TIDMHUM

RNS Number : 9060N

Hummingbird Resources PLC

28 September 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

28 September 2023

Hummingbird Resources pl c

("Hummingbird", the "Group" or the "Company")

H1-2023 Interim Results & Group Refinancing Package

Update

Hummingbird Resources (AIM: HUM) is pleased to announce its

unaudited results for the six months ended 30 June 2023 ("the

period" or "H1-2023") and provide details of a Group refinancing

package with the Company's financing partner Coris Bank

International ("Coris Bank").

Financial Results for H1-2023

-- Strong Group sales of US$98.6 million (H1-2022: US$66.3

million) were generated from 51,149 ounces ("oz") of gold sold

during the period at an average price of US$1,927 per oz (H1-2022:

35,668 oz sold at an average price of US$1,859 per oz).

o An additional US$4.6 million (H1-2022: US$4.1 million) of

revenue generated from the sale of single mine origin ("SMO")

gold.

-- Group adjusted EBITDA of US$33.1 million for H1-2023, marking

a material positive turnaround compared to the previous year

(H1-2022 loss of US$9.3 million) and a pre-tax profit of US$4.1

million for the period (H1-2022 loss of: US$23.9 million).

-- Capital expenditure of US$41.5 million for the period

(H1-2022: US$31.9 million), predominately on the completion of the

Kouroussa Gold Mine and plant construction ("Kouroussa").

-- Net debt of US$122.8 million at the end of H1-2023 (US$119.3

million including gold inventory value).

Post Period Corporate and Operational updates:

Corporate Update

-- The Company has agreed a Group funding package with Coris

Bank for c.US$55 million including:

o Refinancing c.US$35 million of existing loans with Coris Bank,

to provide additional cash flow flexibility as Kouroussa progresses

towards steady state production; and

o An additional c.US$20 million to provide increased capital

support for the Group, including the continual development of

underground mining operations at the Yanfolila Mine, Mali.

-- The Company's revised loan repayment schedule to begin in

FY-2024, versus Q3-2023, with c.US$77 million due in FY-2024,

c.US$61 million scheduled for FY-2025, with the balance c.US$15

million payable by the end of FY-2028.

-- Updated 2023 Company Reserves and Resources statements were

released on 13 September 2023, noting Group Reserves of 4.03

million ounces ("Moz") and Group Resources of 6.95 Moz.

Yanfolila Gold Mine, Mali

-- Following the completion of mining in the Komana East open

pit in Q2-2023, the development of the Komana East Underground Mine

has continued to progress, with significant advancement of the

portal access and development drive declines.

-- Yanfolila remains well positioned to meet its FY-2023

production guidance of 80,000 - 90,000 oz at an AISC of under

US$1,500 per oz.

Kouroussa Gold Mine, Guinea

-- Following Kouroussa's first gold pour in June 2023, the

operations team recently completed a first gold shipment of

approximately 1,000 oz of gold.

-- The Company plans to increase the size and regularity of its

gold pours and shipments through Q4-2023 as the operation

progresses towards steady state production and a full year of

commercial production for FY-2024.

A more detailed update on the Company's operations will be given

at the Company's Q3-2023 operational and trading update, scheduled

for release in late October 2023.

Dan Betts, CEO of Hummingbird, commented:

" Our H1-2023 performance of over 51 Koz of gold produced at an

H1-2023 AISC profile of US$1,170 per oz and US$33 million of group

EBITDA is the result of the focussed efforts by the team over the

last year to stabilise the Yanfolila operation and re-establish a

more reliable platform for the Company to grow from.

At Kouroussa, H1-2023 saw the construction of the project

completed on time and on budget, and conduct its first gold pour,

marking a material milestone for the Company to become a

multi-asset, multi-jurisdictional gold producer. The key focus for

our Kouroussa operations team is on reaching steady state

production and setting the mine up for full commercial production

for FY-2024 and beyond.

Further, we are pleased to have agreed a refinancing package

with our financing partner Coris Bank, who remain committed

supporters to Hummingbird's growth platform. This package will

provide additional flexibility in 2023 to allow Kouroussa to reach

steady state production and provide additional capital support for

the Group.

More details on our operations will be given at our Q3-2023

operational and trading update in late October."

