→ First-half revenue growth up 11.0% organically and 6.6%

overall

→ Q2 revenue up 11.7% organically and 5.9% overall

→ Annual Recurrent Revenue (ARR) of €203.1m, up 11.2%

organically on end-June 2022

→ First-half profit on operating activities of 12.2% on track

for full-year targets

→ Improved free cash flow totaling €16.5m compared to €8.2m

in H1 2022

Regulatory News:

Axway Software's Board of Directors, chaired by Pierre Pasquier,

today approved the financial statements for the first half of 2023,

which were subject to a limited review by the statutory auditors1.

As a consequence, Axway’s management announces:

Axway Software: 2023 Half-year results

Key income statement

items* Half-year 2023 Half-year 2022 (€m) (% Rev)

(€m) (% Rev)

Revenue

145.5

136.4

Organic growth + 11.0% Growth at constant exchange rates + 6.3%

Total growth + 6.6%

Profit on Operating Activities

17.8

12.2%

6.7

4.9%

Profit from Recurring Operations

14.7

10.1%

2.5

1.8%

Operating Profit

11.2

7.7%

1.1

0.8%

Net Profit attributable to the Group

3.7

2.5%

2.4

1.8%

Basic earnings per share (in €)

0.17

0.11

* Alternative performance measures are defined in the glossary at

the end of this document

Patrick Donovan, Chief Executive Officer, declared:

"I’m delighted that Axway has maintained strong organic growth

over the last 3 quarters. Our activities, particularly in Europe,

are benefiting from the solid, long-term relationships we have

built up with our customers, as well as from the relevance of our

core offerings, which have met with considerable commercial success

over the semester. As I mentioned in Q1, Axway's teams continue to

exceed expectations, not only in terms of bookings and sales, but

also in a number of key initiatives . Our efforts to adopt a

completely customer-centric model, including the changes we have

made to our organization over the past 2 years, are producing good

results and clearly improving our clients’ experience. In the

field, this is reflected in our continuously improving NPS, but

above all in smoother interactions and stronger partnerships with

the companies we accompany daily. While the macroeconomic situation

remains uncertain, we see that the need for and commitment to our

offerings are stronger than ever. In the first half of 2023, we

benefited from a favorable comparison basis to get the year off to

a good start, and we're on track, but given the record performance

set in Q4 2022, we know the bar is much higher towards the end of

the year. At this stage, we are not changing our annual guidance as

we still have a lot of work to do, but considering our first-half

results, we are well on the way to reach the upper end of our

forecasts in terms of both revenue growth and profitability."

Comments on business activity in the first half of

2023

Axway (Euronext: AXW.PA) recorded a great performance in Q2 2023

contributing to strong overall first-half revenue growth. Following

the record performance over the previous 2 quarters, Axway once

again set a high mark in terms of revenue in Q2 2023. Over the

quarter, as in the first 3 months of the year, the reinvestments

made by several major customers in their long-term partnerships

with Axway confirmed the full adoption of the subscription-based

business model.

Beyond the contractual aspects, the strategy of rationalizing

the product portfolio to maximize customer engagement and

satisfaction has proved to be effective. To be as close as possible

to its customers, Axway concentrates on its core products and

targets state-of-the-art technologies and offerings. This ongoing

effort, at all levels of the organization, has already resulted in

an acceleration in bookings, a lengthening of collaborations and a

rise in the NPS, attesting to customers' reinforced confidence. In

fact, over H1 2023, bookings were up 130% on the previous year.

In terms of recent M&A operations, the integration of

AdValvas, a European expert in e-invoicing processes acquired by

Axway in Q2 2023, is nearing completion. The capabilities acquired

in the fields of e-invoicing and compliance significantly

strengthen several of Axway's core offerings, as evidenced by the

growing pipeline. The DXchange cloud integration platform, acquired

in mid-2022, has pursued its roadmap evolution and will continue to

be integrated into the overall portfolio. The new Amplify

Integration Platform offering, based on DXchange technology, has

already convinced several early adopters, and will be officially

launched on the market in the second half of 2023.

Finally, during Q2 2023, Axway brought its customers and

partners together with members of its teams at 3 major regional

events in Brussels, Scottsdale and Sao Paulo to present the latest

developments in its markets and technologies to the world's most

advanced companies and experts in the field. These 3 in-person

events were a great success and have since contributed to the

creation of several new opportunities.

