Kosmos Energy Ltd. (the "Offeror", “Kosmos”, or the “Company”)

(NYSE/LSE:KOS) announces the launch of its offers to purchase for

cash (each a “Tender Offer” and, collectively, the “Tender Offers”)

up to (i) $400,000,000 aggregate principal amount (“2026 Notes

Cap”) of the Offeror’s outstanding 7.125% Senior Notes due 2026

(the “2026 Notes”) and (ii) up to $100,000,000 aggregate principal

amount (the “2027/2028 Notes Cap”) of the Offeror’s outstanding

7.750% Senior Notes due 2027 (the “2027 Notes”) and its 7.500%

Senior Notes due 2028 (the “2028 Notes” and, together with the 2026

Notes and 2027 Notes, the “Notes”), subject, in the case of the

2027 Notes, to the 2027 Notes Sub-Cap as further detailed below.

The Offeror reserves the right to modify the 2026 Notes Cap, the

2027/2028 Notes Cap and/or the 2027 Notes Sub-Cap in its sole

discretion.

The Tender Offers are made upon the terms and subject to the

conditions set forth in the offer to purchase dated September 9,

2024 (the “Offer to Purchase”) which is available on the

transaction website (the “Transaction Website”):

https://projects.sodali.com/kosmos, subject to eligibility

confirmation and registration.

The Tender Offers will expire at 5:00 p.m., New York City time,

on October 7, 2024, unless extended or earlier terminated (such

time and date, as the same may be extended, the "Expiration Time").

Holders who tender their Notes may withdraw such Notes at any time

prior to 5:00 p.m., New York City time, on September 20, 2024 (such

time and date, as the same may be extended).

Overview of the Tender Offers

To receive the Total Consideration (as defined below), which

includes an early tender payment of $50.00 per each $1,000

principal amount of the relevant Notes accepted for purchase

pursuant to the Tender Offers (the "Early Tender Payment''),

holders must validly tender and not validly withdraw their Notes

prior to 5:00 p.m., New York City time, on September 20, 2024,

unless extended (such time, as the same may be extended, the "Early

Tender Time"). Holders who validly tender their Notes after the

Early Tender Time but at or prior to the Expiration Time will be

eligible to receive only the Tender Offer Consideration, which is

an amount equal to the Total Consideration (as defined below) minus

the Early Tender Payment.

The following table sets forth certain terms of the Tender

Offers:

Title of Notes

CUSIP/ISIN

Outstanding Principal

Amount

2026 Notes Cap

2026 Notes Priority of

Acceptance

Tender Offer Consideration

(1)(4)

Early Tender

Payment(2)

Total Consideration

(2)(3)(4)

7.125% Senior Notes due 2026

issued by Kosmos Energy Ltd. (the “2026 Notes”)

Rule 144A:

500688AC0 / US500688AC04

Regulation S: U5007TAA3 /

USU5007TAA35

$650,000,000

$400,000,000 aggregate principal

amount, subject to increase in the Offeror’s sole discretion

Tenders specifying a valid 2026

Notes Acceptance Code shall be eligible to receive priority of

acceptance in the Tender Offer (over those without), as detailed

below.

$950.00

$50.00

$1,000.00

Title of Notes

CUSIP/ISIN

Outstanding Principal

Amount

2027/2028

Notes Cap

Acceptance Priority

Level

Tender Offer Consideration

(1)(4)

Early Tender

Payment(2)

Total Consideration

(2)(3)(4)

2027 Notes Sub-Cap

7.750% Senior Notes due 2027

issued by Kosmos Energy Ltd. (the “2027 Notes”)

Rule 144A:

500688AF3 / US500688AF35

Regulation S:

U5007TAD7 / USU5007TAD73

$400,000,000

$100,000,000 aggregate principal

amount, subject to increase in the Offeror’s sole discretion

1

$947.50

$50.00

$997.50

$50,000,000, subject to increase

in the Offeror’s sole discretion

7.500% Senior Notes due 2028

issued by Kosmos Energy Ltd. (the “2028 Notes”)

Rule 144A:

500688AD8 / US500688AD86

Regulation S:

U5007TAB1 / USU5007TAB18

$450,000,000

2

$932.50

$50.00

$982.50

N/A

(1)

Per $1,000 principal amount of Notes

validly tendered after the Early Tender Time but on or prior to the

Expiration Time and accepted for purchase.

