$475 million loan amount represents an increase

of $100 million over the original conditional commitment

First DOE loan facility to be finalized for a

battery resource recovery facility and sustainable lithium-ion

battery materials recycling company

Agreement represents affirmation of Li-Cycle’s

sustainable Spoke & Hub Technologies™ and the Company’s

position as a leading supplier of recycled critical materials for

lithium-ion batteries

Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the

“Company”), a leading global lithium-ion battery resource recovery

company, is pleased to announce that it has entered into an

agreement for a loan facility (“DOE Loan Facility”) of up to $475

million (including up to $445 million of principal and up to $30

million in capitalized interest) through the U.S. Department of

Energy (“DOE”) Loan Programs Office’s (“LPO”) Advanced Technology

Vehicles Manufacturing (“ATVM”) program.

This is the first DOE loan facility to be finalized for a

lithium-ion battery materials recycling company, which further

demonstrates Li-Cycle’s important role in the U.S. battery

materials supply chain as a domestic supplier of recycled critical

battery materials.

The entry by Li-Cycle into definitive documentation with the DOE

follows the DOE's detailed technical, market, financial and legal

due diligence. The DOE Loan Facility is expected to support the

development of the Company’s flagship Rochester Hub project,

located in upstate New York.

Key features of the DOE Loan Facility are summarized below:

DOE Loan Facility

Amount

- Up to $475 million, an increase of $100 million over the

original conditional commitment

- Principal of up to $445 million

- Capitalized interest during the construction period of up to

$30 million

Interest Rate

- Interest rates fixed from the date of each advance to the

maturity date of the loan at the applicable long-dated U.S.

Treasury rate, with a 0% spread

Maturity Date and

Tenor

- Final maturity of March 15, 2040, for an approximately 15-year

term

Principal and Interest Grace

Period

- Grace period on scheduled principal repayments until June 15,

2027

- Interest during the construction period can be capitalized (up

to $30 million), instead of being paid in cash

Conditions Precedent to First

Advance

- First advance under the DOE Loan Facility (“First Advance”1) is

subject to satisfaction or waiver of certain conditions and

requirements, including completing the Company’s base equity

contribution (“BEC”) to the Rochester Hub project. The BEC

includes:

- Settling certain existing commitments relating to the project

for costs incurred but not yet paid (approximately $92 million as

of September 30, 2024)

- Funding approximately $173 million in reserve account

requirements2 of which up to approximately $97 million can be

satisfied through letters of credit

- The amounts above represent a significant portion of the

remaining BEC, are based on current estimates and may change prior

to First Advance, and are among other components of the BEC that

will need to be satisfied prior to First Advance

Other Key Terms

- Customary covenants and events of defaults for a project

finance loan facility

The Company expects the Rochester Hub to be North America's

first commercial hydrometallurgical resource recovery facility and

a significant domestic source of recycled critical materials for

producing lithium-ion batteries, including battery-grade lithium

carbonate and mixed hydroxide precipitate (“MHP”). MHP is an

intermediate product containing nickel, cobalt, and manganese

metals.

Once the Rochester Hub is fully operational, Li-Cycle expects to

produce up to approximately 8,250 tonnes of lithium carbonate and

up to approximately 72,000 tonnes of MHP per year at the Rochester

Hub under the MHP scope. The planned nameplate processing capacity

at the Rochester Hub remains at 35,000 tonnes of black mass per

year. The Rochester Hub project is expected to create approximately

825 construction jobs at peak construction and more than 200

permanent jobs.

The Company estimates the total capital cost of the Rochester

Hub project through to mechanical completion to be approximately

$960 million, of which the remaining estimated cost to complete

(“CTC”) the project is approximately $487 million. The CTC includes

commitments related to the project for costs incurred but not yet

paid (approximately $92 million as of September 30, 2024). The

total capital cost for the Rochester Hub project through to

mechanical completion excludes costs for project commissioning,

ramp-up, working capital or financing.

