Brixton Metals Corporation

(TSX-V: BBB, OTCQB:

BBBXF) (the “

Company” or

“

Brixton”) is pleased to announce its second drill

hole results of the 2024 season from its wholly owned Thorn Project

located in NW British Columbia, Canada. The Thorn Project is an

underexplored copper-gold porphyry district with 16 large scale

exploration target areas identified. Brixton is operating with two

diamond drills and will continue drilling until the end of the

season.

Highlights

- A gold dominant zone identified

above porphyry-copper mineralization in hole THN24-291 from

116.50-178.00m represents a potential southwest extension to the

high-sulphidation gold system of the Talisker Zone to a 900m strike

length yielding:

- 61.50m of 0.89 g/t Au, 10.5 g/t Ag,

0.13% Cu

- Including 37.30m of 1.35 g/t Au,

16.1 g/t Ag, 0.21% Cu

- Including 11.00m of 3.53 g/t Au,

43.7 g/t Ag, 0.67% Cu

- Including 4.65m of 6.15 g/t Au,

61.9 g/t Ag, 0.96% Cu

- Copper dominant porphyry

mineralization within THN24-291 begins at 397.95m depth and ended

in mineralization at 1524m with increasing copper grades observed

over the bottom 25m

- Hole THN24-291 intercepted broad

zones of Cu-Au-Ag-Mo mineralization:

- 1126.05m 0.18% Cu, 0.05 g/t Au,

1.82 g/t Ag, 167 ppm Mo (0.31% CuEq)

- 575.50m of 0.27% Cu, 0.06 g/t Au,

2.32 g/t Ag, 266 ppm Mo (0.45% CuEq)

- 247.94m of 0.34% Cu, 0.10 g/t Au,

2.81 g/t Ag, 295 ppm Mo (0.57% CuEq)

- 55.94 of 0.44% Cu, 0.13 g/t Au,

3.60 g/t Ag, 253 ppm Mo (0.66% CuEq)

- 30.55m of 0.46% Cu, 0.13 g/t Au,

3.95 g/t Ag, 212 ppm Mo (0.67% CuEq)

- 21.00m of 0.38% Cu, 0.05 g/t Au,

2.62 g/t Ag, 456 ppm Mo (0.65% CuEq)

- Hole THN24-291 significantly

extends the footprint of mineralized porphyry at Camp Creek towards

the northwest

Vice President of Exploration, Christina Anstey,

stated, “We are excited to announce that THN24-291 has expanded the

known broad copper mineralization at the Camp Creek Porphyry Target

and provided a 250-meter extension of the Talisker Gold Zone at the

Thorn Project. We look forward to receiving additional assays from

the Camp Creek drilling and some of the new multi-kilometer scale

regional untested drill targets being explored during this fully

funded season.”

Figure 1. Thorn Project Location Map with Copper

Geochemistry.

Table 1. Select Intervals in Hole THN24-291 from

the Gold Dominant Zone.

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

|

THN24-291 |

116.50 |

178.00 |

61.50 |

0.89 |

10.5 |

0.13 |

|

including |

116.50 |

167.30 |

50.80 |

1.06 |

12.5 |

0.16 |

|

including |

130.00 |

167.30 |

37.30 |

1.35 |

16.1 |

0.21 |

|

including |

131.00 |

142.00 |

11.00 |

3.53 |

43.7 |

0.67 |

|

including |

131.70 |

136.35 |

4.65 |

6.15 |

61.9 |

0.96 |

The true width of the mineralized intervals has

not yet been determined.

Figure 2. THN24-291 Cross-Section and Plan Map

for Camp Creek at -400m below sea level.

Table 2. Select Assay Intervals for Camp Creek

Drill Hole THN24-291.

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

CuEq (%) |

|

THN24-291 |

397.95 |

1524.00 |

1126.05 |

0.18 |

0.05 |

1.82 |

167 |

0.31 |

|

including |

520.50 |

1524.00 |

1003.50 |

0.20 |

0.06 |

1.92 |

186 |

0.34 |

|

including |

948.50 |

1524.00 |

575.50 |

0.27 |

0.06 |

2.32 |

266 |

0.45 |

|

including |

948.50 |

1320.40 |

371.90 |

0.31 |

0.08 |

2.73 |

279 |

0.52 |

|

including |

974.06 |

1222.00 |

247.94 |

0.34 |

0.10 |

2.81 |

295 |

0.57 |

|

including |

948.50 |

1030.00 |

81.50 |

0.39 |

0.13 |

3.37 |

214 |

0.60 |

|

including |

974.06 |

1030.00 |

55.94 |

0.44 |

0.13 |

3.60 |

253 |

0.66 |

|

|

1058.45 |

1089.00 |

30.55 |

0.46 |

0.13 |

3.95 |

212 |

0.67 |

|

|

1503.00 |

1524.00 |

21.00 |

0.38 |

0.05 |

2.62 |

456 |

0.65 |

HQ and NQ size core samples were cut in half and

sampled predominantly at 2.0m intervals. Assay values are weighted

averages. The true width of the mineralized intervals has not yet

been determined.