(2)

Per $1,000 principal amount of Notes

validly tendered on or prior to the Early Tender Time and accepted

for purchase.

(3)

The Total Consideration already includes

the Early Tender Payment. The Total Consideration in respect of the

2026 Notes is equal to the current optional redemption price

applying to the 2026 Notes.

(4)

Excludes Accrued Interest, which will also

be paid.

In addition to the Tender Offer Consideration or the Total

Consideration, as applicable, all Holders of Notes accepted for

purchase will also receive accrued and unpaid interest on such

Notes, rounded to the nearest $0.01 per $1,000 principal amount of

Notes, from and including the last interest payment date up to, but

not including, the Early Settlement Date or the Final Settlement

Date (each as defined below), as applicable.

New Notes and Allocation of the New Notes

Concurrently with this announcement of the Tender Offers, the

Offeror announced its intention to commence an offering (the “New

Notes Offering”) of new notes (the “New Notes”). Subject to the

successful closing of the New Notes Offering, the Offeror intends

to use the net proceeds from the New Notes Offering plus cash on

hand to fund the Tender Offers and associated fees and expenses.

The Tender Offers are conditioned upon, among other things, the

successful completion (in the sole determination of the Offeror) of

one or more debt financing transactions, such as the New Notes

Offering, raising aggregate amount of gross proceeds of an amount

at least equal to $500.0 million (the “Financing Condition”). The

New Notes and the guarantees in respect thereof have not been and

will not be registered under the United States Securities Act of

1933, as amended (the "Securities Act").

The Offeror is making the Tender Offers, in combination with the

New Notes Offering, as a way of managing the maturity profile of

its outstanding indebtedness.

A Holder that has validly tendered, or indicated its firm

intention to tender, its Notes in the Tender Offers prior to the

Early Tender Deadline and wishes to subscribe for New Notes in

addition to tendering Notes in the Tender Offers may, after having

made a separate application for the purchase of such New Notes to

the Dealer Manager (in its capacity as a joint bookrunner of the

issue of the New Notes), at the sole and absolute discretion of the

Offeror, receive priority in the allocation of the New Notes,

subject to the issue of the New Notes. When considering allocation

of the New Notes, the Offeror intends, but is not obligated, to

give preference to those Holders who, prior to such allocation,

have tendered, or indicated to the Offeror or any the Dealer

Manager their firm intention to tender, their Notes and subscribe

for New Notes. Holders should refer to the Offer to Purchase for

further details.

2026 Notes Priority of Acceptance in the Tender Offer

Holders of the 2026 Notes who wish to subscribe for and who are

allocated the New Notes in addition to tendering their 2026 Notes

for purchase pursuant to the Tender Offers can additionally receive

“2026 Notes Priority of Acceptance” (over those who do not

subscribe for New Notes) through the use of an acceptance code (a

“2026 Notes Acceptance Code”) for the acceptance of their 2026

Notes in the Tender Offer with respect to the 2026 Notes, subject

to satisfaction of the Financing Condition and completion of such

Tender Offer. Such 2026 Notes Priority of Acceptance may be given,

at the Offeror’s sole discretion, for an aggregate principal amount

of 2026 Notes of up to the aggregate principal amount of New Notes

allocated to the relevant Holder in the primary distribution of the

New Notes. A Holder of 2026 Notes can obtain such a 2026 Notes

Acceptance Code by contacting Merrill Lynch International at the

contact details included in the Offer to Purchase. The receipt of a

2026 Notes Acceptance Code in conjunction with the issue of the New

Notes does not constitute a tender of 2026 Notes for purchase

pursuant to the Tender Offers. Moreover, if the aggregate principal

amount of 2026 Notes validly tendered as of the Early Tender Time

exceeds the 2026 Notes Cap, not all validly tendered 2026 Notes

will be accepted for purchase (though 2026 Notes with 2026 Notes

Priority of Acceptance shall in all cases be accepted with

priority). As a result, the aggregate principal amount of New Notes

allocated to a Holder of 2026 Notes in the New Notes Offering may

exceed the aggregate principal amount of 2026 Notes accepted for

purchase from such Holder pursuant to the Tender Offer for the 2026

Notes.

