0001827821FALSE☐☐☐☐00018278212024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 7, 2024

Forge Global Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39794 | 98-1561111 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

4 Embarcadero Center Floor 15 San Francisco, California (Address of principal executive offices) | 94111 (Zip Code) |

(415) 881-1612

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on

which registered |

| Common Stock, $0.0001 par value per share | | FRGE | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On May 7, 2024, Forge Global Holdings, Inc. issued a press release announcing its results for the quarter ended March 31, 2024, as well as supplemental financial information and key business metrics to its website at https://ir.forgeglobal.com. Copies of the press release and supplemental materials are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The information in this Current Report on Form 8-K and the accompanying exhibits shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Forge Global Holdings, Inc. |

| | |

Date: May 7, 2024 | By: | /s/ Kelly Rodriques |

| Name: | Kelly Rodriques |

| Title: | Chief Executive Officer |

Exhibit 99.1

Forge Global Holdings, Inc. Reports First Quarter Fiscal Year 2024 Results

•Total Revenue Less Transaction Based Expenses Was $19.2 million in 1Q24

•Trading Volume Was $262.5 million in 1Q24

•Net Take Rate Was 3.2% in 1Q24

•Forge Trust Custodial Cash Was $481 million in 1Q24

•Launches ForgePro — first major milestone in the Forge Next Generation Platform

SAN FRANCISCO – May 7, 2024 – Forge Global Holdings, Inc. (“Forge,” or the “Company”) (NYSE: FRGE), a leading private securities marketplace, today announced its financial results for the quarter ended March 31, 2024.

"I’m pleased to share that in the first quarter of 2024, Forge delivered our 4th consecutive quarter of revenue improvement as the market continues its recovery,” said Kelly Rodriques, CEO of Forge. “We believe momentum continues to progressively build in the private market after a long cold winter. As we consistently signaled throughout the last two years — we stayed focused on emerging from the downturn as a market leader — a stronger company with a more robust technology and data portfolio.”

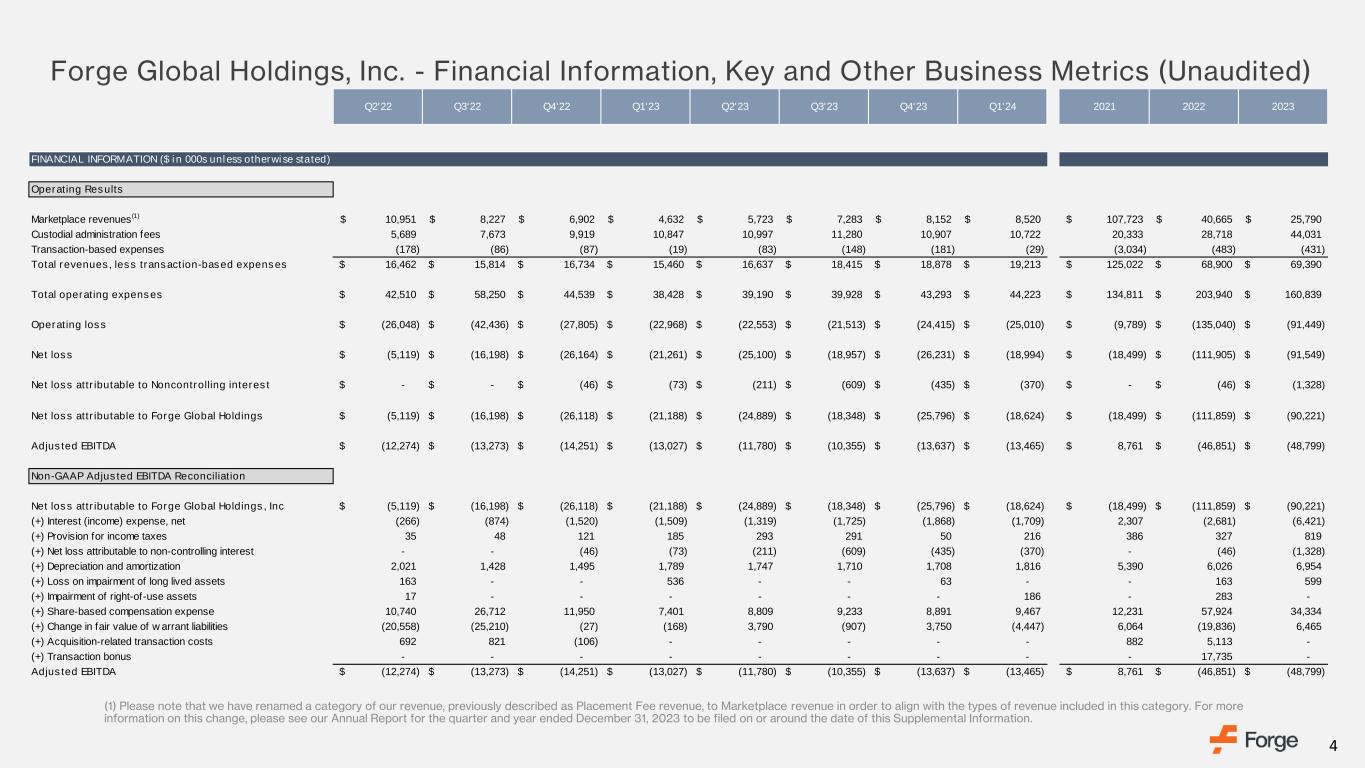

Financial Highlights for the First Quarter 2024

Revenue: Total revenue less transaction-based expenses was $19.2 million compared to $18.9 million in the quarter ended December 31, 2023.