New Group Financing Package and Related Party Transaction

-- The Company has agreed to refinance a portion of its existing

Coris Bank group loan facilities and secured additional funding as

capital support for the Group.

-- The financing package will provide new loans totalling c.US$55 million including:

o Refinancing c.US$35 million of existing Coris Bank loans, with

loan repayments to begin FY-2024, versus Q3-2023, to provide

additional cash flow flexibility as Kouroussa progresses towards

steady state production ; and

o An additional c.US$20 million to provide additional capital

for the Group, including for the ongoing development of underground

mining operations at Yanfolila, Mali.

-- The terms of the new Group refinancing package of c.US$55

million as detailed above, are at a fixed interest rate of 12%

p.a., with the original loans continuing at a fixed interest rate

of 8.5% p.a.

-- Hummingbird remains focused on strengthening its balance

sheet, with scheduled loan repayments of c.US$77 million in

FY-2024, c.US$61 million in FY-2025, with the balance c.US$15

million payable by the end of FY-2028.

-- Coris Bank is controlled by the same principal as the

Company's 26.1 per cent shareholder, CIG SA. The Company is

entering into the financing package with Coris Bank, which is

classified as a related party transaction pursuant to the AIM Rules

for Companies. In this regard, the directors of the Company

confirm, having consulted with the Company's nominated adviser,

Strand Hanson Limited, that they consider that the terms of the

financing package to be fair and reasonable insofar as its

shareholders are concerned.

H1-2023 Operating Summary

-- A rolling Group lost time injury frequency rate ("LTIFR") of

0.69 per million hours worked was achieved for H1-2023, within the

Group's target rate of 1.20 per million hours worked, with an LTIFR

of 0.87 and 0.40 per million hours worked at Yanfolila and

Kouroussa, respectively.

-- A total of 51,147 oz was produced in H1-2023, up c.44% versus H1-2022 (H1-2022: 35,561 oz).

-- Materially improved H1-2023 AISC of US$1,170 per oz, a

decrease of c.42% versus H1-2022 (H1-2022: US$2,019).

-- Through H1-2023 Kouroussa successfully commenced: mining in

early Q1-2023; hot commissioning of the processing plant in

Q2-2023; and completed the operation's first gold pour on 8 June

2023. Further, Kouroussa was built on time and on budget ahead of

the scheduled Q2-2023 timeline.

-- The Company is currently finalising its exploration plans at

both Kouroussa and Yanfolila, with the core focus to increase the

respective Resource bases and, ultimately, enlarge the Reserves

bases and LOM at both assets.

H1-2023 ESG Summary

-- The Company continues to focus on implementing ESG

initiatives, procedures, and protocols across its operations, with

community engagement and generation of local content a key emphasis

for the Company. Through H1-2023, several key sustainability

initiatives were delivered, including:

o Completion of the Sanioumale East ("SE") village resettlement

at Yanfolila, Mali ahead of schedule. The SE resettlement has

resulted in the rehousing of over 40 families, all completed under

the guidance of West African specialist consultants Environmental

and Social Development Company ("ESDCO").

o Community livelihood initiatives and projects continued to

advance during the period at both Yanfolila and Kouroussa,

including, amongst others: local community market gardens; water

infrastructure development programmes; and local reforestation

strategy initiatives.

o An increased number of healthcare and first aid training

initiatives conducted in the communities and schools at Kouroussa

by the on-site clinical nursing team and global remote healthcare

specialists Critical Care International ("CCI") .

o During the period the Company published its inaugural 2022

sustainability report. The full report can be viewed on the

Company's website - 2022 Hummingbird Resources plc Sustainability

Report.

