Wealth Minerals Ltd. (the “Company” or “Wealth”) - (TSXV: WML;

OTCQX: WMLLF; SSE: WMLCL; Frankfurt: EJZN), announces they have

closed the non-brokered private placement previously announced on

December 3, 2019 (the “Placement”). On January 22, 2020, a

total of 7,158,040 units (each, a “Unit”) were issued under the

Placement at a price of $0.20 per Unit for gross proceeds of

$1,431,608. Each Unit consists of one common share in the

capital of the Company (each, a “Share”) and one-half of one common

share purchase warrant (a “Warrant”). Each whole Warrant entitles

the holder to acquire one additional share of the Company at a

price of $0.35 per Share for a period of two years, expiring on

January 22, 2022.

All securities issued by the Company pursuant to

the Placement will have a four month and one day hold period in

Canada ending on May 23, 2020.

In connection with the Placement, insider

participation included Hendrik van Alphen, CEO and Director as to

$50,000 and, David Lies, Director as to $300,000. Also in

connection with the Placement, the Company paid aggregate finder’s

fees of $37,520 cash and 187,600 Broker Warrants. Finder’s

fees were paid to Canaccord Genuity Corp. (as to $17,794 cash and

88,970 Broker Warrants), Haywood Securities Inc. (as to $12,726

cash and 63,630 Broker Warrants), PI Financial Corp. (as to $1,400

cash and 7,000 Broker Warrants) and David Smith (as to $5,600 cash

and 28,000 Finder Warrants). All Warrants issued as finder’s

fees have the same terms and conditions as the Units issued under

the Placement, provided that the Warrants forming part of the Units

issued as finder’s fees are non‑transferable.

The net proceeds from the Offering are intended

to be used to fund exploration and development of Wealth’s Atacama

Project as well as general corporate purposes.

None of the foregoing securities have been and

will not be registered under the United States Securities Act of

1933, as amended (the “1933 Act”) or any applicable state

securities laws and may not be offered or sold in the United States

or to, or for the account or benefit of, U.S. persons (as defined

in Regulation S under the 1933 Act) or persons in the United States

absent registration or an applicable exemption from such

registration requirements. This news release does not

constitute an offer to sell or the solicitation of an offer to buy

nor will there be any sale of the foregoing securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Wealth Minerals Ltd.

Wealth is a mineral resource company with

interests in Canada, Mexico, Peru and Chile. The Company’s main

focus is the acquisition and development of lithium projects in

South America.

The Company opportunistically advances battery

metal projects, namely copper and nickel, where it has a peer

advantage in project selection and initial evaluation.

Lithium market dynamics and a rapidly increasing

metal price are the result of profound structural issues with the

industry meeting anticipated future demand. Wealth is positioning

itself to be a major beneficiary of this future mismatch of supply

and demand. In parallel with lithium market dynamics, Wealth

believes other battery metals will benefit from similar industry

trends.

For further details on the Company readers are

referred to the Company’s website (www.wealthminerals.com) and its

Canadian regulatory filings on SEDAR at www.sedar.com.

On Behalf of the Board of Directors

ofWEALTH MINERALS LTD.

“Hendrik van Alphen”Hendrik van AlphenChief

Executive Officer

For further information, please contact:Marla

Ritchie, Henk van Alphen or Tim McCutcheon

Phone: 604-331-0096 Ext. 3886 or

604-638-3886E-mail: info@wealthminerals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities legislation, including the United

States Private Securities Litigation Reform Act of 1995. All

statements, other than statements of historical fact, included

herein including, without limitation, anticipated exploration

program results from exploration activities, the Company’s

expectation that it will be able to enter into agreements to

acquire interests in additional mineral properties, the discovery

and delineation of mineral deposits/resources/reserves, the closing

and amount of the Placement, and the anticipated business

plans and timing of future activities of the Company, are

forward-looking statements. Although the Company believes that such

statements are reasonable, it can give no assurance that such

expectations will prove to be correct. Forward-looking statements

are typically identified by words such as: “believe”, “expect”,

“anticipate”, “intend”, “estimate”, “postulate” and similar

expressions, or are those, which, by their nature, refer to future

events. The Company cautions investors that any forward-looking

statements by the Company are not guarantees of future results or

performance, and that actual results may differ materially from

those in forward-looking statements as a result of various factors,

including, operating and technical difficulties in connection with

mineral exploration and development activities, actual results of

exploration activities, the estimation or realization of mineral

reserves and mineral resources, the timing and amount of estimated

future production, the costs of production, capital expenditures,

the costs and timing of the development of new deposits,

requirements for additional capital, future prices of lithium,

changes in general economic conditions, changes in the financial

markets and in the demand and market price for commodities, lack of

investor interest in the Placement, accidents, labour disputes and

other risks of the mining industry, delays in obtaining

governmental approvals, permits or financing or in the completion

of development or construction activities, changes in laws,

regulations and policies affecting mining operations, title

disputes, the inability of the Company to obtain any necessary

permits, consents, approvals or authorizations, including

acceptance by the TSX-V, required for the Placement, the timing and

possible outcome of any pending litigation, environmental issues

and liabilities, and risks related to joint venture operations, and

other risks and uncertainties disclosed in the Company’s latest

interim Management Discussion and Analysis and filed with certain

securities commissions in Canada. All of the Company’s Canadian

public disclosure filings may be accessed via www.sedar.com and

readers are urged to review these materials, including the

technical reports filed with respect to the Company’s mineral

properties.

Readers are cautioned not to place undue

reliance on forward-looking statements. The Company undertakes no

obligation to update any of the forward-looking statements in this

news release or incorporated by reference herein, except as

otherwise required by law.

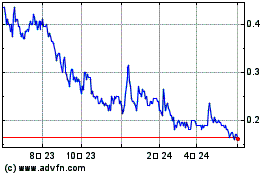

Wealth Minerals (TSXV:WML)

過去 株価チャート

から 11 2024 まで 12 2024

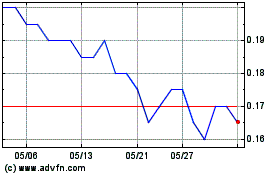

Wealth Minerals (TSXV:WML)

過去 株価チャート

から 12 2023 まで 12 2024