Osisko Development Corp. (NYSE: ODV, TSXV: ODV)

("

Osisko Development" or the

"

Company") announces an updated mineral resource

estimate ("

MRE") for its 100%-owned underground

Trixie deposit (the "

2024 Trixie

MRE"), within the Company's wider Tintic Project

("

Tintic" or the "

Tintic

Project"), located in the historic East Tintic Mining

District in central Utah, U.S.A. The 2024 Trixie MRE incorporated

an additional 1,674 underground chip samples over 1,678 meters

("

m") (5,507 feet ("

ft")) of

underground development, and 7,385 m of drilling (24,229 ft) in 122

holes completed by the Company since the release of the initial

Trixie MRE (the "

2023 Trixie MRE"), with an

effective date of January 10, 2023.

Relative to the 2023 Trixie MRE, contained gold

ounces in measured and indicated resources decreased by 29% and

inferred resources decreased by 79% primarily due to lower

estimated grades that incorporated an updated geologic model

interpretation and conversion of inferred resources. Drill results

and underground mapping from the 2023 exploration program improved

the knowledge of the extent and distribution of mineralization,

resulting in modeling improvements to both mineralization and the

historical mine shape model.

Chris Lodder, President,

stated, "The 2024 Trixie MRE incorporates changes to our

interpretation of the main mineralized structures and reflects

better understanding of the structural controls of the deposit and

realistic mining parameters following our exploration and test

mining work in 2023. To date exploration and mining occurred on

less than 10% of known mineralized structures in the west Tintic

district and thus, we see significant precious metal potential at

depth, on parallel structures to Trixie, along the Trixie and Sioux

Ajax faults to the north and south, as well as around all historic

high-grade gold mines in the West Tintic District. These high-grade

gold targets, combined with the copper-gold porphyry potential

where drilling is underway, and a large area of polymetallic

carbonate replacement potential, illustrate that we have only

scratched the surface in understanding the overall metal endowment

potential of the Tintic district."

Table 1: 2024 Trixie MRE (all zones) –

March 14, 2024

|

Classification |

Tonnes(000's) |

Au Grade(g/t) |

Contained Gold (000's oz) |

Ag Grade(g/t) |

Contained Silver (000's oz) |

|

Measured |

120 |

27.36 |

105 |

61.73 |

238 |

|

Indicated |

125 |

11.17 |

45 |

59.89 |

240 |

|

Measured and Indicated |

245 |

19.11 |

150 |

60.80 |

478 |

|

Inferred |

202 |

7.80 |

51 |

48.55 |

315 |

Notes (applicable to Tables 1, 2, and

3)

- Effective date of the 2024 Trixie

MRE is March 14, 2024.

- Each of Mr. William Lewis, P.Geo.,

of Micon International Limited and Alan J. San Martin, MAusIMM(CP),

of Micon International Limited (i) has reviewed and validated the

2024 Trixie MRE, (ii) is considered to be independent of the

Company for purposes of Section 1.5 of National Instrument 43-101 –

Standards of Disclosure for Mineral Projects ("NI

43-101"), and (iii) is a "qualified person" within the

meaning of NI 43-101.

- The mineral resources were

estimated using the Canadian Institute of Mining

("CIM"), Metallurgy and Petroleum's "CIM

Definition Standards on Mineral Resources and Mineral Reserves"

adopted by the CIM council.

- Mineral resources are reported when

they are within potentially mineable shapes derived from a stope

optimizer algorithm, assuming an underground longhole stoping

mining method with stopes of 6.1 m x 6.1 m x minimum 1.5 m

dimensions.

- Mineral resources that are not

mineral reserves do not have demonstrated economic viability.

- Geologic modelling was completed by

Osisko Development modeling geologist Jody Laing, P.Geo, using

Leapfrog Geo software. The 2024 Trixie MRE was completed by Osisko

Development chief resource geologist, Daniel Downton, P.Geo using

Datamine Studio RM 2.0 software. William Lewis and Alan J. San

Martin of Micon International Limited independently reviewed and

validated the mineral resource model.