**S**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold producing Company, member of the World Gold

Council and founding member of Single Mine Origin

(www.singlemineorigin.com). The Company currently has two core gold

projects, the operational Yanfolila Gold Mine in Mali, and the

Kouroussa Gold Mine in Guinea, which will more than double current

gold production once at commercial production. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by joint venture partners, Pasofino Gold

Limited. The final feasibility results on Dugbe showcase 2.76Moz in

Reserves and strong economics such as a 3.5-year capex payback

period once in production, and a 14-year life of mine at a low AISC

profile. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ("ESG") policies and

practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Gordon Hamilton Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Pope Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 30 31

June June December

2023 2022 2022

Notes $'000 $'000 $'000

---------------- ----------------- ------------

Revenue 103,194 70,443 150,519

Production costs (50,982) (64,865) (126,527)

Amortisation and depreciation (22,590) (16,945) (37,357)

Royalties and taxes (3,841) (2,447) (5,620)

------------------------------------------------------------- ---- ---------------- ----------------- ------------

Cost of sales (77,413) (84,257) (169,504)

Gross profit / (loss) 25,781 (13,814) (18,985)

Share based payments (2,027) (2,069) (1,941)

Other administrative expenses (9,176) (5,853) (11,791)

------------------------------------------------------------- ---- ---------------- ----------------- ------------

Operating profit / (loss) 14,578 (21,736) (32,717)

Finance income 148 4,679 3,641

Finance expense (11,914) (5,589) (14,156)

Share of joint venture profit 2 - 4

(Impairment) / reversals in impairment of financial assets (46) 87 (316)

Gains / (losses) on financial assets measured at fair value 1,313 (1,369) (715)

------------------------------------------------------------- ---- ---------------- ----------------- ------------

Profit / (loss) before tax 4,081 (23,928) (44,259)

Tax 5 (7,104) 3,106 4,269

------------------------------------------------------------- ---- ---------------- ----------------- ------------

Loss for the period / year (3,023) (20,822) (39,990)

============================================================= ==== ================ ================= ============

Attributable to:

Equity holders of the parent (3,846) (18,378) (34,279)

Non-controlling interests 823 (2,444) (5,711)

------------------------------- -------- --------- ---------

Loss for the period/year (3,023) (20,822) (39,990)

=============================== ======== ========= =========

Loss per share (attributable to equity holders of the parent)

Basic ($ cents) 6 (0.73) (4.67) (8.71)

Diluted ($ cents) 6 (0.73) (4.67) (8.71)

--------------------------------------------------------------- ------- ------- -------

Consolidated Statement of Financial Position

As at 30 June 2023

Unaudited Restated Unaudited Audited

30 30 31

June June December

2023 2022 2022

Notes $'000 $'000 $'000

-------------------------------------------------------- ------ ---------- ------------------- ----------

Assets

Non-current assets

Intangible exploration and evaluation assets 131,262 92,252 129,652

Intangible assets software 103 182 143

Property, plant and equipment 242,088 164,264 204,393

Right of use assets 19,769 30,358 25,488

Investments in associates and joint ventures 136 129 133

Financial assets at fair value through profit or loss 2,114 1,899 1,532

Deferred tax assets 3,453 7,638 9,571

398,925 296,722 370,912

-------------------------------------------------------- ------ ---------- ------------------- ----------

Current assets

Inventory 20,672 13,158 15,748

Trade and other receivables 61,210 37,091 51,852

Unrestricted cash and cash equivalents 1,683 - -

Restricted cash and cash equivalents 4,003 3,887 3,892

87,568 54,136 71,492

-------------------------------------------------------- ------ ---------- ------------------- ----------

Total assets 486,493 350,858 442,404

======================================================== ====== ========== =================== ==========

Liabilities

Non-current liabilities

Borrowings 58,841 63,180 71,840

Lease liabilities 11,654 21,530 15,845

Deferred consideration 1,886 4,159 1,801

Other financial liabilities 25,950 9,298 26,795

Provisions 27,750 22,405 27,120

-------------------------------------------------------- ------ ---------- -------------------

126,081 120,572 143,401

-------------------------------------------------------- ------ ---------- ------------------- ----------

Current liabilities

Trade and other payables 88,169 49,357 66,081

Lease liabilities 11,819 9,961 11,819

Deferred consideration - - 1,776

Other financial liabilities 15,000 15,000 15,000

Provisions 830 - 830

Borrowings 69,754 - 43,862

Bank overdraft - 5,171 1,741

185,572 79,489 141,109

-------------------------------------------------------- ------ ---------- -------------------

Total liabilities 311,653 200,061 284,510

-------------------------------------------------------- ------ ---------- ------------------- ----------

Net assets 174,840 150,797 157,894

======================================================== ====== ========== =================== ==========

