Farmland Partners, Ducks Unlimited Complete Land Conservation Project in Virginia

2023年11月30日 - 9:10PM

ビジネスワイヤ(英語)

Farmland Partners Inc. (NYSE: FPI) (the “Company” or “FPI”) and

Ducks Unlimited (“DU”) announced today that they recently completed

the final stage of a three-part conservation transaction along a

vital migratory bird pathway in Virginia.

FPI agreed in 2021 to sell DU approximately 1,268 acres of

farmland adjacent to the Great Dismal Swamp National Wildlife

Refuge – land that DU has prioritized for restoration and habitat

protection. The unique multi-year, staged transaction provided DU

maximum flexibility to secure capital for the project. The final

sale consisted of more than 400 acres.

“We were pleased to be able to work with our partners at

Farmland Partners and look at their portfolio to see where the

farmland they owned happened to be in critical conservation areas,”

explained DU CEO Adam Putnam. “The parcel that bubbled to the top

of that priority list was the Great Dismal Swamp.”

“We purchased the farm in 2015 and were thrilled to have an

opportunity to work with DU to protect the land for years to come,”

said Luca Fabbri, FPI’s President and CEO. “This was a special

transaction for our Company because it benefitted the environment

and was profitable for our shareholders at the same time.”

Fabbri said this transaction was part of the Company’s ongoing

sustainability efforts and was spotlighted in its recently released

Environmental, Social, and Governance Report, which can be viewed

here: https://bit.ly/48KtCJx.

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate

company that owns and seeks to acquire high-quality North American

farmland and makes loans to farmers secured by farm real estate. As

of the date of this release, the Company owns and/or manages more

than 176,000 acres in 19 states, including Alabama, Arkansas,

California, Colorado, Florida, Georgia, Illinois, Indiana, Iowa,

Kansas, Louisiana, Michigan, Mississippi, Missouri, Nebraska, North

Carolina, Oklahoma, South Carolina, and Texas. In addition, the

Company owns land and buildings for four agriculture equipment

dealerships in Ohio leased to Ag Pro under the John Deere brand.

The Company has approximately 26 crop types and over 100 tenants.

The Company elected to be taxed as a real estate investment trust,

or REIT, for U.S. federal income tax purposes, commencing with the

taxable year ended December 31, 2014. Additional information:

www.farmlandpartners.com or (720) 452-3100.

About Ducks Unlimited

Ducks Unlimited Inc. is the world's largest nonprofit

organization dedicated to conserving North America's continually

disappearing wetlands, grasslands, and other waterfowl habitats.

Established in 1937, Ducks Unlimited has restored or protected more

than 16 million acres thanks to contributions from more than a

million supporters across the continent. Guided by science, DU’s

projects benefit waterfowl, wildlife, and people in all 50 states.

Learn more at www.ducks.org.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the federal securities laws, including, without

limitation, statements with respect to our outlook and the outlook

for the farm economy generally, proposed and pending acquisitions

and dispositions, financing activities, crop yields and prices and

anticipated rental rates. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” or similar expressions or their negatives,

as well as statements in future tense. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, beliefs and

expectations, such forward-looking statements are not predictions

of future events or guarantees of future performance and our actual

results could differ materially from those set forth in the

forward-looking statements. Some factors that might cause such a

difference include the following: the on-going war in Ukraine and

its impact on the world agriculture market, world food supply, the

farm economy, and our tenants’ businesses; general volatility of

the capital markets and the market price of the Company’s common

stock; changes in the Company’s business strategy, availability,

terms and deployment of capital; the Company’s ability to refinance

existing indebtedness at or prior to maturity on favorable terms,

or at all; availability of qualified personnel; changes in the

Company’s industry, interest rates or the general economy; adverse

developments related to crop yields or crop prices; the degree and

nature of the Company’s competition; the timing, price or amount of

repurchases, if any, under the Company's share repurchase program;

the ability to consummate acquisitions or dispositions under

contract; and the other factors described in the section entitled

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022, and the Company’s other filings with

the Securities and Exchange Commission. Any forward-looking

information presented herein is made only as of the date of this

press release, and the Company does not undertake any obligation to

update or revise any forward-looking information to reflect changes

in assumptions, the occurrence of unanticipated events, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231130113675/en/

Phillip Hayes phayes@farmlandpartners.com

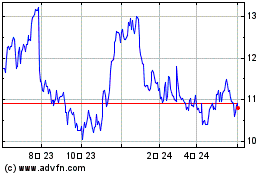

Farmland Partners (NYSE:FPI)

過去 株価チャート

から 11 2024 まで 12 2024

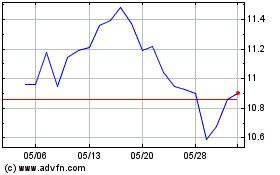

Farmland Partners (NYSE:FPI)

過去 株価チャート

から 12 2023 まで 12 2024