313,350 | | |

| - | |

| Marketing

expenses | |

| 8,297 | | |

| - | | |

| 8,297 | | |

| - | |

| Investor

and public relations | |

| 38,750 | | |

| - | | |

| 74,750 | | |

| - | |

| Other

general and administrative expenses | |

| 13,575 | | |

| 58,924 | | |

| 107,965 | | |

| 128,282 | |

| Total

operating expenses | |

| 747,400 | | |

| 155,282 | | |

| 2,052,476 | | |

| 268,944 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

loss | |

| (747,400 | ) | |

| (155,282 | ) | |

| (2,052,476 | ) | |

| (268,944 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other

income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| (481 | ) | |

| (5,819 | ) | |

| (16,832 | ) | |

| (11,665 | ) |

| Penalties | |

| (30,000 | ) | |

| (30,000 | ) | |

| (60,000 | ) | |

| (60,000 | ) |

| Amortization

of debt discount | |

| - | | |

| (30,111 | ) | |

| - | | |

| (60,222 | ) |

| Gain

on settlement of liabilities, net | |

| 5,826 | | |

| - | | |

| 5,826 | | |

| - | |

| Total

other income (expense) | |

| (24,655 | ) | |

| (65,930 | ) | |

| (71,006 | ) | |

| (131,887 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

$ | (772,055 | ) | |

$ | (221,212 | ) | |

$ | (2,123,482 | ) | |

$ | (400,831 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic

and diluted net loss per common share | |

$ | (0.04 | ) | |

$ | (0.01 | ) | |

$ | (0.11 | ) | |

$ | (0.02 | ) |

| Basic

and diluted weighted average common shares outstanding | |

| 19,669,477 | | |

| 18,381,710 | | |

| 19,596,756 | | |

| 20,449,202 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Genvor

Incorporated

Condensed

Consolidated Statements of Changes in Stockholders’ Deficit

For

the Six Months Ended March 31, 2024

(unaudited)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Stock | | |

Capital | | |

Deficit | | |

Total | |

| | |

Series

A | | |

Series

B | | |

| | |

| | |

| | |

Additional | | |

Accumu- | | |

| |

| | |

Preferred

Stock | | |

Preferred

Stock | | |

Common

Stock | | |

Treasury | | |

Paid-in | | |

lated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Stock | | |

Capital | | |

Deficit | | |

Total | |

| Balance,

September 30, 2022 | |

| 9 | | |

$ | - | | |

| - | | |

$ | - | | |

| 38,678,155 | | |

$ | 38,678 | | |

$ | - | | |

$ | 14,608,815 | | |

$ | (16,041,937 | ) | |

| (1,394,444 | ) |

| Conversion

of common stock into series B preferred stock | |

| - | | |

| - | | |

| 2,060,536 | | |

| 2,061 | | |

| (20,605,334 | ) | |

| (20,605 | ) | |

| - | | |

| 18,544 | | |

| - | | |

| - | |

| Sale

of common stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| 300,000 | | |

| 300 | | |

| - | | |

| 149,700 | | |

| - | | |

| 150,000 | |

| Net

loss for the period ended December 31, 2022 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (179,619 | ) | |

| (179,619 | ) |

| Balance,

December 31, 2022 | |

| 9 | | |

| - | | |

| 2,060,536 | | |

| 2,061 | | |

| 18,372,821 | | |

| 18,373 | | |

| - | | |

| 14,777,059 | | |

| (16,221,556 | ) | |

| (1,424,063 | ) |

| Sale

of common stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| 50,000 | | |

| 50 | | |

| - | | |

| 12,450 | | |

| - | | |

| 12,500 | |

| Net

loss for the period ended March 31, 2023 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (221,212 | ) | |

| (221,212 | ) |

| Balance,

March 31, 2023 | |

| 9 | | |

$ | - | | |

| 2,060,536 | | |

$ | 2,061 | | |

| 18,422,821 | | |

$ | 18,423 | | |

$ | - | | |

$ | 14,789,509 | | |

$ | (16,442,768 | ) | |

$ | (1,632,775 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

September 30, 2023 | |

| 6 | | |

$ | - | | |

| 1,558,024 | | |

$ | 2,061 | | |

| 19,061,936 | | |

$ | 19,062 | | |

$ | (300,000 | ) | |

$ | 16,293,188 | | |

$ | (17,719,307 | ) | |

$ | (1,704,996 | ) |

| Sale

of common stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| 623,600 | | |

| 624 | | |

| - | | |

| 577,976 | | |

| - | | |

| 578,600 | |

| Issuance

of common stock erroneously omitted from prior year | |

| - | | |

| - | | |

| - | | |

| - | | |

| 50,000 | | |

| 50 | | |

| - | | |

| (50 | ) | |

| - | | |

| - | |

| Double

issuance of common stock | |

|

-

| | |

|

-

| | |

|

-

| | |

|

-

| | |

| 60,000 | | |

| 60 | | |

|

-

| | |

| (60 | ) | |

|

-

| | |

|

-

| |

| Issuance

of warrants for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 907,100 | | |

