As filed with the Securities and Exchange Commission on September 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

U-BX

TECHNOLOGY LTD.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

N/A |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

|

Zhongguan Science and Technology Park

No. 1 Linkong Er Road,

Shunyi District, Beijing

People’s Republic

of China |

|

101300 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

2024 Equity Incentive Plan

(Full Title of the Plan)

Cogency Global Inc.

122 East 42nd Street, 18th

Floor

New York, New York 10168

(Name and Address of Agent for Service)

800-221-0102

(Telephone Number, Including Area Code, of Agent

for Service)

Copy To:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

Tel: +1-212-588-0022

Fax: +1-212-826-9307

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

| |

Emerging growth company |

☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This registration statement

(this “Registration Statement”) is filed by U-BX Technology Ltd., an exempted company incorporated under the laws of the Cayman

Islands (the “Registrant”) to register securities issuable pursuant to the U-BX Technology Ltd. 2024 Equity Incentive Plan

(as amended and restated, “the 2024 Equity Incentive Plan”). The securities registered hereby consist of 2,700,000 Ordinary

Shares, US$0.0001 par value per share of the Registrant, which represent the number of Ordinary Shares that were authorized under the

2024 Equity Incentive Plan. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this

Registration Statement also covers an indeterminate number of additional shares which may be offered and issued to prevent dilution from

share splits, share dividends or similar transactions as provided in the 2024 Equity Incentive Plan. Any Ordinary Shares covered by an

award granted under the 2024 Equity Incentive Plan (or portion of an award) that terminates, expires, lapses or repurchased for any reason

will be deemed not to have been issued for purposes of determining the maximum aggregate number of Ordinary Shares that may be issued

under the 2024 Equity Incentive Plan.

PART I

INFORMATION REQUIRED IN THE 10(A) PROSPECTUS

Item 1. Plan Information*

Item 2. Registrant Information and Employee Plan Annual Information*

| * |

The documents containing the information specified in “Item 1. Plan Information” and “Item 2. Registrant Information and Employee Plan Annual Information” of Form S-8 will be sent or given to participants of the 2024 Equity Incentive Plan, as specified by Rule 428(b)(1) under the Securities Act. Such documents are not required to be, and are not, filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of Form S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. |

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, and

all documents we subsequently file pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), prior to the filing of a post-effective amendment to this Registration Statement which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this Registration Statement and shall be deemed to be a part hereof from the date of the filing of such documents:

| |

(1) |

The prospectus dated March

27, 2024 filed by the Registrant with the Commission pursuant to Rule 424(b) under the Securities Act relating to the

Registrant’s Registration Statement on Form F-1, as amended (Registration No. 333-262412), which contains the

Registrant’s audited financial statements for the latest fiscal year for which such statements have been filed; |

| |

(2) |

Our Reports on Form 6-K, filed with the Commission on April 1, 2024, May 9, 2024, May 29, 2024, August 21, 2024, and September 5, 2024; |

| |

(3) |

The description of our ordinary shares incorporated by reference in our registration statement on Form 8-A, as amended (File No. 001-41987) filed with the Commission on March 21, 2024, including any amendment and report subsequently filed for the purpose of updating that description; and |

| |

(4) |

all reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the report referred to in (1) above. |

All documents subsequently

filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment

which indicates that all securities offered have been sold, or which deregisters all securities then remaining unsold, shall be deemed

to be incorporated by reference herein and to be a part hereof from the date of filing of such documents.

Any statement contained in

a document incorporated or deemed to be incorporated by reference herein shall be deemed modified or superseded for purposes of this Registration

Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or deemed to be incorporated

by reference herein modifies or supersedes such statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Cayman

Islands law does not limit the extent to which a company’s memorandum and articles of association may provide for indemnification

of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy,

such as to provide indemnification against civil fraud or the consequences of committing a crime.

