- Q1 Revenue of $2.7 million, up 6% year over year

- Q1 operating loss of $(4.3) million, a 41% improvement year

over year

- Q1 adjusted EBITDA of $(3.4) million, a 38% improvement year

over year

- Company announces state approval of a new customer agreement

with a prominent regional Medicaid health plan for our full suite

of solutions

- Company to Host Conference Call at 4:30 pm ET Today

Ontrak, Inc. (NASDAQ: OTRK) (“Ontrak” or the

“Company”), a leading AI-powered and technology-enabled behavioral

healthcare company, today reported its financial results for the

first quarter ended March 31, 2024.

Management Commentary

“We are thrilled to announce our approval by the Florida Agency

for Health Care Administration (AHCA) as a subcontractor for our

new customer, Community Care Plan, a South Florida-based Health

Plan to serve its adult Medicaid population,” said Brandon LaVerne,

the Company's Chief Executive Officer and Chief Operating Officer.

“We are proud of our value proposition and ROI generation

capabilities, including our NPS score of 77, improved GAD-7 and

PHQ-9 scores of 41%-64% after nine months in our program, medical

cost savings reduction of 43% and inpatient admissions reduction of

62%. We continue to innovate our solutions and are excited to

generate incremental value by delivering these evidenced-based

health outcomes for the members we serve and cost reduction to our

customers.”

First Quarter 2024 Financial Results Highlights

- Revenue for the first quarter of 2024 was $2.7 million,

representing a 6% increase compared to the same period in

2023.

- Operating loss for the first quarter of 2024 was $(4.3) million

compared to an operating loss of $(7.2) million for the same period

in 2023.

- Adjusted EBITDA for the first quarter of 2024 was $(3.4)

million compared to adjusted EBITDA of $(5.4) million for the same

period in 2023.

- Net loss for the first quarter of 2024 was $(4.5) million, or a

$(0.11) diluted net loss per common share (after deduction for

undeclared preferred stock dividends), compared to net loss of

$(8.4) million, or a $(2.26) diluted net loss per common share

(after deduction for undeclared preferred stock dividends) for the

same period in 2023.

- Non-GAAP net loss for the first quarter of 2024 was $(3.7)

million, or a $(0.10) non-GAAP diluted net loss per common share

(after deduction for undeclared preferred stock dividends),

compared to non-GAAP net loss of $(7.7) million, or a $(2.12)

non-GAAP diluted net loss per common share (after deduction for

undeclared preferred stock dividends) for the same period in

2023.

Adjusted EBITDA, non-GAAP net loss and non-GAAP diluted net loss

per common share are non-GAAP financial measures. See our

description and reconciliation of such non-GAAP measures at the end

of this release.

First Quarter 2024 and Recent Operating Highlights

- Total enrolled members in our WholeHealth+ program numbered

1,521 at the end of Q1 2024, compared to 1,758 at the end of Q4

2023 and 1,526 at the end of Q1 2023.

- The Company's effective outreach pool was 5,057 at March 31,

2024 compared to 2,161 at December 31, 2023.

- In May 2024, the Company announced that the Florida Agency for

Healthcare Administration approved Ontrak Health as a subcontractor

for a prominent regional Medicaid health plan for our Wholehealth+,

Ontrak Engage and Ontrak Access solutions. The Company expects to

initiate outreach to new eligible members of the new health plan

customer in the next 30 to 60 days and that the Company's overall

outreach pool of eligible members for our Wholehealth+ program is

expected to grow by upwards of 10% with the addition of these new

eligible members.