| - | | |

| 907,100 | |

| Issuance

of warrants for conversion of note payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 329,418 | | |

| - | | |

| 329,418 | |

| Issuance

of common stock for conversion of note payable | |

| - | | |

| - | | |

|

-

| | |

|

-

| | |

| 40,000 | | |

| 40 | | |

| - | | |

| 48,023 | | |

|

-

| | |

| 48,063 | |

| Net

loss for the period ended December 31, 2023 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,351,427 | ) | |

| (1,351,427 | ) |

| Balance,

December 31, 2023 | |

| 6 | | |

| - | | |

| 1,558,024 | | |

| 2,061 | | |

| 19,835,536 | | |

| 19,836 | | |

| (300,000 | ) | |

| 18,155,595 | | |

| (19,070,734 | ) | |

| (1,193,242 | ) |

| Balance,

value | |

| 6 | | |

| - | | |

| 1,558,024 | | |

| 2,061 | | |

| 19,835,536 | | |

| 19,836 | | |

| (300,000 | ) | |

| 18,155,595 | | |

| (19,070,734 | ) | |

| (1,193,242 | ) |

| Issuance

of common stock for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 251,072 | | |

| 251 | | |

| - | | |

| 305,999 | | |

| - | | |

| 306,250 | |

| Issuance

of common stock for conversion of note payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| 210,000 | | |

| 210 | | |

| - | | |

| 209,790 | | |

| - | | |

| 210,000 | |

| Sale

of common stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| 248,000 | | |

| 248 | | |

| - | | |

| 247,752 | | |

| - | | |

| 248,000 | |

| Issuance

of warrants for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 100,000 | | |

| - | | |

| 100,000 | |

| Cancellation

of common stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| (450,000 | ) | |

| (450 | ) | |

| - | | |

| 450 | | |

| - | | |

| - | |

| Net

loss for the period ended March 31, 2024 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (772,055 | ) | |

| (772,055 | ) |

| Balance,

March 31, 2024 | |

| 6 | | |

$ | - | | |

| 1,558,024 | | |

$ | 2,061 | | |

| 20,094,608 | | |

$ | 20,095 | | |

$ | (300,000 | ) | |

$ | 19,019,586 | | |

$ | (19,842,789 | ) | |

$ | (1,101,047 | ) |

| Balance,

value | |

| 6 | | |

$ | - | | |

| 1,558,024 | | |

$ | 2,061 | | |

| 20,094,608 | | |

$ | 20,095 | | |

$ | (300,000 | ) | |

$ | 19,019,586 | | |

$ | (19,842,789 | ) | |

$ | (1,101,047 | ) |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Genvor

Incorporated

Condensed

Consolidated Statements of Cash Flow

For

the Six Months Ended March 31,

(unaudited)

| | |

2024 | | |

2023 | |

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

loss | |

$ | (2,123,482 | ) | |

$ | (400,831 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation

expense | |

| 916 | | |

| 916 | |

| Stock-based

compensation | |

| 1,313,350 | | |

| - | |

| Late

fee capitalized into notes payable | |

| 60,000 | | |

| 60,000 | |

| Gain on settlement of liabilities, net | |

| (5,826 | ) | |

| - | |

| Amortization

of debt discount | |

| - | | |

| 60,222 | |

| Changes

in assets and liabilities: | |

| | | |

| | |

| Prepaid

expenses | |

| 12,000 | | |

| - | |

| Other

current assets | |

| - | | |

| (13,397 | ) |

| Accounts

payable and accrued expenses | |

| (126,958 | ) | |

| 32,117 | |

| Due

to related party | |

| 7,969 | | |

| - | |

| USDA

CRADA liability | |

| - | | |

| (246,400 | ) |

| Net

cash used in operating activities | |

| (862,031 | ) | |

| (507,373 | ) |

| | |

| | | |

| | |

| Cash

flows from financing activities: | |

| | | |

| | |

| Proceeds

from notes payable | |

| - | | |

| 50,000 | |

| Proceeds

from sale of common stock | |

| 826,600 | | |

| 162,500 | |

| Net

cash provided by financing activities | |

| 826,600 | | |

| 212,500 | |

| | |

| | | |

| | |

| Net

decrease in cash | |

| (35,431 | ) | |

| (294,873 | ) |

| | |

| | | |

| | |

| Cash

at beginning of period | |

| 44,354 | | |

| 296,386 | |

| | |

| | | |

| | |

| Cash

at end of period | |

$ | 8,923 | | |

$ | 1,513 | |

| | |

| | | |

| | |

| Cash

paid for interest | |

$ | - | | |

$ | - | |

| Cash

paid for taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Non-cash

investing and financing activities: | |

| | | |

| | |

| Conversion

of note payable into common stock | |

$ | 258,063 | | |

$ | - | |

| Conversion

of notes payable into warrants | |

$ | 329,418 | | |

$ | - | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

GENVOR

INCORPORATED

Notes

to Condensed Consolidated Financial Statements

March

31, 2024

(unaudited)

NOTE

1 – ORGANIZATION AND BASIS OF PRESENTATION

Company

Background

On

May 27, 2022, Genvor Incorporated, formerly known as Allure Worldwide, Inc. (the “Company” or “Genvor” or “we”),

a Nevada corporation, Genvor Acquisition, Corp., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”),

and Genvor Inc., a Delaware corporation (“Old Genvor”), completed their previously announced merger transaction pursuant

to which the Company acquired Old Genvor (the “Acquisition”), and Old Genvor became a wholly-owned subsidiary of the Company.

