false

0001341235

0001341235

2024-11-15

2024-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 18, 2024 (November 15, 2024)

ALDEYRA THERAPEUTICS, INC.

(Exact name of Registrant as specified in its

charter)

| Delaware |

|

001-36332 |

|

20-1968197 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

131 Hartwell Avenue, Suite 320

Lexington, MA 02421

(Address of principal executive offices and

zip code)

Registrant’s telephone number, including

area code: (781) 761-4904

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

ALDX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 15, 2024, Aldeyra Therapeutics, Inc. (the “Company”)

entered into the Extension Side Letter (the “Extension Letter”) with AbbVie Inc. (“AbbVie”), which amended certain

terms of the Exclusive Option Agreement (the “Option Agreement”) between the Company and AbbVie, dated October 31, 2023. The

Extension Letter makes certain changes to the Option Agreement, among other things, providing that the Company will conduct certain launch

activities, which costs shall not exceed mid-single-digit millions of dollars without AbbVie’s approval, and which costs will be

considered allowable expenses pursuant to the License Agreement (as defined in the Option Agreement) upon the delivery of AbbVie’s

written notice of exercising the Option and entry into the License Agreement (as defined in the Option Agreement), such that 60% of the

Company’s allowable expenses will be reimbursed by AbbVie in the event of exercise. If AbbVie does not deliver a written notice

of exercising the Option and the Company and AbbVie do not execute the License Agreement, the Company will remain solely responsible for

such launch activities costs. AbbVie has also independently initiated pre-commercialization planning activities. In addition, the Exercise

Period (as defined in the Option Agreement) was modified to ten (10) business days following FDA Approval (as defined in the Option Agreement),

provided that AbbVie shall provide the Company notice in case AbbVie determines that it will not exercise the Option (as defined in the

Option Agreement).

The foregoing summary of the Extension Letter does not purport to be

complete and is subject to, and qualified in its entirety by, the full text of the Extension Letter. Aldeyra expects to file a copy of

the Extension Letter, subject to any applicable confidential treatment, as an exhibit to its Annual Report on Form 10-K for the year ending

December 31, 2024.

Item 8.01. Other Events.

On November 18, 2024, the Company issued a press release (the “Press

Release”) to announce the Extension Letter and that the U.S. Food and Drug Administration (FDA) has accepted for review the Company’s

resubmitted New Drug Application (NDA) for reproxalap, a first-in-class investigational new drug candidate, for the treatment of the signs

and symptoms of dry eye disease, and has assigned a Prescription Drug User Fee Act (PDUFA) date of April 2, 2025. The Press Release is

filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Various statements contained in this Current Report on Form 8-K are

“forward-looking statements” under the securities laws, including, but not limited to, statements regarding relating to the

likelihood and timing of the FDA’s potential approval of the resubmitted NDA for reproxalap by the PDUFA date of April 2, 2025,

or at any other time, the adequacy of the data included in the previously submitted NDA and the resubmitted NDA, the potential profile,

benefit and market size of reproxalap in dry eye disease should the resubmitted NDA for reproxalap be approved by the FDA. In some cases,

you can identify forward looking statements by terms such as, but not limited to, “may,” “might,” “will,”

“objective,” “intend,” “should,” “could,” “can,” “would,” “expect,”

“believe,” “anticipate,” “project,” “on track,” “scheduled,” “target,”

“design,” “estimate,” “predict,” “potential,” “aim,” “plan” or

the negative of these terms, and similar expressions intended to identify forward-looking statements. Such forward-looking statements

are based upon current expectations that involve risks, changes in circumstances, assumptions, and uncertainties.

