Dream Chasers Capital to nominate 2 directors to Carver (NASDAQ: CARV) Board

2024年7月23日 - 8:00PM

Dream Chasers Capital believes it's time to Make Carver Great

Again.

In that endeavor, Dream Chasers Capital Group - Carver Bancorp's

largest minority shareholder with a 5% stake - is nominating 2

new members to the bank’s board at its upcoming annual

shareholder meeting and we are asking for your vote.

On July 12, 2024, DCCG sent Carver’s board a slate of 2 new

nominees for election to the board at the bank’s upcoming annual

meeting. On July 18, 2024 Carver notified Dream Chasers of its

receipt of our director nominees.

The fund believes both nominees are not only supremely

qualified, but if successfully elected by you the shareholders,

will execute a new strategic plan for growth which will lead to

profitability, enrich the community and deliver significant

shareholder value. We are confident that fellow Carver shareholders

will view these 2 nominees as aligned with their interests and we

see no reason why the bank should have any issues with these

exceptional directors.

We believe any attempt to deny these directors a vote – out

of self-preservation or self-interest – may be a catalyst for an

eventual sub $1 per share stock price, significantly handicap the

bank's ability to raise future capital to carry out its mission and

present going concern risk. Dream Chasers believes it has the tacit

support of a large percentage of Craver's shareholders and we

remain open to negotiation for the benefit of all shareholders. We

encourage the Board to do the right thing as shareholder watch.

About nominee #1: Jeff Anderson

Mr. Anderson is 63 yr. old and a recently retired financial

executive with J.P. Morgan where he previously served in a CFO role

that oversaw 850 tri-state area banking centers and at the time

comprised of an income statement with $3.7 billion in revenue, $1.7

billion in pretax earnings as well as a balance sheet of $100

billion in deposits and investments, and $15 billion in loans.

Over the last 40 years Jeff has worked at many of the most

prestigious financial service companies and banks such as Goldman

Sachs, Bank of America, AIG, and Arthur Andersen.

In his various roles at these institutions, Jeff has proven to

be a result driven and accomplished senior financial management

executive and corporate officer with extensive experience in

consumer insurance, consumer banking, expense management governance

and execution, project management, budgeting, risk management,

centers of excellence operations, asset management, and compliance.

Additional strengths in incentive programs, cost reduction

initiatives, operational effectiveness, and talent management. Jeff

possesses a successful track record of increasing corporate

profitability and shareholder value by leading the execution of

competitive business strategies that increase revenues and reduce

expenses on a global scale.

Jeff was a long-time resident of Harlem where he was born and

has a deep passion for giving back to this community and currently

serves on four boards (with 3 located in Harlem) and with financial

oversight responsibilities.

About Nominee #2: Jeffrey John Bailey

Mr. Bailey is Carver’s largest individual shareholder and owns

between approximately 5 to 8% of the bank's equity. Mr. Bailey is a

serial entrepreneur, who over the last 30 years, has founded and

successfully implemented business plans, strategies and hired teams

to execute such plans resulting in millions of dollars in revenues

and profits and delivering investor returns. Mr. Bailey shares

a lifelong passion in wanting to see communities of color do better

and has supported such endeavors over the years with capital and

action.

In conclusion, the time for new blood, new energy and new ideas

is now. You the shareholders, you the real owners of the bank, you,

some of whose investments are down 80%, get to decide. No longer

can shareholders afford to sit idle and have a board, who own very

little of the company shares, continue to — out of

self-preservation, status quo and cronyism — resist positive

changes while offering no good ideas to deliver shareholder value.

It is your hard-earned money at stake. We encourage shareholders -

retail and institution - to show up and vote for our nominees at

the bank’s upcoming annual meeting.

Lastly, in a recent press release on January 31, 2024, the

bank said it rejected DCCG offer to buy a 35% stake. Among a few

reasons the board cited were their so-called concerns about

reputation risk, implied valuation and lack of banking experience

(none of which had merit).

To the contrary, the bank’s lack of profitability over the

last few years despite having almost $1 billion in deposits is an

indication of current management not having the right experience or

competence.

Furthermore, under current management, the bank until recent was

under years of OCC (Office of the Controller of the Currency)

oversight. With restrictive OCC oversight, the bank’s ability

to expand and achieve profitability was severely compromised and

shareholders suffered as a result and the bank’s reputation was

compromised.

Thank you in advance to all fellow shareholders and we look

forward to your vote and support.

For more inquiryinfo@dreamchaserscapitalgroup.com

About Dream Chasers Capital Group

LLCwww.dreamchaserscapitalgroup.com

Disclaimer: Nothing in this press release should be considered

an offer to sell or a solicitation of an offer to buy shares of any

securities.

SOURCE Dream Chasers Capital Group LLC

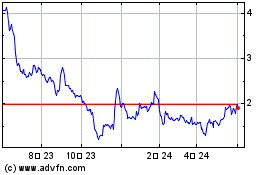

Carver Bancorp (NASDAQ:CARV)

過去 株価チャート

から 6 2024 まで 7 2024

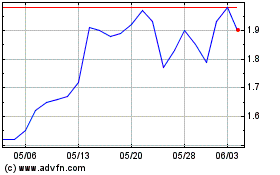

Carver Bancorp (NASDAQ:CARV)

過去 株価チャート

から 7 2023 まで 7 2024