The Acquisition was completed pursuant to an Exchange Agreement, dated as of January 11, 2021 (the “Acquisition Agreement”),

pursuant to which Old Genvor was to be acquired by the Company as its wholly owned subsidiary and each share of Old Genvor common stock

would be exchanged for a share of the Company’s common stock, and a merger agreement, dated March 2, 2022 (the “Merger Agreement”),

pursuant to which Merger Sub merged with and into Old Genvor, with Old Genvor continuing as a wholly owned subsidiary of the Company

and the surviving corporation of the merger, and each share of Old Genvor being converted into the right to receive a share of the Company

(the “Merger”). After closing of the Merger, the Company was renamed “Genvor Incorporated.” Genvor develops plant-based

defense technology designed to help farmers achieve global food security.

During

May 2019, Old Genvor acquired Nexion Biosciences LLC (“NBLLC”) from a founder for nominal consideration as a wholly owned

subsidiary. NBLLC was formed in the state of Delaware on December 28, 2018. The condensed consolidated financial statements of the Company

include the accounts of Genvor Incorporated, Old Genvor, and its wholly owned subsidiary NBLLC. Intercompany accounts and transactions

have been eliminated upon consolidation.

Nature

of Operations

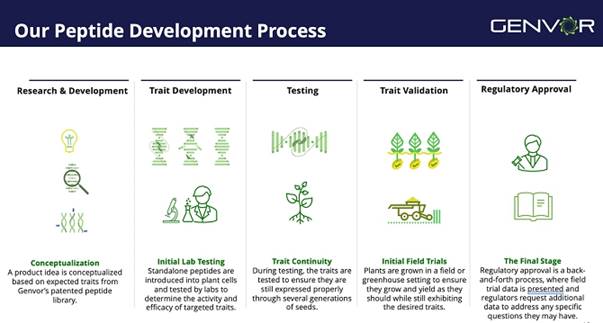

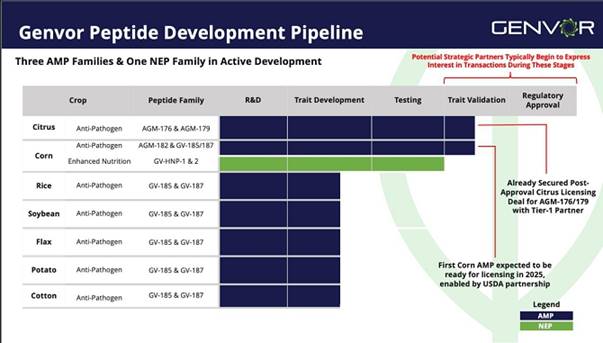

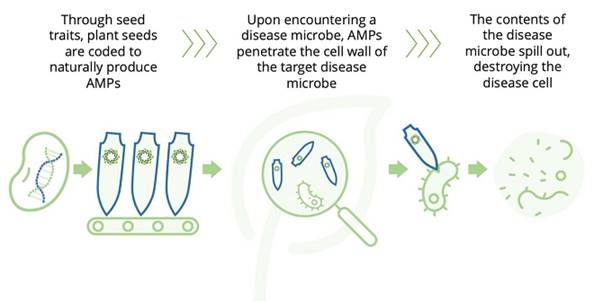

The

Company’s business plan is that Genvor will be continuing its research and development addressing plant-based defense technology

which then can be commercialized to help farmers and growers globally to overcome potentially catastrophic losses resulting from plant

disease, toxins, bacteria, and fungi that destroy their crops. These solutions can result in greater crop yields and economic savings,

which can assist in overcoming world-wide food scarcity.

Basis

of Presentation

The

accompanying unaudited condensed consolidated financial information as of and for the six months ended March 31, 2024, and 2023 has

been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim

financial information and with the instructions to Quarterly Report on Form 10-Q and Article 10 of Regulation S-X. In the opinion of

management, such financial information includes all adjustments (consisting only of normal recurring adjustments) considered necessary

for a fair presentation of our financial position at such date and the operating results and cash flows for such periods. Operating results

for the six months ended March 31, 2024, are not necessarily indicative of the results that may be expected for the entire year or for

any other subsequent interim period.

Certain

information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been omitted

pursuant to the rules of the U.S. Securities and Exchange Commission, or the SEC. These unaudited financial statements and related notes

should be read in conjunction with the audited financial statements and notes thereto contained in the Company’s Annual Report

on Form 10-K for the year ended September 30, 2023, as filed with the SEC.

