Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

VIVOPOWER

INTERNATIONAL PLC

(Exact

name of Registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s name into English)

| England

and Wales |

|

4931 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

VivoPower

International PLC

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-794-116-6696

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Corporation

Service Company

251

Little Falls Drive Wilmington, DE 19808

United

States

Telephone:

+1 302 636 5400

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies

to:

Elliott

M. Smith

White

& Case LLP

1221

Avenue of the Americas

New

York, New York 10020

Telephone:

(212) 819-8200 |

Louis

Taubman

950

Third

Avenue, 19th Floor

New

York, NY 10022

Telephone:

(917) 512-0827 |

Approximate

date of commencement of proposed sale to the public: as and when appropriate after the effective date of this registration statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, as amended, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth

company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the U.S. Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities pursuant to this prospectus until

the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these

securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale of these securities

is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION DATED JULY 26, 2024 |

Up

to [●] Ordinary Shares

VivoPower

International PLC (“VivoPower,” “we,” “us” or the “Company”) is offering in a best efforts

offering under this prospectus of up to [●] Ordinary Shares, nominal value $0.12 (the “Ordinary Shares”).

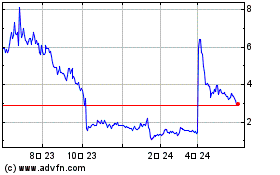

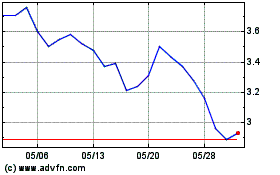

Our

Ordinary Shares are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “VVPR.” The last sale price

of our Ordinary Shares on July 25, 2024 was $2.49 per share.

We

have engaged Chardan Capital Markets LLC (“Chardan”) as our exclusive placement agent, or the Placement Agent, to use its

reasonable best efforts to solicit offers to purchase our securities in this offering. The Placement Agent is not purchasing or selling

any of the securities we are offering and is not required to arrange for the purchase or sale of any specific number or dollar amount

of the securities. Because there is no minimum offering amount required as a condition to closing in this offering the actual public

offering amount, placement agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less

than the total maximum offering amounts set forth below and throughout this prospectus. We have agreed to pay the Placement Agent the

placement agent fees set forth in the table below. See “Plan of Distribution” on page 88 of this prospectus for more

information.

We

have assumed a public offering price of $[●] per Ordinary Share. The actual public offering price will be negotiated between us,

the Placement Agent and the investors in this offering which may be based on, among other things, the trading of our Ordinary Shares

prior to the offering and may be at a discount to the current market price. Therefore, the assumed public offering price used throughout

this prospectus may not be indicative of the final public offering price.

Because

there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the Ordinary Shares

offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive

a refund in the event that we do not sell an amount of Ordinary Shares sufficient to pursue the business goals described in this prospectus.

Because there is no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable

to fulfill our objectives due to a lack of interest in this offering. Also, any proceeds from the sale of Ordinary Shares offered by

us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement

our business plan.

This

offering will terminate on [●], unless we decide to terminate the offering (which we may do at any time in our discretion) prior

to that date. We intend to have one closing for all the securities purchased in this offering, but may undertake one or more closings

on a rolling basis. The public offering price per Ordinary Share will be fixed for the duration of this offering.

| | |

Total | |

| Public offering price | |

| | |

| Placement agent fees (1)(2) | |

| | |

| Proceeds to us (before expenses) (1) | |

| | |

| (1) |

Assumes

the sale of 100% of the Ordinary Shares offered in this offering. Since this is a best efforts offering, we may not sell all or any

of the Ordinary Shares offered pursuant to this prospectus. |

| |

|

| (2) |

In

connection with this offering, we have agreed to pay to Chardan as placement agent a cash fee equal to seven percent (7%) of the

gross proceeds received by us in the offering. For a description of the additional compensation to be received by Chardan, see “Plan

of Distribution.” |

Investing

in our Ordinary Shares is highly speculative and involves a high degree of risk. See “Risk Factors” beginning

on page 9 of this prospectus to read about factors you should consider before buying our Ordinary Shares.

We

are a “foreign private issuer” as defined under the federal securities laws, and, as such, we are subject to reduced public

company reporting requirements. See the section entitled “Prospectus Summary—Implications of Being a Foreign Private Issuer”

for additional information.

Neither

the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the

accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

We

will deliver the Ordinary Shares being issued to the investors electronically, upon closing and receipt of investor funds for the purchase

of the Ordinary Shares offered pursuant to this prospectus.

The

date of this prospectus is July 26, 2024

Chardan

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement of which this prospectus forms a part that we filed with the Securities and Exchange Commission (the “SEC”)

includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related

exhibits filed with the SEC before making your investment decision.

You

should rely only on the information provided in this prospectus or in a prospectus supplement or any amendments thereto. Neither we nor

the Placement Agent have authorized anyone else to provide you with different information. We do not, and the Placement Agent and its

affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may

provide to you. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that

the information in this prospectus is accurate only as of the date hereof, regardless of the time of delivery of this prospectus or any

sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date .

On

October 5, 2023, we effected a 1-for-10 reverse share split of our issued and outstanding Ordinary Shares (the “Reverse Stock Split”).

Unless indicated or the context otherwise requires, all per share amounts and numbers of Ordinary Shares in this prospectus have been

adjusted to account for the Reverse Stock Split.

As

a U.K. incorporated company, we are subject to applicable laws of England and Wales including the Companies Act 2006. Under the rules

of the SEC, we are currently eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we are not

required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities

are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

For

investors outside of the United States: we have not done anything that would permit this offering or possession or distribution of this

prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In

this prospectus, “VivoPower,” the “Group,” the “company,” “we,” “us” and

“our” refer to VivoPower International PLC and its consolidated subsidiaries, except where the context otherwise requires.

INDUSTRY

AND MARKET DATA

Unless

otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including

our general expectations, market position and market opportunity, is based on our management’s estimates and research, as well

as industry and general publications and research, surveys and studies conducted by third parties. We believe that the information from

these third-party publications, research, surveys and studies included in this prospectus is reliable. Management’s estimates are

derived from publicly available information, their knowledge of our industry and their assumptions based on such information and knowledge,

which we believe to be reasonable. These data involve a number of assumptions and limitations which are necessarily subject to a high

degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other

factors could cause our future performance to differ materially from our assumptions and estimates.

