Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405

2024年7月30日 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| |

|

|

|

(Check one):

|

|

☒ Form 10-K ☐ Form 20-F ☐ Form 11-K ☐ Form 10-Q

☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR

|

| |

|

| |

|

For Period Ended: April 30, 2024

|

| |

|

| |

|

☐ Transition Report on Form 10-K

|

| |

|

☐ Transition Report on Form 20-F

|

| |

|

☐ Transition Report on Form 11-K

|

| |

|

☐ Transition Report on Form 10-Q

|

| |

|

| |

|

For Transition Period Ended: ____________________________

|

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing in this Form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

FREQUENCY ELECTRONICS, INC

Full Name of Registrant

Not Applicable

Former Name if Applicable

55 CHARLES LINDBERGH BLVD.,

Address of Principal Executive Office (Street and Number)

MITCHEL FIELD, NEW YORK 11553

City, State and Zip Code

PART II — RULES 12b-25(b) and (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

☒

|

|

(a)

|

|

The reason described in reasonable detail in Part III of this Form could not be eliminated without unreasonable effort or expense;

|

| |

(b)

|

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

| |

(c)

|

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Frequency Electronics, Inc. (the “Registrant”) will not be able to timely file with the U.S. Securities and Exchange Commission (the “SEC”) its Annual Report on Form 10-K for the year ended April 30, 2024 (the “Annual Report”). The Company experienced unanticipated delays in compiling certain necessary information to complete its audited financial statements and prepare a complete filing of its Annual Report in a timely manner without unreasonable effort or expense. The Registrant will file the Form 10-K within the 15-day extension period provided by Rule 12b-25.

The Audit Committee and the Registrant’s management have discussed these matters with its independent registered public accounting firm, Grant Thornton LLP.

PART IV — OTHER INFORMATION

|

(1)

|

Name and telephone number of person to contact in regard to this notification.

|

| |

|

|

|

|

|

Steven L. Bernstein

|

|

(516)

|

|

794-4500

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). ☒ Yes ☐ No

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

On July 22, 2024, the Registrant furnished a Current Report on Form 8-K to the Securities and Exchange Commission that included a press release announcing the Registrant’s unaudited financial results for the three months and 12 months ended April 30, 2024. The Registrant does not expect any material changes to the financial results reported in such press release. As reflected in the Registrant’s press release:

| |

●

|

Revenues for the three months ended April 30, 2024 were approximately $15.6 million, compared to revenues of $13.0 million for the three months ended April 30, 2023;

|

| |

●

|

Operating income for the three months ended April 30, 2024 was approximately $2.5 million, compared to operating income of $0.4 million for the three months ended April 30, 2023;

|

| |

●

|

Net income for the three months ended April 30, 2024 was approximately $2.6 million, compared to a net income of $0.2 million for the three months ended April 30, 2023;

|

| |

●

|

Revenues for the 12 months ended April 30, 2024 were approximately $55.3 million, compared to revenues of $40.8 million for the 12 months ended April 30, 2023;

|

| |

●

|

Operating income for the 12 months ended April 30, 2024 was approximately $5.0 million, compared to an operating loss of $4.7 million for the 12 months ended April 30, 2023; and

|

| |

●

|

Net income for the 12 months ended April 30, 2024 was approximately $5.6 million, compared to net loss of $5.5 million for the 12 months ended April 30, 2023.

|

Additionally, the Registrant expects to report backlog of approximately $78 million as of April 30, 2024, as compared to $57 million as of April 30, 2023.

These are preliminary results based on current expectations and are still under review and subject to change. Actual results may differ.

Cautionary Notice Regarding Forward-Looking Statements

This Form 12-25 includes information that constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the Registrant’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to the Registrant. Such forward-looking statements include statements regarding the anticipated timing of announcement of the Registrant’s financial results for the fiscal ended April 30, 2024 and the Registrant’s expectations with respect to its results of operations for the three and 12 months ended April 30, 2024. By their nature, forward-looking statements address matters that are subject to risks and uncertainties. A variety of factors could cause actual events and results to differ materially from those expressed in or contemplated by the forward-looking statements. These factors include, without limitation, the risk that additional or different information may become known prior to the expected filing of the periodic report described herein. Other risk factors affecting the Registrant are discussed in detail in the Registrant’s filings with the SEC. The Registrant undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by applicable laws.

Frequency Electronics, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

Date: July 29, 2024

|

|

|

|

By

|

|

/s/ Steven L. Bernstein

|

| |

|

|

|

Name

|

|

Steven L. Bernstein

|

| |

|

|

|

Title

|

|

Chief Financial Officer, Secretary and Treasurer

|

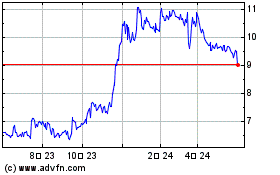

Frequency Electronics (NASDAQ:FEIM)

過去 株価チャート

から 1 2025 まで 2 2025

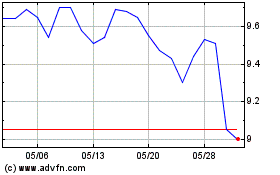

Frequency Electronics (NASDAQ:FEIM)

過去 株価チャート

から 2 2024 まで 2 2025