Form 424B2 - Prospectus [Rule 424(b)(2)]

2024年9月5日 - 4:36AM

Edgar (US Regulatory)

|

|

|

|

|

Prudential Financial InterNotes® , Due Six Months or

More from Date of Issue Filed under Rule 424(b)(2), Registration Statement

No. 333-277590 Final Pricing Supplement No. 3 - Dated Tuesday,

September 3, 2024. To Prospectus Dated March 1, 2024 and Prospectus Supplement dated August 5, 2024

Investors should read this pricing supplement in conjunction with the Prospectus and Prospectus Supplement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP

Number |

|

Aggregate

Principal Amount |

|

Selling

Price |

|

Gross

Concession |

|

Net

Proceeds |

|

Interest

Type |

|

Interest

Rate |

|

Payment

Frequency |

|

Maturity

Date |

|

1st Interest

Payment

Date |

|

1st Interest

Payment

Amount |

|

Survivor’s

Option* |

|

Product

Ranking |

| 74432BAE8 |

|

$4,487,000.00 |

|

100.000% |

|

1.250% |

|

$4,430,912.50 |

|

Fixed |

|

4.050% |

|

Semi-Annual |

|

09/15/2029 |

|

03/15/2025 |

|

$21.26 |

|

Yes |

|

Senior Unsecured Notes |

|

We will pay you interest on the notes on a Semi-Annual basis on Mar 15th and Sep 15th. The first such payment will be

made on Mar 15, 2025. The interest rate per annum and stated maturity date are set out above. The regular record dates for your notes are each business day preceding each date on which interest is paid.

Any notes sold by the selling agents to

securities dealers, or by securities dealers to certain other brokers or dealers, may be sold at a discount from the initial selling price up to 0.6000% of the principal amount.

Redemption Information: Non-Callable

Purchasing Agent: InspereX LLC Agents: BofA Securities, Citigroup, Morgan Stanley, RBC Capital Markets, Wells Fargo

Advisors |

|

|

|

| Offering Date: Monday, August 26, 2024 through Tuesday, September 3, 2024 |

|

Prudential Financial, Inc. |

| Trade Date: Tuesday, September 3, 2024 @ 12:00 PM ET |

|

Prudential Financial Internotes® |

| Settle Date: Friday, September 6, 2024 |

|

Prospectus Dated March 1, 2024 and |

| Minimum Denomination/Increments: $1,000.00/$1,000.00 |

|

Prospectus Supplement Dated August 5, 2024 |

| Initial trades settle flat and clear SDFS: DTC Book-Entry only |

|

|

| DTC Number 0235 via RBC Dain Rauscher Inc. |

|

|

If the maturity date, redemption date or an interest payment date for any note is not a business

day (as that term is defined in the prospectus), principal, premium, if any, and interest for that note is paid on the next business day, and no interest will accrue from, and after, the maturity date, redemption date or interest payment date

(following unadjusted business day convention).

| * |

The survivor’s option feature of your note is subject to important limitations, restrictions and procedural

requirements further described on page S-52 of your prospectus supplement. |

|

The Bank of New York will act as trustee for the Notes. Citibank, N.A., will act as

paying agent, registrar and transfer agent for the Notes and will administer any survivor’s options with respect thereto.

In the opinion of John M. Cafiero, as counsel to Prudential Financial, Inc. (the Company), when the notes offered by this pricing

supplement have been executed and issued by the Company and authenticated by the trustee pursuant to the indenture, and delivered against payment as contemplated herein, such notes will be valid and binding obligations of the Company, subject to

bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability related to affecting creditors’ rights and to general equity principles. This opinion is given as of the date hereof and is

limited to the laws of New Jersey and New York. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the genuineness of signatures and to such

counsel’s reliance on officers of the Compan and other sources as to certain factual matters, all as stated in the opinion of John M. Cafiero, dated August 5, 2024, filed in the Company’s Current Report on Form 8-K dated August 5, 2024 and

incorporated by reference as Exhibit 5.2 to the Company’s registration statement on Form 3-ASR (File No. 333-277590).

InterNotes® is a registered trademark of InspereX Holdings LLC. All Rights Reserved.

0001137774424B2EX-FILING FEES333-277590falseSenior Unsecured Notes10.00014760 0001137774 2024-09-04 2024-09-04 0001137774 1 2024-09-04 2024-09-04 iso4217:USD xbrli:pure xbrli:shares

Calculation of Filing Fee Tables

(Form Type)

Prudential Financial, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Security

Type |

|

Security

Class Title |

|

Fee

Calculation or

Carry

Forward Rule |

|

Amount

Registered |

|

Proposed

Maximum

Offering Price

Per Unit |

|

Maximum

Aggregate

Offering

Price |

|

Fee Rate |

|

Amount of

Registration

Fee |

|

Carry

Forward

Form Type |

|

Carry

Forward

File

Number |

|

Carry

Forward

Initial

effective

date |

|

Filing Fee

Previously

Paid In

Connection

with Unsold

Securities to

be Carried

Forward |

| Newly Registered Securities |

Paid |

|

Debt |

|

Senior

Unsecured Notes |

|

457(r) |

|

$ 4,487,000 |

|

100.00 % |

|

$ 4,487,000 |

|

$ 147.60 per $1 million |

|

$662.28 |

|

|

|

|

|

|

|

|

Fees Previously Paid |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

| Carry Forward Securities |

Carry Forward Securities |

|

— |

|

— |

|

— |

|

— |

|

|

|

— |

|

|

|

|

|

— |

|

— |

|

— |

|

— |

|

|

Total Offering Amounts |

|

|

|

|

|

$4,487,000 |

|

|

|

$662.28 |

|

|

|

|

|

|

|

|

|

|

Total Fees Previously Paid |

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Net Fee Due |

|

|

|

|

|

|

|

|

|

$662.28 |

|

|

|

|

|

|

|

|

The prospectus supplement to which this exhibit is attached is a final prospectus for the related offering. The maximum amount of that offering is $4,487,000.

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 457

-Subsection r

| Name: |

ffd_Rule457rFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlPrevslyPdAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

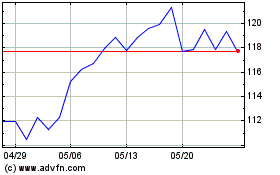

Prudential Financial (NYSE:PRU)

過去 株価チャート

から 8 2024 まで 9 2024

Prudential Financial (NYSE:PRU)

過去 株価チャート

から 9 2023 まで 9 2024