The Company is actively exploring financing and strategic

alternatives for a complete funding package needed to restart the

construction of the Rochester Hub (of which the DOE Loan Facility

is a key component) and for general corporate purposes. The funding

package would assist in satisfying the funding conditions for First

Advance under the DOE Loan Facility, including funding the

remaining BEC (which includes the reserve account requirements) and

a minimum cash balance.

Ajay Kochhar, Li-Cycle President and CEO, commented:

“Throughout 2024, one of Li-Cycle’s primary objectives has been to

finalize negotiations with the DOE in order to enter into

definitive documentation to obtain a DOE loan. Today, we are

excited to announce our achievement of this significant milestone,

which we believe represents a strong vote of confidence in

Li-Cycle's patented and environmentally friendly recycling

technology and business model. Securing the DOE Loan Facility

through our close collaboration with the DOE is a critical step

toward our goal of restarting construction at the Rochester Hub

project.

“We believe that the DOE Loan Facility offers attractive terms

relative to other third-party financing alternatives available to

us. We believe it will also enhance our financial flexibility and

support our mission to create a sustainable, closed-loop battery

supply chain, which is vital to the electrification transition and

securing energy independence in North America.”

Additional information regarding this announcement may be found

in a Current Report Form 8-K filed with the U.S. Securities and

Exchange Commission.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery

resource recovery company. Established in 2016, and with major

customers and partners around the world, Li-Cycle’s mission is to

recover critical battery-grade materials to create a domestic

closed-loop battery supply chain for a clean energy future. The

Company leverages its innovative, sustainable and patent-protected

Spoke & Hub Technologies™ to recycle all different types of

lithium-ion batteries. At our Spokes, or pre-processing facilities,

we recycle battery manufacturing scrap and end-of-life batteries to

produce black mass, a powder-like substance which contains a number

of valuable metals, including lithium, nickel and cobalt. At our

future Hubs, or post-processing facilities, we plan to process

black mass to produce critical battery-grade materials, including

lithium carbonate, for the lithium-ion battery supply chain. For

more information, visit https://li-cycle.com/.

Forward-Looking Statements Certain statements contained

in this press release may be considered “forward-looking

statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995, Section 27A of the U.S. Securities

Act of 1933, as amended, Section 21 of the U.S. Securities Exchange

Act of 1934, as amended, and applicable Canadian securities laws.

Forward-looking statements may generally be identified by the use

of words such as “believe”, “may”, “will”, “continue”,

“anticipate”, “intend”, “expect”, “should”, “would”, “could”,

“plan”, “potential”, “future”, “target” or other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters, although not all

forward-looking statements contain such identifying words.

Forward-looking statements in this press release include but are

not limited to statements about: the expectation that the DOE Loan

Facility will support the development of the Rochester Hub project;

the expectation that the Rochester Hub project will be completed;

the ability of the Company to satisfy the conditions for First

Advance under the DOE Loan Facility and to draw on the DOE Loan

Facility; the expectation that the Rochester Hub will be the first

commercial hydrometallurgical resource recovery facility in North

America, and a significant domestic source of recycled critical

materials for producing lithium-ion batteries, including

battery-grade lithium carbonate and MHP; the expected production

targets and the planned nameplate processing capacity at the

Rochester Hub; the estimated capital cost to complete the Rochester

Hub project; the expected job creation; and the expectation that

Li-Cycle will play a key part in the development of a domestic

sustainable and circular supply chain of battery-grade

materials.

These statements are based on various assumptions, whether or

not identified in this press release, including but not limited to

assumptions regarding the timing, scope and cost of Li-Cycle’s

projects, including paused and curtailed projects; the processing

capacity and production of Li-Cycle’s facilities; Li-Cycle’s

ability to source feedstock and manage supply chain risk;

Li-Cycle’s ability to increase recycling capacity and efficiency;

Li-Cycle’s ability to obtain financing on acceptable terms or at

all; the success of Li-Cycle’s cash preservation plan; the outcome

of the go-forward strategy of the Rochester Hub; Li-Cycle’s ability

to retain and hire key personnel and maintain relationships with

customers, suppliers and other business partners; expectations

related to the outcome of future litigation; general economic

conditions; currency exchange and interest rates; compensation

costs; and inflation. There can be no assurance that such estimates

or assumptions will prove to be correct and, as a result, actual

results or events may differ materially from expectations expressed

in or implied by the forward-looking statements.