PROSPECTUS

SUMMARY

This

summary highlights selected information about us and the Ordinary Shares that we are offering. It may not contain all of the information

that may be important to you. Before investing in the Ordinary Shares, you should read this entire prospectus and other information incorporated

by reference from our other filings with the SEC carefully for a more complete understanding of our business and this offering, including

our consolidated financial statements, and the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus.

Company

Overview

VivoPower

is an award-winning global sustainable energy solutions B Corporation company focused on electric solutions for customised and ruggedised

fleet applications, battery and microgrids, solar and critical power technology and services. The Company’s core purpose is to

provide its customers with turnkey decarbonisation solutions that enable them to move toward net-zero carbon status. VivoPower has operations

and personnel in Australia, Canada, the Netherlands, the United Kingdom, the United States, the Philippines, and the United Arab Emirates.

VivoPower

was incorporated on February 1, 2016, under the laws of England and Wales, with company number 09978410, as a public company limited

by shares. VivoPower recertified as a B Corporation in 2022 and was recognized in the Best For The World program as being in the top

5% amongst B Corporations for Governance.

Management

analyses the business in five segments: Electric Vehicles, Solar Development, Sustainable Energy Solutions, Critical Power Services and

Corporate Office.

Electric

Vehicles

Tembo

e-LV B.V. (“Tembo”) is the electric vehicle business unit and brand of VivoPower. It has operating subsidiaries in the Netherlands,

Australia, the United Arab Emirates and Asia. Founded in the Netherlands in 1969, as a specialist off-road vehicle ruggedisation and

modification company, Tembo now designs and develops of electric battery conversion kits to replace internal combustion engines (“ICE”)

in light utility vehicle fleets, particularly for the mining sector. VivoPower first acquired a shareholding in Tembo in October 2020

before securing full control in February 2021. Since then, the Tembo business has been transformed into a global business and brand with

partners and customers globally.

Today,

Tembo has three divisions and product lines being the Electric Utility Vehicle (“EUV”) conversion kits for mining and other

off-road and ruggedised or customised on-road applications, the Public Utility Vehicle (“PUV”) electric powertrain conversion

kits for the jeepneys in the Philippines and the recently established full Tembo OEM light utility pick up truck range called the Tembo

Tuskers (“Tuskers”).

Tembo’s

customers and partners are located across the globe and span a broad spectrum of sectors including mining, infrastructure, construction,

government services, humanitarian aid, tourism and agriculture.

Sustainable

Energy Solutions

VivoPower’s

Sustainable Energy Solutions (“SES”) segment designs, evaluates, sells, and implements renewable energy infrastructure. This

segment complements our electric vehicle offerings, enabling clients to adopt comprehensive decarbonization measures through on-site

renewable generation, batteries and microgrids, EV charging stations, emergency backup power solutions and digital twin technology.

Critical

Power Services

VivoPower’s

Critical Power Services business was known as Aevitas. Aevitas was a key player in the manufacture, distribution, installation and servicing

of critical energy infrastructure solutions. Its portfolio spans the design, procurement, installation, and upkeep of power and control

systems, including those catering to utility and industrial scale solar farms. Under Aevitas, there were three operating companies, J.A.

Martin Electrical, NDT Services and Kenshaw Electrical. J.A. Martin and NDT Services were sold in July 2022 and Kenshaw Electrical was

sold in July 2024. VivoPower is completing a restructure of Aevitas given it is now a discontinued operation.

Solar

Development

VivoPower’s

portfolio of U.S. solar projects is held in its wholly owned subsidiary, Caret, LLC (“Caret”).

This

segment has historically been characterized as the Solar Development segment and encompassed the Company’s solar development activities

in the U.S. and Australia. The Company no longer has solar development activities in Australia following the sale of its interests in

solar farm projects in FY2021.

In

October 2023, VivoPower announced its board approved a plan to spin off the majority of its Caret business unit’s portfolio, comprising

up to ten solar projects totaling 586MW-DC. This excluded two projects committed to a joint venture. VivoPower shareholders had approved

this spinoff during the November 2022 Annual General Meeting (AGM.

VivoPower’s

focus for its solar development business remains to monetise its portfolio of US solar projects, with the aim of using any funds generated

to be redeployed to its Electric Vehicle and Sustainable Energy Solutions business units.

Recent

Developments

On

October 4, 2023, VivoPower announced 1-for-10 Reverse Stock Split.

On

October 31, 2023, VivoPower announced the establishment of a Board-led ‘Illegal Market Manipulation Task Force’ to address

alleged market manipulation involving its stock. This action includes collaborating with regulators and engaging an external forensic

investigation firm, as well as UK and US legal counsel. The company suspects a coordinated scheme to artificially depress its stock price.

VivoPower and its Board remain committed to upholding the highest standards of governance for the benefit of its stakeholders.

On

November 14, 2023, VivoPower initiated a “sum of the parts” strategic value maximization review, prompted by inbound M&A

expressions of interest for Tembo and Aevitas Kenshaw.

On

April 2, 2024, VivoPower signed a heads of agreement to merge Tembo with Nasdaq-listed Cactus Acquisition Corp. 1 Limited (“CCTS”)

at a pre-money equity value of US$838 million. Should this merger be consummated, it will result in Tembo becoming a separate listed

company on Nasdaq. However, it is expected that VivoPower will continue to be the major shareholder and on that basis, Tembo will continue

to be a controlled entity of VivoPower and consolidated in its financial statements. The merger is targeted to be completed by November

2024.

On

April 3, 2024, VivoPower announced a capital management strategy including a stock buyback program authorized to purchase up to $5 million

of its outstanding common stock, expiring April 3, 2025. This program will be funded by proceeds from business and asset divestitures.

The buyback is subject to market conditions, legal requirements, shareholder approval, and other considerations, and can be modified

by the Board at any time. Repurchases may be made in the open market or through privately negotiated transactions.

On

April 8, 2024, VivoPower announced that its subsidiary Tembo met all milestones to secure the final $2.5 million investment from a UAE-based

private investment office backed by a member of the Al Maktoum family. This brings the total investment to $10 million at a pre-money

valuation of $120 million.

On

May 29, 2024, VivoPower announced that its subsidiary, Tembo, has launched a fully electric OEM pickup utility vehicle. This strategic

development allows Tembo to bypass the capex-intensive assembly process and accelerate revenue generation. The new vehicle features a

range from 330 km on a single charge, 1-tonne payload capacity, and unbraked towing capacity of 750 kg. Initial orders have been secured,

with full homologation expected by July 2024. This initiative significantly expands Tembo’s B2B market and complements its existing

EUV conversion kit program, while reducing direct costs for both EUV and jeepney programs.