Equity

Share capital 7 8,287 5,827 5,828

Share premium 33,647 17,425 17,425

Retained earnings 94,619 120,469 97,177

-------------------------------------------------------- ------ ---------- ------------------- ----------

Equity attributable to equity holders of the parent 136,553 143,721 120,430

======================================================== ====== ========== =================== ==========

Non-controlling interest 38,287 7,076 37,464

Total equity 174,840 150,797 157,894

======================================================== ====== ========== =================== ==========

Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30 June 2023 30 June 2022 31 December 2022

$'000 $'000 $'000

Operating activities

Profit / (loss) before tax 4,081 (23,928) (44,259)

Adjustments for:

Amortisation and depreciation 16,965 11,332 26,048

Amortisation and depreciation - right of use assets 5,719 5,627 11,386

Share based payments 2,650 2,232 1,865

Finance income 2,165 (4,679) (3,641)

Finance expense 9,600 5,589 14,156

Share of joint venture profit (2) - (4)

Impairment/(reversals) in impairment of financial assets 46 (87) 316

(Gains) / losses on financial assets and liabilities measured

at fair value (1,313) 1,369 715

--------------------------------------------------------------- --------------- --------------- -----------------

Operating cash flows before movements in working capital 39,911 (2,545) 6,582

Increase in inventories (4,923) (11) (2,601)

Increase in receivables (14,796) (11,938) (21,491)

Increase in payables 14,647 11,883 32,101

34,839 (2,611) 14,591

-------------------------------------------------------------- --------------- --------------- -----------------

Taxation paid (736) (680) (1,410)

--------------------------------------------------------------- --------------- --------------- -----------------

Net cash generated from / (used in) operating activities 34,103 (3,291) 13,181

--------------------------------------------------------------- --------------- --------------- -----------------

Investing activities

Purchases of exploration and evaluation assets (1,610) (1,109) (5,876)

Purchases of property, plant and equipment (39,856) (30,747) (82,942)

Pasofino funding - 2,827 4,665

Pasofino funding utilisation - (2,827) -

Interest received - 2 2

Net cash used in investing activities (41,466) (31,854) (84,151)

--------------------------------------------------------------- --------------- --------------- -----------------

Financing activities

Exercise of share options - 13 14

Net proceeds from issue of shares 17,066 - -

Lease principal payments (5,739) (6,027) (10,741)

Lease interest payments (1,094) (715) (2,862)

Loan interest paid (6,279) - (3,452)

Commissions and other fees paid (2,188) (2,890) (4,724)

Loans repaid (809) - -

Loan drawdown 9,682 7,520 58,695

Net cash generated from / (used in) financing activities 10,639 (2,099) 36,930

--------------------------------------------------------------- --------------- --------------- -----------------

Net increase / (decrease) in cash and cash equivalents 3,276 (37,244) (34,040)

Effect of foreign exchange rate changes 259 (779) (548)

Cash and cash equivalents at beginning of period/year 2,151 36,739 36,739

Cash and cash equivalents at end of period/year 5,686 (1,284) 2,151

=============================================================== =============== =============== =================

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Total equity

Share Share Retained attributable to the Non-controlling

capital premium earnings parent interest Total

$'000 $'000 $'000 $'000 $'000 $'000

----------------------- --------- --------- ---------- ---------------------- ----------------------- ----------

As at 1 January 2022

(restated) 5,814 17,425 137,895 161,134 9,520 170,654

Loss for the period - - (18,378) (18,378) (2,444) (20,822)

----------------------- ---------- ---------------------- ----------------------- ----------

Total comprehensive

loss for the period - - (18,378) (18,378) (2,444) (20,822)

Share based payments 13 - 952 965 - 965

As at 30 June 2022

(Unaudited) 5,827 17,425 120,469 143,721 7,076 150,797

======================= ========= ========= ========== ====================== ======================= ==========

As at 1 January 2022

(restated) 5,814 17,425 137,895 161,134 9,520 170,654

Loss for the year - - (34,279) (34,279) (5,711) (39,990)

----------------------- --------- --------- ---------- ---------------------- ----------------------- ----------

Total comprehensive

loss for the year - - (34,279) (34,279) (5,711) (39,990)

Transactions with

owners in their

capacity as owners:

Pasofino minority

interest after

earn-in - - (9,528) (9,528) 33,655 24,127

----------------------- --------- --------- ---------- ---------------------- ----------------------- ----------

