false

0000908937

0000908937

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 10, 2024 (September 9, 2024)

SIRIUS XM HOLDINGS INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-34295 |

93-4680139 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| 1221 Avenue of the Americas, 35th Fl., New York, NY |

10020 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| Registrant's

telephone number, including area code: (212)

584-5100 |

| |

| (Former

Name or Former Address, if Changed Since Last Report): N/A |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

| Common Stock, par value $0.001 per share |

SIRI |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

On September 9, 2024 at 4:05 p.m., New York

City time, Liberty Media Corporation (“Liberty Media”) completed its previously announced split-off (the “Split-Off”)

of its former wholly owned subsidiary, Liberty Sirius XM Holdings Inc. (“New Sirius”). The Split-Off was accomplished

by Liberty Media redeeming each outstanding share of Liberty Media’s Series A, Series B and Series C Liberty SiriusXM

common stock, par value $0.01 per share, in exchange for 0.8375 of a share of New Sirius common stock, par value $0.001 per share (the

“Redemption”), with cash being paid to entitled record holders of Liberty SiriusXM common stock in lieu of any fractional

shares of common stock of New Sirius.

Following the Split-Off, on September 9, 2024

at 6:00 p.m., New York City time (the “Merger Effective Time”), a wholly owned subsidiary of New Sirius merged with

and into Sirius XM Holdings Inc. (“Old Sirius”), with Old Sirius surviving the merger as a wholly owned subsidiary

of New Sirius (the “Merger” and together with the Split-Off, the “Transactions”). Upon consummation

of the Merger, each share of common stock of Old Sirius, par value $0.001 per share, issued and outstanding immediately prior to the Merger

Effective Time (other than shares owned by New Sirius and its subsidiaries) was converted into one-tenth (0.1) of a share of New Sirius

common stock, with cash being paid to entitled record holders of Old Sirius common stock in lieu of any fractional shares of common stock

of New Sirius. Concurrently with the Merger Effective Time, Old Sirius was renamed to “Sirius XM Inc.” and New Sirius was

renamed to “Sirius XM Holdings Inc.”

On September 10, 2024, we issued a press release

announcing, among other things, the completion of the Transactions. The full text of the press release is filed as Exhibit 99.1 to

this Current Report on Form 8-K and is incorporated by reference into this Item 7.01.

Following the Merger Effective Time, the Board

of New Sirius authorized a $1.166 billion common stock repurchase program. The $1.166 billion common stock repurchase program is a continuation

of the stock repurchase program of Old Sirius.

This newly authorized amount represents the amount

that remained available under Old Sirius’s $18 billion common stock repurchase program that began in December 2012. Shares

of common stock may be purchased from time to time on the open market and in privately negotiated transactions, including in accelerated

stock repurchase transactions. New Sirius expects to fund the repurchases through cash on hand, future cash flow from operations and borrowings

under its revolving credit facility.

The timing and amount of any shares repurchased

will be determined based on New Sirius’s evaluation of market conditions and other factors and the program may be discontinued or

suspended at any time. Repurchases will be made in compliance with all SEC rules and other legal requirements and may be made in

part under a Rule 10b5-1 plan, which permits stock repurchases when New Sirius might otherwise be precluded from doing so.

Forward-Looking Statements

This Current Report on Form 8-K includes certain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating

to the expected trading of New Sirius common stock on Nasdaq. All statements other than statements of historical fact are “forward-looking

statements” for purposes of federal and state securities laws. These forward-looking statements generally can be identified by phrases

such as “possible,” “potential,” “intends” or “expects” or other words or phrases of similar

import or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,”

“could,” or similar variations. These forward-looking statements involve many risks and uncertainties that could cause actual

results and the timing of events to differ materially from those expressed or implied by such statements. These forward-looking statements

speak only as of the date of this Current Report on Form 8-K, and New Sirius expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in New Sirius’s expectations

with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly

filed documents of New Sirius, including its Registration Statement on Form S-4 (File No. 333-276758), as amended, as such risk

factors may be amended, supplemented or superseded from time to time by other reports New Sirius subsequently files with the SEC, for

additional information about New Sirius and about the risks and uncertainties related to New Sirius’s business which may affect

the statements made in this Current Report on Form 8-K.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Date: September 10, 2024

| |

SIRIUS XM HOLDINGS INC. |

| |

|

|

| |

By: |

/s/ Patrick L. Donnelly |

| |

|

Patrick L. Donnelly |

| |

|

Executive Vice President, General Counsel and Secretary |

Exhibit 99.1

SiriusXM Kicks off New Phase as an Independent

Public Company

With Simplified Capital Structure and a Clear

Path Forward, North America’s Leading Audio Entertainment Company is Well-Positioned to Continue its Transformation

SiriusXM Updates Free Cash Flow Guidance to

Reflect the Impact of the Closing of the Liberty Media Transaction

Company Confirms Quarterly Dividend and Announces

$1.166 Billion Stock Repurchase Authorization

NEW YORK, NY – September 10,

2024 – Sirius XM Holdings Inc. (NASDAQ: SIRI) today kicked off a new chapter as an independent public company with a

simplified capital structure and strategy for continued success following the closing of its transaction with Liberty Media.

