0001748824FALSE00017488242024-09-302024-09-300001748824us-gaap:CommonStockMember2024-09-302024-09-300001748824bsig:A4800NotesDue2026Member2024-09-302024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024

BrightSphere Investment Group Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38979 | 47-1121020 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification Number) |

200 State Street, 13th Floor

Boston, Massachusetts 02109

(617) 369-7300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | BSIG | New York Stock Exchange |

| 4.800% Notes due 2026 | BSIG 26 | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 30, 2024, the Board of Directors (the “Board”) of BrightSphere Investment Group Inc. (the “Company”) appointed Kelly Young as the Company’s President and Chief Executive Officer and as a Director of the Company, each effective as of January 1, 2025.

Ms. Young, age 45, is the Chief Executive Officer of Acadian Asset Management LLC (“Acadian”), a role she has served in since December 2023. Ms. Young joined Acadian in 2009 and is a member of Acadian’s Board of Managers, Executive Management Team and Executive Committee. Prior to her appointment as Chief Executive Officer of Acadian, Ms. Young had served as Executive Vice President and Chief Marketing Officer of Acadian since 2019, responsible for all aspects of the firm’s client service and business development efforts globally. Ms. Young previously held various other positions at Acadian, including Managing Director of Acadian Asset Management (U.K.) Limited and also served for a number of years as a senior relationship manager at Acadian. Before joining Acadian, Ms. Young was the European head of the index fund management business for SGAM Alternative Investments. She has also worked for Northern Trust Global Investments and Barclays Global Investors in senior portfolio management positions. Ms. Young received a B.Sc. (Hons) in economics and business finance from Brunel University. She is a CFA charterholder and member of CFA Society U.K. She also holds the CAIA charter and is a member of CAIA Association.

On September 30, 2024, the Company and Acadian entered into an Amended and Restated Employment Agreement with Ms. Young (the “Employment Agreement”) in connection with the appointment of Ms. Young as the Company’s President and Chief Executive Officer and the continued service of Ms. Young as the Chief Executive Officer of Acadian. Pursuant to the Employment Agreement, Ms. Young’s compensation will consist of an annual base salary of $650,000, and she will be eligible to receive a discretionary annual bonus based on a target bonus amount. The target bonus amount is $8.35 million and the actual bonus amount may exceed or be less than the target bonus amount. The determination of the annual bonus and the portion of which that may take the form of deferred compensation, including equity of the Company which may be subject to time or performance-based vesting, shall be determined by the Board or the Compensation Committee of the Board. Without duplication of any benefits provided under the Employment Agreement, Ms. Young will also be eligible to participate in Acadian benefit plans not less favorable than those made available by Acadian to its executive employees.

In the event of termination of Ms. Young as Chief Executive Officer of the Company (a)(i) by the Company without Cause (as defined in the Employment Agreement) or (ii) by Ms. Young with Good Reason (as defined in the Employment Agreement), all equity awards granted to Ms. Young under an equity plan maintained by the Company will become fully vested (except for awards subject to a performance-based vesting condition, which will remain outstanding and continue to be eligible to vest in accordance with their terms ) or (b) as a result of Ms. Young’s death or disability, all equity awards granted to Ms. Young under an equity plan maintained by the Company will become fully vested (at target level, as applicable, for awards subject to a performance-based vesting condition).

In the event of a termination of Ms. Young’s employment as Chief Executive Officer of Acadian without Cause or termination by Ms. Young for Good Reason, then, in addition to any earned but unpaid base salary and certain earned and vested benefits, subject to Ms. Young’s execution of a release of claims, Ms. Young shall be entitled to receive (i) severance pay consisting of a continuation of her base salary then in effect on the termination date for a period equal to up to 24 months, (ii) payment of a bonus equal to up to two times the average amount of Bonuses (as defined in the Employment Agreement), plus any commissions, paid to Ms. Young by Acadian for the last three (3) fiscal years (the “Termination Bonus”) and (iii) payment for continuation of health benefits for the lesser of the severance period set forth in the Employment Agreement, cessation of COBRA eligibility or eighteen (18) months.

In the event of a termination of Ms. Young’s employment as Chief Executive Officer of Acadian due to her death or disability, Ms. Young will be entitled to severance pay consisting of a continuation of her base salary then in effect on the termination date for a period equal to six (6) months and a pro-rata portion of the Termination Bonus.

The Employment Agreement contains customary restrictive covenants, including, confidentiality, a two (2) year non-solicitation and non-interference obligation and a twelve (12) month non-competition obligation.

The foregoing summary of the Employment Agreement is qualified in its entirety by reference to the Employment Agreement which is attached as Exhibit 10.1 to this Current Report on Form 8-K, and which is incorporated herein by reference.

In connection with the appointment of Ms. Young as President and Chief Executive Officer of the Company, Suren Rana will step down as President and Chief Executive Officer, effective December 31, 2024.

ITEM 7.01 Regulation FD Disclosure.

A copy of the press release announcing the appointment of Ms. Young as President and Chief Executive Officer of the Company and the Company’s name change, as described in Item 8.01 of this Current Report on Form 8-K below, is filed as Exhibit 99.1 hereto and is incorporated by reference.

ITEM 8.01 Other Events.

On October 1, 2024, the Company announced that it will be changing its name to Acadian Asset Management Inc., effective January 1, 2025. As part of the rebranding process, the Company’s New York Stock Exchange symbol will change from BSIG to AAMI. Trading under the new name and symbol will begin on or about January 2, 2025. The New York Stock Exchange symbol for the Company’s 4.800% notes due 2026 will change from BSIG 26 to AAMI 26.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this form to be signed on its behalf by the undersigned, thereto duly authorized.

| | | | | | | | | | | | | | |

| Date: | October 1, 2024 | BRIGHTSPHERE INVESTMENT GROUP INC. | |

| | | |

| | | | |

| | By: | /s/ Richard J. Hart | |

| | Name: | Richard J. Hart | |

| | Title: | Chief Legal Officer and Secretary | |

AMENDED AND RESTATED EMPLOYMENT AGREEMENT

This Amended and Restated Employment Agreement (this “Agreement”), effective as of January 1, 2025 (the “Effective Date”), is entered into by and among Acadian Asset Management LLC, a Delaware limited liability company having its principal place of business in Boston, Massachusetts (the “Company”), Kelly-Ann Young (the “Employee”) and BrightSphere Investment Group Inc., a Delaware corporation (“BSIG”). Capitalized terms used herein and not defined herein or in the Seventh Amended and Restated Limited Liability Agreement of the Company dated February 26, 2018, as amended from time to time (“LLC Agreement”), shall have the meanings ascribed thereto on Annex A.