These forward-looking statements are provided for the purpose of

assisting readers in understanding certain key elements of

Li-Cycle’s current objectives, goals, targets, strategic

priorities, expectations and plans, and in obtaining a better

understanding of Li-Cycle’s business and anticipated operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes and is not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

Forward-looking statements involve inherent risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of Li-Cycle and are not guarantees of

future performance. Li-Cycle believes that these risks and

uncertainties include, but are not limited to, the following:

Li-Cycle’s inability to fund the anticipated costs of, and realize

the anticipated benefits from, its Spoke optimization plan;

Li-Cycle’s inability to satisfy the drawdown conditions and access

funding under the DOE Loan Facility; Li-Cycle’s inability to

develop the Rochester Hub as anticipated or at all, and other

future projects including its Spoke network expansion projects in a

timely manner or on budget or that those projects will not meet

expectations with respect to their productivity or the

specifications of their end products; risk and uncertainties

related to Li-Cycle’s ability to continue as a going concern;

Li-Cycle’s insurance may not cover all liabilities and damages;

Li-Cycle’s reliance on a limited number of commercial partners to

generate revenue; Li-Cycle’s failure to effectively remediate the

material weaknesses in its internal control over financial

reporting that it has identified or its failure to develop and

maintain a proper and effective internal control over financial

reporting; and risks of litigation or regulatory proceedings that

could materially and adversely impact Li-Cycle’s financial results.

These and other risks and uncertainties related to Li-Cycle’s

business are described in greater detail in the sections titled

“Item 1A. Risk Factors” and “Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operation—Key

Factors Affecting Li-Cycle’s Performance” in its Annual Report on

Form 10-K and the sections titled “Part II. Other Information—Item

1A. Risk Factors” and “Part I. Financial Information—Item 2.

Management’s Discussion and Analysis of Financial Condition and

Results of Operation—Key Factors Affecting Li-Cycle’s Performance”

in its Quarterly Reports on Form 10-Q, in each case filed with the

U.S. Securities and Exchange Commission and the Ontario Securities

Commission in Canada. Because of these risks, uncertainties and

assumptions, readers should not place undue reliance on these

forward-looking statements. Actual results could differ materially

from those contained in any forward-looking statement.

Li-Cycle assumes no obligation to update or revise any

forward-looking statements, except as required by applicable laws.

These forward-looking statements should not be relied upon as

representing Li-Cycle’s assessments as of any date subsequent to

the date of this press release.

___________________________________ 1 First Advance shall occur

on or prior to November 7, 2025. 2 The Loan Facility reserve

accounts required for First Advance includes reserves for project

construction, project ramp-up, and Spoke capital expenditures.

Funding of these reserve accounts does not constitute capital

expenditure on the project and the requirement to fund these

reserve accounts is in addition to the total capital cost of the

Rochester Hub project through to mechanical completion. The

majority of these reserve account funds are expected to be released

to the Company on or before the completion of the Rochester Hub

project.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107111197/en/

Investor Relations & Media

Louie Diaz Sheldon D'souza

Investor Relations: investors@li-cycle.com Media:

media@li-cycle.com

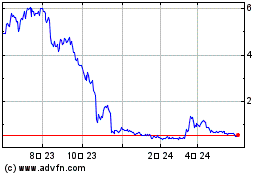

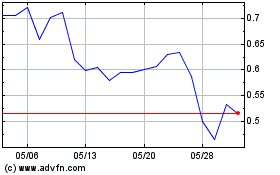

Li Cycle (NYSE:LICY)

過去 株価チャート

から 11 2024 まで 12 2024

Li Cycle (NYSE:LICY)

過去 株価チャート

から 12 2023 まで 12 2024