Operating Loss: Total operating loss was $25.0 million compared to total operating loss of $24.4 million in the quarter ended December 31, 2023.

Net Loss: Net loss was $19.0 million compared to net loss of $26.2 million in the quarter ended December 31, 2023.

Adjusted EBITDA: Total adjusted EBITDA was a loss of $13.5 million compared to total adjusted EBITDA loss of $13.6 million in the quarter ended December 31, 2023. Adjusted EBITDA includes non-recurring charges of $2.8 million and $2.5 million in connection with legacy legal matters in the quarters ended March 31, 2024 and December 31, 2023, respectively.

Cash Flow from Operating Activities: Net cash used in operating activities was $12.4 million compared to $6.6 million in the quarter ended December 31, 2023.

Cash Flow from Financing Activities: Net cash used in financing activities was $2.1 million compared to net cash provided by financing activities of $0.3 million in the quarter ended December 31, 2023.

Ending Cash Balance: Cash and cash equivalents as of March 31, 2024 was $129.6 million.

Share Count: Basic weighted-average number of shares used to compute net loss per share attributable to common stockholders for the quarter ended March 31, 2024, was 180 million shares and fully diluted outstanding share count as of March 31, 2024 was 198 million shares.

We estimate for the quarter ended June 30, 2024 that Forge will have 183 million million weighted average basic shares outstanding, which will be used to calculate earnings per share in a loss position.

Fully diluted outstanding share count includes all common shares outstanding plus shares that would be issued in respect to outstanding options and warrants, net of shares to be withheld in respect to exercise price of the respective instruments. Instruments that are out of the money are excluded from the fully diluted outstanding share count.

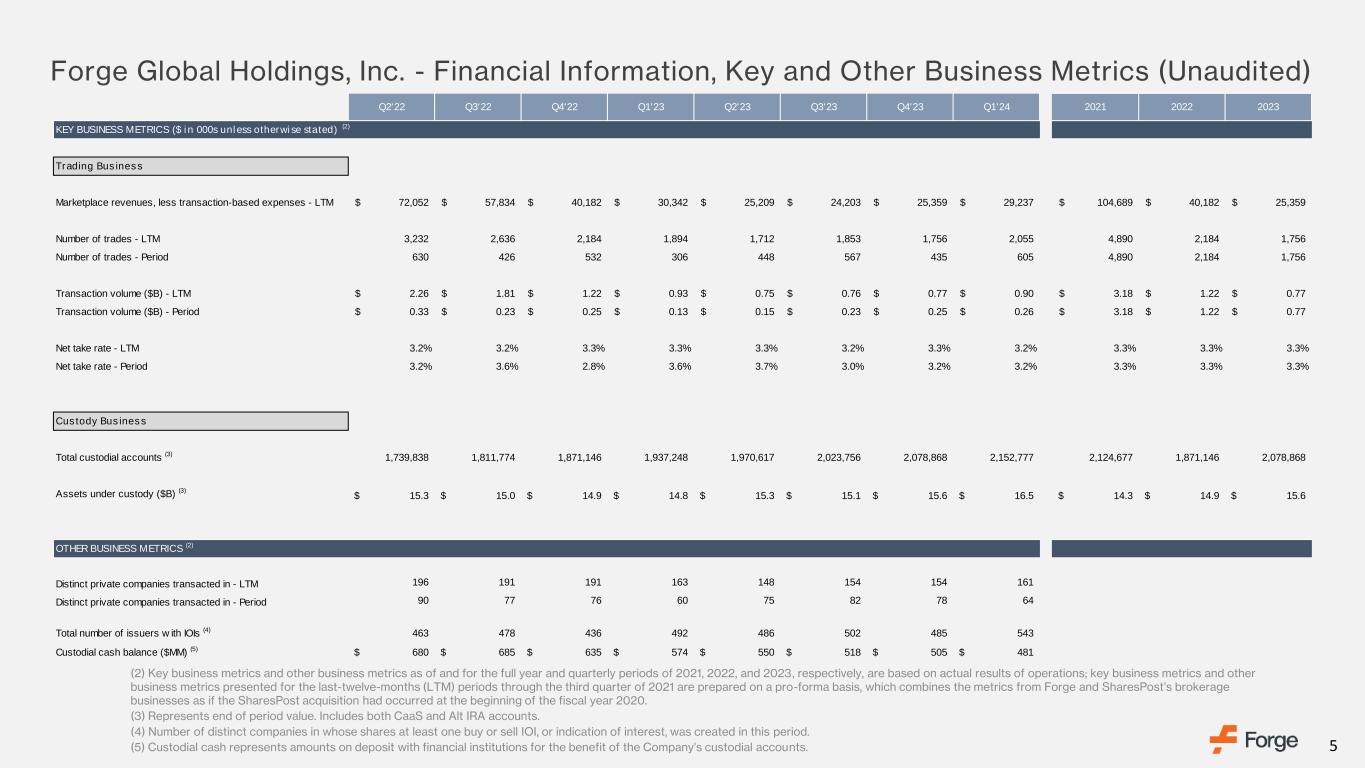

KPIs for the First Quarter 2024

•Trading Volume increased from $250.4 million to $262.5 million, up 5% quarter-over-quarter.

