Growth in Fiber Customer Net Adds and Mobile

Line Net Adds Positive Trends in Customer Experience, Network, and

Operations Optimum Portfolio Evolution Roadmap to Deliver More

Value to Customers Recognized with Network Quality Rankings by

PCMag®(1) and Ookla® Speedtest®(2)

Altice USA (NYSE: ATUS) today reports results for the second

quarter ended June 30, 2024.

Dennis Mathew, Altice USA Chairman and Chief Executive

Officer, said: "In the second quarter our company achieved

significant improvements in operational metrics and customer

satisfaction, growth in our fiber, mobile, and B2B businesses, and

continued stabilization of ARPU across our base. We elevated

product and network quality, introduced refreshed go-to-market

strategies, which are starting to gain traction, and launched

Entertainment TV, Optimum's new low-cost internet TV package

available exclusively on Optimum Stream, providing more choice and

flexibility for customers. Looking ahead, we have an innovative

roadmap of future product and experience enhancements that we are

eager to bring to current and prospective customers this year and

beyond, and we remain focused on advancing network and service

quality, driving profitable customer relationships, and maintaining

financial discipline.”

Second Quarter 2024

Financial Overview

- Total revenue of $2.2 billion (-3.6% year over

year).

- Residential revenue of $1.8 billion (-4.4% year over

year).

- Residential revenue per user (ARPU)(3) of $135.95 (-1.1% or

($1.49) year over year).

- Business Services revenue of $369.3 million (+1.3% year

over year).

- News and Advertising revenue of $105.3 million (-7.2%

year over year).

- Net income attributable to stockholders of $15.4 million

($0.03/share on a diluted basis) in Q2 2024 and $78.3 million

($0.17/share on a diluted basis) in Q2 2023.

- Net cash flows from operating activities of $306.8

million in Q2 2024 compared to $438.8 million in Q2 2023.

- Adjusted EBITDA(4) of $867.2 million (-5.9% year over

year), and margin of 38.7%.

- Cash capital expenditures of $347.7 million (-26.6% year

over year) and capital intensity(5) of 15.5% (12.9% excluding FTTH

and new builds). We have remained disciplined on capital spend in

the first half of this year and now anticipate cash capital

expenditures under $1.6 billion in full year 2024.

- Free Cash Flow (Deficit)(4) of ($40.9) million,

including $57 million of higher cash taxes in Q2 2024 year over

year.

Second Quarter 2024 Key Operational

Highlights

- Significant Growth in Net Promoter Scores (NPS) Driven by

Improved Customer Experience (CX)

- Transactional NPS (tNPS)(6) grew +34 points in the last 2 years

from Q2 2022 to Q2 2024.

- Continued CX Improvement with a Focus on Operations and Base

Management:

- >700k customers speed rightsized in the last 8 months.

- ~1.7 million fewer inbound calls(7) LTM Q2 2024.

- ~235k fewer truck rolls(8) LTM Q2 2024.

- +56% increase in self-install rate(9) Q2 2024.

- Hyper-local go-to-market approach leveraging our brand

platform, Where Local is Big Time, bringing the reach of a

large national provider with the attention of a local

business.

- Optimum Portfolio Evolution to Deliver More Value:

Medium-Term Roadmap

- Introduce Value Added Services to create new revenue streams

with existing customers, including Direct-to-Consumer partnerships,

Total Care and Mobile Device Protection, among others.

- Continue enhancing the broadband experience: Grow fiber

penetration, increase HFC broadband capacity, and enhance customer

value and experience with speed rightsizing.

- Increase customer stickiness by amplifying mobile across

residential and business channels, and expanding the company's

suite of smart devices and offerings.

- Expand B2B product portfolio and Lightpath enterprise business

by continuing to grow subscribers and ARPU.

- Evolve the video business to give customers more options

through innovative video packages, improved programming agreements,

and the continued expansion of Optimum Stream.