- The estimate is reported for an

underground mining scenario and with USD assumptions. The cut-off

grade of 4.32 g/t Au was calculated using a gold price of

US$1,750/oz, a CAD:USD exchange rate of 1.30; total mining,

processing and G&A costs of US$168.04/imperial ton; a refining

cost of US$2.65/ounce; a combined royalty of 4.50%; and an average

metallurgical gold recovery of 80%.

- The stope optimizer algorithm

evaluated the resources based on a gold equivalent grade which

incorporates the silver grade estimate and assumes a silver price

of US$23/oz and metallurgical silver recovery of 45%.

- The 2024 Trixie MRE is comprised of

six zones within the greater Trixie area: T2, T3, T4, Wild Cat, 40

Fault and 75-85.

- Average bulk density values in the

mineralized domains were assigned to the T2 (2.955 T/m3), T3 (2.638

T/m3), T4(2.618 T/m3), Wild Cat, and 40 Fault (2.621 T/m3), and

75-85 (2.617 T/m3) domains.

- Inverse Distance Squared

interpolation method was used with a parent block size of 1.2 m x

2.4 m x 2.4 m.

- The Company intends to file a

technical report (the "Technical Report") in

respect of the 2024 Trixie MRE in accordance with NI 43-101 on

SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko

Development's issuer profile within 45 days of the date of this

news release.

- The 2024 Trixie MRE results are

presented in-situ. Calculations used metric units (metres, tonnes,

g/t). The number of tonnes is rounded to the nearest thousand. Any

discrepancies in the totals are due to rounding effects.

- Neither the Company nor Micon

International Limited is aware of any known environmental,

permitting, legal, title-related, taxation, socio-political,

marketing or other relevant issue that could materially affect the

mineral resource estimate other than disclosed in this news

release.

- Technical information in this news

release differs from similar information made public by U.S.

companies subject to the reporting and disclosure requirements of

the U.S. Securities and Exchange Commission. See below under

"Cautionary Statement to U.S. Investors".

TRIXIE MINERAL RESOURCE

ESTIMATE

- The 2024 Trixie MRE

comprises six mineralized zones within the greater Trixie deposit,

including T2, T3, T4, Wild Cat, 40 Fault and 75-85 over a strike

length of 530 m, a maximum width of 105 m and to a maximum depth of

195 m for the deposit and is 350 m from surface (see cross section

Figure 1). These dimensions are for the overall size of the

mineralized zone structures, with the 2024 Trixie MRE blocks

contained within a smaller 440 m strike length, 60 m total width

and 195 m depth footprint.

- Gold mineralization

is associated with high sulphidation epithermal mineralization,

structurally controlled and hosted within the quartzites.

Mineralization consists of native Au, and rare Au-Ag rich telluride

minerals with quartz and quartz-barite-sulphosalt stockwork

veining.

- The T2

Zone is the highest-grade structure within the overall

deposit. In 2023, a total of 4,637 oz were recovered from

processing mineralized material with an overall feed grade of 35.61

g/t Au. The 2023 drill program also converted ounces from inferred

to indicated, and drilling at depth indicated a transition from

high-grade gold to anomalous copper, which prompted the testing of

the deep porphyry target at Trixie West.

- The T4

Zone envelops the T2, 40 fault, and Wild Cat domains.

Within the T4 domain, there are discrete sub-vertical high-grade

gold structures, defined on multiple levels and sections. However,

these structures appear to be more discontinuous and less

disseminated in the broader area than had been previously

estimated. In 2023, mapping and modeling modified the

interpretation from a stockwork to distinct high-grade structures.

As a result, the model now incorporates tight search parameters

around these structures, increasing confidence within the zone,

while also including the quartz-barite-sulphosalt disseminated

stockwork mineralization.

- A

mineralized fault structure known as the 40 fault, is

mapped over 230 m strike length and 80 m at depth and is about 1 m

wide. This fault is a mineralized domain within the T4 and offsets

vertically dipping epithermal Au-Ag structures.

- The Wildcat

domain, a discrete structure within the T4, is steeply

dipping to the east and strikes for 237 m and terminates at the 40

fault.