- In March 2024, the Company and Acuitas Capital entered into a

Sixth Amendment to the Master Note Purchase Agreement, as amended

(the "Sixth Amendment"). In accordance with the Sixth Amendment, on

April 5, 2024 and May 8, 2024, the Company issued and sold to

Acuitas Capital, and Acuitas Capital purchased from the Company,

senior secured convertible promissory notes, each with a principal

amount of $1.5 million (the first note the "Initial Demand Note"

and the second note the "Demand Note," and together the "Demand

Notes"), and in Acuitas Capital’s sole discretion, Acuitas Capital

may purchase from the Company, and the Company will issue and sell

to Acuitas, up to an additional $12.0 million in principal amount

of Demand Notes. In connection with each Demand Note purchased by

Acuitas from the Company (including the Initial Demand Note),

subject to stockholder approval effective date occurring, the

Company will issue to Acuitas (or an entity affiliated with

Acuitas, as designated by Acuitas) a warrant (“Demand Warrant”), to

purchase such number of shares of the Company’s common stock that

results in 200% warrant coverage. Each Demand Warrant will have a

term of five (5) years. The initial exercise price of each Demand

Warrant will be (a) in the case of the Demand Warrant issued in

connection with the Initial Demand Note and in respect of the next

$3.0 million of principal amount of Demand Notes purchased by

Acuitas, the lesser of (i) $0.3442 (after giving effect to the

reduction of the exercise price of the Public Offering Warrants and

Private Placement Warrant (collectively, the “November 2023

Warrants”) that occurred on April 5, 2024) and (ii) the greater of

(1) the consolidated closing bid price of the Company’s common

stock as reported on The Nasdaq Stock Market or such other exchange

on which the Company’s common stock is listed (the “Exchange”)

immediately preceding the time the applicable Demand Note is deemed

issued by the Company and (2) $0.12, and (b) in the case of the

Demand Warrants issued in connection with any subsequent Demand

Notes, the consolidated closing bid price of the Company’s common

stock as reported on the Exchange immediately preceding the time

the applicable Demand Note is deemed issued by the Company, which

initial exercise price will, in each case of clauses (a) and (b)

above, be subject to further adjustment in accordance with the

terms of the Demand Warrant and the Sixth Amendment.

- From January 1, 2024 through the date of this report, the

Company received a total of $2.0 million of cash proceeds from the

exercise of Public Offering Warrants by certain holders thereof for

a total of 9,499,062 shares of the Company's common stock.

- On February 29, 2024, the Company announced the expansion of

Ontrak's WholeHealth+ program to a larger commercial population

with a health plan customer, one of the largest health systems in

the U.S. Mid-Atlantic and Southeast. On March 12, 2024, the Company

announced a continuing expansion of its strategic partnership with

the same health plan customer to offer its program to eligible

self-insured groups. The expanded partnership initially represents

more than 6.5 times increase in the number of this customer's

members who are eligible for the Ontrak WholeHealth+ program.

- In February 2024, the Company announced the introduction of

Recovering Quality of Life Assessment (ReQoL) into its cutting-edge

WholeHealth+ Product and Solutions Suite. ReQoL assessments can be

used in healthcare and research settings to evaluate the impact of

mental health conditions, psychological interventions, and

healthcare interventions on patients' lives because they focus on

understanding the person over the diagnosis, consistent with

recovery strategies.

Financial Outlook

The following outlook is based on information available as of

the date of this press release and is subject to change in the

future.

For the quarter ending June 30, 2024, the Company estimates

revenue in the range of $2.4 million to $2.8 million.

Conference Call & Webcast Details

The Company will host a conference call/webcast today at 4:30 pm

ET/1:30 pm PT. Investors, analysts, employees and the general

public can access the call by registering online for dial-in

information or via live audio webcast at:

https://ontrakhealth.com/investors/presentations-events.

Participants interested in dialing in to the conference call are

requested to register a day in advance or at a minimum 15 minutes

before the start of the call to obtain a unique pin for the

call.

A replay of the call will be available via webcast for on-demand

listening shortly after the completion of the call, at the same web

link, and will remain available for approximately 90 days.

About Ontrak, Inc.

Ontrak Health (Nasdaq: OTRK) is a leading AI and

technology-enabled healthcare company, whose mission is to help

improve the health and save the lives of as many people as

possible. Ontrak identifies, engages, activates, and provides care

pathways to treatment for the most vulnerable members of the

behavioral health population who would otherwise fall through the

cracks of the healthcare system. We engage individuals with

anxiety, depression, substance use disorder and chronic disease

through personalized care coaching and customized care pathways

that help them receive the treatment and advocacy they need,

despite the socio-economic, medical and health system barriers that

exacerbate the severity of their comorbid illnesses. The company’s

integrated intervention platform uses AI, predictive analytics and

digital interfaces combined with dozens of care coach engagements

to deliver improved member health, better healthcare system

utilization, and durable outcomes and savings to healthcare

payors.

