0001670541FALSE00016705412024-12-132024-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): December 13, 2024

ADIENT PLC

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ireland | 001-37757 | 98-1328821 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | |

3 Dublin Landings, North Wall Quay Dublin 1, Ireland D01 H104 |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: 734-254-5000

Not applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of class | | Trading symbol(s) | | Name of exchange on which registered |

| Ordinary Shares, par value $0.001 | | ADNT | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On December 12, 2024 (the “Amendment Effective Date”), Adient US LLC, a Michigan limited liability company (the “Lead Borrower”), Adient Global Holdings S.à.r.l., a private limited liability company (société à responsabilité limitée) incorporated under the laws of the Grand Duchy of Luxembourg (together with the Lead Borrower, collectively, the “Borrowers” and each, a “Borrower”), Adient plc (“Parent”) and certain of Parent’s other subsidiaries entered into an amendment (the “Amendment”) of the Term Loan Credit Agreement, dated as of May 6, 2019 (as amended prior to the Amendment Effective Date, the “Existing Credit Agreement” and, as amended by the Amendment, the “Credit Agreement”), among the Borrowers, each of the lenders identified therein and Bank of America, N.A., as administrative agent and collateral agent (the “Agent”).

The Amendment reduces the interest rate margin applicable thereunder to 2.25%, in the case of Term SOFR loans, and 1.25%, in the case of Base Rate loans. The total loans outstanding under the Credit Agreement as of the Amendment Effective Date of $632,000,000 remained unchanged. The obligations under the Credit Agreement continue to be guaranteed on a secured basis by Parent and certain of its material wholly-owned restricted subsidiaries on substantially the same terms and subject to the same exceptions as the Existing Credit Agreement.

The foregoing description of the Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amendment, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information set forth under Item 1.01 is incorporated into this Item 2.03 by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| EXHIBIT INDEX |

| Exhibit No. | | Exhibit Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ADIENT PLC |

| Date: December 13, 2024 | By: | /s/ Heather M. Tiltmann |

| Name: | Heather M. Tiltmann |

| Title: | Executive Vice President, Chief Legal and Human Resources Officer, and Corporate Secretary |

AMENDMENT NO. 4

AMENDMENT NO. 4, dated as of December 12, 2024 (this “Amendment”), to the Term Loan Credit Agreement, dated as of May 6, 2019 (as amended by that certain Amendment No. 1, dated as of April 8, 2021, that certain Amendment Agreement, dated as of March 13, 2023, that certain Amendment No. 2, dated as of April 24, 2023, that certain Amendment No. 3, dated as of January 31, 2024, and as further amended, restated, supplemented or modified from time to time prior to the date hereof, the “Credit Agreement”), among ADIENT US LLC, a Michigan limited liability company (the “Lead Borrower”), ADIENT GLOBAL HOLDINGS S.À R.L., a private limited liability company (société à responsabilité limitée) incorporated under the laws of the Grand Duchy of Luxembourg (together with the Lead Borrower, collectively, the “Borrowers” and each, a “Borrower”), each Lender from time to time party thereto, the other parties party thereto and BANK OF AMERICA, N.A. (“Bank of America”), as Administrative Agent and Collateral Agent (in such capacities, the “Agent”), by and among the Borrowers, Adient plc (“Parent”), the other Loan Parties party hereto, the Agent, Bank of America, as New Term Lender and Fronting Lender (each as defined below) and the other Lenders party hereto. Capitalized terms used and not otherwise defined herein shall have the meanings assigned to them in the Amended Credit Agreement (as defined herein).

WHEREAS, the Borrowers have requested an amendment to the Credit Agreement that would decrease the Applicable Margin with respect to the Term B-2 Loans outstanding immediately prior to the Amendment No. 4 Effective Date (as defined below) (the “Existing Term Loans”) and reset the time period set forth in Section 2.11(a) of the Credit Agreement, in each case, in accordance with Sections 2.19(c) and 9.08 of the Credit Agreement (such Existing Term Loans as amended hereby as of the Amendment No. 4 Effective Date, the “Amended Term Loans”);