On

July 2, 2024, VivoPower announced that its subsidiary, Tembo, agreed to a one-month extension of its exclusive heads of agreement with

Nasdaq-listed Cactus Acquisition Corporation I (CCTS) to July 31, 2024. This extension provides additional time to finalize the definitive

business combination agreement and the independent fairness opinion related to the proposed transaction.

On

July 7, 2024, as part of the Company’s previously announced strategic focus on its fast-growing business units being Electric Vehicles

and Sustainable Energy Solutions, the Company announced the sale of its non-core business unit, Kenshaw Electrical, for gross consideration

of approximately A$5.0 million. By divesting non-core assets, VivoPower can concentrate on advancing its core sustainable energy solutions

and electric vehicle businesses.

On

June 28, 2024, VivoPower signed an amendment and extension to its $34 million shareholder loan financing agreement with AWN Holdings

Limited. The agreement consolidates all shareholder loans into a single tranche and reclassifies them as non-current, improving VivoPower’s

balance sheet. AWN receives an option to acquire 1,150,000 Tembo shares post-business combination with Cactus Acquisition Corp 1 Limited

at $1.35 per share.

Corporate

Information

VivoPower

International PLC, a public limited company incorporated under the laws of England, was formed on February 1, 2016. Our registered and

principal executive offices are located at The Scalpel, 18th Floor, 52 Lime Street, London, U.K. Our general telephone number is +44-203-667-5158

and our internet address is http://www.vivopower.com. Our website and the information contained on or accessible through our website

are not part of this prospectus, and our website address is included in this document as an inactive textual reference only. Our agent

for service of process in the United States is Corporation Service Company, 251 Little Falls Drive Wilmington, DE 19808.

VivoPower,

the VivoPower logo and other trademarks or service marks of VivoPower International PLC including Tembo appearing in this prospectus

are the property of VivoPower International PLC. Trade names, trademarks and service marks of other companies appearing in this prospectus

are the property of their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this

prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not

assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names.

Implications

of Being a Foreign Private Issuer

We

are a “foreign private issuer” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As a foreign private issuer under the Exchange Act, we are exempt from certain rules under the Exchange Act, including the proxy rules,

which impose certain disclosure and procedural requirements for proxy solicitations. Moreover, we are not required to file periodic reports

and financial statements with the SEC as frequently or as promptly as domestic U.S. companies with securities registered under the Exchange

Act, and we are not required to comply with Regulation FD, which imposes certain restrictions on the selective disclosure of material

information. In addition, our officers, directors, and principal shareholders will be exempt from the reporting and “short-swing”

profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and

sales of our Ordinary Shares.

The

Nasdaq Listing Rules allow foreign private issuers, such as us, to follow home country corporate governance practices (in our case the

U.K.) in lieu of the otherwise applicable Nasdaq corporate governance requirements, subject to certain exceptions and except to the extent

that such exemptions would be contrary to U.S. federal securities laws. We currently do not intend to take advantage of any such exemptions.

Risk

Factor Summary

An

investment in our securities involves a high degree of risk. A summary of the risk categories that affect us is set out below. These

risks are discussed more fully in the “Risk Factors” section immediately following this Prospectus Summary.

Risks

related to our business and operations

| |

● |

Our

operational and financial results may vary significantly from period to period due to fluctuations in our operating costs and other

factors. |

| |

|

|

| |

● |

We

expect to require additional financing to execute our strategy to operate and grow our business and additional requisite funding may

not be available to us when we need or want it. |

| |

|

|

| |

● |

If

we continue to experience losses and we are not able to raise additional financing to grow the revenue streams of the Company to

become profit making, or generate cash through sales of assets, we may not have sufficient liquidity to sustain our operations and

to continue as a going concern. |

| |

|

|

| |

● |

If

we fail to meet changing customer demands, we may lose customers and our sales could suffer. |

| |

● |

We

face competition in the markets, industries and business segments in which we operate, which could adversely affect our business,

operating results, financial condition and future prospects. |

| |

|

|

| |

● |

Our

inability to protect our intellectual property could adversely affect our business. We may also be subject to intellectual property

rights claims by third parties, which are extremely costly to defend, could require us to pay significant damages and could limit

our ability to use certain technologies. |

| |

|

|

| |

● |

Our

brand and reputation are key assets of our business, and if our brand or reputation is damaged, our business and results of operations

could be materially adversely affected. |

| |

|

|

| |

● |

Our

future business depends in part on our ability to make strategic acquisitions, investments and divestitures and to establish and

maintain strategic relationships, and our failure to do so could have a material and adverse effect on our market penetration and

revenue growth. |

| |

|

|

| |

● |

Our

insurance coverage strategy may not be adequate to protect us from all business risks. |

| |

|

|

| |

● |

Our

insurance coverage strategy may not be adequate to protect us from all business risks. |

| |

|

|

| |

● |

We

may incur unexpected warranty and performance guarantee claims that could materially and adversely affect our financial condition

or results of operations. |

| |

|

|

| |

● |

Our

ability to scale up Tembo, our commercial EV segment, is dependent on securing new business opportunities and orders, meeting the

requirements of customers and the timely delivery of orders across different market sectors. |

| |

|

|

| |

● |

The

future growth and success of Tembo is dependent upon acceptance of its zero-emission specialist battery-electric off-road vehicle

kits amongst key target customers in the mining, infrastructure, government services, humanitarian, tourism and utilities sectors.

|

| |

|

|

| |

● |

Tembo

faces certain operational risks as it seeks to scale up its assembly and delivery capabilities and if it fails to execute properly,

this will expose us to material losses and compromise our cash flows. |

| |

|

|

| |

● |

Constant

innovation and product development is required for Tembo to ensure it remains competitive and relevant. |

| |

|

|

| |

● |

If

the Tembo business does not perform in line with our expectations, we may be required to write-down the carrying value of our investment,

including goodwill and intangible assets. |

| |

|

|

| |

● |

The

market value of our investment in our SES assets may decrease, which may cause us to take accounting charges or to incur losses if

we decide to sell them following a decline in their values. |

| |

|

|

| |

● |

We

have a limited operating track record in the development and sale of SES solutions and, as a result, we may not be successful developing

and scaling up this business segment profitably. |

| |

|

|

| |

● |

Our

Australian critical power services workforce and our Netherlands electric vehicle workforce may become unionized, resulting in higher