Copper Equivalent (CuEq) is calculated based on

US$ 4.02/lb Cu, US$ 2105.6/oz Au, US$ 25.16/oz Ag, $US 20.99/lb Mo.

These prices represent the approximate Metal prices and

calculations assume 95% metal recoveries.

CuEq % = (Cu % + (0.764486* Au g/t) + (0.009134

* Ag g/t) + (0.000523 * Mo ppm)) * 0.95

Discussion

THN24-291 was collared 285m west from THN21-184

collar and drilled at an azimuth of 150 degrees with a dip of -82

degrees to a total depth of 1524.00m. The objective of hole

THN24-291 was to test for the high-grade part of the system and to

expand mineralization footprint to the northwest.

The gold zone in the upper section of hole 291

from 116.50-178.00m yielded 61.5m of 0.89 g/t Au, 10.5 g/t Ag, and

0.13% Cu represents the high-sulphidation part of the porphyry

system and appears to reflect the southwest extension to the near

surface Talisker Zone. Previous drill intercepts at Talisker

include THN11-51 which intersected 49.78m of 1.41g/t Au, 19.00 g/t

Ag, 0.25% Cu from 52.60m depth and THN04-29 which intersected

56.10m of 1.27g/t Au, 16.7g/t Ag, 0.19 Cu% from 21.80m depth. The

Talisker gold zone has a strong Ag-As-Cu-Sb-Bi association

coincident with the gold zone intercepted in hole 291, located 480m

to the southwest from the gold intercept in hole THN11-51, and

provides a potential new total strike length of the Talisker Zone

of 900m. Gold mineralization is hosted within the upper Porphyry Z

unit which is situated above Porphyry Y and Porphyry X units.

Figure 3. HQ Core from Hole THN24-291 from the

Upper Gold Zone.

Hole THN24-291 was successful in extending

Cu-Au-Ag-Mo mineralization both laterally and to depth in this area

with meaningful higher grade sub-intervals within the 1126.05m of

mineralization drilled. The hole ended in 21.00 meters of 0.65%

CuEq well-mineralized siltstone (0.38% Cu, 0.05 g/t Au, 2.62 g/t Ag

and 456 ppm Mo). Porphyry mineralization is hosted in the

Cretaceous aged diorite Porphyry X unit, a crowded plagioclase

porphyry characterized by well-defined stacked biotite, a feature

typical of mineral-related porphyry phases. Mineralization is also

hosted within Triassic Stuhini Group sedimentary rocks, which are

intruded by the porphyry phases. Mineralization consists dominantly

of chalcopyrite, molybdenite and pyrite as disseminations, fracture

fill and within porphyry-style veins. Pyrite is dominate in the

upper part of the hole with chalcopyrite and molybdenite

mineralization increasing with depth. The majority of

copper-molybdenum mineralization within hole 291 is hosted in the

Triassic Stuhini Group sediments with Porphyry X comprising only

200m of the broader 1126m zone of mineralization (Figure 6).

Alteration assemblages transition from advanced argillic at

surface, into a pronounced zone of strong phyllic alteration and

ultimately into potassic assemblages around the core of the system.

Higher-grade mineralization typically occurs around the -400m below

sea level. At this -400-level hole THN24-291 is spaced 95m west

from previously reported holes 184 and 152m north from hole 201,

(see plan map in Figure 2) and constitutes a significant step-out

from previous drilling to the West and Northwest.

Figure 4. Core Photographs of Copper

Mineralization Observed in THN24-291.

Figure 5. Core Photographs of Copper

Mineralization in Hole THN24-291.

Figure 6. Strip-Log of Hole THN24-291 for

Geological Units and Cu-Au-Ag-Mo distribution.