Learn more at www.ontrakhealth.com.

Forward-Looking Statements

This press release contains “forward-looking” statements that

are based on the Company’s beliefs and assumptions and on

information currently available to the Company on the date of this

press release and are made pursuant to the Safe Harbor provisions

of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include all statements that are not

historical facts and can be identified by terms such as “may,”

“will,” “could,” “should,” “believes,” “estimates,” “projects,”

“potential,” “expects,” “plan,” “anticipates,” “intends,”

“continues,” “forecast,” “designed,” “goal,” or the negative of

those words or other comparable words. Forward-looking statements

may include, but are not limited to, the Company’s belief that its

strategy will accelerate the Company’s return to growth by

converting new customers and expand with existing customers,

maximize the Company’s differentiated platform and deliver return

on investment for customers, and the Company’s estimated revenue

for quarter ending June 30, 2024. Forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause the Company’s actual results, performance or

achievements to be materially different from those expressed or

implied by forward-looking statements, including, without

limitation, risks related to: the Company’s ability to successfully

execute on its strategy and business plan; the Company’s ability to

increase its revenue and efficiently manage expenses and achieve

profitability; the Company’s high customer concentration and the

ability of its customers to terminate their contracts for

convenience; the adequacy of the Company’s existing cash resources

and anticipated capital commitments and future cash requirements to

enable the Company to continue as a going concern; the Company’s

ability to raise additional capital when needed; difficulty

enrolling new members and maintaining existing members in the

Company’s programs; the effectiveness of the Company’s treatment

programs; lower than anticipated eligible members under the

Company’s contracts; the Company’s dependence on key personnel and

the Company’s ability to recruit and retain key personnel; the

Company’s ability to maintain the listing of its stock on Nasdaq;

the outcomes of ongoing legal proceedings brought by the U.S.

Department of Justice and the Securities and Exchange Commission

against the Company’s largest stockholder and former Chief

Executive Officer and Chairman, and whether governmental

authorities will institute separate investigations or proceedings

against the Company and/or its current or former executives and/or

directors; substantial regulation in the health care industry;

changes in regulations or issuance of new regulations or

interpretations; the Company’s limited operating history;

difficulty in developing, exploiting and protecting proprietary

technologies; business disruption and related risks; general

economic conditions, nationally and globally, and their effect on

the market for our service; intense competition and competitive

pressures and trends in the Company’s industry and the Company’s

ability to successfully compete; changes in laws, regulations, or

policies; and risks related to the Company’s ability to realize the

potential benefits of and to effectively integrate acquisitions.

For a further list and description of the risks and uncertainties

the Company faces, please refer to the Company’s most recent

Securities and Exchange Commission filings which are available on

its website at http://www.sec.gov. Forward-looking statements are

current only as of the date they are made and the Company assumes

no obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as

required by law.

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles, or GAAP, the Company has provided in this

press release and the quarterly conference call held on the date

hereof certain non-GAAP financial measures. The non-GAAP financial

measures presented include EBITDA, Adjusted EBITDA, Non-GAAP net

loss, and Non-GAAP net loss per common share, which are not U.S.

GAAP financial measures. We believe that the presentation of these

financial measures enhances an investor’s understanding of our

financial performance. We further believe that these financial

measures are useful financial metrics to assess our operating

performance from period-to-period by excluding certain items that

we believe are not representative of our core business.

EBITDA consists of net loss before interest, taxes, depreciation

and amortization expenses. Adjusted EBITDA consists of net loss

before interest, taxes, depreciation, amortization, stock-based

compensation, restructuring, severance and related costs, gain on

termination of operating lease, and gain/loss on change in fair

value of warrant liability. We believe that making such adjustments

provides investors meaningful information to understand our results

of operations and the ability to analyze our financial and business

trends on a period-to-period basis.