costs of operations and reduced labor efficiency. |

| |

|

|

| |

● |

Development

and sales of our solar projects may be delayed or may not be fully realized, which could have a material adverse effect on our financial

condition, results of operations or cash flows. |

Risks

related to raising of capital and financing

| |

● |

We

may not be able to generate sufficient cash flow to service all our indebtedness, any additional debt we may incur and our other

ongoing liquidity needs, and we may be forced to take other actions to satisfy our obligations under our indebtedness or any additional

debt we may incur, which may not be successful. |

| |

|

|

| |

● |

If

we fail to adequately manage our planned growth, our overall business, financial condition and results of operations could be materially

adversely affected. |

| |

|

|

| |

● |

We

may be unable to obtain favorable financing from our vendors and suppliers, which could have a material adverse effect on our business,

financial condition or results of operations and prospects. |

| |

|

|

| |

● |

If

we are unable to enter into new financing agreements when needed, or upon desirable terms, or if any of our current financing partners

discontinue or materially change our financing terms, we may be unable to finance our operations and development projects or our

borrowing costs could increase, which would have a material adverse effect on our business, financial condition and results of operations.

|

| |

● |

We

are a holding company whose material assets consist of our holdings in our subsidiaries, upon whom we are dependent for distributions.

|

| |

|

|

| |

● |

Tembo

is currently engaged in discussions to complete a business combination with Nasdaq-listed Cactus Acquisition Corp. 1 Limited (CCTS).

This process involves significant risks and uncertainties that could adversely affect our business, financial condition, results

of operations, and prospects. |

Risks

related to ownership of our Ordinary Shares

| |

● |

The

trading price of our Ordinary Shares is highly volatile and likely to continue to be so, presenting litigation risks. |

| |

|

|

| |

● |

We

may issue additional securities in the future, which may result in dilution to our shareholders and may depress our share price.

|

| |

|

|

| |

● |

We

do not intend to pay any dividends on our Ordinary Shares at this time. |

| |

|

|

| |

● |

We

cannot assure you that our Ordinary Shares will always trade in an active and liquid public market. In addition, at times trading

in our Ordinary Shares on The Nasdaq Capital Market (“Nasdaq”) has been highly volatile with significant fluctuations

in price and trading volume, and such volatility and fluctuations may continue to occur in the future. Low liquidity, high volatility,

declines in our stock price or a potential delisting of our Ordinary Shares may have a negative effect on our ability to raise capital

on attractive terms or at all and may have a material adverse effect on our operations. |

| |

|

|

| |

● |

As

a foreign private issuer whose shares are listed on Nasdaq, we may follow certain home country corporate governance practices instead

of certain Nasdaq requirements. |

| |

|

|

| |

● |

The

market price of our shares may be significantly and negatively affected by factors that are not in our control. |

| |

|

|

| |

● |

Our

largest shareholder has substantial influence over us and its interests may conflict with or differ from interests of other shareholders.

|

| |

|

|

| |

● |

The

rights of our shareholders may differ from the rights typically offered to shareholders of a U.S. corporation. |

Risks

related to climate, economic and geopolitical factors

| |

● |

We

face risks related to natural disasters, health epidemics, such as COVID-19, and other catastrophes, which could significantly disrupt

our operations or compromise our business continuity. |

| |

|

|

| |

● |

General

economic conditions, including levels of inflation and official interest rates in different jurisdictions in which we operate, could

adversely impact demand for our solutions, products and services. |

| |

|

|

| |

● |

Commodity

prices (particularly for natural gas and coal) could impact the economic viability of our businesses, in particular SES and Solar

Development. |

| |

|

|

| |

● |

Our

operations span multiple markets and jurisdictions, exposing us to numerous legal, political, operational, foreign currency exchange

and other risks that could negatively affect our operations and profitability. |

| |

|

|

| |

● |

Seasonal

variations in demand linked to construction cycles and weather conditions may influence our results of operations and severe weather,

including extreme weather conditions associated with climate change, may negatively affect our operations. |

| |

|

|

| |

● |

A

deterioration or other negative change in economic or financial conditions in the countries in which we operate or in the global

financial markets could have a material adverse effect on our business or results of operations. |

Risks

related to information systems, internal controls, cybersecurity, record keeping and reporting

| |

● |

Our

operations depend on proper performance of various information technology systems. |

| |

|

|

| |

● |

If

we are unable to maintain effective internal controls over financial reporting or effective disclosure controls and procedures, or

if material weaknesses in our internal controls over financial reporting or in our disclosure controls and procedures develop, it

could negatively affect the reliability or timeliness of our financial reporting and result in a reduction of the price of our Ordinary

Shares or have other adverse consequences. |

| |

● |

The

accounting treatment for many aspects of our business is complex and any changes to the accounting interpretations or accounting

rules governing our business could have a material adverse effect on our reported results of operations and financial results. |

| |

|

|

| |

● |

Security

breaches, cyber-attacks, loss of data and other disruptions could compromise sensitive information related to our business or prevent

us from accessing critical information and expose us to liability, which could adversely affect our business and our reputation.

|

| |

|

|

| |

● |

We

make estimates and assumptions in connection with the preparation of our consolidated financial statements, and any changes to those

estimates and assumptions could have a material adverse effect on our reported results of operations. |

| |

|

|

| |

● |

We

currently report our financial results under IFRS, which differs in certain significant respects from U.S. GAAP. |

Risks

related to regulations and governance

| |

● |

Regulations

and policies governing the electric utility industry, as well as changes to these regulations and policies, may adversely affect

demand for our solutions, projects and services and materially adversely affect our business, results of operations and/or financial

condition. |

| |

|

|

| |

● |

Regulations

and policies governing electric vehicles may materially adversely affect the adoption of electric vehicles and hence the demand for and/or

financial viability of our electric vehicle business. |

| |

|

|

| |

● |

Regulations

and policies governing solar power project development, installation and energy generation may adversely affect demand for solutions,

products and services including SES, Critical Power and Solar Development. |

| |

|

|

| |

● |

Changes

to our tax liabilities or changes to tax requirements in the jurisdictions in which we operate could significantly and negatively

affect our profitability. |

| |

|

|

| |

● |

Changes

in, or any failure to comply with, privacy laws, regulations, and standards may adversely affect our business. |

| |

|

|

| |

● |

As

a foreign private issuer under the rules and regulations of the SEC, we are exempt from a number of rules under U.S. securities laws

that apply to U.S.-based issuers and are permitted to file less information with the SEC than such companies. |

| |

|

|

| |

● |

U.S.