Principles

of Consolidation

The

condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiary. All significant intercompany

balances and transactions have been eliminated in the consolidation. The condensed consolidated financial statements included herein,

presented in accordance with U.S. GAAP and stated in United States dollars, have been prepared by the Company, pursuant to the rules

and regulations of the Securities and Exchange Commission.

Liquidity

and Going Concern

The

accompanying condensed consolidated financial statements have been prepared assuming the Company will continue as a going concern, which

contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. At March

31, 2024, the Company had an accumulated deficit of $19,842,789. For the six months ended March 31, 2024, the Company recognized a net

loss of $2,123,482 and had net cash used in operating activities of $862,031, with no revenues earned, and limited operational history.

These matters, among others, raise substantial doubt about the Company’s ability to continue as a going concern.

While

the Company is currently developing its products and technologies, the Company’s cash position may not be significant enough to

support the Company’s daily operations. Management intends to raise additional funds by way of additional public and/or private

offerings of its stock. Management believes that the actions presently being taken to further implement its business plan, develop its

products and technologies, and generate revenues should provide the opportunity for the Company to continue as a going concern. While

the Company believes in the viability of its strategy to generate revenues and in its ability to raise additional funds in the future,

there can be no assurances to that effect. The ability of the Company to continue as a going concern is dependent upon the Company’s

ability to further implement its business plan and generate cash flows from financing activities or operating activities. The financial

statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use

of Estimates

The

preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, and disclosure of contingent liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash

Flow Reporting

The

Company follows Accounting Standards Codification (“ASC 230”), Statement of Cash Flows, for cash flow reporting, classifies

cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions

of each category, and uses the indirect or reconciliation method (“indirect method”) as defined by ASC 230, Statement of

Cash Flows, to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating

activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected future

operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash receipts and

payments.

Cash

Cash

is comprised of cash balances. Cash is held at major financial institutions and is subject to credit risk to the extent that those balances

exceed applicable Federal Deposit Insurance Corporation (“FDIC”) insurance amounts of $250,000. From time to time, the Company

has certain cash balances, including restricted cash, that may exceed insured limits. The Company utilizes large banking institutions

that are reputable, therefore mitigating the risks.

The

Company maintains its cash balances at one financial institution that is insured by the Federal Deposit Insurance Corporation. At March

31, 2024, the Company’s cash balances were not in excess of federally insured limits.

Fixed

Assets

Furniture

and equipment are stated at cost. Depreciation is provided by the straight-line method over the useful lives of the related assets, approximately

seven years. Expenditures for minor enhancements and maintenance are expensed as incurred.

Fair

Value of Financial Instruments

The

book values of cash and accounts payable approximate their respective fair values due to the short-term nature

of these instruments. The fair value hierarchy under U.S. GAAP distinguishes between assumptions based on market data (observable inputs)

and an entity’s own assumptions (unobservable inputs).

The

hierarchy consists of three levels

| |

● |

Level

one — Quoted market prices in active markets for identical assets or liabilities; |

| |

● |

Level

two — Inputs other than level one inputs that are either directly or indirectly observable; and |

| |

● |

Level

three — Unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect

those assumptions that a market participant would use. |

Determining

which category an asset or liability falls within the hierarchy requires significant judgment. We evaluate our hierarchy disclosures

each quarter.

Financial

Instruments

The

Company’s financial instruments include cash and cash equivalents, payables, and accrued interest and short-term and long-term

notes payable and are accounted for under the provisions of ASC 825, Financial Instruments. The carrying amount of these financial

instruments, as reflected in the accompanying condensed consolidated balance sheets approximates fair value.

Long-lived

Assets

The

Company’s long-lived assets and other assets (consisting of furniture, equipment, and a patent) are reviewed for impairment in

accordance with the guidance of the ASC 360, Property, Plant, and Equipment, and ASC 205, Presentation of Financial Statements.

The Company tests for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate

that the carrying amount of the asset may not be recoverable. The recoverability of an asset to be held and used is measured by a comparison

of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the asset. If such an asset is considered

to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair

value. Impairment evaluations involve management’s estimates on asset useful lives and future cash flows. Actual useful lives and

cash flows could be different from those estimated by management, which could have a material effect on our reporting results and financial

positions. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values

and third-party independent appraisals, as considered necessary. During the six months ended March 31, 2024, and 2023, the Company had

not experienced impairment losses on its long-lived assets.

Research

and Development

The

Company expenses the cost of research and development as incurred. Research and development expenses consist primarily of professional

service costs associated with the development of plant-based defense technology products. For the six months ended March 31, 2024, and

2023, the Company had $33,110 and $0 in research and development expenses, respectively.

Patents

Any

patent costs for internally developed patents will be expensed as incurred. Costs to maintain and defend patents are recorded as administrative

expenses in the statement of operations.

Purchased

patents are recorded at cost and reviewed for impairment in accordance with the guidance of the ASC 360,

Income

Taxes

The

Company accounts for income taxes in accordance with FASB ASC 740, Income Taxes. Deferred tax assets and liabilities are recognized

for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets

and liabilities and loss carryforwards and their respective tax bases.