Non-GAAP net loss consists of net loss adjusted for stock-based

compensation, restructuring, severance and related costs, gain on

termination of operating lease and gain/loss on change in fair

value of warrant liability. Non-GAAP net loss per common share

consists of loss per share adjusted for non-GAAP net loss

attributable to common stockholders. We believe that making such

adjustments provides investors meaningful information to understand

our results of operations and the ability to analyze our financial

and business trends on a period-to-period basis.

We believe the above non-GAAP financial measures are commonly

used by investors to evaluate our performance and that of our

competitors. However, our use of the term EBITDA, Adjusted EBITDA,

Non-GAAP net loss and Non-GAAP net loss per common share may vary

from that of others in our industry. None of EBITDA, Adjusted

EBITDA, Non-GAAP net loss or Non-GAAP net loss per common share

should be considered as an alternative to net loss before taxes,

net loss, net loss per common share or any other performance

measures derived in accordance with U.S. GAAP as measures of

performance.

See the Reconciliation of Non-GAAP Measures table at the end of

this press release for a reconciliation of the Non-GAAP financial

measures to U.S. GAAP financial measures.

ONTRAK, INC.

Consolidated Statements of

Operations

(in thousands, except per

share data)

Three Months Ended

March 31,

2024

2023

Revenue

$

2,680

$

2,529

Cost of revenue

975

847

Gross profit

1,705

1,682

Operating expenses:

Research and development

1,078

1,644

Sales and marketing

532

990

General and administrative

4,078

5,818

Restructuring, severance and related

charges

290

457

Total operating expenses

5,978

8,909

Operating loss

(4,273

)

(7,227

)

Other (expense) income , net

(2

)

291

Interest expense, net

(183

)

(1,394

)

Loss before income taxes

(4,458

)

(8,330

)

Income tax expense

—

(20

)

Net loss

(4,458

)

(8,350

)

Dividends on preferred stock -

undeclared

(2,239

)

(2,239

)

Net loss attributable to common

stockholders

$

(6,697

)

$

(10,589

)

Net loss per common share, basic and

diluted

$

(0.11

)

$

(2.26

)

Weighted-average common shares

outstanding, basic and diluted

60,882

4,686

ONTRAK, INC.

Consolidated Balance

Sheets

(in thousands, except share

and per share data)

March 31, 2024

December 31,

2023

Assets

(unaudited)

Current assets:

Cash

$

6,400

$

9,701

Receivables, net

241

—

Unbilled receivables

232

207

Deferred costs

119

128

Prepaid expenses and other current

assets

2,439

2,743

Total current assets

9,431

12,779

Long-term assets:

Property and equipment, net

757

913

Goodwill

5,713

5,713

Intangible assets, net

50

99

Other assets

10,589

147

Operating lease right-of-use assets

183

195

Total assets

$

26,723

$

19,846

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

667

$

563

Accrued compensation and benefits

756

442

Deferred revenue

244

97

Current portion of operating lease

liabilities

59

56

Other accrued liabilities

1,982

2,784

Total current liabilities

3,708

3,942

Long-term liabilities:

Long-term debt, net

1,617

1,467

Long-term operating lease liabilities

151

166

Total liabilities

5,476

5,575

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.0001 par value;

50,000,000 shares authorized; 3,770,265 shares issued and

outstanding at each of March 31, 2024 and December 31, 2023

—

—

Common stock, $0.0001 par value;

500,000,000 shares authorized; 43,950,678 and 38,466,979 shares

issued and outstanding at March 31, 2024 and December 31, 2023,

respectively

7

6

Additional paid-in capital

496,359

484,926

Accumulated deficit

(475,119

)

(470,661

)

Total stockholders' equity

21,247

14,271

Total liabilities and stockholders'

equity

$

26,723

$

19,846

ONTRAK, INC.