holders of our shares could be subject to material adverse tax consequences if we are considered a “passive foreign investment

company” for U.S. federal income tax purposes. |

| |

|

|

| |

● |

We

may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| |

|

|

| |

● |

U.S.

investors may have difficulty enforcing civil liabilities against our Company, our directors or members of senior management and

the experts named in this prospectus. |

| |

|

|

| |

● |

Changes

in U.S. federal income tax policy, including in relation to investment tax credits, may affect the appetite of investors for renewable

project investments that are eligible for such credits and could therefore have a negative impact on the economic viability of our

U.S. solar development projects. |

| |

|

|

| |

● |

From

time to time, we may become involved in costly and time-consuming litigation and other regulatory proceedings which require significant

attention from our management. |

| |

|

|

| |

● |

We

are subject to the U.K. Bribery Act, the U.S. Foreign Corrupt Practices Act (“FCPA”) and other anti-corruption laws,

as well as export control laws, import and customs laws, trade and economic sanctions laws and other laws governing our operations.

|

Risks

related to attracting and retaining talent

| |

● |

Our

future success depends on our ability to retain our chief executive officer and other key executives. |

| |

|

|

| |

● |

The

success of our Company is heavily dependent on the continuing services of key personnel as well as the recruitment and retention

of additional personnel. |

Risks

related to this offering

| |

● |

The

best efforts structure of this offering may have an adverse effect on our business plan. |

| |

|

|

| |

● |

Our

management will have immediate and broad discretion over the use of the net proceeds from this offering and may not use them effectively.

|

| |

|

|

| |

● |

Sales

of a substantial number of our Ordinary Shares in the public market by the investors in this offering and/or by our existing shareholders

could adversely affect the trading price of our Ordinary Shares. |

| |

|

|

| |

● |

You

may experience future dilution as a result of future equity offerings. |

| |

|

|

| |

● |

The

trading price of our Ordinary Shares has been and is likely to continue to be highly volatile and could be subject to wide fluctuations

in response to various factors, some of which are beyond our control. |

THE

OFFERING

| Ordinary

shares offered by us |

|

Up

to Ordinary Shares on a best-efforts basis |

| |

|

|

| Ordinary

shares outstanding prior to this offering |

|

Ordinary

Shares |

| |

|

|

| Offering

price |

|

$

per Ordinary Share |

| |

|

|

| Ordinary

shares to be outstanding after this offering |

|

Ordinary

Shares. |

| |

|

|

| Use

of proceeds |

|

Assuming

we sell the maximum number of Ordinary Shares offered in this offering, we estimate the net proceeds that we will receive from this

offering will be approximately $ million based on an assumed public offering price of $ [●]- per share, which was the last

reported sale price of our Ordinary Shares on The Nasdaq Capital Market on July [●], 2024, after deducting placement agent

fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering, together with our existing

cash and cash equivalents, to fund working capital needs in connection with the expansion of our operations to the commercial electronic

vehicle segment and to reduce our debts, including monies owed to shareholders, as well as for general corporate purposes.

See the “Use of Proceeds” section of this prospectus for additional information. However, this is a best efforts offering

with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of these securities

offered pursuant to this prospectus; as a result, we may receive significantly less in net proceeds. For example, if we sell only

25%, 50% or 75% of the maximum amount offered, our net proceeds will be approximately $[●], $[●], or $[●], respectively. |

| |

|

|

| Risk

Factors |

|

You

should read the “Risk Factors” section of this prospectus beginning on page 9 for a discussion of factors to consider

carefully before deciding to invest in our Ordinary Shares. |

| |

|

|

| Transfer

Agent |

|

The

registrar and transfer agent for the Ordinary Share is Computershare Trust Company, N.A. |

| |

|

|

| The

Nasdaq Capital Market symbol |

|

“VVPR” |

| |

|

|

| Best

Efforts |

|

We

have agreed to offer and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is

not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable

best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page

88 of this prospectus. |

The

number of our Ordinary Shares to be outstanding after this offering is based on 4,439,733 of our Ordinary Shares outstanding as of June

30, 2024, and excludes the following:

| |

● |

125,000

Ordinary Shares authorized for issuance to the Company’s Chairman and CEO in lieu of salary for the period 30 June 2023 to

31 December 2023; |

| |

|

|

| |

● |

423,077

Ordinary Shares upon exercise of Series A warrants issued to investors on August 2, 2022, at an exercise price of $13.00 per share; |

| |

|

|

| |

● |

25,000

Ordinary Shares upon exercise of warrants contracted to be conditionally issued to corporate advisors at an exercise price of $6.60

per share; |

| |

|

|

| |

● |

86,942

Ordinary Shares upon exercise of warrants issued at an exercise price of $6.00 per share to Kevin Chin in lieu of salary. In turn, Kevin

Chin gifted this to a benevolent foundation; and |

| |

|

|

| |

● |

58,599

Ordinary Shares issued upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under

our equity plans as of April 4, 2024. Additional restricted stock units, performance stock units or bonus stock awards for the quarter

up to June 30, 2024, are also excluded as they have yet to be granted. |

RISK

FACTORS

Investing

in our Ordinary Shares involves a high degree of risk. You should carefully consider and evaluate all of the information contained in

this prospectus before you decide to purchase our securities. Any of the risks and uncertainties set forth below could materially and

adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the

value of any securities offered by this prospectus. As a result, you could lose all or part of your investment.

Risks

related to our business and operations

Our

operational and financial results may vary significantly from period to period due to fluctuations in our operating costs and other factors.

In

order to facilitate the growth of our Sustainable Energy Solutions (“SES”) strategy, we will need to make significant investments

of both an operational expenditure and a capital expenditure nature.

We

may not be profitable from period to period because we do not know the rate at which our revenue will grow, if it will grow at all, and

we do not know the rate at which we will incur expenses. If we do achieve profitability, we may not be able to sustain or increase profitability

on a quarterly or annual basis. Our revenue and operating results are difficult to predict and may vary significantly from period to

period. Sustained losses could have a material adverse effect on our business, financial condition or results of operations.

We

expect our period to period financial results to vary based on our operating costs, which we anticipate will fluctuate as the pace at

which we continue to design, develop and manufacture new products and to increase production capacity by expanding our current manufacturing

facilities and adding future facilities. Additionally, our revenues from period to period may fluctuate as we introduce existing products

to new markets for the first time and as we develop and introduce new products. Moreover, our financial results may not meet expectations

of equity research analysts, ratings agencies or investors, who may focus on short-term financial results. Accordingly, the trading price

of our stock could decline substantially, either suddenly or over time.