- Launched Entertainment TV in July 2024, Optimum's new

low-cost internet TV package, available exclusively on Optimum

Stream, and offering 80+ top-rated channels.

- Strong Fiber Net Adds Reaching 434k Fiber Customers, a +74%

Increase in Total Fiber Customers Compared to Q2 2023

- Fiber customer growth continued in Q2 2024 with +40k fiber net

additions, driven by migrations of existing customers and fiber

gross additions.

- Penetration of the fiber network reached 15.3% at the end of Q2

2024, up from 9.4% at the end of Q2 2023.

- Mobile Line Net Adds of +33k in Q2 2024; 2.0x Acceleration

Year Over Year; Reaching 385k Lines

- Optimum Mobile line net additions of +33k in Q2 2024, compared

to +16k in Q2 2023.

- Mobile customer penetration of the broadband base was 5.8% at

the end of Q2 2024, up from 3.8% at the end of Q2 2023.

- Total Broadband Primary Service Units (PSUs) Net Losses of

-51k

- Broadband net losses were -51k in Q2 2024, compared to -37k in

Q2 2023.

- Broadband subscriber net losses in the quarter were principally

driven by seasonal university disconnects, continued competitive

and macro pressures, and less activity in the low-income segment

which is partially attributable to the impact of ACP

sunsetting.

- Continued Progress in Building Quality Broadband Network

Experiences

- Externally recognized for network performance: In New York and

New Jersey, Optimum Fiber was named the best and fastest Internet

provider by PCMag®(1) and having the fastest and most reliable

Internet speeds by Ookla® Speedtest®(2).

- Capital intensity(5) of 15.5% in Q2 2024 compared to 20.4% in

Q2 2023.

- Fiber passings additions of +62k in Q2 2024, reaching 2.8

million fiber passings, and targeting approximately 3 million fiber

passings by year-end 2024.

- Total passings additions of +67k in Q2 2024, reaching 9.7

million total passings, and targeting over 175k additional passings

in full year 2024.

- Continued investment in network enhancements: Increasing

broadband speeds, node splits at lower costs, and proactive network

maintenance.

Balance Sheet Review as of June 30,

2024

- Net debt(10) for CSC Holdings, LLC Restricted

Group was $23,167 million at the end of Q2 2024, representing

net leverage of 7.3x L2QA(11).

- The weighted average cost of debt for CSC Holdings, LLC

Restricted Group was 6.6% and the weighted average life of debt was

4.6 years.

- Net debt(10) for Cablevision Lightpath LLC was

$1,413 million at the end of Q2 2024, representing net leverage of

5.9x L2QA(11).

- The weighted average cost of debt for Cablevision Lightpath LLC

was 5.4% and the weighted average life of debt was 3.6 years.

- Consolidated net debt(10) for Altice USA was

$24,566 million, representing consolidated net leverage of 7.2x

L2QA(11).

- The weighted average cost of debt for consolidated Altice USA

was 6.5% and the weighted average life of debt was 4.6 years.

Shares Outstanding

As of June 30, 2024, we had 460,583,380 combined shares of Class

A and Class B common stock outstanding.

Customer Metrics

(in thousands, except per customer

amounts)

Q1-23

Q2-23

Q3-23

Q4-23

FY-23

Q1-24

Q2-24

Total Passings(12)

9,512.2

9,578.6

9,609.0

9,628.7

9,628.7

9,679.3

9,746.4

Total Passings additions

48.4

66.4

30.4

19.7

164.9

50.6

67.2

Total Customer

Relationships(13)(14)

Residential

4,472.4

4,429.5

4,391.5

4,363.1

4,363.1

4,326.8

4,272.3

SMB

380.9

381.0

381.1

380.3

380.3

379.7

379.7

Total Unique Customer Relationships

4,853.3

4,810.5

4,772.6

4,743.5

4,743.5

4,706.5

4,652.0

Residential net additions (losses)

(26.1)

(42.9)

(38.0)

(28.4)

(135.4)

(36.3)

(54.5)