BACKGROUND

WHEREAS, the Employee presently serves as Chief Executive Officer of the Company;

WHEREAS, the Company desires to retain Employee as its Chief Executive Officer and BSIG desires to appoint Employee to the position of its Chief Executive Officer, and the Employee desires to serve in such capacities;

WHEREAS, the parties wish to amend and restate the Employment Agreement dated May 16, 2023 between the parties (the “Prior Employment Agreement”) to memorialize the terms and conditions of the Employee’s continued employment with the Company and new role with BSIG; and

NOW THEREFORE, in consideration of the foregoing premises, the mutual covenants and agreements hereinafter set forth and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto covenant and agree as follows:

AGREEMENTS

Section 1.Positions. The Employee shall continue to serve as the Chief Executive Officer of the Company and shall serve as the Chief Executive Officer of BSIG, on the terms and conditions hereinafter set forth.

Section 2.Office and Duties. During the Employment Period, the Employee shall hold such positions as specified herein or such other positions as may be assigned by the Executive Committee or the board of directors of BSIG (the “BSIG Board”), as applicable, to the Employee, and shall perform such duties usually associated with such position(s) and relating to each of the Company’s and BSIG’s business and operations as may from time to time be assigned to the Employee by the Executive Committee or the BSIG Board, as applicable. In addition, and for so long as the Employee shall serve as the Chief Executive Officer of BSIG, the BSIG Board shall nominate her, subject to the Notification and Authority Framework, for election to the BSIG Board and, if so elected by shareholders, the Employee shall serve as a member of the BSIG Board. Effective as of the date the Employee ceases to be the Chief Executive Officer of BSIG, the Employee agrees to resign (and will be deemed to have resigned) from any and all positions and offices that the Employee holds with BSIG, without any further action required therefor. During the Employment Period, the Employee shall devote all of the Employee’s business time to the Employee’s duties hereunder and shall, using the Employee’s

best efforts, perform such duties in a manner that will faithfully and diligently further the business and interests of the Company and BSIG and shall not pursue any other business activity, including, without limitation, serving as an officer, director, employee, or adviser to any business entity other than the Company or BSIG without the Company’s and BSIG’s prior written consent, provided that the Employee may manage her investments and serve in such positions with respect to Women’s Money Matters Inc. and to other non-profit entities. The Employee agrees to abide by the rules, regulations, instructions, personnel practices and policies of the Company and BSIG and any changes therein that may be adopted from time to time by the Company or BSIG, as applicable. The Employee agrees that the Employee will travel to whatever extent is reasonably necessary in the conduct of each of the Company’s and BSIG’s business.

Section 3.Salary, Bonus and Benefits.

(a)Salary. The Employee shall receive a gross annual salary of $650,000.00, such salary to be paid in accordance with the Company’s normal payroll procedures and subject to applicable tax deductions and withholdings. The salary shall be reviewed annually by the BSIG Board or the Compensation Committee of the BSIG Board (the “Compensation Committee”).

(b)Bonuses. During the Employment Period, the Employee shall be eligible for a discretionary annual bonus (the “Bonus”) based on a target bonus amount (the “Target Bonus”). The Target Bonus is not a guaranteed amount but serves as a reference for the potential bonus payout (e.g., the actual Bonus may exceed or be less than the Target Bonus). The actual Bonus amount shall be determined by the BSIG Board or the Compensation Committee based on the achievement of such key performance indicators or metrics, if any, as the BSIG Board or the Compensation Committee may establish for the applicable year in its discretion after discussion with the Executive. The allocation of the Bonus (if any) and the portion, if any, that may take the form of deferred compensation, shall be determined by the BSIG Board or the Compensation Committee. To receive the Bonus (or to be granted any form of deferred compensation with respect to the Bonus), the Employee must be an active employee on the day the Bonus is paid.

(c)Benefits. During the Employment Period and subject to the terms of the applicable plan and without duplication of any benefits provided hereunder, the Employee shall be eligible to participate in all other bonus, pension, profit-sharing, group insurance, or other fringe benefit plans not less favorable than those made available by the Company to its executive employees, but the Company shall not be required to establish any additional such program or plan and it may modify, interpret or discontinue such plans in its sole discretion. The Employee shall be entitled to paid leave in accordance with Company’s policies regarding vacations. The Employee shall be entitled to receive prompt reimbursement for all reasonable expenses incurred by the Employee (in accordance with the policies and procedures from time to time established by the Company for its executive employees) in performing services hereunder.

Section 4.Termination of Employment with the Company.

(a)Generally. In the event of termination of the Employee’s employment with the Company for any or no reason, the Employee shall be entitled to receive the Employee’s pro-rated salary then in effect through the termination date, benefits due or to become due to the Employee up to the date of termination of employment pursuant to any Company policy or

applicable law, and such benefits as may be mandated by law following the date of termination of employment.

(b)Termination for Good Reason or without Cause (Approved). In the event of the termination of the Employee’s employment with the Company (i) by the Employee with Good Reason (as defined) that remains uncured or by the Company without Cause; (ii) where neither such termination nor the taking of actions that constituted such Good Reason was mandated by the Board of Managers of the Company (excluding the Employee if the Employee is then a KELP Manager), or, if it was so mandated, received the vote of a majority of the KELP Managers; and (iii) subject to the Employee’s execution without revocation of a release and noncompetition agreement substantially in the form attached to this Agreement as Exhibit A (the “Release and Noncompetition Agreement”), then in addition to the payments specified in Section 4(a), the Employee also shall be entitled to receive severance pay consisting of a continuation of the Employee’s base salary then in effect on the termination date for a period equal to the 4(b) Severance Period, payable in accordance with the Company’s applicable payroll procedures. Notwithstanding the foregoing, in the event that: (a) the termination of the Employee’s employment occurs within fifty-two (52) days prior to the end of a calendar year and (b) the Company provides the Employee with forty-five (45) days to consider the release of claims described in this Section 4(b), the continued base salary payments to the Employee will not commence until January 1 of the next calendar year.

