Richemont Investors Reject Activist's Attempt to Elect Former LVMH Executive to Board -- Update

2022年9月8日 - 1:14AM

Dow Jones News

By Joshua Kirby

Compagnie Financiere Richemont SA on Wednesday welcomed

shareholders' decision to vote against electing a board candidate

proposed by an activist investor in favor of an ally of the Swiss

luxury-goods group's chairman.

Incumbent Nonexecutive Director Wendy Luhabe was elected with a

compelling majority, Richemont said. Ms. Luhabe was proposed by

management as a representative of holders of 'A' shares in the

company in response to a proposal by investor Bluebell Capital

Partners to elect Francesco Trapani to the position.

Mr. Trapani wasn't an appropriate candidate for the board,

Chairman Johann Rupert said in a letter to shareholders ahead of

the vote, given his closeness to luxury-sector rival LVMH Moet

Hennessy Louis Vuitton SE. Mr. Trapani was chief executive of

jeweler Bulgari when it was bought by the French giant in 2011, and

went on to serve as an executive and advisor within the group.

"The board may not responsibly recommend to shareholders to let

a person who has a long history of association with [LVMH]...

become a director of our company and intervene in our company's

decision-making process," Mr. Rupert said.

Under the group's structure, 'A' shareholders hold the majority

of the company's share capital, but the Rupert family controls 50%

of voting rights through their possession of 'B' shares.

Mr. Rupert noted Ms. Luhabe's qualifications to represent 'A'

shareholders. A nonexecutive director of Richemont since 2020, she

is also nonexecutive chairman of South Africa's Pepkor Holdings

Ltd., and has extensive experience across several industries and in

diversity and inclusion, Mr. Rupert said.

Shareholders meanwhile also rejected a Bluebell proposal to

change the composition of Richemont's board, which would have

raised the minimum number of members to six from three. Under the

proposals, each board member would have been designated a

representative of 'A' or 'B' shareholders, with an equal number of

representatives for each.

Mr. Rupert welcomed the vote against the proposals to change the

board.

"The board believes the current governance structure has

underpinned Richemont's performance, allowing the group to take a

long-term view on sustainable value creation, unencumbered by

short-term considerations," he said.

"We recognize, however, that there are reservations about

aspects of our governance, which we will continue to address," he

added.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

September 07, 2022 11:59 ET (15:59 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

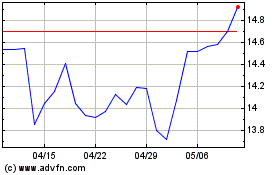

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

過去 株価チャート

から 4 2024 まで 5 2024

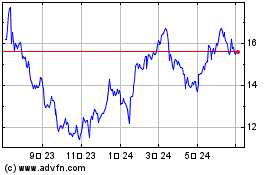

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

過去 株価チャート

から 5 2023 まで 5 2024