Business Services net additions

(losses)

(0.3)

0.1

0.1

(0.8)

(0.9)

(0.7)

0.0

Total customer net additions (losses)

(26.4)

(42.7)

(37.9)

(29.2)

(136.2)

(37.0)

(54.5)

Residential PSUs

Broadband

4,263.7

4,227.0

4,196.0

4,169.0

4,169.0

4,139.7

4,088.7

Video

2,380.5

2,312.2

2,234.6

2,172.4

2,172.4

2,094.7

2,021.9

Telephony

1,703.5

1,640.8

1,572.7

1,515.3

1,515.3

1,452.1

1,391.1

Broadband net additions (losses)

(19.2)

(36.8)

(31.0)

(27.0)

(113.9)

(29.4)

(51.0)

Video net additions (losses)

(58.6)

(68.3)

(77.6)

(62.2)

(266.7)

(77.7)

(72.8)

Telephony net additions (losses)

(60.6)

(62.7)

(68.1)

(57.4)

(248.9)

(63.1)

(61.1)

Residential ARPU ($)(3)(15)

135.32

137.44

138.42

136.01

136.80

135.67

135.95

SMB PSUs

Broadband

349.0

349.1

349.4

348.9

348.9

348.5

348.8

Video

95.3

93.7

91.9

89.6

89.6

87.3

85.4

Telephony

210.0

208.0

205.9

203.2

203.2

200.7

199.2

Broadband net additions (losses)

(0.1)

0.1

0.3

(0.5)

(0.2)

(0.4)

0.3

Video net additions (losses)

(2.0)

(1.6)

(1.8)

(2.3)

(7.7)

(2.3)

(1.9)

Telephony net additions (losses)

(2.3)

(2.0)

(2.1)

(2.6)

(9.1)

(2.6)

(1.4)

Total Mobile Lines(16)

Mobile ending lines

247.9

264.2

288.2

322.2

322.2

351.6

384.5

Mobile ending lines excluding free

service

223.3

257.9

288.1

322.2

322.2

351.6

384.5

Mobile line net additions

7.6

16.3

24.1

34.0

82.0

29.3

33.0

Mobile line net additions ex-free

service

14.6

34.6

30.3

34.1

113.5

29.3

33.0

Fiber (FTTH) Customer Metrics

(in thousands)

Q1-23

Q2-23

Q3-23

Q4-23

FY-23

Q1-24

Q2-24

FTTH Total Passings(17)

2,373.0

2,659.5

2,720.2

2,735.2

2,735.2

2,780.0

2,842.0

FTTH Total Passing additions

214.2

286.6

60.7

14.9

576.4

44.8

62.0

FTTH Residential

207.2

245.9

289.3

333.8

333.8

385.2

422.7

FTTH SMB

2.7

3.9

5.7

7.6

7.6

9.4

11.4

FTTH Total customer

relationships(18)

209.9

249.7

295.1

341.4

341.4

394.6

434.1

FTTH Residential net additions

37.2

38.6

43.4

44.5

163.8

51.4

37.5

FTTH SMB net additions

0.9

1.2

1.9

1.8

5.8

1.9

2.0

FTTH Total customer net

additions

38.1

39.8

45.3

46.3

169.7

53.2

39.5

Altice USA Consolidated

Operating Results

(in thousands, except per share

data)

(Unaudited)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Revenue:

Broadband

$

914,989

$

965,865

$

1,831,983

$

1,922,910

Video

739,445

775,138

1,495,039

1,545,739

Telephony

71,703

76,069

142,668

153,750

Mobile

27,479

18,147

52,372

33,673

Residential revenue

1,753,616

1,835,219

3,522,062

3,656,072

Business services and wholesale

369,290

364,704

734,151

728,345

News and Advertising

105,280

113,465

211,005

212,202

Other

12,569

10,886

24,472

21,633

Total revenue

2,240,755

2,324,274

4,491,690

4,618,252

Operating expenses:

Programming and other direct costs

719,460

762,280

1,463,347

1,533,999

Other operating expenses

670,542

656,128

1,344,792

1,307,373

Restructuring, impairments and other

operating items

(46,599

)

5,178

4,654

34,850

Depreciation and amortization (including

impairments)

395,770

418,705

784,161

834,917

Operating income

501,582

481,983

894,736

907,113

Other income (expense):

Interest expense, net

(442,955

)

(406,709

)

(880,096

)

(795,987

)

Gain on investments and sale of affiliate

interests, net

—

—

292

192,010

Loss on derivative contracts, net

—

—

—

(166,489

)

Gain on interest rate swap contracts,

net

13,574

61,165

55,877

46,736

Gain (loss) on extinguishment of debt and

write-off of deferred financing costs

—

—

(7,035

)

4,393

Other income (loss), net

(1,486

)

(1,570

)

(3,031

)

8,635

Income before income taxes

70,715

134,869

60,743

196,411

Income tax expense

(49,013

)

(48,725

)

(51,937

)

(79,097

)

Net income

21,702

86,144

8,806

117,314

Net income attributable to noncontrolling

interests

(6,341

)

(7,844

)

(14,638

)

(13,149

)

Net income (loss) attributable to

Altice USA stockholders

$

15,361

$

78,300

$

(5,832

)

$

104,165

Basic net income (loss) per

share

$

0.03

$

0.17

$

(0.01

)

$

0.23

Diluted net income (loss) per

share

$

0.03

$

0.17

$

(0.01

)

$

0.23

Basic weighted average common

shares

459,995

454,688

458,682

454,687

Diluted weighted average common

shares

459,995

454,688

458,682

455,139

Altice USA Consolidated

Statements of Cash Flows

(in thousands)

(Unaudited)

Six Months Ended June 30,

2024

2023

Cash flows from operating activities:

Net income

$

8,806

$

117,314

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization (including

impairments)

784,161

834,917

Gain on investments and sale of affiliate

interests, net

(292

)

(192,010

)

Loss on derivative contracts, net

—

166,489

Loss (gain) on extinguishment of debt and

write-off of deferred financing costs

7,035

(4,393

)

Amortization of deferred financing costs

and discounts (premiums) on indebtedness

11,123

18,359

Share-based compensation

30,181

13,253

Deferred income taxes

(9,818

)

(113,402

)

Decrease in right-of-use assets

22,701

22,925

Allowance for credit losses

45,932

43,946

Other

3,674

9,188

Change in operating assets and

liabilities, net of effects of acquisitions and dispositions:

Accounts receivable, trade

(8,230

)

(10,611

)

Prepaid expenses and other assets

(119,050

)

(58,842

)

Amounts due from and due to affiliates

(49,742

)

31,213

Accounts payable and accrued

liabilities

(20,954

)

(22,816

)

Deferred revenue

(835

)

6,649

Interest rate swap contracts

1,763

(6,492

)

Net cash provided by operating

activities

706,455

855,687

Cash flows from investing activities:

Capital expenditures

(683,816

)

(1,056,342

)

Payments for acquisitions, net of cash

acquired

(2,025

)

—

Other, net

(52

)

(1,578

)

Net cash used in investing activities

(685,893

)

(1,057,920

)

Cash flows from financing activities:

Proceeds from long-term debt

3,775,000

1,900,000

Repayment of debt

(3,635,449

)

(1,739,493

)

Proceeds from derivative contracts in

connection with the settlement of collateralized debt

—

38,902

Principal payments on finance lease

obligations

(68,788

)

(76,100

)

Payment related to acquisition of a

noncontrolling interest

(7,261

)

—

Additions to deferred financing costs

(17,553

)

—

Other, net

(5,638

)

(7,974

)

Net cash provided by financing

activities

40,311

115,335

Net increase (decrease) in cash and cash

equivalents

60,873

(86,898

)

Effect of exchange rate changes on cash

and cash equivalents

(817

)

