UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Cango Inc.

(Name of Issuer)

Class A Ordinary Shares, par value US$0.0001

per share

(Title of Class of Securities)

137586 103**

(CUSIP Number)

Mr. Xiaojun Zhang

8F, New Bund Oriental Plaza II

556 West Haiyang Road, Pudong New Area

Shanghai 200124

People’s Republic of China

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

With copies to:

Yi Gao, Esq.

Simpson Thacher & Bartlett

35th Floor, ICBC Tower

3 Garden Road

Central, Hong Kong

+852-2514-7600

August 16, 2024

(Date of Event which Requires Filing of this

Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

| ** |

This CUSIP number applies to the Issuer’s American Depositary Shares (“ADSs”), each representing two Class A ordinary shares. There is no CUSIP number assigned to the Class A ordinary shares. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

CUSIP NO. 137586 103

| 1. |

Names of Reporting Persons.

Xiaojun Zhang |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨ (b) x |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

¨ |

| 6. |

Citizenship or Place of Organization

People’s Republic of China |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

7. |

Sole Voting Power

51,402,223 (1) |

| |

8. |

Shared Voting Power |

| |

9. |

Sole Dispositive Power

51,402,223 (1) |

| |

10. |

Shared Dispositive Power |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

51,402,223 (1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions)

¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

27.5%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) |

Represents (i) 38,275,787 Class B ordinary shares held by Eagle Central Holding Limited and (ii) 13,126,436 Class A ordinary shares that Mr. Xiaojun Zhang has the right to acquire within 60 days after the date hereof pursuant to the terms of the options granted to him. |

| (2) |

The percentage of the class of securities beneficially owned by such reporting person is calculated based on (i) 135,751,299 Class A ordinary shares of the Issuer issued and outstanding as of March 31, 2024, as provided by the Issuer, (ii) 38,275,787 Class B ordinary shares beneficially owned by the reporting person, assuming the conversion of all such Class B ordinary shares into the same number of Class A ordinary shares and (iii) 13,126,436 Class A ordinary shares that Mr. Xiaojun Zhang has the right to acquire within 60 days after the date hereof pursuant to the terms of the options granted to him, assuming such options were exercised. |

The

voting power of the shares beneficially owned by the reporting person represents 48.4% of the total outstanding voting power. The

percentage of voting power is calculated by dividing the voting power beneficially owned by such reporting person by the voting power

of (i) a total of 135,751,299 Class A ordinary shares and 72,978,677 Class B ordinary shares of the Issuer issued and outstanding

as of March 31, 2024, as provided by the Issuer, as well as (ii) 13,126,436 Class A ordinary shares that Mr. Xiaojun

Zhang has the right to acquire within 60 days after the date hereof pursuant to the terms of the options granted to him, assuming such

options were exercised. In respect of all matters subject to a shareholders’ vote, each Class A ordinary share is entitled

to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class. Each Class B ordinary share

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible

into Class B ordinary shares under any circumstances.

CUSIP NO. 137586 103

| 1. |

Names of Reporting Persons.

Eagle Central Holding Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨ (b) x |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

7. |

Sole Voting Power

38,275,787(1) |

| |

8. |

Shared Voting Power |

| |

9. |

Sole Dispositive Power

38,275,787(1) |

| |

10. |

Shared Dispositive Power |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

38,275,787(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions)

¨ |

| 13. |

Percent of Class Represented by Amount in Row (11)

22.0%(2) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) |

Represents 38,275,787 Class B ordinary shares held by Eagle Central Holding Limited. |

| (2) |

The percentage of the class of securities beneficially owned by such reporting person is calculated based on (i) 135,751,299 Class A ordinary shares of the Issuer issued and outstanding as of March 31, 2024 and (ii) 38,275,787 Class B ordinary shares beneficially owned by the reporting person, assuming the conversion of all such Class B ordinary shares into the same number of Class A ordinary shares. |

Explanatory Note

This Amendment No. 2 to Schedule 13D (this “Amendment No. 2”)

hereby amends the prior statement on Schedule 13D initially filed with the U.S. Securities and Exchange Commission on June 23, 2022,

as amended by the Amendment No. 1 to Schedule 13D filed on March 3, 2023 (as so amended, collectively, the “Schedule

13D”), on behalf of each of Mr. Xiaojun Zhang, a citizen of the People’s Republic of China, and Eagle Central Holding

Limited, a company established in the British Virgin Islands and wholly owned by Mr. Xiaojun Zhang. Except as amended and supplemented

herein, the information previously reported in the Schedule 13D remains unchanged. Capitalized terms used but not defined herein have

the meanings assigned thereto in the Schedule 13D.