•Net Take Rate was 3.2%, which was flat quarter-over-quarter.

•Total Marketplace revenues, less transaction-based expenses, increased from $8.0 million to $8.5 million, up 7% quarter-over-quarter.

•Total Custodial Administration Fee revenues decreased from $10.9 million to $10.7 million, down 2% quarter-over-quarter.

•Total Custodial Accounts increased from 2.08 million to 2.15 million, up 4% quarter-over-quarter.

•Total Assets Under Custody increased from $15.6 billion to $16.5 billion, up 5% quarter-over-quarter.

Additional Business Metrics for the First Quarter 2024

•Forge Trust Custodial Cash: Forge Trust Custodial Cash totaled $481 million, down 5% quarter-over-quarter from $505 million.

•Total Number of Companies with Indications of Interest (IOIs): The total number of companies with IOIs were 543, up 12% quarter-over-quarter.

•Headcount: Forge finished out the quarter ended March 31, 2024 with a total headcount of 337.

Please refer to the section titled “Use of Non-GAAP Financial Information” and the tables within this press release which contain explanations and reconciliations of the Company’s non-GAAP financial measures.

Business Highlights

•Forge Releases Forge Pro, a Major Milestone Toward an Institutional Trade Order Management System for Private Company Securities: As institutions increasingly shift their focus to private markets, Forge Pro surfaces valuable private market data while providing investors with the data and technology required to manage transactions. The release of the product is the first major release on Forge’s Next Generation Platform, a modular technology platform including:

◦Order creation and share class specification for private company stock

◦Live order book with bid/ask prices, share quantities and market spreads

◦Trade status tracking

◦Roles, restrictions and permissions for specific firm employees

•Forge Global’s Private Market Index to be Tracked by Accuidity Strategy, Offering Diversified Exposure to Late-Stage Companies: The Forge Accuidity Private Market Index – which tracks the performance of late-stage, venture-backed companies - has been adopted by Accuidity within their Megacorn strategy (“Accuidity”). Accuidity is a Boston-based institutional asset manager that is seeking to replicate this newly created Forge index. The Forge Accuidity Private Market Index tracks the performance of 60 venture-backed, late-stage, private growth companies including SpaceX, Anduril, Scale AI, Epic Games, Chime and others. All names are ranked according to a modified capitalization weighting methodology with an annual rebalance frequency.

•Forge To Accelerate Product Vision and Commercial Strategy with Executive Appointment of James Brooks: Mr. Brooks served as Chief Operating Officer at ICE Data Services, where he focused on growing long-term recurring revenue by providing solutions to investors and their intermediaries. Prior to that, he held executive roles at The New York Stock Exchange (NYSE) including Vice President of NYSE Business/Product Development and Head of NYSE Market Data. Mr. Brooks also served as Vice President, Head of Equities for NASDAQ OMX Group, Inc. At both

exchange groups, he played a pivotal role in creating and enhancing products and steering product development and vision to bolster revenue growth.

•Appointment of Capital Markets Veteran Larry Leibowitz to Forge’s Board of Directors: Mr. Leibowitz brings to Forge decades of entrepreneurial and corporate leadership experience in capital markets, financial technology and asset management. He is currently the Chief Executive Officer of Entrypoint Capital, a quantitative investment management firm, and has also held executive and board positions at a myriad of other companies in the financial services and investment sectors, including as the Chief Operating Officer, Head of Global Equities Markets, and Member of the Board of Directors of NYSE Euronext, a global securities exchange operator, from 2007 to 2013. He also served as Chief Operating Officer of Americas Equities at UBS, and was also Co-Chief Executive Officer of Schwab-Soundview Capital Markets in the early 2000s.

Webcast/Conference Call Details

Forge will host a webcast conference call today, May 7th, 2024, at 5:00 p.m. Eastern Time / 2:00 p.m Pacific Time to discuss these financial results and business highlights. The listen-only webcast is available at https://ir.forgeglobal.com. Investors and participants can access the conference call over the phone by dialing 1 (800) 715-9871 from the United States, or +1 (646) 307-1963 internationally. The conference ID is 6194475.

Following the conference call, an on-demand replay of the webcast will be made available on the Investor Relations page of the Company’s website at https://ir.forgeglobal.com.

Use of Non-GAAP Financial Information

In addition to our financial results determined in accordance with generally accepted accounting principles in the United States of America ("GAAP"), we present Adjusted EBITDA, a non-GAAP financial measure. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA, when taken together with the corresponding GAAP financial measure, provides meaningful supplemental information regarding our performance by excluding specific financial items that have less bearing on our core operating performance. We consider Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA as a tool for comparison. A reconciliation is provided below for Adjusted EBITDA to net loss, the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review Adjusted EBITDA and the reconciliation of Adjusted EBITDA to net loss, and not to rely on any single financial measure to evaluate our business.