548

Net increase (decrease) in cash and cash

equivalents

60,056

(86,350

)

Cash, cash equivalents and restricted cash

at beginning of year

302,338

305,751

Cash, cash equivalents and restricted cash

at end of year

$

362,394

$

219,401

Reconciliation of Non-GAAP Financial Measures

We define Adjusted EBITDA, which is a non-GAAP financial

measure, as net income (loss) excluding income taxes, non-operating

income or expenses, gain (loss) on extinguishment of debt and

write-off of deferred financing costs, gain (loss) on interest rate

swap contracts, gain (loss) on derivative contracts, gain (loss) on

investments and sale of affiliate interests, interest expense, net,

depreciation and amortization, share-based compensation,

restructuring, impairments and other operating items (such as

significant legal settlements and contractual payments for

terminated employees). We define Adjusted EBITDA margin as Adjusted

EBITDA divided by total revenue.

Adjusted EBITDA eliminates the significant non-cash depreciation

and amortization expense that results from the capital-intensive

nature of our business and from intangible assets recognized from

acquisitions, as well as certain non-cash and other operating items

that affect the period-to-period comparability of our operating

performance. In addition, Adjusted EBITDA is unaffected by our

capital and tax structures and by our investment activities.

We believe Adjusted EBITDA is an appropriate measure for

evaluating our operating performance. Adjusted EBITDA and similar

measures with similar titles are common performance measures used

by investors, analysts and peers to compare performance in our

industry. Internally, we use revenue and Adjusted EBITDA measures

as important indicators of our business performance and evaluate

management’s effectiveness with specific reference to these

indicators. We believe Adjusted EBITDA provides management and

investors a useful measure for period-to-period comparisons of our

core business and operating results by excluding items that are not

comparable across reporting periods or that do not otherwise relate

to our ongoing operating results. Adjusted EBITDA should be viewed

as a supplement to and not a substitute for operating income

(loss), net income (loss), and other measures of performance

presented in accordance with U.S. generally accepted accounting

principles ("GAAP"). Since Adjusted EBITDA is not a measure of

performance calculated in accordance with GAAP, this measure may

not be comparable to similar measures with similar titles used by

other companies.

We also use Free Cash Flow (defined as net cash flows from

operating activities less cash capital expenditures) as a liquidity

measure. We believe this measure is useful to investors in

evaluating our ability to service our debt and make continuing

investments with internally generated funds, although it may not be

directly comparable to similar measures reported by other

companies.

Reconciliation of Net Income to

Adjusted EBITDA

(in thousands)

(unaudited)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Net income

$

21,702

$

86,144

$

8,806

$

117,314

Income tax expense

49,013

48,725

51,937

79,097

Other loss (income), net

1,486

1,570

3,031

(8,635

)

Gain on interest rate swap contracts,

net

(13,574

)

(61,165

)

(55,877

)

(46,736

)

Loss on derivative contracts, net

—

—

—

166,489

Gain on investments and sale of affiliate

interests, net

—

—

(292

)

(192,010

)

Loss (gain) on extinguishment of debt and

write-off of deferred financing costs

—

—

7,035

(4,393

)

Interest expense, net

442,955

406,709

880,096

795,987

Depreciation and amortization

395,770

418,705

784,161

834,917

Restructuring, impairments and other

operating items

(46,599

)

5,178

4,654

34,850

Share-based compensation

16,424

15,876

30,181

13,253

Adjusted EBITDA

867,177

921,742

1,713,732

1,790,133

Adjusted EBITDA margin

38.7

%

39.7

%

38.2

%

38.8

%

Reconciliation of net cash flow from

operating activities to Free Cash Flow (Deficit)

(in thousands)

(unaudited)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Net cash flows from operating

activities

$

306,794

$

438,841

$

706,455

$

855,687

Capital Expenditures (cash)

347,721

473,445

683,816

1,056,342

Free Cash Flow (Deficit)

$

(40,927

)

$

(34,604

)

$

22,639

$

(200,655

)