Important factors that could cause actual results to differ materially

from those reflected in Aldeyra's forward-looking statements include, among others, Aldeyra’s plans to develop and commercialize

product candidates, if they are approved; delay in or failure to obtain regulatory approval of Aldeyra's product candidates; the likelihood

and timing of the exercise of the Option by AbbVie pursuant to the Option Agreement with AbbVie; the ability to maintain regulatory approval

of Aldeyra's product candidates, and the labeling for any approved products; uncertainty as to Aldeyra’s ability to commercialize

(alone or with others) and obtain reimbursement for Aldeyra's product candidates following regulatory approval, if any; the size and growth

of the potential markets and pricing for Aldeyra's product candidates and the ability to serve those markets; the rate and degree of market

acceptance of any of Aldeyra's product candidates; the rate and degree of market acceptance of any of Aldeyra’s product candidates,

following regulatory approval, if any; the timing of enrollment, commencement and completion of Aldeyra's clinical trials; the timing

and success of preclinical studies and clinical trials conducted by Aldeyra and its development partners; the risk that prior results,

such as signals of safety, activity, or durability of effect, observed from preclinical or clinical trials, will not be replicated or

will not continue in ongoing or future studies or clinical trials involving Aldeyra's product candidates in clinical trials focused on

the same or on different indications; the scope, progress, expansion, and costs of developing and commercializing Aldeyra's product candidates;

Aldeyra's expectations regarding Aldeyra's expenses and future revenue, the timing of future revenue, the sufficiency or use of Aldeyra's

cash resources and needs for additional financing; Aldeyra's expectations regarding competition; Aldeyra's anticipated growth strategies;

Aldeyra's ability to attract or retain key personnel; Aldeyra’s commercialization, marketing and manufacturing capabilities and

strategy; Aldeyra's ability to establish and maintain development partnerships; Aldeyra’s ability to successfully integrate acquisitions

into its business; Aldeyra's expectations regarding federal, state, and foreign regulatory requirements; political, economic, legal, social,

and health risks, and war or other military actions, that may affect Aldeyra’s business or the global economy; regulatory developments

in the United States and foreign countries; Aldeyra's ability to obtain and maintain intellectual property protection for its product

candidates; the anticipated trends and challenges in Aldeyra's business and the market in which it operates; and other factors that are

described in the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations”

sections of Aldeyra's Annual Report on Form 10-K for the year ended December 31, 2023, and Aldeyra’s Quarterly Report on Form 10-Q

for the quarter ended September 30, 2024, which are on file with the Securities and Exchange Commission (SEC) and available on the SEC's

website at https://www.sec.gov/.

In addition to the risks described above and in Aldeyra's other filings

with the SEC, other unknown or unpredictable factors also could affect Aldeyra's results. No forward-looking statements can be guaranteed,

and actual results may differ materially from such statements. The information conveyed in this Current Report on Form 8-K is provided

only as of the date hereof, and Aldeyra undertakes no obligation to update any forward-looking statements included herein on account of

new information, future events, or otherwise, except as required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated November 18, 2024

| ALDEYRA THERAPEUTICS, INC. |

|

| |

|

|

| By: |

/s/ Todd C. Brady |

|

| |

Name: |

Todd C. Brady M.D., Ph.D. |

|

| |

Title: |

Chief Executive Officer |

|

3

Exhibit 99.1

Aldeyra Therapeutics

Announces FDA Acceptance for Review of Reproxalap New Drug Application for the Treatment of Dry Eye Disease, Expands AbbVie Option Agreement

PDUFA Date is

April 2, 2025

Lexington, Mass., November 18, 2024

– Aldeyra Therapeutics, Inc. (Nasdaq: ALDX) (Aldeyra) today announced that the U.S. Food and Drug Administration (FDA)

has accepted for review the resubmitted New Drug Application (NDA) for topical ocular reproxalap, a first-in-class investigational new

drug candidate, for the treatment of the signs and symptoms of dry eye disease. The FDA assigned a Prescription Drug User Fee Act (PDUFA)

date of April 2, 2025. In conjunction with the acceptance of the NDA for review, Aldeyra announced the expansion of its exclusive option

agreement with AbbVie Inc. (AbbVie).

“Based on the FDA’s acceptance of the NDA resubmission

of reproxalap for dry eye disease for review, we are pleased to announce an expansion of our option agreement with AbbVie, highlighting

the commitment of both companies to accelerating the potential availability of a novel dry eye disease therapy to patients and physicians,”

stated Todd C. Brady, M.D., Ph.D., President and Chief Executive Officer of Aldeyra.