WHEREAS, at the Amendment No. 4 Effective Date, in the event the Amendment is consented to by the Required Lenders, but not all of the Existing Term Lenders (as defined below), then (i) any Lenders holding Term B-2 Loans outstanding immediately prior to the Amendment No. 4 Effective Date (before giving effect to any assignment of Existing Term Loans to the New Term Lender or the Fronting Lender contemplated hereunder) (each such Lender, an “Existing Term Lender”) that have not consented to this Amendment (each, a “Non-Consenting Lender” and, collectively, the “Non-Consenting Lenders”) shall assign and delegate all of their Existing Term Loans to Bank of America, as the Lender set forth on Schedule 1 hereto, as assignee (the “New Term Lender”), in accordance with Sections 2.19(c) and 9.04 of the Credit Agreement, and (ii) the New Term Lender shall purchase such Existing Term Loans of the Non-Consenting Lenders by paying to such Non-Consenting Lenders the price therefor specified in Section 2.19(c) of the Credit Agreement. The aggregate principal amount of the Existing Term Loans of the Non-Consenting Lenders to be purchased by the New Term Lender as of the Amendment No. 4 Effective Date is set forth on Schedule 1 hereto;

WHEREAS, at the Amendment No. 4 Effective Date, each Existing Term Lender that shall have executed and delivered a consent to this Amendment substantially in the form of Exhibit A hereto (a “Lender Consent”) indicating the “Cashless Settlement Option” (each such Existing Term

Lender, a “Consenting Lender”) shall have agreed by executing such Lender Consent to amend its outstanding Existing Term Loans to be Amended Term Loans as provided herein;

WHEREAS, immediately prior to the Amendment No. 4 Effective Date, each Existing Term Lender that shall have executed and delivered a Lender Consent indicating the “Assignment Settlement Option” (each such Lender being an “Assignment Lender”) shall assign all of its Existing Term Loans to Bank of America, as the Lender set forth on Schedule 1 hereto, as assignee (the “Fronting Lender”) in accordance with Section 9.04 of the Credit Agreement. Upon such assignment, the Fronting Lender shall have agreed by executing this Amendment as the Fronting Lender to amend such Existing Term Loans so assigned to be Amended Term Loans as provided herein. At or immediately after the Amendment No. 4 Effective Date, each Assignment Lender shall purchase from the Fronting Lender Amended Term Loans in an aggregate principal amount not less than the aggregate principal amount of the Existing Term Loans held by such Assignment Lender immediately prior to the Amendment No. 4 Effective Date. The aggregate principal amount of Existing Term Loans of the Assignment Lenders to be purchased by the Fronting Lender immediately prior to the Amendment No. 4 Effective Date is set forth on Schedule 1 hereto;

WHEREAS, Bank of America, JPMorgan Chase Bank, N.A., Citigroup Global Markets Inc., Deutsche Bank AG, New York Branch, Barclays Bank PLC, Crédit Agricole Corporate and Investment Bank, MUFG Union Bank, N.A., U.S. Bank National Association, ING Capital LLC, CIBC World Markets Corp., KeyBanc Capital Markets Inc. and Truist Securities, Inc. are acting as the joint lead arrangers and joint bookrunners for this Amendment (in such capacities, the “Amendment No. 4 Lead Arrangers”);

WHEREAS, the Agent, the Borrowers, the Guarantors and the Lenders party hereto, which constitute the Required Lenders under the Credit Agreement, desire to amend the Credit Agreement as set forth below, with such amendments and modifications to become effective at the Amendment No. 4 Effective Date, and have consented to such amendments and modifications to the Credit Agreement effected hereby; and

WHEREAS, in consideration of the mutual agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto have agreed to amend the Credit Agreement to reflect the terms set forth in Section 1 hereto, subject to the conditions set forth herein.

NOW, THEREFORE, in consideration of the premises and covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

Section 1. Amendments to the Credit Agreement. Effective as of the Amendment No. 4 Effective Date, the Credit Agreement is hereby amended (the Credit Agreement, as amended by this Amendment, the “Amended Credit Agreement”) as follows:

(a) The following new definitions are hereby added to Section 1.01 of the Credit Agreement in alphabetical order:

““Amendment No. 4” shall mean Amendment No. 4 to this Agreement, dated as of December 12, 2024, by and among the Administrative Agent, the Borrowers, each of the Guarantors and each of the Lenders party thereto.”