Consolidated Net Debt as of June 30,

2024

($ in millions)

CSC Holdings, LLC Restricted

Group

Principal

Amount

Coupon / Margin

Maturity

Drawn RCF

$1,800

SOFR+2.350%

2027

Term Loan B-5

2,873

L+2.500%(19)

2027

Term Loan B-6

1,977

SOFR+4.500%

2028(20)

Guaranteed Notes

1,310

5.500%

2027

Guaranteed Notes

1,000

5.375%

2028

Guaranteed Notes

1,000

11.250%

2028

Guaranteed Notes

2,050

11.750%

2029

Guaranteed Notes

1,750

6.500%

2029

Guaranteed Notes

1,100

4.125%

2030

Guaranteed Notes

1,000

3.375%

2031

Guaranteed Notes

1,500

4.500%

2031

Senior Notes

1,046

7.500%

2028

Legacy unexchanged Cequel Notes

4

7.500%

2028

Senior Notes

2,250

5.750%

2030

Senior Notes

2,325

4.625%

2030

Senior Notes

500

5.000%

2031

CSC Holdings, LLC Restricted Group

Gross Debt

23,484

CSC Holdings, LLC Restricted Group

Cash

(318)

CSC Holdings, LLC Restricted Group Net

Debt

$23,167

CSC Holdings, LLC Restricted Group

Undrawn RCF

$541

Cablevision Lightpath LLC

Principal Amount

Coupon / Margin

Maturity

Drawn RCF(21)

$—

SOFR+3.360%

Term Loan

579

SOFR+3.360%

2027

Senior Secured Notes

450

3.875%

2027

Senior Notes

415

5.625%

2028

Cablevision Lightpath Gross

Debt

1,444

Cablevision Lightpath Cash

(31)

Cablevision Lightpath Net Debt

$1,413

Cablevision Lightpath Undrawn

RCF

$115

Net Leverage Schedules as of June 30,

2024

($ in millions)

CSC Holdings Restricted

Group(22)

Cablevision Lightpath

LLC

CSC Holdings

Consolidated(23)

Altice USA

Consolidated

Gross Debt Consolidated(24)

$23,484

$1,444

$24,928

$24,928

Cash

(318)

(31)

(362)

(362)

Net Debt Consolidated(10)

$23,167

$1,413

$24,566

$24,566

LTM EBITDA

$3,290

$243

$3,532

$3,532

L2QA EBITDA

$3,188

$240

$3,427

$3,427

Net Leverage (LTM)

7.0x

5.8x

7.0x

7.0x

Net Leverage (L2QA)(11)

7.3x

5.9x

7.2x

7.2x

WACD (%)

6.6%

5.4%

6.6%

6.5%

Reconciliation to Financial Reported

Debt

Actual

Total Debenture and Loans from

Financial Institutions (Carrying Amount)

$24,876

Unamortized financing costs and discounts,

net of unamortized premiums

52

Gross Debt Consolidated(24)

24,928

Finance leases and other notes

335

Total Debt

25,263

Cash

(362)

Net Debt

$24,901

(1)

PCMag is a trademark of Ziff Davis, LLC.

Used under license. Reprinted with permission. © 2024 Ziff Davis,

LLC. All Rights Reserved.

(2)

Based on analysis by Ookla® of Speedtest

Intelligence® data, median download speeds, consistency score, NY,

NJ, Q1–Q2 2024. Ookla trademarks used under license and reprinted

with permission.

(3)

Average revenue per user (ARPU) is

calculated by dividing the average monthly revenue for the

respective period derived from the sale of broadband, video,

telephony and mobile services to residential customers by the

average number of total residential customers for the same period

and excludes mobile-only customer relationships. ARPU amounts for

prior periods have been adjusted to include mobile service

revenue.

(4)

See “Reconciliation of Non-GAAP Financial

Measures” beginning on page 7 of this earnings release.

(5)

Capital intensity refers to total cash

capital expenditures as a percentage of total revenue.

