Roivant (Nasdaq: ROIV) today reported its financial results for the

second quarter ended September 30, 2024, and provided a business

update.

- Brepocitinib 52-week data from the Phase 2 NEPTUNE study in

non-infectious uveitis (NIU) showed potential best-in-indication

efficacy sustained to one year; first patients enrolled in Phase 3

NIU program

- IMVT-1402 cleared five Investigational New Drug (IND)

applications across a range of therapeutic areas and FDA divisions,

including the potentially registrational trial for

difficult-to-treat rheumatoid arthritis (D2T RA) expected to

initiate by March 31, 2025

- Batoclimab proof of concept data in Graves’ disease (GD)

demonstrate potential of deeper IgG reduction with potent FcRn

inhibition to transform treatment for GD patients who are not well

controlled on antithyroid drugs (ATDs); initiation of potentially

registrational trial to evaluate IMVT-1402 in GD expected by year

end

- Mosliciguat, a once-daily inhaled soluble guanylate cyclase

(sGC) activator, unveiled as new pipeline program. Mosliciguat

Phase 1b data in pulmonary hypertension (PH) patients demonstrated

some of the highest pulmonary vascular resistance (PVR) reductions

(~38%) in PH trials to date. The global Phase 2 PHocus trial for

mosliciguat has been initiated in patients with pulmonary

hypertension associated with interstitial lung disease

(PH-ILD)

- Roivant continued to return capital through share repurchases

with $106M purchased for the quarter, resulting in $754M cumulative

share repurchases (inclusive of Sumitomo) through September 30,

2024

- Dermavant transaction with Organon closed on October 28,

2024. At closing, Roivant received $184M in cash, and Organon took

on all of Dermavant’s remaining outstanding long-term debt, which,

inclusive of Dermavant’s senior credit facility repaid at closing,

had a carrying value of $336M as of September 30, 2024. In

addition, Organon will pay Roivant a $75M milestone upon FDA

approval for VTAMA in atopic dermatitis, with a target action date

in Q1 2025

- Roivant reported consolidated cash, cash equivalents and

marketable securities of approximately $5.4B at September 30,

2024

“I am pleased to finish out another quarter with continued

clinical execution, including positive data in Graves’ Disease and

FDA’s clearance of INDs in 5 indications at Immunovant,” said Matt

Gline, CEO of Roivant. “I am also excited today to present the

52-week data from our Phase 2 study of brepocitinib in NIU. The

sustained treatment benefits observed further our belief that

brepocitinib is a potentially compelling and durable agent for a

disease that is poorly treated today. We have a busy year ahead

with major data expected in 2025 from Immunovant and Priovant,

along with continued execution across other programs.”