(c)Termination for Good Reason or without Cause (Not Approved). In the event of the termination of the Employee’s employment with the Company (i) by the Employee with Good Reason (as defined) that remains uncured or by the Company without Cause and (ii) where such termination or the taking of actions that constituted such Good Reason was mandated by the Board of Managers of the Company (excluding the Employee if the Employee is then a KELP Manager), without the vote of a majority of the KELP Managers; and (iii) subject to the Employee’s execution without revocation of the Release and Noncompetition Agreement then, in addition to the payments specified in Section 4(a), the Employee also shall be entitled to receive severance pay consisting of a continuation of the Employee’s salary in effect on the termination date for a period equal to the 4(c) Severance Period payable in accordance with the Company’s applicable payroll procedures. Notwithstanding the foregoing, in the event that: (a) the termination of the Employee’s employment occurs within fifty-two (52) days prior to the end of a calendar year and (b) the Company provides the Employee with forty-five (45) days to consider the release of claims described in this Section 4(b), the continued base salary payments to the Employee will not commence until January 1 of the next calendar year.

(d)Resignation or Termination for Cause. In the event that the Employee resigns from her position with the Company without Good Reason or the Company terminates the Employee’s employment with the Company for Cause, the Company shall be required to make only those payments specified in Section 4(a). The Company may elect to enforce the restrictions in Section 9 in exchange for payment in the amount of half of annual salary during the Covenant Period, payable in accordance with the Company’s regular payroll schedule and commencing on the first regularly scheduled payroll date immediately following thirty days after termination of the Employee’s employment.

(e)Death. In the event of the termination of the Employee’s employment with the Company because of the Employee’s death, in addition to the payments specified in Section 4(a),

the Employee’s estate also shall be entitled to receive severance pay consisting of a continuation of the Employee’s salary then in effect for a period of six (6) months, payable in a lump sum within 30 days of the Employee’s death.

(f)Disability. In the event of the termination of the Employee’s employment with the Company because of the Employee’s Disability, in addition to the payments specified in Section 4(a), the Employee also shall be entitled to receive severance pay consisting of a continuation of the Employee’s salary then in effect for a period of six (6) months, payable at the same rate and times as if the Employee were continuing as an employee of the Company.

(g)Termination Bonus. In the event of the termination of the Employee’s employment with the Company for the reasons described in Section 4(b) of this Agreement, the Employee will receive payment of the Employee’s Termination Bonus, subject to the release requirements described in such Section. In the event of the termination of the Employee’s employment with the Company for the reasons described in Section 4(c) of this Agreement, the Employee will receive payment of two (2) times the Employee’s Termination Bonus, subject to the release requirements described in such Section. In the event of the termination of the Employee’s employment with the Company for the reasons described in either Sections 4(e) or 4(f) of this Agreement, the Employee (or her estate) will receive payment of a pro rata portion of the Employee’s Termination Bonus, with the pro ration determined based upon a fraction, the numerator of which is the number of days in the current fiscal year in which the Employee was employed by the Company through the date of termination, and the denominator of which is 365.

(h)Health Insurance. In the event of the termination of the Employee’s employment with the Company for the reasons described in either Section 4(b) or 4(c) of this Agreement, subject to the release requirements described in such Section, and provided that the Employee elects to continue the Employee’s coverage under the Company’s health insurance plans in accordance with the Consolidated Omnibus Budget Reconciliation Act of 1986 (“COBRA”), the Company will pay the Employee, monthly, an amount equal to the monthly payments that would be due for continuation coverage with respect to health insurance for a period of the lesser of (i) the period during which the Employee is entitled to receive severance pay under Section 4(b) or Section 4(c), as applicable, (ii) the Employee’s ceasing to be eligible for continuation of health coverage under COBRA, or (iii) eighteen (18) months.

Section 5.Termination of Officer Position with BSIG

(a)Accelerated Vesting of Equity Awards. In the event of the termination of the Employee as Chief Executive Officer of BSIG (A) (i) by BSIG without Cause; or (ii) by Employee for Good Reason, all equity awards granted to the Employee under an equity plan maintained by BSIG shall, to the extent outstanding and unvested immediately prior to such termination, become fully vested and nonforfeitable upon such termination (except for awards subject to a performance-based vesting condition, which shall remain outstanding and continue to be eligible to vest in accordance with their terms); or (B) as a result of the Employee’s death or Disability, all equity awards granted to the Employee under an equity plan maintained by BSIG shall, to the extent outstanding and unvested immediately prior to such termination, become fully vested (at target level, as applicable, for awards subject to a performance-based vesting condition) and nonforfeitable upon such termination.

Section 6.All Business to be the Property of the Company: Assignment of Intellectual Property.

(a)The Employee agrees that all business developed by the Employee for any member of the BSIG Group or by any other employee or officer of the BSIG Group, including without limitation all Client contracts, fees, commissions, compensation records, Client lists, agreements, and any other incident of any business developed by any member of the BSIG Group, or earned or carried on by the Employee for the BSIG Group, are and shall be the exclusive property of the applicable member of the BSIG Group for its sole use, as applicable, and (where applicable) shall be payable directly to the applicable member of the BSIG Group. The Employee agrees that the BSIG Group shall own forever and throughout the world (exclusively during the current and renewed or extended term of copyright anywhere in the world and thereafter, non-exclusively) all rights of any kind or nature now or hereafter known in and to all of the products and results of the Employee’s services performed for BSIG or the Company in any capacity and any and all parts thereof, and the Employee hereby assigns such rights to the BSIG Group. The Employee acknowledges and agrees that all memoranda, notes, records and other documents made or compiled by Employee or made available to Employee during the term of the Employee’s service to BSIG or employment by the Company concerning the business of the BSIG Group shall be the property of the BSIG Group, and, upon termination of employment or upon the request of BSIG or the Company, as applicable, the Employee shall use good faith and commercially reasonable efforts to return all property of the BSIG Group in the Employee’s possession or control. In no event shall the Employee willfully retain such property. Except in performance of services for the BSIG Group, the Employee shall not, either during the Employment Period or thereafter, use for the Employee’s own benefit or for the benefit of any person outside the BSIG Group, any Intellectual Property of any member of the BSIG Group in a manner that would violate rights in and to such Intellectual Property of such member of the BSIG Group.