“Amendment No. 4 Arrangers” shall mean Bank of America, N.A., JPMorgan Chase Bank, N.A., Citigroup Global Markets Inc., Deutsche Bank AG, New York Branch, Barclays Bank PLC, Crédit Agricole Corporate and Investment Bank, MUFG Union Bank, N.A., U.S. Bank National Association, ING Capital LLC, CIBC World Markets Corp., KeyBanc Capital Markets Inc. and Truist Securities, Inc., in their capacities as joint lead arrangers and joint bookrunners in connection with Amendment No. 4.”

““Amendment No. 4 Effective Date” shall mean December 12, 2024, the date on which all conditions precedent set forth in Section 4 of Amendment No. 4 were satisfied (or waived).”

(b) The definition of “Applicable Margin” appearing in Section 1.01 of the Credit Agreement is hereby amended by amending and restating it in its entirety as follows:

““Applicable Margin” shall mean a percentage per annum equal to (x) for Term SOFR Loans, 2.25% and (y) for Base Rate Loans, 1.25%.

Notwithstanding the foregoing, the Applicable Margin with respect to any Other Term Loan shall be the “Applicable Margin” as set forth in the Incremental Assumption Agreement, Extension Amendment or Refinancing Amendment (as applicable) relating thereto.”

(c) The definition of “Arrangers” appearing in Section 1.01 of the Credit Agreement is hereby amended by amending and restating it in its entirety as follows:

““Arrangers” shall mean (a) the Joint Lead Arrangers, (b) solely with respect to Amendment No. 1, the Amendment No. 1 Arrangers, (c) solely with respect to Amendment No. 3, the Amendment No. 3 Arrangers and (d) solely with respect to Amendment No. 4, the Amendment No. 4 Arrangers.”

(d) The definition of “Loan Documents ” appearing in Section 1.01 of the Credit Agreement is hereby amended by amending and restating it in its entirety as follows:

““Loan Documents” shall mean (i) this Agreement, (ii) the Guarantee Agreement, (iii) the Security Documents, (iv) each Incremental Assumption Agreement, (v) each Extension Amendment, (vi) each Refinancing Amendment, (vii) any Intercreditor Agreement, (viii) Amendment No. 1, (ix) Amendment Agreement, (x) Amendment No. 2, (xi) Amendment No. 3, (xii) Amendment No. 4 and (xiii) any Note issued under Section 2.09(e).”

(e) Clause (a) of Section 2.11 is hereby amended by amending and restating in its entirety as follows:

“(a) Each Borrower shall have the right at any time and from time to time to prepay any Term Loan to such Borrower in whole or in part, without premium or penalty (but subject to (x) Section 2.16, (y) the last sentence of this Section 2.11(a) and (z) prior notice in accordance with the provisions of Section 2.10(c)), in an aggregate principal amount that is an integral multiple of the Borrowing Multiple and not less than the Borrowing Minimum or, if less, the amount outstanding, subject to prior notice in accordance with Section 2.10(d). If any Repricing Event occurs prior to the date that is six months after the Amendment No. 4 Effective Date, the Borrowers agree to pay to the Administrative Agent, for the ratable account of each Lender with Term Loans that are subject to such Repricing Event, a fee in an amount equal to 1.00% of the aggregate principal amount of the Term Loans subject to such Repricing Event. Such fees shall be earned, due and payable upon the date of the occurrence of such Repricing Event.”

Section 2. Consents and Assignments.

Subject to the terms and conditions set forth herein:

(a) each of the Consenting Lenders consents to this Amendment and, as of the Amendment No. 4 Effective Date, its Existing Term Loans shall become Amended Term Loans;

(b) the New Term Lender agrees to purchase Existing Term Loans from Non-Consenting Lenders at the Amendment No. 4 Effective Date in an aggregate principal amount equal to the aggregate principal amount of the Existing Term Loans held by Non-Consenting Lenders immediately prior to the Amendment No. 4 Effective Date in accordance with Sections 2.19(c) and 9.04 of the Credit Agreement. The execution of this Amendment by the New Term Lender shall be deemed to be the execution of an Assignment and Acceptance between the New Term Lender and each Non-Consenting Lender (and the execution of this Amendment by the Agent and the Borrowers shall be deemed to be the consent of the Agent and the Borrowers (to the extent such consent is required under the Credit Agreement) thereto) which assignment shall be effective upon receipt by each such Non-Consenting Lender of the purchase price required by Section 2.19(c) of the Credit Agreement. As of the Amendment No. 4 Effective Date, each Non-Consenting Lender will be deemed to have executed

an Assignment and Acceptance for all of its then outstanding Existing Term Loans and will be deemed to have assigned all of its then outstanding Existing Term Loans at par to the New Term Lender pursuant to and in compliance with the terms of Section 9.04 of the Credit Agreement, and such Existing Term Loans shall become Amended Term Loans;

