false

0001113809

0001113809

2024-09-12

2024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2024

Build-A-Bear Workshop, Inc.

-------------------------------------------------

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

---------------------------

(State or Other Jurisdiction

of Incorporation)

|

001-32320

-------------------

(Commission

File Number)

|

43-1883836

---------------------------

(IRS Employer

Identification No.)

|

|

415 South 18th St., St. Louis, Missouri

----------------------------------------------------

(Address of Principal Executive Offices)

|

63103

------------------

(Zip Code)

|

(314) 423-8000

------------------------------------------

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

BBW

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02.Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 12, 2024, Build-A-Bear Workshop, Inc. (the “Company”) announced that it had appointed David Henderson, 52, as Chief Revenue Officer, effective as of September 16, 2024.

Over two decades, Mr. Henderson has developed a rich background serving in roles of increasing responsibility across the toy, consumer products and entertainment industries including most recently serving as the Chief Commercial Officer of Melissa & Doug, LLC from May 2020 until May 2024. Additionally, from March 2019 until April 2020, he was President and General Manager-Global of Baby Gear at Newell Brands Inc. Prior to that, during over almost 18 years at Hasbro, Inc., Mr. Henderson expanded his experience though various leadership positions, ultimately holding the office of Senior Vice President Consumer Products/Licensing North America.

The Company and Mr. Henderson have entered into an Employment, Confidentiality and Noncompete Agreement (“Agreement”) effective as of September 16, 2024 with an initial term of three years from the effective date, renewing year-to-year thereafter unless terminated in accordance with the terms of the Agreement. Under the Agreement, and in accordance with the terms and conditions included in the Agreement, Mr. Henderson will receive an annual base salary of not less than $475,000, to be reviewed annually; will be eligible for an annual bonus with a target value equal to no less than 50% of his earned annual base salary, payable in cash, stock, or a combination of the two; will be eligible to receive equity or other awards under the Company’s Amended and Restated 2020 Omnibus Incentive Plan (or any successor plan) (the “Omnibus Plan”); and will receive a signing bonus of $25,000. Mr. Henderson will also be eligible to participate in the Company’s health and other welfare benefits as may be offered from time to time to other similarly situated employees, including relocation assistance and participation in the Company’s 401(k) plan with Company match.

The Agreement may be terminated by the Company prior to the end of the term upon death, disability, for cause (as defined in the Agreement) or without cause. Mr. Henderson may terminate the Agreement with or without good reason (as defined in the Agreement). Mr. Henderson is entitled to certain salary continuation and/or lump sum payments if the Company terminates his employment upon his death, disability or without cause, or if Mr. Henderson terminates his employment for good reason, in accordance with the terms set forth in the Agreement and dependent on the event of termination. In the case of any termination of his employment, Mr. Henderson is entitled to a lump sum payment equivalent to 18 months of the continuation of certain health and welfare benefits.

Mr. Henderson is also subject to non-competition, non-solicitation, non-disparagement, and confidentiality provisions included in the Agreement.

The foregoing summary of Mr. Henderson’s Agreement is qualified in its entirety by reference to the terms of the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Effective September 16, 2024, the Compensation and Development Committee (the “Committee”) of the Board of Directors approved Mr. Henderson’s 2024 annual cash bonus program award under the Omnibus Plan with a target value of 50% of his full 2024 salary rate of $475,000. Also effective September 16, 2024, the Committee awarded Mr. Henderson a 2024 long-term incentive program award under the Omnibus Plan with a target market value of $132,632 (pro-rated based on a full year value of $350,000), 50% of which will be issued in the form of time-based restricted stock (that vests pro-ratably over three years) and 50% of which will be issued in the form of three-year performance-based restricted stock. The number of shares of common stock awarded will be calculated based on the closing price of the Company’s common stock on September 16, 2024 as listed on the New York Stock Exchange. Mr. Henderson’s annual cash bonus program award and long-term incentive program award are subject to the terms of the Omnibus Plan and will be earned and payable upon the satisfaction of the same performance objectives and conditions applicable to the 2024 cash bonus program awards and long-term incentive program awards granted to the Company’s other non-CEO executive officers. Furthermore, Mr. Henderson’s time-based and performance-based restricted stock will be subject to the terms of the Restricted Stock Agreement entered into by Mr. Henderson and the Company in connection with the award grant. Finally, Mr. Henderson’s annual cash bonus program award and three-year performance-based restricted stock award are subject to the Company’s Clawback Policy. A description of these performance objectives and conditions, description of the Company’s cash bonus program, and summary of the terms of the Restricted Stock Agreement are set forth under Item 5.02 of the Form 8-K filed with the U.S. Securities and Exchange Commission by the Company on April 19, 2024, which disclosure and exhibits are incorporated herein by reference.

There are no arrangements between Mr. Henderson and any other persons pursuant to which he was appointed to serve as the Company’s Chief Revenue Officer. There are no family relationships between Mr. Henderson and any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

On September 12, 2024, the Company issued a press release announcing Mr. Henderson’s appointment. A copy of this press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

Description of Exhibit

|

| |

|

|

10.1

|

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BUILD-A-BEAR WORKSHOP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 12, 2024

|

By:

|

/s/ Eric R. Fencl

|

|

|

|

Name:

|

Eric R. Fencl

|

|

|

|

|

Title: Chief Administrative Officer,

General Counsel & Secretary

|

|

Exhibit 10.1

EMPLOYMENT, CONFIDENTIALITY AND NONCOMPETE AGREEMENT

This Employment, Confidentiality and Noncompete Agreement (“Agreement”) is entered into effective as of September 16, 2024 (“Effective Date”), by and between Build-A-Bear Workshop, Inc., a Delaware corporation (“Company”), and David Henderson (“Employee”).

WHEREAS, Company desires to employ and Employee desires to be employed as the Chief Revenue Officer of Company from and after the Effective Date.