Deferred

tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income (loss) in the years in which those

temporary differences are expected to be recovered or settled.

The

effect of a change in tax rules on deferred tax assets and liabilities is recognized in operations in the year of change. A valuation

allowance is recorded when it is “more likely-than-not” that a deferred tax asset will not be realized.

Tax

benefits of uncertain tax positions are recognized only if it is more likely than not that the Company will be able to sustain a position

taken on an income tax return. The Company has no liability for uncertain tax positions as of March 31, 2024. Interest and penalties,

if any, related to unrecognized tax benefits would be recognized as interest expense. The Company does not have any accrued interest

or penalties associated with unrecognized tax benefits, nor was any significant interest expense recognized during the six months ended

March 31, 2024.

Stock-Based

Compensation

The

Company accounts for stock-based instruments issued to employees in accordance with ASC Topic 718, Compensation – Stock Compensation,

and Certain Redeemable Financial Instruments. ASC Topic 718 requires companies to recognize in the statement of operations the grant-date

fair value of stock options and other equity-based compensation issued to employees. The value of the portion of an award that is ultimately

expected to vest is recognized as an expense over the requisite service periods using the straight-line attribution method.

The

Company measures compensation cost for all employee stock-based awards at their fair values on the date of grant. Stock-based awards

issued to non-employees are measured at their fair values on the date of grant and are re-measured at each reporting period through their

vesting dates, as applicable. The fair value of stock-based awards is recognized as expense over the service period, net of estimated

forfeitures, using the straight-line method.

Loss

Per Share of Common Stock

Basic

net loss per common share is computed using the weighted average number of common shares outstanding. Diluted earnings per share (“EPS”)

include additional dilution from common stock equivalents, such as stock issuable pursuant to the exercise of stock options, warrants

and convertible notes. Common stock equivalents are not included in the computation of diluted earnings per share when the Company reports

a loss because to do so would be anti-dilutive for the periods presented. The Company had total potential additional dilutive securities

outstanding at March 31, 2024 and 2023 of $0 and $665,000, respectively.

Recent

Accounting Pronouncements

Recently

Issued Accounting Standards: Management does not believe that any recently issued, but not yet effective, accounting standards if currently

adopted would have a material effect on the accompanying financial statements.

NOTE

3 – BORROWINGS

Commercial

Loan

On

April 9, 2020, the Company received a loan from the Small Business Administration pursuant to the Paycheck Protection Program (“PPP”)

in the principal amount of $48,750. The note bears interest at a variable rate of approximately 1% and matured in April 2022; and it

is currently in default. Forgiveness for the loan was applied for and is pending. The principal amount of the loan was based on the consulting

agreement salary between Nexion Biosciences, Inc., organized in the state of Florida (“NBFL”) (a related party) and the CEO.

Payable

for Patent

Notes

Payable

From

time to time, the Company’s subsidiary, Old Genvor, enters into unsecured notes payable with individual investors. Only Noteholder

E (below) has security in the form of a personal guarantee by the CEO and prior consultant (Note 6). The terms of these notes are listed

below. Several of the notes are convertible into shares of the Company’s common stock as detailed in the following schedule.

SCHEDULE OF CONVERTIBLE NOTES PAYABLE

| | |

| | |

| | |

Interest | | |

Loan | |

| Noteholder | |

Origination | | |

Maturity | | |

Rate | | |

Balance | |

| Brent

Lilienthal (a) (b) | |

| 2019 | | |

| 12/31/2021 | | |

| 0 | % | |

$ | 217,000 | |

| Mel

Wentz (a) (b) | |

| 3/19/2019 | | |

| 4/29/2019 | | |

| 0 | % | |

| 650,000 | |

| | |

| | | |

| | | |

| | | |

$ | 867,000 | |

The

notes do not have default provisions except for Mel Wentz receives a default penalty of $10,000 each month the note goes unpaid.

The

Company is currently disputing amounts claimed to be owed to two noteholders, Brent Lilienthal, and Mel Wentz, under state usury laws

(See Note 6).

On

September 13, 2023, the Company entered into a convertible promissory note with Barkley Capital LLC for $200,000. The note matures on

March 13, 2024, and bear interest of 10%. The note is convertible into 134,000 shares of common stock at a value of $1.50 per share.

On

November 11, 2023, John Hare converted the $300,000 note payable into 300,000 warrants with an exercise price of $0.001 (see Note 4).

On

December 15, 2023, R. Kirk Huntsman converted the $32,500 note payable into 40,000 shares of common stock.

On

March 9, 2024, Barkley converted the $200,000 note payable, with $10,000 accrued interest, into 210,000 shares of common stock.

During

the year ended September 30, 2023, $76,325 principal was converted into 122,115 common stock shares of the Company. Additionally, $350,000

principal and $4,114 interest were converted into 1,400,000 warrants for common stock of the Company.