(b)The Employee shall promptly and fully disclose to BSIG and the Company, as applicable, all Intellectual Property developed or acquired by the Employee while serving as an officer of BSIG or employed by the Company, other than copyrights in or to ordinary or common materials generated by the Employee in the ordinary course of the Employee’s service or employment, as applicable. The Employee hereby assigns and agrees to assign to BSIG (or as otherwise directed by the BSIG) and the Company (or as otherwise directed by the Company), as applicable, the Employee’s full right, title and interest in and to all Intellectual Property developed or acquired by the Employee while serving as an officer of BSIG or employed by the Company. The Employee agrees to execute any and all applications for domestic and foreign patents, copyrights or other proprietary rights and to do such other acts (including without limitation the execution and delivery of assignments, powers of attorney, declarations, affidavits, and instruments of further assurance or confirmation) as may be requested by BSIG or the Company to assign such Intellectual Property to BSIG and/or the Company, as applicable, and to permit BSIG and the Company to enforce any patents, copyrights or other proprietary rights to such Intellectual Property. The foregoing obligations of the Employee shall be performed at Company’s reasonable expense except that the Employee will not charge the BSIG Group for time spent in complying with these obligations. Unless compliance with such obligations is requested by BSIG or the Company in the context of a pending action to enforce said patents, copyrights or other proprietary rights, in no event shall the BSIG Group be obligated to

reimburse the Employee for expenses in excess of $2,500 in connection with complying with these obligations without the prior written consent of BSIG. Under no circumstances shall the Employee be personally obligated to pay for the drafting, filing, or primary prosecution responsibilities associated with a patent application related to such Intellectual Property. All copyrightable works that the Employee creates in connection with or related to the Employee’s services performed for BSIG or the Company shall be considered “work made for hire.” Notwithstanding anything to the contrary herein, the Employee’s obligation to assign the Employee’s rights to Intellectual Property and/or disclose Intellectual Property under this Section 6 shall not apply to any Intellectual Property that the Employee has developed on the Employee’s own time, without using the equipment, supplies, facilities or trade secret information of the BSIG Group, unless such Intellectual Property relates to the current activities of the BSIG Group or to the actual or demonstrably anticipated research or development of the BSIG Group or results from any work performed by the Employee for the BSIG Group.

(c)The Employee recognizes, acknowledges and agrees that the investment performance record (including without limitation performance ratings or rankings provided by any rating or ranking service) of any fund(s) or accounts of Clients with which the Employee is associated while serving as an officer of BSIG or employed at the Company is attributable to a team of professionals of the BSIG Group and not solely the efforts of any single individual and that, therefore, the performance records of the fund(s) or accounts managed by the any member of the BSIG Group are and shall be the exclusive property of the BSIG Group.

Section 7.Confidentiality. The Employee acknowledges that the Employee during the Employee’s service with BSIG and/or employment with the Company has had access to Confidential Information of the BSIG Group and the members thereof and of any Clients and is in contact with such Confidential Information. Except in performance of services for BSIG or the Company, the Employee has not and shall not, either during the Employment Period or thereafter, use for the Employee’s own benefit or disclose to or use for the benefit of any person outside the BSIG Group, any Confidential Information of the BSIG Group or any Clients whether the Employee has such information in Employee’s memory or embodied in writing or other tangible form. All Confidential Information that the Employee generates or to which the Employee obtains access in connection with service as an officer of BSIG or employment with the Company, and all originals and copies of any such Confidential Information, and any other written material relating to the business of the BSIG Group or any Clients that is Confidential Information, shall be the sole property of the BSIG Group. Upon the termination of the Employee’s employment in any manner or for any reason, the Employee shall promptly surrender to the applicable member or members of the BSIG Group, all originals and copies of any such Confidential Information, and the Employee shall not thereafter use any such Confidential Information.

Section 8.Non-Solicitation: Non-Interference. During the Employment Period and for a period of two years after the Employee’s service to BSIG or employment with the Company ends for any reason, the Employee shall not, either alone or in association with others, directly or indirectly do or attempt to do any of the following:

(a)Solicit or call upon any Clients, except on behalf of and for the benefit of the BSIG Group;

(b)Divert or take away any Clients or business of the BSIG Group;

(c)Solicit, induce, or persuade any employee, director, officer, agent, contractor or consultant of the BSIG Group with whom the Employee had contact during the Employee’s employment with the Company to leave or discontinue its business with the BSIG Group; or

(d)otherwise interfere with or disrupt the relationship of the BSIG Group with any person or entity who/that was a Client at any time during the Employment Period.

Section 9.Non-Competition. During the Employment Period and for the duration of the Covenant Period, the Employee shall not, either alone or in association with others, directly or indirectly assist or serve as an employee, employer, owner, operator, manager, advisor, consultant, agent, partner, director, officer, stockholder, volunteer, intern, or in any other similar capacity to any person or entity that is engaged in or is preparing to engage in any Competing Business which (a) involves the same or similar types of services the Employee performed for BSIG or the Company during the Employee’s last two years of service with BSIG or employment with the Company, as applicable; or (b) for which the employee could reasonably be expected to need, use, or disclose Confidential Information. The Employee agrees to refrain from engaging in any such activities in the Restricted Territory. The Employee acknowledges that the consideration provided by the Company and collectively agreed upon by the Employee, BSIG and the Company for the enforcement of this provision is fair and reasonable consideration for the Employee’s compliance with the restrictions set forth herein.