No assurances can be given that any Holder of 2026 Notes that

receives a 2026 Notes Acceptance Code will be given Priority of

Acceptance, or be eligible to participate, in the Tender Offer for

the 2026 Notes. Participating in the Tender Offer for the 2026

Notes and requesting a 2026 Notes Acceptance Code are subject to

all applicable securities laws and regulations in force in any

relevant jurisdiction, including those set out under “Offer and

Distribution Restrictions”. In order for a Holder of 2026 Notes to

be eligible to receive 2026 Notes Priority of Acceptance in the

Tender Offer for 2026 Notes, an Acceptance Code must be quoted in

that Holder’s tender instruction (a “Tender and Priority Acceptance

Instruction”). Holders of 2026 Notes who wish to tender 2026 Notes

for purchase pursuant to the Tender Offer for the 2026 Notes but do

not wish to subscribe for New Notes can submit an instruction to

this effect (a “Tender Only Instruction”). Additionally, Holders of

2026 Notes who have received 2026 Notes Priority of Acceptance in

an amount equal to the aggregate principal amount of New Notes

allocated to the relevant Holder in the primary distribution of the

New Notes but wish to tender additional 2026 Notes in the Tender

Offer for the 2026 Notes may submit a separate Tender Only

Instruction in respect of such excess portion. Holders should refer

to the Offer to Purchase for further details.

2026 Notes Post-Closing Redemption

If the aggregate principal amount of 2026 Notes validly tendered

and not validly withdrawn as of the Expiration Time is less than

the 2026 Notes Cap, the Offeror intends, but is not obligated, to

redeem an aggregate principal amount of 2026 Notes at a redemption

price of 100.00% of the principal amount redeemed (plus accrued and

unpaid interest to, but excluding, the date of redemption) pursuant

to the terms of the indenture governing the 2026 Notes soon as

practicable following the Final Settlement Date, such that no more

than $250,000,000 in aggregate principal amount of 2026 Notes (or a

corresponding smaller amount, in the case that the 2026 Notes Cap

is increased) remain outstanding following the Tender Offer for the

2026 Notes and such redemption.

Acceptance and Pro-Ration

2026 Notes may be subject to proration if the aggregate

principal amount of the 2026 Notes validly tendered and not validly

withdrawn as of the Early Tender Time or the Expiration Time, as

applicable, is greater than the 2026 Notes Cap. Further, 2027 Notes

and 2028 Notes may either or both be subject to proration if the

aggregate principal amount of such Notes validly tendered and not

validly withdrawn as of the Early Tender Time or the Expiration

Time, as applicable, is greater than the 2027/2028 Notes Cap and,

with respect to the 2027 Notes, greater than the 2027 Notes

Sub-Cap. In all cases, Notes validly tendered and not validly

withdrawn at or prior to the Early Tender Time will be accepted for

purchase in priority to those thereafter, regardless of any 2026

Notes Priority of Acceptance or the Acceptance Priority Levels

(where applicable).

In respect of the 2026 Notes, as described in the Offer to

Purchase, at the Early Tender Time or the Expiration Time, as

applicable, the Offeror intends to accept for purchase Notes from

investors tendering with 2026 Notes Acceptance Codes that can be

obtained in connection with the allocation of New Notes in priority

to investors tendering without 2026 Notes Acceptance Codes. To the

extent any 2026 Notes are validly tendered with 2026 Notes

Acceptance Codes and accepted for purchase pursuant to the Tender

Offer for the 2026 Notes, the portion of the 2026 Notes Cap

available to accept for the purchase of 2026 Notes validly tendered

without 2026 Notes Acceptance Codes could be reduced significantly

or eliminated altogether.

Additional Details

It is expected that payment for Notes tendered at or prior to

the Early Tender Time and accepted for purchase will be made on

September 24, 2024 (the "Early Settlement Date"), and payment for

Notes tendered after the Early Tender Time but at or prior to the

Expiration Time and accepted for purchase will be made on October

9, 2024 (the "Final Settlement Date").