Total transactions

with owners in their

capacity as owners - - (9,528) (9,528) 33,655 24,127

Exercise of share

options 14 - - 14 - 14

Share based payments - - 3,089 3,089 - 3,089

As at 31 December 2022

(Audited) 5,828 17,425 97,177 120,430 37,464 157,894

======================= ========= ========= ========== ====================== ======================= ==========

As at 1 January 2023 5,828 17,425 97,177 120,430 37,464 157,894

Comprehensive (loss)/income for the period:

(Loss)/income for the period - - (3,846) (3,846) 823 (3,023)

--------------------------------------------------- --------- ---------- --------- ----------

Total comprehensive (loss)/income for the period - - (3,846) (3,846) 823 (3,023)

Transactions with owners in their capacity as

owners:

Shares issued 2,459 16,222 - 18,681 - 18,681

--------------------------------------------------- -------- --------- --------- ---------- --------- ----------

Total transactions with owners in their capacity

as owners 2,459 16,222 - 18,681 - 18,681

Share based payments - - 1,288 1,288 - 1,288

As at 30 June 2023 (Unaudited) 8,287 33,647 94,619 136,553 38,287 174,840

=================================================== ======== ========= ========= ========== ========= ==========

1. General information

Hummingbird Resources PLC is a public limited company with

securities traded on the AIM market of the London Stock Exchange.

It is incorporated and domiciled in the United Kingdom and has a

registered office at 49-63 Spencer Street, Hockley, Birmingham,

West Midlands, B18 6DE.

The nature of the Group's operations and its principal

activities are the exploration, evaluation, development, and

operating of mineral projects, principally gold, focused currently

in West Africa.

2. Adoption of new and revised standards

The interim financial statements have been drawn up based on

accounting policies consistent with those applied in the financial

statements for the year ended 31 December 2022. There were several

accounting standards updates effective 1 January 2023, which did

not have any material impact on the financial statements of the

Group.

IFRS 17 effective 1 January 2023 Insurance contracts

IAS 1 effective 1 January 2023 Disclosure of accounting policies

IAS 8 effective 1 January 2023 Definition of accounting estimate

IAS 12 effective 1 January 2023 Deferred tax related to assets and liabilities arising from a single transaction

3. Significant accounting policies

Basis of preparation

The financial statements have been prepared in accordance with

UK adopted International Accounting Standards. The principal

accounting policies adopted are set out below. The functional

currency of all companies in the Group is United States Dollar

("$"). The financial statements are presented in thousands of

United States dollars ("$'000").

The consolidated interim financial information for the period 1

January 2023 to 30 June 2023 is unaudited, does not include all the

information required for full financial statements and should be

read in conjunction with the Group's consolidated financial

statements for the year ended 31 December 2022. In the opinion of

the Directors the consolidated interim financial information for

the period represents fairly the financial position, results from

operation and cash flows for the period in conformity with

generally accepted accounting principles consistently applied. The

consolidated interim financial information incorporates comparative

figures for the interim period 1 January 2022 to 30 June 2022 and

the audited financial year to 31 December 2022. As permitted, the

Group has chosen not to adopt IAS34 'Interim Financial

Reporting'.

The annual financial statements of Hummingbird Resources plc are

prepared in accordance with UK adopted International Accounting

Standards. The Group's consolidated annual financial statements for

the year ended 31 December 2022, have been filed with the Registrar

of Companies and are available on the Company's website

www.hummingbirdresources.co.uk. The auditor's report on those

financial statements though unqualified contained an emphasis of

matter paragraph in respect of risks surrounding the going concern

assumption of the Company at that date.

On 30 June 2023, the Group had cash and cash equivalents of $5.7

million and total borrowings of $128.6 million. As of June 30,

2023, the Company had a working capital deficiency (current assets

less current liabilities) of $98.0 million. The current liabilities

include Anglo Pacific royalty liability of $15 million which,

although current due to the nature of the agreement, is not

expected to be paid soon.

Going concern

The Group has prepared cash flow forecasts based on estimates of

key variables including production, gold price, operating costs,

capital expenditure through to December 2024 that supports the

conclusion of the Directors that they expect sufficient funding to

be available to meet the Group's anticipated cash flow requirements

to this date.