On October 31, 2023, Aldeyra entered into an option agreement with

AbbVie. Under the terms of the agreement, AbbVie has the option to obtain a co-exclusive license to develop, manufacture, and commercialize

reproxalap in the United States. Upon exercise of the option, AbbVie would pay Aldeyra a $100 million upfront cash payment, less previously

paid option fees of $6 million. In addition, Aldeyra would be eligible to receive up to $300 million in regulatory and commercial milestone

payments, inclusive of a $100 million milestone payment payable if the FDA approval for reproxalap for dry eye disease is received. In

the United States, Aldeyra would share profits and losses with AbbVie from the commercialization of reproxalap according to a split of

60% for AbbVie and 40% for Aldeyra.

Per the expansion of the option agreement, Aldeyra will initiate certain

pre-commercial activities, 60% of which will be paid by AbbVie and 40% of which will be paid by Aldeyra if the option is exercised. AbbVie

has also independently initiated certain pre-commercial planning activities. The parties have also agreed to amend the expiration of the

option to 10 business days from the date of FDA approval, if any, of reproxalap for dry eye disease.

About Reproxalap

Reproxalap is an investigational new drug candidate in development

for the treatment of dry eye disease and allergic conjunctivitis, two of the largest markets in ophthalmology. Reproxalap is a first-in-class

small-molecule modulator of RASP, which are elevated in ocular and systemic inflammatory diseases. The mechanism of action of reproxalap

has been supported by the demonstration of statistically significant and clinically relevant activity in multiple physiologically distinct

late-phase clinical indications. Reproxalap has been studied in more than 2,500 patients with no observed safety concerns; mild and transient

instillation site irritation is the most commonly reported adverse event in clinical trials.

About Aldeyra

Aldeyra Therapeutics is a biotechnology company devoted to discovering

innovative therapies designed to treat immune-mediated and metabolic diseases. Aldeyra’s approach is to develop pharmaceuticals

that modulate protein systems, instead of directly inhibiting or activating single protein targets, with the goal of optimizing multiple

pathways at once while minimizing toxicity. Aldeyra’s product candidates include RASP (reactive aldehyde species) modulators ADX-629,

ADX-248, ADX-743, ADX-631, and chemically related molecules for the potential treatment of systemic and retinal immune-mediated and metabolic

diseases. Aldeyra’s late-stage product candidates are reproxalap, a RASP modulator for the potential treatment of dry eye disease

and allergic conjunctivitis, and ADX-2191, a novel formulation of intravitreal methotrexate for the potential treatment of retinitis pigmentosa.

For additional information, please visit www.aldeyra.com.

Safe Harbor Statement

This release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding Aldeyra’s future expectations,

plans, and prospects, including without limitation statements regarding: the goals, opportunity, and potential for reproxalap; the outcome

and timing of the FDA’s review, or approval of the resubmitted NDA for reproxalap by the PDUFA date and the adequacy of the data

included in the original NDA and the resubmitted NDA; the likelihood and timing of the exercise of the Option; and Aldeyra’s expectations

regarding the labeling for reproxalap, if approved. Aldeyra intends such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform

Act of 1995. In some cases, you can identify forward-looking statements by terms such as, but not limited to, “may,” “might,”

“will,” “objective,” “intend,” “should,” "could," “can,” “would,”

“expect,” “believe,” “anticipate,” “project,” “on track,” “scheduled,”

“target,” “design,” “estimate,” “predict,” “contemplates,” “likely,”