Section 10. Acknowledgments. In consideration of the provisions set forth in this Agreement, the Employee, BSIG and the Company hereby covenant, agree and acknowledge that the periods of time and the geographic area applicable to the covenants contained in Sections 7, 8 and 9 are reasonable, in view of the geographic scope and nature of the business in which the BSIG Group is engaged and the BSIG Group will be engaged, the Employee’s knowledge of the business of the BSIG Group, and the Employee’s relationships Clients. However, if such period or such area should be adjudged unreasonable in any judicial proceeding, then the period of time shall be reduced by such number of months or such area shall be reduced by elimination of such portion of such area, or both, as are deemed unreasonable, so that this covenant may be enforced in such area and during such period of time as are adjudged to be reasonable.

Section 11. Notices. All notices and other communications hereunder shall be in writing and shall be given by hand delivery or courier to the other party addressed as follows:

If to Employee: To the Employee’s most current address on file with the Company

If to the Company: Acadian Asset Management LLC

260 Franklin Street

Boston, MA 02109

Attention: CEO

With a copy to: BrightSphere Investment Group Inc.

200 State Street, 13th Floor

Boston, MA 02109

Attention: Secretary

If to BSIG: BrightSphere Investment Group Inc.

200 State Street, 13th Floor

Boston, MA 02109

Attention: Secretary

Section 12. Assignability. This Agreement shall be binding upon and inure to the benefit of BSIG and the Company, and to any person or firm who may succeed to all or substantially all of the assets of BSIG or the Company, as applicable, or of any affiliate of BSIG or the Company, as applicable, for which the Employee provides a majority of the Employee’s services. The Employee agrees that any such assignment shall specifically include Sections 6-9 of this Agreement, as modified by the BSIG or Company in order to reflect the assignment to the successor or affiliate, provided that no such modification shall expand the nature of the restrictions in Section 8 and 9 of this Agreement. This Agreement shall not be assignable by the Employee.

Section 13. Entire Agreement. This Agreement contains the entire agreement between BSIG, the Company and the Employee with respect to the subject matter hereof, and, as of the Effective Date, supersedes all prior oral and written agreements, including the Prior Employment Agreement and any other employment agreements, between BSIG, the Company and the Employee with respect to the subject matter hereof, including without limitation any oral agreements; provided, however, for the avoidance of doubt, that the Employee’s restrictive covenant obligations under the Prior Employment Agreement, expressly including Employee’s obligations regarding Confidential Information and Intellectual Property, are not extinguished and are herein incorporated.

Section 14. Equitable Relief. The Employee recognizes and agrees that the BSIG’s and the Company’s remedies at law for any breach of the provisions of Sections 6 through 8 (inclusive) would be inadequate and that for breach or threatened breach of such provisions BSIG and the Company shall, in addition to such other remedies as may be available at law or in equity or as provided in this Agreement, be entitled to injunctive relief and to enforce its or their rights by an action for specific performance to the extent permitted by law, without posting a bond and, in the event the Employee’s employment with the Company is terminated for Cause, to the right of set off against any amounts due to the Employee by BSIG or the Company. The Employee hereby waives the adequacy of a remedy at law as a defense to such relief.

Section 15. Waivers and Further Agreements. Neither this Agreement nor any term or condition hereof, including without limitation the terms and conditions of this Section 15 may be waived or modified in whole or in part as against BSIG, the Company or the Employee except by written instrument executed by or on behalf of each of the parties other than the party seeking such waiver or modification, expressly stating that it is intended to operate as a waiver or modification of this Agreement or the applicable term or condition hereof, it being understood that any action under this Section 15 on behalf of the Company may be taken only with the approval of the BSIG Board or a duly authorized representative thereof.

Section 16. Amendments. This Agreement may not be amended, nor shall any change, modification, consent, or discharge be effected, except by written instrument executed by or on behalf of the party against whom enforcement of any change, modification, consent or discharge is sought, it being understood that any action under this Section 16 on behalf of the Company may be taken only with the approval of the BSIG Board or a duly authorized representative thereof.

Section 17. Severability. If any provision of this Agreement shall be held or deemed to be invalid, inoperative or unenforceable in any jurisdiction or jurisdictions, because of conflicts with any constitution, statute, rule or public policy or for any other reason, such circumstance shall not have the effect of rendering the provision in question unenforceable in any other jurisdiction or in any other case or circumstance or of rendering any other provisions herein contained unenforceable to the extent that such other provisions are not themselves actually in conflict with such constitution, statute or rule of public policy, but this Agreement shall be reformed and construed in any such jurisdiction or case as if such invalid, inoperative, or unenforceable provision had never been contained herein and such provision reformed so that it would be enforceable to the maximum extent permitted in such jurisdiction or in such case.

Section 18. No Conflicting Obligations. The Employee represents and warrants to BSIG and the Company that the Employee is not now under any obligation to any person, firm or corporation, other than the Company or BSIG and has no other interest which is inconsistent or in conflict with this Agreement, or which would prevent, limit, or impair, in any way, the Employee’s performance of any of the covenants or duties hereinabove set forth.

Section 19. Tax Matters.

(a) If and to the extent any portion of any payment, compensation or other benefit provided to the Employee in connection with the Employee’s employment termination is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A of the Internal Revenue Code of 1986 (“Section 409A” and the “Code,” respectively) and the Employee is a specified employee as defined in Section 409A(2)(B)(i) of the Code, as determined by the Company in accordance with its procedures, by which determination the Employee hereby agrees that the Employee is bound, such portion of the payment, compensation or other benefit shall not be paid before the day that is six months plus one day after the date of separation from service (as determined under Section 409A of the Code (the “New Payment Date”), except as Section 409A of the Code may then permit. The aggregate of any payments that otherwise would have been paid to the Employee during the period between the date of separation from service and the New Payment Date shall be paid to the Employee in a lump sum on such New Payment Date, and any remaining payments will be paid on their original schedule. For purposes of this Agreement, each amount to be paid or benefit to be provided shall be construed as a separate identified payment for purposes of Section 409A of the Code, and any payments described in this Section 17 that are due within the “short term deferral period” as defined in Section 409A of the Code shall not be treated as deferred compensation unless applicable law requires otherwise. None of the Company, BSIG or the Employee shall have the right to accelerate or defer the delivery of any such payments or benefits except to the extent specifically permitted or required by Section 409A of the Code. This Agreement is intended to comply with the provisions of Section 409A of the Code and the Agreement shall, to the extent practicable, be construed in accordance therewith. Terms defined in the Agreement shall have

the meanings given such terms under Section 409A of the Code if and to the extent required in order to comply with Section 409A of the Code. Notwithstanding the foregoing, to the extent that the Agreement or any payment or benefit hereunder shall be deemed not to comply with Section 409A of the Code, then none of the Company, the Board of Managers, BSIG, the BSIG Board or its or their designees or agents shall be liable to the Employee or any other person for any actions, decisions or determinations made in good faith.