(c) the Existing Term Loans of each Assignment Lender shall be assigned to the Fronting Lender immediately prior to the Amendment No. 4 Effective Date in accordance with Section 9.04 of the Credit Agreement and such Assignment Lender’s execution of its Lender Consent and the Fronting Lender’s execution of this Amendment shall be deemed to be the execution of an Assignment and Acceptance between such Assignment Lender and the Fronting Lender (and the execution of this Amendment by the Agent and the Borrowers shall be deemed to be the consent of the Agent and the Borrowers (to the extent such consent is required under the Credit Agreement) thereto) which assignment shall be effective upon receipt by such Assignment Lender of an amount equal to the outstanding principal amount of, and accrued and unpaid interest and fees on, such Assignment Lender’s Existing Term Loans outstanding immediately prior to the Amendment No. 4 Effective Date;

(d) the Fronting Lender agrees to purchase Existing Term Loans from each Assignment Lender immediately prior to the Amendment No. 4 Effective Date in an aggregate principal amount equal to the aggregate principal amount of Existing Term Loans held by such Assignment Lender at such time in accordance with Section 9.04 of the Credit Agreement. The execution of this Amendment by such Assignment Lender and the Fronting Lender shall be deemed to be the execution of an Assignment and Acceptance between the Fronting Lender and such Assignment Lender (and the execution of this Amendment by the Agent and the Borrowers shall be deemed to be the consent of the Agent and the Borrowers (to the extent the consent is required under the Credit Agreement) thereto) and, as of the Amendment No. 4 Effective Date, such Existing Term Loans shall become Amended Term Loans;

(e) each Assignment Lender agrees to purchase Amended Term Loans from the Fronting Lender immediately following the Amendment No. 4 Effective Date in an aggregate principal amount equal to the aggregate principal amount of Existing Term Loans held by such Assignment Lender immediately prior to the Amendment No. 4 Effective Date in accordance with Section 9.04 of the Credit Agreement. Such Assignment Lender’s execution of its Lender Consent and the execution of this Amendment by the Fronting Lender shall be deemed to be the execution of an Assignment and Acceptance between such Assignment Lender and the Fronting Lender (and the execution of this Amendment by the Agent and the Borrowers shall be deemed to be the consent of the Agent and the Borrowers (to the extent the consent is required under the Credit Agreement) thereto); and

(f) each of the New Term Lender and the Fronting Lender, by delivering its signature page to this Amendment, and each Assignment Lender and Consenting Lender, by delivering its Lender Consent, shall be deemed to have acknowledged receipt of, and consented to and approved, this Amendment, each Loan Document and each other document required to be delivered to, or be approved by or satisfactory to, the Agent at the Amendment No. 4 Effective Date.

Notwithstanding anything to the contrary in this Amendment or the Amended Credit Agreement, in no event shall any Borrower be required to pay to the Agent the processing and recordation fee specified in Section 9.04(b)(ii)(C) for any assignment described in this Section 2 or any future assignment by the New Term Lender or the Fronting Lender of the Existing Term Loans acquired by such Person as described in this Section 2.

Section 3. Representations and Warranties.