Our

Amended and Restated Memorandum and Articles of Association provide that every director, alternate director or officer, in each case of

the Company, shall be indemnified out of the assets of the Company against any liability incurred by him as a result of any act or failure

to act in carrying out his functions other than such liability (if any) that he may incur by his own actual fraud or wilful default, and

further that no such director, alternate director or officer shall be liable to the Company for any loss or damage in carrying out his

functions unless that liability arises through the actual fraud or wilful default of such director or officer. References in this paragraph

to actual fraud or wilful default mean a finding to such effect by a competent court in relation to the conduct of the relevant party.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to our directors, officers or persons controlling us under the foregoing

provisions, we have been informed that in the opinion of the Commission, such indemnification is against public policy as expressed in

the Securities Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

Reference is hereby made to

the Exhibit Index, which is incorporated herein by reference.

Item 9. Undertakings.

A. The undersigned Registrant

hereby undertakes:

| |

(1) |

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| |

(a) |

To include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

(b) |

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement; and |

| |

(c) |

To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement; |

provided, however,

that paragraphs (1)(a) and (1)(b) above do not apply if the information required to be included in a post- effective amendment by those

paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d)

of the Exchange Act that are incorporated by reference in this Registration Statement.

| |

(2) |

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| |

(3) |

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

B. The undersigned Registrant

hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual

report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant

to the foregoing provisions, or otherwise, the Registrant has been advised that, in the opinion of the Commission, such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling

person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in China, on September 5, 2024.

| |

U-BX Technology Ltd. |

| |

|

|

| |

By: |

/s/ Jian Chen |

| |

Name: |

Jian Chen |

| |

Title: |

Chief Executive Officer and Director |

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Jian Chen |

|

Chief Executive Officer and Director |

|

September 5, 2024 |

| Name: Jian Chen |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Qingcai Li |

|

Chief Financial Officer |

|

September 5, 2024 |

| Name: Qingcai Li |

|

(Principal Accounting and Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Enze Liang |

|

Director |

|

September 5, 2024 |

| Name: Enze Liang |

|

|

|

|

| |

|

|

|

|

| /s/ Danning Wang |

|

Director |

|

September 5, 2024 |

| Name: Danning Wang |

|

|

|

|

| |

|

|

|

|

| /s/ Kongfei Hu |

|

Director |

|

September 5, 2024 |

| Name: Kongfei Hu |

|

|

|

|

SIGNATURE OF AUTHORIZED

REPRESENTATIVE IN THE UNITED STATES

Pursuant

to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of U-BX Technology Ltd., has signed

this registration statement or amendment thereto in New York, NY on September 5, 2024.

| |

Authorized U.S. Representative

Cogency Global Inc. |

| |

|

|

| |

By: |

/s/ Colleen A. De Vries |

| |

Name: |

Colleen A. De Vries |

| |

Title: |

Senior Vice President |

II-6

Exhibit 5.1

|

Mourant Ozannes (Cayman) LLP

94 Solaris Avenue

Camana Bay

PO Box 1348

Grand Cayman KY1-1108

Cayman Islands

T +1 345 949 4123

F +1 345 949 4647 |

U-BX Technology Ltd.

c/o Harneys Fiduciary (Cayman) Limited

PO Box 10240, 4th Floor, Harbour Place

103 South Church Street

P.O. Box 10240

George Town, Grand Cayman

KY1-1002, Cayman Islands

5 September 2024

Dear Addressee

U-BX Technology Ltd. (the Company)

We have acted as Cayman Islands legal advisers

to the Company in connection with the Company’s registration statement on Form S-8 filed on 5 September 2024 with the U.S. Securities

and Exchange Commission (the Commission) under the U.S. Securities Act of 1933, as amended, to register securities issuable pursuant

to the Company’s 2024 Equity Incentive Plan (the Plan), namely 2,700,000 Ordinary Shares in the Company of par value US$0.0001

each and an indeterminate number of additional Ordinary Shares to prevent dilution from share splits, share dividends or similar transactions

(collectively, the Shares) (the Registration Statement, which term does not include any other document or agreement whether

or not specifically referred to therein or attached as an exhibit or schedule thereto).