Item 5. Interest in Securities of the Issuer

Item 5 of the Schedule 13D is hereby amended and restated in its entirety

as follows:

The information set forth in Items 2, 3 and 6 of this Schedule 13D

and the cover pages of this Schedule 13D is hereby incorporated by reference into this Item 5.

(a)-(b) The responses of each Reporting Person to rows 7, 8, 9,

10, 11 and 13 of the cover pages of this Schedule 13D are hereby incorporated by reference into this Item 5.

As of the date hereof, (i) 38,275,787 Class B ordinary shares

are held directly by Eagle Central Holding Limited, and (ii) Mr. Xiaojun Zhang holds options to purchase up to 13,126,436 Class A

ordinary shares exercisable within 60 days of the date hereof.

The percentage of the class of securities beneficially owned is calculated

based on (i) 135,751,299 Class A ordinary shares of the Issuer issued and outstanding as of March 31, 2024, as provided

by the Issuer, (ii) 38,275,787 Class B ordinary shares beneficially owned by the Reporting Persons, assuming the conversion

of all such Class B ordinary shares into the same number of Class A ordinary shares and (iii) 13,126,436 Class A ordinary

shares that Mr. Xiaojun Zhang has the right to acquire within 60 days after the date hereof pursuant to the terms of the options

granted to him, assuming such options were exercised, as applicable.

The

voting power of the shares beneficially owned by Mr. Xiaojun Zhang represents 48.4% of the total outstanding voting power. The

percentage of voting power is calculated by dividing the voting power beneficially owned by such reporting person by the voting power

of (i) a total of 135,751,299 Class A ordinary shares and 72,978,677 Class B ordinary shares of the Issuer issued and outstanding

as of March 31, 2024, as provided by the Issuer, as well as (ii) 13,126,436 Class A ordinary shares that Mr. Xiaojun

Zhang has the right to acquire within 60 days after the date hereof pursuant to the terms of the options granted to him, assuming such

options were exercised. In respect of all matters subject to a shareholders’ vote, each Class A ordinary share is entitled

to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class. Each Class B ordinary share

is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible

into Class B ordinary shares under any circumstances.

In addition to the Special Option Grant, as described further in Item

6 below, the Issuer previously granted certain options to purchase Class A ordinary shares to Mr. Xiaojun Zhang pursuant to

the Issuer’s 2018 share incentive plan (the “2018 Plan”).

By virtue of the voting agreement described further in Item 6 below,

the Reporting Persons and certain parties thereto may each be deemed to be a member of a “group” for purposes of Section 13(d) of

the Exchange Act. However, neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission

that the Reporting Persons are members of any such group. Each Reporting Person disclaims beneficial ownership of the Class A ordinary

shares that may be deemed to be beneficially owned solely by virtue of the voting agreement.

(c) The information set forth in Items 3 and 6 of this Schedule

13D is hereby incorporated by reference into this Item 5. Mr. Xiaojun Zhang became the beneficial owner of 473,783 additional Class A

ordinary shares underlying share options which will vest within 60 days from the date hereof. Except as disclosed in this Schedule 13D,

none of the Reporting Persons has effected any transactions relating to the Class A ordinary Shares during the past 60 days.

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

Item 6 of the Schedule 13D is hereby amended by adding the following

after the fifth paragraph under the caption “Option Grants” thereof:

On August 1, 2022, the Issuer granted options to purchase 28,000

Class A ordinary shares to Mr. Xiaojun Zhang. 50% of the share options are exercisable on the second anniversary of the grant

date; 25% of the share options are exercisable on the third anniversary of the grant date; 25% of the share options are exercisable on

the fourth anniversary of the grant date.

Signatures

After reasonable inquiry and to the best of its knowledge and belief,

the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: August 20, 2024

| XIAOJUN ZHANG |

|

| |

|

|

| By: |

/s/ Xiaojun Zhang |

|

| |

|

| EAGLE CENTRAL HOLDING LIMITED |

|

| |

|

|

| By: |

/s/ Xiaojun Zhang |

|

| |

Name: |

Xiaojun Zhang |

|

| |

Title: |

Authorized Signatory |

|

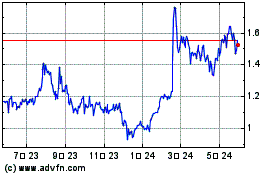

Cango (NYSE:CANG)

過去 株価チャート

から 10 2024 まで 11 2024

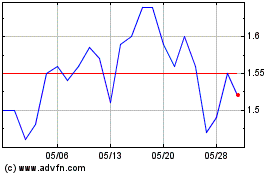

Cango (NYSE:CANG)

過去 株価チャート

から 11 2023 まで 11 2024