Recent Developments

- Immunovant: Endocrinology ProgramIn September

2024, Immunovant reported additional positive results from the

Phase 2a trial of batoclimab in Graves’ Disease. Participants in

the trial received 12 weeks of high dose batoclimab, 680 mg weekly

by subcutaneous injection (SC) followed by 12 weeks of lower dose

batoclimab, 340 mg weekly SC. At the end of the first 12 weeks,

participants experienced a mean IgG reduction of 77% leading to a

76% Response rate. In addition, by the end of 12 weeks of higher

dose batoclimab, 56% achieved an ATD-Free Response. During Weeks 13

to 24, the lower 340mg dose of batoclimab resulted in mean IgG

reduction of 65% (vs. 77% on 680mg dose) with a correspondingly

lower responder rate of 68%. In addition, a lower ATD-Free Response

rate of 36% was also observed in the second 12 weeks. Patients who

achieved at least a 70% IgG reduction at the end of the trial had

nearly a threefold higher ATD-Free Response rate than those who did

not (60% vs. 23%). Batoclimab was well tolerated with no new safety

signals identified.In November 2024, additional data on the

efficacy and safety of batoclimab in Graves’ thyroidal and

extrathyroidal disease were presented in an oral presentation at

the American Thyroid Association (ATA) 2024 Annual Meeting. These

data showed that a 60% response rate (defined as T3 and T4 falling

below the upper limit of normal (ULN) without increasing the ATD

dose) was achieved by Week 2, demonstrating the rapidity of

response to batoclimab 680mg dosed weekly. Meaningful improvements

in proptosis and lid aperture were also observed at both Week 12

and Week 24. Pronounced improvements in multiple Thyroid-Related

Patient-Reported Outcomes (ThyPRO-39) measurement scales were also

observed, with ATD-Free Responders (defined as T3 and T4 falling

below the ULN and ceasing all ATD medications) reporting greater

improvements than other participants.Neurology ProgramIn November

2024, Immunovant announced completion of enrollment for patients

included in Period 1 of the Phase 2b trial of batoclimab in CIDP,

with data expected by March 31, 2025, to inform the trial design

for a potentially registrational program with

IMVT-1402.Rheumatology ProgramIn November 2024, Immunovant also

announced FDA clearance of the IND for IMVT-1402 in D2T RA and

expects to initiate a potentially registrational trial by March 31,

2025.

- Priovant: In September 2024, Priovant

announced receipt of Fast Track designation from FDA for

brepocitinib in NIU and enrolled the first patients in the Phase 3

program. New 52-week data from the Phase 2 NEPTUNE study of

brepocitinib in NIU showed potential best-in-indication efficacy

sustained to one year. Treatment failure rate in the 45 mg dose arm

was 35% at week 52 vs. 29% at week 24. Treatment failure rate in

the 15 mg dose arm was 56% vs. 44% at week 24. In each treatment

arm only one additional patient failed from week 24 to 52. Other

important efficacy measurements at week 52 were consistent with the

week 24 data, including measurements of retinal vascular leakage

and prevention and treatment of macular edema. Safety and

tolerability were consistent with prior clinical studies of

brepocitinib, with no new safety or tolerability signals

identified. Brepocitinib has been dosed in over 1,400 subjects and

patients with a safety profile that appears consistent with

approved and widely prescribed JAK inhibitors.

- Pulmovant: In September 2024, Roivant unveiled

mosliciguat, a potential first-in-class and best-in-category

inhaled once-daily sGC activator. Mosliciguat is being

developed for PH-ILD, which affects ~200,000 patients in the U.S.

and Europe with limited or no treatment options. In September 2024,

Pulmovant also presented data from the Phase 1b ATMOS study showing

a single dose of inhaled mosliciguat in PH patients (N=38) led to

sustained, clinically meaningful mean-max reductions in PVR of up

to ~38%, one of the highest reductions seen in PH trials to date.

Mosliciguat was generally well-tolerated, with low rates of

treatment-emergent adverse events (TEAEs).Pulmovant initiated the

global Phase 2 PHocus trial of mosliciguat in patients with

PH-ILD.

- Roivant: In October 2024, Roivant reported the

close of Organon’s acquisition of Dermavant. At closing, Roivant

received $184M in cash and Organon took on all of Dermavant’s

remaining outstanding long-term debt, which, inclusive of

Dermavant’s senior credit facility repaid at closing, had a

carrying value of $336M as of September 30, 2024. In addition,

Organon will pay Roivant a $75M milestone upon FDA approval for

VTAMA in atopic dermatitis, with a target action date in the first

quarter of calendar year 2025. The transaction also includes

payments of up to $950 million for the achievements of certain

commercial milestones, in addition to the tiered royalties on net

sales that Organon will pay Dermavant shareholders.Roivant

continued to return capital through share repurchases with $106M

purchased for the quarter ending September 30, 2024, resulting in

$754M cumulative share repurchases (inclusive of the repurchase of

Sumitomo’s stake in April 2024) through September 30, 2024.Roivant

reported consolidated cash, cash equivalents and marketable

securities of approximately $5.4B at September 30, 2024.

Major Upcoming Milestones

- Kinevant plans to report topline data from the

ongoing Phase 2 trial of namilumab for the treatment of sarcoidosis

in the fourth quarter of calendar year 2024.

- Immunovant plans to have initiated 4-5

potentially registrational programs by March 31, 2025, and plans to

have initiated studies in a total of 10 indications by March 31,

2026, for IMVT-1402. In pursuit of this goal, Immunovant now has

active INDs in Graves’ Disease and difficult-to-treat rheumatoid

arthritis and expects to initiate potentially registrational trials

in these indications by December 31, 2024 and March 31, 2025

respectively. Topline data from the batoclimab trial in MG is

expected by March 31, 2025. Results from this trial are expected to

inform a decision regarding next steps for batoclimab in MG and the

design of the MG program for IMVT-1402, which is expected to

initiate by March 31, 2025. Data from the batoclimab trial in CIDP

is expected by March 31, 2025 and will be used to inform the trial

design for a potentially registrational program for IMVT-1402.