Subject to applicable law and the terms and conditions of the

Offer to Purchase, the Offeror may terminate the Tender Offers,

waive any or all of the conditions of the Tender Offers prior to

the Early Tender Time or Expiration Time, extend the Early Tender

Time or Expiration Time or amend the terms of the Tender

Offers.

The Offeror has retained Merrill Lynch International to act as

the dealer manager for the Tender Offers and Morrow Sodali Ltd. to

act as information and tender agent for the Tender Offers.

Questions regarding procedures for tendering Notes may be directed

to Sodali & Co at Hong Kong: +852 2319 4130, London: +44 20

4513 6933, Stamford: +1 203 658 9457 or by email to

kosmos@investor.sodali.com. Questions regarding the Tender Offers

may be directed to Merrill Lynch International at +44 20 7996 5420

or by email to DG.LM-EMEA@bofa.com.

The Tender Offers are only being made pursuant to the Offer to

Purchase. Holders of the Notes are urged to carefully read the

Offer to Purchase before making any decision with respect to the

Tender Offers.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders with respect to, the Notes or New Notes,

and this press release does not constitute a notice of redemption

with respect to the 2026 Notes or any other Notes or securities. No

offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful. The Tender Offers are being made solely pursuant to the

Offer to Purchase made available to holders of the Notes. None of

the Company or its affiliates, their respective boards of

directors, the Dealer Manager, the Information and Tender Agent or

the trustees with respect to the Notes is making any recommendation

as to whether or not Holders should tender or refrain from

tendering all or any portion of their Notes in response to the

Tender Offers. Holders are urged to evaluate carefully all

information in the Offer to Purchase, consult their own investment

and tax advisors and make their own decisions whether to tender

Notes in the Tender Offers, and, if so, the principal amount of

Notes to tender.

About Kosmos Energy

Kosmos is a full-cycle, deepwater, independent oil and gas

exploration and production company focused along the offshore

Atlantic Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and the U.S. Gulf of Mexico, as well as

world-class gas projects offshore Mauritania and Senegal. We also

pursue a proven basin exploration program in Equatorial Guinea and

the U.S. Gulf of Mexico. Kosmos is listed on the NYSE and LSE and

is traded under the ticker symbol KOS. Kosmos is engaged in a

single line of business, which is the exploration, development, and

production of oil and natural gas. Substantially all of our

long-lived assets and all of our product sales are related to

operations in four geographic areas: Ghana, Equatorial Guinea,

Mauritania/Senegal and the U.S. Gulf of Mexico.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that Kosmos

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Kosmos’ estimates and

forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words “anticipate,” “believe,” “intend,” “expect,” “plan,” “will,”

“may,” “potential” or other similar words are intended to identify

forward-looking statements. Such statements are subject to a number

of assumptions, risks and uncertainties, many of which are beyond

the control of Kosmos, which may cause actual results to differ

materially from those implied or expressed by the forward-looking

statements. Further information on such assumptions, risks and

uncertainties is available in Kosmos’ Securities and Exchange

Commission filings. Kosmos undertakes no obligation and does not

intend to update or correct these forward-looking statements to

reflect events or circumstances occurring after the date of this

press release, except as required by applicable law. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety by

this cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240908449477/en/

Investor Relations Jamie Buckland +44 (0) 203 954 2831

jbuckland@kosmosenergy.com

or

Media Relations Thomas Golembeski +1-214-445-9674

tgolembeski@kosmosenergy.com

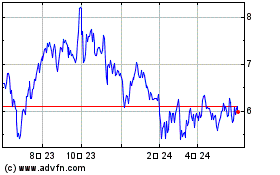

Kosmos Energy (NYSE:KOS)

過去 株価チャート

から 10 2024 まで 11 2024

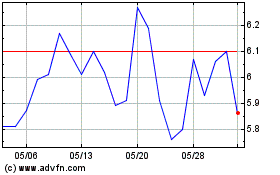

Kosmos Energy (NYSE:KOS)

過去 株価チャート

から 11 2023 まで 11 2024