Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

2023年11月15日 - 8:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM

12b-25 |

SEC FILE NUMBER

|

| NOTIFICATION OF LATE FILING |

001-40218 |

| |

| (Check One): |

☐ Form 10-K |

☐ Form 20-F |

☐ Form 11-K |

☒ Form 10-Q |

|

| |

☐ Form 10-D |

☐ Form N-CEN |

☐ Form

N-CSR |

CUSIP NUMBER

|

| For Period Ended: |

September

30, 2023 |

|

|

G7134L 126 |

| ☐ |

Transition Report on Form 10-K |

|

|

|

|

| ☐ |

Transition Report on Form 20-F |

|

|

|

|

| ☐ |

Transition Report on Form 11-K |

|

|

|

|

| ☐ |

Transition Report on Form 10-Q |

|

|

|

| For the Transition Period Ended: |

|

|

| |

|

|

|

|

| Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

|

|

If the notification relates to a portion of the filing checked above,

identify the Item(s) to which the notification relates: |

|

| PART I -- REGISTRANT INFORMATION |

|

|

Plum Acquisition Corp. I

Full Name of Registrant |

|

|

N/A

Former Name if Applicable |

|

| 2021 Fillmore St., #2089 |

|

|

Address of Principal Executive Office (Street and Number)

San Francisco, CA 94115 |

|

| City, State and Zip Code |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II -- RULES 12b-25(b) AND (c)

If the subject report could not be filed without

unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box

if appropriate)

| |

(a) |

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| ☒ |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

(c) |

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III -- NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q,

10-D, N-CEN, N-CSR, or the transition report portion thereof, could not be filed within the prescribed time period.

Plum Acquisition Corp. I (the

“Company”) is unable to file, without unreasonable effort and expense, its Quarterly Report on Form 10-Q for the period ended

September 30, 2023 (the “Quarterly Report”) by the prescribed date because it needs additional time to complete its final

review of its financial statements and other disclosures in the Quarterly Report. The Company is working diligently to complete the Quarterly

Report and currently expects to file the Quarterly Report within the five-day extension period provided under Rule 12b-25 of the Securities

Exchange Act of 1934, as amended.

PART IV -- OTHER INFORMATION

| (1) | Name and telephone number of person to contact in regard to

this notification |

| |

Kanishka B. Roy | |

415 | |

686-6773 |

|

| |

(Name) | |

(Area Code) | |

(Telephone Number) |

|

| (2) | Have all other periodic reports required under Section 13 or

15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for

such shorter period that the registrant was required to file such report(s) been filed? If answer is no,

identify report(s). ☒ Yes ☐

No |

| (3) | Is it anticipated that any significant change in results of

operations from the corresponding period for the last fiscal year will be reflected by the earnings statements

to be included in the subject report or portion thereof? ☒ Yes No |

If so, attach an explanation of the anticipated change, both

narratively and quantitatively, and, if appropriate, state the

reasons why a reasonable estimate of the results cannot be made.

Based on preliminary results, the Company expects to report no revenue

for the quarter ended September 30, 2023, formation and operating expenses of approximately $0.4 million, loss from operations of approximately

$0.4 million, and a net loss of approximately $3.9 million, or $(0.3) per share (basic and diluted). For the quarter ended September 30,

2022, the Company generated no revenue, incurred formation and operating expenses of $0.6 million and a loss from operations of $0.6 million,

and had net income of $2.5 million, or $0.06 per share (basic and diluted). The financial results presented above reflect preliminary

estimates of the Company’s results of operations as of the date of the filing of the Form 12b-25. These estimates are subject to

change upon the completion of the reporting process and review of the Company’s financial statements, and actual results may vary

significantly from these estimates.

Forward-Looking Statements

This Notification of

Late Filing on Form 12b-25 (“Form 12b-25”) contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements that do not relate to matters of historical fact

should be considered forward-looking statements, including without limitation statements regarding the expected timing of filing the Form 10-Q. These forward-looking statements

are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause actual future events, results or achievements to be materially different

from the Company’s expectations and projections expressed or implied by the forward-looking statements. The important

factors include, but are not limited to, the finalization of the Company’s first quarter financial statements, completion of the

Company’s quarterly closing processes and procedures, as well as the general business, financial and accounting risks and the other

important factors discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022, filed with the SEC on April 17, 2023 and the Company’s other filings with the SEC from time to

time. These forward-looking statements speak only as of the date of this Form 12b-25 and are based on information

available to the Company as of the date of this Form 12b-25, and the Company assumes no obligation to update any forward-looking

statements, whether as a result of new information, future events or otherwise.

Plum Acquisition Corp. I

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: November 15, 2023 |

|

By: |

/s/ Kanishka B. Roy |

| |

|

|

Kanishka B. Roy |

| |

|

|

President and Co-Chief Executive Officer |

3

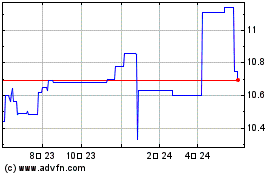

Plum Acquisition Corpora... (NASDAQ:PLMIU)

過去 株価チャート

から 4 2024 まで 5 2024

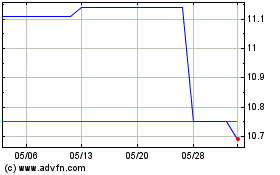

Plum Acquisition Corpora... (NASDAQ:PLMIU)

過去 株価チャート

から 5 2023 まで 5 2024