Each Loan Party represents and warrants to the Agent and the Lenders that, as of the Amendment No. 4 Effective Date:

(a) this Amendment has been duly authorized, executed and delivered by it and constitutes its legal, valid and binding obligation, enforceable against such Loan Party in accordance with its terms, subject to (i) applicable pre-insolvency, bankruptcy, insolvency, concurso mercantil, reorganization, moratorium, fraudulent conveyance or other laws affecting creditors’ rights generally, (ii) general principles of equity, regardless of whether considered in a proceeding in equity or at law and (iii) implied covenants of good faith and fair dealing;

(b) immediately before and immediately after giving effect to this Amendment, the applicable representations and warranties of each Loan Party which are contained in (i) Article III of the Credit Agreement or (ii) any other Loan Document in effect on the Amendment No. 4 Effective Date, in each case, are true and correct in all material respects; provided, that, to the extent that such representations and warranties specifically refer to an earlier date, such representations and warranties were true and correct in all material respects as of such earlier date; provided, further, that any representation and warranty that is qualified as to “materiality,” “Material Adverse Effect” or similar language is true and correct (after giving effect to any qualification therein) in all respects; and

(c) immediately before and immediately after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing or would result from the Amendment and related Credit Event or from the application of the proceeds therefrom.

Section 4. Conditions to Effectiveness.

This Amendment shall become effective on the date (such date, the “Amendment No. 4 Effective Date”) each of the following conditions shall have been satisfied (or waived):

(a) The Agent’s receipt of the following, each of which shall be originals or facsimiles or electronic copies unless otherwise specified:

(i) counterparts of this Amendment executed by (A) each Borrower, (B) each other Loan Party, (C) the Agent, (D) each Consenting Lender, (E) each Assignment Lender and (F) the New Term Lender and the Fronting Lender; and

(ii) a certificate of a Responsible Officer of the Parent certifying compliance with the conditions in clauses (d) and (e) below.

(b) Substantially concurrently with the effectiveness of this Amendment on the Amendment No. 4 Effective Date, the Borrowers shall have paid (or caused to be paid) to the Agent, for the ratable account of each Existing Term Lender, all accrued and unpaid interest on the Existing Term Loans outstanding immediately prior to the effectiveness of this Amendment on the Amendment No. 4 Effective Date to, but not including, the Amendment No. 4 Effective Date.

(c) All fees and expenses due to the Agent, the Amendment No. 4 Arrangers and the Lenders (including, without limitation, pursuant to Section 6 hereof and any fees required to be paid to them by the Borrowers as mutually agreed prior to the Amendment No. 4 Effective Date) required to be paid on the Amendment No. 4 Effective Date shall have been paid, in each case in respect of expenses, to the extent invoiced in reasonable detail prior to the date that is three (3) Business Days (or such lesser period as may be reasonably acceptable to the Lead Borrower) prior to the date hereof.

(d) Immediately before and immediately after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing or would result from the Amendment and related Credit Event or from the application of the proceeds therefrom.

(e) Immediately before and immediately after giving effect to this Amendment, the representations and warranties of each Loan Party set forth in (i) Article III of the Credit Agreement or (ii) any other Loan Document in effect on the Amendment No. 4 Effective Date, in each case, shall be true and correct in all material respects on and as of the Amendment No. 4 Effective Date; provided, that to the extent such representations and warranties specifically relate to an earlier date, such representations and warranties shall be true and correct in all material respects as of such earlier date; provided, further, that any representation and warranty that is qualified as to “materiality,” “Material Adverse Effect” or similar language shall be true and correct (after giving effect to any qualification therein) in all respects on such respective dates.

(f) The Agent and the Lenders (as requested through the Agent) shall have received at least three (3) Business Days prior to the Amendment No. 4 Effective Date (i) all documentation and other information required with respect to the Borrowers by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including, without limitation, the USA PATRIOT Act, and (ii) a Beneficial Ownership Certification in relation to any Loan Party that qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, in each case, to the extent requested in writing at least ten (10) Business Days prior to the Amendment No. 4 Effective Date.

Other than the conditions set forth in this Section 4, there are no other conditions (express or implied) to the Amendment No. 4 Effective Date. For purposes of determining compliance with the conditions specified in this Section 4, to the extent any Lender has signed this Amendment, it

shall be deemed to have consented to, approved or accepted or to be satisfied with, each document or other matter required hereunder to be consented to or approved by or acceptable or satisfactory to the Lenders under this Amendment unless the Agent shall have received notice from such Lender prior to the Amendment No. 4 Effective Date specifying its objection thereto.

The Agent shall notify the Lead Borrower and the Lenders of the Amendment No. 4 Effective Date and such notice shall be conclusive and binding.

Section 5. Expenses.