Interest

expense totaled $16,832 and $11,665, respectively, for the six months ended March 31, 2024, and 2023, including default penalties. Late

fees totaled $60,000 and $60,000, respectively, for the six months ended March 31, 2024, and 2023. These late fees are in dispute and

part of (a) and (b) above.

NOTE

4 – STOCKHOLDERS’ DEFICIT

Preferred

Stock

The

authorized preferred stock of the Company consists of 20,000,000 shares with a $0.001 par value.

Series

A Preferred Stock

On

August 10, 2022, the Company designated 10 shares of its preferred stock as Series A Preferred Stock (“Series A”). Each share

of Series A entitles the holder to ten million (10,000,000) votes on all matters submitted to a vote of the stockholders of the Corporation.

When and as any dividend or distribution is declared or paid by the Company on the common stock, the Series A holders are entitled to

participate in such dividend or distribution. Each Series A share is convertible, at the option of the holder, into one share of fully

paid and non-assessable common stock. Upon any liquidation, dissolution, or winding-up of the Company, the Series A holders are entitled

to receive out the assets of the Company, for each share of Series A, an amount equal to par value before any distribution or payment

shall be made to the holder of any junior securities (including common stock and all other equity or equity equivalent securities of

the Company).

The

preferred stock was issued on August 16, 2022, as follows: Bradley White (former Chief Executive Officer), 3 shares; Dr. Clayton Yates

(Chief Scientific Officer and Chairman), 3 shares; and Dr. Jesse Jaynes (Chief Research Officer and Director), 3 shares. See Note 7.

On

September 28, 2023, as part of the Settlement Agreement with Bradley White (see Notes 6 and 7), Mr. White returned to the Company for

cancellation of 3 shares of Series A preferred stock.

As

of March 31, 2024, and September 30, 2023, there were 6 and 9 shares of Series A preferred stock issued and outstanding, respectively.

Series

B Preferred Stock

On

October 19, 2022, the Company filed a Certificate of Designation with the State of Nevada to designate its Series B Preferred Stock (“Series

B”). The designation authorized 2,500,000 shares of Series B. Each share of Series B shall have 10 votes on all matters submitted

to a vote of the stockholders of the Company. Each share of Series B is convertible into 10 shares of common stock of the Company. See

Note 10.

On

October 19, 2022, the following shareholders converted shares of common stock of the Company into shares of Series B to modify the common

shares outstanding to reduce the outstanding common stock issued by the Company, as follows:

SCHEDULE OF CONVERTED SHARES OF COMMON STOCK

| Name | |

Common

Shares Exchanged | | |

Series

B Issued | |

| Jaynes

Investment LLC (a) | |

| 2,000,000 | | |

| 200,000 | |

| ACT

Holdings LLC (a) | |

| 7,312,612 | | |

| 731,262 | |

| LASB

Family Trust (a) | |

| 3,800,112 | | |

| 380,012 | |

| Jesse

Michael Jaynes (a) | |

| 4,767,611 | | |

| 476,762 | |

| Bradley

White (a) | |

| 1,225,000 | | |

| 122,500 | |

| PJ

Advisory Group | |

| 1,500,000 | | |

| 150,000 | |

| Total | |

| 20,605,334 | | |

| 2,060,536 | |

The

conversion of the common stock into Series B was valued at par, respectively, offset to additional paid-in capital. Series B is convertible

into common stock into the original amount of common stock converted therefore there is no change in the amount of common stock outstanding

on a fully diluted basis.

On

September 28, 2023, as part of the Settlement Agreement with Bradley White (see Notes 6 and 7), Mr. White returned to the Company for

cancellation of 502,512 shares of Series B preferred stock.

As

of March 31, 2024, and September 30, 2023, there were 1,558,024 and 1,558,024 shares of Series B preferred stock issued and outstanding,

respectively.

Common

Stock

The

authorized common stock of the Company consists of 300,000,000 shares with a $0.001 par value. All common stock shares are non-assessable

and have one vote per share.

On

April 21, 2022, the Company issued 569 shares of common stock to an individual under a transfer and exchange agreement for a note receivable

held in NBFL (see Note 3). At the transfer date, the latest sale of common stock was at $0.50, accordingly the shares were valued at

$285, and the note was written off since NBFL has since dissolved.

In

connection with the Merger (see Notes 1 and 8), the founding shareholders of the Company cancelled 18,144,112 shares of common stock,

retaining 5%, or 1,855,888 shares of common stock, as of June 30, 2022. The cancellation is presented in the accompanying statements

of changes in stockholders’ deficit within the line item “Retroactive application of recapitalization.”

During

July 2022, the Company entered into a transfer and exchange agreement with an individual to issue 99,600 shares of common stock for the

note receivable held in NBFL. Since NBFL had minimal assets and was dissolved during the year ended December 31, 2019, the note receivable

was immediately written-off. Based on the latest SPA price per share, the stock was valued at $1.00 per share, or $99,600.

On

September 8, 2022, the Company issued 100,000 shares of common stock to a prior Nexion contractor. This was regarding a claim against

the predecessor management and the Company opted as a settlement to issue the common stock.