For the purposes of this opinion letter, we have

examined a copy of each of the following documents:

| (a) | the certificate of incorporation of the Company dated 30 June 2021; |

| (b) | the certificate of incorporation of the Company on change of name dated 11 October 2021; |

| (c) | the amended and restated memorandum and articles of association of the Company (the M&A)

adopted by a special resolution dated 2 March 2022; |

| (d) | a copy of the Company’s register of directors and officers that was provided to us by the Company (together

with the M&A, the Company Records); |

| (e) | written resolutions of the board of directors of the Company dated 3 September 2024 approving (among other

things) the allotment of the Shares (the Resolutions); |

| (f) | a certificate of good standing dated 27 August 2024, issued by the Registrar of Companies (the Registrar)

in the Cayman Islands (the Certificate of Good Standing); and |

| (g) | the Registration Statement. |

Mourant Ozannes (Cayman) LLP is registered as a limited liability partnership in the Cayman Islands with registration number 601078 |

| |

| | | mourant.com |

The following opinions are given only as to, and

based on, circumstances and matters of fact existing and known to us on the date of this opinion letter. These opinions only relate to

the laws of the Cayman Islands which are in force on the date of this opinion letter. In giving these opinions we have relied upon the

following assumptions, which we have not independently verified:

| 2.1 | copies of documents or drafts of documents provided to us are true and complete copies of, or in the final

forms of, the originals; |

| 2.2 | where a document has been examined by us in draft form, it will be or has been executed and/or filed in

the form of the draft, and where a number of drafts of a document have been examined by us all changes thereto have been marked or otherwise

drawn to our attention; |

| 2.3 | the accuracy and completeness of all factual representations made in the documents reviewed by us; |

| 2.4 | the genuineness of all signatures and seals; |

| 2.5 | the Resolutions were duly passed, are in full force and effect and have not been amended, revoked or superseded; |

| 2.6 | there is nothing under any law (other than the laws of the Cayman Islands) which would or might affect

the opinions set out below; |

| 2.7 | the directors of the Company have not exceeded any applicable allotment authority conferred on the directors

by the shareholders; |

| 2.8 | upon issue of the Shares, the Company will receive in full the consideration for which the Company agreed

to issue the Shares, which shall be equal to at least the par value thereof; |

| 2.9 | the validity and binding effect under the laws of the United States of America of the Registration Statement

and that the Registration Statement has been duly filed with the Commission; |

| 2.10 | each director of the Company (and any alternate director) has disclosed to each other director any interest

of that director (or alternate director) in the transactions contemplated by the Registration Statement in accordance with the M&A; |

| 2.11 | the Company is not insolvent, will not be insolvent and will not become insolvent as a result of executing,

or performing its obligations under the Registration Statement and no steps have been taken, or resolutions passed, to wind up the Company

or appoint a receiver in respect of the Company or any of its assets; |

| 2.12 | the Company Records were, when reviewed by us, and remain at the date of this opinion accurate and complete;

and |

| 2.13 | the Company will have sufficient authorised but unissued share capital to issue each Share. |

Based upon the foregoing and subject to the qualifications

set out below and having regard to such legal considerations as we deem relevant, we are of the opinion that:

| 3.1 | The Company is incorporated under the Companies Act (as amended) of the Cayman Islands (the Companies

Act), validly exists under the laws of the Cayman Islands as an exempted company and is in good standing with the Registrar. The Company

is deemed to be in good standing on the date of issue of the Certificate of Good Standing if it: |

| (a) | has paid all fees and penalties under the Companies Act; and |

| (b) | is not, to the Registrar’s knowledge, in default under the Companies Act. |

| 3.2 | The Certificate of Good Standing is evidence that the Company is in good standing on the date thereof.