(6)

Transactional Net Promoter Score (tNPS)

represents the average monthly satisfaction metric across Care,

Field, Retail and Sales within Fixed, Mobile, and Advanced

Support.

(7)

Compares technical, care and support calls

in the last twelve months (LTM) at the end of Q2-24 compared to the

LTM period at the end of Q2-23.

(8)

Compares service visits or truck rolls,

excluding employee initiated special request orders in the last

twelve months (LTM) at the end of Q2-24 compared to the LTM period

at the end of Q2-23.

(9)

Self set-up % increase is the change in

percentage of residential installs at eligible addresses choosing

self-install, excluding fiber installs.

(10)

Net debt, defined as the principal amount

of debt less cash, and excluding finance leases and other

notes.

(11)

L2QA leverage is calculated as quarter end

net leverage divided by the last two quarters of Adjusted EBITDA

annualized.

(12)

Total passings represents the estimated

number of single residence homes, apartments and condominium units

passed by the HFC and FTTH network in areas serviceable without

further extending the transmission lines. In addition, it includes

commercial establishments that have connected to our HFC and FTTH

network. Broadband services were not available to approximately 30

thousand total passings and telephony services were not available

to approximately 500 thousand total passings.

(13)

Total Unique Customer Relationships

represent the number of households/businesses that receive at least

one of our fixed-line services. Customers represent each customer

account (set up and segregated by customer name and address),

weighted equally and counted as one customer, regardless of size,

revenue generated, or number of boxes, units, or outlets on our

hybrid-fiber-coaxial (HFC) and fiber-to-the-home (FTTH) network.

Free accounts are included in the customer counts along with all

active accounts, but they are limited to a prescribed group. Most

of these accounts are also not entirely free, as they typically

generate revenue through pay-per-view or other pay services and

certain equipment fees. Free status is not granted to regular

customers as a promotion. In counting bulk residential customers,

such as an apartment building, we count each subscribing unit

within the building as one customer, but do not count the master

account for the entire building as a customer. We count a bulk

commercial customer, such as a hotel, as one customer, and do not

count individual room units at that hotel.

(14)

Total Customer Relationship metrics do not

include mobile-only customers.

(15)

Beginning in the second quarter of 2023,

mobile service revenue previously included in mobile revenue is now

separately reported in residential revenue and business services

revenue. In addition, mobile equipment revenue previously included

in mobile revenue is now included in other revenue. Prior period

amounts have been revised to conform with this earnings

release.

(16)

Mobile ending lines include lines

receiving free service. Mobile ending lines excluding free service

exclude additions relating to mobile lines receiving free service

from all periods presented, and includes net additions from when

customers previously on free service start making payments.

(17)

Represents the estimated number of single

residence homes, apartments and condominium units passed by the

FTTH network in areas serviceable without further extending the

transmission lines. In addition, it includes commercial

establishments that have connected to our FTTH network.

(18)

Represents number of households/businesses

that receive at least one of our fixed-line services on our FTTH

network. FTTH customers represent each customer account (set up and

segregated by customer name and address), weighted equally and

counted as one customer, regardless of size, revenue generated, or

number of boxes, units, or outlets on our FTTH network. Free

accounts are included in the customer counts along with all active

accounts, but they are limited to a prescribed group. Most of these

accounts are also not entirely free, as they typically generate

revenue through pay-per view or other pay services and certain

equipment fees. Free status is not granted to regular customers as

a promotion. In counting bulk residential customers, such as an

apartment building, we count each subscribing unit within the

building as one customer, but do not count the master account for

the entire building as a customer. We count a bulk commercial

customer, such as a hotel, as one customer, and do not count

individual room units at that hotel.

(19)

These loans use Synthetic USD LIBOR,

calculated as Term SOFR plus a spread adjustment.

(20)

The Incremental Term Loan B-6 is due on

the earlier of (i) January 15, 2028 and (ii) April 15, 2027 if, as

of such date, any Incremental Term Loan B-5 borrowings are still

outstanding, unless the Incremental Term Loan B-5 maturity date has

been extended to a date falling after January 15, 2028.