Table 3. Collar Information for Hole

THN24-291.

|

Hole ID |

Easting |

Northing |

Elevation (m) |

Dip |

Depth (m) |

|

THN24-291 |

627663 |

6492135 |

733 |

-82 |

1524.00 |

Quality Assurance & Quality Control

Quality assurance and quality control protocols

for drill core sampling was developed by Brixton. Core samples were

mostly taken at 1.0 to 2.0m intervals. Blank, duplicate (lab pulp)

and certified reference materials were inserted into the sample

stream for at least every 20 drill core samples. Core samples were

cut in half, bagged, zip-tied and sent directly to ALS Minerals

preparation facility in Whitehorse, Yukon or Langley, British

Columbia depending on available lab capacity. ALS Minerals

Laboratories is registered to ISO 9001:2008 and ISO 17025

accreditations for laboratory procedures. Samples were analyzed at

ALS Laboratory Facilities in North Vancouver, British Columbia for

gold by fire assay with an atomic absorption finish, whereas Ag,

Pb, Cu and Zn and 48 additional elements were analyzed using four

acid digestion with an ICP-MS finish. Over limits for gold were

analyzed using fire assay and gravimetric finish. The standards,

certified reference materials, were acquired from CDN Resource

Laboratories Ltd., of Langley, British Columbia and the standards

inserted varied depending on the type and abundance of

mineralization visually observed in the primary sample. Blank

material used consisted of non-mineralized siliceous landscaping

rock. A copy of the QAQC protocols can be viewed at the Company’s

website.

Qualified Person (QP)

Mr. Corey A. James, P.Geo., is a Senior Project

Geologist for the Company who is a qualified person as defined by

National Instrument 43-101. Mr. James has verified the referenced

data and analytical results disclosed in this press release and has

approved the technical information presented herein.

About Brixton Metals

Corporation

Brixton Metals is a Canadian exploration company

focused on the advancement of its mining projects. Brixton wholly

owns four exploration projects: Brixton’s flagship Thorn

copper-gold-silver-molybdenum Project, the Hog Heaven

copper-silver-gold Project in NW Montana, USA, which is optioned to

Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel

Project in Ontario and the Atlin Goldfields Project located in

northwest BC which is optioned to Eldorado Gold Corporation.

Brixton Metals Corporation shares trade on the TSX-V under the

ticker symbol BBB, and on the OTCQB under the

ticker symbol BBBXF. For more information about

Brixton, please visit our website at www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEO

For Investor Relations inquiries please contact:

Mr. Michael Rapsch, Senior Manager, Investor Relations. email:

michael.rapsch@brixtonmetals.com or call Tel: 604-630-9707

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Information set forth in this news release may

involve forward-looking statements under applicable securities

laws. Forward-looking statements are statements that relate to

future, not past, events. In this context, forward-looking

statements often address expected future business and financial

performance, and often contain words such as “anticipate”,

“believe”, “plan”, “estimate”, “expect”, and “intend”, statements

that an action or event “may”, “might”, “could”, “should”, or

“will” be taken or occur, including statements that address

potential quantity and/or grade of minerals, potential size and

expansion of a mineralized zone, proposed timing of exploration and

development plans, or other similar expressions. All statements,

other than statements of historical fact included herein including,

without limitation, statements regarding the use of proceeds. By

their nature, forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, among others, the following

risks: the need for additional financing; operational risks

associated with mineral exploration; fluctuations in commodity

prices; title matters; and the additional risks identified in the

annual information form of the Company or other reports and filings

with the TSXV and applicable Canadian securities regulators.

Forward-looking statements are made based on management’s beliefs,

estimates and opinions on the date that statements are made and the

Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or other

circumstances should change, except as required by applicable

securities laws. Investors are cautioned against attributing undue

certainty to forward-looking statements.

Links:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2e6f71e3-ac54-46d8-bd06-587c1ef15429

https://www.globenewswire.com/NewsRoom/AttachmentNg/a9f2b9a8-e6de-431f-830c-64ec15ecfcb5

https://www.globenewswire.com/NewsRoom/AttachmentNg/495dea98-dfa6-45c2-a3b6-cc55ba07eaeb

https://www.globenewswire.com/NewsRoom/AttachmentNg/4f170301-e6d5-4978-bf93-535e8dfdc170

https://www.globenewswire.com/NewsRoom/AttachmentNg/77109914-0e40-4923-9fa2-f0bfe3a3a640

https://www.globenewswire.com/NewsRoom/AttachmentNg/2485728f-b63d-4e61-8a9e-38691244fc4e

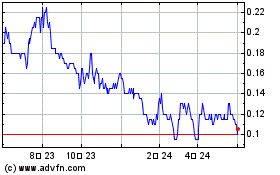

Brixton Metals (TSXV:BBB)

過去 株価チャート

から 7 2024 まで 8 2024

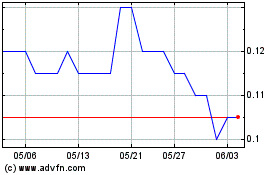

Brixton Metals (TSXV:BBB)

過去 株価チャート

から 8 2023 まで 8 2024