The Borrowers agree to reimburse the Agent and each Amendment No. 4 Arranger for its reasonable and documented out-of-pocket expenses in connection with this Amendment and any Loan Documents executed in connection with this Amendment, including the reasonable and documented fees, charges and disbursements of Cahill Gordon & Reindel llp, counsel for the Agent (and one local counsel for the Agent in any other relevant jurisdiction (including, without limitation, each Specified Jurisdiction)), in each case, to the extent required by Section 9.05 of the Credit Agreement.

Section 6. Counterparts.

This Amendment may be executed in any number of counterparts and by different parties hereto on separate counterparts, each of which when so executed and delivered shall be deemed to be an original, but all of which when taken together shall constitute a single instrument. Delivery of an executed counterpart of a signature page or Consent to this Amendment by facsimile transmission or electronic transmission shall be effective as delivery of a manually executed counterpart hereof. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Amendment and/or any document to be signed in connection with this amendment and the transactions contemplated hereby shall be deemed to include Electronic Signatures (as defined below), deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. “Electronic Signatures” means any electronic symbol or process attached to, or associated with, any contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract or record.

Section 7. Governing Law and Waiver of Right to Trial by Jury.

THIS AMENDMENT AND ANY CLAIM, CONTROVERSY, DISPUTE OR CAUSE OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AGREEMENT, SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK, PROVIDED THAT

SECTIONS 9(D) AND (E) HEREOF, TO THE EXTENT THAT THEY MAY RELATE TO ANY LUXEMBOURG LAW SECURITY DOCUMENTS, SHALL BE GOVERNED BY, AND SHALL BE CONSTRUED IN ACCORDANCE WITH, LUXEMBOURG LAW AND ANY DISPUTE ARISING OUT OF OR IN CONNECTION WITH SUCH SECTIONS 9(D) AND (E) HEREOF, TO THE EXTENT THAT THEY MAY RELATE TO ANY LUXEMBOURG LAW SECURITY DOCUMENTS, INCLUDING A DISPUTE REGARDING ANY LUXEMBOURG LAW SECURITY DOCUMENTS’ EXISTENCE, VALIDITY, INTERPRETATION, PERFORMANCE OR TERMINATION, SHALL BE SUBJECT TO THE EXCLUSIVE JURISDICTION OF THE DISTRICT COURT OF THE CITY OF LUXEMBOURG (TRIBUNAL D'ARRONDISSEMENT DE ET À LUXEMBOURG). The jurisdiction and waiver of right to trial by jury provisions in Section 9.11 and 9.15 of the Credit Agreement are incorporated herein by reference mutatis mutandis.

Section 8. Headings.

The headings of this Amendment are for purposes of reference only and shall not limit or otherwise affect the meaning hereof.

Section 9. Reaffirmation.

Each Loan Party hereby expressly consents to and acknowledges the terms of this Amendment, and confirms and reaffirms, subject to any limitation language applicable as provided in the Credit Agreement and the other Loan Documents, as of the date hereof, (a) the covenants and agreements contained in each Loan Document to which it is a party, as in effect immediately after giving effect to this Amendment and the transactions contemplated hereby, (b) that all Obligations of such Loan Party under the Loan Documents to which such Loan Party is a party shall continue to apply to the Credit Agreement as amended or otherwise modified hereby, (c) its guaranty of the Obligations as amended or otherwise modified hereby, (d) its prior pledges and grants of security interests and Liens on the Collateral to secure the Obligations pursuant to the Security Documents to which it is a party and (e) that such Guarantees, prior pledges and grants of security interests (including any Security Documents) and Liens on the Collateral to secure the Obligations, as applicable, are and shall continue to be in full force and effect as amended or otherwise modified hereby and do, and shall continue to, inure to the benefit of the Agent, the Lenders and the other Secured Parties. Neither this Amendment nor the amendments and restatements made pursuant to this Amendment shall constitute a novation of the Credit Agreement or any other Loan Document.

Section 10. Effect of Amendment; References to the Credit Agreement; Miscellaneous.