Shares

Issued for Services

On

January 1, 2024, the Company issued 3,750 shares of common stock for services valued at $3,750.

On

January 16, 2024, the Company issued 25,000 shares of common stock valued at $25,000 to Good Works Funding, LLC, an entity controlled

by Judith Miller, the CBO and a director of the Company, for services as defined in her employment agreement.

On

January 17, 2024, the Company issued 50,000 shares of common stock valued at $50,000 to Chad Pawlak, the CEO of the Company, for services

as defined in his employment agreement.

On

January 17, 2024, the Company issued 25,000 shares of common stock for services valued at $25,000.

On

February 2, 2024, the Company issued 1,250 shares of common stock for services valued at $1,250.

On

February 5, 2024, the Company issued 6,250 shares of common stock for services valued at $6,250.

On

February 16, 2024, the Company issued 25,000 shares of common stock valued at $25,000 to Good Works Funding, LLC, an entity controlled

by Judith Miller, the CBO and a director of the Company, for services as defined in her employment agreement.

On

February 17, 2024, the Company issued 25,000 shares of common stock valued at $25,000 to Chad Pawlak, the CEO of the Company, for services

as defined in his employment agreement.

On

March 2, 2024, the Company issued 1,429 shares of common stock for services valued at $1,429.

On

March 5, 2024, the Company issued 13,393 shares of common stock for services valued at $13,393.

On

March 11, 2024, the Company issued 25,000 shares of common stock for services valued at $25,000.

On

March 16, 2024, the Company issued 25,000 shares of common stock valued at $25,000 to Good Works Funding, LLC, an entity controlled by

Judith Miller, the CBO and a director of the Company, for services as defined in her employment agreement.

On

March 17, 2024, the Company issued 25,000 shares of common stock valued at $25,000 to Chad Pawlak, the CEO of the Company, for services

as defined in his employment agreement.

Stock

Issued for Cash

On

November 17, 2022, the Company issued 300,000 shares of common stock to an investor for $150,000.

On

May 3, 2023, the Company issued 100,000 shares of common stock to an investor for $50,000.

On

May 12, 2023, the Company issued 15,000 shares of common stock to an investor for $15,000.

On

May 29, 2023, the Company issued 10,000 shares of common stock to an investor for $10,000.

On

July 12, 2023, the Company issued 20,000 shares of common stock to an investor for $10,000.

On

July 13, 2023, the Company issued 20,000 shares of common stock to an investor for $10,000.

On

July 14, 2023, the Company issued 50,000 shares of common stock to an investor for $25,000.

On

July 17, 2023, the Company issued 25,000 shares of common stock to an investor for $10,000.

On

August 25, 2023, the Company issued 50,000 shares of common stock to an investor for $25,000.

On

September 16, 2023, the Company issued 75,000 shares of common stock for the settlement of a debt and accrued interest for $25,000.

On

September 19, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 1, 2023, the Company issued 50,000 shares of common stock to an investor for $50,000.

On

November 1, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 1, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 6, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 8, 2023, the Company issued 25,000 shares of common stock to an investor for $25,000.

On

November 8, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 8, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 8, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 10, 2023, the Company issued 25,600 shares of common stock to an investor for $25,600.

On

November 13, 2023, the Company issued 20,000 shares of common stock to an investor for $20,000.

On

November 14, 2023, the Company issued 25,000 shares of common stock to an investor for $25,000.

On

December 8, 2023, the Company issued 50,000 shares of common stock to an investor for $50,000.

On

December 11, 2023, the Company issued 10,000 shares of common stock to an investor for $10,000.

On

December 13, 2023, the Company issued 100,000 shares of common stock to an investor for $100,000.

On

December 14, 2023, the Company issued 50,000 shares of common stock to an investor for $50,000.

On

December 20, 2023, the Company issued 53,000 shares of common stock to an investor for $53,000.

On

December 26, 2023, the Company issued 50,000 shares of common stock to an investor for $50,000.

On

January 8, 2024, the Company issued 8,000 shares of common stock to an investor for $8,000.

On

January 16, 2024, the Company issued 115,000 shares of common stock to an investor for $115,000.

On

February 29, 2024, the Company issued 50,000 shares of common stock to an investor for $50,000.

On

March 14, 2024, the Company issued 50,000 shares of common stock to an investor for $50,000,

On

March 26, 2024, the Company issued 25,000 shares of common stock to an investor for $25,000.

Other

Stock Issuances

On

June 14, 2023, the Company issued 25,000 shares of common stock related to the conversion of a note payable for $12,500.

On

July 1, 2023, the Company issued 29,665 shares of common stock related to the conversion of a note payable and accrued interest for $14,833.

On

October 16, 2023, the Company issued 50,000 shares of common stock related to a sale of common stock in the prior year for $12,500.

On

October 19, 2023, the Company issued 60,000 shares of common stock, which were a double issuance.

On

December 15, 2023, the Company issued 40,000 shares of common stock related to the conversion of a note payable for $32,500.

