EV Technology Group Ltd. (the “

Company” or

“

EV Technology Group”) (OTCQB: EVTGF, NEO: EVTG,

DE: B96A), announces today that it intends to offer up to C$2.5

million aggregate principal amount of unsecured convertible notes

(the “

Notes”) on a private placement basis (the

“

Offering”).

The Notes will mature one year from the date of

issuance (the “Maturity Date”), unless

repurchased, redeemed, or converted in accordance with their terms

prior to the Maturity Date and shall accrue interest at the rate of

7.0% per annum. At the Company’s election, the Notes may be

converted to common shares of the Company (“Common

Shares”) on the Maturity Date at a price equal to the

trading price of the Common Shares on the Cboe Canada, the new

business name of the NEO Exchange, less a 10% discount (the

“Maturity Conversion Price”). Furthermore, upon

the occurrence of a qualifying transactions, including for example

a public offering of the securities of the Company in the United

States or a merger, amalgamation or combination of the Company with

a public company whose securities are listed on the Nasdaq Stock

Market, the NYSE American or the New York Stock Exchange (a

“Qualifying Transaction”), the Notes shall

automatically convert into Common Shares at a conversion price at a

price equal to the ascribed price per Common Share in the relevant

transaction giving rise to the automatic conversion less a 75%

discount (the “QT Conversion Price”), provided

that the Maturity Conversion Price and the QT Conversion Price

shall not be lower than C$0.045 per Common Share.

The Offering is subject to a number of

conditions, including final approval of the Cboe Canada. Funds from

the Offering will be used for general working capital, acquisitions

and to advance the Company’s business.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation, or sale would be unlawful.

Corporate Update

This Offering occurs at a key moment of growth

for EV Technology Group, and at its completion will help the

Company continue to execute on its strategy of acquiring and

electrifying iconic automotive brands.

EV Technology Group’s strategic partner MOKE

International continues to prove out the power of this strategy. It

has recently opened its order books for the new Electric MOKE

Californian, and inspired the public in its appearances at Goodwood

and with Miami photographer Jordan Braun.

EV Technology Group’s strategic partner MOKE

International continues to prove out the power of this strategy. It

has recently opened its order books for the new Electric MOKE

Californian, and inspired the public in its appearances at Goodwood

with Miami photographer Jordan Braun.

Wouter Witvoet, CEO and Founder of EV

Technology Group said: “As the MOKE brand’s continued

growth demonstrates, our strategy of acquiring and electrifying

iconic automotive brands has resonance with a large market. This

Offering is being made in a context of funding continued

transformational growth for EV Technology Group and our strategic

partners.”

EV Technology Group

EV Technology Group was founded in 2021 with a

vision of electrifying iconic brands –and a mission of redefining

the joy of motoring for the electric age. By acquiring iconic

brands and bringing beloved motoring experiences to the electric

age, EV Technology Group is driving the EV revolution forward.

Backed by a diversified team of passionate entrepreneurs, engineers

and driving enthusiasts, EV Technology Group creates value for its

customers by owning the total customer experience — acquiring and

partnering with iconic brands with significant growth potential in

unique markets and controlling end-to-end capabilities. To learn

more visit: https://evtgroup.com/

EV Technology GroupWouter WitvoetCEO and

Chairman of the Boardwouter@evtgroup.com

Forward-Looking Information

This news release contains forward-looking

statements including, but not limited to, the Offering and the

Note, the terms and conditions of the Notes, the Maturity

Conversion Price and QT Conversion Price of the Notes, occurrence

of any Qualifying Transaction, future acquisitions and the expected

use of proceeds of the Offering. Often, but not always, these

Forward-looking Statements can be identified by the use of words

such as “estimated”, “potential”, “open”, “future”, “assumed”,

“projected”, “used”, “detailed”, “has been”, “gain”, “planned”,

“reflecting”, “will”, “containing”, “remaining”, “to be”, or

statements that events, “could” or “should” occur or be achieved

and similar expressions, including negative variations.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward-looking Statements, including

those factors discussed under “Risk Factors” in the filing

statement and annual information form of the Company. Although the

Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in Forward-looking Statements, there may be other

factors that cause actions, events or results to differ from those

anticipated, estimated or intended.

Forward-looking statements involve significant

risk, uncertainties and assumptions. Many factors could cause

actual results, performance or achievements to differ materially

from the results discussed or implied in the forward-looking

statements. These factors should be considered carefully and

readers should not place undue reliance on the forward-looking

statements. Although the forward-looking statements contained in

this news release are based upon what management believes to be

reasonable assumptions, the Company cannot assure readers that

actual results will be consistent with these forward-looking

statements. The forward-looking statements contained herein are

made as of the date hereof and the Company disclaims any obligation

to update any forward-looking statements, whether as a result of

new information, future events or results or otherwise, except

where required by law. There can be no assurance that these

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

of the Company in the United States. The securities have not been

and will not be registered under the United States Securities Act

of 1933, as amended (the "U.S. Securities Act") or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

THE CBOE CANADA DOES NOT ACCEPT RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THIS RELEASE

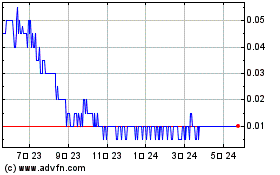

EV Technology (NEO:EVTG)

過去 株価チャート

から 10 2024 まで 11 2024

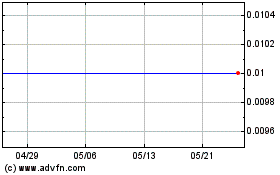

EV Technology (NEO:EVTG)

過去 株価チャート

から 11 2023 まで 11 2024