Except as expressly set forth herein, this Amendment (a) shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders or the Agent under the Credit Agreement or any other Loan Document, and (b) shall not alter, modify, amend, waive or in any way affect any of the terms, conditions, obligations, covenants or agreements

contained in the Credit Agreement or any other provision of the Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect as amended by this Amendment (as applicable). This Amendment shall constitute a Loan Document for all purposes and all references to the Credit Agreement in any Loan Document or other document, instrument, agreement, or writing shall from and after the Amendment No. 4 Effective Date be deemed to refer to the Credit Agreement as amended or otherwise modified hereby, and, as used in the Credit Agreement, the terms “Agreement,” “herein,” “hereafter,” “hereunder,” “hereto” and words of similar import shall mean, from and after the Amendment No. 4 Effective Date, the Credit Agreement as amended or otherwise modified hereby.

[remainder of page intentionally left blank]

IN WITNESS WHEREOF, each of the undersigned has caused its duly authorized officer to execute and deliver this Amendment as of the date first written above.

ADIENT US LLC

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Person

ADIENT GLOBAL HOLDINGS S.À R.L.

Société à responsabilité limitée

Registered office: 35F, Avenue John F Kennedy, L - 1855 Luxembourg

R.C.S. Luxembourg B 214.737

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Person

ADIENT ELDON INC.

ADIENT SYSTEMS ENGINEERING LLC

ADIENT CLANTON INC.

ADIENT INC.

ADIENT HOLDING MEXICO LLC

ADIENT HOLDING SPAIN LLC

ADIENT HOLDING SLOVAKIA LLC

ADIENT HOLDING TURKEY LLC

ADIENT HOLDING SOUTH AFRICA LLC

FUTURIS GLOBAL HOLDINGS, LLC

FUTURIS AUTOMOTIVE (NA) HOLDINGS INC.

FUTURIS AUTOMOTIVE (NA) INTERMEDIATE HOLDINGS INC.

FUTURIS AUTOMOTIVE (US) INC.

FUTURIS AUTOMOTIVE (CA) LLC

CNI ENTERPRISES, INC.

CNI-DULUTH, LLC

NICA, INC.

UNIVERSAL TRIM, INC.

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Person

ADIENT US ENTERPRISES LIMITED PARTNERSHIP

By: :/s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Person

Adient Luxembourg Poland Holding S.à r.l., a Luxembourg company governed under the laws of the Grand Duchy of Luxembourg as a société à responsabilité limitée, with its registered office at 35F, Avenue John F Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Register of Commerce and Companies (Registre de Commerce et des Sociétés, Luxembourg) under number B 204.878

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Signatory

Adient Luxembourg Asia Holding S.à r.l., a Luxembourg company governed under the laws of the Grand Duchy of Luxembourg as a société à responsabilité limitée, with its registered office at 35F, Avenue John F Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Register of Commerce and Companies (Registre de Commerce et des Sociétés, Luxembourg) under number B 208.006

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Signatory

Adient Global Holdings Luxembourg S.à r.l., a Luxembourg company governed under the laws of the Grand Duchy of Luxembourg as a société à responsabilité limitée, with its registered office at 35F, Avenue John F Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Register of Commerce and Companies (Registre de Commerce et des Sociétés, Luxembourg) under number B 214.747

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Signatory

Adient Holding Ireland Limited

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

Adient plc

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Officer

Adient Global Holdings Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorised Representative

Adient International Ltd

By:/s/ Justin Fischer

Name: Justin Fischer

Title: Authorised Representative

| | | | | | | | |

| Adient Industries México S. de R.L. de C.V. |

| Adient Leasing México S. de R.L. de C.V. |

| Adient México S. de R.L. de C.V. |

| Adient México Automotriz S. de R.L. de C.V. |

| Adient México Holding S. de R.L. de C.V. |

| Adient Querétaro S. de R.L. de C.V. |

| Adient Shared Services México S. de R.L. de C.V. |

| Adient Servicios S. de R.L. de C.V. |

| Adient Subholding Leasing S. de R.L. de C.V. |

| Brena Mex S. de R.L. de C.V. |

| Ensamble de Interiores Automotrices México S. de R.L. de C.V. |

| Ensamble de Interiores Automotrices, S. de R.L. de C.V. |

|

| By: | /s/ Phillip A. Rotman II |

| Name: | Phillip A. Rotman II |

| Title: | Attorney-in-fact |

ADIENT BELGIUM BV, a private limited liability company (besloten vennootschap/société à responsabilité limitée) organised and existing under Belgian law, having its registered office a Paul Christiaenstraat 1, 9960 Assenede, Belgium and registered under company number 0437.456.835 RLP Ghent, division Ghent