“potential,” “continue,” “ongoing,” “aim,” “plan,” or the negative of these

terms, and similar expressions intended to identify forward-looking statements. Such forward-looking statements are based upon current

expectations that involve risks, changes in circumstances, assumptions, and uncertainties. Aldeyra is at an early stage of development

and may not ever have any products that generate significant revenue. All of Aldeyra's development timelines may be subject to adjustment

depending on recruitment rate, regulatory review, preclinical and clinical results, funding, and other factors that could delay the initiation,

enrollment, or completion of clinical trials. Important factors that could cause actual results to differ materially from those reflected

in Aldeyra's forward-looking statements include, among others, the timing of enrollment, commencement and completion of Aldeyra's clinical

trials, the timing and success of preclinical studies and clinical trials conducted by Aldeyra and its development partners; delay in

or failure to obtain regulatory approval of Aldeyra's product candidates, including as a result of the FDA not accepting Aldeyra’s

regulatory filings, issuing a complete response letter, or requiring additional clinical trials or data prior to review or approval of

such filings or in connection with resubmissions of such filings; the ability to maintain regulatory approval of Aldeyra's product candidates,

and the labeling for any approved products; the risk that prior results, such as signals of safety, activity, or durability of effect,

observed from preclinical or clinical trials, will not be replicated or will not continue in ongoing or future studies or clinical trials

involving Aldeyra's product candidates in clinical trials focused on the same or different indications; the scope, progress, expansion,

and costs of developing and commercializing Aldeyra's product candidates; uncertainty as to Aldeyra’s ability to commercialize (alone

or with others) and obtain reimbursement for Aldeyra's product candidates following regulatory approval, if any; the size and growth of

the potential markets and pricing for Aldeyra's product candidates and the ability to serve those markets; Aldeyra's expectations regarding

Aldeyra's expenses and future revenue, the timing of future revenue, the sufficiency or use of Aldeyra's cash resources and needs for

additional financing; the rate and degree of market acceptance of any of Aldeyra's product candidates; Aldeyra's expectations regarding

competition; Aldeyra's anticipated growth strategies; Aldeyra's ability to attract or retain key personnel; Aldeyra’s commercialization,

marketing and manufacturing capabilities and strategy; Aldeyra's ability to establish and maintain development partnerships; Aldeyra’s

ability to successfully integrate acquisitions into its business; Aldeyra's expectations regarding federal, state, and foreign regulatory

requirements; political, economic, legal, social, and health risks, public health measures, and war or other military actions, that may

affect Aldeyra’s business or the global economy; regulatory developments in the United States and foreign countries; Aldeyra's ability

to obtain and maintain intellectual property protection for its product candidates; the anticipated trends and challenges in Aldeyra's

business and the market in which it operates; and other factors that are described in the “Risk Factors” and “Management's

Discussion and Analysis of Financial Condition and Results of Operations” sections of Aldeyra's Annual Report on Form 10-K for the

year ended December 31, 2023, and Aldeyra’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which are on

file with the Securities and Exchange Commission (SEC) and available on the SEC's website at https://www.sec.gov/.

In addition to the risks described above and in Aldeyra's other filings

with the SEC, other unknown or unpredictable factors also could affect Aldeyra's results. No forward-looking statements can be guaranteed

and actual results may differ materially from such statements. The information in this release is provided only as of the date of this

release, and Aldeyra undertakes no obligation to update any forward-looking statements contained in this release on account of new information,

future events, or otherwise, except as required by law.

Investor & Media Contact:

Laura Nichols

Tel: (781) 257-3060

investorrelations@aldeyra.com

v3.24.3

Cover

|

Nov. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 15, 2024

|

| Entity File Number |

001-36332

|

| Entity Registrant Name |

ALDEYRA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001341235

|

| Entity Tax Identification Number |

20-1968197

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

131 Hartwell Avenue

|

| Entity Address, Address Line Two |

Suite 320

|

| Entity Address, City or Town |

Lexington

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02421

|

| City Area Code |

781

|

| Local Phone Number |

761-4904

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

ALDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

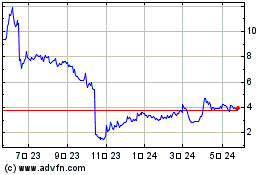

Aldeyra Therapeutics (NASDAQ:ALDX)

過去 株価チャート

から 12 2024 まで 1 2025

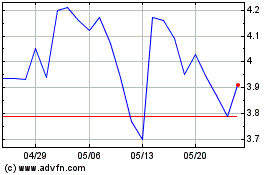

Aldeyra Therapeutics (NASDAQ:ALDX)

過去 株価チャート

から 1 2024 まで 1 2025