“Today SiriusXM embarks on a new phase in our journey as an independent

public company, building on our leading position in audio entertainment,” said Jennifer Witz, Chief Executive Officer of SiriusXM.

“We’ve created a strong and profitable business, anchored by a subscription service that fosters deep and loyal connections

with our listeners and a growing digital audio advertising platform which extends our reach to fans around the world, and we are excited

about the future as we look to expand and strengthen both platforms.”

“As we look ahead, we remain committed to three key objectives:

enhancing subscriber value with a focus on content, technology and pricing; growing our advertising offerings to both engage new listeners

and deliver effective results for advertisers; and driving efficiency across the organization to continue our strong track record of financial

performance. We look forward to building upon SiriusXM’s twenty-year history as the audio platforms of choice for millions of North

Americans in their vehicles, at home, and on the go, with the goal of creating long-term value for our stockholders.”

Financial Update

SiriusXM reiterated its full-year 2024 revenue and adjusted EBITDA

guidance. As the company has stated in past earnings releases, the company planned to update its free cash flow guidance for transaction

impacts. The company estimates these costs to be approximately $200 million and include transaction costs, incremental interest expense

related to the debt assumed and incurred in connection with the Liberty Media transaction, and cash outflows at Liberty Sirius XM Holdings

Inc. prior to the closing.

“As we enter our next phase as an independent company, we expect

SiriusXM to continue delivering solid, profitable results,” said Thomas Barry, Chief Financial Officer of SiriusXM. “After

completing the transaction, which had the effect of reducing our outstanding common stock by approximately 12% before giving effect to

the 1 for 10 adjustment, our capital allocation priorities are consistent: investing in our business, focusing in the near- to mid-term

on reducing debt to return to our long-term target leverage, and continuing our capital return posture. In connection with our first day

as an independent company, we have reiterated our revenue and adjusted EBITDA guidance and incorporated the impact of the transaction

in our updated free cash flow guidance.”

The company’s 2024 financial guidance is as follows:

| · | Total revenue of approximately $8.75 billion, |

| · | Adjusted EBITDA of approximately $2.7 billion, and |

| · | Free cash flow of approximately $1.0 billion. |

The company’s $200 million change to its free cash flow guidance

reflects approximately $70 million associated with closing costs and go-forward incremental interest and approximately $130 million associated

with historical, year-to-date cash outflows at Liberty Sirius XM Holdings Inc. prior to the closing of the transaction.

Adjusted EBITDA and free cash flow are non-GAAP financial measures.

The company has not provided a reconciliation of adjusted EBITDA to projected net income (loss) or free cash flow to net cash provided

by operating activities because full-year net income (loss) and net cash provided by operating activities will include special items that

have not occurred and are difficult to predict with reasonable certainty prior to year-end. Due to this uncertainty, the company cannot

reconcile adjusted EBITDA and free cash flow to their comparable GAAP measures without unreasonable effort.

Capital Return Program

SiriusXM plans to continue its recurring dividend, which adjusted for

the 1 for 10 change in the Liberty Media transaction exchange ratio, would be approximately 27 cents per quarter.

Upon completion of the Liberty Media transaction, the Board of SiriusXM

authorized a $1.166 billion common stock repurchase program. The $1.166 billion common stock repurchase program is a continuation of the

stock repurchase program of the former SiriusXM.

This newly authorized amount represents the amount that remained available

under former SiriusXM’s $18 billion stock repurchase program that began in December 2012. Shares of common stock may be purchased

from time to time on the open market and in privately negotiated transactions, including in accelerated stock repurchase transactions.

SiriusXM expects to fund any repurchases through cash on hand, future cash flow from operations and borrowings under its revolving credit

facility.

The timing and amount of any shares repurchased will be determined

based on SiriusXM’s evaluation of market conditions and other factors and the program may be discontinued or suspended at any time.

Repurchases will be made in compliance with all SEC rules and other legal requirements and may be made in part under a Rule 10b5-1

plan, which permits stock repurchases when SiriusXM might otherwise be precluded from doing so.

Target Leverage Ratio

The company also reiterated its long-term target leverage ratio of

mid-to-low three times adjusted EBITDA. After appropriate investments in the business and its continuing regular dividend, SiriusXM expects

to focus excess cash flows on debt reduction until it reaches this long-term leverage target while continuing to be mindful of strategic

investment and capital return opportunities.