- The T1

Zone, previously described in the 2023 Trixie MRE, has

been incorporated into the T4 Zone. The T1 Zone was previously an

envelope on the contacts of both the 75-85 and T2 Zones. The T1

Zone had similar high-grade fissure zones as described in the T4

Zone, that are constrained within the T4 envelope. Additional

drilling in this area also reduced the estimated contained gold

above cut-off.

- The 75-85

Zone is a moderately west dipping silica sulphide cemented

breccia zone. Drilling along strike to the south suggests that the

75-85 Zone truncates both the T2 structure and T4 zone. Mine

development in 2023 intersected previously unknown stopes within

the modelled 75-85 Zone and high-grade assays were less continuous

at depth, although increasing down plunge.

Table 2: 2024 Trixie MRE Separated by

Domain – March 14, 2024

|

Domain |

Category |

Tonnes |

Grade (Au g/t) |

ContainedGold (oz) |

Grade(Ag g/t) |

ContainedSilver (oz) |

|

T2 |

Measured |

22,678 |

106.27 |

77,484 |

115.99 |

84,572 |

|

Indicated |

11,939 |

23.19 |

8,902 |

51.07 |

19,602 |

|

M+I |

34,617 |

77.62 |

86,387 |

93.60 |

104,173 |

|

Inferred |

1,996 |

9.82 |

630 |

61.38 |

3,938 |

|

T3 |

Measured |

2,385 |

9.46 |

725 |

75.34 |

5,776 |

|

Indicated |

970 |

5.47 |

171 |

57.32 |

1,787 |

|

M+I |

3,355 |

8.30 |

896 |

70.13 |

7,564 |

|

Inferred |

139 |

6.27 |

28 |

63.14 |

282 |

|

T4 + Wild Cat + 40 FLT |

Measured |

94,784 |

8.93 |

27,227 |

48.41 |

147,520 |

|

Indicated |

51,827 |

6.48 |

10,795 |

37.59 |

62,637 |

|

M+I |

146,611 |

8.07 |

38,023 |

44.58 |

210,156 |

|

Inferred |

104,676 |

6.57 |

22,127 |

38.57 |

129,792 |

|

75-85 |

Measured |

- |

|

- |

|

- |

|

Indicated |

60,008 |

12.93 |

24,943 |

80.95 |

156,185 |

|

M+I |

60,008 |

12.93 |

24,943 |

80.95 |

156,185 |

|

Inferred |

94,793 |

9.12 |

27,784 |

59.28 |

180,666 |

|

Total |

Measured |

119,847 |

27.36 |

105,437 |

61.73 |

237,868 |

|

Indicated |

124,743 |

11.17 |

44,811 |

59.89 |

240,211 |

|

M+I |

244,590 |

19.11 |

150,248 |

60.80 |

478,078 |

|

Inferred |

201,603 |

7.80 |

50,569 |

48.55 |

314,678 |

Refer to notes described under Table 1, which

are also applicable to Table 2 in their entirety.

TRIXIE AND GREATER TINTIC CONCLUSIONS

AND RECOMMENDATIONS

- In 2023, the

Company completed a total of 6,028 m (19,776 ft) of underground

drilling in 73 diamond drill holes at Trixie. Assays were finalized

up to hole TRXU-DD-23-069 and were included in the 2024 Trixie

MRE.

- The new drilling,

mapping and historical data compilation improved the interpretation

and revealed that there is significant potential for parallel

high-grade gold fissure zones similar to T2 and adjacent to the

existing mine development. Much of the Trixie area remains

unexplored.

- At Trixie,

exploration potential remains highly prospective at depth near

historical stopes that ceased mining at the water table. The Trixie

deposit remains open to the north, along strike of T2, down dip

below the historical 756, down plunge to the Survey Vein and

additional, parallel structures are highly possible within the

epithermal system.

- The Company

continues to explore for additional high-sulphidation epithermal Au

and Ag targets along the 4 km strike length of historical mines and

has identified at least a dozen new drill ready targets from

extensive data compilation and regional field work in 2023. Further

work is recommended to test these targets (see Figure 3 for

property wide historical deposits and exploration targets).

PORPHYRY TARGET DRILLING

-

Copper-gold-molybdenum porphyry potential remains an exploration

priority for the Company. One diamond drill rig is currently active

at surface testing a porphyry target at Big Hill and is at a

current depth of 1,180 m (3,872 ft). Assays are pending for this

drillhole.