Consolidated Statements of

Cash Flows

(in thousands)

For the Three Months Ended

March 31,

2024

2023

Cash flows from operating

activities

Net loss

$

(4,458

)

$

(8,350

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Stock-based compensation expense

352

651

Paid-in-kind interest expense

112

848

Gain on termination of operating lease

—

(471

)

Depreciation expense

198

295

Amortization expense

100

912

Change in fair value of warrant

liability

2

19

Changes in operating assets and

liabilities:

Receivables

(241

)

278

Unbilled receivables

(25

)

217

Prepaid expenses and other current

assets

365

836

Accounts payable

104

(258

)

Deferred revenue

146

(18

)

Leases liabilities

(13

)

(118

)

Other accrued liabilities

99

206

Net cash used in operating activities

(3,259

)

(4,953

)

Cash flows from investing

activities

Purchase of property and equipment

(37

)

(25

)

Net cash used in investing activities

(37

)

(25

)

Cash flows from financing

activities

Proceeds from Keep Well Notes

—

8,000

Proceeds from warrants exercised

523

—

Finance lease obligations

—

(50

)

Financed insurance premium payments

(528

)

(611

)

Net cash (used in) provided by financing

activities

(5

)

7,339

Net change in cash and restricted cash

(3,301

)

2,361

Cash and restricted cash at beginning of

period

9,701

9,713

Cash and restricted cash at end of

period

$

6,400

$

12,074

Supplemental disclosure of cash flow

information:

Interest paid

$

30

$

27

Non-cash financing and investing

activities:

Warrants issued in connection with Keep

Well Notes

$

—

$

10,797

Debt issuance costs

10,495

—

Loss on extinguishment of debt with

related party

—

2,153

Finance lease and accrued purchases of

property and equipment

4

44

Common stock issued to settle contingent

consideration

64

—

ONTRAK, INC.

Reconciliation of Non-GAAP

Measures

(in thousands, except per

share data)

Reconciliation of

Operating Loss to EBITDA and Adjusted EBITDA

Three Months Ended

March 31,

2024

2023

Operating loss

$

(4,273

)

$

(7,227

)

Depreciation expense

198

295

Amortization expense (1)

61

391

EBITDA

(4,014

)

(6,541

)

Stock-based compensation expense

352

651

Restructuring, severance and related costs

(2)

290

457

Adjusted EBITDA

$

(3,372

)

$

(5,433

)

Reconciliation of

Net Loss to Non-GAAP Net Loss; and Net Loss per Common Share to

Non-GAAP Net Loss per Common Share

Three Months Ended

March 31,

2024

2023

Net loss

$

(4,458

)

$

(8,350

)

Stock-based compensation expense

352

651

Restructuring, severance and related costs

(2)

290

457

Loss on change in fair value of warrant

liability

2

19

Gain on termination of operating lease

(3)

—

(471

)

Non-GAAP net loss

(3,714

)

(7,694

)

Dividends on preferred stock -

undeclared

(2,239

)

(2,239

)

Non-GAAP net loss attributable to common

stockholders

$

(5,953

)

$

(9,933

)

Net loss per common share - basic and

diluted

$

(0.11

)

$

(2.26

)

Non-GAAP net loss per common share - basic

and diluted

(0.10

)

(2.12

)

Weighted-average common shares outstanding

- basic and diluted

60,882

4,686

_______________________

(1)

Relates to operating and financing

right-of-use assets and acquired intangible assets.

(2)

Includes one-time severance and related

benefit costs related to reduction in workforce plans announced in

February 2024 and March 2023 as part of Company's continued cost

savings measure.

(3)

Relates to gain realized on derecognition

of ROU operating asset and related lease liability due to early

termination of the lease of the office space located in Santa

Monica, CA in February 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514957690/en/

For Investors:

Ryan Halsted Gilmartin Group investors@ontrakhealth.com

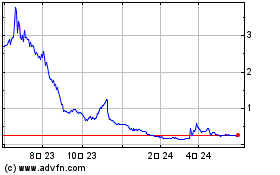

Ontrak (NASDAQ:OTRK)

過去 株価チャート

から 11 2024 まで 12 2024

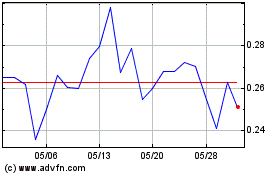

Ontrak (NASDAQ:OTRK)

過去 株価チャート

から 12 2023 まで 12 2024