Believes News Corp Suffers from

Worst-In-Class Corporate Governance That Has Exacerbated the

Company’s Valuation Discount

Contends There Are No Reasonable Arguments

to Extend Super-Voting Rights and De Facto Control to the

Inheritors of a Founder

Plans to File a Proxy Statement with

Additional Details and Looks Forward to Continued Engagement with

Shareholders

Starboard Value LP (together with its affiliates, “Starboard” or

“we”), a significant shareholder of News Corporation (Nasdaq: NWSA,

NWS) (“News Corp” or the “Company”), today released the below

letter sent to News Corp shareholders. A copy of the letter can be

reviewed below or downloaded at:

https://www.starboardvalue.com/presentations.

***

September 9, 2024

Dear Fellow Shareholders,

Starboard Value LP (together with its affiliates, “Starboard” or

“we”) is a large shareholder of News Corporation (“News Corp” or

the “Company”). We have great respect for News Corp and the

evolution of the business since its formation in 2013. News Corp

has transformed itself from a business comprised primarily of

newspaper assets in decline to a growing, digital-first,

highly-recurring, subscription-oriented business. As we outlined

last year at the 13D Monitor Active-Passive Investor Summit, we

believe News Corp has an opportunity for significant shareholder

value creation. Since that time, we have enjoyed discussions with

our fellow shareholders, who share our concerns that the Company is

significantly undervalued and is burdened by its dual-class share

structure that provides outsized influence to the Murdoch

family.

To be clear, we believe dual-class share structures are

NOT in the best interests of

shareholders and are NOT reflective of

best-in-class corporate governance practices. That being said, we

can understand that there are limited and unique circumstances

where some may consider the structure to be beneficial.

Theoretically, some may believe dual-class share structures could

provide potential benefits to recently listed companies that,

perhaps, want their visionary founder to be insulated against

short-term pressures for a limited period of time. However, News

Corp could not be further from this archetype.

News Corp and its predecessor and related companies have had

dual-class share structures in place for decades under the

leadership of founder Rupert Murdoch. However, at last year’s

annual meeting, Rupert Murdoch transitioned to Chairman Emeritus

and his son, Lachlan Murdoch, became the sole Chair of News Corp.

As noted above, while we can understand how some could see a

benefit to a visionary founder retaining outsized control for a

limited duration of time, that potential understanding vanishes as

super-voting power and the associated protections transition to

others.

This transition of power from Rupert Murdoch to his children has

allowed for complicated family dynamics to potentially impact the

stability and strategic direction of News Corp. For background, the

Murdoch family’s ownership in News Corp is managed by the Murdoch

Family Trust (the “Trust”), which is reportedly controlled by

Rupert Murdoch and four of his children. Recent press reports have

described a legal battle over ongoing control of the Trust, with

Rupert and Lachlan Murdoch on one side, and three of Rupert

Murdoch’s other children on the other side. We believe, and reports

have highlighted, that one of the root causes for the conflict is

disagreement over the future strategic direction of News Corp and

Fox Corporation. This uncertainty represents a risk to shareholders

that is only amplified by the Murdoch family’s super-voting shares

and the poor governance and oversight that stems from the

dual-class share structure.

While the legal proceedings are not public, press reports

include excerpts of legal documents that point to Rupert Murdoch

seeking to have his family influence the strategic direction of

both companies in perpetuity, viewing them both as family

businesses:

“According to the court’s decision, Mr.

[Rupert] Murdoch was concerned that the “lack of consensus” among

his children “would impact the strategic direction at both

companies including a potential reorientation of editorial policy

and content.” It states that his intention

was to “consolidate decision-making power in Lachlan’s hands and

give him permanent, exclusive control” over the

company.”

– The New York Times, July 24,

2024

“The family battle has been years in the

making. Murdoch has always sought to keep

his media enterprise in the family’s hands, and he

brought several of his children into the business over the

years.”

– The Wall Street Journal, July 24, 2024

There are no reasonable arguments to extend super-voting rights

and de facto control to the inheritors of a founder. The situation

at News Corp is a textbook example of one of the worst forms of a

dual-class share structure – one that extends beyond any reasonable

timeline and one in which super-voting rights are moving from a

visionary founder to the founder’s children. The four Murdoch

siblings with voting rights within the Trust are reported to have

widely differing worldviews, which, collectively, could be

paralyzing to the strategic direction of the Company; more

importantly, we are not sure why their perspectives should carry

greater weight than the views of other shareholders. This is

clearly not the appropriate governance structure for a public

company, and we believe it has exacerbated News Corp’s valuation

discount relative to its inherent value.