WHEREAS, Company has pioneered the retail concept of “make your own” stuffed plush toys, including animals and dolls, and is engaged in, among other things, the business of production, marketing, promotion and distribution of plush stuffed toys, clothing, accessories and similar items, including without limitation, the ownership, management, franchising, leasing and development of retail stores in which the basic operation is the selling of such items, and the promotion of the related concepts and characters through merchandising and mass media. Company is headquartered and its principal place of business is located in, and this Agreement is being signed in, St. Louis, Missouri.

WHEREAS, Company conducts business in selected locations throughout the United States and internationally directly and through franchise arrangements.

WHEREAS, Company has expended a great deal of time, money and effort to develop and maintain its proprietary Confidential Information (as defined herein) which is material to Company and which, if misused or disclosed, could be very harmful to Company’s business.

WHEREAS, the success of Company depends to a substantial extent upon the protection of its Confidential Information and goodwill by all of its employees.

WHEREAS, Company compensates its employees to, among other things, develop and preserve goodwill with its customers, landlords, suppliers and partners on Company’s behalf and business information for Company’s ownership and use.

WHEREAS, if Employee were to leave Company, Company, in all fairness, would need certain protections in order to prevent competitors of Company from gaining an unfair competitive advantage over Company or diverting goodwill from Company, or to prevent Employee from misusing or misappropriating the Confidential Information.

NOW, THEREFORE, in consideration of the compensation and other benefits of Employee’s employment by Company and the recitals, mutual covenants and agreements hereinafter set forth, Employee and Company agree as follows:

1. Employment Services.

(a) As of the Effective Date, Employee shall be employed by Company, and Employee accepts such employment, upon the terms and conditions hereinafter set forth. Employee shall serve as Chief Revenue Officer throughout the Employment Period, and agrees to do so on a full-time basis. Employee shall carry out such duties as are assigned to him by Company’s Chief Executive Officer.

(b) Employee agrees that throughout Employee’s employment with Company, Employee will (i) faithfully render such services as may be delegated reasonably to Employee by Company, (ii) devote substantially all of Employee’s entire business time, good faith, best efforts, ability, skill and attention to Company’s business, and (iii) follow and act in accordance with all of the rules, policies and procedures of Company which are applicable to its senior executives, including but not limited to working hours, sales and promotion policies, and specific Company rules.

(c) “Company” means Build-A-Bear Workshop, Inc. or one of its Subsidiaries. The term “Subsidiary” means any corporation, joint venture or other business organization in which Build-A-Bear Workshop, Inc. now or hereafter, directly or indirectly, owns or controls more than fifty percent (50%) interest.

2. Term of Employment. The term of this Agreement shall commence on the Effective Date first set forth above, and shall end on the third anniversary of the Effective Date, unless sooner terminated as provided in Section 4 hereof (the “Renewal Term”). Following the Renewal Term, this Agreement shall renew for successive one-year periods (each a “Renewal Period”; collectively, the Renewal Term and each Renewal Period, the “Employment Period”), unless either party notifies the other party of its decision not to renew the Agreement at least sixty (60) days prior to the third anniversary of the Effective Date or the expiration of any Renewal Period, or unless the Agreement is sooner terminated as provided in Section 4 hereof. For the avoidance of doubt, if either party provides notice of non-renewal of the Agreement at least sixty (60) days prior to the end of the Renewal Term or the end of any Renewal Period, then the Agreement shall expire.

3. Compensation.

(a) Base Salary. Throughout the Employment Period, Company shall pay Employee as compensation for his services an annual base salary of not less than Four Hundred Seventy-Five Thousand Dollars ($475,000.00), payable in accordance with Company’s usual practices. Employee’s annual base salary rate shall be reviewed by the Compensation Committee of the Board of Directors (the “Compensation Committee”) at least annually and may be subject to adjustment following each fiscal year so that Employee’s salary will be commensurate with similarly situated executives with firms similarly situated to Company. However, Employee’s annual base salary rate shall not be subject to decrease at any time during the Employment Period.

(b) Bonus. Should Company meet or exceed the sales, profits and other objectives established by the Compensation Committee for any fiscal year, Employee shall be eligible to receive a bonus for such fiscal year in the amount as determined by the Compensation Committee; provided however, the target bonus opportunity established for Employee in any given fiscal year will be set by the Compensation Committee at not less than fifty percent (50%) of Employee’s earned annual base pay for such fiscal year. Any bonus payable to Employee will be payable in cash, stock or stock options, or combination thereof, all as determined by the Board of Directors or any duly authorized committee thereof, and unless (to the extent consistent with Section 409A of the Code) a different payout schedule is applicable for all executive employees of Company, any such bonus payment will be payable in a single, lump sum payment in the calendar year that contains the April 30th immediately following such fiscal year, but no later than April 30th of such year. In the event of termination of this Agreement because of Employee’s death or disability (as defined by Section 4.1(b)), termination by Company without Cause pursuant to Section 4.1(c), or pursuant to Employee’s right to terminate this Agreement for Good Reason under Section 4.1(d), (1) any bonus for the fiscal year preceding the fiscal year in which such termination occurs shall be paid at the time and in the form such bonus would have been paid had Employee’s employment continued until the payment date, and (2) the bonus for the fiscal year in which such termination occurs shall be pro-rated based on the number of full calendar weeks during the applicable fiscal year during which Employee was employed hereunder, based on the bonus amount that Employee would have earned based on actual performance for the fiscal year had Employee’s employment not terminated, and shall be paid at the time and in the form such bonus would have been paid had Employee’s employment continued; provided, however, in the event of termination of this Agreement because of Employee’s termination by Company without Cause pursuant to Section 4.1(c) or pursuant to Employee’s right to terminate this Agreement for Good Reason under Section 4.1(d) and such termination is on the date of a Change in Control or during a period of twenty-four (24) months after a Change in Control, Employee’s target bonus for the fiscal year in which such termination occurs shall be prorated based on the number of full calendar weeks during the applicable fiscal year during which Employee was employed hereunder and shall be paid within thirty (30) days of such termination (subject to any delay in payout required under Section 4.2(b)). Notwithstanding anything herein to the contrary, no bonus shall be payable hereunder in the event that Employee’s employment terminates for any other reason prior to the date on which any bonus is actually paid.