Topline data from the current pivotal program evaluating batoclimab

in thyroid eye disease (TED) now expected in the second half of

calendar year 2025.

- Priovant plans to

report topline data from the ongoing Phase 3 trial of brepocitinib

in DM in the second half of calendar year 2025.

- Genevant Markman

hearing in Pfizer / BioNTech action scheduled for December 2024.

Summary judgment phase of Moderna action scheduled for second and

third quarter of calendar year 2025; Moderna trial scheduled for

September 2025.

Second Quarter Ended

September 30, 2024 Financial

Summary

Cash and Marketable Securities

As of September 30, 2024, the Company had consolidated

cash, cash equivalents, restricted cash and marketable securities

of approximately $5.4 billion.

Research and Development Expenses

Research and development (R&D) expenses increased by $28.3

million to $143.1 million for the three months ended

September 30, 2024, compared to $114.8 million for the three

months ended September 30, 2023. This increase was primarily

driven by increases in program-specific costs of $19.2 million,

personnel-related expenses of $7.2 million, and share-based

compensation of $1.6 million.

Within program-specific costs, the increase of $19.2 million was

primarily driven by an increase in expense of $34.2 million related

to the anti-FcRn franchise, partially offset by a decrease in

expense of $18.6 million related to RVT-3101, which was sold to

Roche in December 2023.

Non-GAAP R&D expenses were $132.4 million for the three

months ended September 30, 2024, compared to $105.3 million

for the three months ended September 30, 2023.

General and Administrative Expenses

General and administrative (G&A) expenses increased by

$114.3 million to $202.9 million for the three months ended

September 30, 2024, compared to $88.6 million for the three

months ended September 30, 2023. This increase was primarily

due to an increase in personnel-related expenses of $87.0 million,

of which $79.1 million related to the one-time cash retention

awards approved in July 2024 for each of Matthew Gline, Chief

Executive Officer; Mayukh Sukhatme, President and Chief Investment

Officer; and Eric Venker, President and Chief Operating Officer

(the "2024 Senior Executive Compensation Program") and $6.6 million

related to the special one-time cash retention bonus award granted

to employees, following approval in December 2023. The increase was

also driven by an increase in share-based compensation expense of

$21.7 million, primarily due to the long-term equity incentive

awards granted in July 2024 pursuant to the 2024 Senior Executive

Compensation Program.

Non-GAAP G&A expenses were $142.3 million for the three

months ended September 30, 2024, compared to $49.6 million for

the three months ended September 30, 2023.

Loss from continuing operations, net of tax

Loss from continuing operations, net of tax was $236.8 million

for the three months ended September 30, 2024, compared to a

loss from continuing operations, net of tax of $244.6 million for

the three months ended September 30, 2023. On a basic and

diluted per common share basis, loss from continuing operation was

$0.25 and $0.28, respectively, for the three months ended

September 30, 2024 and September 30, 2023. Non-GAAP loss

from continuing operations, net of tax was $218.7 million for the

three months ended September 30, 2024, compared to $154.8

million for the three months ended September 30, 2023.

|

ROIVANT SCIENCES LTD. |

|

Selected Balance Sheet Data |

|

(unaudited, in thousands) |

| |

| |

September 30, 2024 |

|

March 31, 2024 |

| |

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

1,969,914 |

|

|

$ |

6,506,189 |

|

|

Marketable securities |

|

3,428,021 |

|

|

|

— |

|

|

Total assets |

|

6,206,028 |

|

|

|

7,222,482 |

|

|

Total liabilities |

|

625,986 |

|

|

|

773,953 |

|

|

Total shareholders’ equity |

|

5,580,042 |

|

|

|

6,448,529 |

|

|

Total liabilities and shareholders’ equity |

|

6,206,028 |

|

|

|

7,222,482 |

|

|

ROIVANT SCIENCES LTD. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited, in thousands, except share and per share amounts) |