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Signatory

ADIENT SWEDEN AB

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Authorized Officer

| | | | | | | | |

| ADIENT SEATING HOLDING SPAIN, S.L.U. |

| ADIENT SEATING SPAIN, S.L.U. |

| ADIENT AUTOMOTIVE, S.L.U. |

| ADIENT REAL ESTATE HOLDING SPAIN, S.L.U. |

|

| By: | /s/ Justin Fischer |

| Name: | Justin Fischer |

| Title: | Attorney |

Adient Seating UK Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

Adient Properties UK Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

Adient Holding Germany Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

Adient Holding UK Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

Adient UK Financing Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

Adient Financing International Ltd

By: /s/ Justin Fischer

Name: Justin Fischer

Title: Attorney

| | | | | | | | | | | |

ADIENT SEATING POLAND SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ, a Polish company with its registered office in Siemianowice Śląskie, at 93 Krupanka Street 41-100 Siemianowice Śląskie, entered into the register of entrepreneurs of the National Court Register, maintained by the District Court Katowice-Wschód in Katowice, VIII Commercial Division of the National Register Court, under the number KRS 0000236927, having the following numbers NIP: 5862148358 and REGON: 220066313 and a share capital of PLN 229,741,500.00. | |

| |

| By: | /s/ Phillip Allan Rotman II | |

| Name: | Phillip Allan Rotman II | |

| Title: | Attorney | |

| | | |

ADIENT FOAM POLAND SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ, a Polish company with its registered office in Żory, 6 Wygoda Street, 44-240 Żory, entered into the register of entrepreneurs of the National Court Register maintained by the District Court in Gliwice, X Commercial Division of the National Register Court, under the KRS number: 0000251430, having the following numbers NIP: 7010029670 and REGON: 140581505 and a share capital of PLN 15,529,000.00. | |

| |

| By: | /s/ Phillip Allan Rotman II | |

| Name: | Phillip Allan Rotman II | |

| Title: | Attorney | |

| | | |

| | | | | | | | | | | |

ADIENT POLAND SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ, a Polish company with its registered office in Świebodzin, at Zachodnia 78, 66-200 Świebodzin, entered into the register of entrepreneurs of the National Court Register, maintained by the District Court in Zielona Góra, VIII Commercial Division of the National Register Court, under the number KRS: 0000013213, having the following numbers NIP: 9271756246 and REGON: 971291505 and a share capital of PLN 3,465,000.00. |

|

| By: | /s/ Phillip Allan Rotman II |

| Name: | Phillip Allan Rotman II |

| Title: | Attorney |

BANK OF AMERICA, N.A., as

Administrative Agent and Collateral Agent

By: /s/ Gerund Diamond

Name: Gerund Diamond

Title: Vice President

BANK OF AMERICA, N.A., as

New Term Lender and Fronting Lender

By: /s/ Elizabeth Gretz

Name: Elizabeth Gretz

Title: Director

[LENDER CONSENTS ON FILE WITH THE ADMINISTRATIVE AGENT]

SCHEDULE 1

| | | | | |

New Term Lender | Principal amount of Existing Term Loans of Non-Consenting Lenders to be purchased by the New Term Lender: |

Bank of America, N.A. | $42,886,930.45 |

Total: | $42,886,930.45 |

Fronting Lender | Principal amount of Existing Term Loans of Assignment Lenders to be purchased by the Fronting Lender: |

Bank of America, N.A. | $3,107,477.06 |

Total: | $3,107,477.06 |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

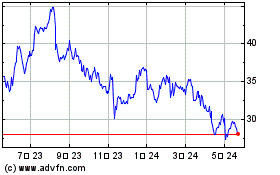

Adient (NYSE:ADNT)

過去 株価チャート

から 2 2025 まで 3 2025

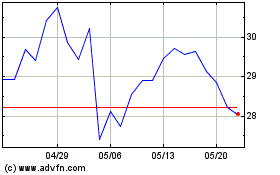

Adient (NYSE:ADNT)

過去 株価チャート

から 3 2024 まで 3 2025