Such bonus, if any, shall be payable after Company’s accountants have determined the sales and profits and have issued their audit report with respect thereto for the applicable fiscal year, which determination shall be binding on the parties. Any such bonus shall be paid in the calendar year that contains the April 30 immediately following such fiscal year, but no later than April 30th of such year.

(c) Equity Awards. Employee may in the future be granted, a certain number of restricted shares and/or stock options to purchase shares of Company’s common stock (the “Common Stock”) and/or other awards, pursuant to the terms set forth more particularly in the stock option and/or restricted stock and/or other award agreements (“Stock Agreement”) used in connection with the Build-A-Bear Workshop, Inc. Amended and Restated 2020 Omnibus Incentive Plan (or any successor plan) (the “Plan”). The Plan and applicable Stock Agreement(s) shall govern any grants of restricted shares and/or stock options to purchase shares of Company’s Common Stock and/or such other awards.

(d) Discounts. Employee and his immediate family will be entitled to a minimum 20% discount for all merchandise purchased at Company’s stores.

(e) Vacation. Employee shall be entitled to paid vacation and paid sick leave on the same basis as may from time to time apply to other Company executive employees generally. Vacations will be scheduled with the approval of Company’s Chief Executive Officer. One-third of one year’s vacation (or any part of it) may be carried over to the next year; provided that such carry over is used in the first calendar quarter of the next year. Unless otherwise approved by Company’s Chief Executive Officer, all unused vacation shall be forfeited. No more than two weeks of vacation can be taken at one time. Employee shall also be entitled to one (1) additional day per calendar year of paid vacation to be taken in the month of his birthday.

(f) Other. Employee shall be eligible for such other perquisites as may from time to time be awarded to Employee by Company payable at such times and in such amounts as Company, in its sole discretion, may determine. All compensation under this Agreement shall be subject to customary withholding taxes and other employment taxes as required with respect thereto. Throughout the Employment Period, Employee shall also qualify for all rights and benefits for which Employee may be eligible under any benefit plans including group life, medical, health, dental and/or disability insurance or other benefits (“Welfare Benefits”) which are provided for employees generally at his then current location of employment.

(g) Signing Bonus. Employee shall receive a lump sum cash bonus in the amount of Twenty-Five Thousand Dollars ($25,000) paid on the Company’s first regular pay date that occurs at least ninety (90) days following the Effective Date, such bonus subject to withholding and other employment taxes as required; provided Employee shall repay such amount to the Company if, prior to the first anniversary of the Effective Date, he terminates his employment with the Company without Good Reason or if the Company terminates his employment with Cause.

4. Termination Provisions.

4.1 Termination of Employment. Prior to the expiration of the Employment Period, this Agreement and Employee’s employment may be terminated as follows:

(a) Upon Employee’s death;

(b) By Company upon thirty (30) days’ prior written notice to Employee in the event Employee, by reason of permanent physical or mental disability (which shall be determined by a physician selected by Company or its insurers and acceptable to Employee or Employee’s legal representative (such agreement as to acceptability not to be withheld unreasonably)), following such time as Employee has been unable to perform the essential functions of his position, with or without reasonable accommodation, for the longer of: (i) six (6) consecutive months or (ii) the maximum health leave provided under Company’s Health Leave of Absence policy for Employee’s length of service with Company; provided, however, Employee shall not be terminated due to permanent physical or mental disability unless or until said disability also entitles Employee to benefits under such disability insurance policy as is provided to Employee by Company, provided however that continued entitlement to disability benefits coverage shall be not required where Employee fails to qualify for benefits coverage continuation due to an act or omission by Employee.

(c) By Company with or without Cause. For the purposes of this Agreement, “Cause” shall mean: (i) Employee’s engagement in any conduct which, in Company’s reasonable determination, constitutes gross misconduct, or is illegal, unethical or improper provided such conduct brings detrimental notoriety or material harm to Company; (ii) gross negligence or willful misconduct; (iii) any act which results in a conviction for a felony involving moral turpitude, fraud or misrepresentation; (iv) a material breach of a material provision of this Agreement by Employee, or (v) failure of Employee to follow a written directive of the Chief Executive Officer or the Board of Directors within thirty (30) days after receiving such notice, provided that such directive is reasonable in scope and is otherwise within the Chief Executive Officer’s or the Board’s reasonable business judgment, and is reasonably within Employee’s control; provided Employee does not cure said conduct or breach as set forth in (i)-(v)(to the extent curable) within thirty (30) days after the Chief Executive Officer or the Board of Directors provides Employee with reasonably-detailed written notice of said conduct or breach accompanied by a clear written statement of Company’s intent to terminate the Employee’s employment for Cause in the absence of a cure. Cause shall not exist unless and until the Employee (and his counsel if he wishes) has been afforded an opportunity prior to the actual date of termination to discuss the matter with the Board of Directors at a duly-called Board meeting at which the matter is timely placed on the agenda and the Board subsequently votes to terminate the relationship for Cause.

(d) By the Employee with or without Good Reason. For purposes of this Agreement, “Good Reason” shall mean (i) a material breach of a material provision of this Agreement by Company, (ii) Company’s issuance of a notice of non-renewal of this Agreement under Section 2, (iii) a material diminution in Employee’s total annual compensation, including base salary, annual bonus opportunity and long-term incentives, (iv) a material diminution in Employee’s authority, duties or responsibilities, or (v) a change in the geographic location at which Employee must perform services hereunder of more than twenty-five (25) miles; provided, that, Employee provides the Board of Directors with written notice of Good Reason within thirty (30) days of the date on which Employee becomes aware of the condition alleged to give rise to Good Reason, Company does not cure such condition within thirty (30) days after such notice (to the extent curable), and Employee terminates his employment within ninety (90) days following the onset of one or more conditions giving rise to Good Reason.

4.2 Impact of Termination.

(a) Survival of Covenants. Upon termination of this Agreement, all rights and obligations of the parties hereunder shall cease, except termination of employment pursuant to Section 4 or otherwise shall not terminate or otherwise affect the rights and obligations of the parties pursuant to Sections 5 through 13 hereof.