(b) The Employee agrees and acknowledges that neither BSIG nor the Company has made any representations or warranties regarding the tax treatment or tax consequences of any compensation, benefits or payments under this Agreement. The Employee shall be responsible for all taxes with respect to any payments or benefits hereunder, except for the Company’s portion of any Social Security and Medicare taxes, and the Employee shall indemnify the Company for any tax liabilities or penalties it may incur by reason thereof. All payments hereunder shall be reduced by applicable withholding and payroll taxes.

Section 20. Governing Law. The execution, interpretation, and performance of this Agreement and any claims arising out of this Agreement shall be governed by the laws of the Commonwealth of Massachusetts without regard to the conflict of law provisions thereof. BSIG, the Company and the Employee hereby consent to the jurisdiction of any state or federal court located within Suffolk County, Massachusetts, waive personal service of process, and assent that service of process may be made by registered mail to the parties’ respective addresses as provided in Section 11 hereof and shall be effective in the same manner as notices are effective under such Section 11. THE COMPANY, BSIG AND THE EMPLOYEE EACH IRREVOCABLY WAIVES ANY RIGHT TO A TRIAL BY JURY IN ANY ACTION, SUIT, OR OTHER LEGAL PROCEEDING ARISING UNDER OR RELATING TO ANY PROVISION OF THIS AGREEMENT, EXCEPT WITH RESPECT TO CLAIMS FOR WHICH JURY TRIAL MAY NOT BE WAIVED.

Section 21. Opportunity to Consult with Counsel. By signing this Agreement, the Employee acknowledges that BSIG and the Company have informed her of her right to consult with independent legal counsel prior to signing this Agreement and has given her a minimum of ten (10) business days to do so. The Employee further acknowledges that she has read this agreement carefully, she understands and accepts its terms, and is entering into this agreement freely and voluntarily.

[Signature page follows]

IN WITNESS WHEREOF, the parties have executed this Agreement as a sealed instrument as of the date first above written.

EMPLOYEE:

/s/ Kelly-Ann Young

Kelly-Ann Young

Date: September 30, 2024

COMPANY:

Acadian Asset Management LLC

By: /s/ Brendan Bradley

Name: Brendan Bradley

Title: Chief Investment Officer

Date: September 30, 2024

BrightSphere Investment Group Inc.

By: /s/ Richard J. Hart

Name: Richard J. Hart

Title: Chief Legal Officer

Date: September 30, 2024

ANNEX A

“4(b) Severance Period” shall mean eighteen (18) months, provided, however, that if, following the effective date of this Agreement, the Employee transfers any KELP Points during the Employee’s employment with the Company pursuant to Section 8.3 of the Third Amended and Restated Limited Partnership Agreement of Acadian KELP LP, as amended, the period shall be calculated as follows: eighteen months, if the Employee should hold equity interests representing 10% or more of the Class B-2 Interests of the Company at the time the Employee’s employment terminates; twelve months if the Employee should hold equity interests representing 5% or more but less than 10% of the Class B-2 Interests of the Company at the time the Employee’s employment terminates; or six months if the Employee should hold equity interests representing less than 5% of the Class B-2 Interests of the Company at the time the Employee’s employment terminates.

“4(c) Severance Period” shall mean twenty-four (24) months, provided, however, that if, following the effective date of this Agreement, the Employee transfers any KELP Points during the Employee’s employment with the Company pursuant to Section 8.3 of the Third Amended and Restated Limited Partnership Agreement of Acadian KELP LP, as amended, the period shall be calculated as follows: twenty-four months, if the Employee should hold equity interests representing 10% or more of the Class B-2 Interests of the Company at the time the Employee’s employment terminates; eighteen months if the Employee should hold equity interests representing more than 5% or more but less than 10% of the Class B-2 Interests of the Company at the time the Employee’s employment terminates; or twelve months if the Employee should hold equity interests representing less than 5% of the Class B-2 Interests of the Company at the time the Employee’s employment terminates.

“BSIG Group” means, collectively, the Company, BSIG, and any Affiliate of BSIG.

“Cause” shall mean the Employee’s: (i) participation in conduct constituting a violation of any federal or state law applicable to the securities industry, larceny, embezzlement, conversion or any other act involving the misappropriation of the funds of the BSIG Group in the course of employment or participation in any illegal conduct that causes material damage to the reputation of the BSIG Group; (ii) the willful refusal to follow reasonable and lawful directions from the BSIG Board; (iii) conviction of a felony or any final adjudication of commission of fraud against any member of the BSIG Group; (iv) commission of any act of gross negligence or intentional misconduct in the performance or non-performance of the Employee’s duties as an employee of the Company or officer of BSIG, including but not limited to a failure to disclose any conflict of interest that constitutes such gross negligence or intentional misconduct; or (v) a material breach by the Employee of any agreement with BSIG or the Company, or a willful violation of any BSIG or Company policy; provided, however, that if such breach is curable (including, by way of example, an unintentional misappropriation of funds), “Cause” shall mean the Employee’s failure to cure such breach within forty-five (45) days’ after prior written notice of breach by BSIG or the Company, as applicable.

“Client” shall include all Past, Present and Potential Clients.

“Competing Business” means any business or part thereof that provides investment management services or that otherwise competes with services provided by the BSIG Group to any Client.