| |

| |

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

Revenue, net |

$ |

4,475 |

|

|

$ |

3,648 |

|

|

$ |

12,465 |

|

|

$ |

8,131 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Cost of revenues |

|

234 |

|

|

|

223 |

|

|

|

447 |

|

|

|

1,206 |

|

|

Research and development (includes $9,911 and $8,309 of share-based

compensation expense for the three months ended September 30, 2024

and 2023 and $20,443 and $15,726 for the six months ended September

30, 2024 and 2023, respectively) |

|

143,073 |

|

|

|

114,790 |

|

|

|

263,580 |

|

|

|

224,206 |

|

|

Acquired in-process research and development |

|

— |

|

|

|

13,950 |

|

|

|

— |

|

|

|

26,450 |

|

|

General and administrative (includes $59,443 and $37,755 of

share-based compensation expense for the three months ended

September 30, 2024 and 2023 and $96,284 and $76,472 for the six

months ended September 30, 2024 and 2023, respectively) |

|

202,881 |

|

|

|

88,576 |

|

|

|

302,773 |

|

|

|

179,858 |

|

|

Total operating expenses |

|

346,188 |

|

|

|

217,539 |

|

|

|

566,800 |

|

|

|

431,720 |

|

|

Gain on sale of Telavant net assets |

|

— |

|

|

|

— |

|

|

|

110,387 |

|

|

|

— |

|

|

Loss from operations |

|

(341,713 |

) |

|

|

(213,891 |

) |

|

|

(443,948 |

) |

|

|

(423,589 |

) |

|

Change in fair value of investments |

|

(48,375 |

) |

|

|

45,849 |

|

|

|

(63,601 |

) |

|

|

53,413 |

|

|

Change in fair value of liability instruments |

|

(635 |

) |

|

|

11,789 |

|

|

|

515 |

|

|

|

51,967 |

|

|

Gain on deconsolidation of subsidiaries |

|

— |

|

|

|

(17,354 |

) |

|

|

— |

|

|

|

(17,354 |

) |

|

Interest income |

|

(69,773 |

) |

|

|

(14,299 |

) |

|

|

(141,900 |

) |

|

|

(31,014 |

) |

|

Other expense, net |

|

1,453 |

|

|

|

1,530 |

|

|

|

5,061 |

|

|

|

4,357 |

|

|

Loss from continuing operations before income taxes |

|

(224,383 |

) |

|

|

(241,406 |

) |

|

|

(244,023 |

) |

|

|

(484,958 |

) |

|

Income tax expense |

|

12,458 |

|

|

|

3,236 |

|

|

|

24,421 |

|

|

|

4,911 |

|

|

Loss from continuing operations, net of tax |

|

(236,841 |

) |

|

|

(244,642 |

) |

|

|

(268,444 |

) |

|

|

(489,869 |

) |

|

(Loss) income from discontinued operations, net of tax |

|

(43,083 |

) |

|

|

(86,476 |

) |

|

|

46,010 |

|

|

|

(169,094 |

) |

|

Net loss |

|

(279,924 |

) |

|

|

(331,118 |

) |

|

|

(222,434 |

) |

|

|

(658,963 |

) |

|

Net loss attributable to noncontrolling interests |

|

(49,740 |

) |

|

|

(26,791 |

) |

|

|

(87,547 |

) |

|

|

(62,820 |

) |

|

Net loss attributable to Roivant Sciences Ltd. |

$ |

(230,184 |

) |

|

$ |

(304,327 |

) |

|

$ |

(134,887 |

) |

|

$ |

(596,143 |

) |

|

Amounts attributable to Roivant Sciences Ltd.: |

|

|

|

|

|

|

|

|

Loss from continuing operations, net of tax |

$ |

(187,101 |

) |

|

$ |

(218,226 |

) |

|

$ |

(181,052 |

) |

|

$ |

(427,784 |

) |

|

(Loss) income from discontinued operations, net of tax |

|

(43,083 |

) |

|

|

(86,101 |

) |

|

|

46,165 |

|

|

|

(168,359 |

) |

|

Net loss attributable to Roivant Sciences Ltd. |

$ |

(230,184 |

) |

|

$ |

(304,327 |

) |

|

$ |

(134,887 |

) |

|

$ |

(596,143 |

) |

|

|

|

Basic and diluted net (loss) income per common share: |

|

Basic and diluted loss from continuing operations |

$ |

(0.25 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.56 |

) |

|

Basic and diluted (loss) income from discontinued operations |

$ |

(0.06 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.06 |

|

|

$ |

(0.22 |

) |

|

Basic and diluted net loss per common share |

$ |

(0.31 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.78 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