Sirius XM Evaluating Non-Cash Goodwill and other Intangible

Assets

SiriusXM also announced that, with the completion

of the Liberty Media transaction, the company will perform an evaluation of its goodwill and other intangible assets, particularly the

goodwill and other intangible assets attributed from the Liberty Media transaction. The company has regularly assessed any asset impairments

or impairment indicators of its legacy assets, and, as a result, any such post-transaction charges would primarily relate to goodwill

and intangible assets associated with the Liberty Media transaction. The company expects to complete its analysis of this goodwill and

the other intangible assets in the third quarter of 2024.

Such impairment charge, if any, would represent

a non-cash charge to earnings, and it would not affect the company's liquidity, cash flows from operating activities or debt covenants,

or have any impact on future operations.

Transaction Closing Details

On September 9, 2024, at 4:05 p.m., New York City time, Liberty

Media completed its previously announced split-off (the “Split-Off”) of its former wholly owned subsidiary, Liberty Sirius

XM Holdings Inc. (“New Sirius”). The Split-Off was accomplished by Liberty Media redeeming each outstanding share of Liberty

Media’s Series A, Series B and Series C Liberty SiriusXM common stock, par value $0.01 per share, in exchange for

0.8375 of a share of New Sirius common stock, par value $0.001 per share (the “Redemption”), with cash being paid to entitled

record holders of Liberty SiriusXM common stock in lieu of any fractional shares of common stock of New Sirius.

Following the Split-Off, on September 9, 2024 at 6:00 p.m., New

York City time, a wholly owned subsidiary of New Sirius merged with and into Sirius XM Holdings Inc. (“Old Sirius XM”), with

Old Sirius XM surviving the merger as a wholly owned subsidiary of New Sirius (the “Merger” and together with the Split-Off,

the “Transactions”). Upon consummation of the Merger, each share of common stock of Old Sirius XM, par value $0.001 per share,

issued and outstanding immediately prior to the merger effective time (other than shares owned by New Sirius and its subsidiaries) was

converted into one-tenth (0.1) of a share of New Sirius common stock, with cash being paid to entitled record holders of Old Sirius XM

common stock in lieu of any fractional shares of common stock of New Sirius. Concurrently with the merger effective time, Old Sirius XM

was renamed “Sirius XM Inc.” and New Sirius was renamed “Sirius XM Holdings Inc.”

As a result of the Transactions, Sirius XM Holdings Inc. is an independent,

publicly traded company. Sirius XM Holdings Inc. common stock begins trading on Nasdaq under the ticker symbol “SIRI” on September 10,

2024.

Additional information regarding the Transactions is available in a

Current Report on Form 8-K that the company filed yesterday with the U.S. Securities and Exchange Commission.

1 for 10 Adjustment

Upon consummation of the Liberty Media transaction, each share of common

stock of Sirius XM issued and outstanding immediately prior to closing and held by the former minority stockholders of the company was

converted into one-tenth (0.1) of a share of SiriusXM common stock. As a result, a holder of 100 shares of SiriusXM common stock, which

closed on the Nasdaq Global Select Market at $2.67 prior to the transaction closing, received in exchange for such 100 shares 10 shares

of SiriusXM common stock.

Share Reduction

Following the

closing of the Liberty Media transaction, Sirius XM had approximately 339.1 million shares of common stock outstanding. The former holders

of Liberty SiriusXM common stock own approximately 81% of Sirius XM and former Sirius XM minority stockholders own the remaining 19% of

the new company.

The Liberty Media

transaction resulted in the net reduction of approximately 12% of the company’s outstanding shares before giving effect to the 1

for 10 adjustment. The former holders of Liberty SiriusXM common stock surrendered a portion of their shares in the calculation of the

exchange ratio in the new company in exchange for the assumption of certain net liabilities by the new company in the transaction.

About Sirius XM Holdings Inc.

SiriusXM

is the leading audio entertainment company in North America with a portfolio of audio businesses including its flagship subscription entertainment

service SiriusXM; the ad-supported and premium music streaming services of Pandora; an expansive podcast network; and a suite of business

and advertising solutions. Reaching a combined monthly audience of approximately 150 million listeners, SiriusXM offers a broad range

of content for listeners everywhere they tune in with a diverse mix of live, on-demand, and curated programming across music, talk, news,

and sports. For more about SiriusXM, please go to: www.siriusxm.com.

This communication contains "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products

and services; and other statements identified by words such as "will likely result," "are expected to," "will

continue," "is anticipated," "estimated," "believe," "intend," "plan," "projection,"

"outlook" or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of

our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which

are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results

anticipated in these forward-looking statements.