We

expect to require additional financing to execute our strategy to operate and grow our business and additional requisite funding may

not be available to us when we need or want it.

Our

operations and our future plans for expansion are capital intensive requiring significant investment in operational expenditures and

capital expenditures to realize the growth potential of our electric vehicle, critical power services, sustainable energy solutions and

solar development businesses. In addition, we are subject to substantial and ongoing administrative and related expenses required to

operate and grow a public company. Together these items impose substantial requirements on our cash flow and the specific timing of cash

inflows and outflows may fluctuate substantially from period to period. As a result, we expect to require some combination of additional

financing options in order to execute our strategy and meet the operating cash flow requirements necessary to operate and grow our business.

We may need or want to raise additional funds through the issuance of equity, equity-related or debt securities or through obtaining

credit from financial institutions to fund, together with our principal sources of liquidity, the costs of developing and manufacturing

our current or future products, to pay any significant unplanned or accelerated expenses or for new significant strategic investments,

or to refinance our significant consolidated indebtedness, even if not required to do so by the terms of such indebtedness. We may not

be able to obtain the additional or requisite funding on favorable terms when required, or at all, in order to execute our strategic

development plans or to meet our cash flow needs. Our inability to obtain funding or engage in strategic transactions could have a material

adverse effect on our business, our strategic development plan for future growth, our financial condition, and our results of operations.

If

we continue to experience losses and we are not able to raise additional financing to grow the revenue streams of the Company to become

profit making, or generate cash through sales of assets, we may not have sufficient liquidity to sustain our operations and to continue

as a going concern.

We

experienced a loss of $24.3 million, $22.1 million and $8.0 million for the years ended June 30, 2023, 2022 and 2021, respectively. For

the half years ended 31 December 2023, 2022 and 2021 we experienced losses of $7.8 million, $11.2 million and $10.2 million, respectively.

If we are unable to generate sufficient revenue from the operation of our businesses, grow our electric vehicle sales, and generate sales

of SES projects, or if we are unable to reduce our expenses sufficiently, we may continue to experience substantial losses.

The

accompanying consolidated financial statements are prepared on a going concern basis and do not include any adjustments that result from

uncertainty about our ability to continue as a going concern. However, if losses continue, and if we are unable to raise additional financing

on sufficiently attractive terms or generate cash through sales of solar projects or other material assets or other means, then we may

not have sufficient liquidity to sustain our operations and may not be able to continue as a going concern. Similarly, the report of

our independent registered public accounting firm on our consolidated financial statements as of and for the year ended June 30, 2023

includes an explanatory paragraph indicating that a material uncertainty exists which may cast material doubt on the group’s ability

to continue as a going concern if it is unable to secure sufficient funding. Our consolidated financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

If

we fail to meet changing customer demands, we may lose customers and our sales could suffer.

The

industry in which we operate changes rapidly. Changes in our customers’ requirements result in new and more demanding technologies,

product specifications and sizes, and manufacturing processes. Our ability to remain competitive will depend upon our ability to develop

technologically advanced products and processes. We must continue to meet the increasingly sophisticated requirements of our customers

on a cost-effective basis. We cannot be certain that we will be able to successfully introduce, market and cost-effectively source any

new products, or that we will be able to develop new or enhanced products and processes that satisfy customer needs or achieve market

acceptance. Any resulting loss of customers could have a material adverse effect on our business, financial condition or results of operations

We

face competition in the markets, industries and business segments in which we operate, which could adversely affect our business, operating

results, financial condition and future prospects.

We

face competition in each of the business segments and jurisdictions in which we operate. Some of our competitors (i) have more financial,

technological, engineering and manufacturing resources than we do to develop products, services and solutions that may compete favorably

against our products; (ii) are developing or are currently producing products, services and solutions based on new technologies that

may ultimately have costs similar to or lower than ours; (iii) have government-backed financial resources or parent companies with greater

depths of resources than are available to us; (iv) have access to a lower cost of capital than we do; (v) have stronger distribution

partnerships and channels than we do, enabling access to larger customer bases; and (vi) may have longer operating histories, greater

name and brand recognition and greater economies of scale than we do.

In

addition, new competitors or alliances among existing competitors could emerge and rapidly acquire significant market share, adversely

impacting our business in the process.

We

expect that our competitors will continuously innovate to improve their ability to deliver products, services and solutions to meet customer

demands. Should we fail to compete effectively, this could have a material adverse effect on our business, results of operations and

financial condition.

Our

inability to protect our intellectual property could adversely affect our business. We may also be subject to intellectual property rights

claims by third parties, which are extremely costly to defend, could require us to pay significant damages and could limit our ability

to use certain technologies.

Any

failure to protect our proprietary rights adequately could result in our competitors offering similar sustainable energy solutions more

quickly than anticipated, potentially resulting in the loss of some of our competitive advantage and a decrease in our revenue which

would adversely affect our business prospects, financial condition and operating results. Our success depends, at least in part, on our

ability to protect our core technology and intellectual property. We rely on intellectual property laws, primarily a combination of copyright

and trade secret laws in the U.S., U.K., Europe, United Arab Emirates and Australia, as well as license agreements and other contractual

provisions, to protect our proprietary technology and brand. We cannot be certain our agreements and other contractual provisions will

not be breached, including a breach involving the use or disclosure of our trade secrets or know-how, or that adequate remedies will

be available in the event of any breach. In addition, our trade secrets may otherwise become known or lose trade secret protection.

We

cannot be certain our products and our business do not or will not violate the intellectual property rights of a third party. Third parties,

including our competitors, may own patents or other intellectual property rights that cover aspects of our technology or business methods.

Such parties may claim we have misappropriated, misused, violated or infringed upon third-party intellectual property rights and if we

gain greater recognition in the market, we face a higher risk of being the subject of claims we have violated others’ intellectual

property rights. Any claim we violated a third party’s intellectual property rights, whether with or without merit, could be time-consuming,

expensive to settle or litigate and could divert our management’s attention and other resources, all of which could adversely affect

our business, results of operations, financial condition and cash flows. If we do not successfully settle or defend an intellectual property

claim, we could be liable for significant monetary damages and could be prohibited from continuing to use certain technology, business

methods, content or brands. To avoid a prohibition, we could seek a license from third parties, which could require us to pay significant

royalties, increasing our operating expenses. If a license is not available at all or not available on commercially reasonable terms,

we may be required to develop or license a non-violating alternative, either of which could adversely affect our business, results of

operations, financial condition and cash flows.