Under Cayman Islands law, good standing means that the Company has paid all fees and penalties under the Companies Act and is not,

to the Registrar’s knowledge, in default under the Companies Act. |

| 3.3 | Based solely on our review of the M&A, the authorised share capital of the Company is US$50,000 divided

into 500,000,000 Ordinary Shares of par value US$0.0001 each. |

| 3.4 | The Shares have been duly authorised and when allotted, issued and paid for in accordance with the Plan

and the Resolutions and when appropriate entries have been made in the register of members of the Company in respect thereof will be legally

issued and allotted, fully paid and non-assessable. As a matter of Cayman Islands law, a share is only issued when it has been entered

in the register of members (shareholders). |

Except as specifically stated herein, we make

no comment with respect to any representations and warranties which may be made by or with respect to the Company in any of the documents

or instruments cited in this opinion or otherwise with respect to the commercial terms of the transactions the subject of this opinion.

In this opinion the phrase non-assessable

means, with respect to Shares in the Company, that a member shall not, solely by virtue of its status as a member, be liable for additional

assessments or calls on the Shares by the Company or its creditors (except in exceptional circumstances and subject to the M&A, such

as involving fraud, the establishment of an agency relationship or an illegal or improper purpose or other circumstances in which a court

may be prepared to pierce or lift the corporate veil).

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement and to the reference to our name in the Registration Statement. In giving such consent, we

do not hereby admit that we come within the category of persons whose consent is required under Section 7 of the U.S. Securities

Act of 1933, as amended, or the Rules and Regulations of the Commission promulgated thereunder.

Yours faithfully

/s/ Mourant Ozannes (Cayman) LLP

Mourant Ozannes (Cayman) LLP

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation

by reference in the Registration Statement on Form S-8 of U-BX Technology Ltd. of our report dated November 17, 2023, with respect to

our audits of the consolidated financial statements of U-BX Technology Ltd. as of and for the years ended June 30, 2023 and 2022.

/s/ Wei, Wei & Co., LLP

Flushing, New York

September 5, 2024

Exhibit 107

Calculation of Filing Fee Tables

S-8

(Form Type)

U-BX TECHNOLOGY LTD

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type | |

Security Class Title | |

Fee

Calculation

Rule | |

Amount

Registered (1) | | |

Proposed

Maximum

Offering

Price Per

Share

(2) | | |

Maximum

Aggregate

Offering

Price | | |

Fee

Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Ordinary Shares, US$0.0001 par value per share | |

Rule 457(c) and (h) | |

| 2,700,000 | | |

$ | 1.415 | | |

$ | 3,820,500 | | |

$ | 0.00014760 | | |

$ | 564 | |

| Total Offering Amounts | |

| | | |

| | | |

| | | |

| | | |

$ | 564 | |

| Total Fee Offsets | |

| | | |

| | | |

| | | |

| | | |

$ | 0 | |

| Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 564 | |

| (1) |

This Registration Statement on Form S-8 covers Ordinary Shares, US$0.0001 par value per share of U-BX Technology Ltd (“Registrant”) issuable pursuant to the 2024 Equity Incentive Plan (as amended and restated, the “2024 Equity Incentive Plan”) of the Registrant. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement is deemed to cover an indeterminate number of ordinary shares which may be offered and issued to prevent dilution resulting from share splits, share dividends or similar transactions as provided in the 2024 Equity Incentive Plan. |

| |

|

| (2) |

The proposed maximum offering price per share, which is estimated solely for the purposes of calculating the registration fee under Rule 457(h) and Rule 457(c) under the Securities Act, is based on US$1.415 per Ordinary Share, the average of the high and low prices for the Registrant’s Ordinary Share as quoted on the Nasdaq Capital Market on August 30, 2024. |

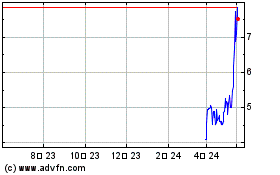

U BX Technology (NASDAQ:UBXG)

過去 株価チャート

から 11 2024 まで 12 2024

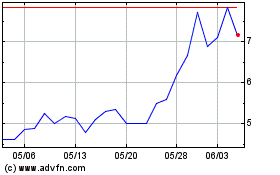

U BX Technology (NASDAQ:UBXG)

過去 株価チャート

から 12 2023 まで 12 2024