TIDMRCOI

RNS Number : 1765R

Riverstone Credit Opps. Inc PLC

25 October 2023

25 October 2023

Riverstone Credit Opportunities Income

Quarterly Update

Full Deployment Sustained Resulting in Robust Q3 Performance

Targeted annual dividend returns of 8-10% on subscribed

capital

Riverstone Credit Opportunities Income ("RCOI" or the

"Company"), the LSE-listed energy infrastructure and

energy-transition credit investor, is pleased to announce a robust

portfolio performance for the quarter ended 30 September 2023, in

which full deployment in energy transition investments now means

that shareholders will benefit from the portfolio's high earnings

power and targeted annual dividend returns of 8-10% on subscribed

capital.

Unaudited Net Asset Value

As at 30 September 2023, the unaudited net asset value per

Ordinary Share, including net revenue for the quarter ended 30

September, stayed stable at $1.07 ($1.07: 30 June 2023). The

stability was due to continued strong performance by the unrealised

portfolio.

Portfolio Summary and Key Performance Indicators

-- Portfolio of 100% floating rate, short duration, senior

secured loans supporting RCOI's ambition to deliver annual returns

to shareholders of 8-10% whilst investing in companies engaged in

the energy transition

-- 39.8% NAV total return(5) since IPO in May 2019 (33.7% at 31 December 2022)

-- 29.6 cents in dividends paid since inception(6)

Portfolio Update

-- Against a backdrop of strong energy market performance, the

global focus on decarbonisation and the Company's unique focus on

short duration lending, the Company remains extremely well

positioned in the current environment with a portfolio of

accredited energy-transition focused investments entirely through

green or sustainability-linked structured loans.

-- Based on current portfolio commitments, as well as the

addition of the revolving credit facility in Q4 2022, the Company

is nearly fully invested as of 30 September 2023.

Reuben Jeffery III, Chairman of RCOI, commented:

"The RCOI portfolio performed strongly in Q3 2023. The Company

continues to be a beneficiary of the current interest rate

environment with a strategy focused on floating rate, short

duration loans that are designed to capture the elevated value for

our shareholders in the rapidly changing macro environment.

Since launch in May 2019, the Company has now delivered a total

NAV return(5) of 39.8% (33.7% at 31 December 2022) including 29.6

cents per share in dividend distributions(6) ."

Christopher Abbate and Jamie Brodsky, Co-Founders of Riverstone

Credit, the investment adviser, added:

" We continue to be encouraged by the Company's strong

performance and its advantageous positioning in the current

environment. In addition to the attractive financial returns

delivered, we would also highlight that the portfolio consists

entirely of Green and Sustainability-Linked loans that contribute

positively towards the energy transition across a wide variety of

applications. The Company's near complete deployment in such

investments means that shareholders will benefit from full exposure

to the high earnings power of the portfolio's energy transition

investments, which should further supplement available income to

deliver the targeted annual dividend returns of 8-10% on subscribed

capital."

Cumulative Portfolio Summary

Unrealised Portfolio[1]

Investment Subsector Commitment Cumulative Cumulative Gross Gross Gross % of % of 30 30

Name Date Committed Invested Realised Unrealised Realised Par Par Sep Sep

Capital Capital Capital Value Capital as of as of 2023 2023

($mm) ($mm) ($mm)(1) ($mm) & 30 Sep 30 June Gross Net

Unrealised 2023(2) 2023(2) MOIC MOIC

Value

($mm)

Caliber

Midstream(3) Infrastructure Aug-19 4.0 4.0 0.5 0.5 1.0 36.12% 38.44% 0.24x 0.17x

Imperium3NY Energy 0.91 0.91

LLC Transition Apr-21 6.8 5.4 6.7 0.9 7.6 (4) (4) 1.42x 1.34x

Blackbuck

Resources

LLC Infrastructure Jun-21 11.5 11.0 4.1 10.3 14.4 103.19% 102.57% 1.31x 1.23x

Harland

& Wolff

Group Holdings Infrastructure

PLC Services Mar-22 14.6 14.6 1.2 17.9 19.1 106.92% 106.11% 1.31x 1.24x

Seawolf 13.06 12.99

Water Resources Services Sept-22 9.0 9.0 0.6 13.1 13.6 (4) (4) 1.51x 1.44x

EPIC Propane

Pipeline,

LP Infrastructure Sept-22 13.9 13.9 1.9 13.9 15.8 99.33% 99.24% 1.14x 1.06x

Hoover

Circular Infrastructure

Solutions Services Nov-22 13.7 13.7 1.1 14.2 15.4 98.32% 98.18% 1.12x 1.04x

Clean

Energy Energy

Fuels Corp Transition Dec-22 13.9 13.9 1.4 13.9 15.3 99.39% 99.47% 1.11x 1.03x

Max Midstream Infrastructure Dec-22 5.0 5.0 0.4 5.2 5.6 101.38% 100.84% 1.13x 1.05x

Streamline

Innovations Infrastructure

Inc. Services Jun-23 9.9 3.5 0.3 3.6 3.8 99.20% 99.13% 1.08x 1.06x

----------- ----------- --------- ----------- ----------- -------- -------- ------ ------

$102.3 $94.0 $18.2 $93.5 $111.7 1.19x 1.11x

Direct Lending Consolidated Portfolio Key Stats at Entry As of 30 September

2023

Weighted Avg. Entry Basis 97.5%

---------------------------------------------------------------

Weighted Avg. All-In Benchmark Rate 4.6 p.a.

at Entry

---------------------------------------------------------------

Weighted Avg. Floating Rate Spread 7.1 p.a.

at Entry

---------------------------------------------------------------

Weighted Avg. All-in Coupon at Entry 11.7 p.a.