Comments on operational performance in the first half of

2023

In the first half of 2023, Axway generated revenue of €145.5m,

up 11.0% organically and 6.6% in total. The scope effect for the

semester was negative by €5.8m following the different product

portfolio rationalization operations finalized in H2 2022 and the

acquisition of AdValvas finalized at the beginning of Q2 2023.

Currency fluctuations had a positive impact on revenue of €0.4m.

Profit on operating activities amounted to €17.8m for the period,

or 12.2% of revenue, up sharply compared with the first half of

2022 (€6.7m or 4.9% of revenue).

Axway Software: Revenue by business line Half-year 2023

(€m) H1 2023 H1 2022Restated* H1

2022Reported TotalGrowth OrganicGrowth License

3.0

5.5

6.3

-52.5%

-44.9%

Subscription

78.7

52.3

55.9

40.8%

50.5%

Maintenance

44.6

55.1

56.0

-20.4%

-19.1%

Services

19.2

18.2

18.2

5.3%

5.7%

Axway Software

145.5

131.0

136.4

6.6%

11.0%

* Revenue at 2023 scope and exchange rates

Primarily limited to one of Axway's specialized products,

License activity revenue was €3.0m for the half-year, down

organically by 44.9% on H1 2022 and now representing only 2% of

Axway’s total revenue.

The Subscription activity delivered, as expected, a very

good performance in the first half of 2023, and is on track for

strong full-year growth for the fourth year in a row. With revenue

of €78.7m, up organically by 50.5% over the first 6 months of the

year, the activity continues to drive the company's growth, and

represented 54% of its total revenue. Axway Managed contracts

pursued their sustained and steady growth, with a revenue increase

close to 11% compared to H1 2022, while Customer Managed contracts

once again reached record levels, with sales growth over 75%

generating the recognition of €34.2m in upfront revenue over the

period. During the half-year, the annual value of new subscription

contracts signed (ACV) reached €18.7m, an increase of 13.2%.

Maintenance revenue amounted to €44.6m in the first half

of 2023 (31% of total revenue), down 19.1% organically, in line

with forecasts. Customers are continuing to migrate to the new

subscription offers, which they now systematically favor.

At the end of June 2023, Axway's ARR (Annual Recurrent Revenue)

which combines recurring revenues from all active Maintenance and

Subscription contracts, including, where applicable, upfront

subscription revenue recalculated monthly, was €203.1m, up 11.2% at

constant scope and exchange rates. In addition, revenue from

renewable contracts reached a high of 85% of total revenue in H1

2023.

Services generated revenue of €19.2m in H1 2023, up

organically by 5.7%, staying in a strategic range of 10 to 13% of

Axway’s total revenue. The activity continued on the good trend

established in 2022 with strong traction in EMEA and North America

thanks to recurrent business with several key customers.

Axway Software: Revenue by geographic area Half-year 2023

(€m) H1 2023 H1 2022Restated* H1

2022Reported TotalGrowth OrganicGrowth France

45.5

37.2

37.7

20.5%

22.1%

Rest of Europe

35.6

26.6

27.2

31.0%

34.2%

Americas

57.2

56.7

60.8

-5.9%

0.9%

Asia/Pacific

7.1

10.5

10.7

-33.6%

-32.6%

Axway Software

145.5

131.0

136.4

6.6%

11.0%

* Revenue at 2023 scope and exchange rates

France had a particularly dynamic first half, with sales

of €45.5m over the period. The 22.1% organic growth in revenue was

due in particular to the continued conversion of the License and

Maintenance customer base to Subscription, allowing greater

consumption and maximizing long-term commitment. This resulted in

the signature of several Axway Managed contracts, primarily with

the Amplify Marketplace offering.

With revenue of €35.6m, the Rest of Europe zone enjoyed

strong growth over the half-year (+34.2% organically), mainly

thanks to Customer Managed subscription offers. Several clients in

the region increased their use of Axway's MFT and B2B offerings and

the company was able to conclude a major deal through a multi-year

MFT contract with one of its long-standing German B2B

customers.

The Americas (USA & Latin America) generated revenue

of €57.2m over H1 2023, with an organic growth of 0.9%. Demand for

Axway Managed subscription contracts from new and existing

customers was strong in the US, explaining the modest growth over

the period as generated revenue is recognized evenly over the

duration of the contract.