(b) Severance. In the event during the Employment Period (i) Company terminates Employee’s employment without Cause pursuant to Section 4.1(c) or (ii) the Employee terminates his employment for Good Reason pursuant to Section 4.1(d), subject to the execution and non-revocation of a release and waiver of all claims described below, Company shall continue his base salary in accordance with its regular payroll practices for a period of (A) twelve (12) months, commencing on the date that is thirty (30) days after the termination in the case of a termination of employment either prior to a Change in Control or following a period of twenty-four (24) months after a Change in Control or (B) eighteen (18) months, commencing on the date that is thirty (30) days after the termination in the case of a termination of employment during the twenty-four (24) month period immediately following a Change in Control. Notwithstanding anything herein to the contrary, receipt of any payment in connection with a termination of employment shall be conditioned on Employee signing a release and waiver of all claims against Company and its affiliates within thirty (30) days after his termination of employment, in such form and manner as Company shall reasonably prescribe, which release shall become effective and irrevocable within thirty (30) days after Employee’s termination of employment. Employee shall accept these payments in full discharge of all obligations of any kind which Company has to his except obligations, if any (i) for post-employment benefits expressly provided under this Agreement and/or at law, (ii) to repurchase any capital stock of Company owned by Employee (as may or may not be set forth in the applicable stock agreement); or (iii) for indemnification under separate agreement by virtue of Employee’s status as a director/officer of Company. Employee shall also be eligible to receive a bonus with respect to the year of termination to the extent provided in Section 3(b).

For purposes of these severance pay provisions and any other term of this Agreement which provides for a payment upon termination of employment, Employee shall be considered as having terminated employment only if such termination constitutes a “separation from service” within the meaning of Section 409A of the Code, and any proposed or final regulations and guidance promulgated thereunder. Notwithstanding anything herein to the contrary, in the event that Employee is determined to be a specified employee within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), for purposes of any payment on termination of employment hereunder, payment(s) shall be made or begin, as applicable, on the first payroll date which is more than six months following the date of separation from service, to the extent required to avoid any adverse tax consequences under Section 409A of the Code. Any payments that would have been made during such six (6) month period shall be made in a lump sum on the first payroll date which is more than six months following the date Employee separates from service with Company. Each payment under this Agreement shall be treated as a separate payment for purposes of Section 409A of the Code. In no event may Employee, directly or indirectly, designate the calendar year of any payment to be made under this Agreement. This Agreement shall be interpreted and administered in a manner consistent with Section 409A of the Code.

For purposes of this Agreement, “Change in Control” shall mean: (i) the purchase or other acquisition (other than from Company) by any person, entity or group of persons, within the meaning of Section 13(d) or 14(d) of the Securities Exchange Act of 1934, as amended (“Act”) (excluding, for this purpose, Company or its subsidiaries or any employee benefit plan of Company or its subsidiaries), of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Act) of 20% or more of either the then-outstanding shares of common stock of Company or the combined voting power of Company’s then-outstanding voting securities entitled to vote generally in the election of directors; (ii) individuals who, as of the date hereof, constitute Company’s Board of Directors (and, as of the date hereof, the “Incumbent Board”) cease for any reason to constitute at least a majority of Company’s Board of Directors, provided that any person who becomes a director subsequent to the date hereof whose election, or nomination for election by Company’s stockholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board (other than an individual whose initial assumption of office is in connection with an actual or threatened election contest relating to the election of directors of Company, as such terms are used in Rule 14a-11 of Regulation 14A promulgated under the Act) shall be, for purposes of this Section, considered as though such person were a member of the Incumbent Board; (iii) a reorganization, merger or consolidation involving Company, in each case with respect to which persons who were the stockholders of Company immediately prior to such reorganization, merger or consolidation do not, immediately thereafter, own more than 50% of, respectively, the common stock and the combined voting power entitled to vote generally in the election of directors of the reorganized, merged or consolidated corporation’s then-outstanding voting securities; or (iv) a liquidation or dissolution of Company, or the sale of all or substantially all of the assets of Company.

(c) Termination due to Employee Non-Renewal of Term or Termination by Employee without Good Reason. If the Agreement expires either at the end of the Renewal Term or at the end of any Renewal Period, due to the issuance of notice of non-renewal by Employee under Section 2, then no severance under Section 4.2(b) shall be paid to the Employee and his employment shall terminate upon the anniversary date. If Employee terminates his employment without Good Reason, then no severance under Section 4.2(b) shall be paid to Employee and his employment shall terminate on the effective date of such termination. For the avoidance of doubt, if Company ends the employment relationship either at the end of the Renewal Term or at the end of any Renewal Period without Cause under Section 4.1(c), Company shall remit to Employee the severance specified in Section 4.2(b) provided Company has received the release and waiver referred to in Section 4.2(b).

(d) Welfare Benefits. Upon termination or expiration of this Agreement for any reason, Employee shall be provided with such Welfare Benefits continuation notices, rights and obligations as may be required under federal or state law (including COBRA). In the event that Employee becomes entitled to any severance under paragraph 4.2(b) above, the Company shall pay Employee, within thirty (30) days of his termination of employment, a single lump sum equal to eighteen multiplied by the monthly Company-paid portion of health, dental and vision plan coverage premiums for those benefits in which Employee and his dependents are enrolled on the date of termination of employment. Such amount shall be subject to applicable income and employment tax withholdings.

5. Confidential Information.

(a) Employee agrees to keep secret and confidential, and not to use or disclose to any third parties, except as directly required for Employee to perform Employee’s employment responsibilities for Company, any of Company’s proprietary Confidential Information.

