Farmland Partners Releases First Sustainability Report

2023年9月28日 - 8:15PM

ビジネスワイヤ(英語)

Farmland Partners Inc. (NYSE: FPI) (the “Company” or “FPI”)

today released a report outlining the Company’s environmental,

social, and governance (“ESG”) initiatives.

“When we think of the environmental and social components of

ESG, we start with two core beliefs – that everyone has a right to

an affordable and nutritious diet, and U.S. farmers are maximizing

food production for a growing planet while minimizing their

environmental impact,” said Luca Fabbri, FPI’s President and CEO.

“Our first ESG report was designed to help spotlight the great work

being done in agriculture as a whole, and by our tenants in

particular.”

Key Report Highlights

- FPI’s tenants are good long-term stewards of the land. To help

quantify their commitment, the Company surveyed tenants and found

that 97% invest in soil health, 94% practice conservation tillage,

87% use variable rate technology, and more than half participate in

federal conservation programs.

- FPI expanded its solar and wind energy portfolio, which now

spans more than 13,000 acres and has the collective capacity to

generate approximately 260 megawatts of renewable energy.

- FPI continued its partnership with Ducks Unlimited to support

conservation and habitat restoration.

- FPI crafted a series of sustainability policies, which were

adopted by the Company’s Board of Directors in February 2023.

- FPI calculated the Company’s Scope 1 and Scope 2 greenhouse gas

emissions for the first time.

FPI’s 2022 ESG report is available on the Investor Relations

section of www.farmlandpartners.com.

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate

company that owns and seeks to acquire high-quality North American

farmland and makes loans to farmers secured by farm real estate. As

of the date of this release, the Company owns and/or manages nearly

180,000 acres in 20 states, including Alabama, Arkansas,

California, Colorado, Florida, Georgia, Illinois, Indiana, Iowa,

Kansas, Louisiana, Michigan, Mississippi, Missouri, Nebraska, North

Carolina, Oklahoma, South Carolina, Texas, and Virginia. In

addition, the Company owns land and buildings for four agriculture

equipment dealerships in Ohio leased to Ag Pro under the John Deere

brand. The Company has approximately 26 crop types and over 100

tenants. The Company elected to be taxed as a real estate

investment trust, or REIT, for U.S. federal income tax purposes,

commencing with the taxable year ended December 31, 2014.

Additional information: www.farmlandpartners.com or (720)

452-3100.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the federal securities laws, including, without

limitation, statements with respect to our environmental, social

and governance (“ESG”)-related performance and initiatives, our

outlook and the outlook for the farm economy generally, proposed

and pending acquisitions and dispositions, financing activities,

crop yields and prices and anticipated rental rates.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “may,” “should,” “could,”

“would,” “predicts,” “potential,” “continue,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” or similar expressions or their negatives, as well as

statements in future tense. Although the Company believes that the

expectations reflected in such forward-looking statements are based

upon reasonable assumptions, beliefs and expectations, such

forward-looking statements are not predictions of future events or

guarantees of future performance and our actual results could

differ materially from those set forth in the forward-looking

statements. Some factors that might cause such a difference include

the following: the ongoing war in Ukraine and its impact on the

world agriculture market, world food supply, the farm economy, and

our tenants’ businesses; general volatility of the capital markets

and the market price of the Company’s common stock; changes in the

Company’s business strategy, availability, terms and deployment of

capital; the Company’s ability to refinance existing indebtedness

at or prior to maturity on favorable terms, or at all; availability

of qualified personnel; changes in the Company’s industry, interest

rates or the general economy; adverse developments related to crop

yields or crop prices; the degree and nature of the Company’s

competition; the timing, price or amount of repurchases, if any,

under the Company's share repurchase program; the ability to

consummate acquisitions or dispositions under contract; and the

other factors described in the section entitled “Risk Factors” in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2022, and the Company’s other filings with the

Securities and Exchange Commission. In addition, historical,

current, and forward-looking ESG and sustainability-related

information may be based on standards for measuring progress that

are still developing and internal controls and processes that

continue to evolve. The standards and metrics included herein,

unless otherwise specifically indicated, are non-audited estimates,

were not prepared in accordance with U.S. generally accepted

accounting principles (GAAP) and have not been externally assured.

Any forward-looking information presented herein is made only as of

the date of this press release, and the Company does not undertake

any obligation to update or revise any forward-looking information

to reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230928272354/en/

Phillip Hayes phayes@farmlandpartners.com

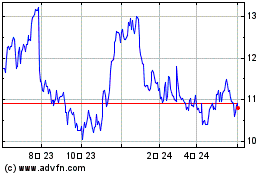

Farmland Partners (NYSE:FPI)

過去 株価チャート

から 11 2024 まで 12 2024

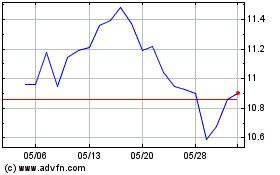

Farmland Partners (NYSE:FPI)

過去 株価チャート

から 12 2023 まで 12 2024