To address these concerns, we have submitted a non-binding

business proposal to be voted upon at News Corp’s upcoming 2024

Annual Meeting of Shareholders (the “2024 Annual Meeting”) that

calls upon the Board of Directors (the “Board”) to take all

necessary actions to collapse the Company's dual-class share

structure. We have submitted this proposal to give shareholders the

opportunity to stand up for their rights and to communicate to the

Board that the time for News Corp’s dual-class share structure has

long passed.

While News Corp is often described as a controlled company and

shareholders often feel bound to the desires of the Company’s

founding family, the Murdoch family’s economic ownership stake in

News Corp is approximately 14%1, and even when accounting for the

unequal voting rights of the Company’s share classes, the Murdoch

family controls 41%1 of the vote.

Shareholders do have a choice and will have an opportunity to

make their voices heard – there is a path to achieve majority

support for this proposal. We believe majority support for this

proposal will send a clear and direct message to the Board to

eliminate the dual-class share structure. If the Board refuses to

listen, we can then take further action.

Previous proposals to eliminate the dual-class structure were

soundly supported by shareholders unaffiliated with the Murdoch

family. In fact, nearly 90%2 of unaffiliated shareholders supported

a previously submitted proposal, resulting in 49.5%2 of total votes

being in favor of eliminating the dual-class share structure.

Despite this clear message from unaffiliated shareholders, the

Board failed to take action. The situation has become even more

important in light of recent reporting on Murdoch family dynamics.

We hope shareholders will once again clearly express their views,

but we hope that this time, the Board will finally realize its

obligation to represent the best interests of all shareholders.

Shareholders deserve better.

We will be filing a proxy statement in the coming weeks with

more details on the proposal. We look forward to continuing to

engage with our fellow shareholders.

Sincerely,

Jeffrey C. Smith Managing Member Starboard Value

***

About Starboard Value LP

Starboard Value LP is an investment adviser with a focused and

differentiated fundamental approach to investing in publicly traded

companies. Starboard invests in deeply undervalued companies and

actively engages with management teams and boards of directors to

identify and execute on opportunities to unlock value for the

benefit of all shareholders.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Starboard Value LP, together with the other participants named

herein (collectively, "Starboard"), intends to file a preliminary

proxy statement and accompanying proxy card with the Securities and

Exchange Commission ("SEC") to be used to solicit votes for the

approval of a business proposal at the 2024 annual meeting of

stockholders of News Corporation, a Delaware corporation (the

"Company").