(b) Employee acknowledges and confirms that certain data and other information (whether in human or machine readable form) that comes into his possession or knowledge (whether before or after the date of this Agreement) and which was obtained from Company, or obtained by Employee for or on behalf of Company, and which is identified herein (the “Confidential Information”) is the secret, confidential property of Company. This Confidential Information includes, but is not limited to:

(1) lists or other identification of customers or prospective customers of Company;

(2) lists or other identification of sources or prospective sources of Company’s products or components thereof, its landlords and prospective landlords and its current and prospective alliance, marketing and media partners (and key individuals employed or engaged by such parties);

(3) all compilations of information, correspondence, designs, drawings, files, formulae, lists, machines, maps, methods, models, studies, surveys, scripts, screenplays, artwork, sketches, notes or other writings, plans, leases, records and reports;

(4) financial, sales and marketing data relating to Company or to the industry or other areas pertaining to Company’s activities and contemplated activities (including, without limitation, leasing, manufacturing, transportation, distribution and sales costs and non-public pricing information);

(5) equipment, materials, designs, procedures, processes, and techniques used in, or related to, the development, manufacture, assembly, fabrication or other production and quality control of Company’s products, stores and services;

(6) Company’s relations with its past, current and prospective customers, suppliers, landlords, alliance, marketing and media partners and the nature and type of products or services rendered to, received from or developed with such parties or prospective parties;

(7) Company’s relations with its employees (including, without limitation, salaries, job classifications and skill levels); and

(8) any other information designated by Company to be confidential, secret and/or proprietary (including without limitation, information provided by customers, suppliers and alliance partners of Company).

Notwithstanding the foregoing, the term Confidential Information shall not consist of any data or other information which has been made publicly available or otherwise placed in the public domain other than by Employee in violation of this Agreement. Notwithstanding the foregoing, Employee will not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that: (A) is made (i) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney, and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. In addition, if Employee files a lawsuit for retaliation by the Company for reporting a suspected violation of law, Employee may disclose the trade secret to Employee’s attorney and use the trade secret information in the court proceeding if Employee files any document containing the trade secret under seal and does not disclose the trade secret except pursuant to court order.

(c) During the Employment Period, Employee will not copy, reproduce or otherwise duplicate, record, abstract, summarize or otherwise use, any papers, records, reports, studies, computer printouts, equipment, tools or other property owned by Company except as expressly permitted by Company in writing or required for the proper performance of his duties on behalf of Company.

6. Post-Termination Restrictions. Employee recognizes that (i) Company has spent substantial money, time and effort over the years in developing and solidifying its relationships with its customers, suppliers, landlords and alliance, marketing and media partners and in developing its Confidential Information; (ii) long-term customer, landlord, supplier and partner relationships often can be difficult to develop and require a significant investment of time, effort and expense; (iii) Company has paid its employees to, among other things, develop and preserve business information, customer, landlord, vendor and partner goodwill, customer, landlord, vendor and partner loyalty and customer, landlord, vendor and partner contacts for and on behalf of Company; and (iv) Company is hereby agreeing to employ and pay Employee based upon Employee’s assurances and promises not to divert goodwill of customers, landlords, suppliers or partners of Company, either individually or on a combined basis, or to put himself in a position following Employee’s employment with Company in which the confidentiality of Company’s Confidential Information might somehow be compromised. Accordingly, Employee agrees that during the Employment Period and for the period of time set forth below following termination of employment, provided termination is in accordance with the terms of Section 4.1(b), (c), or (d), or due to expiration of the Agreement due to non-renewal by either party, Employee will not, directly or indirectly (whether as owner, partner, consultant, employee or otherwise):

(a) for one (1) year, engage in, assist or have an interest in, or enter the employment of or act as an agent, advisor or consultant for, any person or entity which is engaged in, or will be engaged in, the development, manufacture, supplying or sale of a product, process, service or development which is competitive with a product, process, service or development on which Employee worked or with respect to which Employee has or had access to Confidential Information while at Company (“Restricted Activity”), and which is located within the United States or within any country where Company has established a retail presence either directly or through a franchise arrangement; provided, however, that following termination of his employment, Employee shall be entitled to be an employee of an entity that engages in Restricted Activity so long as: (i) the sale of stuffed plush toys is not a material business of the entity; (ii) Employee has no direct or personal involvement in the sale of stuffed plush toys; and (iii) neither Employee, his relatives, nor any other entities with which she is affiliated own more than 1% of the entity. As used in this paragraph 6, “material business” shall mean that either (A) greater than 10% of annual revenues received by such entity were derived from the sale of stuffed plush toys and related products, or (B) or the entity otherwise annually derives or is projected to derive annual revenues in excess of $5 million from a retail concept that is similar in any material regard to Company; or

(b) for one (1) year, induce or attempt to induce any employee, consultant, partner or advisor of Company to accept employment or an affiliation with any other entity.

7. Acknowledgment Regarding Restrictions. Employee recognizes and agrees that the restraints contained in Section 6 (both separately and in total), including the geographic scope thereof in light of Company’s marketing efforts, are reasonable and enforceable in view of Company’s legitimate interests in protecting its Confidential Information and customer goodwill and the limited scope of the restrictions in Section 6.

8. Inventions.

(a) Any and all ideas, inventions, discoveries, patents, patent applications, continuation-in-part patent applications, divisional patent applications, technology, copyrights, derivative works, trademarks, service marks, improvements, trade secrets and the like (collectively, “Inventions”), which are developed, conceived, created, discovered, learned, produced and/or otherwise generated by Employee, whether individually or otherwise, during the time that Employee is employed by Company, whether or not during working hours, that relate to (i) current and anticipated businesses and/or activities of Company, (ii) the current and anticipated research or development of Company, or (iii) any work performed by Employee for Company, shall be the sole and exclusive property of Company, and Company shall own any and all right, title and interest to such Inventions. Employee assigns, and agrees to assign to Company whenever so requested by Company, any and all right, title and interest in and to any such Invention, at Company’s expense, and Employee agrees to execute any and all applications, assignments or other instruments which Company deems desirable or necessary to protect such interests, at Company’s expense.