- One drill hole

tested a copper-gold-porphyry target below Trixie and was drilled

to a depth of 759.6 m (2,492 ft) when it crossed the Eureka Lily

Fault to the east and out of the prospective alteration zone.

Further drill testing of a copper-gold porphyry target at depth

below the Trixie deposit is recommended to the west.

- The development of

the 1,390 m decline ramp at Trixie, completed in September 2023,

significantly improving access to the underground workings for

exploration development and drilling beyond the 625 level.

- The Company has

advanced rehabilitation at the 750 level to allow for further

underground diamond drilling to test for the down dip extent of the

756 zone and the porphyry target below Trixie.

Figure 1: Trixie geologic model

and mineral domains cross section

Figure 2: Exploration potential

at Trixie

Figure 3: Property wide

mineralization and exploration targets

Table 3: Trixie MRE Cut-Off Grade

("COG") Sensitivity (Base Case in Bold) – March 14,

2024

|

Classification |

Tonnes |

COG |

Grade(Au g/t) |

ContainedGold (oz) |

Grade(Ag g/t) |

ContainedSilver (oz) |

|

Measured + Indicated |

366,130 |

2.50 |

13.79 |

162,348 |

50.18 |

590,666 |

|

324,251 |

3.00 |

15.23 |

158,722 |

53.31 |

555,740 |

|

291,005 |

3.50 |

16.64 |

155,716 |

56.19 |

525,681 |

|

261,219 |

4.00 |

18.14 |

152,350 |

58.95 |

495,091 |

|

244,590 |

4.32 |

19.11 |

150,248 |

60.80 |

478,078 |

|

237,143 |

4.50 |

19.58 |

149,266 |

61.52 |

469,058 |

|

217,327 |

5.00 |

20.99 |

146,677 |

64.07 |

447,646 |

|

198,538 |

5.50 |

22.55 |

143,909 |

66.19 |

422,504 |

|

182,842 |

6.00 |

24.01 |

141,164 |

68.57 |

403,074 |

|

165,955 |

6.50 |

25.81 |

137,734 |

71.39 |

380,902 |

|

152,986 |

7.00 |

27.55 |

135,503 |

74.34 |

365,663 |

|

Inferred |

438,189 |

2.50 |

5.26 |

74,056 |

34.46 |

485,528 |

|

342,880 |

3.00 |

5.99 |

66,034 |

38.38 |

423,112 |

|

279,722 |

3.50 |

6.65 |

59,767 |

41.84 |

376,306 |

|

224,039 |

4.00 |

7.42 |

53,438 |

46.31 |

333,578 |

|

201,603 |

4.32 |

7.80 |

50,569 |

48.55 |

314,678 |

|

190,002 |

4.50 |

8.02 |

49,009 |

49.90 |

304,803 |

|

163,894 |

5.00 |

8.60 |

45,313 |

53.08 |

279,718 |

|

141,728 |

5.50 |

9.16 |

41,742 |

55.92 |

254,818 |

|

123,472 |

6.00 |

9.71 |

38,532 |

58.70 |

233,028 |

|

106,080 |

6.50 |

10.35 |

35,291 |

60.43 |

206,087 |

|

91,725 |

7.00 |

10.99 |

32,397 |

61.91 |

182,579 |

Note: Micon International Limited's QP has

reviewed the COG used in the sensitivity analysis relating to the

2024 Trixie MRE and is of the opinion that the individual cut-off

grades used in the sensitivity analysis meet the test of reasonable

prospects of economic extraction. The numbers in bold represent the

current 2024 Trixie MRE.

Table 4: Trixie MRE Cut-off Grade

Calculation Breakdown

|

PARAMETERS |

VALUES |

|

|

Mining Cost ($/ST) |

$74.33 |

|

|

G&A ($/ST) |

$52.71 |

|

|

Heap Leach ($/ST) |

$41.00 |

|

|

Total Refining Cost/ OZ |

$2.65 |

|

|

Gold Price |

$1,750 |

|

|

Royalty (Combination) |

4.50% |

|

|

Heap Leach Au Recovery |

80.0% |

|

|

Cut-off Grade (COG) |

4.32 |

|

The cut-off grade for the 2024 Trixie MRE is

4.32 g/t Au compared to 4.85 g/t Au in the 2023 Trixie MRE

primarily due to the difference in the estimated cost of heap leach

processing ($41/ST) relative to the previously estimated mill

processing scenario ($89/ST).