The trend towards Axway Managed subscription offers was even

more marked in Asia/Pacific, where more than 50% of

first-half bookings were made on this type of contract. Half-year

revenue thus totaled €7.1m, representing an organic decrease of

32.6% compared with the first half of 2022, which represented a

high basis of comparison with more than €3.0m of upfront revenue

recognized at that time.

Comments on net profit for the first half of 2023

Profit from recurring operations was €14.7m in H1 2023, or 10.1%

of revenue, up significantly compared to 1.8% (€2.5m) in H1 2022.

It includes amortization of allocated intangible assets of €1.7m

and a share-based payment expense of €1.4m.

Operating profit for the half-year was €11.2m, or 7.7% of

revenue, also up strongly from the €1.1m, or 0.8% of revenue in H1

2022.

Net profit for the period was €3.7m, representing 2.5% of

revenue compared to 1.8% in H1 2022.

Basic earnings per share were €0.17 for the period, up from

€0.11 in H1 2022.

Financial position at June 30, 2023

At June 30, 2023, Axway's financial position was solid, with

cash of €14.2m and bank debt of €87.5m.

As expected, following the transition to a subscription-based

business model, Axway’s free cash flow started to improve in H1

2023 reaching €16.5m, compared to €8.2m a year earlier.

Shareholders' equity stood at €314.6m at June 30, 2022, compared

to €381.1m at the end of June 2022.

Axway’s bank lines, in place through 2027, provide financing of

up to €125.0m. Axway highlights that, if necessary, it has access

to available financing capacity under its existing revolving credit

facility.

Change in the workforce

At June 30, 2023, Axway had 1,457 employees compared to 1,525 at

December 31, 2022.

2023 Targets & Outlook

For 2023, Axway confirms its annual objectives of organic

revenue growth of between 0 and 3% and further improvement of

profit on operating activities to reach 15 to 18% of revenue.

Axway's medium-term ambitions remain:

- to achieve revenue of €500m through organic growth and

acquisitions;

- to deliver a profit on operating activities approaching 20% of

revenue.

Today, Wednesday, July 26, 2023, 6.30 p.m.

(UTC+2)

2023 Half-Year Results Virtual Analyst

Conference

- Conference registration: Click here Or join by phone by

dialing one of the numbers below and announcing "Axway" at the

operator's request:

- International: +44 (0) 33 0551 0200

- France: +33 (0) 1 70 37 71 66

- USA: +1 786 697 3501

Please note that the meeting will be held in

English.

Financial Calendar

Friday, August 4, 2023: Filing of the 2023 Half-Year Financial

Report

Thursday, October 26, 2023, before market opening: Publication

of Q3 2023 Revenue

Glossary and Alternative Performance Measures

ACV: Annual Contract Value – Annual

contract value of a subscription agreement.

ARR: Annual Recurring Revenue –

Expected annual billing amounts from all active maintenance and

subscription agreements.

Employee Engagement Score:

Measurement of employee engagement through an independent annual

survey.

Growth at constant exchange rates:

Growth in revenue between the period under review and the prior

period restated for exchange rate impacts.

NPS: Net Promoter Score – Customer

satisfaction and recommendation indicator for a company.

Organic growth: Growth in revenue

between the period under review and the prior period, restated for

consolidation scope and exchange rate impacts.

Profit on operating activities:

Profit from recurring operations adjusted for the non-cash

share-based payment expense, as well as the amortization of

allocated intangible assets.

Restated revenue: Revenue for the

prior year, adjusted for the consolidation scope and exchange rates

of the current year.

TCV: Total Contract Value – Full

contracted value of a subscription agreement over the contract

term.

Disclaimer

This press release contains forward-looking statements that may

be subject to various risks and uncertainties concerning Axway’s

growth and profitability, notably in the event of future

acquisitions. Axway highlights that signature of contracts, which

represent investments for customers, are more significant in the

second half of the year and may therefore have a more or less

favorable impact on full-year performance. In addition, Axway notes

that potential acquisition(s) could also impact this financial

data. Furthermore, activity during the year and/or actual results

may differ from those described in this document as a result of a

number of risks and uncertainties set out in the 2021 Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers, AMF) on March 24, 2022,

under number D.22-0145. The distribution of this document in

certain countries may be subject to prevailing laws and

regulations. Natural persons present in these countries and in

which this document is disseminated, published, or distributed,

should obtain information about such restrictions, and comply with

them.