(b) Employee acknowledges that as part of his work for Company he may be asked to create, or contribute to the creation of, computer programs, documentation and other copyrightable works. Employee hereby agrees that any and all computer programs, documentation and other copyrightable materials that he has prepared or worked on for Company, or is asked to prepare or work on by Company, shall be treated as and shall be a “work made for hire,” for the exclusive ownership and benefit of Company according to the copyright laws of the United States, including, but not limited to, Sections 101 and 201 of Title 17 of the U.S. Code (“U.S.C.”) as well as according to similar foreign laws. Company shall have the exclusive right to register the copyrights in all such works in its name as the owner and author of such works and shall have the exclusive rights conveyed under 17 U.S.C. §§ 106 and 106A including, but not limited to, the right to make all uses of the works in which attribution or integrity rights may be implicated. Without in any way limiting the foregoing, to the extent the works are not treated as works made for hire under any applicable law, Employee hereby irrevocably assigns, transfers, and conveys to Company and its successors and assigns any and all worldwide right, title, and interest that Employee may now or in the future have in or to the works, including, but not limited to, all ownership, U.S. and foreign copyrights, all treaty, convention, statutory, and common law rights under the law of any U.S. or foreign jurisdiction, the right to sue for past, present, and future infringement, and moral, attribution, and integrity rights. Employee hereby expressly and forever irrevocably waives any and all rights that he may have arising under 17 U.S.C. §§ 106A, rights that may arise under any federal, state, or foreign law that conveys rights that are similar in nature to those conveyed under 17 U.S.C. §§ 106A, and any other type of moral right or droit moral.

9. Company Property. Employee acknowledges that any and all notes, records, sketches, computer diskettes, training materials and other documents relating to Company obtained by or provided to Employee, or otherwise made, produced or compiled during the Employment Period, regardless of the type of medium in which they are preserved, are the sole and exclusive property of Company and shall be surrendered to Company upon Employee’s termination of employment and on demand at any time by Company.

10. Nondisparagement. Employee agrees that he will not in any way disparage Company or its affiliated entities, officers, or directors; and the officers and directors shall not in any way disparage Employee. Further, Employee agrees that he will neither make nor solicit any comments, statements, or the like to the media or to third parties that may be considered to be derogatory or detrimental to the good name or business reputation of Company or any of its affiliated entities, officers or directors; and the officers and directors will neither make nor solicit any comments, statements, or the like to the media or to third parties that may be considered to be derogatory or detrimental to the good name or business reputation of Employee. This Section 10 does not, in any way, restrict or impede the Employee from exercising protected rights to the extent that such rights cannot be waived by agreement or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by the law, regulation, or order.

11. Non-Waiver of Rights. Either party’s failure to enforce at any time any of the provisions of this Agreement or to require at any time performance by the other party of any of the provisions hereof shall in no way be construed to be a waiver of such provisions or to affect either the validity of this Agreement, or any part hereof, or the right of the non-breaching party thereafter to enforce each and every provision in accordance with the terms of this Agreement.

12. Company’s Right to Injunctive Relief. In the event of a breach or threatened breach of any of Employee’s duties and obligations under the terms and provisions of Sections 5, 6, or 8 hereof, Company shall be entitled, in addition to any other legal or equitable remedies it may have in connection therewith (including any right to damages that it may suffer), to seek temporary, preliminary and permanent injunctive relief restraining such breach or threatened breach, without the necessity of posting any bond. Employee hereby expressly acknowledges that the harm which might result to Company’s business as a result of any noncompliance by Employee with any of the provisions of Sections 5, 6 or 8 would be largely irreparable.

13. Judicial Enforcement. If any provision of this Agreement is adjudicated to be invalid or unenforceable under applicable law in any jurisdiction, the validity or enforceability of the remaining provisions thereof shall be unaffected as to such jurisdiction and such adjudication shall not affect the validity or enforceability of such provisions in any other jurisdiction. To the extent that any provision of this Agreement is adjudicated to be invalid or unenforceable because it is overbroad, that provision shall not be void but rather shall be limited only to the extent required by applicable law and enforced as so limited. The parties expressly acknowledge and agree that this Section is reasonable in view of the parties’ respective interests.

14. Employee Representations. Employee represents that the execution and delivery of the Agreement and Employee’s employment with Company do not violate any previous employment agreement or other contractual obligation of Employee. Employee further represents and agrees that he will not, during his employment with Company, improperly use or disclose any proprietary information or trade secrets of former employers and will not bring on to the premises of Company any unpublished documents or any property belonging to his former employers unless consented to in writing by such employers.

15. Amendments. No modification, amendment or waiver of any of the provisions of this Agreement shall be effective unless in writing specifically referring hereto, and signed by the parties hereto. This Agreement supersedes all prior agreements and understandings between Employee and Company to the extent that any such agreements or understandings conflict with the terms of this Agreement.

16. Assignments. This Agreement shall be freely assignable by Company to and shall inure to the benefit of, and be binding upon, Company, its affiliates, successors and assigns and/or any other entity which shall succeed to the business presently being conducted by Company. Being a contract for personal services, neither this Agreement nor any rights hereunder shall be assigned by Employee.

17. Choice of Forum and Governing Law. In light of Company’s substantial contacts with the State of Missouri, the parties’ interests in ensuring that disputes regarding the interpretation, validity and enforceability of this Agreement are resolved on a uniform basis, and Company’s execution of, and the making of, this Agreement in Missouri, the parties agree that: (i) any litigation involving any noncompliance with or breach of the Agreement, or regarding the interpretation, validity and/or enforceability of the Agreement, shall be filed and conducted in the state or federal courts in St. Louis City or County, Missouri; and (ii) the Agreement shall be interpreted in accordance with and governed by the laws of the State of Missouri, without regard for any conflict of law principles.

18. Notices. Except as otherwise provided for herein, any notices to be given by either party to the other shall be affected by personal delivery in writing or by mail, registered or certified, postage prepaid, with return receipt requested. Mailed notices shall be addressed as follows:

(a) If to Company:

Sharon Price John

President and Chief Executive Officer

415 South 18th Street, Suite 200

St. Louis, MO 63103

With copy to:

Eric Fencl

Chief Administrative Officer & General Counsel

415 South 18th Street, Suite 200

St. Louis, MO 63103

(b) If to Employee:

David Henderson

19. Arbitration.Any controversy or claim arising out of, or relating to this Agreement, the breach thereof, or Employee’s employment by Company, shall, at Company’s sole option, be settled by binding arbitration in the County of St. Louis in accordance with the employment rules then in force of the American Arbitration Association, and judgment upon the award rendered may be entered and enforced in any court having jurisdiction thereof. The controversies or claims subject to arbitration at Company’s option under this Agreement include, without limitation, those arising under Title VII of the Civil Rights Act of 1964, 42 U.S.C. Section 1981, the Age Discrimination in Employment Act, the Americans with Disabilities Act, the Family and Medical Leave Act, the Worker Adjustment and Retraining Notification Act, the Missouri Human Rights Act, local laws governing employment, and the statutory and/or common law of contract and tort. In the event Employee commences any action in court which Company has the right to submit to binding arbitration, Company shall have sixty (60) days from the date of service of a summons and complaint upon Company to direct in writing that all or any part of the dispute be arbitrated. Any remedy available in any court action shall also be available in arbitration.