Qualified Persons

The scientific and technical information

contained in this news release has been reviewed and approved by

Maggie Layman, P.Geo., Vice President, Exploration of Osisko

Development, and a "qualified person" within the meaning of NI

43-101.

The independent QPs for the 2024 Trixie MRE,

within the meaning of NI 43-101, are William Lewis, P.Geo. and Alan

J. San Martin MAusIMM(CP) of Micon International Limited. Each QP

is independent of Osisko Development within the meaning of NI

43-101 and has reviewed and approved the content in this news

release.

Quality Assurance (QA) – Quality Control

(QC)

All drill core and exploration samples are

dispatched to ALS Geochemistry or SGS Canada for offsite sample

preparation and analysis. Both labs are ISO/IEC 17025 certified,

and ALS Geochemistry is also ISO 9001 certified. Samples are

assigned a unique sample ID. All geological and sampling

information is entered into a Datamine Fusion database. Core is

sawn in half and half is sampled. Certified standards and blanks

are inserted into all sample dispatches. Samples are collected by

Old Dominion Transportation and dispatched to SGS Canada's

laboratory in Burnaby, British Columbia or ALS Geochemistry’s

laboratories in Elko, Nevada or Twin Falls, Idaho. Sample

submission forms accompany the samples, and digital copies are

emailed to the destination lab.

Core sample preparation is completed by ALS

Geochemistry or SGS Canada, including drying, crushing, and

pulverizing of samples. Analytical assays include gold by 30-gram

fire assay with AAS finish, and gold overlimits by fire assay with

gravimetric finish. Screen metallic analyses are performed on

selected samples. Multielement analysis (including silver) is by

four-acid digest with ICP-AES/ICP-MS finish. The pulps are returned

to Osisko Development and coarse rejects are disposed after 90

days. Assays are reported to Osisko Development and then loaded

into Datamine Fusion. Quality Assurance-Quality Control samples are

checked, and assays are merged with sample information for future

reporting.

Underground face samples are collected by

Company geologists from each of the active mining faces, with

samples transported by the geologists from Trixie to the on-site

Company laboratory located at the Burgin administrative complex.

Underground samples are dried, crushed to <10 mm and a 250 g

split is taken. The split is pulverized, and a 30 g Fire Assay with

gravimetric finish is completed to determine gold and silver

grades, reported in oz/short ton and g/t.

The Company's Burgin laboratory is not a

certified analytical laboratory, but the facility is managed by a

qualified laboratory manager with annual auditing by technical

staff. The laboratory has been independently audited by Qualitica

Consulting and Micon International Limited's QP with

recommendations implemented. Inter-laboratory check assays using

ALS Geochemistry as a third-party independent analysis of samples

is routinely carried out as part of ongoing QA/QC work. Certified

OREAS QC standards and blanks are inserted at regular intervals in

the sample stream to monitor laboratory performance.

True width is estimated to be approximately 0.5

m - 3 m (1.6 - 10 ft) for all fissure veins and discrete structures

(T2, T3, 75-85, Wildcat and 40 Fault) and the T4 zone is modelled

at an average width of 90 m (300 ft) and encompasses disseminated

mineralization and discontinuous veins ranging from several cm to 1

m (3 ft).

ABOUT OSISKO

DEVELOPMENT CORP.

Osisko Development Corp. is a North American

gold development company focused on past-producing mining camps

located in mining friendly jurisdictions with district scale

potential. The Company's objective is to become an intermediate

gold producer by advancing its 100%-owned Cariboo Gold Project,

located in central B.C., Canada, the Tintic Project in the historic

East Tintic mining district in Utah, U.S.A., and the San Antonio

Gold Project in Sonora, Mexico. In addition to considerable

brownfield exploration potential of these properties, that benefit

from significant historical mining data, existing infrastructure

and access to skilled labour, the Company's project pipeline is

complemented by other prospective exploration properties. The

Company's strategy is to develop attractive, long-life, socially

and environmentally sustainable mining assets, while minimizing

exposure to development risk and growing mineral resources.