We define Adjusted EBITDA as net loss attributable to Forge Global Holdings, Inc., adjusted to exclude: (i) interest income, (ii) provision for income taxes, (iii) net loss attributable to noncontrolling interest, (iv) depreciation and amortization, (v) share-based compensation expense, (vi) change in fair value of warrant liabilities, and (vii) other significant gains, losses, and expenses such as impairments or acquisition-related transaction costs that we believe are not indicative of our ongoing results.

Forward-Looking Statements

This press release contains “forward-looking statements,” which generally are accompanied by words such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “goal,” “expect,” “should,” “would,” “plan,” “predict,” “project,” “forecast,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict, indicate or relate to future events or trends or Forge’s future financial or operating performance, or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Forge’s beliefs regarding its financial position and operating performance, as well as future opportunities for Forge to expand its business. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, while considered reasonable by Forge and its management, are subject to risks and uncertainties that may cause actual results to differ materially from current expectations. You should carefully consider the risks and uncertainties described in Forge’s documents filed, or to be filed, with the SEC, including in its Quarterly Report on Form 10-Q that will be filed on or around the date of this press release. There may be additional risks that Forge presently does not know of or that it currently

believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect Forge’s expectations, plans or forecasts of future events and views as of the date of this press release. Forge anticipates that subsequent events and developments will cause its assessments to change. However, while Forge may elect to update these forward-looking statements at some point in the future, Forge specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Forge’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

About Forge

Forge is a leading provider of marketplace infrastructure, data services and technology solutions for private market participants. Forge Securities LLC is a registered broker-dealer and a Member of FINRA that operates an alternative trading system.

Contacts

Investor Relations Contact:

Dominic Paschel

ir@forgeglobal.com

Media Contact:

Lindsay Riddell

press@forgeglobal.com

FORGE GLOBAL HOLDINGS, INC.

Unaudited Condensed Consolidated Balance Sheets

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 129,606 | | | $ | 144,722 | |

| Restricted cash | 1,075 | | | 1,062 | |

| Accounts receivable, net | 5,553 | | | 4,067 | |

| | | |

| Prepaid expenses and other current assets | 12,418 | | | 13,253 | |

| Total current assets | $ | 148,652 | | | $ | 163,104 | |

| Internal-use software, property and equipment, net | 4,540 | | | 5,192 | |

| Goodwill and other intangible assets, net | 128,940 | | | 129,919 | |

| Operating lease right-of-use assets | 7,985 | | | 4,308 | |

| Payment-dependent notes receivable, noncurrent | 6,236 | | | 5,593 | |

| Other assets, noncurrent | 2,324 | | | 2,615 | |

| Total assets | $ | 298,677 | | | $ | 310,731 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,671 | | | $ | 1,831 | |

| Accrued compensation and benefits | 7,037 | | | 11,004 | |

| Accrued expenses and other current liabilities | 11,507 | | | 8,861 | |

| Operating lease liabilities, current | 2,922 | | | 2,516 | |

| | | |

| Total current liabilities | $ | 24,137 | | | $ | 24,212 | |

| Operating lease liabilities, noncurrent | 6,253 | | | 2,707 | |

| Payment-dependent notes payable, noncurrent | 6,236 | | | 5,593 | |

| Warrant liabilities | 5,169 | | | 9,616 | |

| Other liabilities, noncurrent | 285 | | | 185 | |

| Total liabilities | $ | 42,080 | | | $ | 42,313 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Common stock, $0.0001 par value; 180,011,227 and 176,899,814 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 18 | | | 18 | |

| Treasury stock, at cost; 157,193 shares as of March 31, 2024 and December 31, 2023, respectively | $ | (625) | | | $ | (625) | |

| Additional paid-in capital | 551,274 | | | 543,846 | |

| Accumulated other comprehensive income | 765 | | | 911 | |

| Accumulated deficit | (299,262) | | | (280,638) | |

| Total Forge Global Holdings, Inc. stockholders’ equity | $ | 252,170 | | | $ | 263,512 | |

| Noncontrolling Interest | 4,427 | | | 4,906 | |

| Total stockholders’ equity | $ | 256,597 | | | $ | 268,418 | |

| Total liabilities and stockholders’ equity | $ | 298,677 | | | $ | 310,731 | |

FORGE GLOBAL HOLDINGS, INC.

Unaudited Condensed Consolidated Statements of Operations

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Revenues: | | | |

| Marketplace revenues | $ | 8,520 | | | $ | 4,632 | |

| Custodial administration fees | 10,722 | | | 10,847 | |

| Total revenues | $ | 19,242 | | | $ | 15,479 | |

| Transaction-based expenses: | | | |

| Transaction-based expenses | (29) | | | (19) | |

| Total revenues, less transaction-based expenses | $ | 19,213 | | | $ | 15,460 | |

| Operating expenses: | | | |

| Compensation and benefits | 29,843 | | | 25,762 | |

| Technology and communications | 3,060 | | | 3,390 | |

| Professional services | 2,217 | | | 2,736 | |

| Advertising and market development | 1,090 | | | 677 | |

| Rent and occupancy | 1,135 | | | 1,326 | |

| General and administrative | 5,062 | | | 2,748 | |

| Depreciation and amortization | 1,816 | | | 1,789 | |

| Total operating expenses | $ | 44,223 | | | $ | 38,428 | |

| Operating loss | $ | (25,010) | | | $ | (22,968) | |

| Interest and other income (expense): | | | |

| Interest income | 1,709 | | | 1,509 | |

| Change in fair value of warrant liabilities | 4,447 | | | 168 | |

| Other income, net | 76 | | | 215 | |

| Total interest and other income (expense) | $ | 6,232 | | | $ | 1,892 | |

| Loss before provision for income taxes | $ | (18,778) | | | $ | (21,076) | |

| Provision for income taxes | 216 | | | 185 | |

| Net loss | $ | (18,994) | | | $ | (21,261) | |

| Net loss attributable to noncontrolling interest | $ | (370) | | | $ | (73) | |