20. Excise Taxes. Anything in this Agreement to the contrary notwithstanding and except as set forth below, in the event it shall be determined that any payment, benefit, vesting or distribution to or for the benefit of Employee (whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise) (a “Payment”) would but for this Section 20 be subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended (the “Code”), or any comparable successor provisions (the “Excise Tax”), then the Payments shall be either (i) provided to Employee in full, or (ii) provided to Employee as to such lesser extent which would result in no portion of such Payments being subject to the Excise Tax, whichever of the foregoing amounts, when taking into account applicable income and employment taxes, the Excise Tax, and any other applicable taxes, results in the receipt by Employee on an after-tax basis, of the greatest amount of Payments, notwithstanding that all or some portion of such Payments may be subject to the Excise Tax. Any determination required under this Section 20 shall be made in writing in good faith by the Company's independent certified public accountants, appointed prior to any change in ownership (as defined under Code Section 280G(b)(2), and/or tax counsel selected by such accountants (the “Accounting Firm”) in accordance with the principles of Section 280G of the Code. In the event of a reduction of Payments hereunder, the Payments shall be reduced as follows: (i) first from cash payments which are included in full as parachute payments, (ii) second from equity awards which are included in full as parachute payments, (iii) third from cash payments which are partially included as parachute payments, and (iv) fourth from equity awards that are partially included as parachute payments. In applying these principles, any reduction or elimination of the Payments shall be made in a manner consistent with the requirements of Code Section 409A and where two economically equivalent amounts are subject to reduction but payable at different times, such amounts shall be reduced on a pro rata basis but not below zero. For purposes of making the calculations required by this Section 20, the Accounting Firm may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of the Code, and other applicable legal authority. The Company and Employee shall furnish to the Accounting Firm such information and documents as the Accounting Firm may reasonably request in order to make a determination under this Section 20. All fees and expenses of the Accounting Firm shall be borne solely by the Company.

If, notwithstanding any reduction described in this Section 20, the Internal Revenue Service (the “IRS”) determines that Employee is liable for the Excise Tax as a result of the receipt of the Payments as described above, then Employee shall be obligated to pay back to the Company, within thirty (30) days after a final IRS determination or in the event that Employee challenges the final IRS determination, a final judicial determination, a portion of the Payments equal to the “Repayment Amount.” The Repayment Amount with respect to the Payments shall be the smallest such amount, if any, as shall be required to be paid to the Company so that Employee's net after-tax proceeds with respect to the Payments (after taking into account the payment of the Excise Tax and all other applicable taxes imposed on such payment) shall be maximized. The Repayment Amount with respect to the Payments shall be zero if a Repayment Amount of more than zero would not result in Employee’s net after-tax proceeds with respect to the Payments being maximized. If the Excise Tax is not eliminated pursuant to this paragraph, Employee shall pay the Excise Tax.

Notwithstanding any other provision of this Section 20, if (i) there is a reduction in the Payments as described in this Section 20, (ii) the IRS later determines that Employee is liable for the Excise Tax, the payment of which would result in the maximization of Employee’s net after-tax proceeds (calculated as if Employee’s Payments had not previously been reduced), and (iii) Employee pays the Excise Tax, then the Company shall pay to Employee those Payments which were reduced pursuant to this subsection as soon as administratively possible after Employee pays the Excise Tax so that Employee’s net after-tax proceeds with respect to the Payments are maximized.

For the avoidance of doubt, Employee acknowledges she is solely responsible for the payment of any Excise Tax and that the Company will not reimburse or otherwise indemnify her for such amount. Any reimbursements or repayments provided under this subsection shall be made strictly in accordance with Section 409A of the Code, including Treasury Regulation 1.409A-3(i)(1)(v).

Notwithstanding anything in this Agreement to the contrary, if any payments or benefits due to Employee hereunder would cause the application of an accelerated or additional tax under Section 409A of the Code (“Section 409A”), such payments or benefits shall be restructured in a manner which does not cause such an accelerated or additional tax. Without limiting the foregoing and notwithstanding anything contained herein to the contrary, to the extent required in order to avoid accelerated taxation and/or tax penalties under Section 409A, amounts that would otherwise be payable and benefits that would otherwise be provided pursuant to this Agreement during the six-month period immediately following Employee’s separation from service shall instead be paid on the first (1st) business day after the date that is six (6) months following Employee’s date of termination (or death, if earlier). In the event that Employee receives reduced payments and benefits as a result of the application of this paragraph, reduction shall be made from payments and benefits which are determined not to be nonqualified deferred compensation for purposes of Section 409A of the Code first, and then shall be made (to the extent necessary) out of payments and benefits which are subject to Section 409A of the Code and which are due at the latest future date, to the extent such reduction would not trigger adverse tax consequences under Section 409A of the Code.

21. Headings. Section headings are provided in this Agreement for convenience only and shall not be deemed to substantively alter the content of such sections.

PLEASE NOTE: BY SIGNING THIS AGREEMENT, EMPLOYEE IS HEREBY CERTIFYING THAT EMPLOYEE (A) HAS RECEIVED A COPY OF THIS AGREEMENT FOR REVIEW AND STUDY BEFORE EXECUTING IT; (B) HAS READ THIS AGREEMENT CAREFULLY BEFORE SIGNING IT; (C) HAS HAD SUFFICIENT OPPORTUNITY BEFORE SIGNING THE AGREEMENT TO ASK ANY QUESTIONS EMPLOYEE HAS ABOUT THE AGREEMENT AND HAS RECEIVED SATISFACTORY ANSWERS TO ALL SUCH QUESTIONS; AND (D) UNDERSTANDS EMPLOYEE’S RIGHTS AND OBLIGATIONS UNDER THE AGREEMENT.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of September 16, 2024.