735,470,796 |

|

|

|

770,227,849 |

|

|

|

735,642,721 |

|

|

|

764,780,630 |

|

|

Diluted |

|

735,470,796 |

|

|

|

770,227,849 |

|

|

|

735,642,721 |

|

|

|

764,780,630 |

|

|

ROIVANT SCIENCES LTD. |

|

Reconciliation of GAAP to Non-GAAP Financial

Measures |

|

(unaudited, in thousands) |

| |

|

|

|

|

|

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations, net of tax |

|

|

$ |

(236,841 |

) |

|

$ |

(244,642 |

) |

|

$ |

(268,444 |

) |

|

$ |

(489,869 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

Research and development: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(1) |

|

|

9,911 |

|

|

|

8,309 |

|

|

|

20,443 |

|

|

|

15,726 |

|

|

Depreciation and amortization |

(2) |

|

|

724 |

|

|

|

1,205 |

|

|

|

1,419 |

|

|

|

2,694 |

|

|

General and administrative: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(1) |

|

|

59,443 |

|

|

|

37,755 |

|

|

|

96,284 |

|

|

|

76,472 |

|

|

Depreciation and amortization |

(2) |

|

|

1,094 |

|

|

|

1,235 |

|

|

|

2,184 |

|

|

|

2,485 |

|

|

Gain on sale of Telavant net assets |

(3) |

|

|

— |

|

|

|

— |

|

|

|

(110,387 |

) |

|

|

— |

|

|

Other: |

|

|

|

|

|

|

|

|

|

|

Change in fair value of investments |

(4) |

|

|

(48,375 |

) |

|

|

45,849 |

|

|

|

(63,601 |

) |

|

|

53,413 |

|

|

Change in fair value of liability instruments |

(5) |

|

|

(635 |

) |

|

|

11,789 |

|

|

|

515 |

|

|

|

51,967 |

|

|

Gain on deconsolidation of subsidiaries |

(6) |

|

|

— |

|

|

|

(17,354 |

) |

|

|

— |

|

|

|

(17,354 |

) |

|

Estimated income tax impact from adjustments |

(7) |

|

|

(3,986 |

) |

|

|

1,100 |

|

|

|

(4,190 |

) |

|

|

369 |

|

|

Adjusted loss from continuing operations, net of tax

(Non-GAAP) |

|

|

$ |

(218,665 |

) |

|

$ |

(154,754 |

) |

|

$ |

(325,777 |

) |

|

$ |

(304,097 |

) |

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

$ |

143,073 |

|

|

$ |

114,790 |

|

|

$ |

263,580 |

|

|

$ |

224,206 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(1) |

|

|

9,911 |

|

|

|

8,309 |

|

|

|

20,443 |

|

|

|

15,726 |

|

|

Depreciation and amortization |

(2) |

|

|

724 |

|

|

|

1,205 |

|

|

|

1,419 |

|

|

|

2,694 |

|

|

Adjusted research and development expenses

(Non-GAAP) |

|

|

$ |

132,438 |

|

|

$ |

105,276 |

|

|

$ |

241,718 |

|

|

$ |

205,786 |

|

| |

|

|

Three Months Ended September 30, |

|

Six Months Ended September 30, |

| |

Note |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

$ |

202,881 |

|

|

$ |

88,576 |

|

|

$ |

302,773 |

|

|

$ |

179,858 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

(1) |

|

|

59,443 |

|

|

|

37,755 |

|

|

|

96,284 |

|

|

|

76,472 |

|

|

Depreciation and amortization |

(2) |

|

|

1,094 |

|

|

|

1,235 |

|

|

|

2,184 |

|

|

|

2,485 |

|

|

Adjusted general and administrative expenses

(Non-GAAP) |

|

|

$ |

142,344 |

|

|

$ |

49,586 |

|

|

$ |

204,305 |

|

|

$ |

100,901 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to non-GAAP financial measures:(1) Represents non-cash

share-based compensation expense.(2) Represents non-cash

depreciation and amortization expense.(3) Represents a gain on the

sale of Telavant net assets to Roche due to achievement of a

one-time milestone in June 2024.(4) Represents the unrealized

(gain) loss on equity investments in unconsolidated entities that

are accounted for at fair value with changes in value reported in

earnings.(5) Represents the change in fair value of liability

instruments, which is non-cash and primarily includes the

unrealized (gain) loss relating to the measurement and recognition

of fair value on a recurring basis of certain liabilities.(6)

Represents the one-time gain on deconsolidation of subsidiaries.(7)

Represents the estimated tax effect of the adjustments.