| Net loss attributable to Forge Global Holdings, Inc. | $ | (18,624) | | | $ | (21,188) | |

| Net loss per share attributable to Forge Global Holdings, Inc. common stockholders: | | | |

| Basic | $ | (0.10) | | | $ | (0.12) | |

| Diluted | $ | (0.10) | | | $ | (0.12) | |

| Weighted-average shares used in computing net loss per share attributable to Forge Global Holdings, Inc. common stockholders: | | | |

| Basic | 179,910,522 | | | 171,816,522 | |

| Diluted | 179,910,522 | | | 171,816,522 | |

FORGE GLOBAL HOLDINGS, INC.

Unaudited Condensed Consolidated Statements of Cash Flows

(In thousands of U.S. dollars)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (18,994) | | | $ | (21,261) | |

| Adjustments to reconcile net loss to net cash (used in) provided by operations: | | | |

| Share-based compensation | 9,467 | | | 7,401 | |

| Depreciation and amortization | 1,816 | | | 1,789 | |

| Amortization of right-of-use assets | 643 | | | 845 | |

| Loss on impairment of long lived assets | — | | | 536 | |

| Impairment of right-of-use assets | 186 | | | — | |

| Allowance for doubtful accounts | 109 | | | 122 | |

| Change in fair value of warrant liabilities | (4,447) | | | (168) | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (1,596) | | | 135 | |

| Prepaid expenses and other assets | 1,125 | | | 2,446 | |

| Accounts payable | 1,066 | | | (1,377) | |

| Accrued expenses and other liabilities | 2,782 | | | (403) | |

| Accrued compensation and benefits | (3,967) | | | (6,731) | |

| Operating lease liabilities | (555) | | | (1,049) | |

| Other | (10) | | | — | |

| Net cash used in operating activities | (12,375) | | | (17,715) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (400) | | | (71) | |

| | | |

| Net cash used in investing activities | (400) | | | (71) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Proceeds from exercise of options | 226 | | | 61 | |

| Taxes withheld and paid related to net share settlement of equity awards | (2,302) | | | (557) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | (2,076) | | | (496) | |

| Effect of changes in currency exchange rates on cash and cash equivalents | (253) | | | 228 | |

| Net decrease in cash and cash equivalents | (15,104) | | | (18,054) | |

| Cash, cash equivalents and restricted cash, beginning of the period | 145,785 | | | 194,965 | |

| Cash, cash equivalents and restricted cash, end of the period | $ | 130,681 | | | $ | 176,911 | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash to the amounts reported within the consolidated balance sheets | | | |

| Cash and cash equivalents | $ | 129,606 | | | $ | 175,268 | |

| Restricted cash | 1,075 | | | 1,643 | |

| Total cash, cash equivalents and restricted cash, end of the period | $ | 130,681 | | | $ | 176,911 | |

FORGE GLOBAL HOLDINGS, INC.

Reconciliation of GAAP to Non-GAAP Results

(In thousands of U.S. dollars)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Net loss attributable to Forge Global Holdings, Inc. | $ | (18,624) | | | $ | (21,188) | |

| Add: | | | |

| Interest (income) expense, net | (1,709) | | | (1,509) | |

| Provision for income taxes | 216 | | | 185 | |

| Depreciation and amortization | 1,816 | | | 1,789 | |

| Net loss attributable to noncontrolling interest | (370) | | | (73) | |

| Loss on impairment of long lived assets | — | | | 536 | |

| Impairment of right-of-use assets | 186 | | | — | |

| Share-based compensation expense | 9,467 | | | 7,401 | |

| Change in fair value of warrant liabilities | (4,447) | | | (168) | |

| Adjusted EBITDA | $ | (13,465) | | | $ | (13,027) | |

FORGE GLOBAL HOLDINGS, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

KEY OPERATING METRICS

(In thousands of U.S. dollars)

Key Business Metrics

We monitor the following key business metrics to help us evaluate our business, identify trends affecting our business, formulate business plans and make strategic decisions. The tables below reflect period-over-period changes in our key business metrics, along with the percentage change between such periods. We believe the following business metrics are useful in evaluating our business:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| Dollars in thousands | | March 31, 2024 | | December 31, 2023 | | Change | | % Change |

| TRADING BUSINESS | | | | | | | | |

| Trades | | 605 | | | 435 | | | 170 | | | 39 | % |

| Volume | | $ | 262,538 | | | $ | 250,414 | | | $ | 12,124 | | | 5 | % |

| Net Take Rate | | 3.2 | % | | 3.2 | % | | 0.1 | % | | 2 | % |

| Marketplace revenues, less transaction-based expenses | | $ | 8,491 | | | $ | 7,971 | | | $ | 520 | | | 7 | % |

•Trades are defined as the total number of orders executed by us and entities we have acquired on behalf of private investors and stockholders. Increasing the number of orders is critical to increasing our revenue and, in turn, to achieving profitability.