(21)

Under the extension amendment to the

Lightpath credit agreement entered into in February 2024, $95

million of revolving credit commitments, if drawn, would be due on

June 15, 2027 and $20 million of revolving credit commitments, if

drawn, would be due on November 30, 2025.

(22)

CSC Holdings, LLC Restricted Group

excludes the unrestricted subsidiaries, primarily Cablevision

Lightpath LLC and NY Interconnect, LLC.

(23)

CSC Holdings Consolidated includes the CSC

Holdings, LLC Restricted Group and the unrestricted

subsidiaries.

(24)

Principal amount of debt excluding finance

leases and other notes.

Certain numerical information is presented on a rounded

basis. Minor differences in totals and percentage calculations may

exist due to rounding.

About Altice USA

Altice USA (NYSE: ATUS) is one of the largest broadband

communications and video services providers in the United States,

delivering broadband, video, mobile, proprietary content and

advertising services to approximately 4.7 million residential and

business customers across 21 states through its Optimum brand. We

operate Optimum Media, an advanced advertising and data business,

which provides audience-based, multiscreen advertising solutions to

local, regional and national businesses and advertising clients. We

also offer hyper-local, national and international news through our

News 12 and i24NEWS networks.

FORWARD-LOOKING STATEMENTS

Certain statements in this earnings release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, all statements other

than statements of historical facts contained in this earnings

release, including, without limitation, those regarding our

intentions, beliefs or current expectations concerning, among other

things: our future financial conditions and performance, our

revenue streams, results of operations and liquidity, including

Free Cash Flow; our strategy, objectives, prospects, trends,

service and operational improvements, base management strategy,

capital expenditure plans, broadband, fiber, video and mobile

growth, product offerings and passings; our ability to achieve

operational performance improvements; and future developments in

the markets in which we participate or are seeking to participate.

These forward-looking statements can be identified by the use of

forward-looking terminology, including, without limitation, the

terms “anticipate”, “believe”, “could”, “estimate”, “expect”,

“forecast”, “intend”, “may”, “plan”, “project”, “should”, “target”,

or “will” or, in each case, their negative, or other variations or

comparable terminology. Where, in any forward-looking statement, we

express an expectation or belief as to future results or events,

such expectation or belief is expressed in good faith and believed

to have a reasonable basis, but there can be no assurance that the

expectation or belief will result or be achieved or accomplished.

To the extent that statements in this earnings release are not

recitations of historical fact, such statements constitute

forward-looking statements, which, by definition, involve risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements including risks

referred to in our SEC filings, including our Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and subsequent

Quarterly Reports on Form 10-Q. You are cautioned to not place

undue reliance on Altice USA’s forward-looking statements. Any

forward-looking statement speaks only as of the date on which it

was made. Altice USA specifically disclaims any obligation to

publicly update or revise any forward-looking statement, as of any

future date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801748956/en/

Investor Relations John Hsu: +1 917 405 2097 /

john.hsu@alticeusa.com Sarah Freedman: +1 631 660 8714 /

sarah.freedman@alticeusa.com Media Relations Lisa Anselmo:

+1 516 279 9461 / lisa.anselmo@alticeusa.com Janet Meahan: +1 516

519 2353 / janet.meahan@alticeusa.com

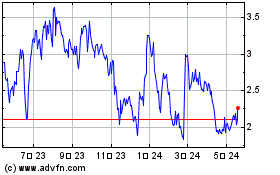

Altice USA (NYSE:ATUS)

過去 株価チャート

から 7 2024 まで 8 2024

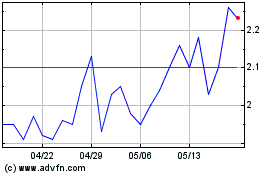

Altice USA (NYSE:ATUS)

過去 株価チャート

から 8 2023 まで 8 2024