These cashflow forecasts are subject to several risks and

uncertainties, in particular the ability of the Group to achieve

the planned levels of production and the recent average higher gold

prices being sustained. The Board reviewed and challenged the key

assumptions used by management in its going concern assessment, as

well as the scenarios applied and risks considered, including the

risks associated with the recent change in governments in Mali and

Guinea.

The biggest material uncertainty and risk remains ounces

produced and whether the current mine plan can be achieved

(including expected production from the newly completed Kouroussa

mine), mining contractor equipment performance. Where additional

funding may be required, the Group believes it has several options

available to it, including but not limited to, use of the overdraft

facility, cost reduction strategies, selling of non-core assets,

raising additional funds from current investors and debt

partners.

The Board also considered sensitivities to those cash flow

scenarios (including where production is lower than forecast and

gold prices lower than current levels) which would require

additional funding. Should this situation arise, the Directors

believe that they have several options available to them, such as

use of the current overdraft facility, obtaining additional

funding, delaying expenditures, sale of non-core assets, which

would allow the Group to meet its cash flow requirements through

this period, however, there remains a risk that the Group may not

be able to achieve these in the necessary timeframe.

Based on its review, the Board has a reasonable expectation that

the Group has adequate resources to continue operating for the

foreseeable future and hence the Board considers that the

application of the going concern basis for the preparation of the

Financial Statements was appropriate. However, the risk of

lower-than-expected production levels, timing of VAT offsets and

receipts and the ability to secure any potential required funding

at date of signing of these financial statements, indicates the

existence of a material uncertainty which may cast significant

doubt on the Group's ability to continue as a going concern.

Should the Group be unable to achieve the required levels of

production and associated cashflows, defer expenditures or obtain

additional funding such that the going concern basis of preparation

was no longer appropriate, adjustment would be required including

the reduction of balance sheet asset values to their recoverable

amounts and to provide for future liabilities should they

arise.

4. EBITDA and adjusted EBITDA

Earnings before interest, taxes, depreciation and amortisation

("EBITDA") is a factor of volumes, prices and cost of production.

This is a measure of the underlying profitability of the Group,

widely used in the mining sector. Adjusted EBITDA removes the

effect of impairment charges, foreign currency translation

gains/losses and other non-recurring expense adjustments but

including IFRS 16 lease payments.

Reconciliation of Net Earnings to EBITDA and Adjusted EBITDA

Unaudited

Unaudited six months

six months ended 30 ended 30 Audited year ended 31 December

June 2023 June 2022 2022

$'000 $'000 $'000

--------------------------------------------- --------------------- ------------ -------------------------------

Profit / (loss) before tax 4,081 (23,928) (44,259)

Less: Finance income 2,165 (4,679) (3,641)

Add: Finance costs 9,600 5,589 14,156

Add: Depreciation and amortisation 22,683 16,959 37,357

---------------------------------------------- --------------------- ------------ -------------------------------

EBITDA 38,529 (6,059) 3,613

---------------------------------------------- --------------------- ------------ -------------------------------

IFRS 16 lease interest and principal payments (6,833) (6,742) (13,602)

Share based payments 2,650 2,232 1,866

Share of joint venture gain (2) - (4)

Impairment / (reversal) of financial assets 46 (87) 316

(Gains) / losses on financial assets and

liabilities measured at fair value (1,313) 1,369 715

---------------------------------------------- --------------------- ------------ -------------------------------

Adjusted EBITDA 33,077 (9,287) (7,096)

============================================== ===================== ============ ===============================

5. Tax

The tax charge/(income) for the period/year is summarised as

follows:

Unaudited six months ended Unaudited six months ended Audited year ended 31

30 June 2023 30 June 2022 December 2022

$'000 $'000 $'000

---------------------------- ---------------------------- ---------------------------- ----------------------------

Minimum tax pursuant to

Malian law 986 664 1,434

Deferred tax

expense/(income) 6,118 (3,770) (5,703)

Tax expense / (income) for

the period / year 7,104 (3,106) (4,269)

============================ ============================ ============================ ============================

The taxation charge for the period/year can be reconciled to the

loss per the statement of comprehensive income as follows:

Audited year ended 31 December 2022

Unaudited six months ended 30 June 2023 Unaudited six months ended 30 June 2022 $'000

$'000 $'000

------------------ ----------------------------------------- ----------------------------------------- ------------------------------------

Profit / (loss)

before tax for

the period /

year 4,081 (23,928) (44,259)

------------------ ----------------------------------------- ----------------------------------------- ------------------------------------

Tax expense at

the rate of tax

30.00% 1,224 (7,178) (13,278)

Tax effect of

non-deductible

items - - 55

Origination and

reversal of

temporary

differences 5,058 3,946 9,766

Deferred tax

asset

(recognised)/not

recognised (6,282) 3,232 3,457

Recognised net

deferred tax

assets 6,118 (3,770) (5,703)

Minimum tax

pursuant to

Malian law 986 664 1,434

Tax expense /

(income) for the

period / year 7,104 (3,106) (4,269)

================== ========================================= ========================================= ====================================

The Group's primary tax rate is aligned with its operations in

Mali of 30%. The taxation of the Group's operations in Mali are

aligned to the Mining Code of Mali 1999 under which tax is charged

at an amount not less than 1% of turnover and not more than 30% of

taxable profits.

6. Loss per ordinary share

Basic loss per ordinary share is calculated by dividing the net

loss for the period/year attributable to ordinary equity holders of

the parent by the weighted average number of ordinary shares

outstanding during the period/year.

The calculation of the basic and diluted loss per share is based

on the following data:

Audited year ended 31 December 2022

Unaudited six months ended 30 June 2023 Unaudited six months ended 30 June 2022 $'000

$'000 $'000

--------------------------- ----------------------------------------- ------------------------------------------ ------------------------------------

Loss

Loss for the purposes of

basic loss per share

being loss attributable

to equity holders of

the parent (3,846) (18,378) (34,279)

=========================== ========================================= ========================================== ====================================

31 December 2022

Number of shares

30 June 2023 30 June 2022 Number

Number Number

Weighted average number of

ordinary shares for the

purposes of basic loss

per share 529,047,722 393,416,579 393,525,771

Adjustments for share

options and warrants 24,444,473 29,899,569 25,362,582

Weighted average number of

ordinary shares for the

purposes of diluted loss

per share 553,492,195 423,316,148 418,888,353

=========================== ========================================= ========================================== ====================================

Loss per ordinary share 30 June 30 June 31 December 2022

2023 2022 $ cents

$ cents $ cents

--------------------------- ----------------------------------------- ------------------------------------------ ------------------------------------

Basic (0.73) (4.67) (8.71)

Diluted (0.73) (4.67) (8.71)

=========================== ========================================= ========================================== ====================================

For the period ended 30 June 2023, because there is a reduction

in diluted loss per share due to the loss-making position,

therefore there is no difference between basic and diluted loss per

share.

7. Share capital

Authorised share capital

As permitted by the Companies Act 2006, the Company does not

have an authorised share capital.

Audited year ended 31

Unaudited six months ended Unaudited six months ended December 2022

30 June 2023 30 June 2022

Number Number Number

---------------------------- ---------------------------- ---------------------------- ----------------------------

Issued and fully paid

Ordinary shares of GBP0.01

each 601,918,700 393,607,988 392,724,051

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total Ordinary shares after

issue - shares of GBP0.01

each 601,918,700 393,607,988 392,724,051

============================ ============================ ============================ ============================

Issued and fully paid

30 June 2023 30 June 2022 31 December 2022

$'000

$'000 $'000

============================ ============================ ============================ ============================

Issued and fully paid

Ordinary shares of GBP0.01

each 8,287 5,828 5,828

---------------------------- ---------------------------- ---------------------------- ----------------------------

Ordinary shares after issue

of GBP0.01 each 8,287 5,828 5,828

============================ ============================ ============================ ============================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSDAFIDFIV

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

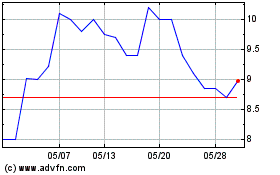

Hummingbird Resources (LSE:HUM)

過去 株価チャート

から 4 2024 まで 5 2024

Hummingbird Resources (LSE:HUM)

過去 株価チャート

から 5 2023 まで 5 2024