Investor Conference Call Information

Roivant will host a live conference call and webcast at 8:00

a.m. ET on Tuesday, November 12, 2024, to report its financial

results for the second quarter ended September 30, 2024, and

provide a corporate update.

To access the conference call by phone, please register online

using this registration link. The presentation and webcast details

will also be available under “Events & Presentations” in the

Investors section of the Roivant website at

https://investor.roivant.com/news-events/events. The archived

webcast will be available on Roivant’s website after the conference

call.

About Roivant

Roivant is a biopharmaceutical company that aims to improve the

lives of patients by accelerating the development and

commercialization of medicines that matter. Roivant’s pipeline

includes IMVT-1402 and batoclimab, fully human monoclonal

antibodies targeting FcRn in development across several

IgG-mediated autoimmune indications; brepocitinib, a potent small

molecule inhibitor of TYK2 and JAK1 in development for the

treatment of dermatomyositis and non-infectious uveitis;

mosliciguat, an inhaled sGC activator in development for pulmonary

hypertension associated with interstitial lung disease; and

namilumab, an anti-GM-CSF monoclonal antibody in development for

the treatment of pulmonary sarcoidosis. We advance our pipeline by

creating nimble subsidiaries or “Vants” to develop and

commercialize our medicines and technologies. Beyond therapeutics,

Roivant also incubates discovery-stage companies and health

technology startups complementary to its biopharmaceutical

business. For more information, www.roivant.com.

Roivant Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release may include statements that are

not historical facts and are considered forward-looking within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), which are usually

identified by the use of words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and variations of such words or similar

expressions. The words may identify forward-looking statements, but

the absence of these words does not mean that a statement is not

forward-looking. We intend these forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act.

Our forward-looking statements include, but are not limited to,

statements regarding our or our management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future, and

statements that are not historical facts, including statements

about the clinical and therapeutic potential of our product

candidates, the availability and success of topline results from

our ongoing clinical trials and any commercial potential of our

product candidates following applicable regulatory approvals. In

addition, any statements that refer to projections, forecasts or

other characterizations of future events, results or circumstances,

including any underlying assumptions, are forward-looking

statements. Actual results may differ materially from those

contemplated in these statements due to a variety of risks,

uncertainties and other factors.

Although we believe that our plans, intentions, expectations and

strategies as reflected in or suggested by those forward-looking

statements are reasonable, we can give no assurance that the plans,

intentions, expectations or strategies will be attained or

achieved. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a number of risks, uncertainties and assumptions,

including, but not limited to, those risks set forth in the Risk

Factors section of our filings with the U.S. Securities and

Exchange Commission. Moreover, we operate in a very competitive and

rapidly changing environment in which new risks emerge from time to

time. These forward-looking statements are based upon the current

expectations and beliefs of our management as of the date of this

press release, and are subject to certain risks and uncertainties

that could cause actual results to differ materially from those

described in the forward-looking statements. Except as required by

applicable law, we assume no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts:InvestorsKeyur Parekh

keyur.parekh@roivant.com

MediaStephanie Leestephanie.lee@roivant.com

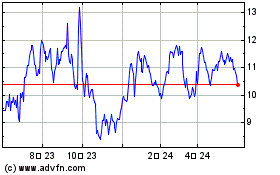

Roivant Sciences (NASDAQ:ROIV)

過去 株価チャート

から 11 2024 まで 12 2024

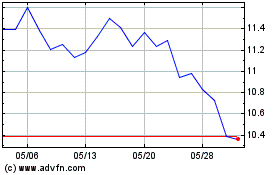

Roivant Sciences (NASDAQ:ROIV)

過去 株価チャート

から 12 2023 まで 12 2024