Our

brand and reputation are key assets of our business, and if our brand or reputation is damaged, our business and results of operations

could be materially adversely affected.

If

we fail to deliver our renewable products, critical power services and electric vehicle (“EV”) conversion kits within planned

timelines and contracted obligations, or our products and services do not perform as anticipated, or if we materially damage any of our

clients’ properties, or cancel projects, our brand name and reputation could be significantly impaired. If customers or potential

customers have or develop a less favorable view of our brand or reputation, for the reasons stated above or for any other reason, it

could materially adversely affect our business, results of operations and financial condition.

Our

future business depends in part on our ability to make strategic acquisitions, investments and divestitures and to establish and maintain

strategic relationships, and our failure to do so could have a material and adverse effect on our market penetration and revenue growth.

We

frequently look for and evaluate opportunities to acquire other businesses, make strategic investments or establish strategic relationships

with third parties to improve our market position or expand our products and services. When market conditions permit and opportunities

arise, we may also consider divesting part of our current business to focus management attention and improve our operating efficiency.

Investments, strategic acquisitions and relationships with third parties could subject us to a number of risks, including risks associated

with integrating their personnel, operations, services, internal controls and financial reporting into our operations as well as the

loss of control of operations that are material to our business. If we divest any material part of our business, we may not be able to

benefit from our investment and experience associated with that part of the business and may be subject to intensified concentration

risks with less flexibility to respond to market fluctuations. Moreover, it could be expensive to make strategic acquisitions, investments,

divestitures and establish and maintain relationships, and we may be subject to the risk of non-performance by a counterparty, which

may in turn lead to monetary losses that materially and adversely affect our business. We cannot assure you that we will be able to successfully

make strategic acquisitions and investments and successfully integrate them into our operations or make strategic divestitures or establish

strategic relationships with third parties that will prove to be effective for our business. Our inability to do so could materially

and adversely affect our market penetration, our revenue growth and our profitability.

Additionally,

any acquisition involves potential risks, including, among other things:

| |

● |

mistaken

assumptions about assets, revenues and costs of the acquired company, including synergies and potential growth; |

| |

|

|

| |

● |

an

inability to successfully integrate the assets or businesses we acquire; |

| |

|

|

| |

● |

complexity

of coordinating geographically disparate organizations, systems and facilities; |

| |

● |

the

assumption of unknown liabilities for which we are not indemnified or for which our indemnity is inadequate; |

| |

|

|

| |

● |

mistaken

assumptions about the acquired company’s suppliers or dealers or other vendors; |

| |

|

|

| |

● |

the

diversion of management’s and employees’ attention from other business concerns; |

| |

|

|

| |

● |

unforeseen

difficulties operating in new geographic areas and business lines; |

| |

|

|

| |

● |

customer

or key employee losses at the acquired business; and |

| |

|

|

| |

● |

acquiring

poor quality assets, systems and processes. |

Our

insurance coverage strategy may not be adequate to protect us from all business risks.

We

may be subject, in the ordinary course of business, to losses resulting from products liability, accidents, acts of God and other claims

against us, for which we may have no insurance coverage. Additionally, the policies that we do have may include significant deductibles

or self-insured retentions, policy limitations and exclusions, and we cannot be certain that our insurance coverage will be sufficient

to cover all future losses or claims against us. A loss that is uninsured or which exceeds policy limits may require us to pay substantial

amounts, which may harm our business, operating results and financial condition.

Our

operations may be adversely affected by failure to maintain or renegotiate distribution, supply, manufacturing or license agreements

on favorable terms

We

have distribution, supply, manufacturing and license agreements for our businesses. These agreements vary depending on the particular

business, but tend to be for a fixed number of years. There can be no assurance that our businesses will be able to renegotiate rights

on favorable terms when these agreements expire or that they will not be terminated. Failure to renew these agreements on favorable terms,

or any disputes with distributors of our businesses’ products or suppliers of materials, could have an adverse impact on our business

and financial results.

In

particular in the case of Tembo we depend on suppliers for the components of our kit to maintain or improve their prices as volumes ordered

increase and to deliver their products to Tembo within agreed timeframes. There can be no assurance that our volumes of orders and our

suppliers’ pricing and lead times will be aligned with our agreements or forecast, which may have an adverse impact on our business

and financial results.

We

may incur unexpected warranty and performance guarantee claims that could materially and adversely affect our financial condition or

results of operations.

In

connection with our products and services, we may provide various system warranties and/or performance guarantees. While we generally

are able to pass through manufacturer warranties we receive from our suppliers to our customers, in some circumstances, our warranty

period may exceed the manufacturer’s warranty period, or the manufacturer warranties may not otherwise fully compensate for losses

associated with customer claims pursuant to a warranty or performance guarantee we provided. For example, most manufacturer warranties

exclude many losses that may result from a system component’s failure or defect, such as the cost of de-installation, re-installation,

shipping, lost electricity, lost renewable energy credits or other solar incentives, personal injury, property damage, and other losses.

In addition, in the event we seek recourse through manufacturer warranties, we will also be dependent on the creditworthiness and continued

existence of these suppliers. These risks are exacerbated in the event such manufacturers cease operations or fail to honor their warranties.

As

a result, warranty or other performance guarantee claims against us that exceed reserves could cause us to incur substantial expense

to repair or replace defective products. Warranty reserves include management’s best estimates of the projected costs to repair

or to replace items under warranty, which are based on actual claims incurred to date and an estimate of the nature, frequency and costs

of future claims. Such estimates are inherently uncertain and subject to change based on our historical or projected experience. Significant

repair and replacement costs could materially and negatively impact our financial condition or results of operations, as well divert

employee time to remedying such issues. In addition, quality issues can have various other ramifications, including delays in the recognition

of revenue, loss of revenue, loss of future sales opportunities, increased costs associated with repairing or replacing products, and

a negative impact on our reputation, any of which could also adversely affect our business or operating results.

Our

group SES strategy, including electric vehicles and electrical services to the solar power industry market, may not be successful, could

disrupt our existing operations and increase costs, decrease profitability and reduce cash flows across the group.

Our

strategy is to focus on delivering end-to-end sustainable energy solutions to corporate customers (including electric vehicles and electrical

services to the solar power industry market) to help them accelerate achievement of their net zero carbon goals.