The following factors, among others, could cause actual results

and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

Risks Relating to our Business and Operations: We face substantial competition and that competition is likely to increase over

time; if our efforts to attract and retain subscribers and listeners, or convert listeners into subscribers, are not successful, our business

will be adversely affected; we engage in extensive marketing efforts and the continued effectiveness of those efforts is an important

part of our business; we rely on third parties for the operation of our business, and the failure of third parties to perform could adversely

affect our business; we are migrating our billing system and payment processing function to a new service provider; failure to successfully

monetize and generate revenues from podcasts and other non-music content could adversely affect our business, operating results, and financial

condition; we may not realize the benefits of acquisitions or other strategic investments and initiatives; the impact of economic conditions

may adversely affect our business, operating results, and financial condition; and we may be adversely affected by the war in Ukraine.

Risks Relating to our Sirius XM Business: A substantial number of our Sirius XM service subscribers periodically cancel their subscriptions

and we cannot predict how successful we will be at retaining customers; our ability to profitably attract and retain subscribers to our

Sirius XM service is uncertain; our business depends in part upon the auto industry; failure of our satellites would significantly damage

our business; and our Sirius XM service may experience harmful interference from wireless operations. Risks Relating to our Pandora

and Off-platform Business: Our Pandora ad-supported business has suffered a substantial and consistent loss of monthly active users,

which may adversely affect our Pandora and Off-platform business; our Pandora and Off-platform business generates a significant portion

of its revenues from advertising, and reduced spending by advertisers could harm our business; our failure to convince advertisers of

the benefits of our Pandora ad-supported service could harm our business; if we are unable to maintain revenue growth from our advertising

products our results of operations will be adversely affected; changes to mobile operating systems and browsers may hinder our ability

to sell advertising and market our services; and if we fail to accurately predict and play music, comedy or other content that our Pandora

listeners enjoy, we may fail to retain existing and attract new listeners. Risks Relating to Laws and Governmental Regulations:

Privacy and data security laws and regulations may hinder our ability to market our services, sell advertising and impose legal liabilities;

consumer protection laws and our failure to comply with them could damage our business; failure to comply with FCC requirements could

damage our business; environmental, social and governance expectations and related reporting obligations may expose us to potential liabilities,

increased costs, reputational harm, and other adverse effects; and we may face lawsuits, incur liability or suffer reputational harm as

a result of content published or made available through our services. Risks Associated with Data and Cybersecurity and the Protection

of Consumer Information: If we fail to protect the security of personal information about our customers, we could be subject to costly

government enforcement actions and private litigation and our reputation could suffer; we use artificial intelligence in our business,

and challenges with properly managing its use could result in reputational harm, competitive harm, and legal liability and adversely affect

our results of operations; and interruption or failure of our information technology and communications systems could impair the delivery

of our service and harm our business. Risks Associated with Certain Intellectual Property Rights: The market for music rights is

changing and is subject to significant uncertainties; our Pandora services depend upon maintaining complex licenses with copyright owners,

and these licenses contain onerous terms; failure to protect our intellectual property or actions by third parties to enforce their intellectual

property rights could substantially harm our business and operating results; some of our services and technologies may use “open

source” software, which may restrict how we use or distribute our services or require that we release the source code subject to

those licenses; and rapid technological and industry changes and new entrants could adversely impact our services. Risks Related to

our Capital and Ownership Structure: We have a significant amount of indebtedness, and our debt contains certain covenants that restrict

our operations; and while we currently pay a quarterly cash dividend to holders of our common stock, we may change our dividend policy

at any time. Other Operational Risks: If we are unable to attract and retain qualified personnel, our business could be harmed;

our facilities could be damaged by natural catastrophes or terrorist activities; the unfavorable outcome of pending or future litigation

could have an adverse impact on our operations and financial condition; we may be exposed to liabilities that other entertainment service

providers would not customarily be subject to; and our business and prospects depend on the strength of our brands. Additional factors

that could cause our results to differ materially from those described in the forward-looking statements can be found in Sirius XM Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the Securities and Exchange

Commission (the "SEC") and available at the SEC's Internet site (http://www.sec.gov). The information set forth herein speaks

only as of the date hereof, and we disclaim any intention or obligation to update any forward looking statements as a result of developments

occurring after the date of this communication.

Source: SiriusXM

Investor contacts:

Hooper Stevens

212-901-6718

hooper.stevens@siriusxm.com

Natalie Candela

212-901-6672

natalie.candela@siriusxm.com

Media Contact:

Maggie Mitchell

617-797-1443

maggie.mitchell@siriusxm.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

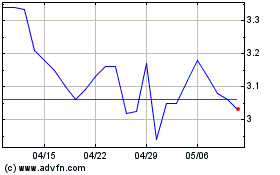

Sirius XM (NASDAQ:SIRI)

過去 株価チャート

から 9 2024 まで 10 2024

Sirius XM (NASDAQ:SIRI)

過去 株価チャート

から 10 2023 まで 10 2024