About Axway

Axway enables enterprises to securely open everything by

integrating and moving data across a complex world of new and old

technologies. Axway’s API-driven B2B integration and MFT software,

refined over 20 years, complements Axway Amplify, an open API

management platform that makes APIs easier to discover and reuse

across multiple teams, vendors, and cloud environments. Axway has

helped over 11,000 businesses unlock the full value of their

existing digital ecosystems to create brilliant experiences,

innovate new services, and reach new markets. Learn more at

axway.com

Appendices (1/4)

Axway Software: Revenue by business line 1st

Quarter 2023 (€m) Q1 2023 Q1 2022Restated* Q1

2022Reported TotalGrowth OrganicGrowth License

2.1

3.5

3.7

-42.6%

-39.5%

Subscription

37.8

24.7

26.4

43.1%

53.1%

Maintenance

22.5

27.9

27.9

-19.5%

-19.6%

Services

9.5

9.0

9.0

6.1%

5.4%

Axway Software

71.8

65.1

66.9

7.3%

10.3%

2nd Quarter 2023 (€m) Q2 2023 Q2

2022Restated* Q2 2022Reported TotalGrowth

OrganicGrowth License

0.9

1.9

2.6

-66.6%

-54.8%

Subscription

40.9

27.6

29.5

38.7%

48.2%

Maintenance

22.1

27.2

28.1

-21.3%

-18.6%

Services

9.7

9.1

9.3

4.5%

6.0%

Axway Software

73.6

65.9

69.5

5.9%

11.7%

* Revenue at 2023 scope and exchange rates

Axway Software:

Revenue by geographic area 1st Quarter 2023 (€m)

Q1 2023 Q1 2022Restated* Q1 2022Reported

TotalGrowth OrganicGrowth France

24.7

17.9

18.1

36.2%

38.3%

Rest of Europe

13.5

12.6

13.2

1.7%

6.9%

Americas

30.9

29.3

30.3

1.9%

5.2%

Asia/Pacific

2.8

5.3

5.3

-46.8%

-47.4%

Axway Software

71.8

65.1

66.9

7.3%

10.3%

2nd Quarter 2023 (€m) Q2 2023 Q2

2022Restated* Q2 2022Reported TotalGrowth

OrganicGrowth France

20.8

19.4

19.6

6.0%

7.2%

Rest of Europe

22.2

14.0

14.0

58.7%

58.8%

Americas

26.4

27.4

30.5

-13.6%

-3.6%

Asia/Pacific

4.3

5.2

5.4

-20.7%

-17.3%

Axway Software

73.6

65.9

69.5

5.9%

11.7%

* Revenue at 2023 scope and exchange rates

Appendices (2/4)

Axway Software : Consolidated Income Statement

Half-year 2023 H1 2023 H1 2022 Full-year

2022 €m % Rev. €m % Rev. €m % Rev.

Revenue

145.5

136.4

314.0

of which License

3.0

6.3

11.6

of which Subscription

78.7

55.9

154.0

of which Maintenance

44.6

56.0

111.2

Sub-total License, Subscription & Maintenance

126.3

118.2

276.7

Services

19.2

18.2

37.3

Cost of sales

42.9

45.8

91.4

of which License and Maintenance

10.8

13.4

26.4

of which Subscription

14.2

14.5

29.4

of which Services

17.9

17.9

35.6

Gross profit

102.6

70.5%

90.6

66.4%

222.6

70.8%

Operating expenses

84.8

83.9

176.4

of which Sales and marketing

42.1

42.8

93.2

of which Research and development

29.4

28.2

57.3

of which General and administrative

13.3

12.9

25.9

Profit on operating activities

17.8

12.2%

6.7

4.9%

46.3

11.5%

Share-based payment expense

-1.4

-1.3

-3.4

Amortization of intangible assets

-1.7

-2.9

-5.5

Profit from recurring operations

14.7

10.1%

2.5

1.8%

37.4

7.0%

Other income and expenses

-3.5

-1.4

-83.8

Operating profit

11.2

7.7%

1.1

0.8%

-46.4

6.1%

Cost of net financial debt

-2.1

-0.7

-2.1

Other financial revenues and expenses

0.4

1.0

1.0

Income taxes

-5.9

1.1

7.4

Net profit

3.7

2.5%

2.4

1.8%

-40.0

3.4%

Basic earnings per share (in €)