For further information, visit our website at

www.osiskodev.com or contact:

|

Sean Roosen |

Philip Rabenok |

|

Chairman and CEO |

Director, Investor Relations |

|

Email: sroosen@osiskodev.com |

Email: prabenok@osiskodev.com |

|

Tel: +1 (514) 940-0685 |

Tel: +1 (437) 423-3644 |

CAUTIONARY STATEMENTS

Cautionary Statement Regarding Test Mining

Without Feasibility Study

The Company cautions that its prior decision to

commence small-scale underground mining activities and batch vat

leaching at the Trixie test mine was made without the benefit of a

feasibility study, or reported mineral resources or mineral

reserves, demonstrating economic and technical viability, and, as a

result there may be increased uncertainty of achieving any

particular level of recovery of material or the cost of such

recovery. The Company cautions that historically, such projects

have a much higher risk of economic and technical failure. Small

scale test-mining at Trixie was suspended in December 2022 and

resumed in the second quarter of 2023. Even with the resumption of

small-scale test-mining at Trixie, there is no guarantee that

production will continue as anticipated or at all or that

anticipated production costs will be achieved. The failure to

continue production may have a material adverse impact on the

Company's ability to generate revenue and cash flow to fund

operations. Failure to achieve the anticipated production costs may

have a material adverse impact on the Company's cash flow and

potential profitability. In continuing current operations at

Trixie, the Company has not based its decision to continue such

operations on a feasibility study, or reported mineral resources or

mineral reserves demonstrating economic and technical

viability.

Cautionary Statement to U.S. Investors

The Company is subject to the reporting

requirements of the applicable Canadian securities laws and, as a

result, reports information regarding mineral properties,

mineralization and estimates of mineral reserves and mineral

resources, including the information in its technical reports,

financial statements, MD&A and this news release, in accordance

with Canadian reporting requirements, which are governed by NI

43-101. As such, such information concerning mineral properties,

mineralization and estimates of mineral reserves and mineral

resources, including the information in its technical reports,

financial statements, MD&A and this news release, is not

comparable to similar information made public by U.S. companies

subject to the reporting and disclosure requirements of the U.S.

Securities and Exchange Commission ("SEC").

CAUTION REGARDING FORWARD LOOKING

STATEMENTS

Certain statements contained in this news

release may be deemed "forward-looking statements" within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and "forward-looking information" within the meaning of

applicable Canadian securities legislation (together,

"forward-looking statements"). These forward-looking statements, by

their nature, require Osisko Development to make certain

assumptions and necessarily involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in these forward-looking

statements. Forward-looking statements are not guarantees of

performance. Words such as "may", "will", "would", "could",

"expect", "believe", "plan", "anticipate", "intend", "estimate",

"continue", or the negative or comparable terminology, as well as

terms usually used in the future and the conditional, are intended

to identify forward-looking statements. Information contained in

forward-looking statements is based upon certain material

assumptions that were applied in drawing a conclusion or making a

forecast or projection, including the assumptions, qualifications

and limitations relating to the significance of the high-priority

target drilling; the utility of modern exploration techniques; the

potential for parallel high-grade gold fissure zones; the potential

of Tintic to host a copper-gold porphyry center; the significance

of regional exploration potential; the results of the 2024 Trixie

MRE; the capital resources available to Osisko Development; the

ability of the Company to execute its planned activities; the

ability of the Company to obtain future financing and the terms of

such financing; management's perceptions of historical trends,

current conditions and expected future developments; the Company's

ability to prepare and file the Technical Report within 45 days;

the utility and significance of historic data, including the

significance of the district hosting past producing mines; future

mining activities; unique mineralization at Trixie; the potential

of high-grade gold mineralization on Trixie; the potential for

unknown mineralized structures to extend existing zones of

mineralization; category conversion; the timing and status of

permitting; the results (if any) of further exploration work to

define and expand mineral resources; the ability of exploration

work (including drilling and chip sample assays, and face sampling

methodologies) to accurately predict mineralization; the ability to

generate additional drill targets; the ability of management to

understand the geology and potential of the Company's properties;