There

can be no assurance that the SES strategy will succeed, especially as it is a new business model. For example, there may not be enough

customers who engage us to deliver full end-to-end SES solutions to drive the growth that our management is targeting. We may not be

able to perfect solutions that meet the expectations of customers, and we may be surpassed by competitors with better technologies. We

may not be able to scale up Tembo appropriately or sufficiently integrate it with our existing business operations.

The

new SES strategy may transform our growth trajectory but in doing so it will involve significant investment and place strain on our financial

and management resources, as well as our business and compliance systems, people and processes. We may not be able to scale up our systems,

hire enough people and upgrade our processes effectively so as to realize this growth. If we fail to achieve the targeted growth upon

which our investments are made, this could have a material adverse effect on our business, results of operations and financial condition.

Any

of the above could have a material adverse effect on our business, results of operations and financial condition.

Our

ability to scale up Tembo, our commercial EV segment, is dependent on securing new business opportunities and orders, meeting the requirements

of customers and the timely delivery of orders across different market sectors.

We

plan to expand significantly in the commercial electric vehicle market, providing electric utility vehicles (“EUV”) with

a key focus initially on servicing EUV customers in the mining, infrastructure, government services, humanitarian, tourism, and utilities

sectors. As we look to develop these opportunities, monetise our pipeline and secure firm orders, we will incur increased operational

expenditures and capital expenditures that may impact our profitability and cash flows.

We

will continue to be engaged in product innovation with Tembo as we look to introduce new products, including EUV conversion kits with

a longer range and/or greater payload capacity. To the extent that such innovation does not successfully meet regulatory requirements,

quality and safety standards and/or customer expectations more generally, future sales could be impaired.

Following

the acquisition of Tembo, we signed distribution agreements with a number of partners in North America, Australia, the Middle East, Africa,

Southeast Asia and Europe to sell Tembo EUV conversion kits. If Tembo is not able to meet the technical specifications, quality and safety

standards of our customers and partners, this will have a material adverse effect on Tembo’s brand, reputation, revenue and future

prospects. Furthermore, if Tembo is unable to fulfill product delivery volumes in accordance with timelines agreed with our customers

and partners, this could have a material adverse effect on future sales, operating results and the financial condition of the business.

The

future growth and success of Tembo is dependent upon acceptance of its zero-emission specialist battery-electric off-road vehicle kits

amongst key target customers in the mining, infrastructure, government services, humanitarian, tourism and utilities sectors.

Our

strategy for Tembo is to focus its vehicle fleet electrification efforts on the ruggedized, customized and off-road segments of the electric

vehicle market including for the mining, infrastructure, government services, humanitarian, tourism and utilities sectors. This market

is relatively new, rapidly evolving, and characterized by rapidly changing technologies, new competitors, evolving government regulation

and industry standards, frequent new vehicle announcements and changing consumer demands and behaviors. If this market does not develop

as we expect or develops more slowly than we expect, our business, results of operations, financial condition and prospects will be materially

adversely affected.

Factors

that may influence the market acceptance of new zero-emission vehicles and the conversion of existing vehicles to zero-emission electric

vehicles include:

| |

● |

perceptions

about zero-emission electric vehicle quality, safety design, performance and cost, especially if adverse events or accidents occur

that are linked to the quality or safety of any electric vehicle; |

| |

|

|

| |

● |

perceptions

about the limitations on the range over which zero-emission electric vehicles may be driven on a single battery charge; |

| |

|

|

| |

● |

perceptions

about vehicle safety in general, in particular safety issues that may be attributed to the use of advanced or new technology; |

| |

|

|

| |

● |

the

availability of, and perceptions about, alternative fuel vehicles, including hydrogen, as well as the cost of these fuels, which

may reduce demand for battery electric vehicles; |

| |

|

|

| |

● |

the

availability of service infrastructure for zero-emission electric vehicles; |

| |

|

|

| |

● |

changes

in the costs of oil, diesel and gasoline; |

| |

|

|

| |

● |

government

regulations and economic incentives, including a change in the administrations and legislations of federal and state governments,

promoting fuel efficiency and alternate forms of energy; |

| |

|

|

| |

● |

access

to charging stations, standardization of electric vehicle charging systems and perceptions about convenience and cost to charge an

electric vehicle; |

| |

|

|

| |

● |

the

availability of tax and other governmental incentives and rebates to purchase and operate electric vehicles or future regulation

requiring increased use of zero-emission or hybrid electric vehicles, such as the Infrastructure Investment and Jobs Act enacted

in November 2021 in the United States; and |

| |

|

|

| |

● |

macroeconomic

factors. |

The

influence of any of the factors described above may cause current or potential customers not to purchase Tembo’s electric vehicles,

which would materially adversely affect our business, results of operations, financial condition and prospects.

Tembo

faces certain operational risks as it seeks to scale up its assembly and delivery capabilities and if it fails to execute properly, this

will expose us to material losses and compromise our cash flows.

The

Tembo business faces operational risks as a maker of battery-electric ruggedized and off-road vehicles embarking on a scale up of its

assembly and delivery capabilities. These risks include:

| |

● |

industrial

accidents or pollution which may result in operational disruptions such as work stoppages and which could result in increased production

costs as well as financial and regulatory liabilities; |

| |

|

|

| |

● |

actual

and potential supply chain shortages, in particular with regard to batteries and other vehicle inputs, as well as increases in the

prices of such inputs, which may have a material adverse effect on the operations, profits and cash flow of Tembo; |

| |

|

|

| |

● |

issues

relating to design or manufacturing defects; |

| |

|

|

| |

● |

issues

relating to safety, including compliance with safety regulations and standards; |

| |

|

|

| |

● |

inability

to secure appropriate premises and equipment; |

| |

|

|

| |

● |

inability

to attract and retain appropriately qualified personnel; and |

| |

|

|

| |

● |

delays

in launching or scaling up production and assembly of new products and features. |

Constant

innovation and product development is required for Tembo to ensure it remains competitive and relevant.

Tembo

operates in a market that is relatively new, rapidly evolving, and characterized by rapidly changing technologies, new competitors, evolving

government regulation and industry standards, frequent new vehicle announcements and changing consumer demands and behaviors. In order

to stay competitive and relevant, it needs to continuously innovate and invest in product development and new technologies.

In

particular, we are in the process of testing EV conversion kits with new battery platforms. Our ability to execute on the research, development

and design of the EV conversion kit within the intended time and budget is key to deliver to our distribution partners and customers

in accordance with our existing and upcoming agreements and to grow revenues at Tembo.

If