On

March 9, 2024, the Company issued 210,000 shares of common stock related to the conversion of a note payable for $200,000 and accrued

interest of $10,000.

Stock

Cancellation

On

January 16, 2024, a shareholder agreed to return 450,000 shares of common stock that they received incorrectly in a prior year.

Stock

Options and Warrants

During

the year ended September 30, 2023, the Company issued 2,362,900 warrants for common stock of the Company. The issuance was for the following:

| |

● |

Services

- 162,900 warrants for common stock with an exercise price of $0.001, valued at $142,900 |

| |

● |

Services

by related party – 600,000 warrants for common stock with an exercise price of $0.001, valued at $600,000 |

| |

● |

Settlement

of debt – 200,000 warrants for common stock with an exercise price of $0.001, valued at $200,000 |

| |

● |

Conversion

of notes payable and accrued interest – 1,400,000 warrants for common stock with an exercise price of $0.001, valued at $359,414 |

During

the six months ended March 31, 2024, the Company issued 1,292,800 warrants for common stock of the Company. The issuance was for the

following:

| |

● |

Services

– 392,800 warrants for common stock with an exercise price of $0.001, valued at $392,800 |

| |

● |

Services

by a related party – 600,000 warrants for common stock with an exercise price of $0.001, valued at $600,000 |

| |

● |

Conversion

of notes payable – 300,000 warrants for common stock with an exercise price of $0.001, valued at $343,718 (see Note 3) |

NOTE

5 – FEDERAL INCOME TAX

No

provision for federal, state or foreign income taxes has been recorded for the six months ended March 31, 2024, and 2023. The Company

has incurred net operating losses for all of the periods presented and has not reflected any benefit of such net operating loss carryforwards

in the accompanying condensed financial statements due to uncertainty around utilizing these tax attributes within their respective carryforward

periods. The Company has recorded a full valuation allowance against all of its deferred tax assets as it is not more likely than not

that such assets will be realized in the near future. The Company’s policy is to recognize interest expense and penalties related

to income tax matters as income tax expense. For the six months ended March 31, 2024, and 2023, the Company has not recognized any interest

or penalties related to income taxes.

NOTE

6 – COMMITMENTS AND CONTINGENCIES

From

time to time, the Company may be involved in litigation in the ordinary course of business. The Company is not currently involved in

any litigation that we believe could have a material adverse effect on its financial condition or results of operations except as noted.

The

Company is currently disputing amounts claimed to be owed to two noteholders, Brent Lilienthal, and Mel Wentz, under state usury laws

(see Note 3).

On

February 7, 2024, the Company filed suit against Justin Kimbrough and Prosperity Consultants, LLC, in the 14th Judicial District Court

for Dallas County, Texas (case no. DC-24-02022), alleging fraud, conversion, unjust enrichment and other causes of action arising from

the defendants’ improper receipt of shares of Company common stock under agreements which required the defendants to provide services

to the Company and which services the defendants ultimately never provided. The Company is seeking monetary damages and for a constructive

trust to be imposed on defendants’ shares of Company common stock and for them to be returned to the Company.

On

April 12, 2024, the Company filed suit against Richard Saied, in the 192nd Judicial District Court for Dallas County, Texas (case no.

DC-24-05442), alleging fraud, conversion, unjust enrichment and other causes of action arising from the defendant’s improper receipt

of shares of Company common stock under an agreement which required the defendant to provide services to the Company and which services

the defendant ultimately never provided. The Company is seeking monetary damages and for a constructive trust to be imposed on defendant’s

shares of Company common stock and for them to be returned to the Company.

Subscription

Agreement and Cash Held in Escrow

On

February 20, 2019, the Company entered into a subscription escrow agreement (the “Trust Agreement”) with Branch Banking

and Trust Company (“BB&T”). This Trust Agreement was established for the subscription agreement proceeds raised and

escrowed pursuant to the Company’s prior Rule 419 S-1 offering. The balance held in trust at March 31, 2024 and September 30,

2023 totaled $19,705.

Consulting

Agreements

On

October 5, 2023, the Company entered into an Interim CEO & Executive Consultant Agreement (the “Executive Consulting Agreement”)

with Judith S. Miller, pursuant to which Judith S. Miller would serve as the Company’s Interim CEO, and with the Executive Consulting

Agreement intended to be considered effective as of June 20, 2023, the date of Ms. Miller’s original appointment as Interim CEO

of the Company. Under the Executive Consulting Agreement, which can be terminated at any time with or without cause by the Company and

upon 30 days’ advance written notice by Ms. Miller, Ms. Miller will act as the Interim CEO of the Company and, among other management

duties, assist the Company in recruiting a full-time CEO and/or agricultural biotechnology management professional. Following the appointment

of a full-time CEO, Ms. Miller will be retained as an executive consultant for a period of 6 months thereafter. For the six months ended

March 31, 2024, Ms. Miller earned $120,000.

Research

and Development Agreement

During

September 2020, the Company assumed a Cooperative Research and Development Agreement (“CRADA”) with the United States Department