“Confidential Information” means any proprietary information, research, client lists, data, trade secrets or know-how, including, without limitation, proprietary information relating to investment, technical and research data, products, services, clients, prospective clients, markets, costs, pricing, methods, processes, employee lists, supplier lists, software, forms and records, developments, prospects, marketing, finances or other business information of the BSIG Group or any Client, whether disclosed to the Employee by any member of the BSIG Group or its Clients directly or indirectly, in writing or other tangible form, orally or by observation. Notwithstanding anything to the contrary set forth herein, the term “Confidential Information” does not include any information which (a) was in Employee’s possession without a duty of confidentiality before receipt from the BSIG Group; (b) is or becomes a matter of public knowledge through no fault of the Employee; (c) is rightfully received by the Employee from a third party without a duty of confidentiality; (d) is disclosed under operation of law; (e) is disclosed by the Employee with the prior written approval of the applicable member of the BSIG Group; or (f) is general knowledge and skill acquired by the Employee.

“Covenant Period” shall mean the twelve-month period after the Employee’s employment with the Company ends for any reason. In the event that the Employee breaches her fiduciary duty to BSIG or the Company or unlawfully takes, physically or electronically, property belonging to any member of the BSIG Group, the Covenant Period shall be extended for one additional year, for a maximum period of two years following the termination of the Employee’s employment with the Company. Should the Covenant Period be extended due to the Employee’s breach of her fiduciary duty to BSIG or the Company or unlawful taking of property belonging to any member of the BSIG Group, the Company shall not be required to provide payments to the employee during the extension of the Covenant Period.

“Disability” means the Employee’s inability to perform the essential functions of the Employee’s position due to physical or mental disability that (i) has continued for at least 120 consecutive days or (ii) exists for a cumulative total of at least 180 days during any twelve-month period; provided that such inability cannot be accommodated in accordance with the Americans with Disabilities Act of 1990, as amended, or other applicable federal or state laws or regulations.

“Employment Period” means the period beginning on the Effective Date and ending on the last day on which the Employee is an officer of BSIG or employee of the Company, whichever is later.

“Good Reason” means any of the following that shall occur without the Employee’s written consent: (i) any material breach of this Agreement by BSIG or the Company, as applicable, or any successor to BSIG or the Company, as applicable; (ii) a material reduction by the Company or BSIG (or any successor to the Company or BSIG) in the Employee’s job responsibilities, duties, or authority for the Company and/or BSIG; or (iii) a material reduction in the Employee’s gross annual salary or the Target Bonus; provided, however, that an occurrence shall not be deemed to be Good Reason unless (a) the Employee has provided written notice to BSIG or the Company, as applicable, of the occurrence no more than 45 days after it occurs and of the Employee’s intent to resign for such Good Reason and (b) has provided BSIG or the Company, as applicable, not less than 45 days after BSIG’s or the Company’s, as applicable, receipt of such written notice within which to cure the occurrence. For the avoidance of doubt, the termination or removal of the Employee as Chief Executive Officer of BSIG, or a material reduction in her job responsibilities, duties, or authority for BSIG, will not be considered, or give rise to a claim for, Good Reason as it relates to the Company.

“Intellectual Property” means all United States, international and foreign intellectual property, including, without limitation, any or all of the following: (a) all rights in inventions, and proprietary methods and processes (in each case, whether patentable or not), as well as all United States, international and foreign patents and applications therefor, and all reissues, divisions, renewals, extensions, provisionals, continuations and continuations-in-part thereof throughout the world; (b) all proprietary information, trade secrets, and know how, including but not limited to, confidential software, source code, invention disclosures, improvements, customer lists, supplier lists, business plans, development projects, technical data, and documentation; (c) all rights in expressive works of authorship, whether or not copyright registration has been obtained therefor, including without limitation all copyrights, copyright registrations and applications therefore and all other rights corresponding thereto, including all moral rights of authors, throughout the world; (d) all rights in trade names, marks and brand identifiers used in connection with the business of BSIG or the Company, whether or not registration has been obtained or applied for, all trademarks, service marks, trade names, trade dress, domain names, slogans, and logos, and registrations and applications therefore throughout the world, and all goodwill arising from or associated with the foregoing; and (e) all computer source code and object code.

“Past Client” shall mean at any particular time any person or entity who at any point within the last 18 months had been but at such time is not an advisee, customer, or client of any member of the BSIG Group.

“Potential Client” shall mean at any particular time any person or entity to whom any member of the BSIG Group, through any of its or their officers or employees, has within one year prior to such time offered (by means of a personal meeting, or a letter or a written proposal specifically directed to the particular person or entity) to provide investment advisory services but who is not at such time an advisee or customer or client of any member of the BSIG Group. Form letters and blanket mailings are specifically excluded from the preceding sentence.

“Present Client” shall mean at any particular time any person or entity who is at such time an advisee, customer, or client of any member of the BSIG Group.

“Restricted Territory” means any city, county, state, and country in which (a) the Employee provided services or had a material presence or influence at any time during the last two years of the Employee’s employment with the Company or (b) in which any member of the BSIG Group provides services or plans to provide services as of the time of termination of the Employee’s employment.

“Target Bonus” shall mean $8.35 million. Such target amount shall be reviewed annually by the BSIG Board or the Compensation Committee.

“Termination Bonus” for purposes of this Agreement shall mean a bonus equal to the average amount of the Bonuses, plus any commissions, paid to the Employee by the Company, its predecessors or successors for the last three (3) fiscal years (or such shorter time as the Employee has been employed by the Company, its predecessors or successors). For the avoidance of doubt, “Termination Bonus” shall be calculated based on the cash bonus, plus any commissions, paid to the Employee without regard to any long-term incentive plans, stock appreciation rights, or equity interests held or awarded to the Employee.

Contact:

Investor Relations

ir@bsig.com

(617) 369-7300

BrightSphere Appoints Kelly Young as President and Chief Executive Officer,

Announces Rebranding as Acadian Asset Management Inc.

•Kelly Young to become CEO and Director

•BrightSphere Investment Group to rebrand to Acadian Asset Management Inc.