STARBOARD STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO

READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH

PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB

SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS

PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT

WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES

SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be

Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O

Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”),

Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard

P Fund LP (“Starboard P LP”), Starboard Value P GP LLC (“Starboard

P GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value

and Opportunity Master Fund L LP (“Starboard L Master”), Starboard

Value L LP (“Starboard L GP”), Starboard Value R GP LLC (“Starboard

R GP”), Starboard G Fund, L.P. (“Starboard G LP”), Starboard Value

G GP, LLC (“Starboard G GP”), Starboard Value A LP (“Starboard A

LP”), Starboard Value A GP LLC (“Starboard A GP”), Starboard X

Master Fund Ltd (“Starboard X Master”), Starboard Value LP,

Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal

Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal

GP”), Jeffrey C. Smith and Peter A. Feld. As of the close of

business on September 6, 2024, Starboard V&O Fund beneficially

owned directly 3,982,090 shares of Class A Common Stock, par value

$0.01 per share (the “Class A Common Stock”) and 5,029,605 shares

of Class B Common Stock, par value $0.01 per share (the “Class B

Common Stock”). As of the close of business on September 6, 2024,

Starboard S LLC directly owned 517,744 shares of Class A Common

Stock and 610,586 shares of Class B Common Stock. As of the close

of business on September 6, 2024, Starboard C LP directly owned

402,457 shares of Class A Common Stock and 472,065 shares of Class

B Common Stock. As of the close of business on September 6, 2024,

Starboard P LP directly owned 3,577,549 shares of Class A Common

Stock, consisting of 3,577,549 shares of Class A Common Stock

underlying certain forward purchase contracts exercisable within 60

days of the date hereof. Starboard P GP, as the general partner of

Starboard P LP may be deemed the beneficial owner of an aggregate

of 3,577,549 shares of Class A Common Stock owned by Starboard P

LP. Starboard R LP, as the general partner of Starboard C LP and

the managing member of Starboard P GP, may be deemed the beneficial

owner of the 402,457 shares of Class A Common Stock owned by

Starboard C LP and 3,577,549 shares of Class A Common Stock

beneficially owned by Starboard P LP, and 472,065 shares of Class B

Common Stock owned by Starboard C LP. As of the close of business

on September 6, 2024, Starboard L Master directly owned 224,349

shares of Class A Common Stock and 259,890 shares of Class B Common

Stock. Starboard L GP, as the general partner of Starboard L

Master, may be deemed the beneficial owner of the 224,349 shares of

Class A Common Stock and 259,890 shares of Class B Common Stock

owned by Starboard L Master. Starboard R GP, as the general

partner of Starboard R LP and Starboard L GP, may be deemed the

beneficial owner of the 402,457 shares of Class A Common Stock

owned by Starboard C LP, 3,577,549 shares of Class A Common Stock

beneficially owned by Starboard P LP, and 224,349 shares of Class A

Common Stock owned by Starboard L Master, and 472,065 shares of

Class B Common Stock owned by Starboard C LP and 259,890 shares of

Class B Common Stock owned by Starboard L Master. As of the close

of business on September 6, 2024, Starboard G LP directly owned

3,200,058 shares of Class A Common Stock beneficially owned

directly, consisting of 3,200,058 shares of Class A Common Stock

underlying certain forward purchase contracts exercisable within 60

days of the date hereof. Starboard G GP, as the general partner of

Starboard G LP, may be deemed the beneficial owner of the 3,200,058

shares of Class A Common Stock owned by Starboard G LP. Starboard A

LP, as the managing member of Starboard G GP, may be deemed the

beneficial owner of the 3,200,058 shares of Class A Common Stock

owned by Starboard G LP. Starboard A GP, as the general partner of

Starboard A LP, may be deemed the beneficial owner of the 3,200,058

shares of Class A Common Stock owned by Starboard G LP. As of the

close of business on September 6, 2024, Starboard X Master directly

owned 1,305,223 shares of Class A Common Stock and 1,468,894 shares

of Class B Common Stock. As of the close of business on

September 6, 2024, 769,530 shares of Class A Common Stock and

890,960 shares of Class B Common Stock were held in an account

managed by Starboard Value LP (the “Starboard Value LP Account”).

Starboard Value LP, as the investment manager of each of Starboard

V&O Fund, Starboard C LP, Starboard P LP, Starboard L Master,

Starboard X Master, Starboard G LP and the Starboard Value LP

Account and the manager of Starboard S LLC, may be deemed the

beneficial owner of an aggregate of 13,979,000 shares of Class A

Common Stock and 8,732,000 shares of Class B Common Stock directly

owned by Starboard V&O Fund, Starboard S LLC, Starboard C LP,

Starboard P LP, Starboard L Master, Starboard X Master, Starboard G

LP and held in the Starboard Value LP Account. Each of Starboard

Value GP, as the general partner of Starboard Value LP, Principal

Co, as a member of Starboard Value GP, Principal GP, as the general

partner of Principal Co, and Messrs. Smith and Feld, as members of

Principal GP and as members of each of the Management Committee of

Starboard Value GP and the Management Committee of Principal GP,

may be deemed the beneficial owner of 13,979,000 shares of Class A

Common Stock and 8,732,000 shares of Class B Common Stock directly

owned by Starboard V&O Fund, Starboard S LLC, Starboard C LP,

Starboard P LP, Starboard L Master, Starboard X Master, Starboard G

LP and held in the Starboard Value LP Account.

1 Source: Company filings. Note: The Murdoch family’s economic

ownership and voting rights are based on the shares held by the

Murdoch Family Trust and the K. Rupert Murdoch 2004 Revocable Trust

as of the 2023 proxy statement. 2 Source: Company filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909244109/en/

Investor Contacts: Peter Feld, (212) 201-4878 Gavin Molinelli,

(212) 201-4828 www.starboardvalue.com

Media Contacts: Longacre Square Partners Greg Marose / Charlotte

Kiaie, (646) 386-0091 starboard@longacresquare.com

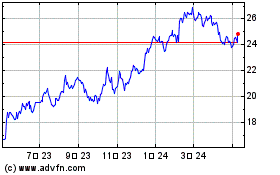

News (NASDAQ:NWSA)

過去 株価チャート

から 11 2024 まで 12 2024

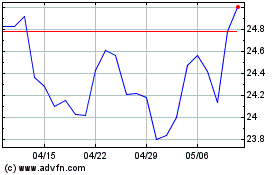

News (NASDAQ:NWSA)

過去 株価チャート

から 12 2023 まで 12 2024