0.17

0.11

-1.85

Appendices (3/4)

Axway Software: Simplified Balance Sheet Half-year

2023 6/30/2023 6/30/2022 12/31/2022 (€m)

(€m) (€m)

Assets Goodwill

299.3

383.7

297.8

Intangible assets

6.9

13.0

8.7

Property, plant and equipment

10.4

13.2

12.5

Lease right-of-use assets

12.9

21.7

20.1

Other non-current assets

32.6

26.5

34.9

Non-current assets

362.1

458.2

374.0

Trade receivables

135.2

106.8

148.1

Other current assets

34.0

36.0

30.6

Cash and cash equivalents

14.2

19.5

18.3

Current assets

183.4

162.3

197.1

Total Assets

545.4

620.5

571.1

Equity and Liabilities Share capital

43.3

43.3

43.3

Reserves and net profit

271.4

337.8

284.5

Total Equity

314.6

381.1

327.8

Financial debt - long-term portion

83.8

76.1

84.6

Lease liabilities - long-term portion

13.2

25.7

23.5

Other non-current liabilities

14.1

11.7

11.7

Non-current liabilities

111.2

113.4

119.8

Financial debt - short-term portion

3.7

2.3

3.2

Lease liabilities - short-term portion

6.1

5.6

5.8

Deferred Revenues

66.5

78.8

55.6

Other current liabilities

43.3

39.3

58.9

Current liabilities

119.7

126.0

123.5

Total Liabilities

230.8

239.4

243.3

Total Equity and Liabilities

545.4

620.5

571.1

Appendices (4/4)

Axway Software: Cash Flow Statement Half-year

2023 H1 2023 H1 2022 Full-year 2022

(€m) (€m) (€m) Net profit for the

period

3.7

2.4

-40.0

Net charges to amortization, depreciation and provisions

9.4

8.8

16.5

Other income and expense items

-1.0

1.6

85.3

Cash from operations after cost of net debt and tax

12.2

12.8

61.8

Change in operating working capital requirements (incl. employee

benefits liability)

4.5

2.3

-41.0

Cost of net financial debt

2.1

0.7

2.1

Income tax paid net of accrual

4.4

-2.7

-10.0

Net cash from operating activities

23.1

13.1

13.0

Net cash used in investing activities

-8.6

-9.7

-11.1

Purchases and proceeds from disposal of treasury shares

-4.4

-8.6

-13.7

Dividends paid

-8.4

-8.5

-8.5

Change in loans

-0.4

10.5

20.7

Change in lease liabilities

-3.5

-3.7

-7.2

Net interest paid

-1.6

-0.4

-1.2

Other flows

-0.3

0.2

0.6

Net cash from (used in) financing activities

-18.6

-10.5

-9.4

Effect of foreign exchange rate changes

-0.1

1.0

0.7

Net change in cash and cash equivalents

-4.2

-6.1

-6.9

Opening cash position

18.3

25.2

25.2

Closing cash position

14.2

19.1

18.3

Axway Software: Impact on revenue of changes in scope and

exchange rates Half-year 2023 (€m) H1 2023

H1 2022 Growth Revenue

145.5

136.4

6.6%

Changes in exchange rates +0.4

Revenue at constant exchange

rates

145.5

136.8

6.3%

Changes in scope

-5.8

Revenue at constant scope and exchange rates

145.5

131.0

11.0%

Axway Software: Changes in exchange rates

Half-year 2023For 1€ Average rateH1 2023 Average

rateH1 2022 Change US Dollar

1.081

1.093

+ 1.2%

1 The interim consolidated financial statements were subject to

limited review procedures. The limited review report is in the

process of being issued by the auditors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726763162/en/

Investor Relations: Arthur Carli – +33 (0)1 47 17 24 65 –

acarli@axway.com

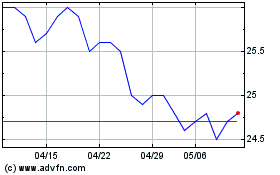

Axway Software (EU:AXW)

過去 株価チャート

から 4 2024 まで 5 2024

Axway Software (EU:AXW)

過去 株価チャート

から 5 2023 まで 5 2024