•BSIG ticker to change to AAMI

BOSTON, October 1, 2024 – BrightSphere Investment Group Inc. (NYSE: BSIG), or the “Company,” today announced that it is taking the logical next step in transitioning from its multi-boutique legacy structure to an efficient, streamlined and singularly focused asset manager. As part of this transition, which included the successful divestiture of six (6) of the company’s seven (7) affiliates, the Board of Directors has appointed Kelly Young, Chief Executive Officer of the Company’s sole remaining affiliate, Acadian Asset Management, as the Company’s President and Chief Executive Officer. Additionally, Ms. Young has been appointed to the Board of Directors of the Company. Ms. Young will continue to run the day-to-day operations of the Acadian Asset Management business. All changes are effective January 1, 2025.

Acadian, with $113 billion of assets under management and over 35 years of data-driven insights, is one of the top performing systematic investment managers in the world with unique capabilities in active equities, credit, and alternatives. Acadian uses rigorous portfolio construction, risk controls, and trading models to achieve outstanding investment performance, with 93%, 86%, 92% and 93% of strategies by revenue outperforming benchmarks over 1-, 3-, 5-, and 10-year periods.

As part of the transition, BSIG plans to change its name to Acadian Asset Management Inc., and the Company’s New York Stock Exchange symbol for its common stock will change to AAMI from BSIG. The Company’s New York Stock Exchange symbol for its 4.800% notes due 2026 will change to AAMI 26 from BSIG 26. Trading under the new name and symbol will begin on or about January 2, 2025.

“This repositioning of the public company allows for continued, sustained success and organic growth,” said Ms. Young. “I’m excited to continue working alongside the experienced team at Acadian and the Board to deliver best-in-class investment performance, diversified systematic strategies, and top-tier service to our investors.” Ms. Young will lead the more streamlined enterprise with a continued focus on generating alpha across its systematic investment platform. She added, “client-centered engagement is at the foundation of our business and will remain at the core of everything we do.”

In connection with the appointment of Ms. Young as President and Chief Executive Officer of the Company, Suren Rana will step down as President and Chief Executive Officer, effective December 31, 2024. There are no additional changes in personnel at Acadian or BrightSphere expected in connection with this transition.

“When I acquired our stake in BrightSphere, we had seven different affiliates. Over time we sold six of the affiliates to strategic acquirors and kept our crown jewel Acadian. This simplification of our business also allowed us to return $1.3 billion of capital to shareholders via share buybacks and strengthen our balance sheet by reducing debt. We also reduced our corporate overhead by approximately 70% over time, while making meaningful investments in expanding Acadian’s business into new areas including credit and equity alternatives which we expect will help generate sustained organic growth for the Company over time. Collectively, these efforts have produced strong returns for our shareholders. I thank Suren for his leadership and execution of this business transformation and wish him continued success in his future endeavors.

“This evolution to a single asset management company presents an exciting opportunity to focus exclusively on this exceptional business. At $113bn of AUM, Acadian has the scale, expertise, and track record to prosper as an independent public company. Kelly has years of hands-on experience building trusted relationships with Acadian’s clients from around the globe and is best positioned to lead the Company going forward. I look forward to continuing our work to build future value for Acadian’s clients and our shareholders,” said John Paulson, Chairman of the Board of Directors.

About BrightSphere and Acadian

BrightSphere is a global asset management holding company with one operating subsidiary, Acadian Asset Management, with approximately $113 billion of assets under management as of June 30, 2024. Acadian offers institutional investors across the globe access to a wide array of leading systematic strategies designed to meet a range of risk and return objectives. For more information, please visit BrightSphere’s website at www.bsig.com or Acadian’s website at www.acadian-asset.com. Information that may be important to investors will be routinely posted on the BSIG website.

Forward-Looking Statements

This press release includes forward-looking statements which may include, from time to time, statements about the Company’s board and management transition, the changes to the Company’s name and New York Stock Exchange symbols, and the Company’s operations, prospects and the anticipated performance of its business going forward. The words or phrases ‘‘will be,’’ ‘‘will continue,’’ ‘‘will remain,’’ ‘‘may be,’’ “plans,” and other similar expressions are intended to identify such forward-looking statements. Such statements are subject to various known and unknown risks and uncertainties and readers should be cautioned that any forward-looking information provided by or on behalf of the Company is not a guarantee of future performance.

Actual results may differ materially from those in forward-looking information as a result of various factors, some of which are beyond the Company’s control. Additional factors that could

cause actual results to differ from the forward-looking statements in this release include: the board and management transition and the name and symbol changes may not occur as expected, including on the planned timing, or result in the expected benefits; our reliance on key personnel; our use of a limited number of investment strategies; our ability to attract and retain assets under management; the potential for losses on seed and co-investment capital; foreign currency exchange risk; risks associated with government regulation; and other facts that may be described in the Company's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 28, 2024. Due to such risks and uncertainties and other factors, the Company cautions each person receiving such forward-looking information not to place undue reliance on such statements. Further, such forward-looking statements speak only as of the date of this press release and the Company undertakes no obligations to update any forward-looking statement to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

This communication does not constitute an offer for any fund managed by the Company or any Affiliate of the Company.

v3.24.3

Cover Page

|

Sep. 30, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 30, 2024

|

| Entity Registrant Name |

BrightSphere Investment Group Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38979

|

| Entity Tax Identification Number |

47-1121020

|

| Entity Address, Address Line One |

200 State Street

|

| Entity Address, Address Line Two |

13th Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02109

|

| City Area Code |

617

|

| Local Phone Number |

369-7300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001748824

|

| Amendment Flag |

false

|

| Common stock, par value $0.001 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

BSIG

|

| Security Exchange Name |

NYSE

|

| 4.800% Notes due 2026 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.800% Notes due 2026

|

| Trading Symbol |

BSIG 26

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bsig_A4800NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

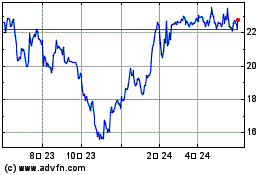

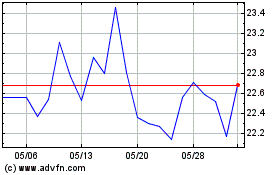

BrightSphere Investment (NYSE:BSIG)

過去 株価チャート

から 10 2024 まで 11 2024

BrightSphere Investment (NYSE:BSIG)

過去 株価チャート

から 11 2023 まで 11 2024