the ability of the Company to expand mineral resources beyond

current mineral resource estimates; the ability of the Company to

complete its exploration objectives for its projects in 2024 in the

timing contemplated (if at all); the ongoing advancement of the

deposits on the Company's properties; the deposit remaining open

for expansion at depth and down plunge; the ability to realize upon

any mineralization in a manner that is economic; the ability to

adapt to changes in gold prices, estimates of costs, estimates of

planned exploration and development expenditures; the ability of

the Company to obtain further capital on reasonable terms; assay

results presented in this news release; the profitability (if at

all) of the Company's operations; the Company being a

well-positioned gold development company in Canada, USA and Mexico;

sustainability and environmental impacts of operations at the

Company's properties; as well as other considerations that are

believed to be appropriate in the circumstances, and any other

information herein that is not a historical fact may be "forward

looking information". Material assumptions also include,

management's perceptions of historical trends, the ability of

exploration (including drilling and chip sample assays, and face

sampling) to accurately predict mineralization, budget constraints

and access to capital on terms acceptable to the Company, current

conditions and expected future developments, regulatory framework

remaining defined and understood, results of further exploration

work to define or expand any mineral resources, as well as other

considerations that are believed to be appropriate in the

circumstances. Osisko Development considers its assumptions to be

reasonable based on information currently available, but cautions

the reader that their assumptions regarding future events, many of

which are beyond the control of Osisko Development, may ultimately

prove to be incorrect since they are subject to risks and

uncertainties that affect Osisko Development and its business. Such

risks and uncertainties include, among others, risks relating to

capital market conditions and the Company's ability to access

capital on terms acceptable to the Company for the contemplated

exploration and development at the Company's properties; the

ability to continue current operations and exploration; regulatory

framework and presence of laws and regulations that may impose

restrictions on mining; the ability of exploration activities

(including drill and chip sampling, and face sampling results) to

accurately predict mineralization; errors in management's

geological modelling; the ability to expand operations or complete

further exploration activities, including drilling and chip sample

assays and face sampling; the timing and ability of the Company to

obtain required approvals and permits; the results of exploration

activities; risks relating to exploration, development and mining

activities; the global economic climate; metal and commodity

prices; fluctuations in the currency markets; dilution;

environmental risks; and community, non-governmental and

governmental actions and the impact of stakeholder actions. Readers

are urged to consult the disclosure provided under the heading

"Risk Factors" in the Company's annual information form for the

year ended December 31, 2022 as well as the financial statements

and MD&A for the year ended December 31, 2022, which have been

filed on SEDAR+ (www.sedarplus.ca) under Osisko Development's

issuer profile and on the SEC's EDGAR website (www.sec.gov), for

further information regarding the risks and other factors

applicable to the exploration results. Although the Company's

believes the expectations conveyed by the forward-looking

statements are reasonable based on information available as of the

date hereof, no assurances can be given as to future results,

levels of activity and achievements. The Company disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or results or otherwise,

except as required by law. Forward-looking statements are not

guarantees of performance and there can be no assurance that these

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/5265bf87-9b39-4fd6-bcf4-4638a07c0fa0

https://www.globenewswire.com/NewsRoom/AttachmentNg/177d92ca-9d18-459d-b2d0-169d1be165e2

https://www.globenewswire.com/NewsRoom/AttachmentNg/e73ace39-4e7e-4c40-be7d-a952349dcfb6

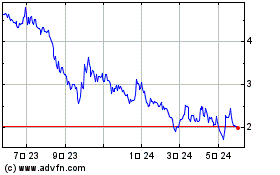

Osisko Development (NYSE:ODV)

過去 株価チャート

から 11 2024 まで 12 2024

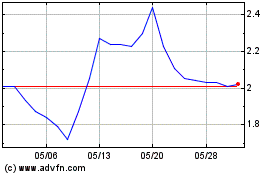

Osisko Development (NYSE:ODV)

過去 株価チャート

から 12 2023 まで 12 2024