•Volume is defined as the total sales value for all securities traded through our Forge Markets platform which is the aggregate value of the issuer company’s equity attributed to both the buyer and seller in a trade and as such a $100 trade of equity between buyer and seller would be captured as $200 volume for us. Although we typically capture a commission on each side of a trade, we may not in certain cases due to factors such as the use of a third-party broker by one of the parties or supply factors that would not allow us to attract sellers of shares of certain issuers. Volume is influenced by, among other things, the pricing and quality of our services as well as market conditions that affect private company valuations, such as increases in valuations of comparable companies at IPO.

•Net Take Rates are defined as our marketplace revenues, less transaction-based expenses, divided by Volume. These represent the percentage of fees earned by our marketplace on any transactions executed from the commission we charged on such transactions (less transaction-based expenses), which is a determining factor in our revenue. The Net Take Rate can vary based upon the service or product offering and is also affected by the average order size and transaction frequency.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| Dollars in thousands | | March 31, 2024 | | December 31, 2023 | | Change | | % Change |

| CUSTODY BUSINESS | | | | | | | | |

| Total Custodial Accounts | | 2,152,777 | | | 2,078,868 | | | 73,909 | | | 4 | % |

| Assets Under Custody | | $ | 16,454,327 | | | $ | 15,647,469 | | | $ | 806,858 | | | 5 | % |

•Total Custodial Accounts are defined as our customers’ custodial accounts that are established on our platform and billable. These relate to our Custodial Administration fees revenue stream and are an important measure of our business as the number of Total Custodial Accounts is an indicator of our future revenues from certain account maintenance, transaction and cash administration fees.

•Assets Under Custody is the reported value of all client holdings held under our agreements, including cash submitted to us by the responsible party. These assets can be held at various financial institutions, issuers and in our vault. As the custodian of the accounts, we collect all interest and dividends, handle all fees and transactions, and any other considerations for the assets concerned. Our fees are earned from the overall maintenance activities of all assets and are not charged on the basis of the dollar value of Assets Under Custody, but we believe that Assets Under Custody is a useful metric for assessing the relative size and scope of our business.

1 Supplemental Investor Information May 2024

2 Important Information As previously announced, on March 21, 2022, as contemplated by that certain Agreement and Plan of Merger, dated September 13, 2021 (the “Merger Agreement”), by and among Motive Capital Corp, a Cayman Islands exempted company (“Motive”), FGI Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Motive (“Merger Sub”), and Forge Global, Inc., a Delaware corporation (“Forge Global”), Motive changed its jurisdiction of incorporation by deregistering as an exempted company in the Cayman Islands and continuing and domesticating as a corporation incorporated under the laws of the State of Delaware (the “Domestication”), changing its name to “Forge Global Holdings, Inc.” (the “Company”), and following the Domestication, as contemplated by the Merger Agreement, Merger Sub merged with and into Forge Global, with Forge Global surviving the merger as a wholly owned subsidiary of the Company (together with the Domestication, the “Business Combination”). On March 25, 2022, the Company filed a Current Report on Form 8-K (the “Form 8-K”) which, among other things, included the audited financial statements (and notes thereto) of Forge Global as of and for the fiscal years ended December 31, 2021 and 2020 (the “Forge Global 2021 Financial Statements”), Management’s Discussion and Analysis of Financial Condition and Results of Operations for Forge Global for the years ended December 31, 2021 and 2020 (the “Forge Global 2021 MD&A”), and Unaudited Pro Forma Condensed Combined Financial Information of Motive and Forge Global as of and for the year ended December 31, 2021 giving effect to the Business Combination and related transactions (the “Pro Forma Financial Information,” and together with the Forge Global 2021 Financial Statements, Forge Global 2021 MD&A, and Pro Forma Financial Information, the “2021 Financial Information”). In addition, the Company issued press releases announcing its results for the periods and on the dates detailed below, which include certain quarterly or annual financial information and key business metrics (collectively, the “Earnings Releases”). The Company also filed or will file corresponding Quarterly Reports on Form 10-Q (each, a “Quarterly Report”) and Annual Reports on Form 10-K (each, an “Annual Report”) for the periods and on the dates detailed below. Among other things, such filings included or will include the interim unaudited or audited financial statements (and notes thereto) of the Company and Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Company for such periods (collectively, the “Periodic Filings”). • Quarter ended June 30, 2022: Press release issued on August 11, 2022. Quarterly Report filed on August 12, 2022. • Quarter ended September 30, 2022: Press release issued on November 9, 2022. Quarterly Report filed on November 14, 2022. • Quarter and year ended December 31, 2022: Press release issued on February 28, 2023. Annual Report filed on March 1, 2023. • Quarter ended March 31, 2023: Press release issued on May 9, 2023. Quarterly Report filed on May 9, 2023. • Quarter ended June 30, 2023: Press release issued on August 8, 2023. Quarterly Report filed on August 8, 2023. • Quarter ended September 30, 2023: Press release issued on November 7, 2023. Quarterly Report filed on November 7, 2023. • Quarter and year ended December 31, 2023: Press release issued on March 26, 2024. Annual Report filed on March 26, 2024. • Quarter ended March 31, 2024: Press release issued on May 7, 2024. Quarterly Report to be filed on or around such date. To further assist investors, the Company is furnishing the following additional financial information, key business metrics, and data (the “Supplemental Information”). The following Supplemental Information is unaudited, has not been reviewed by the Company’s independent registered public accounting firm, and is subject to change. The Supplemental Information is qualified by in its entirety, and should be read in conjunction with, 1) the 2021 Financial Information, 2) the Earnings Releases, and 3) the Periodic Filings.