---------------------------------------------------------------

Weighted Avg. Undrawn Spread at Entry 4.0 p.a.

---------------------------------------------------------------

Weighted Avg. Tenor at Entry 3.4 years

---------------------------------------------------------------

Weighted Avg. Call Premium at Entry 102.6

---------------------------------------------------------------

Security 100% Secured

---------------------------------------------------------------

Realised Portfolio

Investment Subsector Commitment Realisation Cumulative Cumulative Gross 30 Sep 30

Name Date Date Committed Invested Realised 2023 Sep

Capital Capital Capital Gross 2023

($mm) ($mm) ($mm)(1) MOIC Net

MOIC

Rocky Creek Exploration 1.15 1.10

Resources & Production Jun-19 Dec-19 6.0 4.3 4.9 x x

Infrastructure 1.02 0.97

CIG Logistics Services Jan-20 Jan-20 8.7 8.7 8.9 x x

Mallard Exploration 1.13 1.08

Exploration & Production Nov-19 Apr-20 13.8 6.8 7.7 x x

Market 1.01 0.96

Based Multiple Aug-20 Nov-20 13.4 13.4 13.6 x x

Project 1.23 1.18

Yellowstone Infrastructure Jun-19 Mar-21 5.8 5.8 7.2 x x

Ascent Exploration 1.21 1.16

Energy & Production Jun-19 Jun-21 13.3 13.3 16.1 x x

Pursuit Exploration 1.22 1.16

Oil & Gas & Production Jul-19 Jun-21 12.3 12.3 15 x x

Infrastructure 1.13 1.07

U.S. Shipping Services Feb-21 Aug-21 6.5 6.5 7.3 x x

Aspen Power 1.27 1.22

Partners Infrastructure Dec-20 Oct-21 6.9 3.4 4.3 x x

Project Infrastructure 1.28

Mariners Services Jul-19 Apr-22 13.2 13.2 17.6 1.33x x

Roaring 1.11

Fork Midstream Infrastructure Mar-21 Jun-22 5.9 5.9 6.9 1.16x x

FS Crude, 1.18

LLC Infrastructure Mar-20 Sept-22 13.7 13.7 16.9 1.23x x

EPIC Propane

Pipeline, 1.27

LP Infrastructure Dec-19 Sept-22 14.8 14.8 19.6 1.32x x

Circulus

Holdings, 1.09

PBLLC Infrastructure Aug-21 Oct-22 12.3 12.3 14.0 1.14x x

Hoover

Circular Infrastructure 1.05

Solutions Services Oct-20 Nov-22 15.4 15.4 17.0 1.10x x

Streamline

Innovations Infrastructure

Inc. Services Nov-21 Jun-23 13.8 6.9 8.9 1.29x 1.23x

$175.9 $156.7 $185.7 1.18x 1.13x

The Gross Realised Capital column includes interest, fee income,

and principal received. The Gross Unrealised Value column includes

the amortization of OID, accrued interest, fees and any unrealised

change in the value of the investment.

For Riverstone Credit Opportunities Income Plc:

Adam Weiss

+1 212 271 2953

J.P. Morgan Cazenove (Corporate

Broker) +44 (0)20 7742 4000

William Simmonds

Jérémie Birnbaum

James Bouverat (Sales)

Media Contacts:

Buchanan

Helen Tarbet Henry Tel: +44 (0) 20 7466 5109 Tel:

Wilson Verity Parker +44 (0) 20 7466 5111 Tel: +44

(0) 20 7466 5197 Email: rcoi@buchanan.uk.com

About Riverstone Credit Opportunities Income Plc :

RCOI lends to companies that build and operate the

infrastructure used to generate, transport, store and distribute

both renewable and conventional sources of energy, and companies

that provide services to that infrastructure. RCOI also lends to

companies seeking to facilitate the energy transition by

decarbonizing the energy, industrial and agricultural sectors,

building sustainable infrastructure and reducing or sequestering

carbon emissions. The Company seeks to ensure that its investments

are having a positive impact on climate change by structuring each

deal as either a green loan or a sustainability-linked loan,

documented using industry best practices.

For further details, see https://www.riverstonecoi.com/.

Neither the contents of RCOI's website nor the contents of any

website accessible from hyperlinks on the websites (or any other

website) is incorporated into, or forms part of, this

announcement.

1 Gross realised capital is total gross income realised on

invested capital.

(2) Includes fair market value of equity and rights where

applicable as a percentage of par.

(3) Includes Caliber HoldCo Escrow, Caliber MFC LLC equity,

Caliber Midstream Term Loan & Priming Facility.

(4) Reflects the total fair market value in millions.

(5) NAV total return equals cumulative paid dividend cents per

share and NAV per share as of 30 September 2023 divided by the

opening capital net of share issuance costs as of 28 May 2019.

(6) Reflects cumulative dividend cents per share declared as of

30 June 2023 and paid as of 30 September 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUFFFLFIFLSFIV

(END) Dow Jones Newswires

October 25, 2023 02:00 ET (06:00 GMT)

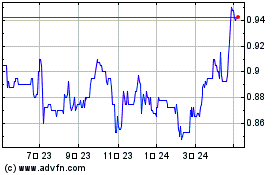

Riverstone Credit Opport... (LSE:RCOI)

過去 株価チャート

から 4 2024 まで 5 2024

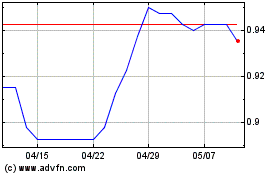

Riverstone Credit Opport... (LSE:RCOI)

過去 株価チャート

から 5 2023 まで 5 2024