THIS AGREEMENT CONTAINS A BINDING ARBITRATION PROVISION WHICH MAY BE ENFORCED BY COMPANY.

| |

/s/ David Henderson |

| |

David Henderson |

|

|

BUILD-A-BEAR WORKSHOP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Sharon John

|

|

|

|

|

|

|

| |

Name: |

Sharon John |

|

| |

|

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

Exhibit 99.1

BUILD-A-BEAR WORKSHOP NAMES DAVID HENDERSON CHIEF REVENUE OFFICER

Company strategically expands leadership team with continued focus on sustained profitable growth through monetizing the power of the Build-A-Bear brand

ST. LOUIS, MO (September 12, 2024) – Build-A-Bear Workshop, Inc. (NYSE: BBW) today announced the appointment of David Henderson to the position of Chief Revenue Officer, effective September 16, 2024.

Henderson will focus on continuing to drive profitable growth for the iconic Build-A-Bear brand across its primary revenue streams including corporately-operated retail and Ecommerce, while promoting expansion opportunities for the company beyond these traditional areas. As a part of his responsibilities, he will also oversee the warehouse operations and play a key part in the strategic management of the organization. Dave will report directly to Sharon Price John, President and Chief Executive Officer, as a member of the executive team.

“Throughout his impressive career, Dave has demonstrated an ability to create value in organizations across a wide scope of responsibilities,” said Ms. John. “We are delighted that Dave will join our senior leadership team as we work to continue to drive record setting results while delivering on our corporate mission of adding a little more heart to life.”

“We believe Dave’s experience and proven skills provide an opportunity for him make an immediate contribution as we accelerate our long-term strategic initiatives and continue to work toward the creation of value for our shareholders.”

Mr. Henderson has over two decades of increasing responsibilities and a rich background across the toy, consumer products and entertainment industries including most recently serving as the Chief Commercial Officer of Melissa & Doug. Additionally, he was President and General Manager-Global of Baby Gear at Newell Brands. Prior to that, during his multiple years at Hasbro, Mr. Henderson expanded his experience though leadership positions of increasing responsibility, ultimately holding the office of Senior Vice President Consumer Products/Licensing North America.

About Build-A-Bear

Since its beginning in 1997, Build-A-Bear has evolved to become a beloved multi-generational brand focused on its mission to “add a little more heart to life” where guests of all ages make their own “furry friends” in celebration and commemoration of life moments. Guests create their own stuffed animals by participating in the stuffing, dressing, accessorizing, and naming of their own teddy bears and other plush toys based on the Company’s own intellectual property and in conjunction with a variety of best-in-class licenses. The hands-on and interactive nature of our more than 500 company-owned, partner-operated and franchise experience locations around the world, combined with Build-A-Bear’s pop-culture appeal, often fosters a lasting and emotional brand connection with consumers, and has enabled the Company to expand beyond its retail stores to include e-commerce sales on www.buildabear.com and non-plush branded consumer categories via out-bound licensing agreements with leading manufacturers, as well as the creation of engaging content via Build-A-Bear Entertainment (a subsidiary of Build-A-Bear Workshop, Inc.). The brand’s newest communications campaign, "The Stuff You Love," commemorates more than a quarter-century of creating cherished memories worldwide. Build-A-Bear Workshop, Inc. (NYSE: BBW) posted consolidated total revenues of $486.1 million for fiscal 2023. For more information, visit the Investor Relations section of buildabear.com.

Forward-Looking Statements

This press release contains certain statements that are, or may be considered to be, “forward-looking statements” for the purpose of federal securities laws, including, but not limited to, statements that reflect our current views with respect to future events and financial performance. We generally identify these statements by words or phrases such as “may,” “might,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “future,” “potential” or “continue,” the negative or any derivative of these terms and other comparable terminology. All the information concerning our future liquidity, future revenues, margins and other future financial performance and results, achievement of operating of financial plans or forecasts for future periods, sources and availability of credit and liquidity, future cash flows and cash needs, success and results of strategic initiatives and other future financial performance or financial position, as well as our assumptions underlying such information, constitute forward-looking information.

These statements are based only on our current expectations and projections about future events. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by these forward-looking statements, including those factors discussed under the caption entitled “Risks Related to Our Business” and “Forward-Looking Statements” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on April 18, 2024 and other periodic reports filed with the SEC which are incorporated herein.

All our forward-looking statements are as of the date of this Press Release only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of or any material adverse change in one or more of the risk factors or other risks and uncertainties referred to in this Press Release or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the SEC could materially and adversely affect our continuing operations and our future financial results, cash flows, available credit, prospects, and liquidity. Except as required by law, the Company does not undertake to publicly update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

All other brand names, product names, or trademarks belong to their respective holders.

Investor Relations Contact

Gary Schnierow, Vice President, Investor Relations & Corporate Finance

garys@buildabear.com

Media Relations Contact

pr@buildabear.com

###

v3.24.2.u1

Document And Entity Information

|

Sep. 12, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Build-A-Bear Workshop, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 12, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32320

|

| Entity, Tax Identification Number |

43-1883836

|

| Entity, Address, Address Line One |

415 South 18th St.

|

| Entity, Address, City or Town |

St. Louis

|

| Entity, Address, State or Province |

MO

|

| Entity, Address, Postal Zip Code |

63103

|

| City Area Code |

314

|

| Local Phone Number |

423-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BBW

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001113809

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

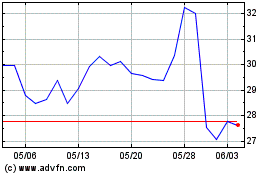

Build A Bear Workshop (NYSE:BBW)

過去 株価チャート

から 10 2024 まで 11 2024

Build A Bear Workshop (NYSE:BBW)

過去 株価チャート

から 11 2023 まで 11 2024