3 Use of Non-GAAP Financial Information In addition to its financial results determined in accordance with generally accepted accounting principles in the United States of America (“GAAP”), the Company presents Adjusted EBITDA, a non-GAAP financial measure. The Supplemental Information includes Adjusted EBITDA, a non-GAAP financial measure. The Company uses Adjusted EBITDA to evaluate its ongoing operations and for internal planning and forecasting purposes. The Company believes that Adjusted EBITDA, when taken together with the corresponding GAAP financial measure, provides meaningful supplemental information regarding its performance by excluding specific financial items that have less bearing on its core operating performance. The Company considers Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in its business and its historical operating performance on a more consistent basis. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in the Company’s industry, may calculate similarly titled non- GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA as a tool for comparison. A reconciliation is provided in the Supplemental Information for Adjusted EBITDA to net income (loss), the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review Adjusted EBITDA and the reconciliation of Adjusted EBITDA to net income (loss), and not to rely on any single financial measure to evaluate the Company’s business. The Company defines Adjusted EBITDA as net loss attributable to Forge Global Holdings, Inc., adjusted to exclude: (i) interest income, (ii) provision for income taxes, (iii) net loss attributable to noncontrolling interest, (iv) depreciation and amortization, (v) share-based compensation expense, (vi) change in fair value of warrant liabilities, and (vii) other significant gains, losses, and expenses such as impairments or acquisition-related transaction costs that the Company believes is not indicative of its ongoing results. Forward-Looking Statements The Supplemental Information may contain “forward-looking statements,” which generally are accompanied by words such as “believe,” “may,” ”could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “goal,” “expect,” “should,” “would,” “plan,” “predict,” “project,” “forecast,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict, indicate, or relate to future events or trends or the Company’s future financial or operating performance, or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the Company’s beliefs regarding its financial position and operating performance, as well as future opportunities for the Company to expand its business. Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, while considered reasonable by the Company and its management, are subject to risks and uncertainties that may cause actual results to differ materially from current expectations. You should carefully consider the risks and uncertainties described in the Company’s documents filed, or to be filed, with the SEC, including but not limited to the Periodic Filings. There may be additional risks that the Company presently does not know of or that it currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans, or forecasts of future events and views as of the date of this Supplemental Information. The Company anticipates that subsequent events and developments will cause its assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this Supplemental Information. Accordingly, undue reliance should not be placed upon the forward-looking statements.

4 (1) Please note that we have renamed a category of our revenue, previously described as Placement Fee revenue, to Marketplace revenue in order to align with the types of revenue included in this category. For more information on this change, please see our Annual Report for the quarter and year ended December 31, 2023 to be filed on or around the date of this Supplemental Information. Forge Global Holdings, Inc. - Financial Information, Key and Other Business Metrics (Unaudited) Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 2021 2022 2023 FINANCIAL INFORMATION ($ in 000s unless otherwise stated) Operating Results Marketplace revenues(1) 10,951$ 8,227$ 6,902$ 4,632$ 5,723$ 7,283$ 8,152$ 8,520$ 107,723$ 40,665$ 25,790$ Custodial administration fees 5,689 7,673 9,919 10,847 10,997 11,280 10,907 10,722 20,333 28,718 44,031 Transaction-based expenses (178) (86) (87) (19) (83) (148) (181) (29) (3,034) (483) (431) Total revenues, less transaction-based expenses 16,462$ 15,814$ 16,734$ 15,460$ 16,637$ 18,415$ 18,878$ 19,213$ 125,022$ 68,900$ 69,390$ Total operating expenses 42,510$ 58,250$ 44,539$ 38,428$ 39,190$ 39,928$ 43,293$ 44,223$ 134,811$ 203,940$ 160,839$ Operating loss (26,048)$ (42,436)$ (27,805)$ (22,968)$ (22,553)$ (21,513)$ (24,415)$ (25,010)$ (9,789)$ (135,040)$ (91,449)$ Net loss (5,119)$ (16,198)$ (26,164)$ (21,261)$ (25,100)$ (18,957)$ (26,231)$ (18,994)$ (18,499)$ (111,905)$ (91,549)$ Net loss attributable to Noncontrolling interest -$ -$ (46)$ (73)$ (211)$ (609)$ (435)$ (370)$ -$ (46)$ (1,328)$ Net loss attributable to Forge Global Holdings (5,119)$ (16,198)$ (26,118)$ (21,188)$ (24,889)$ (18,348)$ (25,796)$ (18,624)$ (18,499)$ (111,859)$ (90,221)$ Adjusted EBITDA (12,274)$ (13,273)$ (14,251)$ (13,027)$ (11,780)$ (10,355)$ (13,637)$ (13,465)$ 8,761$ (46,851)$ (48,799)$ Non-GAAP Adjusted EBITDA Reconciliation Net loss attributable to Forge Global Holdings, Inc (5,119)$ (16,198)$ (26,118)$ (21,188)$ (24,889)$ (18,348)$ (25,796)$ (18,624)$ (18,499)$ (111,859)$ (90,221)$ (+) Interest (income) expense, net (266) (874) (1,520) (1,509) (1,319) (1,725) (1,868) (1,709) 2,307 (2,681) (6,421) (+) Provision for income taxes 35 48 121 185 293 291 50 216 386 327 819 (+) Net loss attributable to non-controlling interest - - (46) (73) (211) (609) (435) (370) - (46) (1,328) (+) Depreciation and amortization 2,021 1,428 1,495 1,789 1,747 1,710 1,708 1,816 5,390 6,026 6,954 (+) Loss on impairment of long lived assets 163 - - 536 - - 63 - - 163 599 (+) Impairment of right-of-use assets 17 - - - - - - 186 - 283 - (+) Share-based compensation expense 10,740 26,712 11,950 7,401 8,809 9,233 8,891 9,467 12,231 57,924 34,334 (+) Change in fair value of w arrant liabilities (20,558) (25,210) (27) (168) 3,790 (907) 3,750 (4,447) 6,064 (19,836) 6,465 (+) Acquisition-related transaction costs 692 821 (106) - - - - - 882 5,113 - (+) Transaction bonus - - - - - - - - - 17,735 - Adjusted EBITDA (12,274)$ (13,273)$ (14,251)$ (13,027)$ (11,780)$ (10,355)$ (13,637)$ (13,465)$ 8,761$ (46,851)$ (48,799)$

5 (2) Key business metrics and other business metrics as of and for the full year and quarterly periods of 2021, 2022, and 2023, respectively, are based on actual results of operations; key business metrics and other business metrics presented for the last-twelve-months (LTM) periods through the third quarter of 2021 are prepared on a pro-forma basis, which combines the metrics from Forge and SharesPost’s brokerage businesses as if the SharesPost acquisition had occurred at the beginning of the fiscal year 2020. (3) Represents end of period value. Includes both CaaS and Alt IRA accounts. (4) Number of distinct companies in whose shares at least one buy or sell IOI, or indication of interest, was created in this period. (5) Custodial cash represents amounts on deposit with financial institutions for the benefit of the Company's custodial accounts. Forge Global Holdings, Inc. - Financial Information, Key and Other Business Metrics (Unaudited) Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 2021 2022 2023 KEY BUSINESS METRICS ($ in 000s unless otherwise stated) (2) Trading Business Marketplace revenues, less transaction-based expenses - LTM 72,052$ 57,834$ 40,182$ 30,342$ 25,209$ 24,203$ 25,359$ 29,237$ 104,689$ 40,182$ 25,359$ Number of trades - LTM 3,232 2,636 2,184 1,894 1,712 1,853 1,756 2,055 4,890 2,184 1,756 Number of trades - Period 630 426 532 306 448 567 435 605 4,890 2,184 1,756 Transaction volume ($B) - LTM 2.26$ 1.81$ 1.22$ 0.93$ 0.75$ 0.76$ 0.77$ 0.90$ 3.18$ 1.22$ 0.77$ Transaction volume ($B) - Period 0.33$ 0.23$ 0.25$ 0.13$ 0.15$ 0.23$ 0.25$ 0.26$ 3.18$ 1.22$ 0.77$ Net take rate - LTM 3.2% 3.2% 3.3% 3.3% 3.3% 3.2% 3.3% 3.2% 3.3% 3.3% 3.3% Net take rate - Period 3.2% 3.6% 2.8% 3.6% 3.7% 3.0% 3.2% 3.2% 3.3% 3.3% 3.3% Custody Business Total custodial accounts (3) 1,739,838 1,811,774 1,871,146 1,937,248 1,970,617 2,023,756 2,078,868 2,152,777 2,124,677 1,871,146 2,078,868 Assets under custody ($B) (3) 15.3$ 15.0$ 14.9$ 14.8$ 15.3$ 15.1$ 15.6$ 16.5$ 14.3$ 14.9$ 15.6$ OTHER BUSINESS METRICS (2) Distinct private companies transacted in - LTM 196 191 191 163 148 154 154 161 Distinct private companies transacted in - Period 90 77 76 60 75 82 78 64 Total number of issuers w ith IOIs (4) 463 478 436 492 486 502 485 543 Custodial cash balance ($MM) (5) 680$ 685$ 635$ 574$ 550$ 518$ 505$ 481$

v3.24.1.u1

Cover

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

Forge Global Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39794

|

| Entity Tax Identification Number |

98-1561111

|

| Entity Address, Address Line One |

4 Embarcadero Center

|

| Entity Address, Address Line Two |

Floor 15

|

| Entity Address, City or Town |

San Francisco,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94111

|

| City Area Code |

(415)

|

| Local Phone Number |

881-1612

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

FRGE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001827821

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Forge Global (NYSE:FRGE)

過去 株価チャート

から 4 2024 まで 5 2024

Forge Global (NYSE:FRGE)

過去 株価チャート

から 5 2023 まで 5 2024